Upwards movement was not expected.

Price has so far reached to just below a short term invalidation point.

Summary: The bear wave count still requires more downwards movement to a minimum at 1,165.76. The bull count requires upwards movement to a minimum 1,195.71. There is no clear trend, and the bear wave count (which is slightly favoured at this point) sees Gold in a B wave within a second wave correction. Of all Elliott waves, B waves exhibit the greatest variety in form and structure, and low degree B waves do not normally offer good trading opportunities.

To see the bigger picture and weekly charts go here.

Changes to last analysis are italicised.

Bull Wave Count

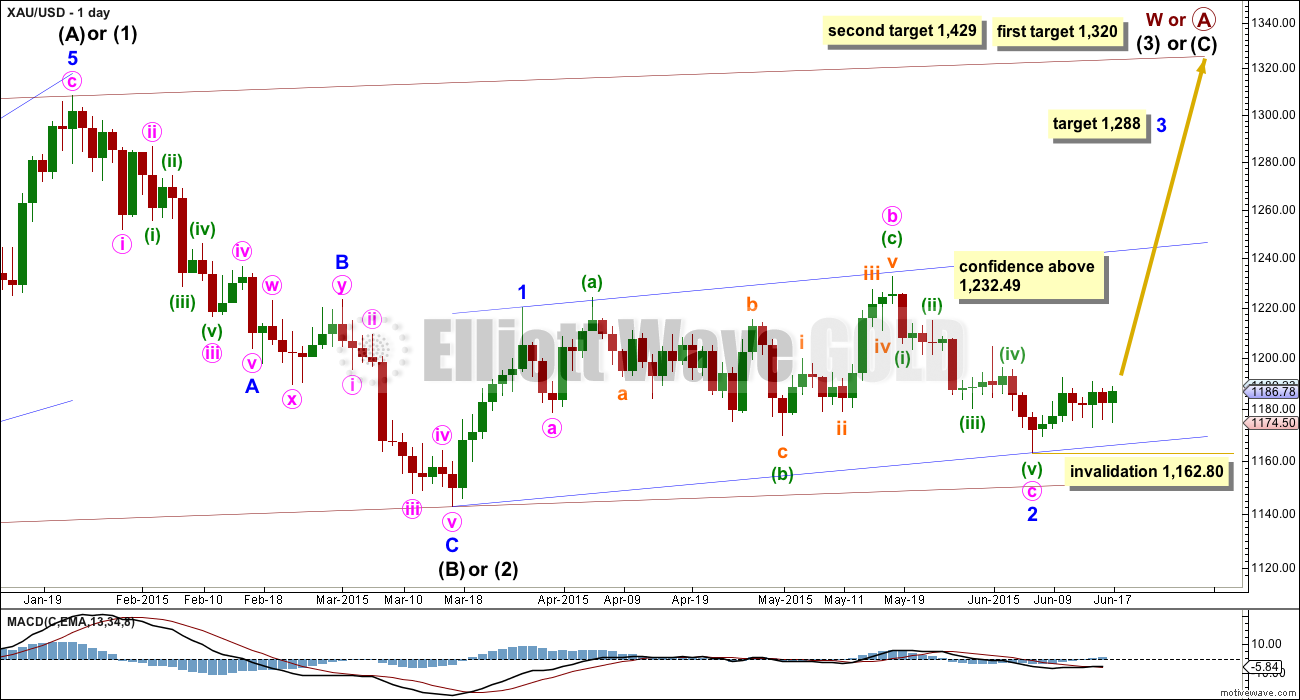

The bull wave count sees primary wave 5 and so cycle wave a a complete five wave impulse on the weekly chart.

Pros:

1. The size of the upwards move labelled here intermediate wave (A) looks right for a new bull trend at the weekly chart level.

2. The downwards wave labelled intermediate wave (B) looks best as a three.

3. The small breach of the channel about cycle wave a on the weekly chart would be the first indication that cycle wave a is over and cycle wave b has begun.

Cons:

1. Within intermediate wave (3) of primary wave 5 (now off to the left of this chart), to see this as a five wave impulse requires either gross disproportion and lack of alternation between minor waves 2 and 4 or a very rare running flat which does not subdivide well. I have tried to see a solution for this movement, and no matter what variation I try it always has a major problem.

2. Intermediate wave (5) of primary wave 5 (now off to the left of the chart) has a count of seven which means either minor wave 3 or 5 looks like a three on the daily chart.

3. Expanding leading diagonals (of which intermediate wave (A) or (1) is) are are not very common (the contracting variety is more common).

4. Volume does not support this bull wave count.

For volume to clearly support the bull wave count it needs to show an increase beyond 187.34 (30th April) and preferably beyond 230.3 (9th April) for an up day. Only then would volume more clearly indicate a bullish breakout is more likely than a bearish breakout.

Within cycle wave b, primary wave A may be either a three or a five wave structure. So far within cycle wave b there is a 5-3 and an incomplete 5 up. This may be intermediate waves (A)-(B)-(C) for a zigzag for primary wave A, or may also be intermediate waves (1)-(2)-(3) for an impulse for primary wave A. At 1,320 intermediate wave (C) would reach equality in length with intermediate wave (A) and primary wave A would most likely be a zigzag. At 1,429 intermediate wave (3) would reach 1.618 the length of intermediate wave (1) and primary wave A would most likely be an incomplete impulse.

Intermediate wave (A) subdivides only as a five. I cannot see a solution where this movement subdivides as a three and meets all Elliott wave rules (with the sole exception of a very rare triple zigzag which does not look right). This means that intermediate wave (B) may not move beyond the start of intermediate wave (A) below 1,131.09. That is why 1,131.09 is final confirmation for the bear wave count at the daily and weekly chart level.

Intermediate wave (C) is likely to subdivide as an impulse to exhibit structural alternation with the leading diagonal of intermediate wave (A). This intermediate wave up may be intermediate wave (3) which may only subdivide as an impulse.

Minor wave 2 is over here. Minute wave c is just 2.7 longer than 1.618 the length of minute wave a. At 1,288 minor wave 3 would reach 1.618 the length of minor wave 1.

Within minor wave 3, no second wave correction may move beyond its start below 1,162.80.

A new high above 1,232.49 would eliminate the bear wave count and provide full confidence in the targets.

Hourly Bull Wave Count

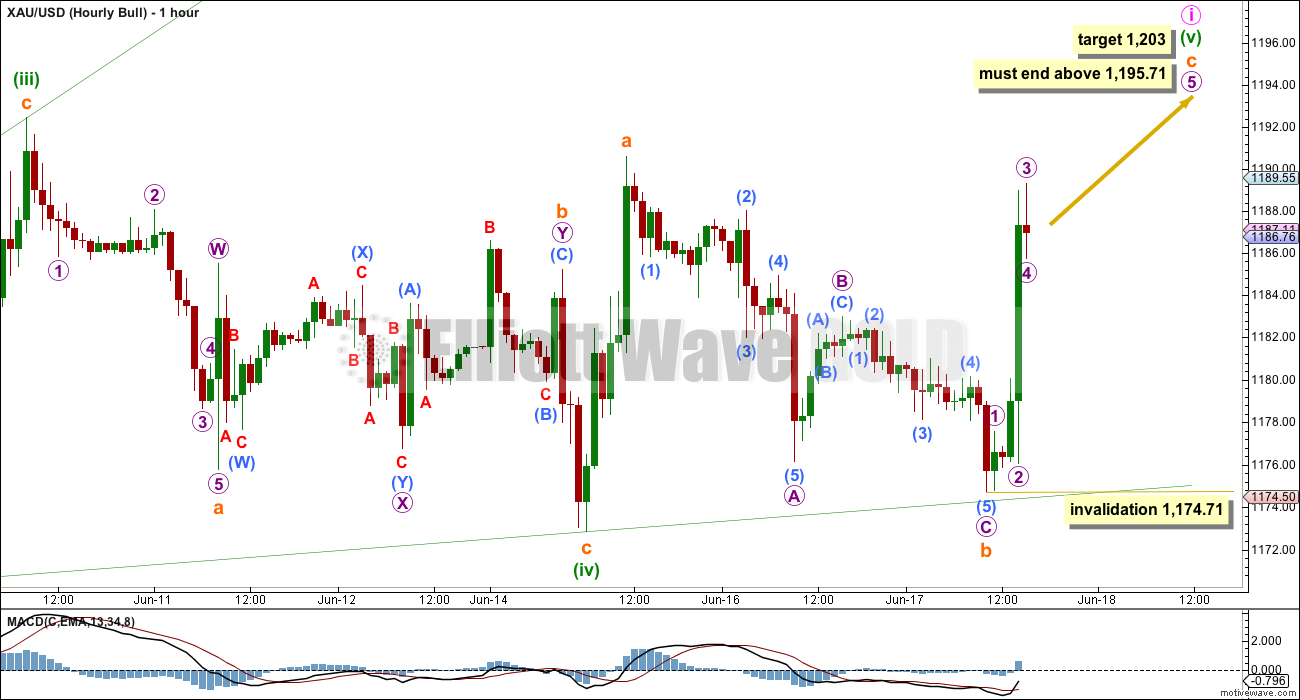

Minute wave i must subdivide as a five wave structure, either an impulse or a leading diagonal. Leading diagonals are most commonly contracting, with the expanding variety not so common. This rarity reduces the probability of this wave count.

Leading diagonals require the second and fourth waves to subdivide as zigzags, and the fourth wave must overlap first wave price territory, which this one does. The first, third and fifth waves are also most often zigzags.

The most common depth of second and fourth waves within diagonals is between 0.66 to 0.81 the prior wave. Here minuettte wave (ii) is 0.54 and minuette wave (iv) is 0.86. Neither are within normal range further slightly reducing the probability of this wave count.

Within minuette wave (iv) zigzag, subminuette wave b is labelled as a double zigzag, but it has an atypical look. This structure moves sideways, whereas double zigzags should have a clear slope against the main trend and not a sideways look.

If minuette wave (v) has begun, then it must be longer than minuette wave (iii), because the diagonal is expanding, and must reach above 1,195.71. Leading diagonals may not have truncated fifth waves so minuette wave (v) must end above the end of minuette wave (iii) at 1,192.44.

At 1,203 subminuette wave c would reach 1.618 the length of subminuette wave a.

Within subminuette wave c, no second wave correction may move beyond its start below 1,174.71.

Bear Wave Count

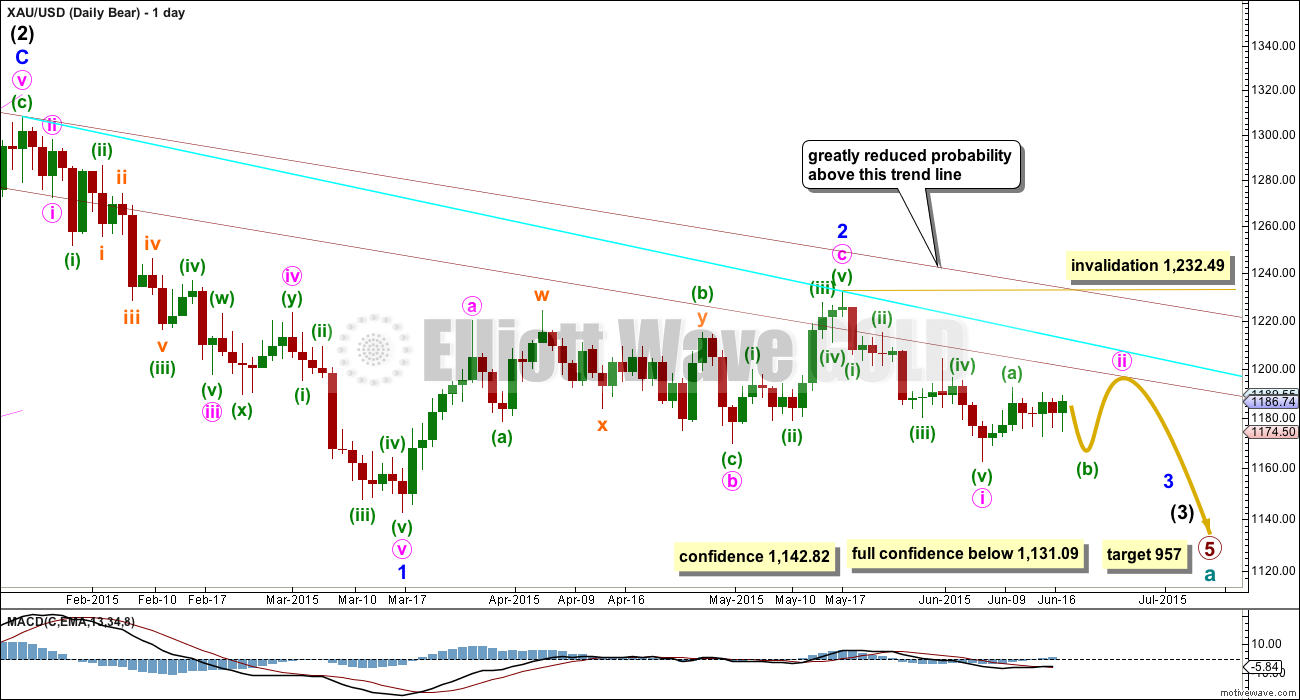

This wave count follows the bear weekly count which sees primary wave 5 within cycle wave a as incomplete. At 957 primary wave 5 would reach equality in length with primary wave 1.

Pros:

1. Intermediate wave (1) (to the left of this chart) subdivides perfectly as a five wave impulse with good Fibonacci ratios in price and time. There is perfect alternation and proportion between minor waves 2 and 4. For this piece of movement, the bear wave count has a much better fit than the bull wave count.

2. Intermediate wave (2) is a very common expanded flat correction. This sees minor wave C an ending expanding diagonal which is more common than a leading expanding diagonal.

3. Minor wave B within the expanded flat subdivides perfectly as a zigzag.

4. Volume at the weekly and daily chart continues to favour the bear wave count. Since price entered the sideways movement on 27th March it is a downwards week which has strongest volume, and it is downwards days which have strongest volume.

5. On Balance Volume on the weekly chart recently breached a trend line from back to December 2013. This is another bearish indicator.

Cons:

1. Intermediate wave (2) looks too big on the weekly chart.

2. Intermediate wave (2) has breached the channel from the weekly chart which contains cycle wave a.

3. Minor wave 2 is much longer in duration than a minor degree correction within an intermediate impulse normally is for Gold. Normally a minor degree second wave within a third wave should last only about 20 days maximum. This one is 44 days long.

4. Within minor wave 1 down, there is gross disproportion between minute waves iv and ii: minute wave iv is more than 13 times the duration of minute wave i, giving this downwards wave a three wave look.

Minor waves 1 and 2 are complete. Minute wave i within minor wave 3 may be incomplete on the hourly chart.

Minute wave ii may not move beyond the start of minute wave i above 1,232.49.

A new low below 1,142.82 would provide a lot of confidence in this bear wave count. At that stage, the bull wave count may not be continuing its second wave correction. But only a new low below 1,131.09 would invalidate any variation of a bull wave count and provide full and final confirmation for a bear wave count.

Main Hourly Bear Wave Count

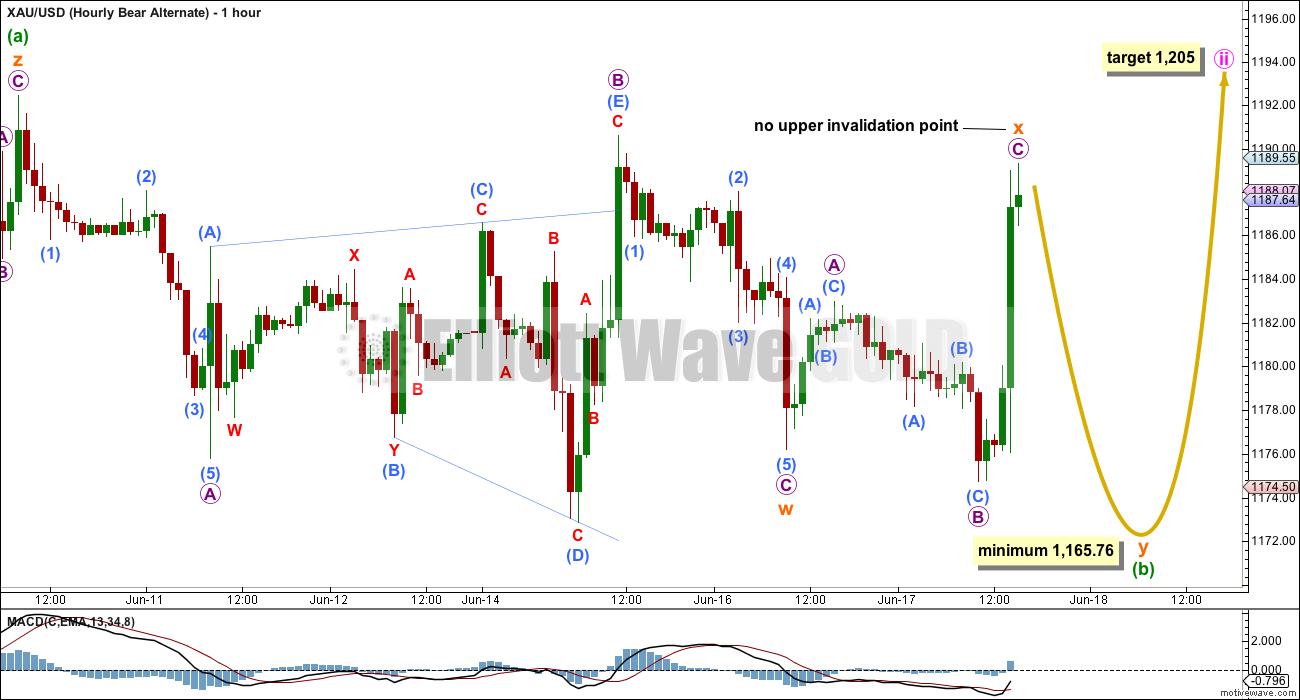

The structure of minuette wave (a) is the key to this correction for minute wave ii. This upwards movement (now off to the left of the chart) subdivides perfectly as a triple zigzag; it will not subdivide as a five because it fits neither as an impulse nor a complete diagonal. The first wave within minute wave ii is a multiple, which eliminates the possibility of a combination because multiples may not exist within multiples. The maximum number of corrective structures within a multiple is three.

When A waves subdivide as threes a flat correction is indicated, and because minuette wave (a) is a corrective structure a zigzag may be eliminated for minute wave ii.

Minute wave ii may only be a flat correction (at least, the first structure within it must be a flat). This requires minuette wave (b) to reach a minimum 90% retracement of minuette wave (a) at 1,165.76. At 1,164 subminuette wave c would reach 1.618 the length of subminuette wave a.

Within subminuette wave c, micro wave 2 may not move beyond the start of micro wave 1 above 1,190.61. If this main wave count is correct, then a third wave down must begin from here.

If upwards movement continues above 1,190.61, then I will use the alternate below. It is concerning for this wave count today that micro wave 2 is so deep and time consuming; I would not have expected to see it show up on the daily chart.

Alternate Hourly Bear Wave Count

There are multiple structural possibilities for minuette wave (b). The only thing required of it is that it moves back down to 1,165.76 or below.

Of all Elliott waves, it is B waves which exhibit the greatest variety in form and structure, from quick sharp deep zigzags to very time consuming complicated combinations. At the daily chart level, the last five daily candlesticks look like a typical B wave so far.

This alternate wave count looks at the possibility that minuette wave (b) may be a double combination or double zigzag. The first structure in the double is a zigzag labelled subminuette wave w. Within it, micro wave C is slightly truncated reducing the probability of this wave count to an alternate. The subdivisions all fit.

Within a double combination, the X wave may make a new price extreme beyond the start of the first structure in the double labelled subminuette wave w. Subminuette wave x has no upper invalidation point and may move above 1,192.44.

Within a double zigzag, the X wave is normally a quick shallow zigzag. This one is a deep expanded flat, so a double combination may be more likely than a double zigzag.

The second structure in the double may be either a zigzag (while X is below 1,192.44), flat or triangle, and must end at 1,165.76 or below.

Technical Analysis

Weekly Chart: Overall volume still favours a downwards breakout eventually. During this sideways movement, it is still down days and a down week which have higher volume. On Balance Volume breaches a trend line (lilac line) which began in December 2013, and the breach is significant.

While price has made higher lows, On Balance Volume has made lower lows (green trend lines). This small rise in price is not supported by volume, and it is suspicious.

Daily Chart: ADX remains very low and declining. ADX is very clear: there is no trend. The market remains range bound, and a range trading system is best employed as opposed to a trend following system. Trading range bound markets is inherently more risky than trading a trending market. It is essential that good money management techniques are employed to avoid wiping out your account in this type of market. A good rule to follow may be to risk no more than 2% of equity in any one trade.

The last five days sees volume declining while price moves sideways. This looks like a typical correction. The sloping blue trend line is no longer providing resistance.

The range bound system illustrated here uses horizontal lines of support and resistance with fast Stochastics to indicate the end of each swing. However, price can move substantially above and below the horizontal lines at the end of each swing and this illustrates the risk involved in trading this market. It is impossible to tell exactly where and when each swing ends and the next one begins.

This approach now expects an upwards swing from here to end only when price finds resistance at the upper horizontal lines and Stochastics is again overbought.

This analysis is published about 05:04 p.m. EST.

Gold up in 3 ways today worldwide reaction to FED FOMC. Greece talk breakdown today. China stock market bubble fears.

Despite ratio problems, I’m still going with my triangle idea and still making money. Here is my rough chart. Beware of thrust out of triangle .

Jaf

Jaff, thanks, would like to see your chart but it’s very small, unreadable.

Increase the size of your font a few times.

Jaf, thanks for the update. Looking good. Didn’t you have a GDX chart also? Bob

I’ll try to clean up and increase font after midnight tonight. GDx is similar although it seems to be leading the downside and lagging to the upside.

Will post GDx too

I meant for readers to see the chart you’ve uploaded in better detail all we need to do is to increase the font size on our screens a few times.

I don’t think you need to increase the font size on your chart.

Upsize Google to 300% and chart fills screen.

Lara,

Did gold peak for today for both Bull and Bear and do both have a big drop coming next near term? If the bull is suddenly more likely how low could it’s minute ii wave drop down to? Is hourly bear alternate minute wave ii complete now or just wave C x then down to 1165 area?

I’m thinking of shorting gold by buying DUST but only if both bull & bear are retracing deep down near term.

My conclusion is yes, for both bull and bear that’s it for now.

Both will expect a big drop.

The bull because the leading diagonal is now complete, and second wave corrections following first wave leading diagonals are often very deep.

The bear now expects the middle of a third wave to begin down from here.

Any further upwards movement should find resistance at the blue line on the bear daily chart.

Thanks Lara you’re the best there is in!

Ben Lockhart interesting charts and looking to layer shorts. He is an EW expert.

Ben Lockhart , Contributor

Comments (1669)| + Follow | Send Message

Author’s reply » Folks, gold has a sketchy 5 down and the 3 wave retrace hit perfectly on the 618 today, which was also the low end of the range I posted yesterday.. sure we can go a touch higher but IMO it’s time to start layering in shorts..

http://bit.ly/1K0SV9L

http://bit.ly/1FFymPm

silver also retraced to a standard fib and dropped pretty quickly.. if it gets another little wave down that’s 5 from the top and the retrace should be a good short candidate with a stop just above today’s high.

http://bit.ly/1K0SV9N

I know everyone is expecting this seasonal rally, but the set ups are bearish from a chart perspective.. don’t shoot the messenger – just calling it as I see it.

18 Jun, 02:00 PMReply

I believe gold already peaked for today at 1205.84 at 11:21 am and will be headed down much lower.

I’m curious if Lara will become more bullish now or if the hourly bear alternate can somehow still be more likely and if so how today will fit into it as it looks like gold skipped the big drop to 1165 before heading up to 1205 or if today was the bear alternate top of C x in some strange EW way?

The US Dollar $DXY dropped 1% from 2 pm FOMC yesterday 94.6 to it’s low today at 8:30 am at 93.6

Currently Gold price appears to be basing off 1198 looking to seek a leg higher perhaps up to 1215…. I wouldn’t go chasing it with price so close to the upper band and hourly RSI tagging 70+ with upside risk at 200dma/20weekMA (1206-07). On the downside, need to see Gold price break below 1198, 1195, 1190, 1185…. I am sure Lara’s analysis later will clarify the situation.

I think the bear count will need to be reworked. Gold could be in a 4th wave, with a final 5th wave up to come. That may ultimately take gold to 1210 or low teens. The aqua line on the daily bear seems like a reasonable place for upward movement to stop.

The bear wave count does need to be reworked.

Looking at this move up on the daily chart it looks so far like A-B-C if the bear count is correct. That sideways move of the prior five days does look like a B wave.

So for the bear minute wave ii may be over here or very soon indeed. If it keeps going higher it should find resistance at the blue trend line on the daily chart for the bear.

Volume is higher today at 150.7k, but that’s still not the strongest volume since 27th March. That was 230.3k on 9th April, 187.8k on 30th April, 181.8k on 29th April and 176.9k on 16th April. All down days. Five of them.

Volume on the weekly chart is still strongest for a down week.

So volume still favours a bearish breakout eventually.

ADX continues to show no clear trend. That approach expected an upwards swing from here, and now that’s what we’re getting.

I believe there is a good possibility that the USD put in a major low today. That was one of the biggest (inverse) contributors to gold’s recent rise.

This will be interesting to watch. A few people I listen to are saying this is a bounce in the USD and looking for 92’s, along with a steeper drop in the USDJPY (which Gold movements seem to stick to like glue).

I will be taking a little more profit today/tomorrow on my longs. My opinion is that I don’t expect much to change between today and tomorrow because of OPEX, and GDX is about where I thought it would be between $19 and $19.5, and GLD is about $115.

Gold is ignoring the bounce in the USD, USDJPY, and Yields today.

Well, I think gold did take advantage of the dollar’s drop but stalled once the dollar started to recover. I would say that the USD may be on the cusp of a 3rd wave up.

We are definitely still left with diverging possibilities.

Lara: could today’s movement be part of the final C wave to complete minute wave ii? Gold has reached the 0.618 retracement, so the price target has been satisfied. However, I am still struggling to find a first wave for C that is a five.

Yes. I have a solution for that, it abandons the triple zigzag idea and sees minuette (a) as a short leading contracting diagonal. It doesn’t have the best look, but the subdivisions fit.

Which means minute wave ii could be over here or very soon. I’ll be taking a close look at how many subdivisions are in this upwards wave to see if it could be over or if it needs more up to go.

I am just thinking: If gold price were not to get above 1206-07 (upper band/200dma) and come back down to break below 1197-95 would then look to see the downside….

Lara, hi.

Sure looks like the bull chart has reached its target… but the alt. bear has no upward invalidation point– is there any way the EW count on the alt bear would be able to be moved up one degree putting us at the minute ii pink? Its the notorious question — is it bull or is it bear.

The bear count needs to be reworked for minute wave ii.

It looks like my analysis of minuette wave (a) as a triple zigzag was wrong.

Gold’s Seasonal and COT rules ????

On June 15 Richard post:

http://www.gunner24.com/newsletter/nl-061415/

Sold my $8.95 NUGT for $10.16 this morning.

Still holding remaining longs for now.

Ben, congrats, you made the call on nugt.

Thanks! Tough to tell if we are in bull or bear, but I was inclined to believe OPEX would work like a magnet and pull miners and gold up.

Also, recall I rode a position in JNUG from $19.60 to $27, and then back down to $20.05, so I decided it was time to put a few bucks in the bank along the way.

Smart to take profits on a jump up today like this in gold and JNUG.

Took 15% of my longs off the table just a moment ago, with JNUG at $23.10.

Matt, where do you expect gold to go from here?

I’m trying to do counts right now to see where they could have been viewed differently. However, I would say that gold is close to it’s peak and this is a shorting opportunity. Gold could go up another few dollars, but not much.

Thanks. If I were to short here, what should my stop be?

For now I would just use the aqua line on the daily bear chart to show where resistance should lie.

If minute wave ii is supposed to divide as a 3-3-5, then superficially it would appear that gold just finished, or is finishing, the 3rd wave of 5 up for a c wave. However, looking closer, the 1st wave (ended at 1190.61) of this alleged c wave only subdivides as a three. It should be a five. Perhaps someone else can take a stab at this.

All in all, I would be surprised if the x wave in the alt bear were this long.

Thanks again

I agree, it’s too high for an X wave. I don’t think that’s what it is.

I’m going with A-B-C zigzag for minute ii, abandoning the triple zigzag for minuette wave (a).

I have pointed this out several times. The level of physical buying is huge and unprecedented.

This is not being reflected in the futures prices which are a leveraged non delivery paper market which is rigged by the central banks through the usual culprits like Goldman Sachs, JP Morgan et al.

Although the Western central banks would love to keep gold down and have peddled bearish sentiment the game is up.

Asian buying is massive and relentless.

Price has just moved above 1190.61, hence invalidating the Main Hourly Bear count.

What do you make of the current movement, is it the alternate bear or the main bull in play?

It can be either. Lara says there is no upper invalidation point for the Alternate Bear.

For the Alternate Bear, it means that minuette B is likely to be an expanded flat.

Just a caveat. Technically, the bear has an upper invalidation point of 1232.42.

Once price has reached the zenith, and starts to fall, that movement may differentiate between Bull and Alternate Bear, and I say “may” not “will”. Bull cannot move below 1162.80. Alternate Bear can (and in so doing, it will result in an expanded flat for its Minute 2 wave). Since Alternate Bear must move below 1165.76, there is a good possibility that a differentiation can be made.

As both counts call for a drop soon, this provides a good opportunity for a quick short today.

Don’t you think that this must be the final c already and that the count was incorrect? Gold is practically at the 0.618 retracement.

I am just wondering: 1165 looks like a long shot given that Gold price would now need to break below 1184-81 for 1176 and with the lower band moved up to 1169…. Just waiting for this upside to conclude, seems to be having trouble getting past 1189-90 which looks likely to break above…

Hi all!

Is it possible that wave 2 is a triangle and is almost over?

No, because a triangle may not be the sole corrective structure in a second wave position.

Put another way…. second waves can’t subdivide as triangles.

Lara: was the x wave in the alt bear supposed to be a 3 wave structure? While you’re answering this, what do you make of gold’s movement since your published analysis? Could the 1st of a 3rd wave down be complete, with a 2nd wave close to completion as well? Thanks.

The X wave in the bear alt is an expanded flat correction, in the same way that micro wave 2 is an expanded flat for the main bear hourly.

The movement since publication looks like a separate wave, it’s time consuming enough to be. On the 5 minute chart this sideways move breaches any channel drawn about the prior upwards move.

But on the 5 minute chart it’s so choppy and overlapping, it’s not easy to see if the down is a five or three, and the up is a five or three.

It could be a 1-2 down, or it could also (less likely) be a 4-5 up to complete the correction.