Click on charts to enlarge.

The first thing I have some confidence in for this wave count is the structure of primary wave 1 downwards as a five. This indicates a trend change at the high of 0.88435.

Primary wave 1 subdivides as a leading expanding diagonal (albeit with a shorter than expected fifth wave). Leading diagonals in first wave positions are commonly followed by very deep second wave corrections. Primary wave 2 is likely to be over now as a deep 93% correction of primary wave 1.

Primary wave 2 subdivides as a double zigzag. The second zigzag has deepened the correction and primary wave 2 slopes upwards.

I have drawn a best fit channel about primary wave 2. When this channel is breached by a full weekly candlestick below the lower trend line and not touching it, then I would have full and final confidence that the Kiwi should move to new lows. At that stage a third wave would be underway.

At 0.63631 primary wave 3 would reach 1.618 the length of primary wave 1.

Primary wave 2 may not move beyond the start of primary wave 1 above 0.88435.

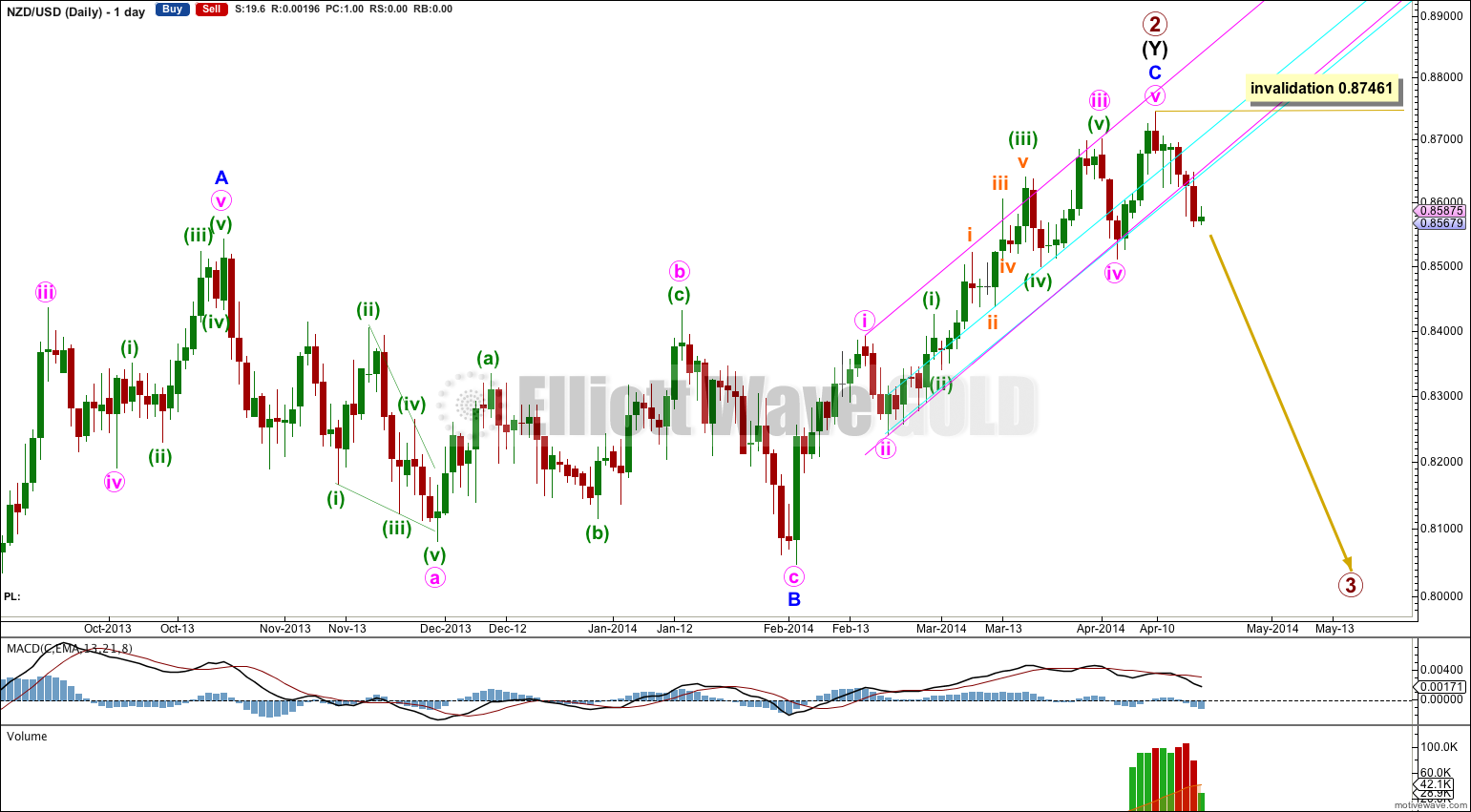

The daily chart shows the structure within the end of intermediate wave (Y) of primary wave 2.

Within intermediate wave (Y) minor wave C is now a complete five wave impulse.

The pink channel drawn about minor wave C is drawn using Elliott’s first technique; the first trend line is drawn from the ends of minute waves i to iii, a parallel copy is placed upon the end of minute wave ii. This channel is now clearly breached by a full daily candlestick below the lower edge and not touching the lower trend line. This provides me with some confidence that minor wave C should be over and so primary wave 2 is finally over and primary wave 3 has arrived.

I would expect to see a throwback as a second wave correction brings price up to the lower edge of the channel, to find resistance there. After that we should begin to see some increase in downwards momentum.

This trend channel breach is very important.

Within the new downwards trend no second wave correction may move beyond the start of its first wave. This wave count is invalidated at the daily chart level with movement above 0.87461.