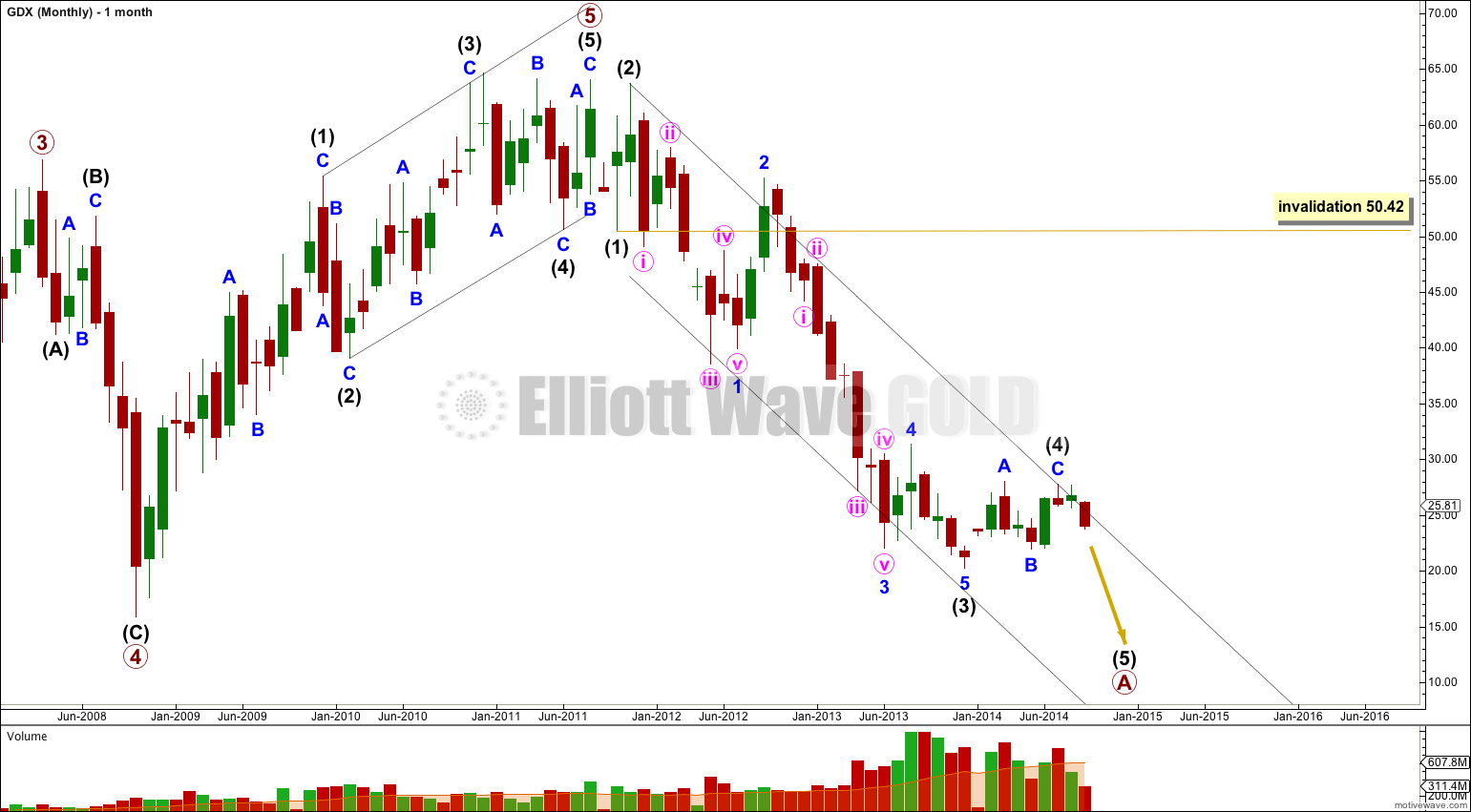

As expected GDX has moved lower. This Elliott wave count looks correct so far. We have some price confirmation with a new low below 25.59.

Click charts to enlarge.

The clearest piece of movement is the downwards movement from the high. This looks most like a first, second and third wave. This may be the start of a larger correction.

Intermediate wave (3) is $1.06 longer than 2.618 the length of intermediate wave (1).

Within intermediate wave (3) there are no Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within minor wave 1 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $2.19 longer than 0.618 the length of minute wave i.

Ratios within minor wave 3 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $0.63 longer than 0.382 the length of minute wave iii.

I have played with how to best draw a channel about this downwards movement, which does not fit perfectly into a channel drawn using either of Elliott’s techniques but does fit best if his first technique is used: draw the first trend line from the lows of intermediate waves (1) to (3), then place a parallel copy on the high of intermediate wave (2).

Intermediate wave (5) must subdivide as a five wave structure, either an impulse or an ending diagonal. So far the first five down for minor wave 1 is incomplete. If minor wave 1 completes as a five wave impulse then intermediate wave (5) must be unfolding as an impulse, because an ending diagonal requires all the subwaves to be zigzags.

At 22.32 minute wave iii would reach 2.618 the length of minute wave i.

Ratios within minuette wave (i) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.6489 short of 0.618 the length of subminuette wave i.

Ratios within minuette wave (iii) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is 0.13 longer than equality with subminuette wave iii.

I am not sure if minuette wave (iv) is complete or not; if not, minuette wave (iv) could move price further sideways and higher but may not move into minuette wave (i) price territory above 25.75. Minuette wave (ii) lasted four days and was a relatively deep 55% zigzag. Minuette wave (iv) may be a relatively shallow flat, triangle or combination.

Minute wave ii was a very deep expanded flat. When minute wave iv arrives I would expect it to most likely be a very shallow correction of minute wave iii. I also expect minute wave iv may be a very shallow zigzag, triangle or combination; should be a sideways movement; would most likely last up to 21 days; and may be more brief than this if it is a zigzag as they do tend to be briefer structures.

At this stage I would expect the target at 22.32 to be about one or two weeks away.

At 14.15 intermediate wave (5) would reach equality in length with intermediate wave (1). This target is likely to be several weeks away.

*Note: My last calculation for this target was wrong.