The Elliott wave counts still diverge and price has still not indicated which one is correct.

Summary: The bear wave count expects downwards movement to continue, with an increase in momentum, and the bull wave count expects upwards movement. The critical trend line is the pink / green downwards sloping channel on both daily charts. A break above that channel would favour the bull, but while price remains within the channel the bear will be slightly favoured. In the short term, use the channel on the hourly bear chart to indicate the end of a possible second wave and the start of a third wave down. A new low below 1,098.95 would further increase the probability of the bear wave count over the bull.

Changes to last analysis are bold.

To see the bigger picture on weekly charts click here.

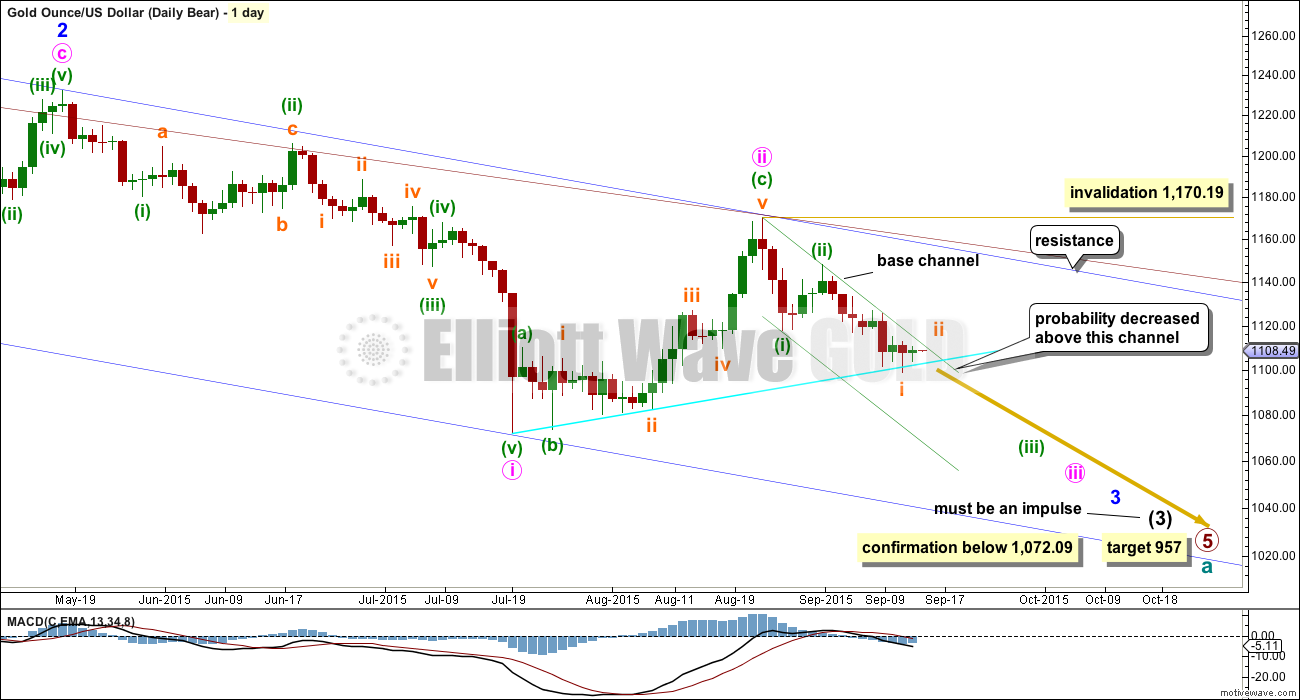

BEAR ELLIOTT WAVE COUNT

Gold has been in a bear market since September 2011. There has not yet been confirmation of a change from bear to bull, and so at this stage any bull wave count would be trying to pick a low which is not advised. Price remains below the 200 day moving average and below the blue trend line (copied over to the daily chart). The bear market should be expected to be intact until we have technical confirmation of a big trend change.

This wave count now sees a series of five overlapping first and second waves: intermediate waves (1) and (2), minor waves 1 and 2, minute waves i and ii, minuette waves (i) and (ii), and now subminuette waves i and ii. Minute wave iii should show a strong increase in downwards momentum beyond that seen for minute wave i. If price moves higher, then it should find very strong resistance at the blue trend line. If that line is breached, then a bear wave count should be discarded. The blue channel is copied over here from the weekly chart.

The blue channel is drawn in the same way on both wave counts. The upper edge will be critical. Here the blue channel is a base channel drawn about minor waves 1 and 2. A lower degree second wave correction for minute wave ii should not breach a base channel drawn about a first and second wave one or more degrees higher. If this blue line is breached by one full daily candlestick above it and not touching it, then this wave count will substantially reduce in probability.

Minuette wave (ii), if it were to continue, may not move beyond the start of minuette wave (i) above 1,170.19. A breach of that price point should see this wave count discarded as it would also now necessitate a clear breach of the blue channel and the maroon channel from the weekly chart.

An earlier indication of which wave count is correct would come from the green base channel drawn about minuette waves (i) and (ii). This channel too is drawn in the same way on both daily charts for bull and bear. Price must find resistance at the upper edge of this channel for the bear wave count. A breach of that channel would substantially reduce the probability of the bear wave count. Minuette wave (iii) should have the power to break below support at the lower edge of this channel. If that happens, then the probability of this bear wave count would substantially increase.

Full and final confirmation of this wave count would come with a new low below 1,072.09.

If primary wave 5 reaches equality with primary wave 1, then it would end at 957. With three big overlapping first and second waves, now this target may not be low enough.

I am changing the labelling of the downwards movement from the end of minuette wave (ii) to be the whole of subminuette wave i, rather than three overlapping first and second waves. The downwards movement from the end of minute wave ii is still seen as subdividing 5-3-5, now for minuette wave (i), minuette wave (ii) and subminuette wave i. The subdivisions are seen in exactly the same way for the bull wave count; there, the 5-3-5 down is minute waves a-b-c.

The size of the upwards movement for Monday does not look like a very low degree second wave. It is a higher degree wave, so I have moved the labelling up a few degrees. This has a better look.

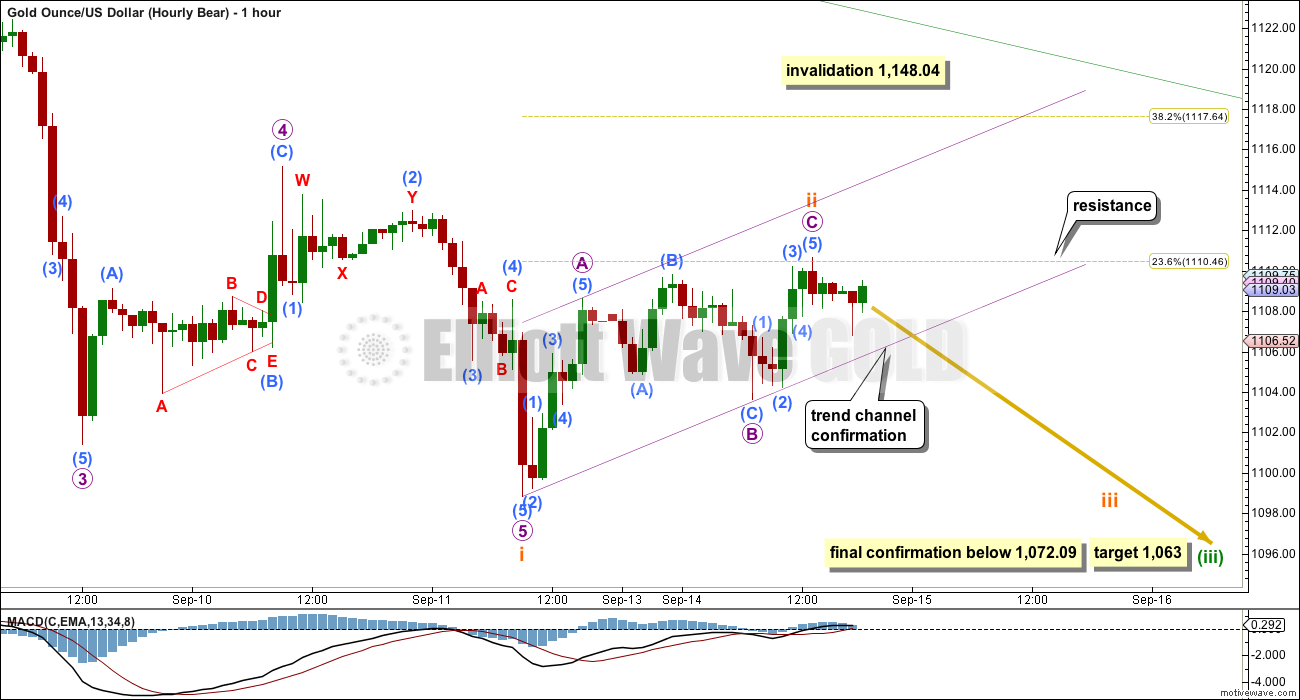

The upper edge of the green channel is copied over from the daily chart. This is the critical line which today differentiates bull and bear. If price remains below that line, then the bear wave count will be favoured. A breach of that line by upwards movement would see the bull wave count increase in probability.

There is now a complete zigzag up for subminuette wave ii. There is no Fibonacci ratio between micro waves A and C. The zigzag fits nicely within a small parallel channel.

To the downside, a breach of this upwards sloping channel about the zigzag of subminuette wave ii would be earliest indication that subminuette wave ii is over and subminuette wave iii should have begun.

At 1,063 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

The invalidation point must remain at the start of subminuette wave i, at 1,148.04, while there is no confirmation that subminuette wave ii is over. Subminuette wave ii may not move beyond the start of subminuette wave i. However, price should not get anywhere near that point for this bear wave count as it should find very strong resistance and not break above the green trend line.

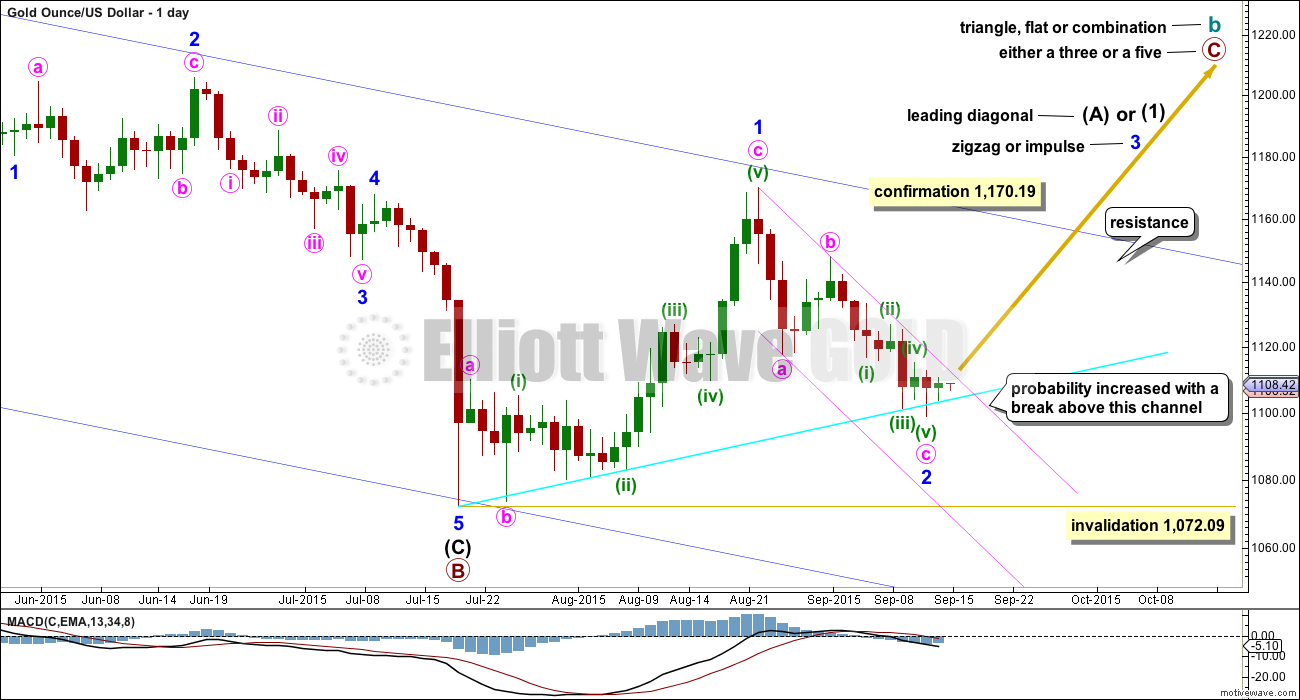

BULL ELLIOTT WAVE COUNT

The bull wave count sees cycle wave a complete and cycle wave b underway as either an expanded flat, running triangle or combination. This daily chart works for all three ideas at the weekly chart level.

For all three ideas, a five up should unfold at the daily chart level for a movement at primary degree. This is so far incomplete. With the first wave up being a complete zigzag the only structure left now for intermediate wave (1) or (A) would be a leading diagonal. While leading diagonals are not rare they are not very common either. This reduces the probability of this bull wave count.

A leading diagonal requires the second and fourth waves to subdivide as zigzags. The first, third and fifth waves are most commonly zigzags, the but sometimes may appear to be impulses. So far minor wave 1 fits well as a zigzag.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,072.09. If this invalidation point is breached, then it would be very difficult to see how primary wave B could continue yet lower. It would still be technically possible that primary wave B could be continuing as a double zigzag, but it is already 1.88 times the length of primary wave A (longer than the maximum common length of 1.38 times), so if it were to continue to be even deeper, then that idea has a very low probability. If 1,072.09 is breached, then I may cease to publish any bullish wave count because it would be fairly clear that Gold would be in a bear market for cycle wave a to complete.

To the upside, a new high above 1,170.19 would invalidate the bear wave count and provide strong confirmation for this bull wave count.

Upwards movement is finding resistance at the upper edge of the blue channel and may continue to do so. Use that trend line for resistance, and if it is breached, then expect a throwback to find support there.

In the short term, use the smaller pink channel drawn about the zigzag of minor wave 2 using Elliott’s technique for a correction as shown. Copy this channel over to the hourly chart. This channel is also drawn in the same way for the bear wave count, and there it is correctly termed a base channel. Both wave counts should expect upwards corrections for the short term to find resistance at the upper edge of this smaller channel.

I added a bright aqua blue trend line to this chart. Price has found support there and is bouncing up.

Minor wave 2 can now be seen as a complete zigzag. It is 0.73 the depth of minor wave 1, nicely within the normal range of between 0.66 to 0.81 for a second wave within a diagonal. Downwards movement really should be over for this bull wave count. Minor wave 2 can technically continue lower this week, but further downwards movement will reduce the probability of this bull wave count.

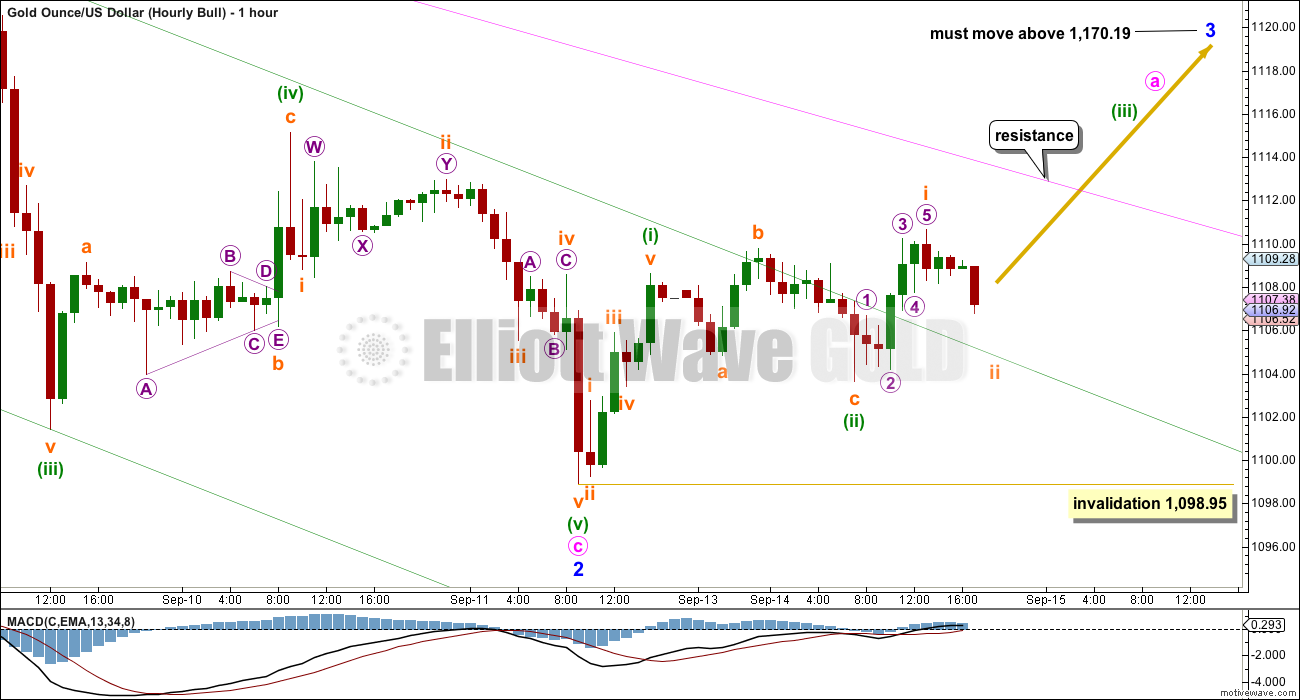

A breach of the pink channel would provide trend channel confirmation that the zigzag of minor wave 2 is over and the next wave up for minor wave 3 should be underway. Third waves within leading diagonals are most commonly zigzags, but sometimes they may be impulses. Minor wave 3 should show some increase in upwards momentum beyond that seen for minor wave 1. Minor wave 3 must move above the end of minor wave 1 above 1,170.19. That would provide price confirmation of the bull wave count and invalidation of the bear.

The bull wave count sees the subdivisions of minor wave 2 down as 5-3-5 for a complete zigzag.

Because the bull wave count sees a leading diagonal unfolding upwards, with the third wave of the diagonal just beginning, a zigzag up is most likely. Third waves (as well as first and fifth) within leading diagonals are most commonly zigzags, but sometimes they may also be impulses.

Within minor wave 3, no second wave nor B wave may move beyond its start below 1,098.95. A new low below this point could be minor wave 2 extending lower, but this has a low probability.

Along the way up, price may first find resistance at the upper edge of the green channel. This is drawn about minute wave c using Elliott’s technique.

A new high above 1,115.16 would provide first price confirmation for this wave count. But, before I would have reasonable confidence in it, this wave count absolutely requires a breach of the pink channel on the daily chart with a full daily candlestick above it and not touching it.

TECHNICAL ANALYSIS

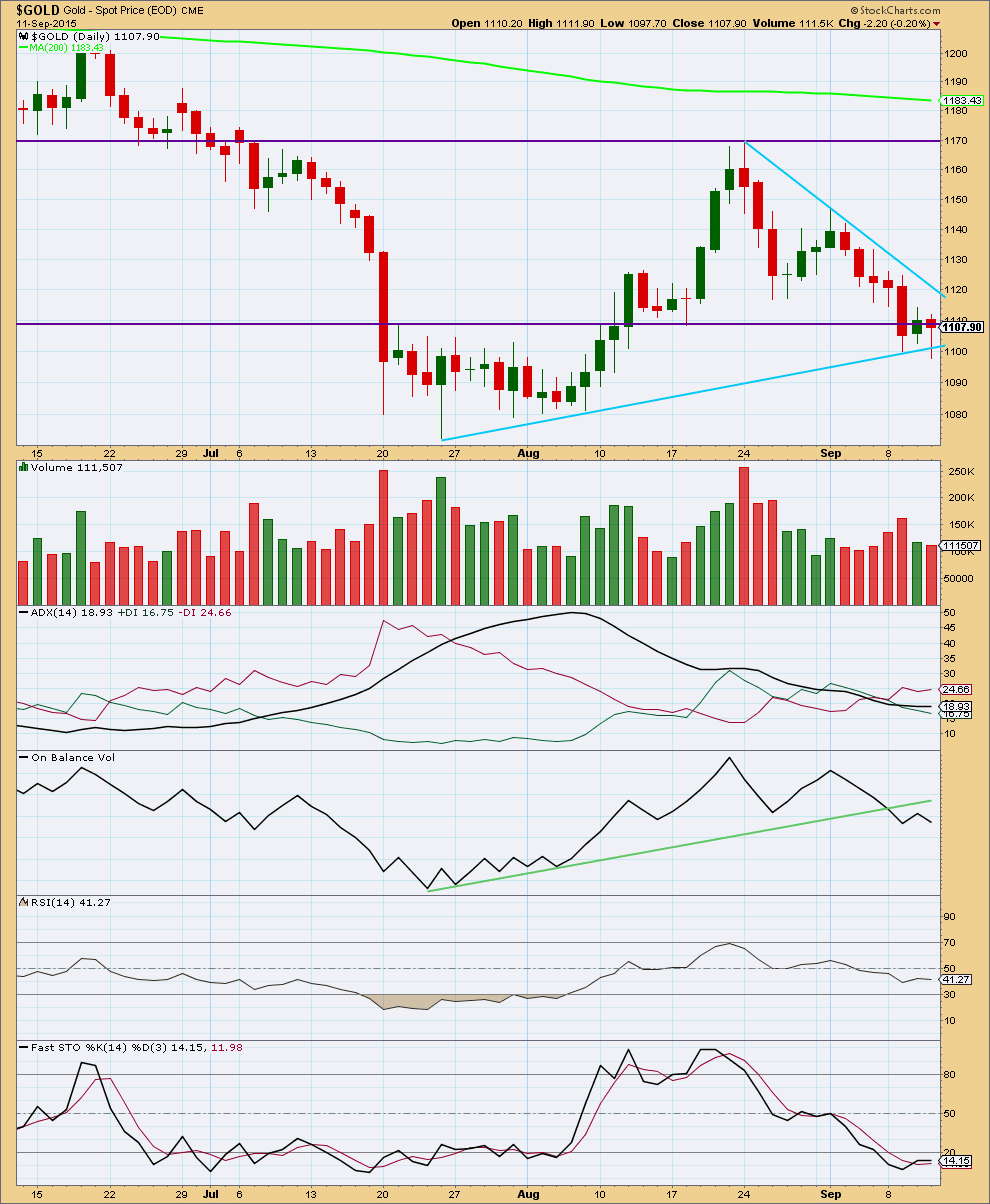

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: A small green doji on lighter volume looks corrective. As price drifts sideways for the last three days volume declines indicating that this move is a consolidation. This fits the bear wave count better than the bull.

As price falls there is some support with some rising volume since the last swing high at about 1,170. The strongest volume days in this fall are for down days. Overall the volume profile looks more bearish than bullish, but it is not as clear as it could be.

I have two sloping blue trend lines to show support and resistance. These are coming to cross, and price is being squeezed. This indicates a strong movement to come shortly, either up or down. The test and overshoot of the lower trend line may be the earliest indication the break will be more likely down than up.

ADX is flat indicating there is no clear trend and the market is range bound. If a range bound system is used here, then it would expect an upwards swing because price has reached to the lower horizontal line of support and Stochastics has reached oversold. However, trading a range bound market is more risky than trading a clearly trending market. The final swing never comes; that is when price breaks out of the range and begins a trend. The bear Elliott wave count has serious implications, because it expects a strong downwards move from here, so any expectation of an upwards swing must be approached with caution and good risk management.

While On Balance Volume remains below its trend line it is bearish.

RSI at the daily chart level is neither overbought or oversold. There is room for the market to rise or fall.

Overall the regular technical analysis picture is unclear. We may have more clarity this week.

This analysis is published about 08:08 p.m. EST.

they have to raise interest rates cause the economy is slowing down so or so. i think it is already and they know it.

what would happen after this long period of zero interest rates and 3 QE programs when the economy starts to slow down?

They have to raise it so they can say the economy slowed down cause of the too early rate hike

Maybe then after the Fed can save the markets one last time with another QE.

when the market will awake from its drug trip? im not sure the FED can save the markets one more. maybe USA wants to go to war i dont know. porobably Putin will then be the reason for this chaos.

the other thing is that the manipulatoin in PM was still present the last weeks and still high especially in silver.

so who better knows what the FED will do than JP Morgan and friends?

this kind of manipulation is atypical for a major trendchange to the upside. i expect at least one more drop

I think this sideways move for Tuesday was a continuation of subminuette ii for the bear.

If the B wave within it is seen as a very rare expanding triangle all the subdivisions fit perfectly and make sense.

For the bull minuette (ii) continued sideways as an expanded flat. The C wave is a little problematic, it will subdivide as a five on the five minute chart but the proportions of it’s second and fourth waves in it are so disproportionate, it makes the move look like a three on the hourly chart. The bear resolves this problem.

Overall I still favour the bear.

Gold does often begin it’s impulses in a somewhat sluggish way, with overlapping first and second waves. The acceleration comes in the middle of the third wave, and then even more right at the very end for the fifth wave which can often be explosive.

Following on the heels of prior day inside day and narrow trade range, with today’s H 1109.4 / L 1102.5 so far, Gold price upside appears restricted to under 1107-09; despite a slowdown in momentum and an upturn in MacdMA, indicative of a short term rally, Gold was not really able to mount one…. The question is (as yet unclear) – do we get to see Gold price break below 1100-1099…. Is Gold price saving the best for the last waiting on Fed’s monitory policy statement? Cant help but get anxious…. 🙂

Lara gold is trading below the pink channel at 1104.76. Is this confirmation of bear hourly wave count?????

No there is no price confirmation on hourly bear chart other than 1072.09 and also invalidation of bull hourly under 1098.95.

However as I mentioned below at 9:05 am.

“trend channel confirmation” of the bear count.

The Downward pink channel has been breached by at least 3 hourly candlesticks 5 am, 6 am and 7 am just needed at least 1 full houly candlestick below.

Yes, it’s below the violet channel on the hourly chart (the small upwards sloping channel).

I think the market answered your question for me while I was asleep.

It’s short term confirmation that the upwards movement of the last two days prior to today is over, and was corrective. It’s some more confidence in the bear count, but full confidence will only come with a new low below 1,072.09.

The bear is looking more likely for sure at this time.

I bought some DUST.

Good choice. I also bought some just now.

My analysis showed that DUST completed a wave 2 at 30.14. The rise should target 33.32 initially.

Sold at 31.00. Better take some gains while I can.

Pre-Fed days are very capricious.

I sold my DUST also thanks for the tip.

Question for you, Alan…

Do find that short-term EW analysis of DUST works out for you much of the time? I’ve hesitated to rely on it myself because of the odd push and pull dynamics gold and US stocks seem to have on GDX and these related leveraged ETFs.

Your thoughts?

Hi Curtis. I analyse DUST solely on its own. Although there is some inverse correlation with GDX, I don’t refer to GDX at all. It is more often a distractor than a help. Anyway, they are marketed by different companies.

You are right that in choppy markets these leveraged ETFs get pushed around too much. To iron out perturbations, I trade very short-term, more like scalping. Although EW analysis indicates quite specific targets, I feel that unless one buys and then doesn’t monitor, he/she must have very strong guts and free from any heart disease to manoeuvre through all those wild movements. It does severely test your faith in your EW count.

Thank you Alan. I appreciate your helpful insights!

When is the FED event?

FED FOMC is

THURSDAY, SEPT. 17

2 pm FOMC statement

2:30 pm Janet Yellen press conference

http://www.marketwatch.com/Economy-Politics/Calendars/Economic

We also need a clear 5 down on the hourly. Anyone see that? Looks like more sideways chop. Seems like gold wants to wait until Thursday to make its move.

The drop to 1102.57 meant that, for the bull count, Lara’s minuette 2 data point at 1103.58 could be wrong. 1102.57 could be minuette 2 or only its first wave. I won’t rule out the bull count now until it is proven. Sentiments out there are still quite bullish.

For the bear, micro 3 of subminuette 3 may have just started. But so far it does not show any increase of momentum. Hence, no indication yet.

So, it is still a guessing game. Patience is the order of the day. Perhaps the Fed might stir things up.

hourly Bear count, To the downside, a breach of this upwards sloping channel about the zigzag of subminuette wave ii would be earliest indication that subminuette wave ii is over and subminuette wave iii should have begun. It’s been breached by about 4 dollars.

We have “trend channel confirmation”.

The Downward pink channel has been breached by at least 3 hourly candlesticks 5 am, 6 am and 7 am. This is the earliest indication that subminuette wave ii is over and subminuette wave iii should have begun.

Lara is looking for the bottom channel to be breached by at least one full hourly candlestick below it and not touching it.

You mean the bottom aqua line??? I think it is also broken.

Hourly bear bottom line is pink.

I do not see downward pink channel line.

Papudi it is the bottom of the upwards pink channel on hourly bear chart with trend channel confirmation below it.

I am reminded of a comedy sketch where men are said to see colours in terms of “red, blue, green, yellow”, while women see colours in terms of “aqua, teal, peacock, periwinkle, violet, maroon etc.”.

The upwards sloping channel on the hourly chart I see as violet.

The downwards sloping channel on the daily bull chart I see as pink.

The upwards sloping trend line on both daily charts I see as bright aqua blue.

Lara are you sure it’s a violet line?

At first I thought it was pink, however looks more like a light purple line to me. LOL

Thanks.

Is it possible to post the chart??

Jack Chen on PM sector :

http://www.321gold.com/editorials/chan/chan091415.html

PM Sector VERY LOW RISK TRADING SETUP at POSSIBLE SECTOR BOTTOM..

http://www.clivemaund.com/print.php?art_id=3565&PHPSESSID=7e85f652b40310bcfeb481d6f5108613

9 Gold charts