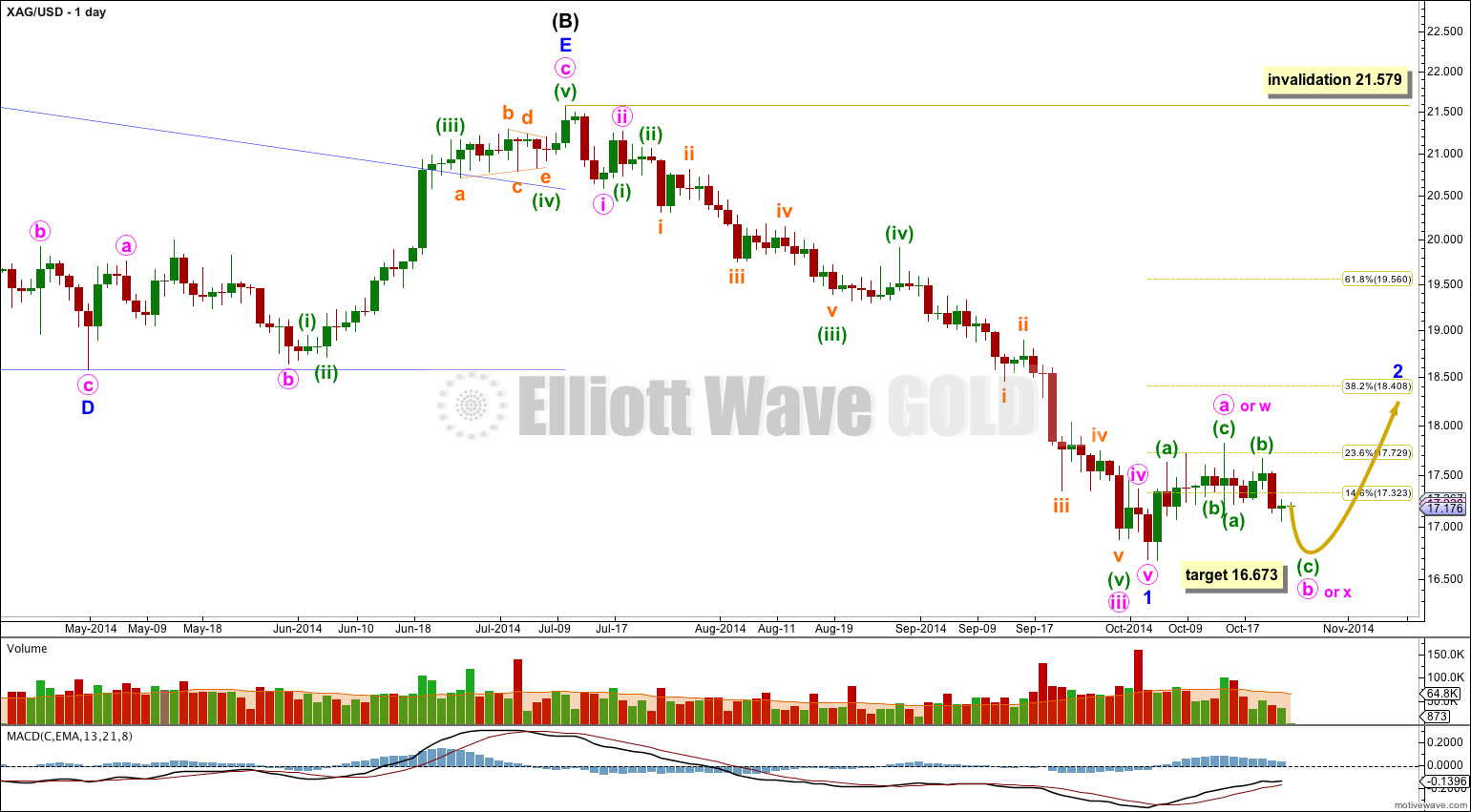

Sideways movement has confirmed an end to minor wave 1.

Click on charts to enlarge.

At this stage it looks like minor wave 2 may be a shallow correction, maybe only reaching up to the 0.382 Fibonacci ratio of minor wave 1 at 18.408. Second waves are most commonly deep corrections, but they are not always deep. That is a tendency not a rule.

So far minor wave 2 may be labeled minute wave a-b-c or w-x-y.

So far the first upwards movement within minor wave 2 subdivides as a zigzag. This may be either minute wave a within a flat correction for minor wave 2, or the first zigzag in a double zigzag for minor wave 2, or a zigzag as the first structure of a combination for minor wave 2.

If minor wave 2 is a flat correction then within it minute wave b must reach a minimum 90% length of minute wave a at 16.799. Minute wave b must subdivide as a three wave structure.

If minor wave 2 is a double zigzag then minute wave x should be a relatively shallow correction. The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough. To achieve this purpose their X waves are normally very shallow.

If minor wave 2 is a double combination then minute wave x be a deep correction. The purpose of double combinations is to take up time and move price sideways. To achieve this purpose their X waves are commonly rather deep (and may be very time consuming).

Within minute wave b downwards (or minute wave x) at 16.673 minuette wave (c) would reach 1.618 the length of minuette wave (a).

If minor wave 2 is an expanded flat or combination then minute wave b or x may make a new price extreme beyond the start of minute wave a or w. A new low below 16.685 is possible. There is no lower invalidation point for this reason.