Downwards movement was expected to end soon and be followed by upwards movement.

There was no more downwards movement. Price turned and moved higher.

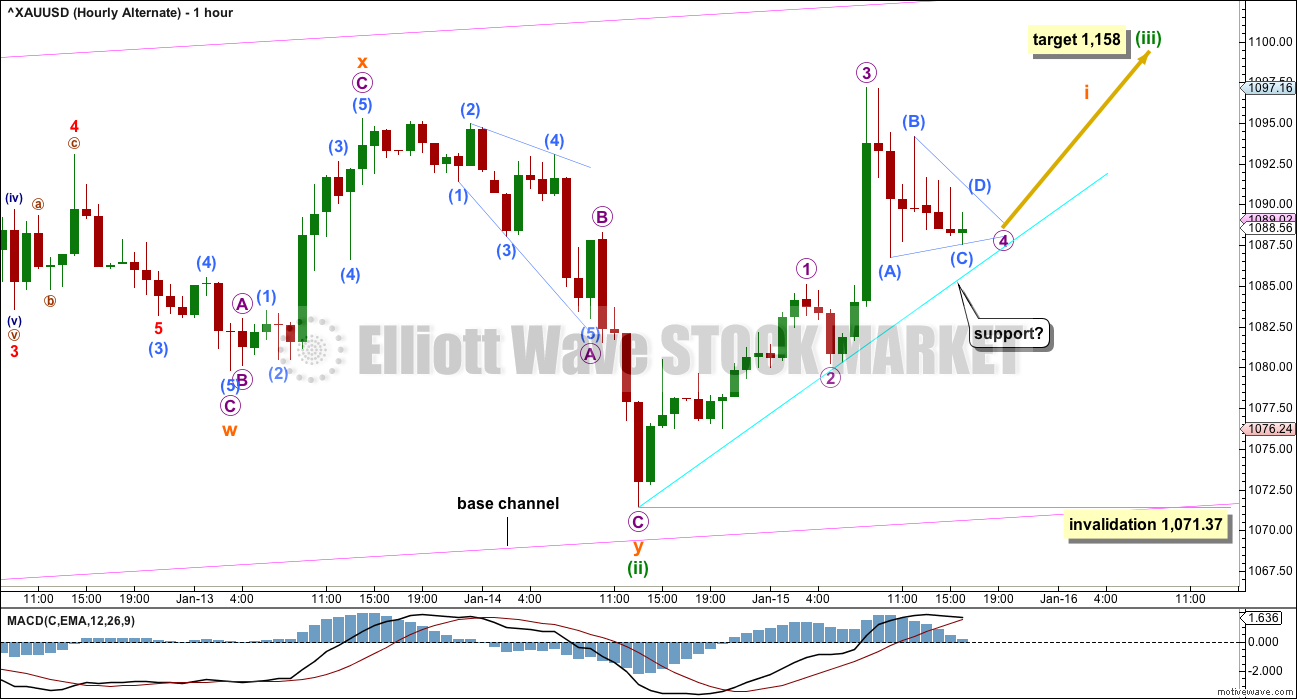

Summary: Both wave counts expect upwards movement next week to make a new high above 1,112.19. The main bear wave count requires upwards movement to a minimum at 1,125.13. The target for the alternate bull wave count is at 1,158.

New updates to this analysis are in bold.

Last published weekly charts with the bigger picture are here.

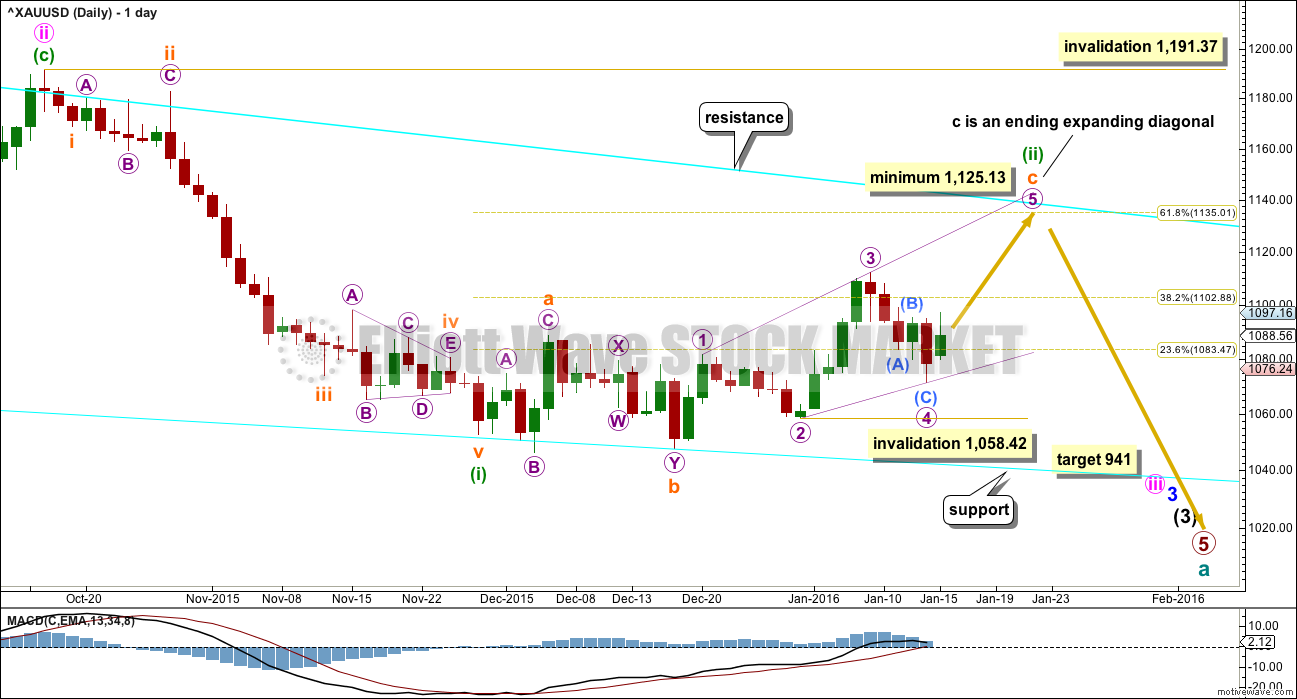

MAIN BEAR ELLIOTT WAVE COUNT

Gold has been in a bear market since September 2011. There has not yet been confirmation of a change from bear to bull, so at this stage any bull wave count would be trying to pick a low which is not advised. Price remains below the 200 day moving average and below the cyan trend line. The bear market should be expected to be intact until we have technical confirmation of a big trend change.

That technical confirmation would come with a breach of the upper cyan trend line by at least one full daily candlestick above and not touching the line. A new high above 1,191.37 would provide full and final price confirmation.

The final line of resistance (cyan line copied over from weekly charts) is only overshot and not so far properly breached. Simple is best, and the simplest method to confirm a trend change is a trend line.

Minute wave ii is a complete zigzag and deep at 0.73 the length of minute wave i.

At 941 minute wave iii would reach 1.618 the length of minute wave i.

Minuette wave (i) is complete.

Minuette wave (ii) looks like a fairly typical expanded flat correction which may end about the 0.618 Fibonacci ratio at 1,135.

There are two structural possibilities for a C wave within a flat correction: either an impulse or an ending diagonal. Because the impulse is now invalidated with the fourth wave overlap into first wave price territory, that leaves only one possible structure for subminuette wave c, an ending expanding diagonal.

All the subwaves must subdivide as zigzags within an ending diagonal. I have checked subdivisions on the hourly chart and both micro waves 1 and 3 can be seen as zigzags. The fourth wave must overlap back into first wave price territory within a diagonal. The rule for the end of the fourth wave is it may not move beyond the end of the second wave. Micro wave 4 may not move below 1,058.42.

The diagonal must be expanding because micro wave 3 is longer than micro wave 1, and micro wave 4 is longer than micro wave 2. The trend lines must diverge.

There is still the possibility that minuette wave (ii) could be labelled as complete at the last high. If it was over, then the only structure I can see which would fit is a double combination. But double combinations are sideways structures; they should not have a slope against the trend one degree higher. This correction has a clear slope. For that reason I still do not want to publish this idea because the probability is too low. I will only publish it if price breaks below 1,058.42.

The fourth wave must subdivide as a zigzag within an ending diagonal. The diagonal trend lines diverge. All rules so far are met.

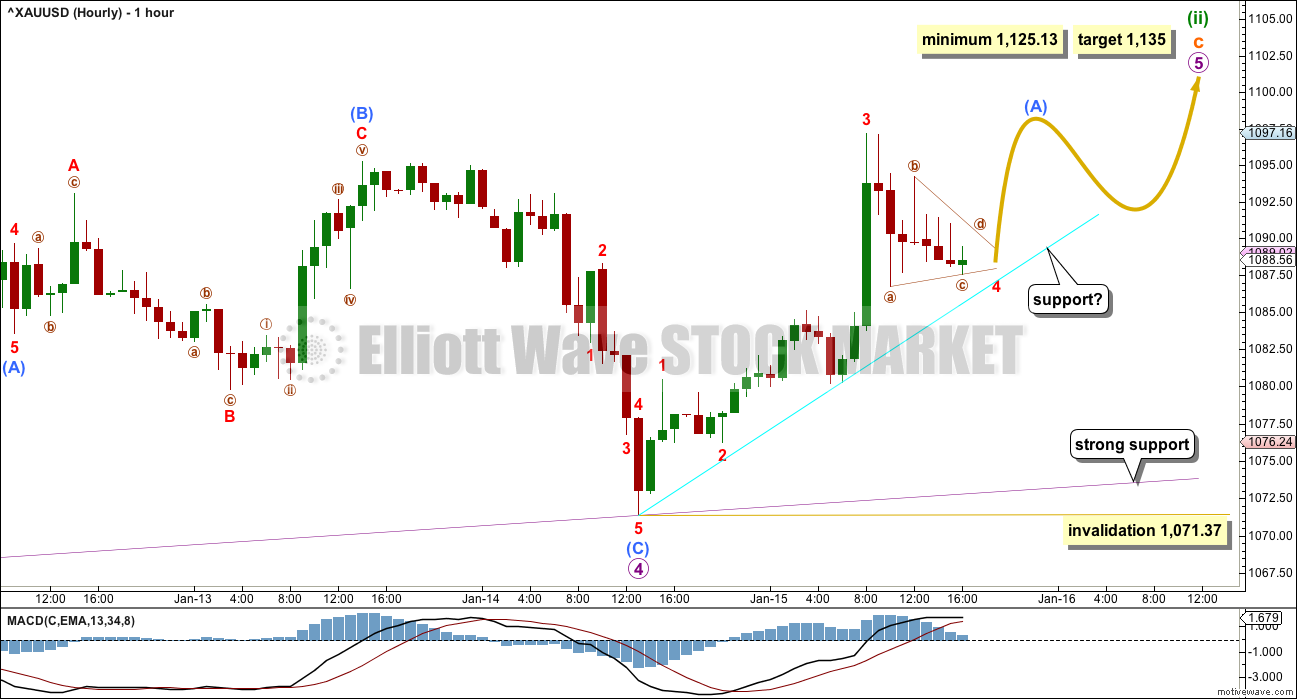

Micro wave 4 is most likely complete. Micro wave 5 upwards is underway and must subdivide as a zigzag.

The diagonal is expanding, so micro wave 5 must be longer than micro wave 3. Micro wave 5 would reach equality with micro wave 3 at 1,125.13. It must end above this point.

The target will remain the 0.382 Fibonacci ratio at 1,135. The cyan line, the final bear market trend line on the daily chart, should provide strong resistance for this wave count.

Within micro wave 5, submicro wave (B) may not move below the start of submicro wave (A) at 1,071.37.

The cyan line drawn on the hourly charts may provide some support for corrections along the way up. If that line is breached, then for this wave count the lower 2-4 diagonal trend line should provide final support. Diagonals normally adhere very well to their trend lines, that is part of what gives them the right look.

Corrections may find support at the cyan line while submicro wave (A) is an incomplete impulse. When submicro wave (B) arrives it would be very likely to move below that line.

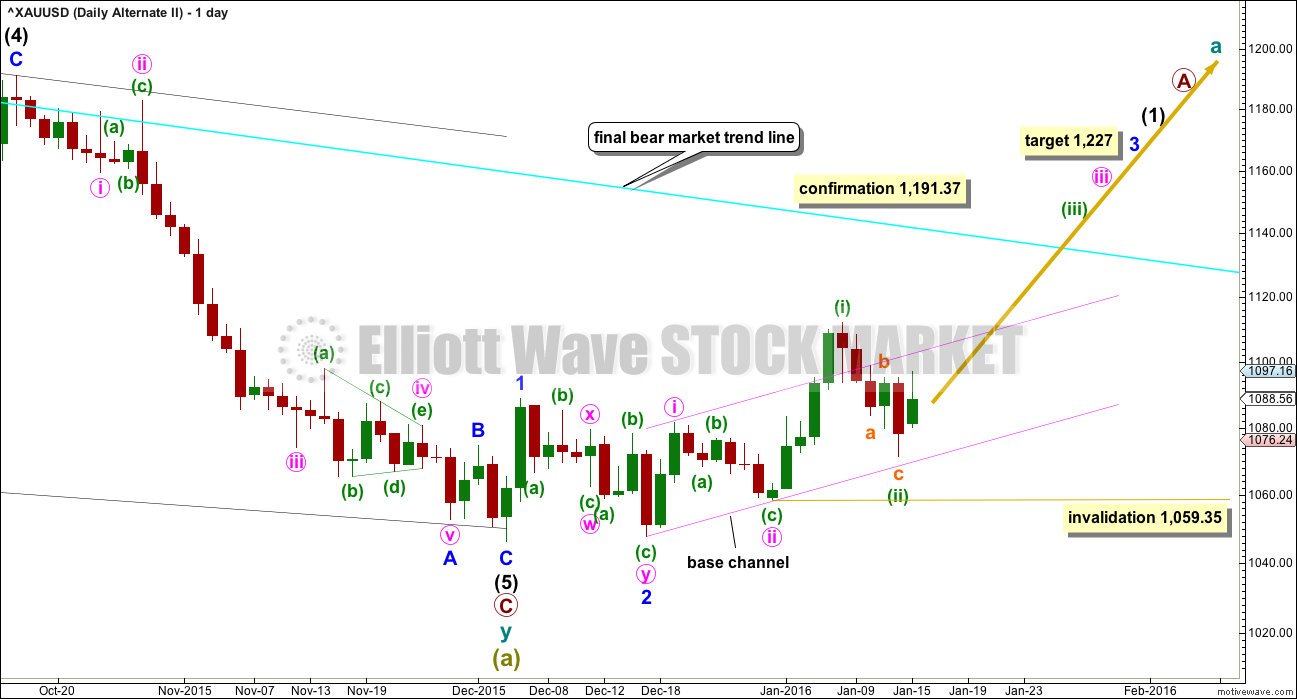

ALTERNATE BULL WAVE COUNT

This was published here as a second alternate wave count. I will use it as the only regular alternate bull wave count because it is the only bull wave count to meet all Elliott wave rules.

I want to remind members that last time Gold saw a reasonable upwards movement from 24th July, 2015, to 15th October, 2015, there were many who expected that rise meant the bear market had ended and a new bull market had begun. It turned out that idea was premature: price turned around and made new lows. On 21st August I developed three bullish wave counts, partly in response to a demand from members, and one by one they have all been eliminated.

Now, again, price rises and there is a demand for bullish wave counts.

It is my strong view that this is premature. I will publish this wave count with that strong caveat.

Eventually the market will change from bear to bull, and when that change is confirmed that is the time to have confidence in a bull wave count. That time is not now.

Price remains below the 200 day moving average. Price has made a series of lower highs and lower lows down to the last recent low. There is not a clear five up on the daily chart. Price remains below the bear market trend line. While price remains below that line this wave count will be an alternate and comes with a strong warning that it is premature.

Downwards movement from the all time high for this bull wave count is seen as a big double zigzag which would most likely be complete at super cycle degree for an A wave.

When an A wave subdivides as a three, then the larger structure may be either a flat or triangle. The B wave may make a new price extreme beyond the start of the A wave within flats and triangles. Here, super cycle wave (b) may move above 1,920.18 as in an expanded flat or running triangle.

When the first move of a larger correction subdivides as a multiple (w-x-y), then a combination may be eliminated. Combinations may not have multiples within multiples, because that would increase the number of corrective structures within a multiple beyond three and violate the rule.

A new wave up at super cycle degree must begin with a clear five up on the daily chart (and probably the weekly as well). So far only minor waves 1 and 2 are complete. At 1,227 minor wave 3 would reach 4.236 the length of minor wave 1.

Minute waves i and ii are complete within minor wave 3. The acceleration channel is not working, so a more conservative base channel is drawn about these two waves. Copy it over to the hourly chart. A lower degree second wave correction for minuette wave (ii) should not breach a base channel drawn about a first and second wave one or more degrees higher. The lower pink line should provide support, if this wave count is correct.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,059.35.

The downwards wave labelled minuette wave (ii) has a slightly better fit as a double zigzag than a single zigzag.

The structure is complete.

This wave count now sees a third wave up at three degrees in the very early stages. Upwards momentum should increase next week as new highs are made. Minuette wave (iii) must move above the end of minuette wave (i) above 1,112.19.

At 1,158 minuette wave (iii) would reach 1.618 the length of minuette wave (i). If price keeps rising through this first target, or if when price gets there the structure is incomplete, then the next target would be at 1,212 where minuette wave (iii) would reach 2.618 the length of minuette wave (i).

The first wave of subminuette wave i is incomplete within minuette wave (iii). When it is done, then subminuette wave ii may not move below the start of subminuette wave i at 1,071.37.

Micro wave 4 may be an incomplete triangle within subminuette wave i. It may find support at the short term cyan trend line drawn here. This line is drawn in the same way on both hourly charts.

Micro wave 5 upwards would complete a five wave impulse for subminuette wave after micro wave 4 is complete. When that is complete, then the cyan line may be breached as subminuette wave ii unfolds as a downwards correction.

The final line of support for this wave count should be the lower edge of the base channel.

TECHNICAL ANALYSIS

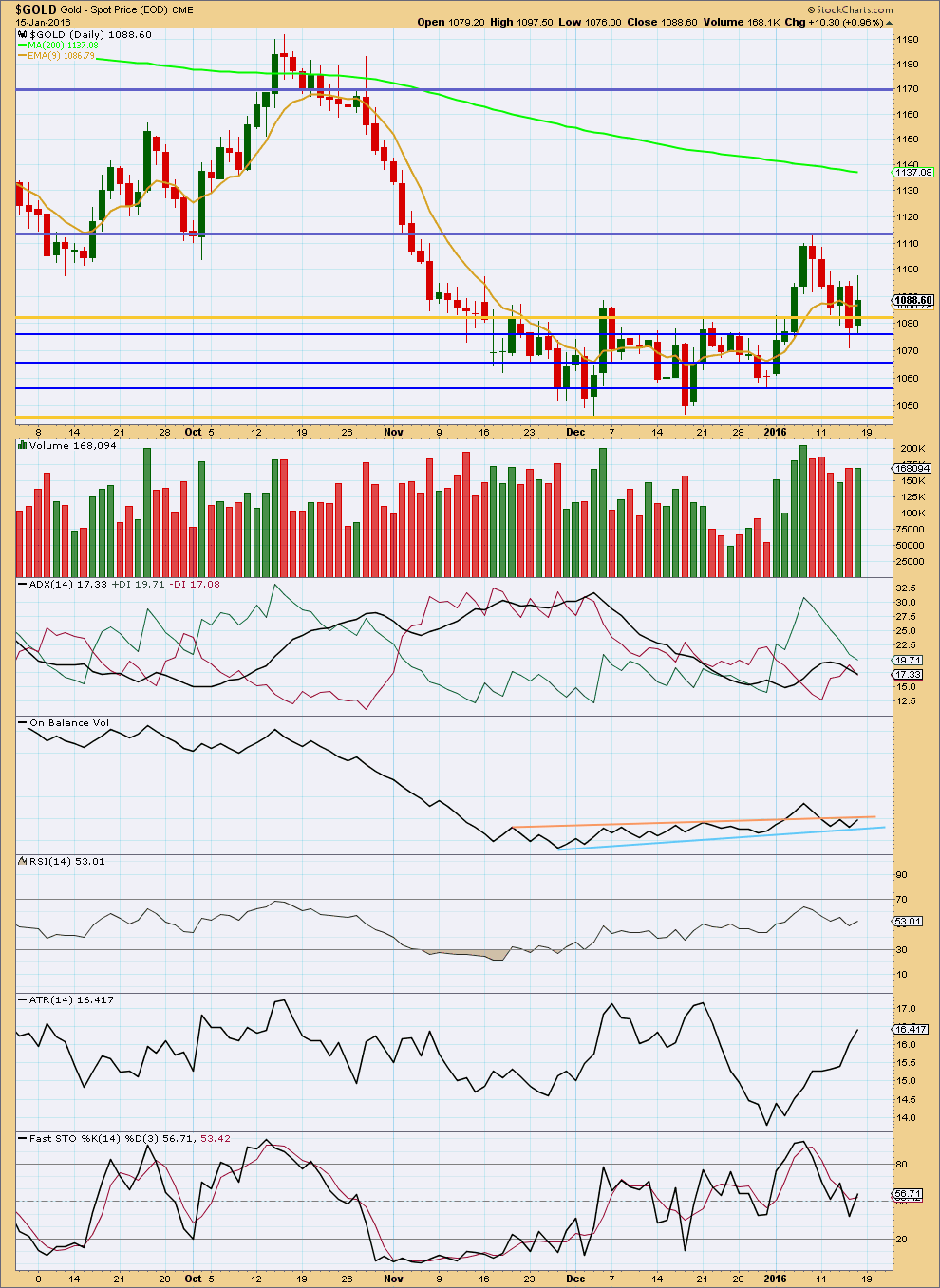

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume for Friday’s green daily candlestick is slightly lighter than the prior downwards day. This gives a slight doubt to the wave count; the upwards movement in price was not well supported by volume. If another upwards day comes with a clear increase in volume, more confidence may be had in the Elliott wave analysis.

Since the last low of 3rd December, as price has risen it has done so on increasing volume. Overall sideways movement from 4th December to 31st December came on overall declining volume. Thereafter, as price broke above resistance on 6th January, the rise in price to the next high came on increasing volume.

The last fall in price from 8th to 14th January came on a decline in volume.

Overall, the volume profile from the last low of 3rd December is bullish and overall supports the Elliott wave analysis.

On Friday price found support about 1,076, a previous area of resistance. If the analysis is correct, then this price point should hold.

ATR indicates price is most likely trending as it is increasing, but ADX disagrees as it is declining. ADX has not indicated a trend change as the +DX line remains above the -DX line. If the black ADX line turns upwards, then it would indicate the market is again trending and the trend would be up.

Neither RSI nor Stochastics are overbought or oversold. There is room for this market to move up… or down. Volume indicates it is more likely to move upwards.

This analysis is published @ 08:47 p.m. EST.

This is a boring fourth wave triangle taking its time.

Importantly I cannot see the move from the last low at 1,071.37 on the hourly chart to the high of Friday as a complete five wave impulse. To label it as such would see the third wave within it the shortest, violating a rule.

And so this triangle is still a fourth wave even though it has broken well below my cyan trend line. The trend line didn’t work.

The triangle cannot be a B wave.

When the triangle is done we should see a breakout upwards. Fifth wave movements following fourth wave triangles for Gold are sometimes surprisingly short and quick.

Well ,and properly stated Lara. Seen these “coiled” 4th waves before. When ready to spring they strike like a rattlesnake in the Arizona Desert Dont want to be on the wrong side when that happens!

Gold Speculators Turn Positive After 9-Week Hiatus – CFTC Data

Monday January 18, 2016 11:01

http://www.kitco.com/news/2016-01-18/Gold-Speculators-Turn-Positive-After-9-Week-Hiatus-CFTC-Data.html

GOLD Trading in Asia and Europe today was like watching paint dry. Obviously they are leaving it up to us Yankees to call the shots( or they also celebrate MLK day). Gold coiling like a spring for a quick move to 1112 and 1125 next day or two IMHO.

Latest Rambus post on the miners

http://rambus1.com/2016/01/17/weekend-report-84/

This may be an unpopular view right now, but considering the length of the more significant corrections over the last 18 months, gold may move sideways for several more weeks. Here are some examples:

Nov 7, 2014 – Jan 22, 2015 = 64 days

Mar 17, 2015 – May 18, 2015 = 51 days

Jul 24, 2015 – Oct 15, 2015 = 71 days

Dec 3, 2015 – ? = 35 days….and counting

Based on these past corrections, the current one could easily carry into February before peaking.

While I see the main count as the most probable at this time, I am keeping an eye on the possibility that the move to 1112 was only wave A. In other words, gold may be a few days into a B wave down.

As to main wave count, I would give it an extra week. This week may be a little too soon to expect a peak.

I am thinking that we will see a short term move up next week to the 1125 to 1135 area; whether we get to 1158 is problematic. THEN a medium term move to below 1000 into March . THEN AFTER SOME CONSOLIDATION, the beginning of a bull move up into Sept. to at least 1400. ( Based on 40 years experience involved with Gold and Silver- mining, trading, observing , analyzing, investing etc, in the precious metals markets. Good Luck ,and thanks for your excellent EW work LARA.

Good news for Australian investors??? Miners have been in bull market for some time.

NST, Australia premier gold miner now. its called a 100 bagger. 3c to $3. There are many more like NST in the beginning stage.

US investor can not invest in these companies.

http://goldtadise.com/?p=360381

The difference of miners abroad and US shows up in ratio chart of XGD.TO to XAU :

http://goldtadise.com/?p=360415

Gold COT – Commercials moved from 47% bullish to only 43% bullish. After holding above 47% bullish for the last 7 weeks, this seems significant.

Silver COT – Commercials for Silver moved only 1% less bullish, from 39% to 38% bullish. Overall they have stayed in this range for the last 8 weeks.

Next week I am expecting USO Oil , S&P and gold to bounce upward. Hold’ EW report is confirming the upward bounce.

BUT miners are not confirming.

Two most important ratios : XAU to GOLD and Silver to Gold chart are pointing down.

I can post only one chart to make the point. Weekly XAU/Gold ratio chart has a brake out to down side this week.

I can not see a bullish wave count to last too long?????

Lara is correct PM sector needs price point to determine a major trend change from bear to bullish.

I’m thinking gold only had a few weeks to correct here, maybe only two before a larger drop happen. If overall markets start collapsing further,no don’t think any asset is going to be safe, this could be the final capitulation in metals we have been waiting for. Check out June July 2008, Gold and SPX….may be something similar happening. N

Yes in 2008 Markets and gold crashed.

Gold dropped from March 10, 2008 then came back up July 17th then dropped until October 10, 2008

http://goldprice.org/gold-price-history.html