Upwards movement was expected. I still have two hourly wave counts for you. They both expect that this trend is incomplete.

Summary: The short term trend remains up. It should either continue for another week and a half (slightly more likely) or it may be very choppy and overlapping and end towards the end of next week (slightly less likely).

This analysis is published about 04:25 p.m. EST. Click on charts to enlarge.

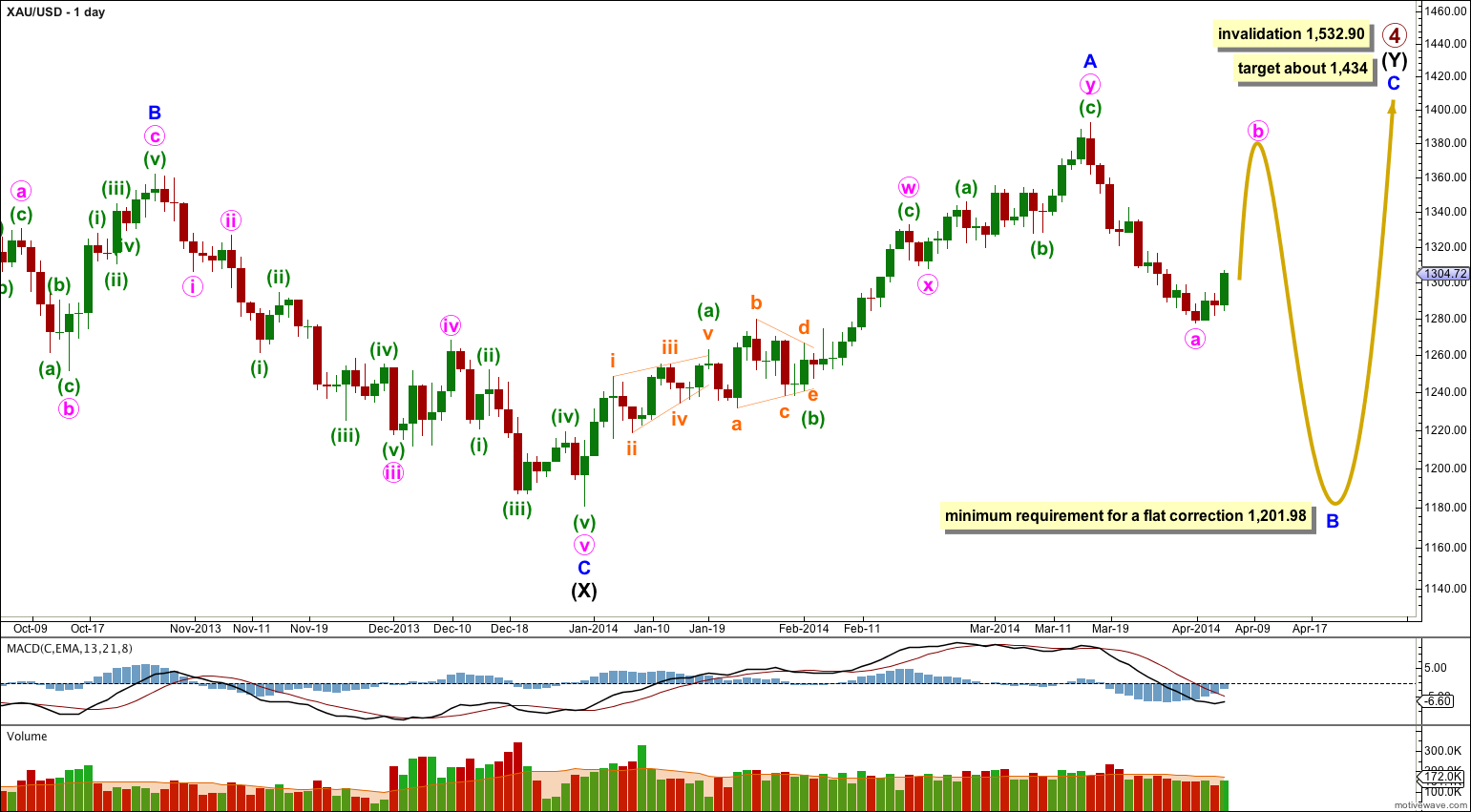

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

This main wave count expects upwards movement for about two weeks. This wave count expects minor wave B to unfold as a flat correction.

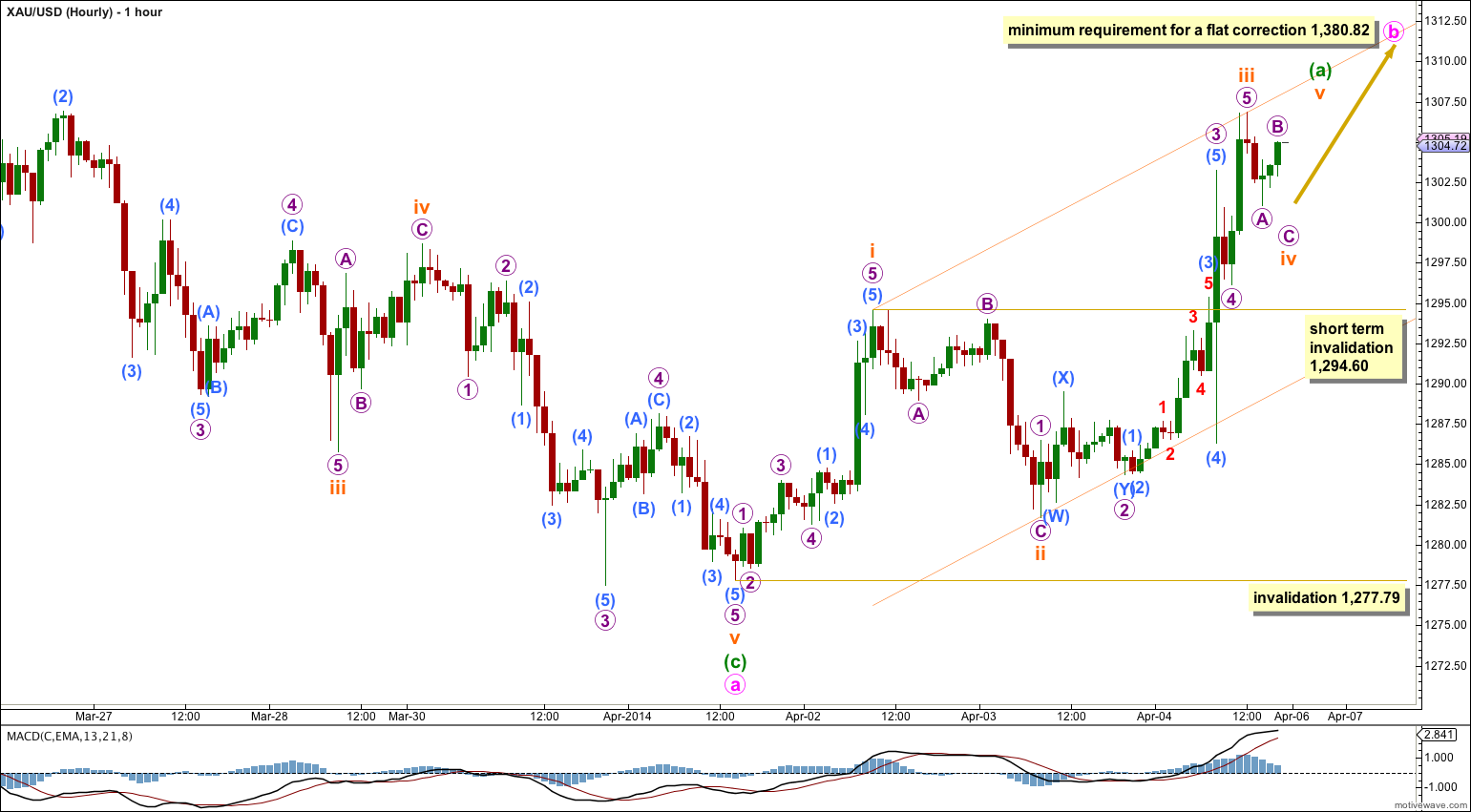

I have reanalysed upwards movement for subminuette wave i. It can be seen as a three, or a five with an extended fifth wave. Friday’s upwards movement looks like a clear third wave with a corresponding increase in upwards momentum, and it is 2.07 short of 1.618 the length of subminuette wave i.

If minuette wave (a) is unfolding as an impulse then minute wave b is unfolding as a zigzag, because a zigzag subdivides 5-3-5.

Within minuette wave (a) subminuette wave iv may not move into subminuette wave i price territory. This wave count is invalidated in the short term with movement below 1,294.60. At this stage subminuette wave iv is incomplete and should move a little lower at the beginning of Monday’s session. Subminuette wave v upwards should follow during Monday, and it may or may not end during Monday. It is most likely to make a new high above 1,306.83.

As soon as subminuette wave v may be complete the invalidation point must move down to the start of minuette wave (a). Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

Draw a channel about minuette wave (a) using Elliott’s first technique: draw the first trend line from the highs of subminuette waves i to iii, then place a parallel copy on the low of subminuette wave ii. Expect subminuette wave iv to remain within this channel. Subminuette wave v may find resistance at the upper edge of the channel. When the channel is breached by subsequent downwards movement then minuette wave (a) may be over and minuette wave (b) downward may have begun.

Minute wave b may make a new high beyond the start of minute wave a at 1,392.30. This wave count has no upper invalidation point for this reason.

Minute wave b within the flat correction must reach a minimum of 90% the length of minute wave a at 1,380.82. If minor wave B is an expanded flat correction then minute wave b may end at or above 1,398.80 where it would be 105% the length of minute wave a.

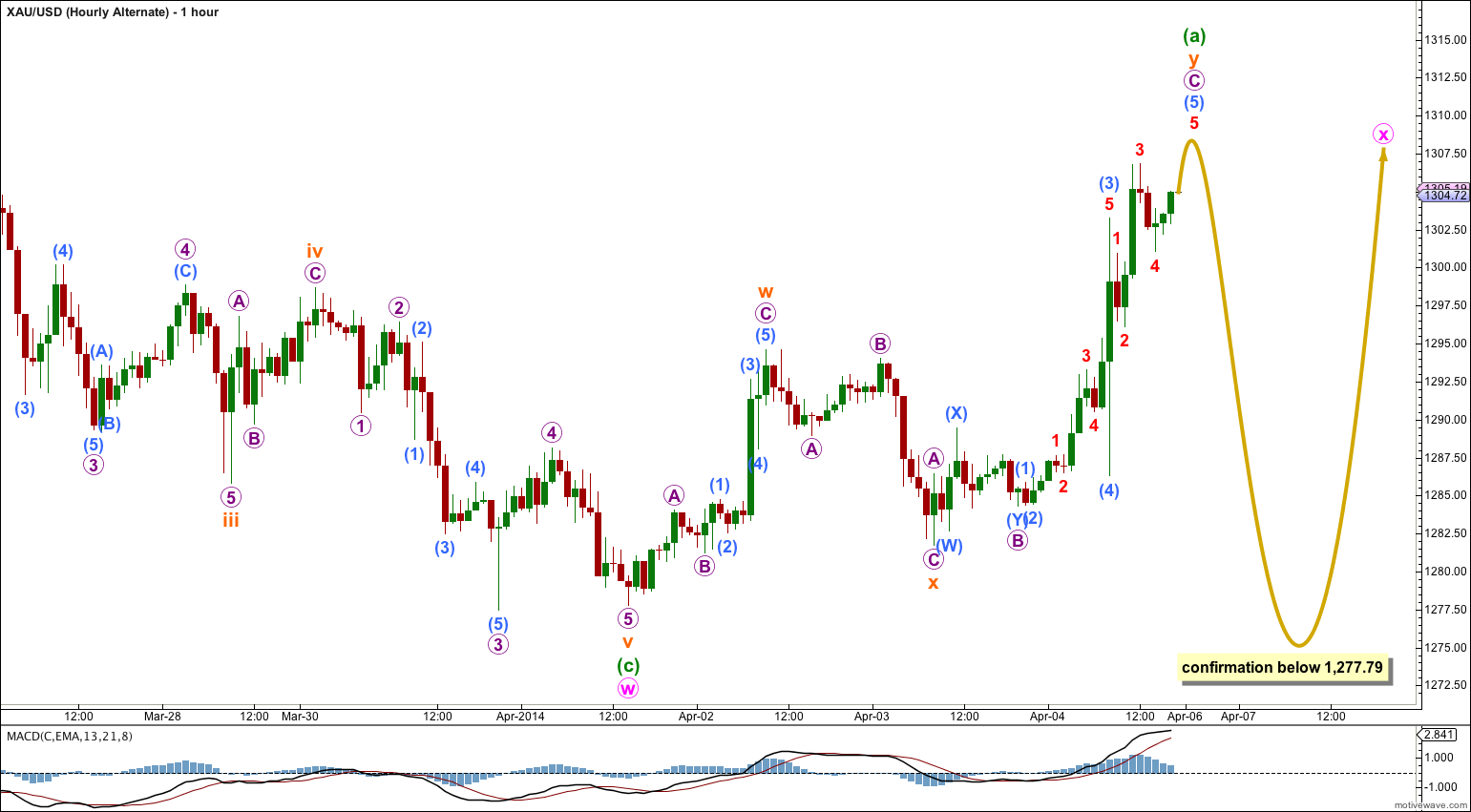

Alternate Hourly Wave Count.

If minor wave B is a double zigzag then within it the first structure of the double, a zigzag labeled minute wave w, is now complete.

The double should be joined by a “three” in the opposite direction labeled minute wave x. There is no minimum upwards requirement for an X wave within doubles.

Minute wave x may subdivide as any corrective structure. If minor wave B is a double zigzag I would expect minute wave x to be relatively shallow.

The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough. Considering the lower target for minor wave B on the daily chart of 1,201.98 a double zigzag would nicely fit the purpose. This indicates a shallow X wave may unfold.

At this stage there are several different possible structures I can see which may be unfolding for minute wave X. I am labeling it with the most likely structure as I see it today but this labeling may change. Overall, I would expect to see very choppy overlapping movement for several days yet. This could still fit nicely with my wave count for Silver which expects slow upwards movement for a few days.

I am labeling minuette wave (a) within minute wave x as an incomplete double zigzag. If minuette wave (a) subdivides as a double zigzag that indicates minute wave x is either a flat correction or a triangle. All of these possibilities expect very choppy overlapping movement, and all of them may include a new low below 1,277.79.

If the main wave count is invalidated in the next few days with movement below 1,277.79 then this is the alternate I would use.

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

Within the triangle one of the subwaves, intermediate wave (C), is a double zigzag. The remaining subwaves may not be double zigzags and must be single zigzags. If intermediate wave (D) is a zigzag then it is likely now to be over. This would be a remarkably shallow D wave within a triangle, and it does not look right. The probability of this alternate is today reduced.

This alternate wave count now only requires a final zigzag upwards for intermediate wave (E) which may not move beyond the end of intermediate wave (C) above 1,392.30.

Lara, do you have an estimate on time (trading days) to reach the minimum correction of 1201.98 shown on daily chart?