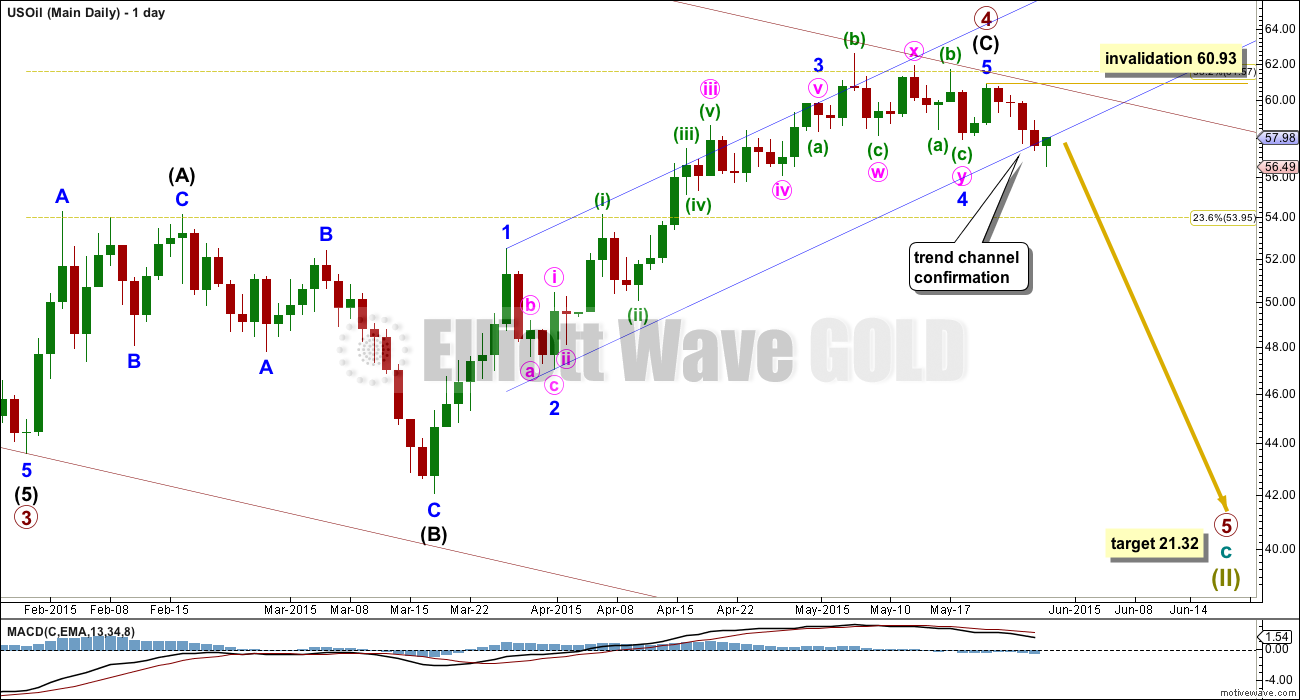

US Oil did not continue higher towards the target which was at 64.39. It has turned lower.

Summary: Upwards movement looks to be over. I am waiting now for trend channel confirmation of a trend change. When that comes I will have some confidence that primary wave 4 is over and primary wave 5 down has begun. The target for primary wave 5 is 21.32. This may be met in five or eight months time.

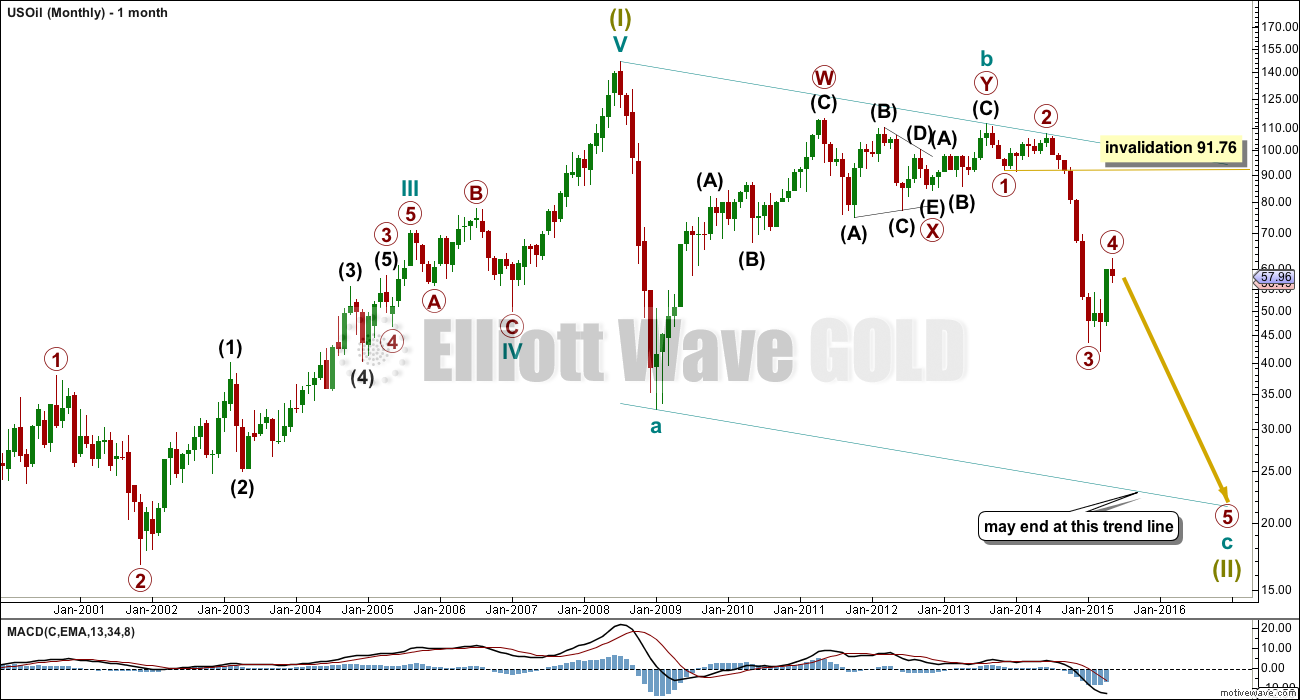

This wave count sees US Oil as within a big super cycle wave (II) zigzag. Cycle wave c is highly likely to move at least slightly below the end of cycle wave a at 32.70 to avoid a truncation. Cycle wave c may end when price touches the lower edge of the big teal channel about this zigzag.

Within cycle wave c, primary wave 5 is expected to be extended which is common for commodities.

Primary wave 4 may not move into primary wave 1 price territory above 91.76.

It looks like primary wave 4 is over. The breach of the channel about intermediate wave (C) needs to be clearer though before I have confidence in this trend change.

When there is a full daily candlestick below the lower edge of this channel and not touching it, that shall provide a clear trend channel breach. At that stage, I will look for a throwback to the lower blue trend line and I may decide to enter a short position there. I will be looking to enter at the high of a second wave correction, but only if the throwback does not breach the trend line. This may happen in another three or so days time. If it unfolds as I expect, I will update members with charts before I enter a short for US Oil.

Intermediate wave (C) has no adequate Fibonacci ratio to intermediate wave (A).

Ratios within intermediate wave (C) are: there is no Fibonacci ratio between minor waves 3 and 1, and minor wave 5 is just 0.03 longer than 0.236 the length of minor wave 3.

Minor wave 5 is not truncated, because it moved beyond the end of minor wave 3, but did not manage to make a new high beyond the price extreme of minor wave 4.

Minor waves 2 and 4 exhibit perfect alternation: minor wave 2 was a relatively deep 0.52 zigzag and minor wave 4 was a very shallow 0.15 double flat.

At 21.32 primary wave 5 would reach 0.618 the length of primary wave 3. The lower edge of the big teal green channel on the monthly chart may be a better way to see when the next wave down is over though. I will expect downwards movement to be over when the target is reached or the channel is touched, whichever comes first.

Within the new downwards trend, no second wave correction may move beyond the start of the first wave above 60.93.

This analysis is published about 01:18 a.m. EST.

Friday Is Judgment Day In Crude Oil’s Financial Cold War

Jun. 4, 2015 5:34 AM ET

http://seekingalpha.com/article/3235276-friday-is-judgment-day-in-crude-oils-financial-cold-war

Lara today US oil price broke down and closed below the channel line. It appears wave v has begun.

Pls comment?????

Lara, price has returned to channel. And there’s minor 5 invalidation if I read this right. Is 4 going into tripple zigzag? Just looking at daily right now

Lara wrote: “Intermediate wave (C) has no adequate Fibonacci ratio to intermediate wave (A).”

If this is an expanded flat than wave c extension be witnin fib of 100% to 150% of wave A????

Currently wave c is 194%. Must be over or close to be over.

Is this an expanded flat???

We touched 60.64? Do let us know when you consider short,Thanks

Lara, thanks, nice update. Will just wait and watch for a few days.

Oil is roaring higher this morning…probably wont get the full daily candlestick trend channel breach today.

No, no breach. If a stop was set at the invalidation point it would have a low risk for an entry, but for me I’m not happy with that this morning. I’m not confident enough in this wave count to try and enter a short here. I’m going to wait a few days yet.