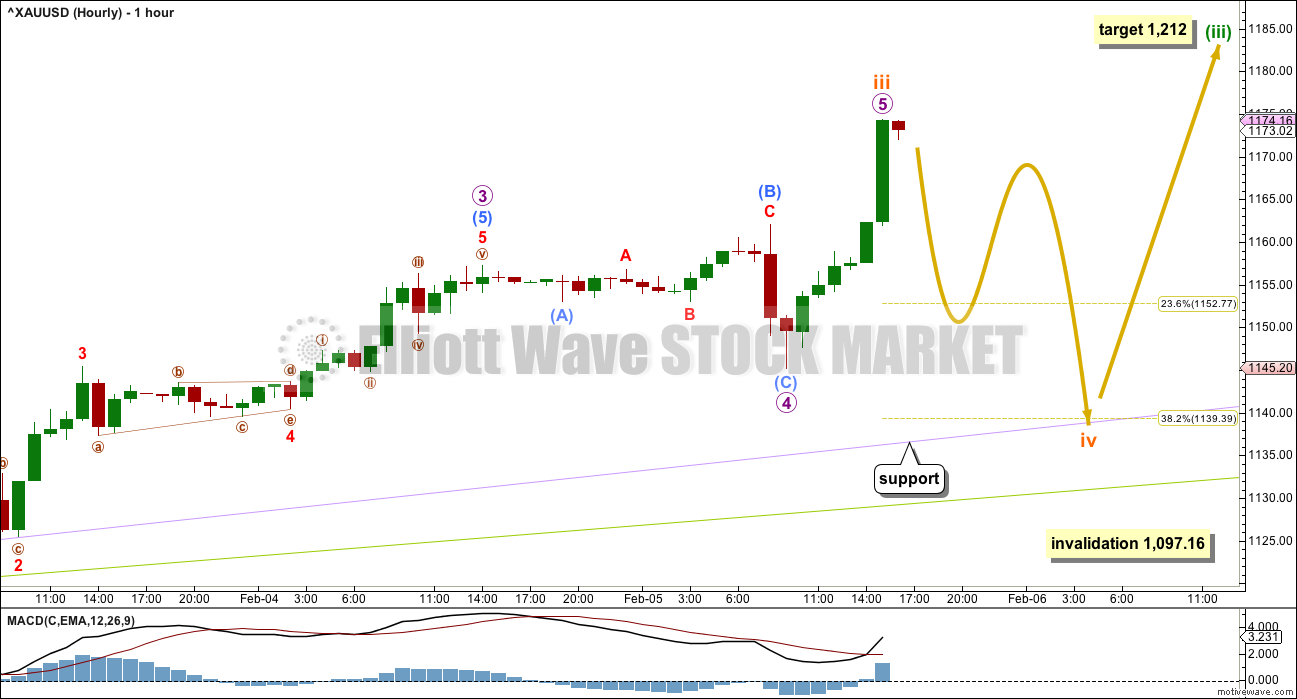

A small fourth wave correction unfolded as expected, reaching down to 1,145.2, into the target zone which was 1,145.4 – 1,137.29.

Thereafter, upwards movement continued as expected.

Summary: The trend is up. In the short term, another fourth wave correction may begin Monday to last one to three days and end about 1,139. However, expect surprises to the upside as there are a number of fifth waves approaching, and for Gold these are often swift and strong. Use the lilac trend line as the first line of support. Corrections present opportunities to join a trend.

New updates to this analysis are in bold.

Last published weekly charts with the bigger picture are here, with video here.

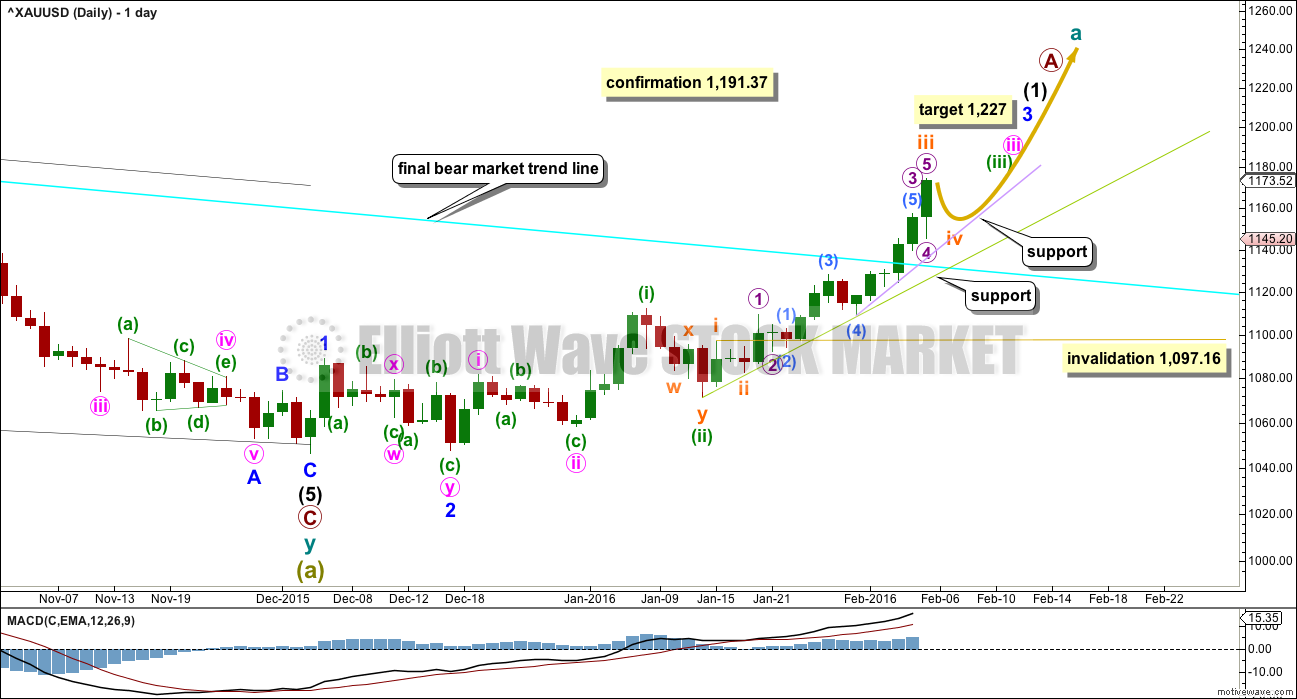

MAIN BULL ELLIOTT WAVE COUNT

The final bear market trend line is drawn on weekly and daily charts on a semi-log scale from the price points as marked. This has now been breached by two full daily candlesticks above it and not touching it. If this line is breached by a full weekly candlestick (the earliest that could be would now be next week), then all bear wave counts should be discarded.

For now this bull wave count will be the main wave count and the bear will be an unlikely alternate.

Super Cycle wave (b) may be any one of 23 possible corrective structures. First, a move of this size should have a clear five up on the daily and weekly charts. That is still to complete.

So far, within the first five up, the middle of the third wave is now most likely complete. The strongest move may yet be ahead. Gold typically exhibits swift strong fifth waves to end its third wave impulses. Look out for surprises to the upside for one or more of subminuette wave v, minuette wave (v), minute wave v, and minor wave 5.

At 1,227 minor wave 3 would reach 4.236 the length of minor wave 1. If this target is wrong, it may not be high enough. Minor wave 3 may not exhibit a Fibonacci ratio to minor wave 1.

Within minor wave 3, minute waves i and ii are complete. Minute wave iii is incomplete.

Within minute wave iii, minuette waves (i) and (ii) are complete. Minuette wave (iii) is incomplete. At 1,212 it would reach 2.618 the length of minuette wave (i).

Minuette wave (ii) was a time consuming and deep double zigzag which lasted 4 sessions. When minuette wave (iii) is complete, then the following correction for minuette wave (iv) should also be a multi day correction showing up clearly on the daily chart. This would be the next expected multi day interruption to the trend.

Within minuette wave (iii), subminuette waves i, ii and now also iii are more likely all complete. There is no Fibonacci ratio between subminuette waves i and iii.

Ratios within subminuette wave iii are: micro wave 3 is 4.69 short of 2.618 the length of micro wave 1, and micro wave 5 is 2.63 longer than equality in length with micro wave 1.

Subminuette wave ii was a relatively deep 0.56 zigzag which lasted two sessions. Given the guideline of alternation subminuette wave iv may be expected to be more shallow and either a flat, combination or triangle. The 0.382 Fibonacci ratio of subminuette wave iii would be the most likely target, and within or close to the fourth wave of one lesser degree would also be a likely place to it to end.

If subminuette wave iv lasts one to three sessions, then the wave count at the daily chart level will have the right look. The right look for an impulse is based upon the proportion of the second and fourth wave corrections within it.

However, Gold has a tendency to exhibit swift strong fifth waves. This sometimes forces the fourth wave correction before it to be more brief and shallow than otherwise. Look out for this tendency over the next couple of weeks.

Subminuette wave iii may now be over with a swift fifth wave to end it. This would be typical behaviour for Gold.

Micro wave 4 unfolded as expected as a flat correction, ending within the price territory of minuscule wave 4. Within the expanded flat, submicro wave (B) is 2.13 times the length of submicro wave (A). This is longer than the maximum common length of 1.38 and longer than the convention of 2, but there is no Elliott wave rule stating the maximum length of a B wave within a flat.

Within the expanded flat, submicro wave (C) is 0.94 short of 4.236 the length of submicro wave (A).

Either way, no matter how the end of micro waves 3 and 4 are seen, it is highly likely that both are over now.

Along the way up to the target for minor wave 3 at 1,227, there should be three more fourth wave corrections. The next one may begin on Monday and should show up on the daily chart as one to three red candlesticks or doji, or a mixture of the two.

There are two possible areas where subminuette wave iv may end. It may end within the price territory of the fourth wave of one lesser degree, from 1,162.01 to 1,145.2. Or it may end a little lower to reach down to the 0.382 Fibonacci ratio of subminuette wave iii at 1,139.

If subminuette wave iv is an expanded flat or running triangle, then it may include a new high above its start at 1,174.40. There is no upper invalidation point for this correction, and a new high does not mean it is over.

Subminuette wave iv should find support at the lilac trend line, if it manages to get down that low.

The target for minuette wave (iii) remains the same at 1,212 where it would reach 2.618 the length of minuette wave (i). When subminuette wave iv is complete, then this target may be calculated at a second wave degree. At that stage, it may widen to a small zone or it may change.

Subminuette wave iv may not move into subminuette wave i price territory below 1,097.16, but it should not get near that point. If it moves reasonably lower, it should find very strong support and not break below the final bear market trend line (cyan on the daily chart).

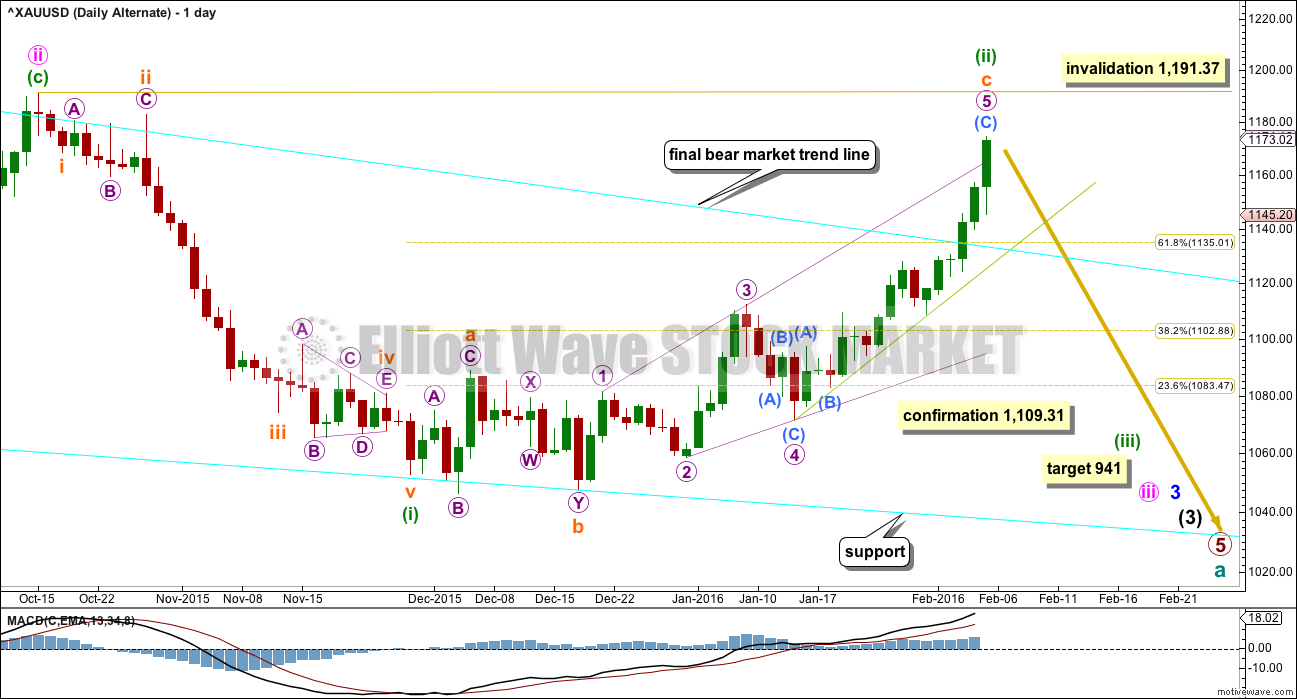

ALTERNATE BEAR WAVE COUNT

This is now an alternate wave count. With two full daily candlesticks above the final bear market trend line and not touching it, this provides simple trend line confirmation of a trend change from bear to bull for Gold.

This bear wave count would expect to see strong red candlesticks next week, and it expects price to move strongly lower for a third wave at four wave degrees.

The probability of this wave count has reduced further today. It should not be relied upon. If the final bear market trend line is breached at the weekly chart level, this wave count will be discarded.

This wave count requires a new low below 1,109.31 to have any confidence in it.

TECHNICAL ANALYSIS

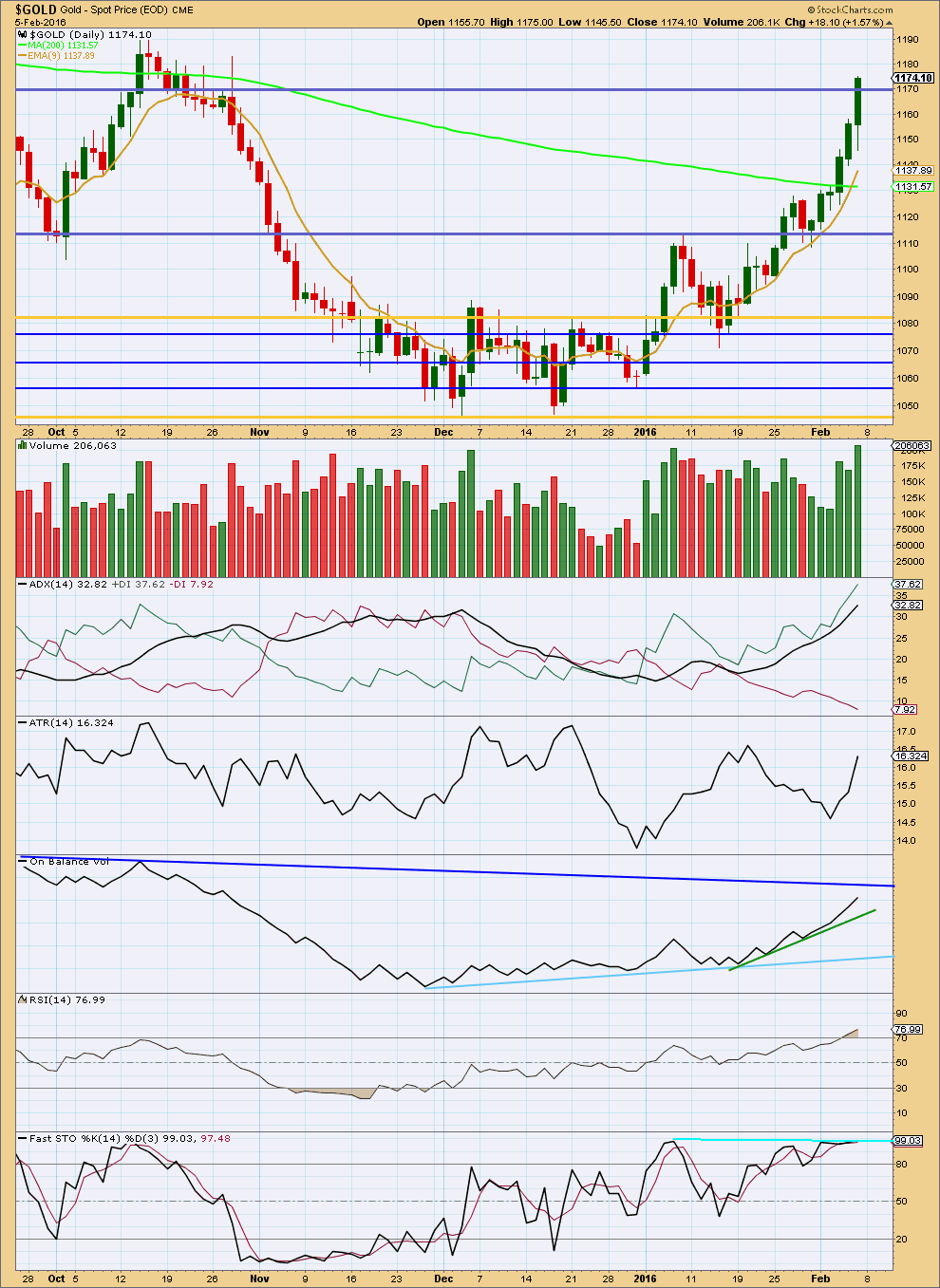

Click chart to enlarge. Chart courtesy of StockCharts.com.

This section of the analysis is updated Sunday 7th Feb, 3:55pm EST.

Friday’s upwards movement came with an increase in volume to support the rise in price.

ADX and ATR agree that there is a trend and it is up.

RSI is overbought. This may remain extreme for some time while a trend continues, I will be looking for short term divergence between price and RSI to indicate a correction to begin. There is no divergence today.

There is slight divergence with price and Stochastics. As price has made new highs for the last two sessions Stochastics has failed to make corresponding highs. This divergence is now more persistent, it warns a correction within this upwards trend may be coming. This supports the Elliott wave count.

If price continues higher then it may be interrupted when On Balance Volume finds resistance at the dark blue line.

This analysis is published @ 06:43 p.m. EST.

Today the invalidation point was passed above 1,191.37 for the remaining daily bear wave count and this also would provide price confirmation for the daily bull wave count.

However one full week above the final bear market cyan trend line at about 1,140 and the bear wave count would be discarded.

Today this has now been breached by three full daily candlesticks above it and not touching it. If this line is breached by a full weekly candlestick (the earliest that could be this week), then all bear wave counts should be discarded.

For now this bull wave count will be the main wave count and the bear will be an unlikely alternate.

Hi Richard,

Do you have a bearish count sill valid?

No the only bearish count was the daily and it was invalidated today. The bear count would be discarded after today with 2 more days above cyan bear line around 1140.

Price is the final determinator. It has invalidated the bear count.

The bear is dead. Long live the bull 🙂

Gols seasonality in play. Per my old post on gold seasonality this is Feb high from Dec low. AND now look for March low soon.

Lara: How to find my old comments short of going thru past reports?

That’s a good question.

I don’t know.

I’ll ask Cesar.

For gold on trading platform use this

/GC

It looks today like subminuette iv was very quick and shallow.

And this upwards movement is subminuette v, the final fifth wave up within minuette (iii).

Gold does that. It has quick shallow fourth waves when its fifth waves are strong.

I am not expecting the next multi day correction to arrive until minuette (iii) is complete. For now the target is 1,212, but I’ll look at subminuette ratios and see if I can add to the target calculation at a second degree.

If targets are wrong they may not be high enough.

The trend is up. Expect surprises to the upside.

Yes now i will buy gold…thers much more to go…this was just a begining…now let us see what are the correction targets lara will give…eagerly waiting for a corrective dip now.. :))..

On the other hand also waiting for oil analysis…its looking a bit unclear..

Lara the Super Woman has all the answers..

🙂

Oil looks clear to me.

It came up again to touch a trend line and turned down from there. I’m using that as an opportunity to join the trend, which for Oil I think remains down.

Oil has lower highs, but so far not lower lows. And so while the trend remains down it’s still possible that the fourth wave is continuing as a triangle. The breakout should be down.

Bear count is now invalidated and Bull confirmed with a move above 1191.37.

Any corrective wave count you can suggest since wave iii target is met at 1199???

Yay! One less chart to follow.

Good for you and us.

It looks like subminuette wave iv already ended although it didn’t quite make it down to the target range. “1,162.01 to 1,145.2. Or it may end a little lower to 1,139.”

Gold has gone up $23 since the Friday’s high.

Gold must have moved up to a higher wave in Lara’s count by now.

Perhaps there is a bigger correction due early this week.

The stock market is down today and pushing up gold.

I dont think so..3 wave structure cant be seen on hourly chart..

This move up is too high to be part of the correction.

It was a quick shallow fourth wave, followed by a strong fifth wave.

I would not expect the next multi day correction to arrive until minuette (iii) is finished, and I don’t think it is finished yet.

Bear market in gold is over.

Step sum for gold is finally down and turn.

Also Lara: Is it possible for you to analyse EW count for BGMI to gold ratio from 1920 to today? The chart is in the link.

Miners have been in bear trend since 1966 high. If EW tells us the bottom is here, this is the life time opportunity for the miners. I am already IN.

http://goldtadise.com/?p=362305

Edit: Miners have been in bear trend since 1966 high.

I meant miners to gold ratio in bear trend. The ratio indicates valuation given to miners in relation to gold price.

Hi Papudi,

Would you mind sharing which specific miners you have bought / are interested in?

I have bot many. But not any leveraged etc,

Etf: SGDM,SGDJ,GDXX

Seniors: RGLD, FNV, AEM

Juniors: LSG, ROG.V, TGM.V,RIC,MUX ,NG and many other

Plan to buy more once this correction is over.

Gold is out of the gate first time. It will retrace big time soon and then Lara will advise when to have position.

Do not chase now.

Many thanks

Dear Members long time subscriber or just visitors- I learn every day on this board from u all. Thanks for your postings.

If you are here to make money by trading gold and gdx. That is fine.

But if you want to generate wealth in this very soon to be declared new gold bull trend than start putting togather a portfolio of juniors now.

It is an once in life time opportunity. It is here.

In PM sector real bull market juniors will perform 1000% or more than gold and GDX or 3xetf.

Below is an article from Casey research. It makes the same point. In the article Casey has provided several lists of junior performance vs the senior gold producers during past BMR’s between 1980 to 2000. Those were the Bear market rallies in a bear market.

Current trend is also corrective wave b but much bigger than past BMRs.

I have already put togather my portfolio of juniors and continue to add more.

What 10 baggers and 100 baggers look like??

http://www.caseyresearch.com/articles/what-10-baggers-and-100-baggers-look-like

An interesting article, thanks for the link Papudi!

The Wave Trading – huge upside potential in GDX

http://www.safehaven.com/article/40387/gdx-gold-miners-etf-substantial-upside-potential

Video on gold, miners, and USD

http://thedailygold.com/precious-metals-video-market-update-17/

It is appropriate to look back in recent time (history) when gold bottom last time in 1999-2001.

We do not have Lara’s Elliott wave count from 1980 top to 2001 bottom.

Gold rocketed higher to wave 1. There after it took almost year and half for corrective wave to bottom. With that second bottom gold never look back.

may be this time it is going to be different structure?????? May be Lara can enlighten us.

In Jan 2015 gold made new high at 1308 and Lara came out with a bull wave count.

Almost a year later Feb 4 2016 once again gold has breached the bearish trend line again with low at 1045. AND Lara leaning again towards Bull wave count.

HMMMMM ????? is it a repeat of 1999-2000 turn???

The problem with the Jan 2015 high was it did not breach the final bear market trend line.

And we never did get price confirmation.

This time price has breached the more conservative bear market trend line (more conservative than the Elliott channel I used in Jan 2015).

This is at the end of a 20 year bear. What about the move up around 1984-85? That may be a better comparison to where we are today. Can you chart that?

Dreamer

Gold bottom in 1985 is different than 2015-2016 bottom.

Elliott wave counts are different in these period. Analyst have been making comparisons of chart for some time but they are not aware of the difference of EW counts.

I learn this since I join Lara ‘s EW analysis. I stop doing comparison of chart patterns of the past to the current.

Besides Since 1980 to 2001 gold was in a major bear trend. During this period all the reverse trends were nothing but Bear Market Rallies (BMR). That bear trend ended in 1999.

Today per Lara’s EW count gold is in a super cycle corrective trend (wave iv) within the major bull market which started in 1999.

Thanks to Lara for educating me.

This is my wave count of the bear market from 1980 to 1999

Thanks Papudi and Lara. I think the move up from 1985 to 1988 is a pretty good comparison to where we are now. That move morphed into a triangle which is an option for the current bear market rally. Maybe since that was a triangle, this time it will be a flat. Time will tell.

Lara, could the rise from 2000-2011 be just cycle wave l of super cycle V with the correction of the last 4.5 years wave ll?

Just trying to see if $10,000 gold could be supported by an Elliott wave count.

Lara: “It may not be a zigzag because Super Cycle wave (a) subdivides as a three and not a five…….This leaves two groups of corrective structures: flats or triangles.”….

Since this cycle wave b is expected to last many years we will not know what type of structure for a long time.

AM I correct?????

.

If I understand correctly, I think Lara was refering to the entire Super Cycle correction (of which we have only just (possibly) finished Super Cycle wave A).

If Super Cycle wave A is a three, then the entire ABC correction at Supercycle Degree cannot be a zig zag (as a zig zag is a 5-3-5 structure). So the entire Supercycle ABC structure must be a flat or triangle. The Super Cycle wave B (of which the prefered count expects we have probably just started) can be pretty much any 3 wave structure.

That’s why b waves are such a nightmare to trade and analyse imho. I think there are over 20 different patterns this upcoming Super Cycle wave B could morph into – so it could be like Rodeo, unless Mr Market is nice to us.

I think the confusion comes because the bull(ish) count has the bottom as Supercycle wave A (so Supercycle Wave A finished), whereas the bear count would see a new low as only Cycle wave A, with Cycle waves B & C still required before Supercycle Wave A was finished.

Lara says super cycle wave a is a 3 structure and complete. So there canbe a flats or a triangle for super cycle wave b.

I understand flats target.

What about if super cycle wave unfolds as triangle then what to expect gold’s price to be???

Would it go higher than 2011 price??????

A running triangle may have wave B that moves beyond A.

So yes, a triangle could see a new all time high.

For this super cycle wave (b) upwards it may be one of 23 possible structures.

When I list all the possible types of flats, triangles or combinations I come up with 23.

That’s a lot of variation.

Incredibly interesting charts on COT – many thanks to everyone for posting.

I’m very familiar with EW, but not at all with COT – the data on this chart seems in stark contrast what technical analysis is saying more probable.

Personally I am waiting until the bear is invalidated before getting on board the bull. This is much more of a gut feeling – something does not quite smell right to me. If the broader markets take a dive, I expect gold will follow them down, not diverge the opposite way. Albeit I understand the reasoning that scared money might flow into gold this time rather than USD, especially following all the recent chatter about the war on cash. It would also very much fit the profile of the market fooling as many people as possible most of the time.

That said, I totally agree with Lara’s reasoning and analysis and I am on very high alert to that fact. The main reason I subscribe to this site and Lara’s S&P site (another site with the best EW analysis you will find on the internet imho), is that I get a totally impartial view of what *probabilities* Lara sees in the charts. More importantly, these probabilities are ranked in an order which is as free from emotion and bias as any human (that I know) can possibly achieve.

On closer inspection of the COT chart below (very kindly posted by Papudi), it would appear (to me) that the data is more useful to show the end of a wave at lower degree, than direction of trend, so I’m not sure it helps me reconcile probability between the main bull and bear counts.

It seems the COT figure could just get more extreme then turn minus again on the next wave down at lower degree.

Would be very interested to hear real world views on that – are members using COT for fairly short term swing trading?. The COT chart does seems to indicate that it would be useful for that.

I’m using it as part of my analysis. I use it similar to what you deceive – swaps build positions agains Managed Money for a few weeks before turns at tops and bottoms. I’m using it for swing trading.

If you are unfamiliar with COT data, I encourage you to look into the detail itself. The CFTC dot gov posts it under Commitment of Traders, and you can download the historical compressed excel files to look at the data and positions that each are holding for all prior weeks.

Keep in mind that there are two versions – futures only (that’s the one I use), and Options and Futures Combined. I don’t like the combined version because there are a lot more smaller traders in there. Futures is producers, banks, institutions, and hedge funds mainly- that’s what I like to observe in position changes.

I think Papudi uses options and futures combined. Papudi, is that right?

Ah right – I get it…

Very useful – thanks so much for sharing your chart and the above information

That’s should have said perceive….not deceive…lol…autocorrect.

Thank you very much Olga for the kind words 🙂

I do try to be as logical and objective as I can be.

A side note:

I have been told by an old dude in the town I live in that women can’t possibly be logical and reasonable because… women? That men are logical and better at math. Women apparently are manipulative. His reason? Chess. There has never been a top female chess player. Women are better at bridge which apparently means they’re manipulative.

I’m always well aware that my approach to markets and analysis is more commonly considered a male approach. And I’m a woman in a very male dominated field. About 95% of this membership is male (based on names obviously so some assumptions there).

I find it intensely interesting that this field is so male dominated, and I wonder why.

I am deeply appreciative to this membership for accepting me as a woman in this male domain, and no one has ever made any comment that it is odd or unusual.

And just like when I’m surfing and am happy to see other women out, I am lifted up by seeing women join this membership.

So thank you Olga.

You just gotta love those wise old dudes! 🙂

Presuming he was intelligent enough to understand your work, I would like to think he would change his tune but then probably not. Would more likely just go into denial.

Your track record speaks for itself so I’m sure a few narrow minded people don’t worry you too much – some people are very set in their ways. Sad really.

Personally I think the respect you command and your approach to trading has alot more to do with the time you put into learning EW (and other TA), experience and self discipline than you being female, but if you being female gives your members an extra competitive edge then I don’t think you’ll hear anybody complaining!

Back in 2013, I had already been trading gold miners when I came across the new EWG site. I was relatively new to Elliott wave and was not convinced of it’s value. It was the detail in the analysis and accuracy that quickly made me a believer. Never gave it a thought that Lara was a women, but the kiwi accent is a plus. lol. ?

Lara

One of my own trading maxims is that testosterone is the arch enemy of success. My own trading apprenticeship has been much longer, harder and ruinously expensive as a result of my being late to understand this. So no reservations about your gender from me!

Fortunately, I am more in touch with my feminine side these days and it shows in my results. Also, I have not noticed that women find me any less attractive. 🙂

… expecting Gold price to top this week, lets see….

Gold did exactly as your analysis lara….

Hats off..

This week is actual trend decider i guess…last minimal hope for bears…

Im not long…want to get more confident…once RSI and SLOW STO gets a lil neutral…next week might give me a confident entry point..

IKR!

And did you all notice that hourly chart I put up in comments at 2:50pm with a target at 1,172? Two hours later that was reached and passed by 2.40.

I thought that was pretty good.

Unfortunately for me I was tied up with trades on S&P, FTSE, NZDUSD and US Oil. So no Gold entry for me yet. I’m waiting and watching to see if it will find support at one of those trend lines for an entry. Hopefully that won’t happen while I’m asleep 🙂

Lara, could you add the analysis on the 4th to “gold historical”? I think it makes sense because you have a weekly chart and it is the change to bull for the main count in your analysis. Also, would be great if you could update your wave notation with the levels below “miniscule” that you occasionally use. Many thanks.

Dreamer

Thanks for the request. I was waiting for the weekend to request the same.

Yes Lara I have the same request.

Plus thanks Dreamer for posting the ending diagonal and requesting Lara to look in to the alternative wave count. Now it is a main count.

Great job??????

I do not remember which day you had suggested. This was the great suggestion.

Lara cought the bottom at right time.

Yaa…special thanks to dreamer

Thanks Papudi and Ruppu for the appreciation! I read a lot and when I see a count that looks legit, I like to present it to Lara. As good as she is, she is one person and EW is very complex with many options. It’s great that she is open to other ideas and adopts them when they fit EW rules, have the right look, and offer a more probable solution. End game = we all help each other achieve our goals!!!

Yes, and sorry, that should have been done when it was published.

Lara, looks like the Feb 5 analysis was added to Gold Historical. Was hoping that Feb 4, not Feb 5 be added. Thanks for taking another look at it.

Thank you Dreamer. Fixed now.

Lara, any chance you could update GDX? One daily count is invalidated, but the other is still valid by $0.17. I’d love a perspective if you don’t mind.

Thanks,

M

I will get it done this weekend.

Thank you.

MTLSD

Thanks for COT chart It is a good visual to follow for gold trend.

Week of Dec 4 was bottom alerted by bullish COT data. Now looking forward to significant top in gold in next few weeks.

Below is my simple daily chart showing price movement with overlay of large commercial’s short position. Commercials short has jumped more than 23000.

Good Evening Everyone, I am going to keep this short. I have clearly been on the wrong side the past few days, but I am ok with that for now. I am watching the alternate bear, 1191 for confirmation on the bull, and my COT analysis. I am currently long DUST (might be my last 3x miner trade), and long GLD April puts. I really like the puts because I love the time involved and how it fits into my strategy, and they have a built in stop loss – the option investment.

Updated COT Analysis. I expect the blue line will be over 150K by next Friday’s report with the squeeze we got this week. Gold is $50 higher than when this report was taken on Tuesday. It is week 10 on 2/9 and week 11 on 2/16, so in my estimation we are near a cycle high. I added some weekly notation as well to the chart.

Have a great weekend and good luck trading!

Mtlsd have you ever tried mitigating your leveraged bear etf with an option call on gold?

Exp. purchase $20k bear etf and offset the risk by purchasing an option to go long if things go sour with the bear..? Will the math and logistics work out for both bull/bear scenario? Never tried….

I’ve looked into it but the 3x’s are already so leveraged it takes quite a bit of capital on a hedge.

What I am learning is that they tend to pound the dickens out of the miners right before a turn, so gold might be calm, but they collapse the miners then let gold run and the miners catch up (or squeeze then turn). I think they do that with the 3x ETFs because they can blow people out and accumulate mountains of shares then turn it. This has happened to me in the past on winning and losing sides, and on these intermediate trades I don’t like to use stops especially in 3x ETFs because they can blow stops and then turn it right away. My objective it turning from day trading to intermediate swing trading, and the 3x ETFs just don’t fit what works for what I am designing. Lesson learned.

So in the end, I think I am going to isolate my vehicles so they are directly connected to the instrument – GLD options as my vehicle for Gold. I can keep the position much smaller and still get lots of leverage when it runs my way.

Learning every day, adjust and sharpen the strategy to improve odds each time. I plan to trade these blue lines each time now, which should be 6 times per year. or so. I will use 2016 to sharpen my entries and exits and which strikes I am purchasing. In 2017 I will start to work with larger positions.

What is the signal? Turn on blue line or the top above 150K or weeks 10/11??

Plus the how far in future in option to not to pay high time premium?

I suppose more than 13 weeks out.

There is no specific signal, I’m already short gold and will add more in the next week or two if it make sense. I am looking for the blue line peak as a confirmation, which can happen between 100k and 220k (but could go higher). Swaps have had two-three weeks building short positions in the COT. These last three days I am sure will be significant short position builds for swaps.

I bought April puts because the down turns have been lasting only 7 to 9 weeks usually. Assuming a peak next week, I should catch most of that move down.