I will let Gold lead. For this reason only I will not publish a bull wave count for GDX.

GDX does not appear to have sufficient volume for Elliott wave analysis of this market to be reliable. It exhibits truncations readily, and often its threes look like fives while its fives look like threes. I will let my Gold analysis lead GDX, and I will not let GDX determine my Gold analysis for this reason.

Changes to last analysis are bold.

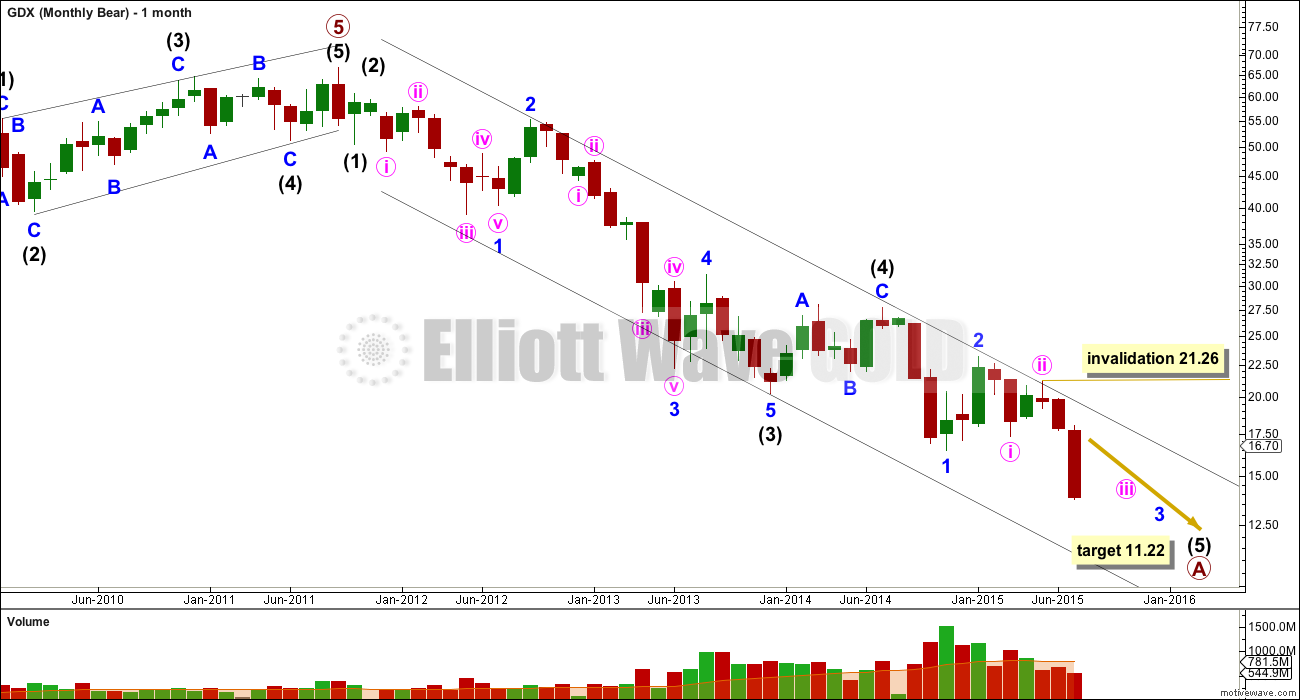

MONTHLY ELLIOTT WAVE COUNT

Price remains within the best fit channel on the monthly chart. A five wave structure down is completing, which may be an A wave within a larger correction.

Within minute wave iii, a second wave correction may not move beyond its start above 21.26.

At 11.22 intermediate wave (5) would reach equality in length with intermediate wave (1).

At this stage, regular technical analysis strongly favours the bear wave count. A downwards trend is clear and strong.

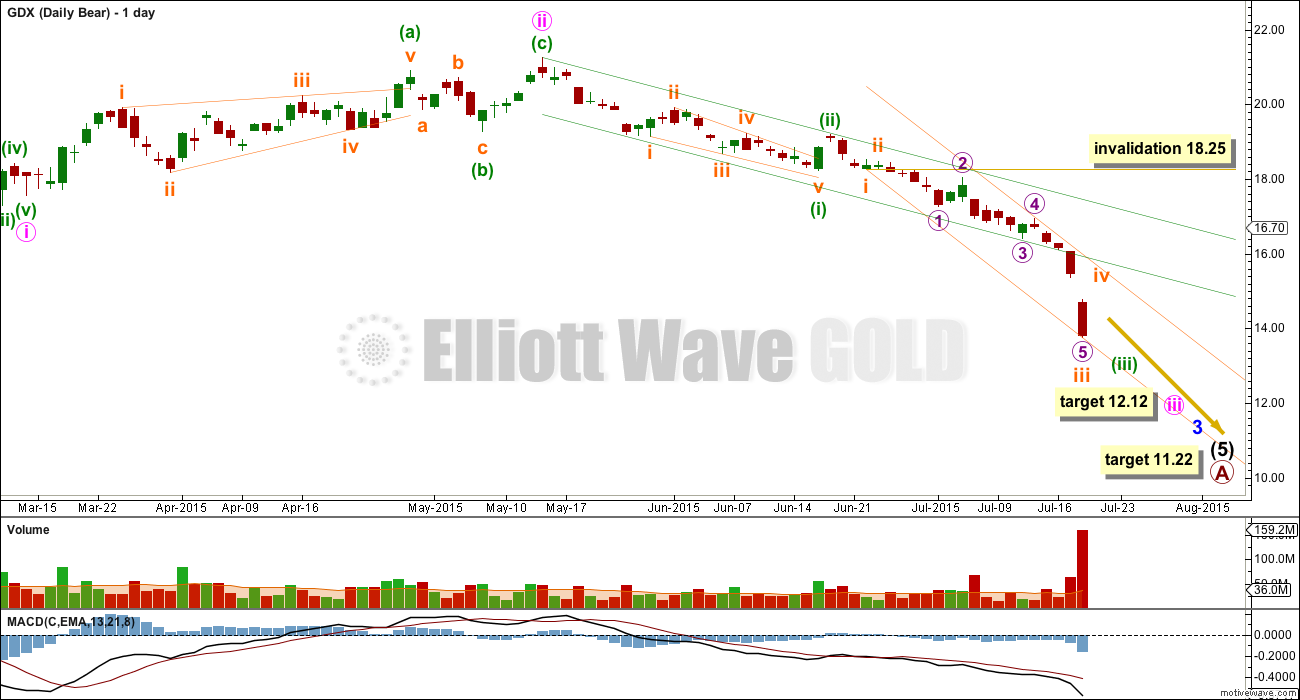

The middle of the third wave for GDX may have now passed.

At 12.12 minute wave iii would reach 1.618 the length of minute wave i. This target expects there would be no more swift strong fifth wave extensions for GDX, which may not be a very reasonable expectation.

If the target is wrong, then it may be too high.

Subminuette wave iv may not move into subminuette wave i price territory. Look for it to find resistance at the upper edge of the orange channel, and if that is breached at the lower edge of the green channel.

Looking back at past major lows for GDX, a volume spike is not seen right at the low but one to four days prior to the low.

TECHNICAL ANALYSIS

ADX continues to indicate a strengthening downward trend for GDX. On Balance volume continues to move lower along with price, the trend is supported by volume.

Price is below the 34 day EMA indicating a downward trend.

The gap looks like a breakaway or measuring gap and not a pattern gap, so it should not be expected to be filled.

I have come across this count on spot gold. Any comments on this? (Chart attached)

That ending diagonal is invalid. The third wave is longer than the first, the fifth wave is shorter than the third and first.

It does not meet the rules for wave lengths of diagonals.

For a contracting diagonal, five must be shorter than three and three must be shorter than one.

Waves 5 are longer than waves 3 in many commodities and in Gold.