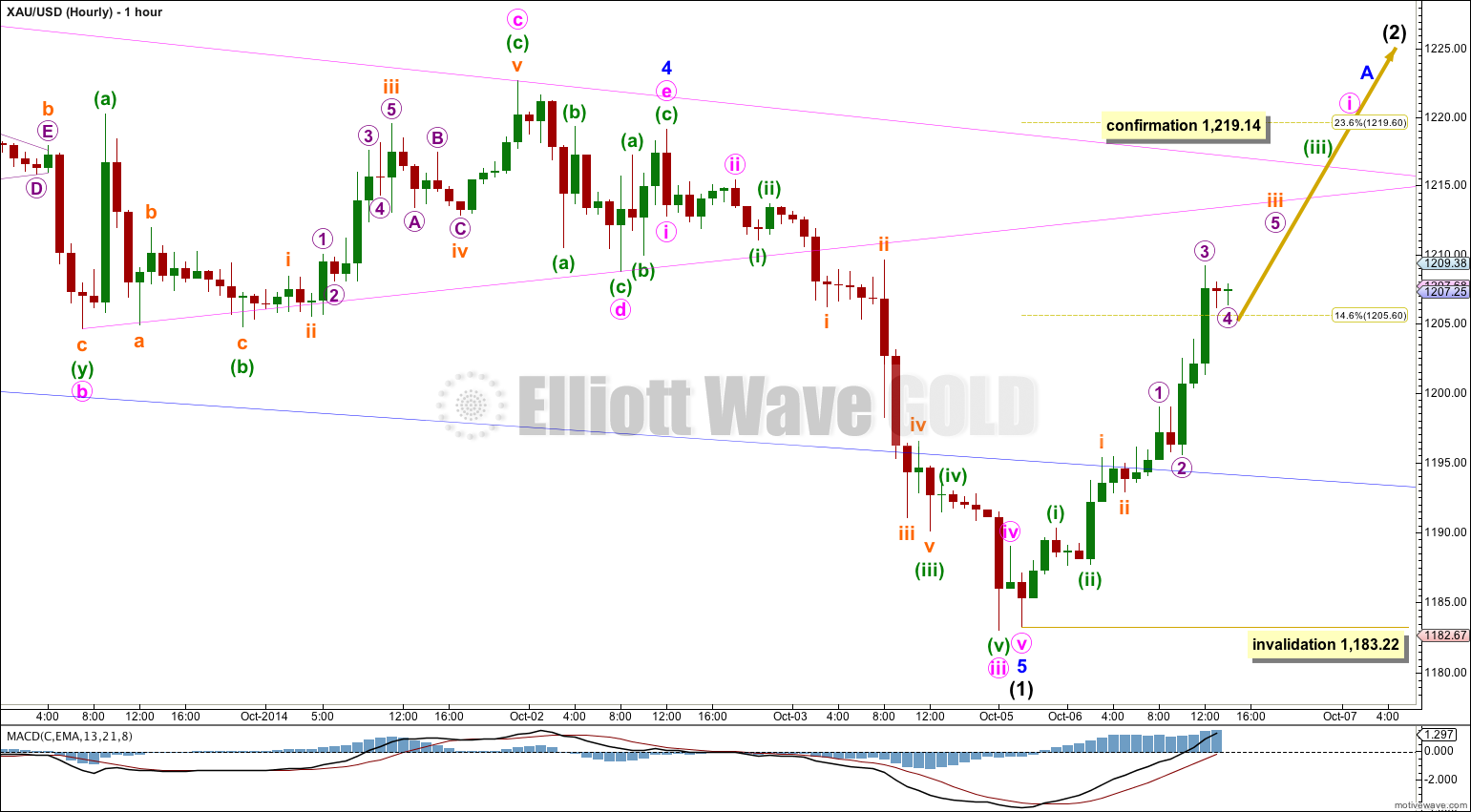

Downwards movement continued for a little, which as expected, and was followed by a deep upwards movement which was also expected for minute wave ii (as labeled in last Elliott wave analysis).

I have two wave counts for you today.

Summary: Intermediate wave (1) may be over. A breach of 1,219.14 would confirm it. I expect this idea is about 55-60% likely. Alternatively, a new low below 1,183.06 would indicate intermediate wave (1) is incomplete. I expect this alternate idea is about 40-45% likely.

Click on charts to enlarge.

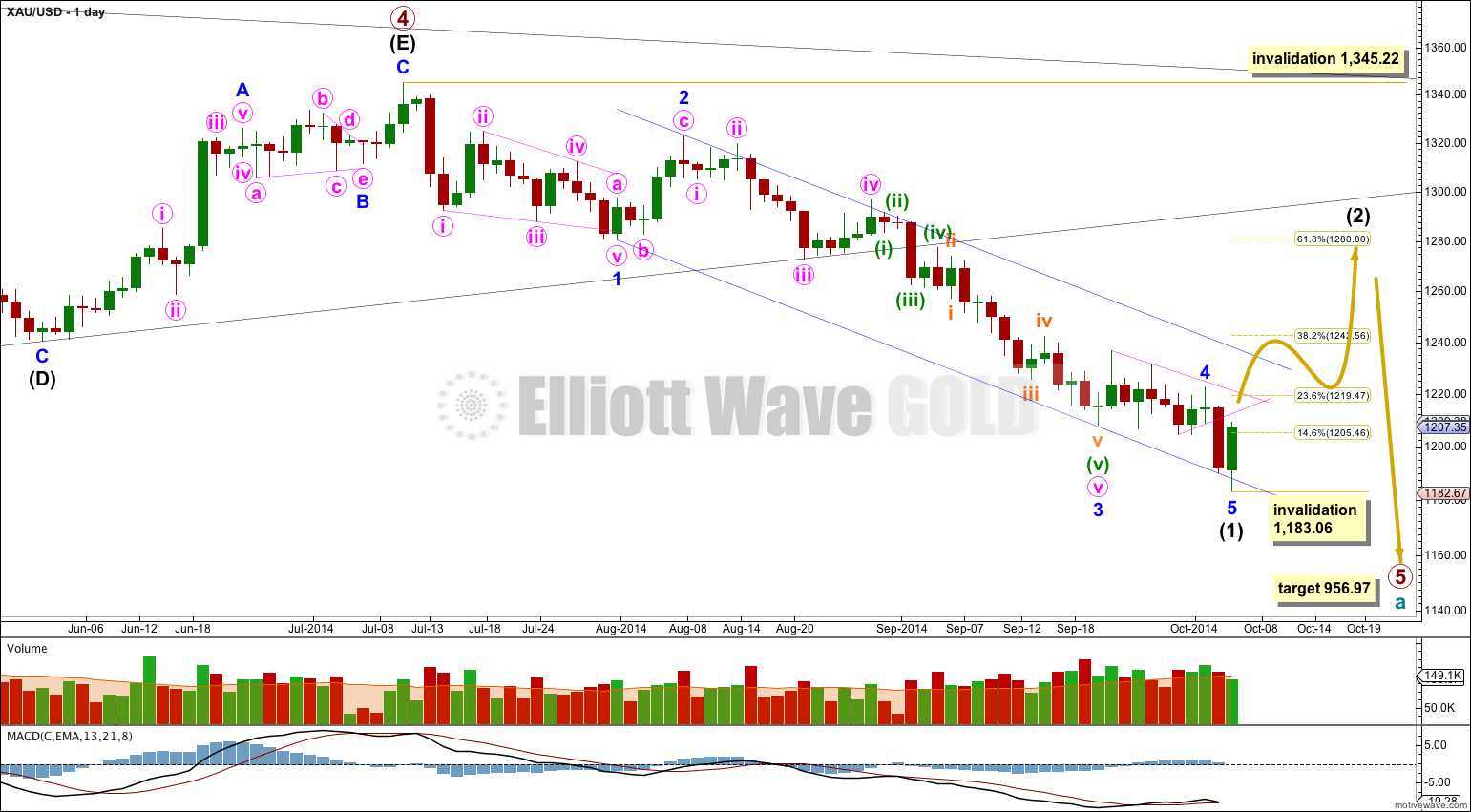

Main Wave Count

On the weekly chart extend the triangle trend lines of primary wave 4 outwards. The point in time at which they cross over may be the point in time at which primary wave 5 ends. This does not always work, but it works often enough to look out for. It is a rough guideline only and not definitive. A trend line placed from the end of primary wave 4 to the target of primary wave 5 at this point in time shows primary wave 5 would take a total 26 weeks to reach that point, and that is what I will expect. Primary wave 5 is beginning its 13th week.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1, and equality between primary waves 5 and 1 would give a perfect Elliott relationship for this downwards movement.

However, when triangles take their time and move close to the apex of the triangle, as primary wave 4 has (looking at this on a weekly chart is clearer) the movement following the triangle is often shorter and weaker than expected. If the target at 956.97 is wrong it may be too low. In the first instance I expect it is extremely likely that primary wave 5 will move at least below the end of primary wave 3 at 1,180.40 to avoid a truncation. When intermediate waves (1) through to (4) within primary wave 5 are complete I will recalculate the target at intermediate degree because this would have a higher accuracy. I cannot do that yet; I can only calculate it at primary degree.

Minor wave 3 is $9.65 longer than 1.618 the length of minor wave 1. This variation is less than 10% the length of minor wave 3 and so I would consider it an acceptable Fibonacci ratio. Just. At 1,154 minor wave 5 would reach equality in length with minor wave 1. When I can add to the target calculation at minute degree this target may change, and if it changes it may move higher.

Movement comfortably below 1,180.84 would provide further confidence in this main wave count as at that stage an alternate idea which sees primary wave 4 as continuing as a barrier triangle would be invalidated.

Draw a channel about intermediate wave (1): draw the first trend line from the lows labeled minor waves 1 to 3, then place a copy on the high labeled minor wave 2. The slight overshoot of the lower edge of this channel indicates minor wave 5 may be over there. Intermediate wave (2) should breach the upper edge of this channel.

Intermediate wave (2) may end close to a Fibonacci ratio of intermediate wave (1). Only because second waves are more commonly deep than shallow is the 0.618 ratio at 1,280.80 slightly favoured. But it does not have to be this deep. When I know where minor waves A and B within this correction have ended then a target should be calculated using the ratio between minor waves A and C.

Intermediate wave (2) is most likely to be a zigzag, but it may also be one of several other possible corrective structures. Due to the large degree the first movement should be a five up. Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22.

This is my main wave count for three reasons:

1. Upwards movement from the low looks most like an incomplete impulse. This looks to be too large for a minute degree second wave, and looks more like the start of an intermediate degree correction, which looks incomplete.

2. Fifth waves following fourth wave triangles are often relatively short and brief. I have been caught out before with this, and have learned the hard way that it should be expected as very likely, not just considered as an alternate.

3. Minor wave 5 overshot the lower edge of the blue channel.

Minor wave 5 moved a little lower after last analysis and may have ended with a very slightly truncated fifth wave. I have checked minute wave v on the five minute chart and it does fit as an impulse.

If minor wave 5 is over already it has no Fibonacci ratio to either of minor waves 1 or 3.

Within minor wave 5 there are no adequate Fibonacci ratios between minute waves i, iii and v.

Ratios within minute wave iii are: there is no Fibonacci ratio between minuette waves (i) and (iii), and minuette wave (v) is 0.9 longer than 0.382 the length of minuette wave (iii).

Ratios within minuette wave (iii) are: subminuette wave iii is 1.03 short of 2.618 the length of subminuette wave i, and subminuette wave v has no adequate Fibonacci ratio to either of subminuette waves iii or i.

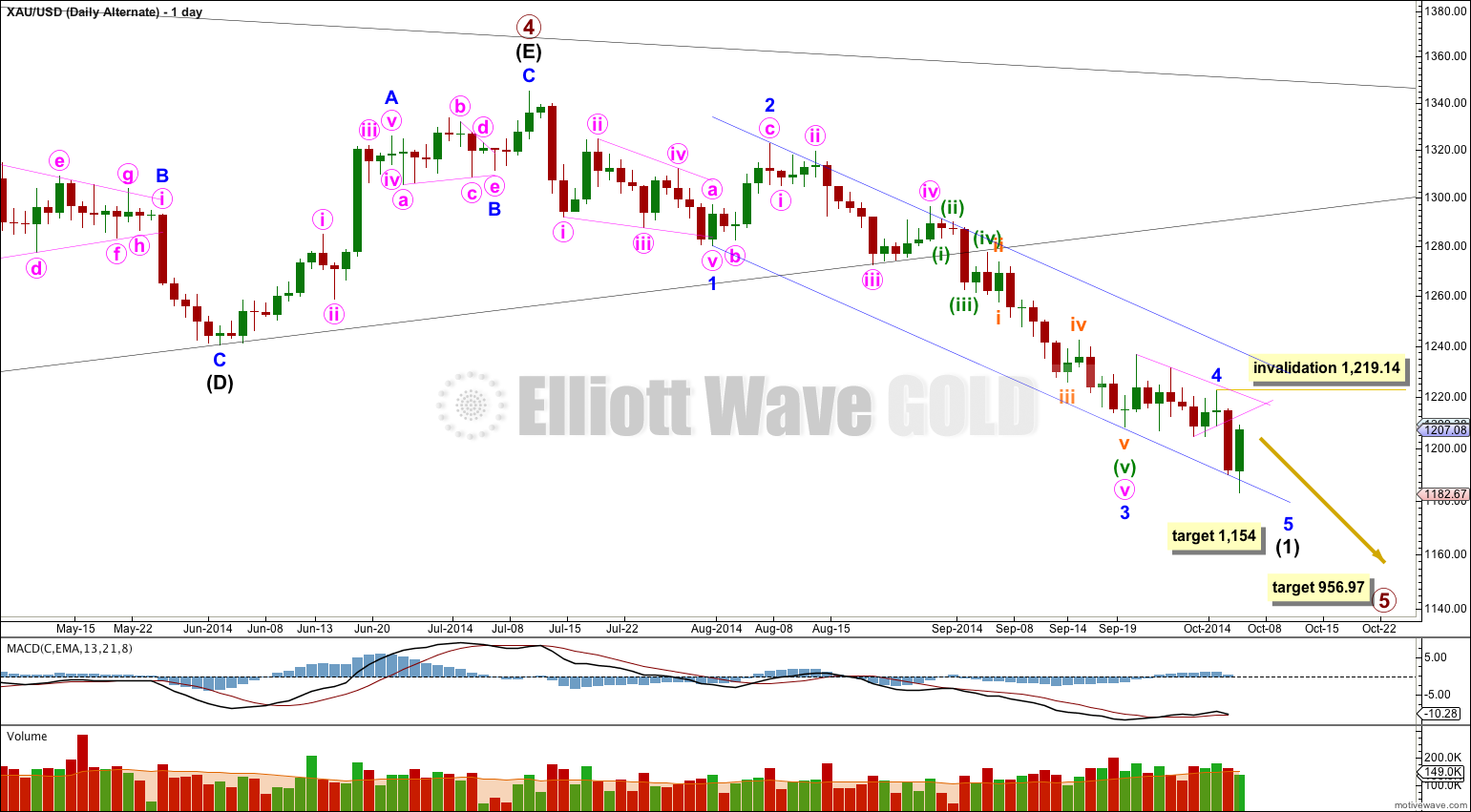

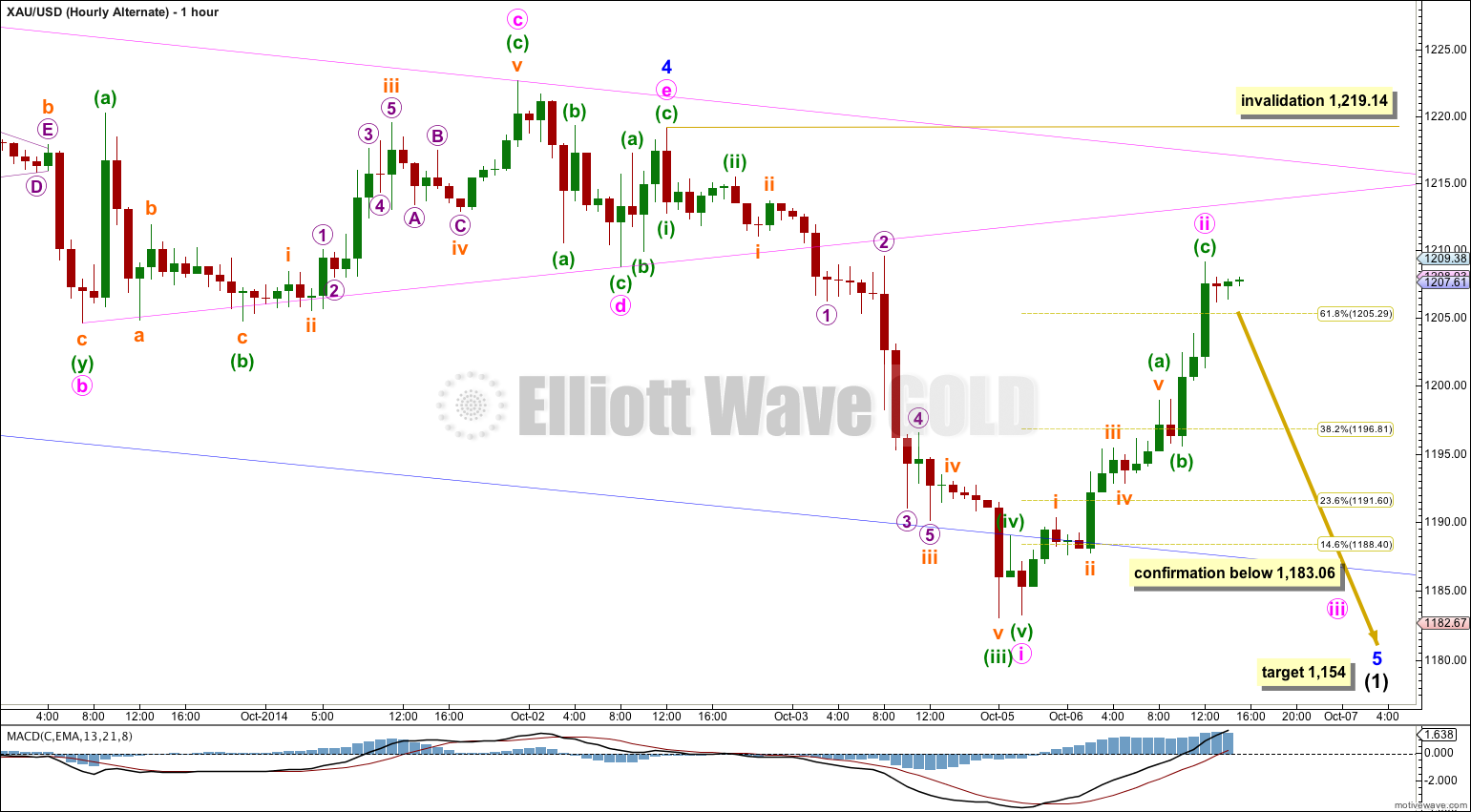

Alternate Wave Count

It is still quite possible that minor wave 5 is incomplete. Upwards movement may be minute wave ii within minor wave 5.

At 1,154 minor wave 5 would reach equality in length with minor wave 1.

Within minor wave 5 minute wave ii may not move beyond the start of minute wave i above 1,219.14.

If upwards movement is minute wave ii then it has already reached above the 0.618 Fibonacci ratio of minute wave i. So far the structure can be seen as a complete zigzag, and zigzags do sometimes look like this. Further upwards movement would change the labeling within minute wave ii.

For this alternate idea minute wave ii must have a corrective wave count; it must have a total of 3, 7, 11 etc. (add a further count of 4 for each extension). So far the count is 7. If the count is impulsive (5, 9, 13 etc.) it would not fit this wave count.

If upwards movement is a minute degree second wave then it should be over here. A third wave down should follow very soon. I have not calculated a target for minute wave iii for you because if it were to reach 1.618 the length of minute wave i it would end just below the target for minor wave 5 at 1,154.

Minute wave iii must make a new low below the price territory of minute wave i below 1,183.06.

Minute wave ii may not move beyond the start of minute wave i above 1,219.14.

This analysis is published about 04:09 p.m. EST.