Yesterday’s Elliott wave analysis expected the current structure to be over more quickly, but it is taking its time.

Summary: The triangle is still completing, taking its time and testing our patience. I am still confident that when it is done the breakout will be downwards to move at least slightly below 1,072. A small wave up to reach slightly above 1,094.98 should complete the triangle, and most likely fall short of the A-C trend line and find resistance at the bright aqua blue line on the daily chart. Thereafter, the breakout downwards may be surprisingly swift and short lived. A new low below 1,081.10 would confirm price is breaking out downwards, especially if it comes on a day with higher volume.

To see weekly charts and analysis click here.

Changes to last analysis are bold.

ELLIOTT WAVE COUNT

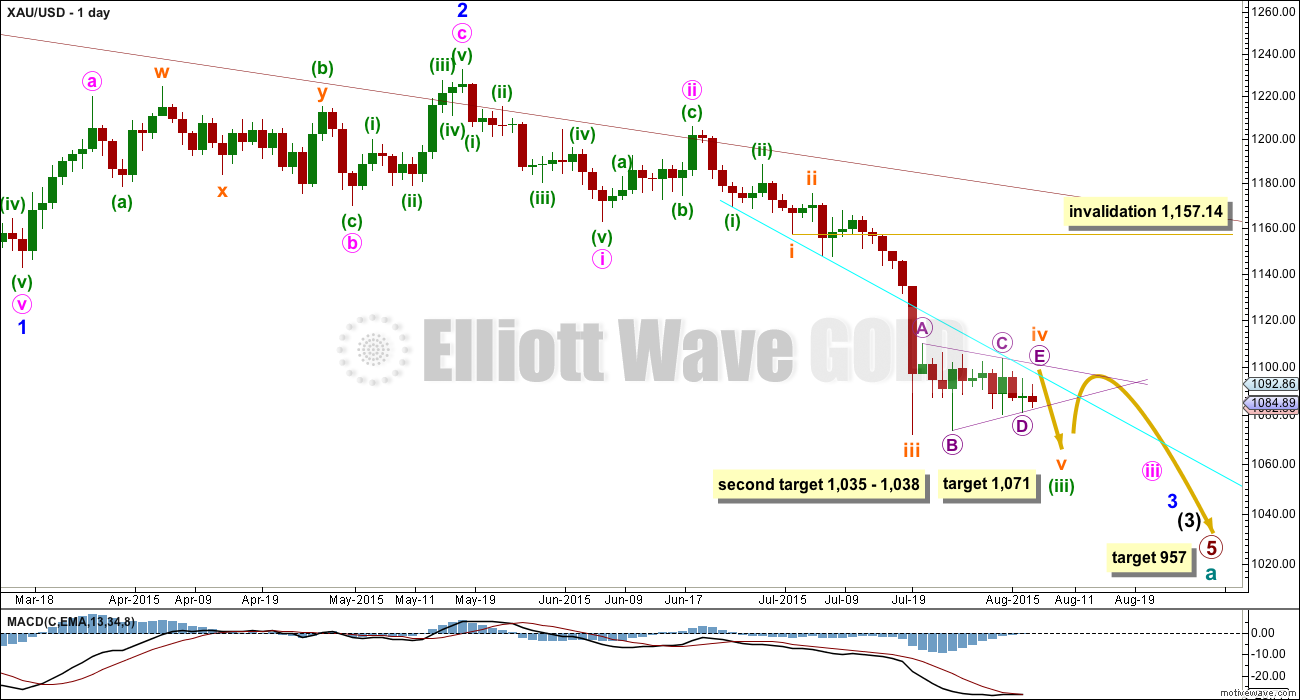

Cycle wave a is an incomplete impulse.

Within primary wave 5, the daily chart focuses on the middle of intermediate wave (3). Within intermediate wave (3), minor wave 3 now shows a slight increase in momentum beyond that seen for the end of minor wave 1 at the left of the chart. Third waves for Gold usually have clearly stronger momentum than its first waves, so I still expect to see a further increase in downwards momentum. The strongest downwards momentum may appear in a fifth wave somewhere within minor wave 3, maybe the fifth wave to end minuette wave (iii) or minute wave iii, or that to end minor wave 3 itself.

Subminuette wave iii looks like it is over at the daily chart level. Subminuette wave iii has a typical curved look to it at the daily chart level and this wave count has the right look.

Subminuette wave iv may not move into subminuette wave i price territory above 1,157.14.

Subminuette wave iv is a regular contracting triangle. The structure is clear on the daily and hourly charts. Subminuette wave ii was a relatively deep 0.58 zigzag lasting two days, and subminuette wave iv exhibits perfect alternation as a shallow 0.29 triangle lasting twelve days. Zigzags are normally quicker than triangles, so some disproportion would be expected; the disproportion is just acceptable.

I am removing the channel about minuette wave (iii) in favour of the bright aqua blue trend line, because this line shows nicely where price is finding resistance when it previously provided support. The triangle may now end when price touches that trend line which would see micro wave E fall short of the A-C triangle trend line, the most common look for the E wave of a contracting triangle.

At this stage targets are approximate. When the triangle is complete it will be known at which point the fifth wave begins, then targets can be calculated more accurately for it to end. It is most likely to reach equality in length with subminuette wave i about 1,071.

If price reaches the first target and the structure is incomplete, or if price just keeps falling through it, then a second target may be at 1,035 – 1,038; at 1,035 minuette wave (iii) would reach 4.236 the length of minuette wave (i) and at 1,038 subminuette wave v would reach 0.618 the length of subminuette wave iii.

Extend the triangle trend lines outwards. The point in time at which they cross may see a trend change. Sometimes this is when the fifth wave to follow ends. Sometimes it is a trend change within the fifth wave.

Once price is below 1,072, look for the structure of subminuette wave v to be a completed five wave impulse on the hourly chart. Once that is clear, a subsequent breach of the bright aqua blue trend line would provide some confirmation that minuette wave (iii) would be over and minuette wave (iv) would have begun.

Minuette wave (iv) should unfold sideways. It may be very shallow because minuette wave (ii) was relatively deep at 0.52. Minuette wave (ii) lasted three days and was an expanded flat. Minuette wave (iv) may exhibit alternation as another triangle or a zigzag most likely, and may last about five to eight days. If it is a zigzag, then it may be quicker and sharp.

At 957 primary wave 5 would reach equality in length with primary wave 1.

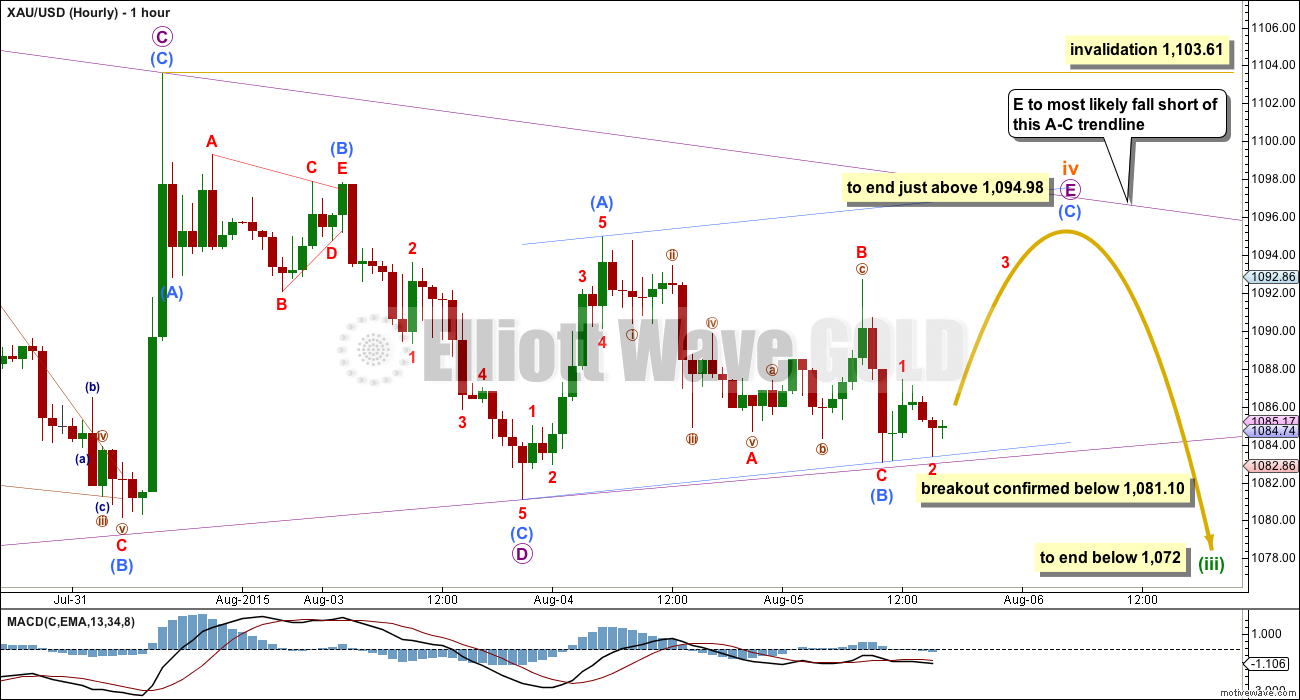

The final wave of micro wave E still looks incomplete. This triangle really is taking its time, but then that is what they do.

Triangles normally adhere very well to their trend lines; sometimes they have small overshoots, but generally they do not have breaches of their trend lines. Because of this tendency, I expect submicro wave (B) is over since it found support at the B-D trend line.

If submicro wave (C) were to reach equality in length with submicro wave (A), then it would end right at the upper triangle A-C trend line. That is not how E waves normally look. I expect submicro wave (C) may not exhibit a Fibonacci ratio to submicro wave (A) because it is most likely to end short of the A-C trend line.

The second less common possible way for submicro wave E to end is with an overshoot of the A-C trend line.

Submicro wave (C) is very likely to end at least slightly above the end of submicro wave (A) at 1,094.98 to avoid a truncation. As soon as price reaches above this point, look out for a quick end to this sideways triangle.

Micro wave E is subdividing as a zigzag. Within micro wave E, submicro wave (B) may not move beyond the start of submicro wave (A) below 1,081.10. A new low below this point may not be a continuation of micro wave E, so at that point downwards movement would very likely be the downwards breakout we are waiting for. At that stage, the lower B-D trend line of the triangle would also be breached.

The downwards breakout should be swift, very strong, and possibly also very short lived. Subminuette wave v is very likely to make at least a slight new low below the end of subminuette wave iii at 1,072.09 to avoid a truncation. As soon as price reaches below that point, if the structure is a clear five wave impulse, then it could be over. Fifth waves following fourth wave triangles for Gold are sometimes surprisingly short in both price and time.

Micro wave E may not move beyond the end of micro wave C above 1,103.61. If upwards movement were to invalidate the triangle, then subminuette wave iv may be morphing into a combination. They too are sideways movements, so substantial upwards movement would not be expected. At this late stage, because the triangle looks right, I expect price will not move above 1,103.61.

TECHNICAL ANALYSIS

The small pennant pattern continues to unfold. Pennants are smaller versions of triangles. This classic technical analysis pattern is the most reliable continuation pattern, particularly when it turns up in a clearly defined trend and unfolds on declining volume as this one does. During the unfolding of this pennant pattern, it is a downwards day which clearly has the strongest volume providing further indication that the breakout of this pattern is likely to be downwards. When price breaks below the lower trend line of the pennant, and when volume shows an increase, then a downwards breakout should be expected to be underway.

Pennants can last up to three weeks. This one is within its second week. If it ends within the next two days, then it will still be a pennant pattern. To become a classic technical analysis triangle it would need to continue into next week.

ADX continues to rise during the formation of this consolidation. Despite price drifting sideways the trend continues to strengthen and remains down.

A trend following strategy should be used. Trading with the trend is advised. A mean reverting system which allows trades against the trend should only be used by the most experienced professional traders, and for all others it is strongly advised to never trade against the trend.

The simplest system for a downwards trend like this is to use resistance lines: each time price touches resistance that represents an opportunity to enter in the direction of the trend. Trades may be held until price either reaches support, a target, or if the trade is held for one day if you are a day trader. Depending upon your trading style, your risk management, and management of the equity in your account, stops as always are essential: they may be money management stops, they may be just above lines of resistance (allow for small overshoots), or they may be Elliott wave invalidation points.

Corrections against the trend offer an opportunity to join the trend at a good price. Corrections do not offer good trading opportunities when they are at low wave degrees; trying to trade the small waves within a correction exposes your account to the potential for big losses.

This approach outlined here is just one trend following method of many.

There is a little positive bullish divergence last week: the low for 23rd July did not move below the prior low of 17th July, but On Balance Volume did make a new low. OBV moved lower while price did not. This bullish divergence indicates a correction against the trend to unfold, which is what has been happening. This correction should resolve this divergence.

Today’s candlestick continues the pattern of small sideways movement, and is finding support at the lower trend line of the pennant pattern. Price is drifting sideways in a small consolidation, and volume continues to decline. The consolidation is now very mature, so the breakout is closer.

I am redrawing the trend line to match that on the daily Elliott wave count. That trend line previously showed where price found support, and now shows where price is finding resistance. It is reasonably shallow and repeatedly tested, so it is reasonably technically significant. While price remains below that line and ADX indicates a downwards trend, then that line may be used as an opportunity to join the trend each time price touches it.

This analysis is published about 05:17 p.m. EST.

brown cup

black cup

To All Elliott Wavers:

I saw the attached charts published on TradingView.com last night from 2lalit and they absolutely amaze me. The publisher refers to cup-n-handle chart pattern. (Looks like failed cups to me.) Simply in awe of the correlation he/she has drawn here. Anyone familiar with this? I would love to understand how this works /if it works/ and hear your comments. First chart is explanation of black cup targeting. Second is black cup . Third is brown

Note: I see the “brown cup” has a 42 day period for new low.

Why would the “black cup” follow 42 days?

Using calculations: 42 days is 37.5% of 112 day period on brown cup

so 98 days (black cup) x 37.5% of would be 36 – 37 days from today for new low.

Using 42 days(from 8-5): I get October 1st (excluded Labor Day Market Close)

Using 36 days(from 8-5): I get September 24th (excluded Labor Day Market Close)

I mentioned to Tham I have to step out today, but I first wanted to post this for everyone. I’ll check back later and look forward to your thoughts and comments.

Micro wave E still looks incomplete. I expect that as the market closes for the day submicro wave (C) is close to completion. I see this small correction as minuscule wave 4, and then it needs minuscule wave 5 up to end this.

Submicro (C) still needs to move above the end of (A) at 1,094.98 to avoid a truncation. The final fifth wave up within it will probably just manage it.

It looks like it will not end today. It should end tomorrow.

Volume is really light, the range is narrow, this consolidation is very mature. The breakout is very close… but still not there.

Minuscule 4 may not move into 1 price territory below 1,087.42. That may now be used as the first price point to provide confirmation that the whole of subminuette wave iv triangle is finally over.

When price moves below 1,087.42 it can’t be part of submicro (C) and so submicro (C) must be over. Because this whole thing is so mature the probability of it being over then would be so high.

Or you could wait for price confirmation below 1,081.10 for more confidence that it’s over and breaking out downwards.

Analysis will not be too much different from yesterday.

Good luck everybody!

Thanks Lara. This is wonderful.

me: Great plans and great preparation. Execution, ah, “F”. I had planned to add today and my stop was too close so early am while I slept the computer chopped me off. (but I pulled a measly $167 bucks out)

So now maybe I’ll get back in lower than before. Ha Ha automated trading!!!! See you later.

dsprospering – out of interest which platform do you use to trade dust/nugt

At the moment I use a brokerage and I need a 2% move before I even cover costs.

Today I bought nugt at 3.16 and sold at 3.22 and broke even!

Currently I use TC2000’s free version: Freestockcharts.com

I SOOOO have to make upgrades to my computer/trading system. Really, won’t even tell you how old my ssystem is

To begin to see Gold price coasting below 1089-88 would be reassuring?

Few views stated below that we are expecting one more wave up.

Waiting for this before buying DUST.

Hello.

Any EW analysts out there? Do we have E wave near complete?

Think we need $2 higher to 1095 to prevent truncation.

Dust seems to be rising already though…

I think so, and volume came in on pmbull.com chart to confirm that this is the end of the wave.

I believe I can see miniscule 3 as a 5. However, it might be possible for the 5-th wave of miniscule 3 to stretch up more. So if Lara’s count last night is right, we are at the turn and heading down to 1071 or below. What’s the chance it hits that low just before the NFP release tomorrow morning?

Re Aidan’s comment about preventing truncation, Lara uses a different data source than the pmbull.com I look at. It is not unusual for the two data sources to differ by a dollar or two and so I would not worry about truncation if we are close.

35.55

Anyone tempted?

In at 34.39.

After a tortuous series of 4th and 5th waves, we are now at the final approach. One last drop to 1090+ followed by a final surge to 1096.2-1096.8.

Agreed

Thank you Tham and Joseph

nice

Looking good – appreciated.

Nice work, Thanks Tham

Tham are you still sure on this, or is there a revision to the 1096 area?

Your help is appreciated.

I still think so. Miniscule 4 has probably ended at 1089.54, and now begins the slow ascent up in the final lap. However, as there are less than 2 hours before market closes, I don’t think it could happen today. Probably when NFP data is released tomorrow?

My entry point for DUST will be less than 34.01, the low reached today. My computations indicate a value of 33.23, but I would need smaller degree waves on DUST to pinpoint the target entry.

Thanks.

Have you noticed a disconnect between XAU and Dust since about an hour ago? Both moving down… strange.

I look forward to tomorrows NFPs.

Gotta take the dog to the vet today. See you later.

Technically, XAU and DUST are two separate entities, with their own EW counts. It so happens that their inverse correlation is high, but that doesn’t mean that they will always move in opposition to each other. I do my EW counts for the two separately, and currently basing more on DUST as I am trading DUST not gold. I use gold’s EW count only as cross-reference.

I’m off to bed also. I don’t expect much movement in the remaining market hours. Chat again tomorrow.

oh, wait. Quick question. Almost forgot, also want to ask you if you still have a $41/$43 (not sure exactly what you had) target on dust from the other day.

I have not reworked the (new) target yet. I currently have the high of 40.00 as the first wave (my EW count labels it as micro 1) and 33.23 if it materialises as the second. If the third wave is going to be at 1.618 retrace, then it should reach 45+. At the moment, that looks somewhat lofty. And the retrace may not be 1.618. I will need at least two subwaves in micro 3 to arrive at a reasonable target.

SPELLBOUND~!

The thought of Gold price getting to 1094-95 and then dropping from there for 1072 is fascinating indeed; appears to be facing resistance 1092-93….

It certainly hasn’t been a smooth movement higher. If we are at resistance is it possible once it breaks we move beyond the target?

Hello Aidan: Suggest you stay with EWG given targets…. I am expecting 1093 to be curtailing but once Gold price gets above here (1093), favors bullish bias in which case 1095+ is likely….

I see no posts. Is something broken? If everyone is bored by a dull market and nested triangles, maybe that is a sign that should be noted by contrarians….

I just looked at DUST and by my calulations Richard is on his third trade today!

Anyone happy to share their target entry price for DUST today?

I’m just watching 1094.98. I bought NUGT last night at $2.93 with plans to exit around $3.20 and enter DUST about $36.00, but with the stock market down today it’s an upstream battle against the current, so I don’t think it will get to my targets. Good Luck

for dust

wave a was from roughly 40 to 38 = 2

wave c so far is from roughly 39 to 37.17 = 1.83

Wave .C usually 62% 100% 162% of Wave A

so we are in-between 62% and 100%, so maybe the correction is over?

not sure, but gut says we go lower, and lara’s gold target supports it

looks like we are heading to the 162% which would target 35.76

Thanks Shahab – we are still a distance of 1095 however, I have sold my nugt for a profit and looking to get into DUST at around the 35.76 mark.

Appreciated

correction might be over, looks like 35.97 was the low, will try to get in on dust during wave 2

wow wave 1 is looking like a pretty decent size, so far 37.50 – 35.97 = 1.53

looking for a wave 2 retrace usually > 50% < 78.6% of wave 1

I will be looking to get in at around 37ish

remember I am an average joe off the street with no track record, been doing this for about 1 week, trade at your own risk

Appreciate your views Shahab and always at own risk 🙂

Thanks Shahab. Do you have a DUST target for after you get your entry/the gold 1071 target? Also, if the correction is over here, is there any way to reconcile that with Lara’s count?

no, not yet

but if we go over the 37.60, we should be heading to 39.40

if we go below 35.97 we are heading to 35.76, maybe