Last Elliott wave analysis for Silver (and GDX) expected the trend was down. It turns out this was correct, as it has been confirmed for Gold today.

Although the alternate wave count for Silver is not technically invalidated, I expect it should be within another couple of weeks. I will just present the one wave count for you today, with Gold, Silver and GDX all in alignment.

Click on charts to enlarge.

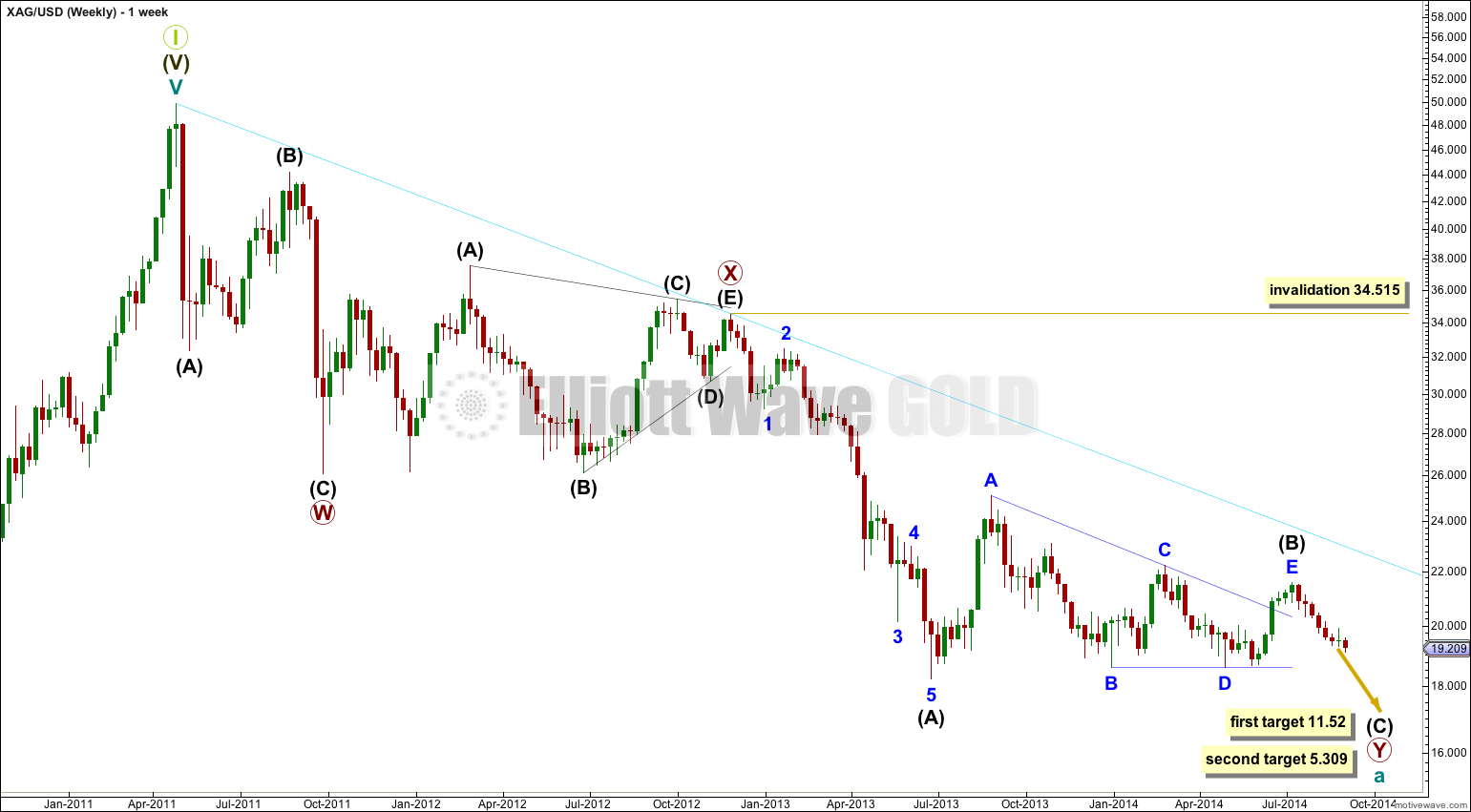

Downwards movement subdivides so far as an incomplete double zigzag. This cannot be an impulse if the movement which I have labeled primary wave X is correct as a triangle because a triangle may not be the sole structure in a second wave position.

The first zigzag in the double is labeled primary wave W. The double is joined by a “three”, a triangle, in the opposite direction labeled primary wave X.

The second zigzag for primary wave Y is moving price lower to deepen the correction, and so this structure has a typical double zigzag look in that it has a clear slope against the main trend.

Within primary wave Y the triangle for intermediate wave (B) is now a complete barrier triangle. Movements following triangles, and particularly barrier triangles, have a tendency to be relatively short and brief. The higher target has a higher probability for this reason.

Within primary wave Y at 11.52 intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 5.309 intermediate wave (C) would reach equality in length with intermediate wave (A).

Within primary wave Y intermediate wave (A) lasted 30 weeks, and intermediate wave (B) lasted exactly a Fibonacci 54 weeks. I would expect intermediate wave (C) to end in a total 21 or 34 weeks. So far it has lasted 8, so it may yet continue towards the target for a further 13 or 26 weeks if it exhibits a Fibonacci duration. However, please note, Silver does not reliably exhibit Fibonacci durations nor do its waves reliably exhibit Fibonacci ratios to each other in terms of duration. This expectation of another 13 or 26 weeks can only be a rough guideline.

The triangle for intermediate wave (B) is very likely to be complete. It is a barrier triangle: the B-D trend line is essentially flat (in fact, minor wave D ends very slightly below the end of minor wave B by 0.004). This may indicate a brief movement to follow for intermediate wave (C).

Intermediate wave (C) downwards should subdivide as a five wave structure, either an impulse (most likely) or an ending diagonal (less likely). At this stage it is far too early to tell which structure may unfold although an impulse does look to be what is happening.

Minor wave 1 is incomplete, and it is unfolding as a simple impulse. Within it the middle of a third wave has passed. There are no Fibonacci ratios between minuette waves (iii) and (i), nor any Fibonacci ratios within the subdivisions of minuette wave (iii). This is slightly unusual for Silver.

Minute wave iii has no Fibonacci ratio to minute wave i. I would expect it likely we should see a Fibonacci ratio for minute wave v. At 18.913 minute wave v would reach equality in length with minute wave i. This target has the higher probability because it expects the most common relationship for minute wave v. At 18.693 minute wave v would reach 0.618 the length of minute wave iii. This target has a slightly lower probability.

Minor wave 1 so far fits nicely in an Elliott channel: draw the first trend line from the highs labeled minute waves ii to iv, then place a parallel copy on the low labeled minute wave iii. I would expect minute wave v to end about the lower edge of that channel, or possibly to overshoot the channel if a strong extended fifth wave develops.

Most importantly this channel may be used to confirm the end of minor wave 1. When there is one full daily candlestick above the upper pink trend line, and not touching it, then I would have confidence that minor wave 1 is over and minor wave 2 has begun. At that stage the invalidation point would be moved right up to the start of minor wave 1 at 21.579 and I would expect minor wave 2 to last a few weeks.

For now minute wave v is incomplete. While it is underway no second wave correction may move beyond its start above 19.907.