Downwards movement was expected for both Elliott wave counts. The main and alternate Elliott wave counts remain mostly the same and still expect downwards movement should continue.

Summary: Downwards movement should continue to at least 1,280. If the lower black (B)-(D) trend line is breached in the next few days then the trend should remain down for much longer. What is more likely is that downwards movement will end about 1,280 in another couple of days and thereafter the next wave should be upwards.

Click on charts to enlarge.

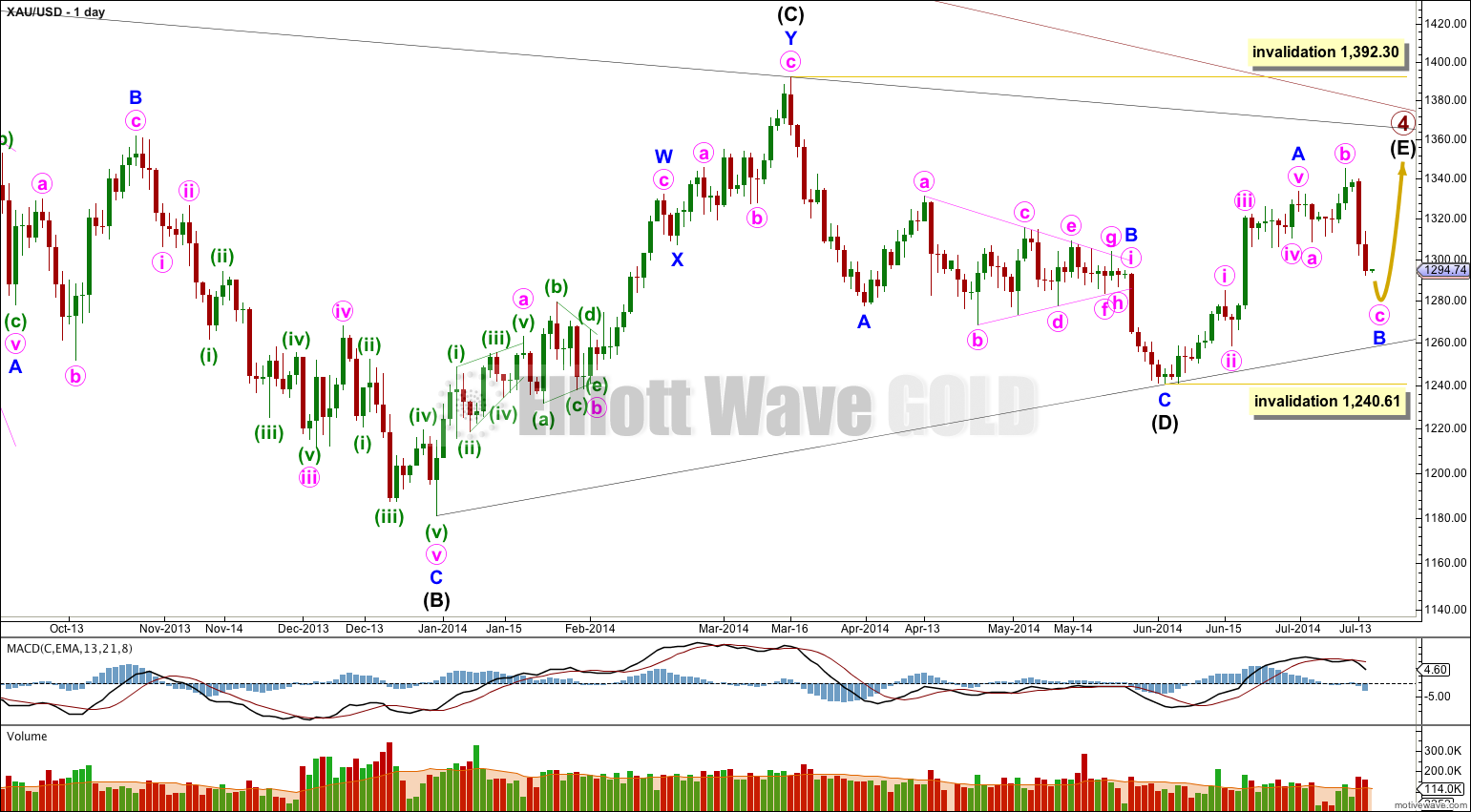

Main Wave Count.

It is likely that only minor wave A is complete and sideways movement is an incomplete minor wave B. This wave count could see primary wave 4 last another two weeks to complete in 56 weeks, just one week longer than a Fibonacci 55. It could also end very quickly this week, but I don’t think that would allow enough time for the structure to unfold.

Minor wave B may not move beyond the start of minor wave A below 1,240.61. Invalidation of this wave count at the daily chart level would provide full confidence in the alternate wave count.

If minor wave B moved substantially lower it should find very strong resistance at the (B)-(D) trend line. A breach of this trend line would look very atypical and at that stage this main wave count would significantly reduce in probability, so much so I would discard it.

B waves exhibit the greatest variety in form and structure of all waves. At this stage it looks like minor wave B is an expanded flat, which when it is done should have a similar look as minor wave B within intermediate wave (B) (at the left hand side of the chart).

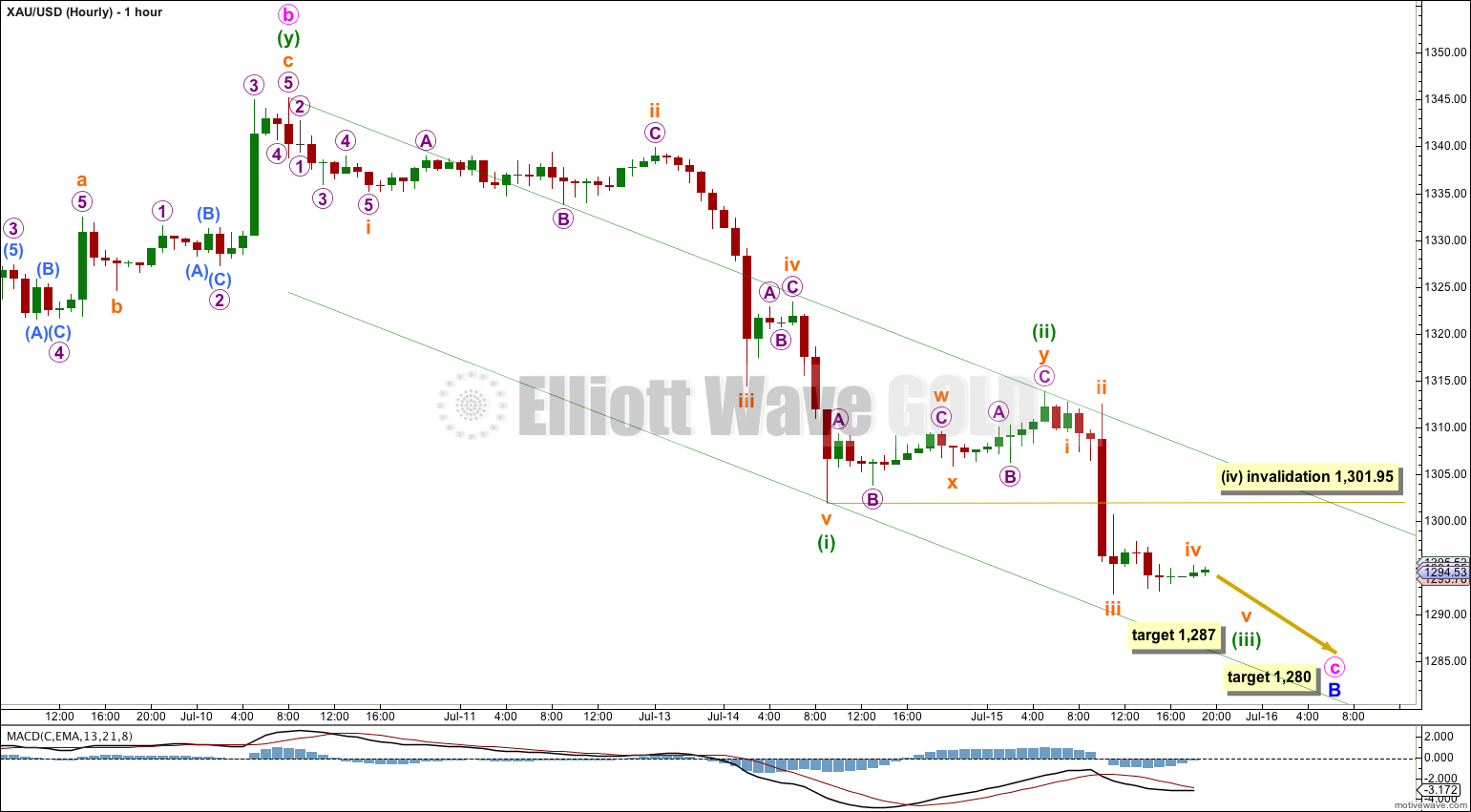

I have adjusted labeling of most recent movement again because minuette wave (i) more likely ended lower down. Minuette wave (ii) is a shallow double zigzag. Minuette wave (iii) is incomplete. At 1,287 minuette wave (iii) would reach 0.618 the length of minuette wave (i).

Minuette wave (iv) should be relatively deep and may not move back into minuette wave (i) price territory.

Thereafter, minuette wave (v) downwards should complete a five wave impulse. At 1,280 minute wave c would reach 2.618 the length of minute wave a.

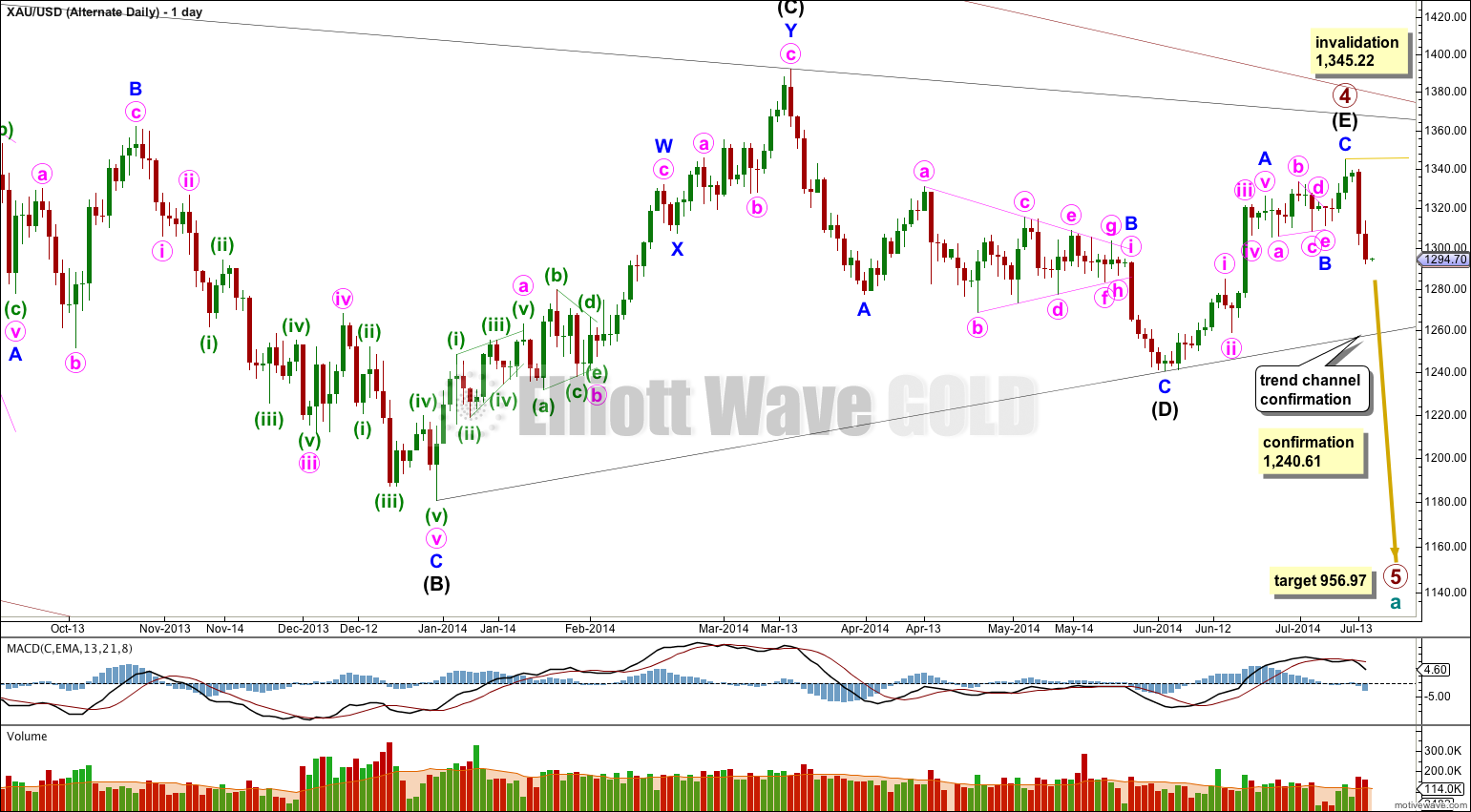

Alternate Wave Count.

It is possible that primary wave 4 is complete in a total 54 weeks, just one short of a Fibonacci 55 and just one week longer than primary wave 2 which was 53 weeks in duration.

The subdivisions for this alternate do not have as neat a fit as the main wave count:

– The triangle for minor wave B has an overshoot of the b-d trend line within minute wave c which looks significant on the hourly chart.

– At the end of minor wave A minute wave v does not subdivide well as a five wave structure on the hourly chart. This movement fits better as a three.

– Minor wave C subdivides here as a five wave structure, but it has a much better fit as a zigzag (which is how the main wave count sees it).

For the three reasons above this alternate has a lower probability. I would judge it at this stage to have a 20 – 30% probability.

In the short term both wave counts expect more downwards movement, so there is no divergence in expectations. The differentiating point is the lower (B)-(D) trend line here on the daily chart. If this trend line is breached by a full daily candlestick below it and not touching it then I would discard the main wave count and this alternate would be my only wave count.

Final price confirmation would come with movement below 1,240.61. At that stage the main wave count would be fully invalidated.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 1 was a remarkably brief three weeks in duration. Primary wave 5 could also be as brief, but it is more likely to show a little alternation and be longer lasting.

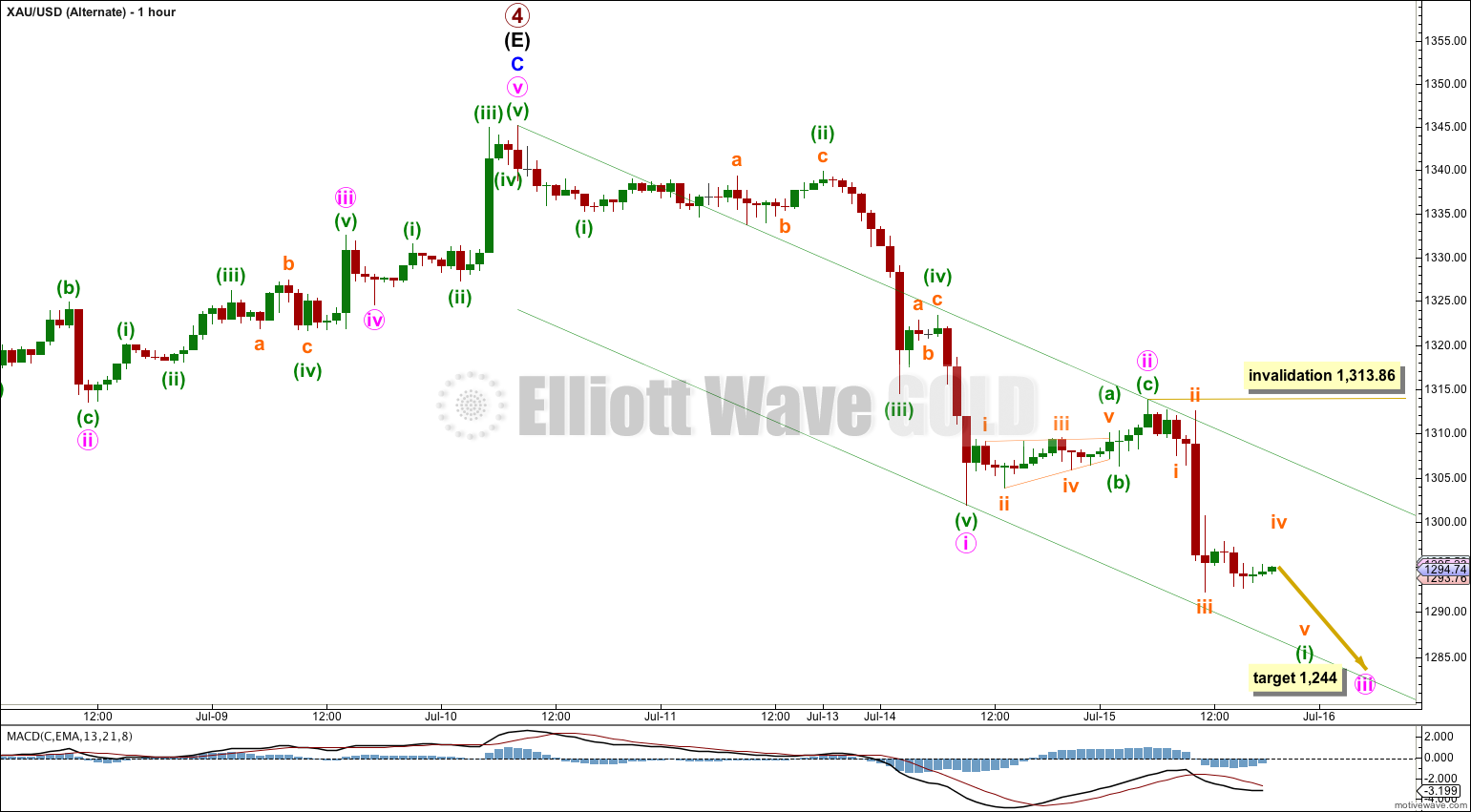

The labeling for downwards movement is mostly the same as the main wave count.

The target is different though. At 1,244 minute wave iii would reach 1.618 the length of minute wave i.

Within minute wave iii no second wave correction may move beyond the start of the first wave above 1,313.86.

This analysis is published about 09:02 p.m. EST.