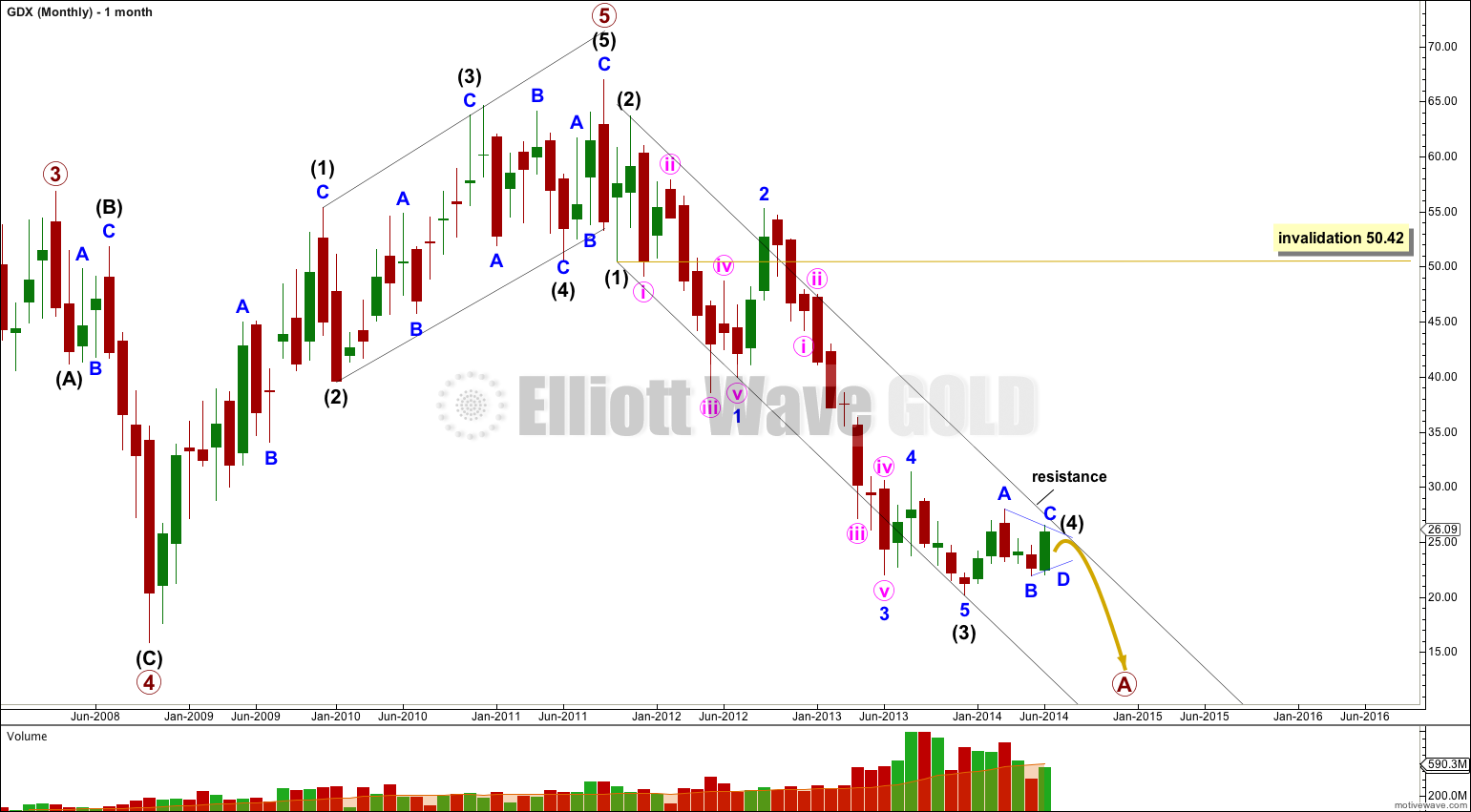

Last Elliott wave analysis expected to see downwards movement for a D wave within the triangle. Price did move lower in choppy overlapping sideways movement, but wave D has not yet arrived.

Click charts to enlarge.

The clearest piece of movement is the downwards movement from the high. This looks most like a first, second and third wave. This may be the start of a larger correction.

Intermediate wave (3) is $1.06 longer than 2.618 the length of intermediate wave (1).

Within intermediate wave (3) there are no Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within minor wave 1 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $2.19 longer than 0.618 the length of minute wave i.

Ratios within minor wave 3 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $0.63 longer than 0.382 the length of minute wave iii.

Draw a parallel channel about this downwards movement. Draw the first trend line from the lows of intermediate waves (1) to (3), then place a parallel copy upon the high of intermediate wave (2). I would expect intermediate wave (4) to find resistance at the upper edge of the channel, and it may end there.

Intermediate wave (4) should last one to a few months.

Minor wave C is incomplete because a new high since last analysis cannot be minor wave D. Price should move higher before minor wave C is done.

Sideways movement since last analysis may have been an expanded flat for minute wave b within minor wave C.

At this stage it cannot be confirmed that minute wave b is complete. This movement may only be minuette wave (a) or (w) within a larger flat or combination. If minute wave b continues further it would very likely move sideways and not substantially lower.

Minute wave c upwards may not exhibit a Fibonacci ratio to minute wave a. It may find resistance and end at the upper edge of the black channel copied over here from the monthly chart.

Minor wave D may not move beyond the end of minor wave B below 21.93 for a contracting triangle. For a barrier triangle minor wave D may end about the same level as minor wave B, as long as the B-D trend line remains essentially flat. In practice this means minor wave D may move very slightly below 21.93 as this invalidation point is not black and white.

Minor wave E would most likely fall short of the A-C trend line.

The whole triangle for intermediate wave (4) may find resistance, and may end, at the upper edge of the black channel which is here copied over from the monthly chart.

Lara

1) Do you have a time estimate for completion of minor D?

2) In your view, does gdx minor D completion coincide with a similar down in gold? If yes which wave?

Thanks for the update! Under this scenario, looks like GDX triangle wave E could align with a wave 2 correction in primary 5 for gold.