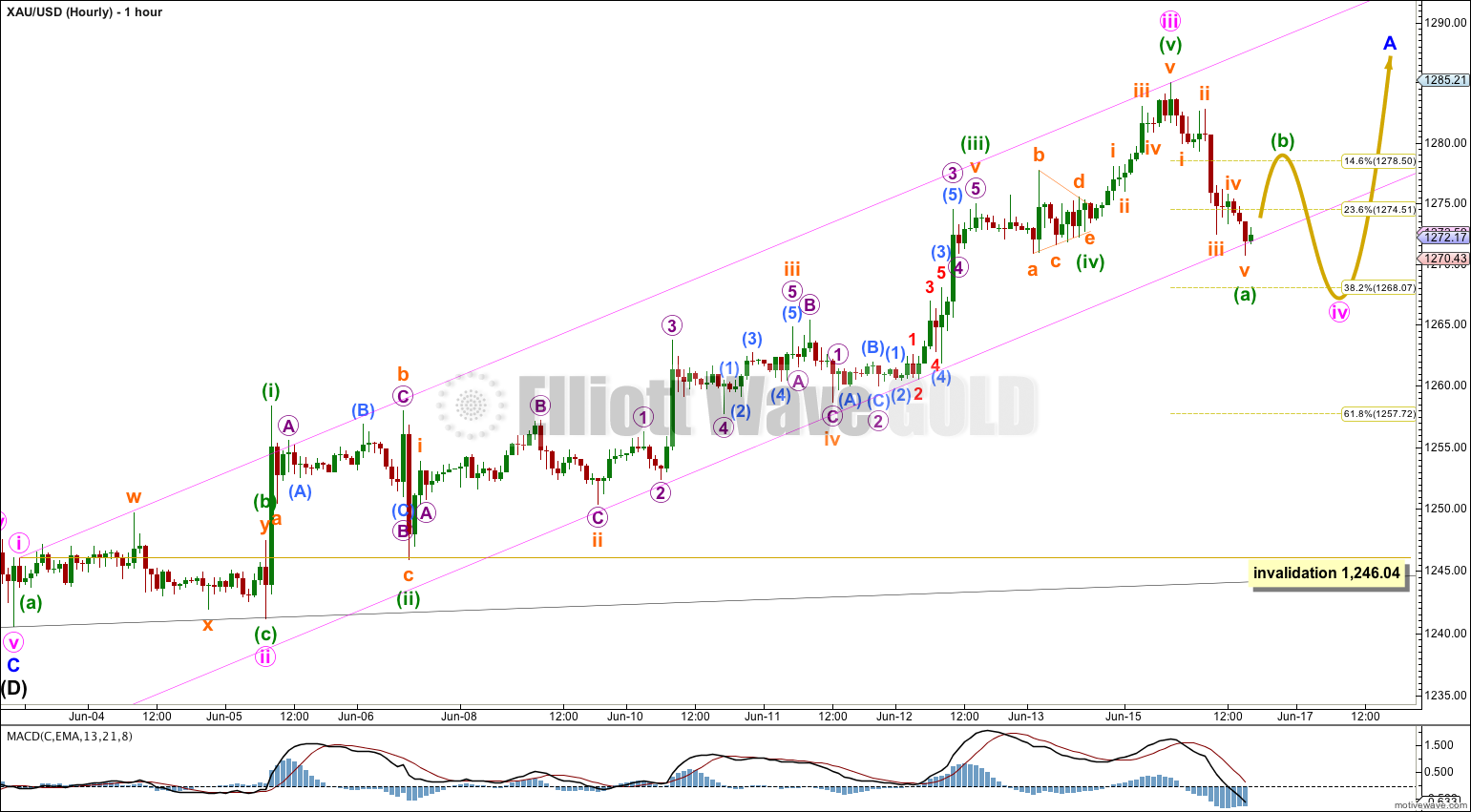

For the last Elliott wave technical analysis upwards movement for Gold was expected, but fell short of the target at 1,291 by 6.01.

Summary: A fourth wave correction should continue for another session. The target for it to end is at 1,268.07. Thereafter, the upwards trend should resume with a final fifth wave.

Click on charts to enlarge.

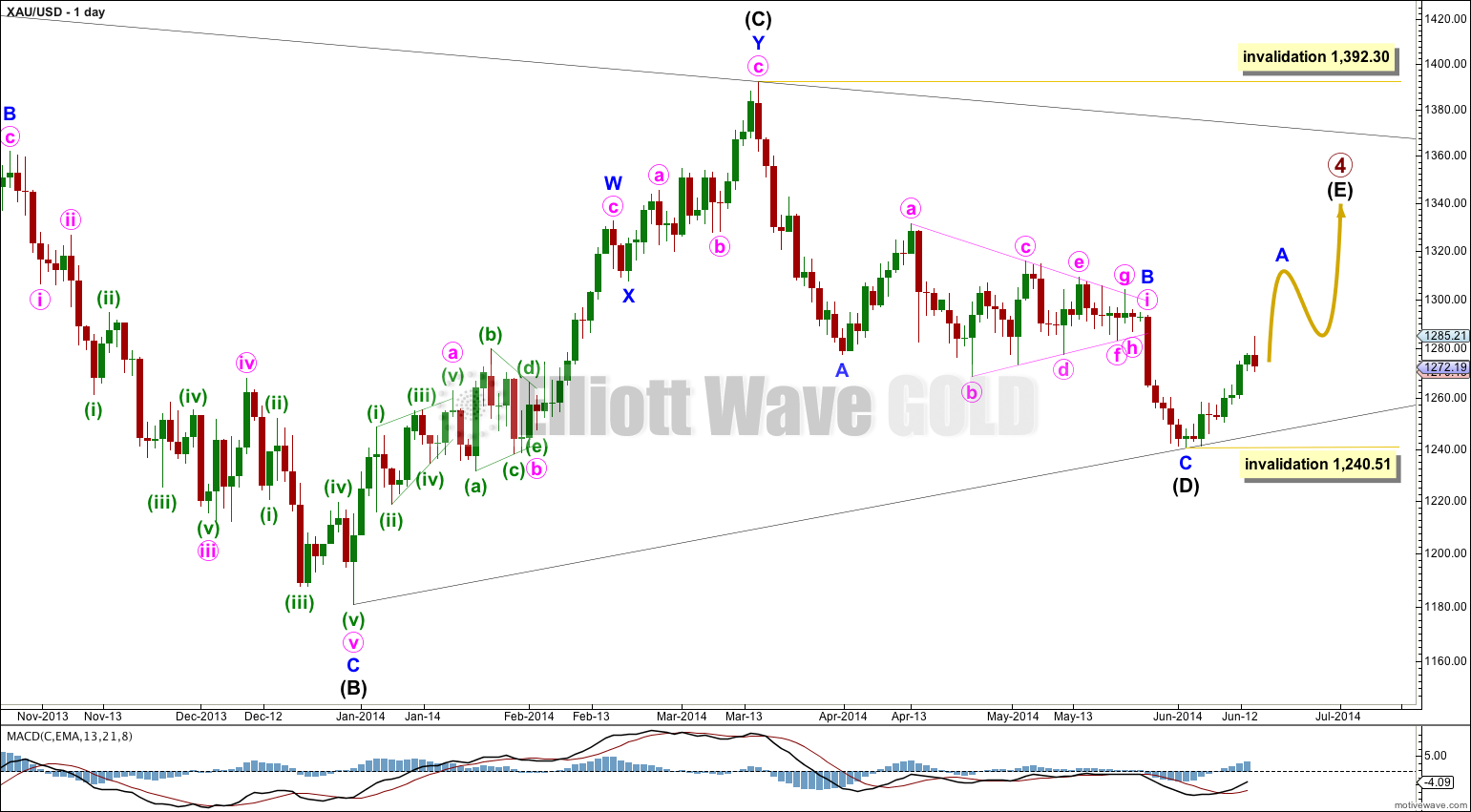

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to be time consuming and fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days, intermediate wave (B) lasted 88 days, intermediate wave (C) lasted 53 days and intermediate wave (D) lasted 56 days. Intermediate wave (E) may last a total of about 43 to 56 days. So far it has only lasted 9 days.

Minute wave iii is completed. Ratios within minute wave iii are: minuette wave (iii) is 1.19 longer than 1.618 the length of minuette wave (i), and minuette wave (v) is 0.96 longer than 0.618 the length of minuette wave (i) and 0.50 longer than 0.382 the length of minuette wave (iii).

Ratios within minuette wave (v) are: subminuette wave iii is 0.48 short of 1.618 the length of subminuette wave i, and subminuette wave v 0.20 short of 0.618 the length of subminuette wave i.

Minute wave ii lasted 43 hours. I would expect minute wave iv to be around about the same duration, so it should last longer than one day.

Minute wave ii was a very deep expanded flat correction. So far it looks like minute wave iv may show alternation as a relatively shallow zigzag. Within the zigzag minuette wave (b) may not move above the start of minuette wave (a) at 1,284.99. Minute wave (iv) may be most likely to end about 1,268.07, the 0.382 Fibonacci ratio of minute wave iii.

Minuette wave (c) would be very likely to make a new low below the end of minuette wave (a) at 1,270.74 to avoid a truncation. This would mean minute wave iv does not remain within the parallel channel. Sometimes fourth waves are not contained within these channels.

Minute wave iv may not move into minute wave i price territory below 1,246.04.

When minute wave iv is completed then I would expect minute wave v upwards to move to a new high beyond the end of minute wave iii, and this should complete the five wave impulse for minor wave A.

This analysis is published about 05:15 p.m. EST.