I am changing the wave count at the daily chart level. I have more confidence in this wave count today.

Click charts to enlarge.

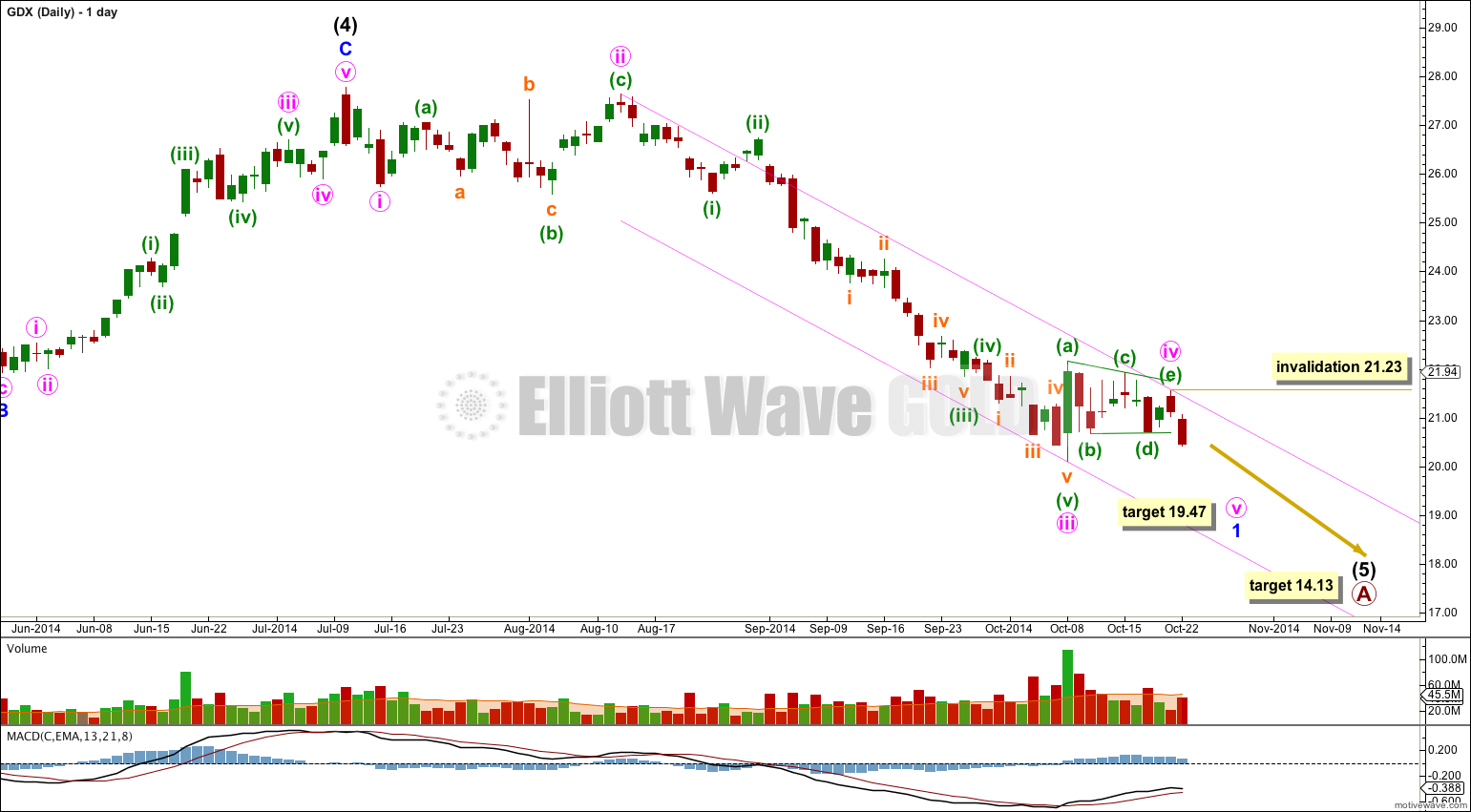

Sideways movement over the last week or so fits nicely as a barrier triangle. Now minute waves ii and iv are better in proportion, and the wave count has a better look.

Minute wave ii was a very deep expanded flat and minute wave iv is a very shallow triangle; there is good alternation between them.

I would expect a short fifth wave to follow the barrier triangle of minute wave iv. At 19.47 minute wave v would reach equality in length with minute wave i. As there is no Fibonacci ratio between minute waves iii and i it is more likely that minute wave v would exhibit a Fibonacci ratio with either of i or iii, and equality with minute wave i is the most common ratio. This target has a very good probability.

Ratios within minute wave iii are: minuette wave (iii) is 0.40 short of 2.618 the length of minuette wave (i), and minuette wave (v) is just 0.04 longer than equality with minuette wave (i). This gives a little more confidence that this portion of the wave count is right.

Redraw the channel about minor wave 1: draw the first trend line from the highs labeled minute waves ii to iv, then place a parallel copy on the low labeled mintue wave iii. I would expect minute wave v to end midway within the channel or about the lower edge, with midway more likely.

While minute wave v is unfolding no second wave correction within it may move beyond the start of its first wave above 21.23.

As soon as minute wave v may be seen as complete then the invalidation point must move right up to the start of minor wave 1 at 27.78. Minor wave 2 should last at least a couple of weeks and may be very deep.

The long term target remains the same. At 14.13 intermediate wave (5) would reach equality in length with intermediate wave (1). Intermediate wave (5) should last several more weeks. It is already longer in duration that intermediate wave (1).