Price has again moved sideways to complete another doji candlestick. The wave count is mostly the same, but recent movement on the hourly chart is reanalysed. The target remain the same.

Summary: A third wave down has still most likely begun. The target for it to end is 1,247 and this may be reached in either five or ten more days.

This analysis is published about 05:05 p.m. EST. Click on charts to enlarge.

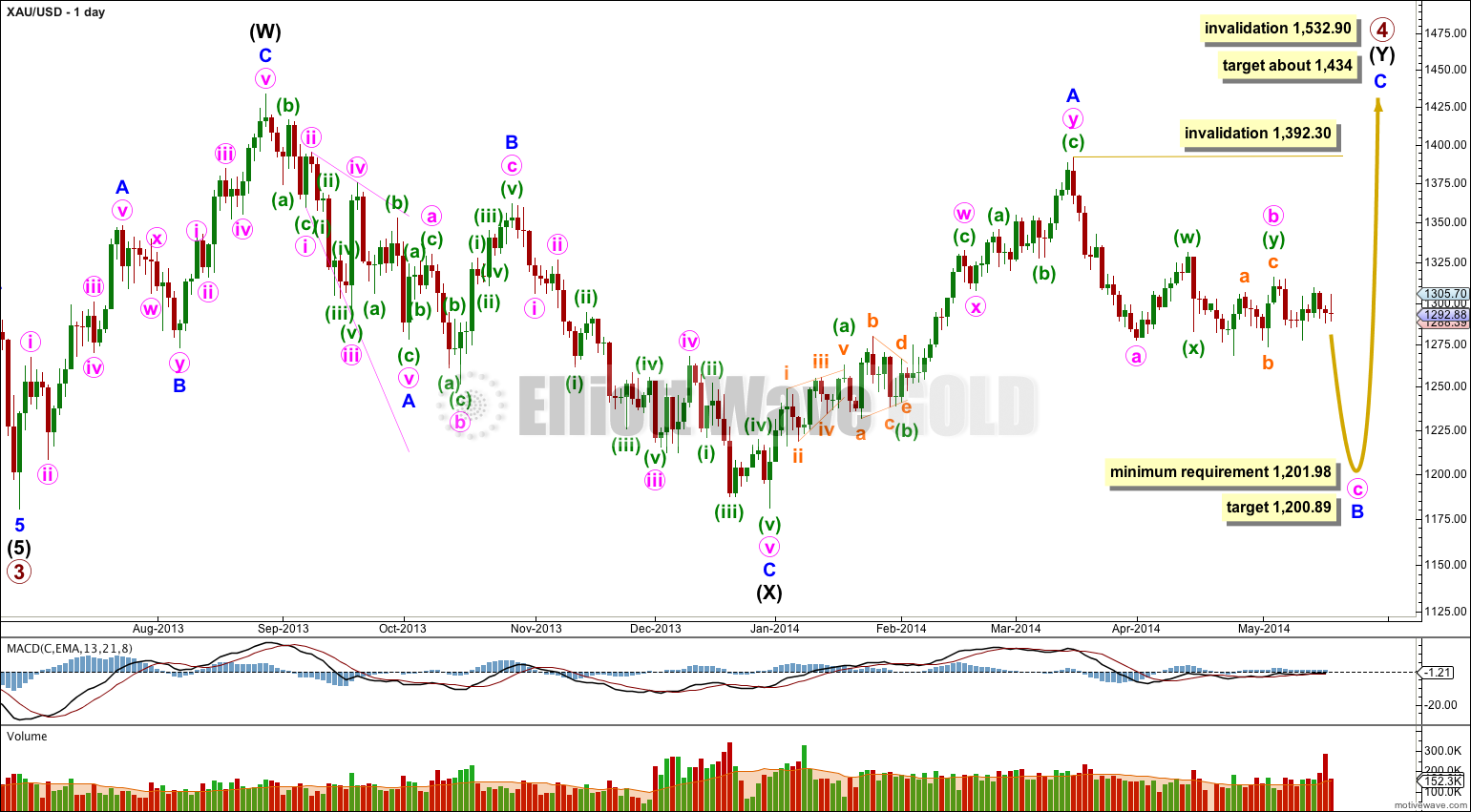

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

If downwards movement does not reach 1,201.98 or below then intermediate wave (Y) may not be a flat correction and may be a contracting triangle. I will keep this alternate possibility in mind as this next wave down unfolds. If it looks like a triangle may be forming I will again chart that possibility for you.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure may be either a single zigzag (as labeled here) or a double zigzag (relabel A-B-C to W-X-Y). While this next wave unfolds I will have to consider two structural possibilities: it may be an impulse for a C wave, or it may be a zigzag for a Y wave.

If minor wave B is a single zigzag then within it minute wave b may not move beyond the start of minute wave a above 1,392.30. Minute wave c would reach equality in length with minute wave a at 1,200.89.

If minor wave B is a double zigzag, relabeled minute w-x-y, then within it there is no invalidation point for minute wave x. But X waves within double zigzags are usually relatively brief and shallow, as they very rarely make new price extremes beyond the start of the first zigzag in the double.

Upwards movement invalidated the last main hourly wave count and fitted the alternate. However, the alternate did not have a very good fit because the proportions were wrong. I have reanalysed recent movement for this reason.

The last wave down can be seen as a complete impulse and upwards movement thereafter fits perfectly as a three. It found resistance exactly at the upper edge of the base channel drawn about minuette waves (i) and (ii).

If this interpretation is correct (and it has the most typical look) then gold has just begun on the middle of a third wave down. We should see an increase in downwards momentum this week.

At 1,271 subminuette wave iii would reach 1.618 the length of subminuette wave i.

At 1,247 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

If these targets are wrong they may be too high.

Minuette wave (i) lasted six days. If minuette wave (iii) is extended it would be longer in duration than minuette wave (i) and may be either eight or thirteen days. So far it has lasted three days and may continue for another five or ten days.

Minuette wave (iii) should break through support at the lower edge of the green base channel. After this channel is breached the lower edge should provide resistance to upwards corrections.

Within subminuette wave iii no second wave correction may move beyond the start of its first wave above 1,305.51.