Sideways movement was expected to continue for a correction.

Summary: The correction is still incomplete. It looks like it may most likely continue sideways as a triangle which may end in two more trading days. It is still possible that it could end Monday as a quicker zigzag but this looks much less likely. The trend is up, so the breakout should be up.

New updates to this analysis are in bold.

Last published weekly chart is here.

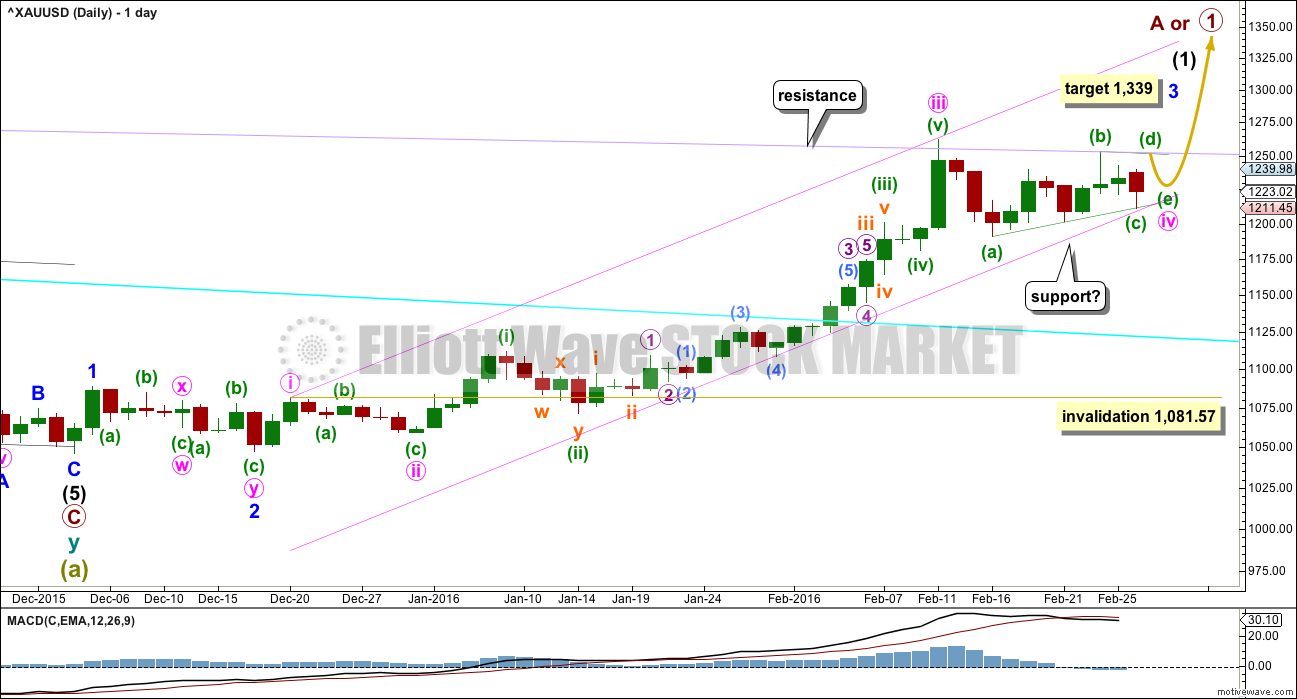

DAILY ELLIOTT WAVE COUNT

Gold has very likely changed from bear to bull.

So far, within the first five up, the middle of the third wave is now most likely complete. The strongest move may still be ahead. Gold typically exhibits swift strong fifth waves to end its third wave impulses. Look out for surprises to the upside for minute wave v and minor wave 5.

At 1,339 minor wave 3 would reach 6.854 the length of minor wave 1. When minute wave iv is confirmed as over, then this target may be calculated at a second degree. At that stage, it may widen to a zone, it may change, or a second target may be added.

Minute waves i, ii and now iii are complete within minor wave 3.

The pink channel is a best fit. Draw the first trend line from the highs labeled minute waves i to iii then place a parallel copy lower to contain the whole upwards wave. Minute wave iv may find support at the lower pink line. If price touches that line, it should offer a low risk entry point to join the upwards trend.

The main hourly wave count now expects a triangle is most likely unfolding sideways. Upwards movement is finding resistance at the lilac line and downwards movement is finding support at the (a)-(c) triangle trend line. To see how to draw the lilac line see the weekly chart here.

If the main hourly wave count is correct and Gold continues sideways to complete a triangle, then the following fifth wave may not be a strong extension and may be surprisingly short. Gold often exhibits very short quick fifth waves after its fourth wave triangles. The target for minor wave 3 at 1,339 may be too high. When minute wave iv is complete, if it is a triangle, then the target will probably be recalculated. If minute wave v is just 33.88 in length, which would be the most likely length, then at that point it would reach equality in length with minute wave i.

If the alternate hourly wave count is correct, then the lower pink trend line may be breached. Sometimes fourth waves are not contained nicely within channels; sometimes they breach channels.

Minute wave iv may not move into minute wave i price territory below 1,081.57.

MAIN HOURLY WAVE COUNT

This main hourly wave count expects to see alternation in structure between the zigzag of minute wave ii and the triangle of minute wave iv. This is the main wave count mostly for this reason.

Minuette wave (b) subdivides as a double zigzag. Minuette wave (a) may be seen as a single zigzag. Minuette wave (b) is less than 0.9 the length of minuette wave (a), so a flat correction is not possible as the minimum requirement was not met. A triangle may still be unfolding sideways.

Within a possible regular contracting or barrier triangle, minuette wave (c) may not move below the end of minuette wave (a) at 1,190.9. Thereafter, minuette wave (d) may not move substantially above the end of minuette wave (b) at 1,253.1. The triangle will remain valid as long as the (b)-(d) trend line remains essentially flat.

This main wave count expects minute wave iv to find support at the pink trend line. It may end about the 0.236 Fibonacci ratio at 1,213.91. If it continues for a further two sessions, it may total a Fibonacci thirteen daily candlesticks.

Within minuette wave (c) down, subminuette wave b fits as a zigzag. Within the zigzag, micro wave B was a running contracting triangle supported by an almost flat MACD that is very close to the zero line. I have tried alternate ideas to see subminuette wave b complete at the high labelled micro wave 2, but so far I have not been able to find a solution which fits that meets all Elliott wave rules and avoids very rare structures like running flats. The conclusion is that subminuette wave c begins where it is labelled, which means it is most likely incomplete.

Within subminuette wave c, micro wave 5 only needs to complete. It may move slightly below the end of micro wave 3 at 1,211.45. In the short term, if price moves above 1,228.47 (the low of micro wave 1) before making a new low, then subminuette wave c must be over and the next triangle subwave of minuette wave (d) upwards must be underway. At that stage, the alternate below may be invalidated.

ALTERNATE HOURLY WAVE COUNT

Minute wave iv may be continuing as a zigzag. This would offer no structural alternation with minute wave ii which was also a zigzag. For this reason, this must be an alternate wave count with a lower probability.

If any movement below 1,190.9 is seen, then the triangle would be invalidated leaving only this alternate wave count. At that stage, expect price to continue lower to the target and overshoot the pink trend line.

In the short term, subminuette wave iii must subdivide as an impulse. Micro wave 4 may not move into micro wave 1 price territory above 1,228.47 within subminuette wave iii.

At 1,182 minuette wave (c) would reach equality in length with minuette wave (a). This is close to the 0.382 Fibonacci ratio at 1,184 giving a $2 target zone with a reasonable probability.

This alternate wave count could see minute wave iv end in just one more session. It would not exhibit a Fibonacci duration.

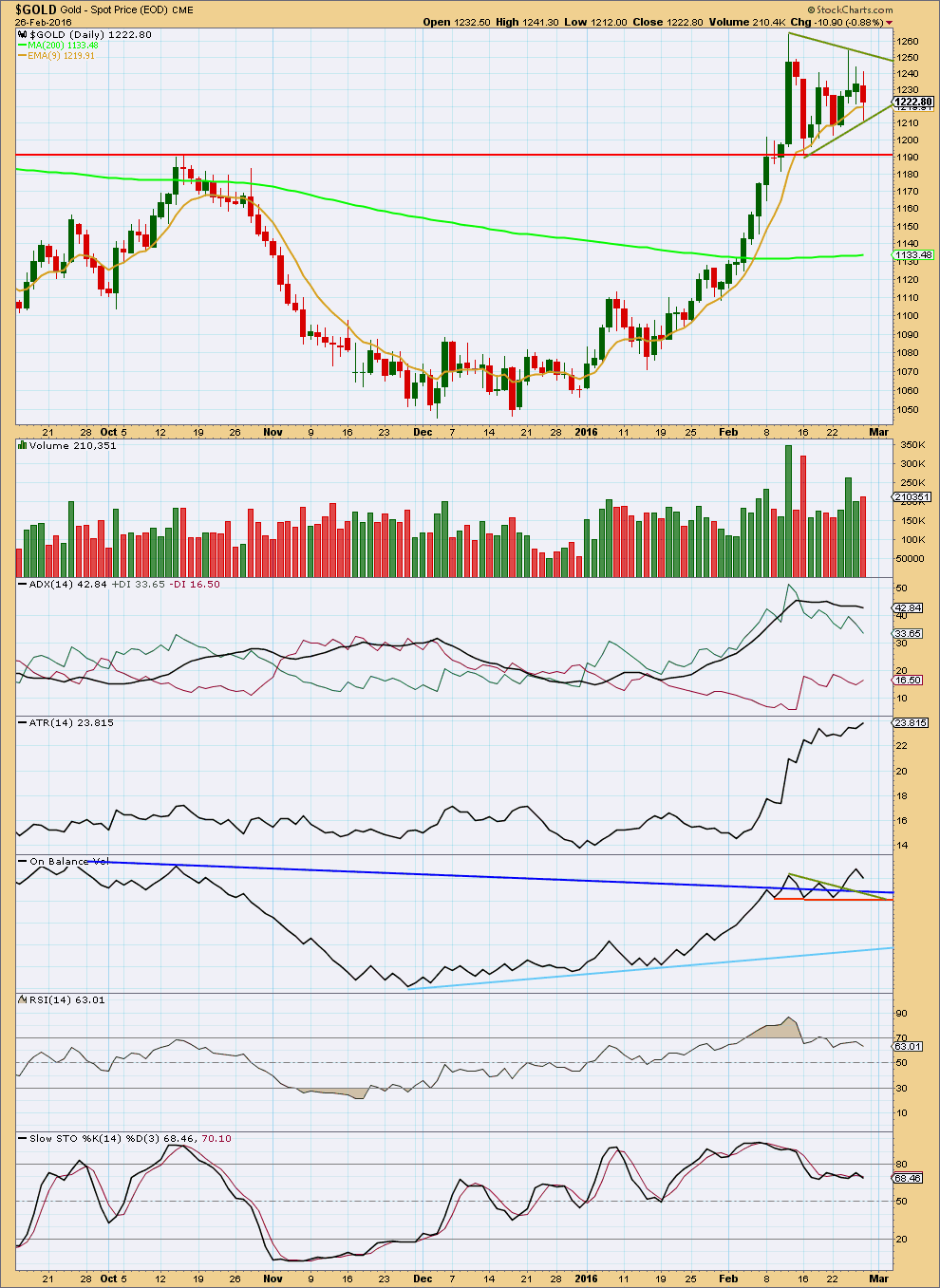

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

A triangle pattern looks to be forming. The trend lines are drawn across the top and bottom of the pattern. This is a fairly reliable continuation pattern.

Volume overall for the last four days is slowly increasing. This is opposite to what is normally seen during consolidation; normally, volume declines.

ADX is flat to declining indicating the market is correcting. ATR is now again increasing, so it now disagrees.

Apart from the outlier of 16th February, highest volume is for an upwards day. The 16th of February may include data for the holiday session of 15th February for which there is no daily candlestick in StockCharts data. If this candlestick for 16th February is ignored, then the breakout direction indicated by volume should be upwards.

If the volume for the daily candlestick of 16th February is taken into account. then the breakout direction indicated by volume should be downwards.

On Balance Volume may be providing an early indication. It has broken above all of its trend lines. OBV is often a reliable early indicator for price. This supports the Elliott wave count.

RSI is neutral. There is plenty of room for this market to rise or fall. Stochastics has returned from overbought.

This analysis is published @ 03:34 a.m. EST on 27th February, 2016.

So far it certainly looks like Gold is in a fourth wave triangle.

Again, I will try to see alternates. Triangles are horribly tricky structures. When you get too complacent and feel sure you’ve got it right… they then invalidate. Sometimes right at the last minute!

My first alternate idea will again see the triangle as a B wave within a zigzag. Which means a short sharp thrust lower for the C wave could end it.

The price point to differentiate that idea will be at 1,211.45. A new low below 1,211.45 now would invalidate the fourth wave triangle and see this fourth wave as a zigzag.

Now, that idea must have a low probability. At this stage I think it has a very low probability for a few reasons, but low probability does not mean no probability. We need to be prepared for all possibilities.

What is much more likely is a simple fourth wave triangle is unfolding. Minuette (d) upwards doesn’t look complete, I have found a target range about 0.8 to 0.85 for triangle subwaves to be somewhat reliable. Minuette (d) would be in that range 1,245 to 1,247.

Minuette (e) would most likely fall short of the (a)-(c) trend line. One more daily candlestick would see the triangle total a Fibonacci thirteen.

Gold may be just now in the process of finishing the 5th wave up of minuette wave (d) at 2:17 pm EST at 1,237.

Here we go…. the right chart…

thoughts..?

The first part of your wave count was one I had many months (years?) ago but discarded due to a low probability.

It is technically possible. But it suffers from the following problems:

1. Intermediate (2) is much longer in duration than primary 2 one degree higher. It should be more brief for the wave count to have the right look.

2. Intermediate (2) not only breaches a base channel drawn about primary 1 and 2, but the entire movement thereafter sits outside the base channel. Lower degree second wave corrections should find resistance / support at a base channel drawn about a first and second wave one or more degrees higher. This is most common, but not always seen. Sometimes base channels are breached. But to see the entire following impulsive movement well outside the base channel is extremely unusual and so must have a very low probability.

3. Within primary 4 triangle, the subwave of minor A in intermediate (B) has a strong three wave look to it. It should look like a five at the daily chart level. When Golds impulses have a curved three wave look to them it’s because the third wave within the impulse ends with a swift strong fifth wave, and the fourth wave correction is more brief and shallow. But here the fourth wave is much more time consuming than the second wave, not the usual other way around. Again, this is technically possible but highly unusual for Gold. Giving the count a very low probability.

I pretty much have the same technical reservations but U.S. data has been exceptional- giving the Fed plan some credence- and with wkly stochastics pushing the envelope this technically improbable idea begins to look more possible.

Thanks

wrong chart

“Elliott Wave Principle” by Frost and Prechter, page 54: within combinations regarding triangles “neither is there more than one triangle”.

That combination has two triangles. I don’t think that’s a valid wave count.

Any wave count?

Was the 1230.19 low at 1:17 pm EST the end of an A wave of an A-B-C wave down towards 1214. Or was 1230.19 the bottom of a 4th wave up in minuette wave (d)?

Jack Chen

Gold on buy signal, silver on sell signal. GDX on buy signal.

COT data remains in bear market values and is now at levels of previous tops. (last chart)

http://www.321gold.com/editorials/chan/chan022916.html

I bought GDX Friday at 18.73 at 3:57 pm and sold it today at a profit.

Now I wait to buy GDX back at the day low today.

Lara analysis mentioned 1 to 2 days to end minute wave iv.

With the invalidation last night of the hourly alternate and subminuette wave c than I’m expecting minute wave iv to end today so I’m buying back into GDX before the close.

Minute wave v up is forecast to be $34 in length, which would end minor wave 3.

I’ll sell GDX then and look for Lara’s forecast of minor wave 4 time and depth down.

I hope it is really deep to get miners a lot cheaper for minor wave 5 up.

Minor wave 5 up would end intermediate wave (1) and a full five wave count up before the full 5 wave down to retest the gold low.

I’m sure you mean 3 down to retest the low…

Yes you are correct. Intermediate wave (2) down would be a 3 wave to test the gold low of 1046.38 December 3rd.

Problem is gold is NOT falling, and SPX may have not topped. If gold continues UP past 1240 then we may have had a truncated low at 1216 in overnight trading. So what do you do then , my trader friend??

Gold takes time to drop from what may have been the day high of 1,235.95 at 10:07 am. I’m looking for gold to drop towards the 1,214 target to end minute wave iv and I will buy at GDX low today so I don’t miss a possible overnight surprise of minute wave v up $34. Perhaps we might get a comment from Lara before the close?

Lara did advise today, “Lara February 28, 2016 at 4:11 am

Richard, I am considering setting an order to buy at about 1,214. But I won’t set that until (d) is finished.”

Lara..

Oil is unclear…it raises a small thought in my mind…

If the rollover of april contract gave us a candle up 2$ than shouldnt we take the april contract high for minor 4 which was around 36.5$ as a invalidation point…and by this does the EWcount becomes clear…???

I cant say about anyone or any data…i can just say that the move in gold right now is the miror of laras analysis…i can say that lara is doing extreme hardwork to teach us the right technique of understanding EWCounts…im glad to be a part of elliott wave gold..

Thank u lara

🙂

+1

You’re all most welcome 🙂

Pupudi – do you know how Clive Maund supports that statement? And does he have an idea of the range of the imminent ‘severe drop’. What are his thoughts on how imminent is imminent? Does he use technical analysis?

My reasons for asking are because I’ve also joined EWI for their short term analysis and financial forecasts of various markets, which includes gold and silver, and am here too. EWI and Lara are completely in synch. Lara’s charts are much easier to read because of the different coloured Zapf dingbats fonts whereas EWI use just black and white font. However what each says is almost a mirror of the other but I prefer Lara’s as hers is much more indepth and teaches as she goes along, whereas EWI refer to their book.

Both EWI and EWG discuss scenarios of corrections to around 1190.+ and 1150-1180 and according to the Elliott Waves an eventual wave uptrend to B which could take a very long time. Is the possible correction to 1150 the imminent drop to which Maund refers? I hope you don’t mind me asking these questions.

Lara is the best when it comes to EW and TA. Yes I like her perspective on Gold, silver, GDX and oil.

As far Clive has been TA for man years and his projection may be the same as EW low to 1190 to 1184 area. His support for his claim for imminent drop is basically from extreme COT report of last three weeks. Many COT data observers would come out with the same outcome for metals G/S.

I would not put too much weight on 1150 level. I would go with EW target only.

Once this wave iv correction is declared by Lara i am buyer of miner in a big way srecially juniors and micro juniors like Oceana gold operating in NZD.

I think we nearly touchd our wave d target …lets be hopefull for a down move… I will place order for 1214$ to go long 🙂

Here is another COT analysis on recent extreme Gold COT data by Clive Mound:

http://www.clivemaund.com/article.php?art_id=3739

SILVER BREAKS LOWER – GOLD & PM STOCKS SET TO PLUNGE…

…the latest COT data not only confirms this view, but suggests that a severe drop is imminent, and it already started in silver on Friday. Fortunately we exited most of our long positions in the sector, many at a handsome profit, over the past 2 weeks, having spotted the danger.

….The latest gold COT chart, which may be directly compared to the 1-year gold chart above, because it also goes back a year, shows that Commercial short and Large Spec long positions exploded higher last week, the culmination of a multi-week exponential ramp. As the Commercials are collectively always right and the Large Specs wrong, this means trouble. This is characteristic of an important top, and gold is now expected to plunge, probably immediately.

This assumption is incorrect especially in a super cycle change from gold bear to gold bull wave.

“As the Commercials are collectively always right”

Not always accurate and may be delayed.

Gold COT and gold trade:

The Dumb Money is Suddenly Dangerously Long Gold Futures:

Despite a ~$70/ounce pullback since trading up to $1263.90 a couple of weeks ago gold futures speculators continued to pile on bullish bets, reaching the highest levels of net speculative length since last October…….

Perhaps the most notable aspects of the latest CoT (Commitments of Traders) data is that small speculators have clearly moved to the largest net length in slightly more than a year (February 2015, which coincided with a major top) and each time that managed money net length has moved over 100,000 contracts (see blue line at bottom) a major top hasn’t been far away……

http://energyandgold.com/2016/02/26/the-dumb-money-is-suddenly-dangerously-long-gold-futures/

Main hourly Lara says – “In the short term, if price moves above 1,228.47 (the low of micro wave 1) before making a new low, then subminuette wave c must be over and the next triangle subwave of minuette wave (d) upwards must be underway. At that stage, the alternate below may be invalidated.”

Gold went above 1228.47 at 1:00 am to 1228.61 so alternate hourly may be invalidated and the subminuette wave c is over and may now be heading up in minuette wave (d).

I will sell GDX today at a profit if hits 1240 area then buy when drops to 1214 area Monday or Tuesday before heading up in minute wave v up $34.

Gold at 1:00 am Monday moved above the hourly alternate, short term invalidation above 1,228.47 up to 1,228.61.

Gold moved up as the US dollar moved down.

1:15am Dollar tumbles as G-20 fails to reassure, China stocks drop

Woowww predicted right…alt invalidated jst in an hr… 🙂

Gold moved down in an early asian trade and bounced back…

US futures down…Europe opening seems negative…and looking at the surprising nature of gold right now my call is that C is completed with a failed 5th wave

I AM NOT CONCERNED ABOUT THE LARGE SHORT POSITION of Commercials in here. As I know from my experience in working for a Precious metals mining company when gold and silver have been down for a while and a reprieve occurs(higher prices) the mining companies tend to want to lock in their unexpected gain in prices by selling forward to lock in profits for the next quarter(in case prices go south (down) again. So that is why the COT (Commitment of Traders) shows a large short position at present. This can change rapidly!!. If the large specs hold the price above the 1210 or so area and it begins to climb these short positions will be removed quickly. and in some cases long positions will be put on. Also the Technicals are looking good with favorable stochastics and a large bull flag forming. In addition Lara’s formidable contribution in analyzing the gold and silver Elliot Wave show that the bear market has indeed turned to bull. Finally one must consider the fundamental economic environment worldwide and the excess money printing which has occured by Drahgi in the E.U ,Yellen at the FED and other international currency problems which have led to the Precious metals being viewed as alternative money to other currencies. The ,of course are the geo-political aspects of ISIS, problems in Syria,Iraq, Iran, the North Korea problem, Russian intervention, China etc etc. etc. All this considered one must conclude that the path of least rsistance for gold and silver is definitely up as world sentiment and conciousness drive the Elliot B wave in gold up to its inevitable top of at least 1500 by Sept 2016 and possibly(probably) testing the old high of $1920 per ounce sometime in 2017. From someone who has “been there-done that ” twice before in the late 70’s to early 80’s period and the 2001 to 2011 period. This is my humble (but not too humble) 0pinion. Got Gold??

Now that Lara has discarded bear wave count I have bot an income closed end precious metal fund distributing monthly dividend at 12% annual rate.

The fund top investments are senior gold /resource miners. So it is like GDX.

It is a leverage fund and managers writes call and income from call options is distributed every month around 1.5% rate.

I have been watching this fund during this bear market and it has gone down along with miners. But the fund maintained the dividend at annual distribution of 12%.

Going forward I expect them to maintain their div rate around 12% as fund’s NAV increases. Thus on original investment yield will increase higher and higher.

In addition to that I have enrolled in re-investment dividend program.

This give a significant compounding effect on original investment at this important bottom.

Do your due diligence if you invest.

Thomas

Gary”Looks like it’s a birth of another gold bull market like 2001-2002. ”

Since 2011 top many brand name analysts have been comparing gold chart to 1976 chart and signal it is bottom. Bottom was never there.

Coming to Lara’s analysis I learned EW. One can compare old chart (not pattern) to the current situation. Times are different and waves are different at those times.

In 2001-2008 gold had just finished a major multi decade bear market and a new EW was upon it.

Todays bottom is a corrective bottom and a different EW cycle wave b. Gold will behave differently than 2001 to 2008.

Lara has wrottten about this corrective wave many times in her previous reports:

August 4 2015:

“I have a Grand Supercycle EW analysis, look under “Gold Historical” category.

When primary wave 5 down is complete then I’m expecting a bear market rally. The rally should last one to several years. But beware, it will be a B wave. They’re the worst. They can be choppy and overlapping and hideous to analyse and trade, or they can be quick sharp zigzags that look like impulses. B waves exhibit the greatest variety in form and behaviour. There are a total of 23 possible patterns for them to unfold as. It could be a sideways drift or a sharp rally up.”

Have a good day!!

I saw that EW chart a few months ago when I subscribed to EWI and it scares me. I can’t imagine how much lower miners can go down if EW is correct after the bear market rally is over. At $600 gold, HUI will be like 10-20 from today 160.

I’m starting to look at oil and base metal. There’s head and shoulder pattern in copper that targets $1.30. It may reach that if oil goes to $11. The bargains in the base metal market is ridiculous at the moment. Ivanhoe Mines has $530 million US as of December and is trading at $391 million US. What? It is trading less than the cash it has! So you get all the mines that Ivanhoe for free! wow…free money. Friedland is pissed. He’s going to try to pump Ivanhoe during PDAC for sure. I do not own Ivanhoe or intend to buy any soon as long as oil keeps on crashing. It’s just very interesting.

WoW is true!!!! IVN should be buy here. I did not know this. Thanks for sharing.

Not scary as would be years away and EW and Lara can guide investing in miners whether bull or bear along the way.

Papudi..

Investing.com updated COT net long 145.0k..

What does this mean..??

What is net long????

Large speculators net long is 178979 contracts.

Large commercials are net shorts: 196913 contracts

Simple and basic theory of COT is that large commercials are always right in gold market and large speculators loose money on their long/short positions.

Looking at just recent history of COT one can confirm with some confidence that this un -written rule has been correct most times than other.

On 12/04/2016 Commercial shorts 225,105 (-6370) Net Shorts +7050, Gold closed:1084.

Since then gold is higher today at 1250 (+$176)

http://www.321gold.com/cot_gold.html

One thing that does bother me a bit and that is the big candle on the 11th February which is about three times the average volume of the other candles. From Lara’s analysis I can see there are possibly two scenarios that can unfold in the next few days, but I do keep looking back at that candle and wonder what part it’s going to play. If there is ever a retracement from the high of that candle could that end up quite low? e.g. below 1190? maybe lower than 1175 before things get back on the upwards trend? Maybe I am being too jittery. I am very much an EW learner.

I think you mean range, not volume, for that candle.

That it totally normal for the end of a wave for Gold. It ends it’s impulses with a fifth wave spike on increased range and higher volume.

It’s a typical blowoff top.

It means the market will correct. But it does not mean the market must completely change trend.

Lara – Thank you – and for all the other responses you’ve made to other members. Your comments are all very clear and extremely helpful. It really helps me to learn how to trade more intelligently.

I am currently short April gold futures and if higher levels are seen ,Sunday evening, in overseas trading , will add to my short position ;then cover and go long( as a large Spec.), at the 1210 area, Sunday night or Monday. Good Luck All,and thank you Lara for your excellent analytical work. As a former blues guitar player and Merger Acquisition guy and a Trader, I say again :” You Rock The House”, Lara !!! from New London, Connecticut, U.S.A.

Thank you very much Stephen. From Mangawhai, Northland, New Zealand 🙂

Gold Cot more bearish at top.

May be alt count will resolve the COT shorts?

http://snalaska.com/cot/current/charts/GC.png

http://snalaska.com/cot/current/charts/SI.png

Worst case scenario. PDA is next week which crashes gold consistently. And COT at these levels suggest “we will see a new low”. This happens every time COT hit the lower Bollinger Band in the past. COT seems to be saying this is like 1999 when gold was in a Bull market for only 40 days after popping 29%, then re-enter a Bear market for another 540 days (about 1.5 years). HUI went from 100 to 43. So far, currently, gold has only made a daily high of $1250 or 19% (need 20% + to officially call a Bull market) after 80 days. If HUI crashes through 100, we’re on the express line to 60-70 HUI.

Best case scenario. Elliot Wave triumphs and gold pops to 1300+. Ignore COT because this is 2009 again!

I like Lara’s advise to bet only 3-5% on any position.

http://nftrh.com/2016/02/26/gold-silver-cot-worsen-yet-again/

Gary not worry about COT. Looks like it’s a birth of another gold bull market like 2001-2002. Commercial will keep on increasing their short as gold continues to rise. That’s normal . I would not short gold and wait for confirmation from Lara to go long.

I agree I wouldn’t short. In the meantime however I would have ‘some’ miners as frustrating if the 5th wave happens overnight and didn’t buy any yet. Then buy more when Lara confirms to go long.

Richard, I am considering setting an order to buy at about 1,214. But I won’t set that until (d) is finished.

If (c) down unfolds as expected, and price turns up from there, then (d) unfolds as expected and MACD hovers about zero… then I will set an order.

So much can go wrong between now and then so this is a theory only. If it all unfolds as this wave count expects I’ll share my strategy with you all again at the opportune time.

For now, may everybody have a wonderful weekend.

My opinion is that the miners have hedged to protect their profits by selling forward , however ,the Specs will keep the market from dropping much below 1210 and after Sunday night overseas buying will begin putting pressure on the shorts (as you are ,I believe ,suggesting) and we will see the gold market begin to be driven by Commercial short Covering , then buying, to drive the gold pricing higher. IMHO

Hi stephen: Lara’s analysis certainly rocks! It is more than just superb…. I am onboard with you for the short side looking to cover at around 1209, expecting a pullback (short term decline) on Monday and subsequent topping this week; unlikely Gold price will get much above its pivot on Monday…..Gold price is generally ranging $17-$25… Got in a sell on Friday to go long at 1212 and again in sell mode lol…. Lets see how this plays out. Good luck.

Thank you very much Syed. That is a lot to live up to. I will try to do just that 🙂

Thank you lara..

Todays analysis seems to be not so BULL confident…Is their any concern or worries for bulls..??

“Volume overall for the last four days is slowly increasing. This is opposite to what is normally seen during consolidation; normally, volume declines.”

Slight.

If this fourth wave is a triangle as it so far looks like, then the following fifth wave upwards breakout may be very quick and surprisingly short. It could be over in just one or two days and only about $38 in total length.

And then Gold may move into another deeper more long lasting correction for minor 4.

That could fit with the bearish COT nicely.

The high may not be quite yet in, but another correction lasting a week to three may resolve the bearish mood.

Ok..so you are not expecting any fireworks for now on the upside…!!..

But i will still love to have those 38$ in my pocket.. 🙂

Thers a huge bull flag too in gold…im not concern with COT data….its ok…it can get changed in a day…all matters is technicals…

Regular TA would take the bear triangle continuation pattern and use the length of the move into it as a target for the length of the move out of it.

But I will use my experience with this market and say it is more likely (but not definite) that the move out of this triangle (if it remains a triangle) is more likely to be surprisingly short.

We have been surprised before. I want to learn that lesson and not be surprised again.