Upwards movement was expected.

Summary: The trend is up. The mid term target is at 1,437. The long term target is at 1,585. At this stage, expectations are for price to continue overall upwards for another one to few days before another counter trend pullback begins.

New updates to this analysis are in bold.

Last weekly charts are here.

Grand SuperCycle analysis is here.

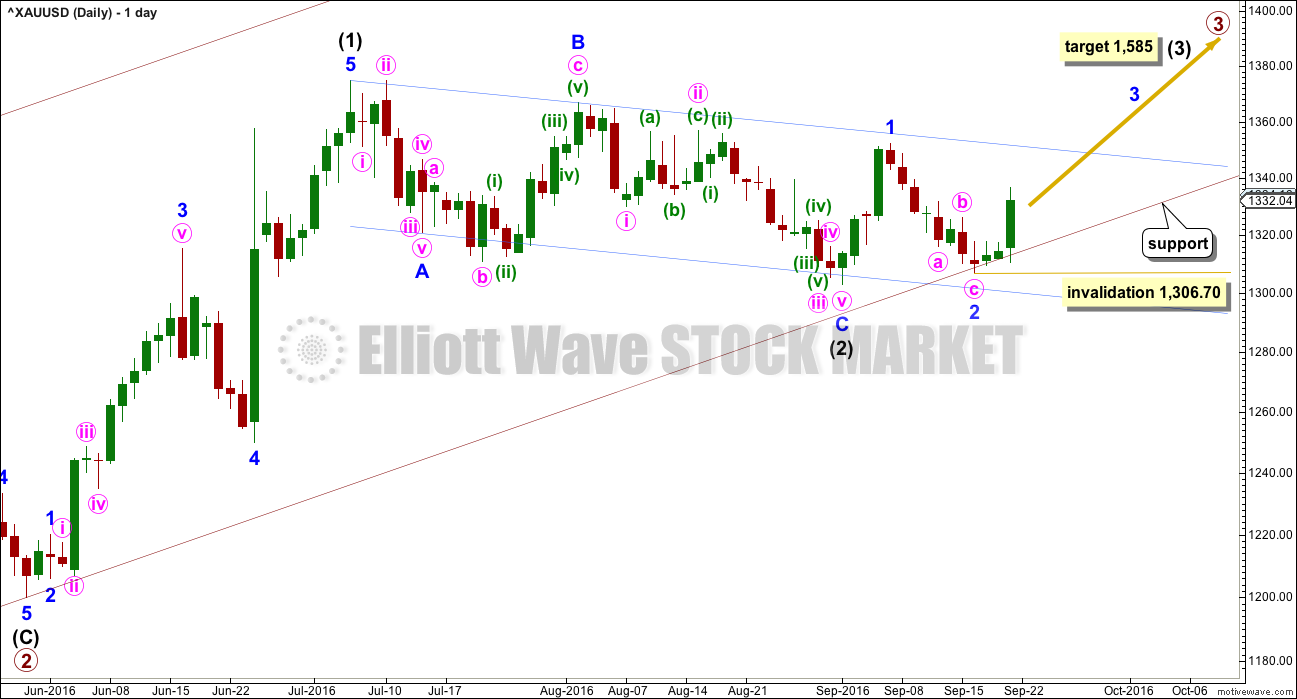

DAILY ELLIOTT WAVE COUNT

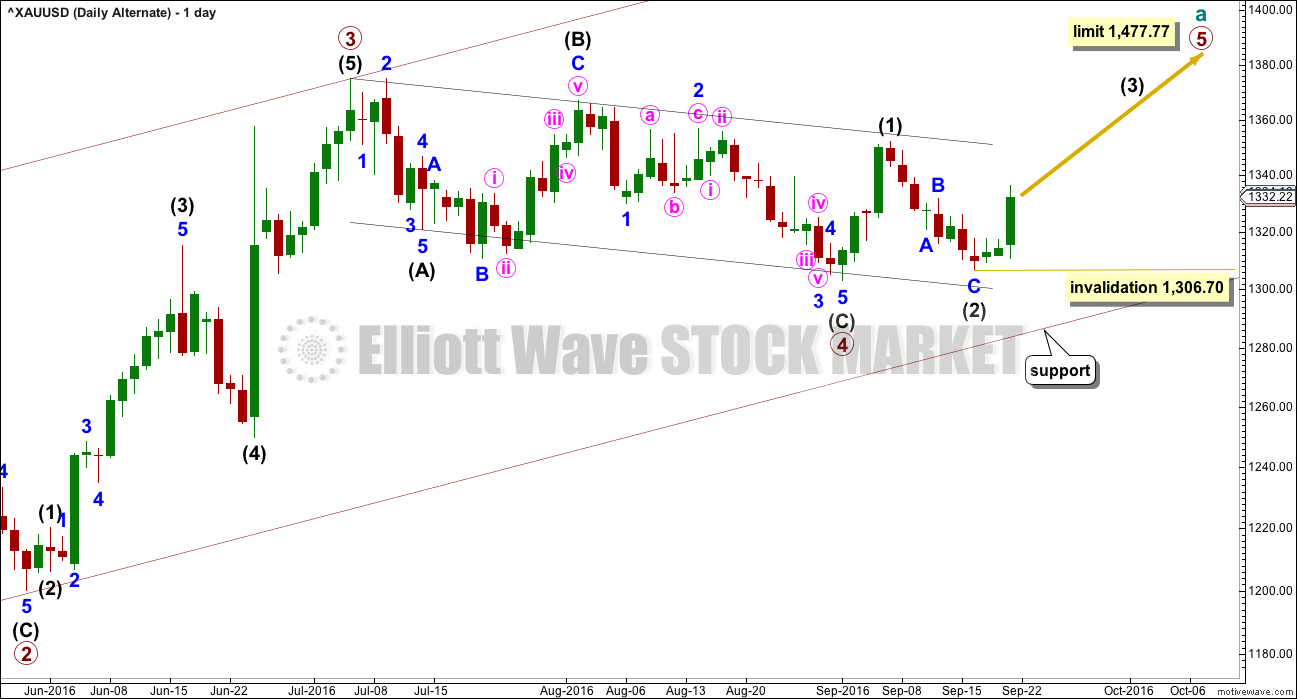

Primary waves 1 and 2 are complete. Thereafter, this wave count differs from the alternate.

This main wave count will expect primary wave 3 to be longer than primary wave 1. Because this is very common, this is the main wave count. It expects the most common scenario is most likely. At 1,585 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Intermediate wave (2) may now be complete ending just below the 0.382 Fibonacci ratio of intermediate wave (1) and lasting 40 days. Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 1,302.93.

Draw a channel about intermediate wave (2) using Elliott’s technique for a correction (blue lines). Price is finding some resistance on the way up about the upper edge. After breaking through resistance at the upper blue line price may then turn down to find support about there.

With this wave count expecting a third wave at two large degrees to begin, look out for surprises to the upside at this stage.

Intermediate wave (1) lasted 27 days and intermediate wave (2) lasted 40 days. Intermediate wave (3) may be reasonably expected to last longer than intermediate wave (1) in both time and price. A Fibonacci 55 days would be a first expectation. Intermediate wave (3) may end with a blowoff top.

The lower edge of the maroon base channel has proven to be providing strong support. Copy this over from weekly charts: draw a base channel from the start of a first wave to end end of the second wave, then place a parallel copy on the end of the first wave. In this case, the lower edge of the base channel is providing support. If price again comes down to touch it for another pullback, then it would provide an opportunity to join the trend at a very good price.

I will not publish the second alternate wave count that looked at the possibility of intermediate wave (2) continuing lower. At this stage, the probability is too low for reasonable consideration.

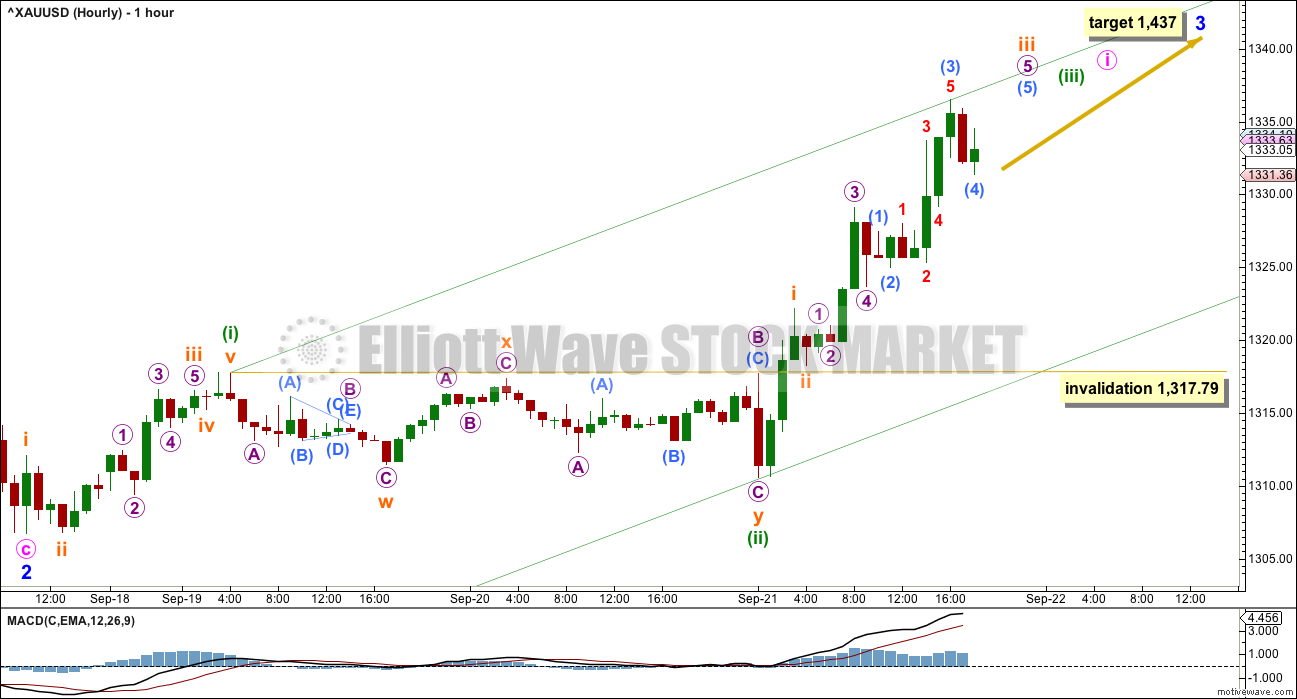

HOURLY ELLIOTT WAVE COUNT

At 1,437 minor wave 3 would reach 2.618 the length of minor wave 1.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, the correction for minute wave ii is very likely to show up as a multi day pullback on the daily chart. First, minute wave i needs to complete.

Minute wave i must subdivide as a five wave structure. It is unfolding as an impulse. Within the impulse, the correction for minuette wave (ii) can be seen on the daily chart with smaller range days but no red daily candlesticks. When it arrives, minuette wave (iv) may show on the daily chart as one to three red daily candlesticks or doji and may last more than one day. Minuette wave (iv) may not move into minuette wave (i) price territory below 1,317.79.

At 1,339 minuette wave (iii) would reach 2.618 the length of minuette wave (i). When minuette wave (iii) is complete, then minuette wave (iv) may unfold sideways.

At this stage, the structure of minute wave i is incomplete. Overall, it should be expected that price will continue to move higher to complete a five wave impulse for minute wave i. It may end in another one to three days.

At this stage, this wave count expects a third wave up at three large degrees to be in the early stages. Gold’s third waves often start out relatively slowly, building momentum towards the middle and exploding at the end. This allows plenty of opportunity to join the trend at the beginning, but only if traders have confidence in the trend. Buy the dips. Use corrections as opportunities to join the trend.

Risk is now at 1,306.70. When minute wave i is complete and minute wave ii arrives, minute wave ii may not move beyond the start of minute wave i at 1,306.70.

As always, never invest more than 3-5% of equity on any one trade. Always use a stop loss for all trades. Risk management is the difference between profit and loss, between traders who remain in the game and those who get wiped out.

While the alternate hourly count from yesterday remains technically valid, it would require a substantial breach of the base channel now for minor wave 2 to move lower and complete. Because the base channel is proving such strong support this idea is now discarded.

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is possible that primary wave 3 is over and shorter than primary wave 1. Primary wave 3 shows stronger volume than primary wave 1 (see technical analysis weekly chart).

If primary wave 3 is over, then the current consolidation for Gold would be primary wave 4.

Primary wave 2 was a relatively shallow 0.35 expanded flat correction. Primary wave 4 may be a deeper zigzag which would exhibit perfect alternation.

Within primary wave 5, no second wave correction may move beyond the start of its first wave below 1,302.93.

Primary wave 5 would be limited to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 would have a limit at 1,477.77.

The hourly chart would be exactly the same.

TECHNICAL ANALYSIS

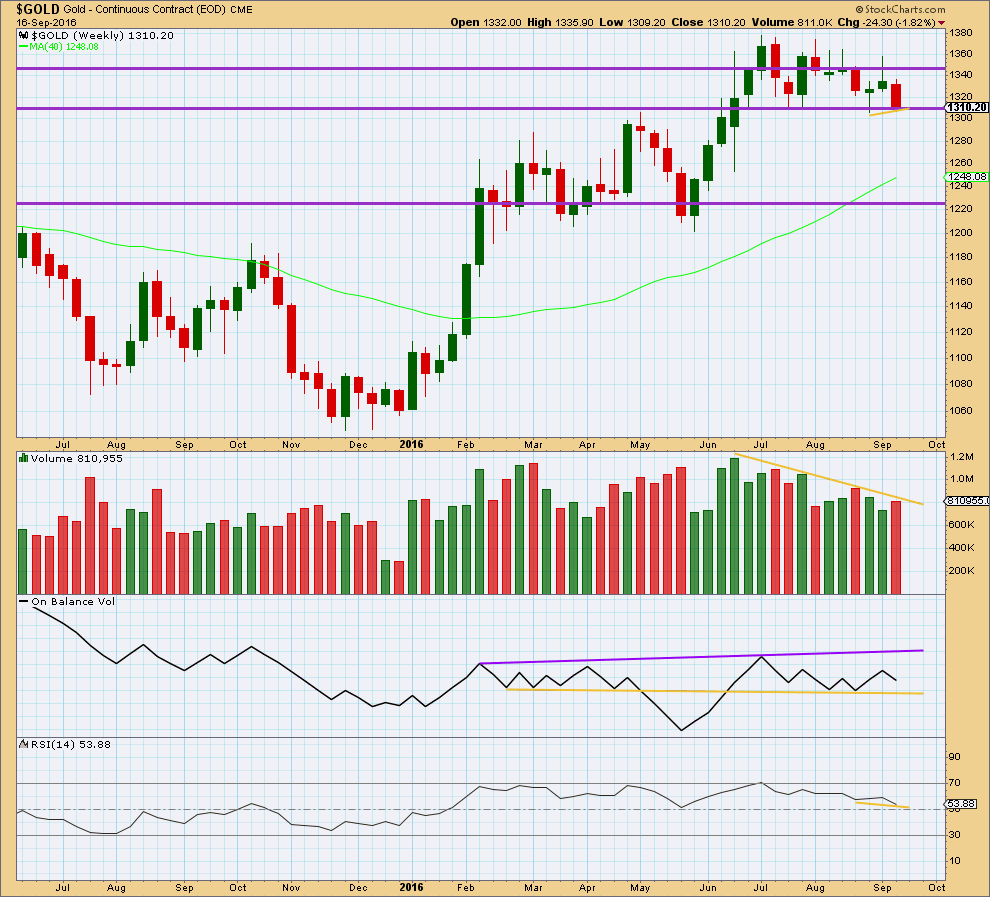

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term stronger volume for last week compared to the prior green weekly candlestick is short term bearish. Again, it is important to look inside last week at daily candlesticks to have a clearer picture to what is happening here.

Mid term price is again finding support about 1,310 – 1,305. Volume is declining as price has been moving sideways. This sideways movement is more likely to be a consolidation than the start of a new trend.

On Balance Volume remains overall bullish with the last signal a bounce up from support at the yellow line. A break above the purple line would be a strong bullish signal. A break below the yellow support line would be a reasonable bearish signal.

RSI is close to neutral. There is room for price to rise or fall. RSI exhibits short term divergence at last week’s low with its last low, indicated by short yellow lines on price and RSI. This divergence is bullish and indicates weakness in the downwards movement from price last week. For Gold this divergence at the weekly chart level at its lows is usually a fairly reliable signal of a bottom. This reliability in the past means this divergence should be given reasonable weight in this analysis.

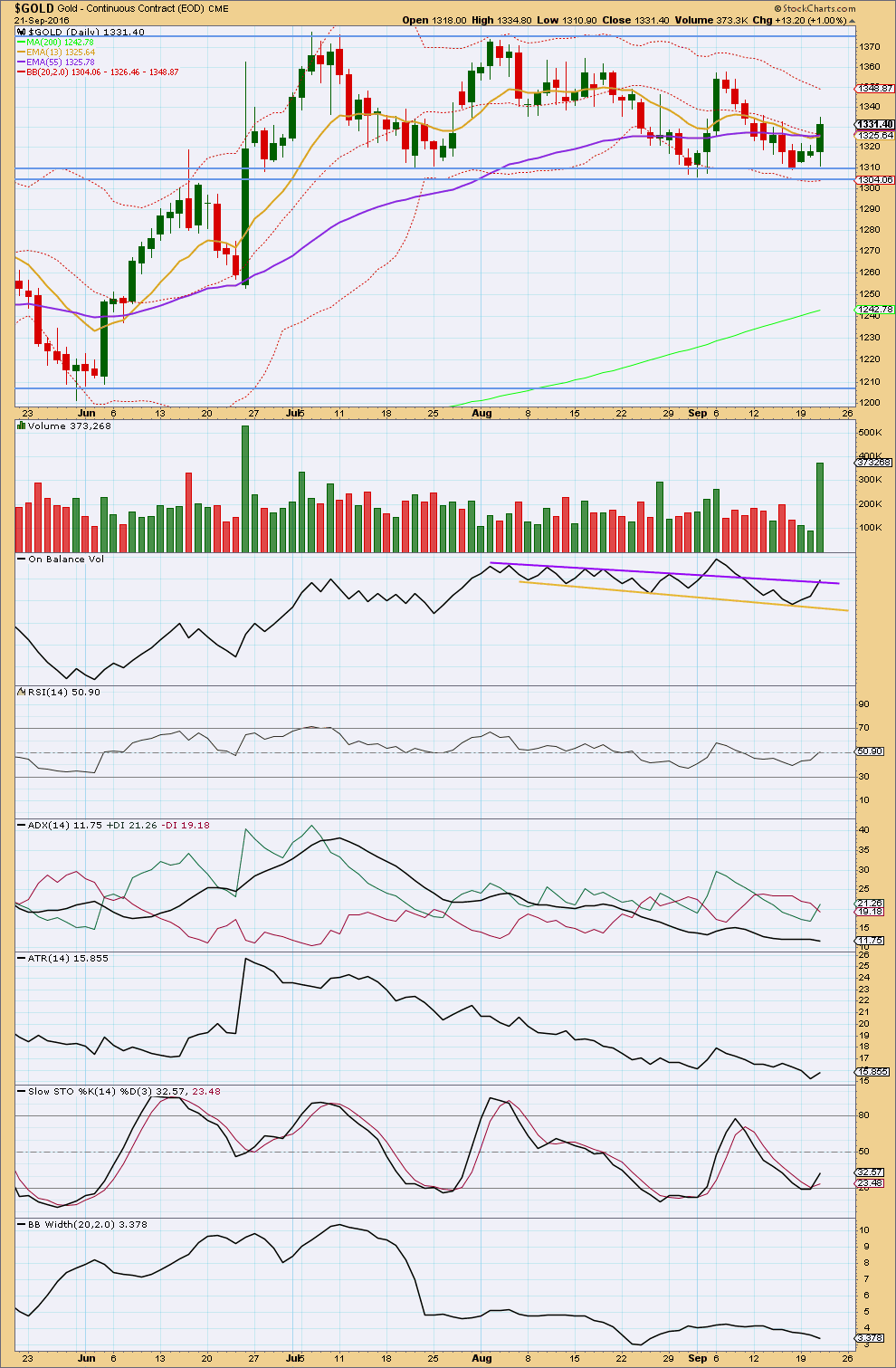

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A very strong upwards day with strong volume supports the wave count. The volume for Wednesday’s session may yet be adjusted by StockCharts, but it is likely to remain relatively strong.

There is very strong support at the horizontal trend lines at 1,310 and 1,305. With these lines repeatedly tested and proven to hold, they should be expected at this stage to continue to hold.

The next line of resistance will be about 1,375.

On Balance Volume will give a strong bullish signal if it breaks above the purple line. It may be beginning to do that today, but there is a little leeway in how this line may be drawn and so a clearer break above it is required before confidence that OBV is giving a bullish signal.

RSI is today almost at neutral. There is plenty of room for price to rise.

ADX is today slightly declining. The +DX line has crossed above the -DX line. If ADX turns up from here and reaches above 15, then an upwards trend would be indicted. For now it may be too early in a new trend for this. ADX today indicates the market may still be consolidating.

If this market is still consolidating, then an upwards swing would be reasonably expected to continue from here, and to only end when price finds resistance about 1,375 and Stochastics is overbought at the same time. Stochastics is only just turning up from almost reaching oversold.

ATR turned up today, but one day of increase is not enough to suggest a trend is returning. Overall, ATR has been declining while price moves sideways.

Bollinger Bands slightly contracted again today. Volatility will return to this market when a trend returns.

During the consolidation, which began back on 7th of July, it is now four upwards days which have strongest volume. This strongly suggests an upwards breakout is more likely than downwards. This supports the Elliott wave count.

This analysis is published @ 8:34 p.m. EST.

I agree with Alan, I see the wave count in subminuette iv. So there should be more upside overall, another green daily candlestick from here, before any more time consuming pullback.

The green channel is an acceleration channel. As price moves higher adjust it; the first trend line from the end of minuette (i) to the last high, then a copy on the end of minuette (ii). When minuette (iii) is over and minuette (iv) arrives it should find support at the lower edge of the channel.

At this stage I’ll expect minuette (iv) may possibly show on the daily chart as one doji or maybe even a small red candlestick.

I will not be expecting a deeper more sustained pullback until the whole structure of minute i is completed.

Oh, and look out for possible surprises to the upside! If this wave count is right Gold is beginning a third wave at three large degrees.

Finally, always manage risk. It is the most important aspect of trading.

Lara’s two golden Risk Management Rules:

1. Always use a stop loss.

2. Never invest more than 3-5% of equity on any one trade.

This will ensure losses are contained, and your account can sustain a series of 10 losses in a row and still survive.

Hi Laura

Love these end of day recaps!

Any chance of posting say 15 min. prior to the 4PM bell?

Thanks

Looks like Lara’s expectations for gold have been nailed. So impressive and scary at the same time. Truly an enviable art!

Gold tested 1340 a couple of times and then broke through to nearly 1344 before back testing the 1341 area.

I don’t know how to count waves but would guess based on pricing and Lara’s price guide from last night’s analysis that we’re probably in subminuette 4 of Minute 1. Then again, there’s reference made to red daily candles (plural) for subminuette 4 so it’s just a guess.

What’s interesting is the price differences between gold and GDX/ NUGT. GDX is having a difficult time with the 28 area and only up a small amount as opposed to gold gains.

I did notice that RSI for GDX was touching 80 on the hourly (market open) which was a signal that a pull back was needed.

Now, the big question is if GDX/ NUGT has more room to run and when to sell in anticipation of minute 2.

Any thoughts from members are welcome!

Thanks!

Stephen.

To me, subminuette 3 of minuette 3 of Minute 1 completed at the high of 1343.76. (The fifth wave of subminuette 3 was extended). We are now in subminuette 4.

Moving on, I don’t expect minuette 4 to drop very much, probably 0.382 or 0.236 Fib. That’s because minuette 2 was very deep. It follows the rule of alternation.

I will sell my NUGT most probably at the end of Minute 1. It’s still too early to tell where Minute 1 will end. Currently, I expect it to be anywhere between 1351 and 1361. More clarity may be had when more waves complete, of course.

Alan – Thanks so much for your comments and guidance. I’ll be holding right along side of you!! It’s such a refreshing and exciting feeling to be on the right side of the trade with more upside potential before the pause of Minute 2. Greatly appreciated!!

Stephen. I use trailing stops. This would protect my profits as price advances. I’ll post when I deem a sale is necessary.

Rambus on GDXJ

https://rambus1.com/2016/09/21/gdxj-update-132/

Metals at a critical juncture. Silver especially looks to either be on the threshold of a third up, or a third down. A break above 20 would in my mind confirm the former.

I’ll be updating Silver today. I have struggled to see a bearish wave count for Silver, in fact, I just don’t have one. Silver has recently found good support at a strong trend line…. should be up up and away from here!

This is what I have for my hourly update of Lara’s main GDX count. Looks pretty bullish.

Dreamer, thanks for sharing your charts. I also great appreciate your consistent efforts! 🙂

Finally….the BoJ moved the markets and the reaction to the FED was muted.

GDX broke it’s downtrend line for the last month:

> RSI moved back above 50 (bullish)

> Volume was strong (bullish)

> MACD had a bullish cross

> OBV moved up above one line of resistance (bullish) although more resistance lies above

Yep. That all looks pretty bullish Dreamer!

As always, a big THANK YOU to you for kindly sharing your charts and knowledge.

We are all richer (hopefully, literally!) for your kindness 🙂