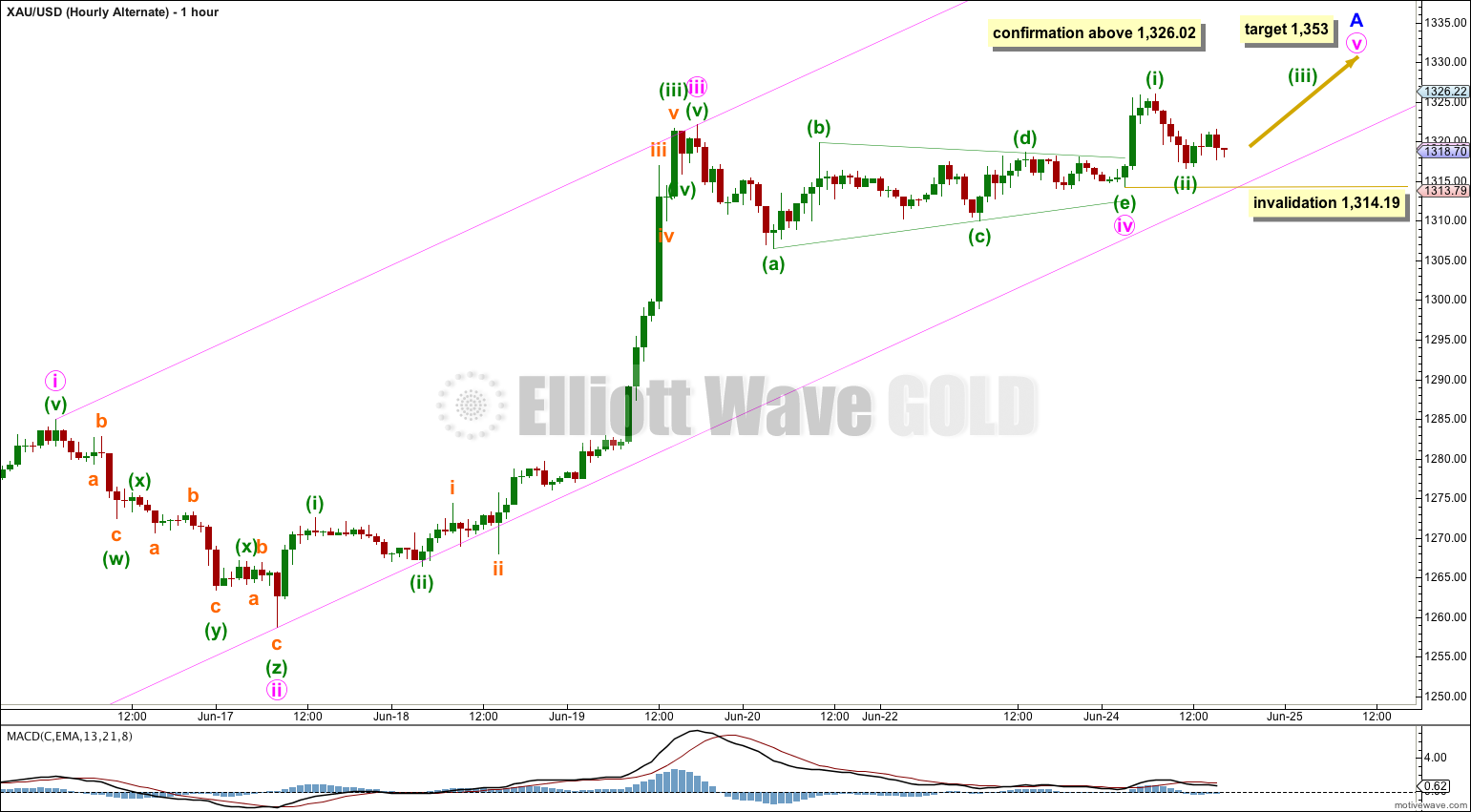

Yesterday’s Elliott wave analysis expected a small triangle to end and be followed by a sharp upwards thrust. This is what happened, but the target at 1,330 has not yet been met.

Summary: It is most likely upwards movement is over for the next two or three weeks. Movement below 1,314.19 would confirm this. Alternately, a new high above 1,326.02 would indicate more upwards movement as a long extended fifth wave, and the target for that is at 1,353.

Click on charts to enlarge.

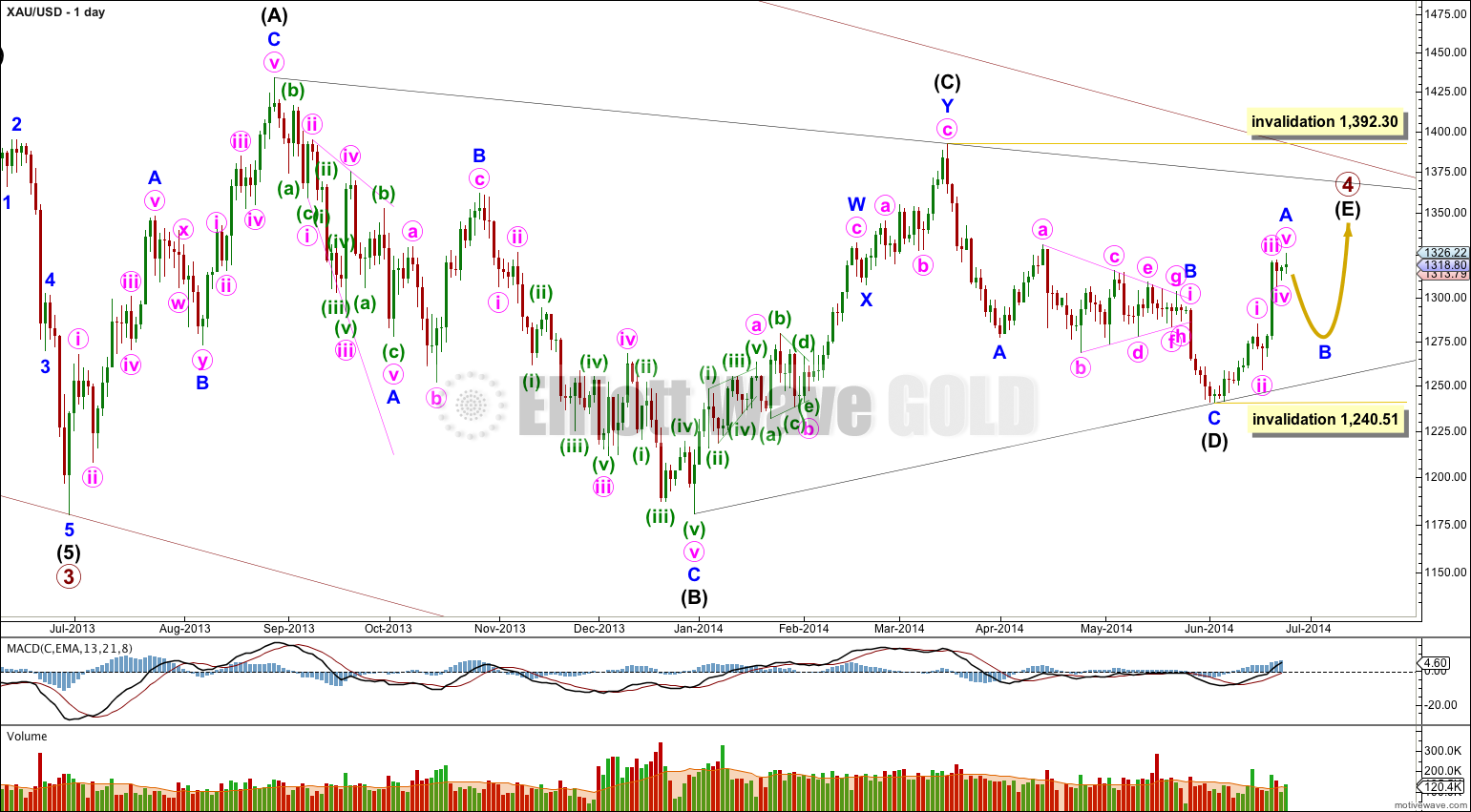

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days (no Fibonacci relationship), intermediate wave (B) lasted 88 days (just one day short of a Fibonacci 89), intermediate wave (C) lasted 53 days (just two days short of a Fibonacci 55) and intermediate wave (D) lasted 56 days (just one day more than a Fibonacci 55). If intermediate wave (E) exhibits a Fibonacci relationship then I would expect it to last either 34 or 55 days (give or take one or two days either side of these numbers). So far it has lasted only 15 days.

Main Hourly Wave Count.

Barrier triangles in fourth wave positions are commonly followed by either a short sharp thrust for a brief fifth wave, or a very long extended fifth wave. For this wave count considering the bigger picture at the daily chart level I judge a short sharp thrust to be the more likely of these two situations.

The fourth wave triangle for minute wave iv ended and was followed by a short sharp upwards thrust. This may be a complete minute wave v. I had expected it to be closer to $17 in length, but it may be over already at only $11.83 in length. Minute wave v has no adequate Fibonacci ratio to either of minute waves i or iii.

On the five minute chart the first small wave downwards from the high at 1,326.02 subdivides best as a five wave structure. This supports this main wave count.

To have confidence in this wave count I would first want to see a clear breach of the pink channel containing minor wave A. Draw this channel using Elliott’s first technique: draw the first trend line from the highs of minute waves i to iii, then place a parallel copy upon the low of minute wave ii. Minute wave iv is contained within this channel. When the channel is breached we have trend channel confirmation that minor wave A is over and minor wave B downwards has begun.

Price movement below 1,314.19 would provide full confidence that minute wave v is over as at that stage downwards movement cannot be a second wave correction.

Minor wave A lasted 15 days, or three weeks. I would expect minor wave B to be about the same duration, or longer. It may be very choppy and overlapping or it could be a swift sharp zigzag. There are more than thirteen possible corrective structures for a B wave and so once there is some structure to analyse it will be essential to have alternate wave counts for this movement.

Minor wave B may not move beyond the start of minor wave A below 1,240.51.

Alternate Hourly Wave Count.

Movement above 1,326.02 would invalidate the main hourly wave count and so confirm this alternate. At that stage minute wave v would not be a short sharp thrust but more likely a long extension.

By simply moving the degree of labeling within minute wave v down one degree it may be that just minuette wave (i) is complete.

At 1,353 minute wave v would reach 0.618 the length of minute wave i.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,314.19. Minuette wave (ii) should find support at the lower edge of the parallel channel.

This analysis is published about 05:00 p.m. EST.