Slow sideways and upwards movement continued as expected. The main wave count is the same and the triangle wave count is different today.

Summary: The correction is still most likely incomplete. I expect a little more upwards movement to 1,271. Thereafter, downwards movement should continue. The correction may end within the next 24 hours. Please note: the alternate triangle idea has changed today.

Click on charts to enlarge.

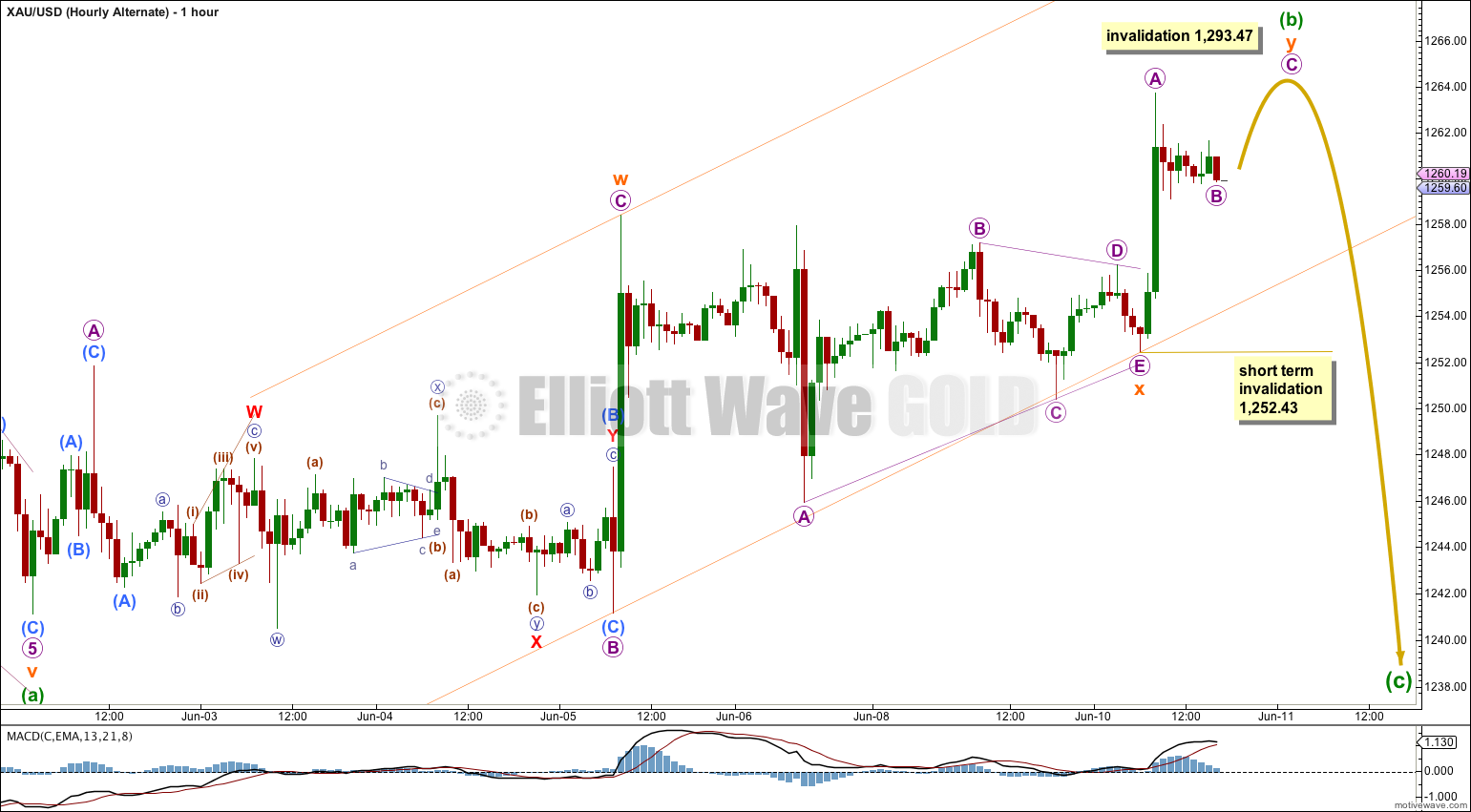

Main Wave Count.

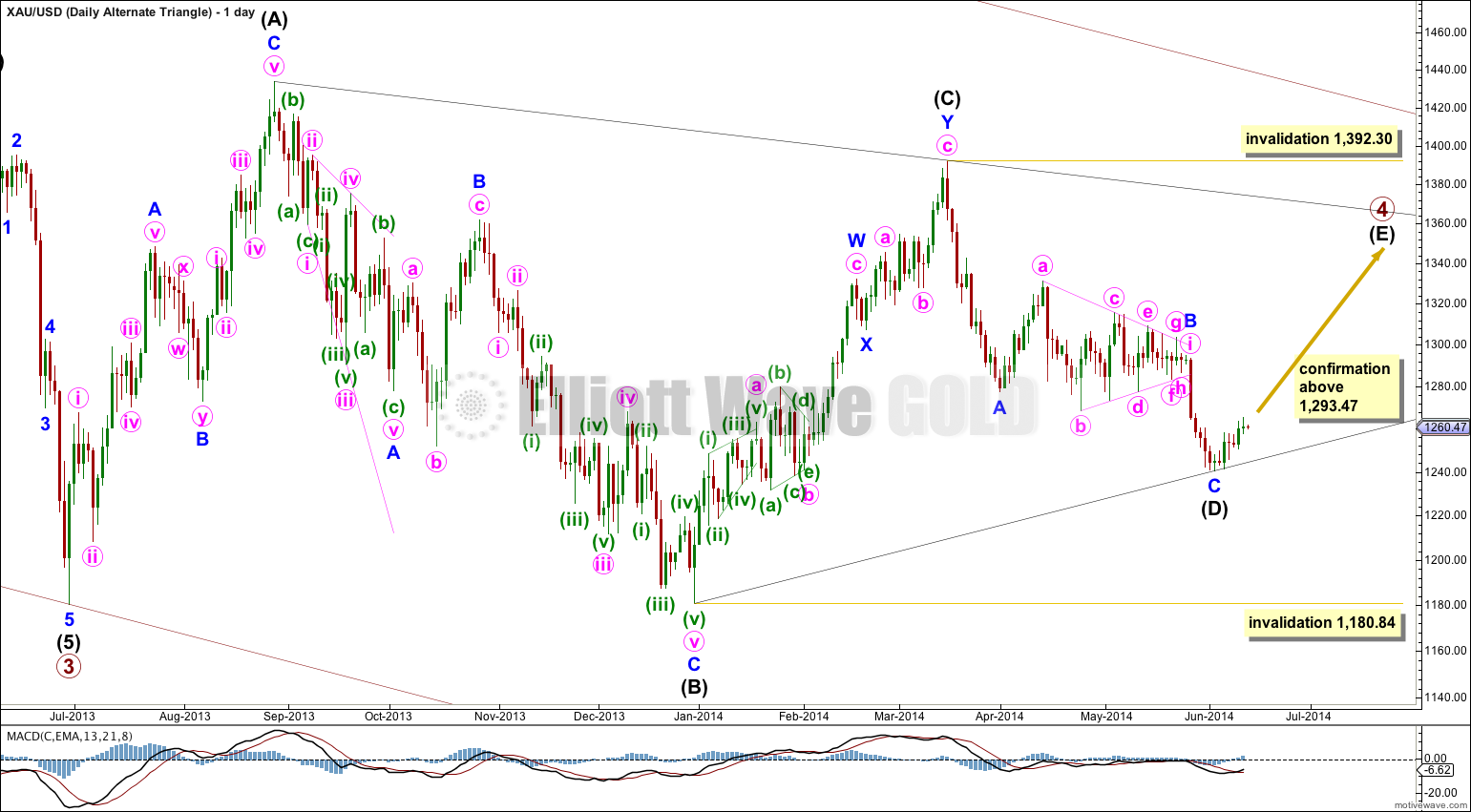

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

If downwards movement does not reach 1,201.98 or below then intermediate wave (Y) may not be a flat correction and may be a contracting triangle. I will keep this alternate possibility in mind as this next wave down unfolds. If it looks like a triangle may be forming I will again chart that possibility for you.

It remains possible that primary wave 4 in its entirety is a huge contracting triangle. This alternate idea is published at the end of this analysis daily.

Overall a double combination for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is incomplete. It may be a single zigzag as labeled here. If it is a single zigzag then minute wave c is unfolding as a five wave impulse. Within the impulse minuette wave (ii) may not move beyond the start of minuette wave (i) at 1,293.47. At 1,178 minute wave c would reach equality in length with minute wave a.

This is the main wave count because minute wave a fits perfectly and best as a five wave impulse. The alternate wave count sees this movement as a three wave zigzag.

Within minute wave c downwards when the next wave down is complete then this main wave count will diverge from the alternate. This main wave count would then expect a fourth wave correction and the alternate would then expect downwards movement to be over. The point of differentiation at that stage would be 1,241.12.

I have drawn a channel about minor wave B downwards: draw the first trend line from the start of minute wave a to the end of minute wave b, then place a parallel copy upon the end of minute wave a. I will expect downward movement to find support at the lower end of this channel due to this being the most common place for minute wave c to end. Minuette wave (ii) within minute wave c should find resistance at the upper edge of the channel, if it reached up that high.

Minuette wave (ii) may be completing as a double combination: flat – X – zigzag, with subminuette wave x as regular contracting triangle.

Within subminuette wave y micro wave B may now be a complete running contracting triangle.

The target may be optimistic, and may be too high. It would see subminuette wave y end substantially above the end of subminuette wave w and so the combination would have a clear slope. This is possible, but it is also unusual.

At 1,271 micro wave C would reach equality in length with micro wave A and minuette wave (ii) would also end about the 0.618 Fibonacci ratio of minuette wave (i) which is at 1,273.22. Minuette wave (ii) may also then find resistance at the upper edge of the pink channel on the daily chart.

I have drawn a best fit channel about this correction. I will use the channel as first indication of a trend change; when this channel is clearly breached by downwards movement then a third wave may be underway. At that stage price movement below 1,241.16 would provide full and final confidence that a third wave is underway.

When minuette wave (ii) is complete then I can calculate a target for you for minuette wave (iii). I cannot do that today.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,293.47.

Alternate Wave Count.

If within minor wave B downwards the first wave is a three wave zigzag and not a five wave impulse then minor wave B may be completing as a double zigzag, with minute wave x a nine wave triangle. This means that the current downwards movement may be completing as a zigzag and not an impulse. This may explain the sideways movement of the last few days quite nicely. The overall direction is the same as I still expect more downwards movement.

This alternate has a lower probability than the main wave count because when the downwards wave for minute wave w is seen as a three it does not fit as neatly with momentum and the Fibonacci ratios are not as startlingly good as the main wave count.

Within minute wave y once minuette wave (b) is complete then minuette wave (c) downwards would be the final movement to complete minor wave B. At that stage subsequent movement above 1,241.12 would confirm this alternate wave count and invalidate the main wave count. But that is still weeks away at this stage.

Within minute wave y minuette wave (b) would be incomplete on the hourly chart. It may not move beyond the start of minuette wave (a) above 1,293.47.

If the next piece of downwards movement does not show a strong increase in downwards momentum then this alternate would be an excellent explanation.

At this stage there is absolutely no difference in the short term expectation, invalidation points, short term structure or trend channels between the main and alternate wave counts.

Daily – Triangle.

It remains possible that primary wave 4 in its entirety is a huge regular contracting triangle.

I am changing the wave count for this triangle idea today to see intermediate wave (D) as complete, just over 71% the length of intermediate wave (C). Movement above 1,293.47 in the next few days or so would invalidate the main wave count and confirm this alternate.

I have checked the subdivisions within minor wave C downwards and it can be seen as a complete five wave impulse.

Intermediate wave (E) must subdivide as a zigzag and would most likely end short of the (A) – (C) trend line.

Intermediate wave (E) may not move beyond the end of intermediate wave ©.

This analysis is published about 10:55 p.m. EST. Click on charts to enlarge.