Last week’s Silver analysis expected more sideways movement, which is again exactly what has happened.

Summary: The correction is closer to completion. Volume from StockCharts indicates the breakout is more likely to be upwards, which favours the alternate wave count. The alternate wave count would be invalidated by a new low below 13.569.

New updates to this analysis are in bold.

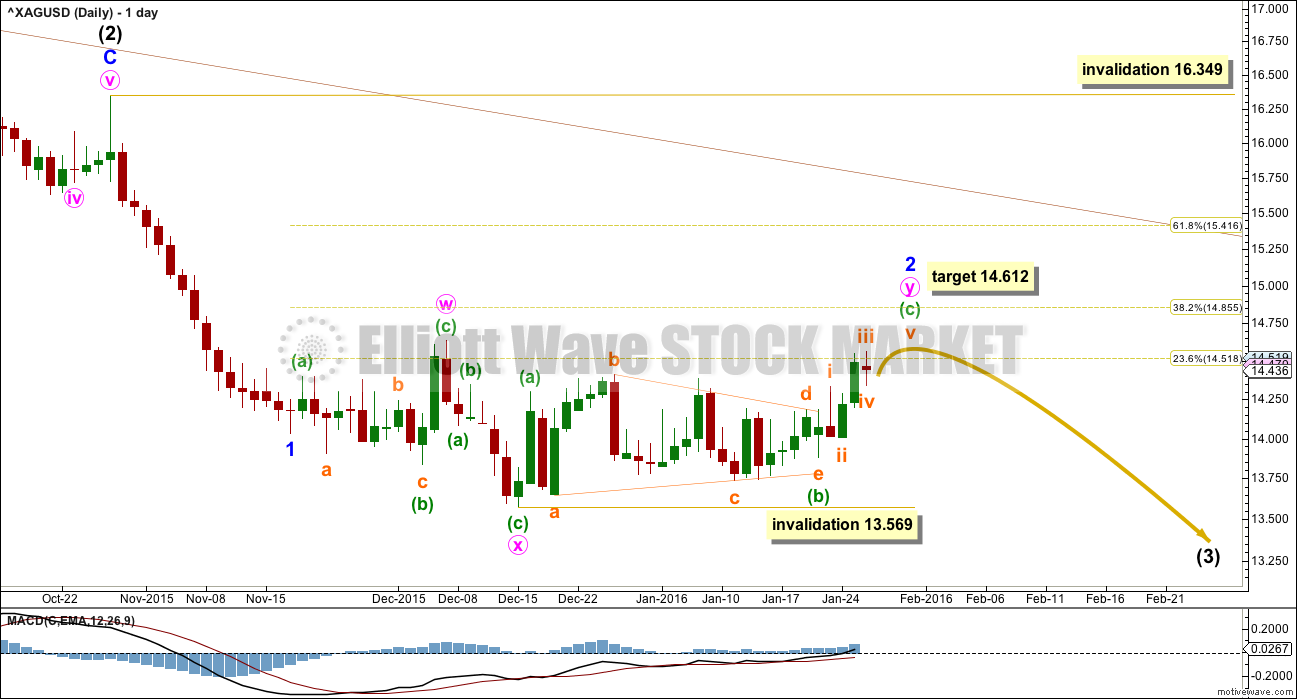

MAIN WAVE COUNT

Primary wave 4 may be complete and primary wave 5 may be underway.

Primary waves 2 and 4 exhibit perfect alternation and good proportion: primary wave 2 was a deep zigzag lasting 15 weeks and primary wave 4 was a shallow combination lasting 24 weeks, 1.618 the duration of primary wave 2.

At 11.02 primary wave 5 would reach 0.382 the length of primary wave 1.

This wave count is preferred primarily for the reason that there has been no technical confirmation of a trend change from bear to bull for Silver.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 17.71. A breach of this invalidation point would now also require a strong breach of the bear market channel, so this invalidation point should not be moved any higher. When that channel is breached that should indicate a trend change for Silver from bear to bull. At that stage, only bullish wave counts should be seriously considered.

When cycle wave a is a complete five wave impulse, then the following upwards movement for cycle wave b should last one to several years, may be any one of 23 possible corrective structures, and may not move beyond the start of cycle wave a at 49.752.

All wave counts at the daily chart level this week will show movement since the high at 16.349 on 28th October.

A second wave correction would still be incomplete for minor wave 2.

Minor wave 2 fits as an incomplete double combination at this stage. The first structure in the double labelled minute wave w is an expanded flat. The double is joined by a three, a zigzag in the opposite direction, labelled minute wave x. The second structure in the double is a zigzag labelled minute wave y.

Subminuette wave (b) is a time consuming regular contracting triangle within minute wave y.

At 14.612 minuette wave (c) would reach equality in length with minuette wave (a). This would see minute wave y end about the same level as minute wave w, so the whole combination structure would move sideways and have a typical look.

Only a final fifth wave up would be required to complete the structure within minuette wave (c). This main wave count expects the correction is very close indeed to an end. If this wave count unfolds as expected, then after one last new high price should turn and move lower. At that stage, a new low below 13.569 would invalidate the alternate and provide confirmation for this main wave count.

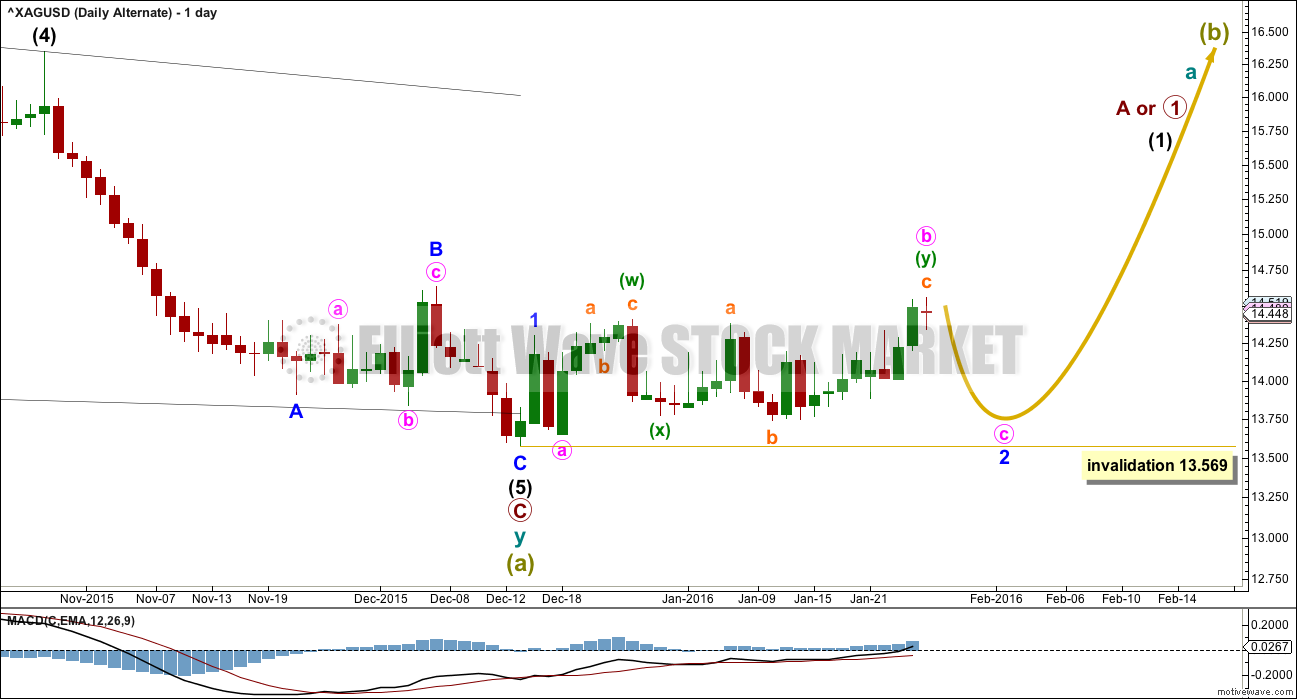

ALTERNATE WAVE COUNT

If super cycle wave (a) is a double zigzag, then within the second zigzag of the double labelled cycle wave y the structure may be complete.

Primary wave C is an ending contracting diagonal within the zigzag of cycle wave y. All subwaves subdivide as zigzags. The third wave is shorter than the first, the fifth wave is shorter than the third, and the fourth wave is shorter than the second. The trend lines converge.

There is a small overshoot of the (1)-(3) trend line at the end. This indicates the contracting diagonal structure is very likely to be complete.

If this wave count is correct, then super cycle wave (a) has subdivided as a three wave structure. That indicates Grand Super Cycle wave II may be a flat correction.

If this correction at Grand Super Cycle is a second wave (as opposed to a fourth wave), then a triangle may be eliminated.

A combination may also be eliminated because the first wave is a multiple. Combinations may only consist of a maximum of three corrective structures, so within each of W, Y and Z they may only subdivide into simple A-B-C structures (or A-B-C-D-E in the case of triangles). To label multiples within multiples increases the maximum beyond three, violating the rule.

Super Cycle wave (b) must retrace a minimum 90% of super cycle wave (a) at 23.945. Super cycle wave (b) may make a new price extreme beyond that seen for super cycle wave (a) above 49.752 as in an expanded flat.

Super cycle wave (b) may be any one of 23 possible corrective structures. It is impossible to predict at this early stage which one it will be, only to say it is unlikely to be a rare structure such as a running flat, expanding triangle or triple combination. That still leaves multiple structural possibilities.

The first movement up for a wave of this large degree must subdivide as a clear five at the daily chart level, and probably at the weekly chart level also.

If there has been a trend change at super cycle degree, then a clear five wave structure upwards must develop.

The ending contracting diagonal for primary wave C would very likely be complete as there is a slight overshoot of the (1)-(3) trend line.

So far only a first wave would be complete. Minor wave 2 may be unfolding as a very deep flat correction. It may also morph into a combination.

Minor wave 2 may not move beyond the start of minor wave 1 below 13.569.

Minute wave b may be a complete (or almost complete) double combination within minor wave 2.

Minute wave c should make a new low below the end of minute wave a at 13.645 to avoid a truncation and a very rare running flat. But it may not move below 13.569.

TECHNICAL ANALYSIS

DAILY CHART

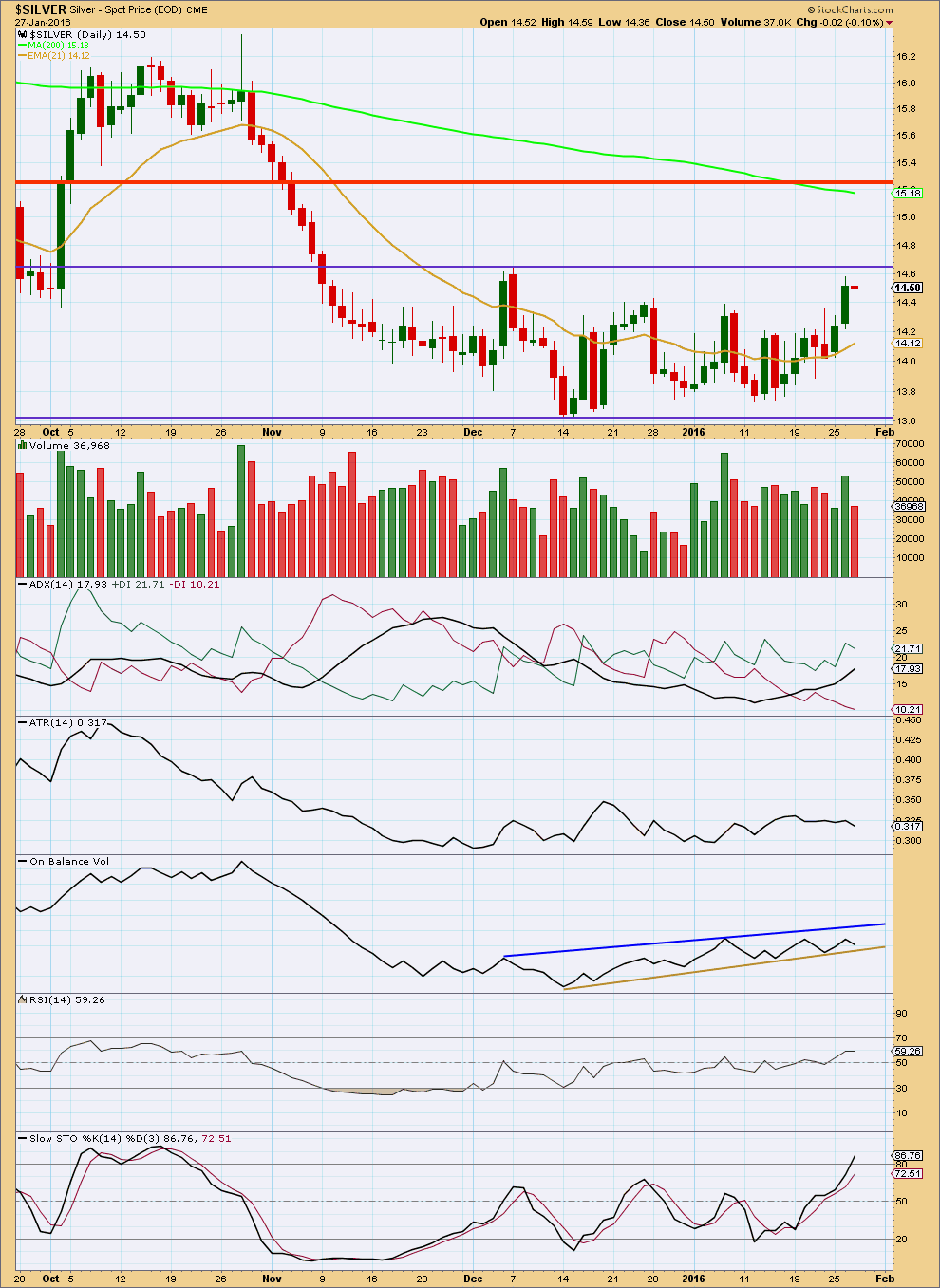

Click chart to enlarge. Chart courtesy of StockCharts.com.

During this sideways consolidation that Silver began back in November 2015, it is an upwards day for 7th January, 2016, which shows strongest volume. This suggests that price may break out of this consolidation upwards. This trick does not always work, but it works more often than it does not work. At the completion of another week, there is now another upwards day for 26th January with high volume. This is further suggestion that price should break out of this correction upwards.

This week I have adjusted the horizontal lines for support and resistance to include all of this consolidation.

ADX now indicates there may be the early stage of a new trend; the ADX line is above 15 and rising. ATR disagrees though; it is declining. With these two indicators disagreeing, it may be wise to wait for ADX to be above 20 or ATR to turn upwards before confidence may be had in a new upwards trend.

If price breaks above the upper horizontal line at 14.60 on an upwards day with an increase in volume, then an upwards breakout would be indicated. At that stage, confidence may be had that there is an upwards trend in place. The line at 14.60 should then provide support.

On Balance Volume remains bound within the blue and brown lines. A break above or below either of these lines may indicate the direction of price breakout.

RSI is neutral, there is plenty of room for this market to rise or fall.

Stochastic has returned from oversold and is now entering overbought. Expect the upwards swing in price to end about here and the next downwards swing to begin.

This analysis is published @ 10:58 p.m. EST.