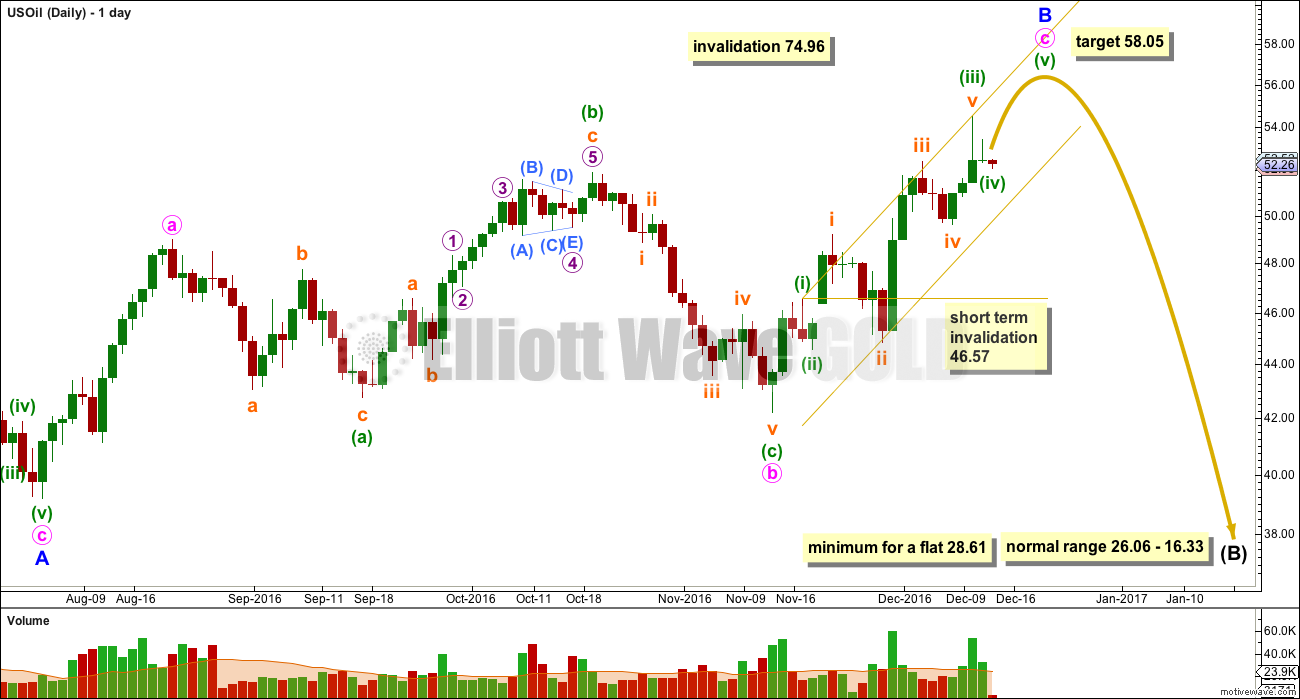

Upwards movement has continued as expected from last Elliott wave analysis.

The small consolidation also unfolded as expected and remained above the invalidation point at 46.57.

Summary: The target for upwards movement to end is still about 58.05. Another small consolidation, the last one on the way up to the target, may continue for a few more days.

New updates to this analysis are in bold.

MONTHLY ELLIOTT WAVE COUNT

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

Primary wave 4 is likely to exhibit alternation with primary wave 2. Primary wave 4 is most likely to be a flat, combination or triangle. Within all of these types of structures, the first movement subdivides as a three. The least likely structure for primary wave 4 is a zigzag.

Primary wave 4 is likely to end within the price territory of the fourth wave of one lesser degree; intermediate wave (4) has its range from 42.03 to 62.58.

Primary wave 4 may end if price comes up to touch the upper edge of the maroon channel. The upper edge of this channel has been pushed up to sit on the end of intermediate wave (2) within primary wave 3.

Primary wave 4 is most likely to be shallow to exhibit alternation in depth with primary wave 2. So far it has passed the 0.382 Fibonacci ratio at 45.52. It may now continue to move mostly sideways in a large range.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

At this stage, primary wave 4 has completed intermediate wave (A) only. Intermediate wave (B) is incomplete.

DAILY ELLIOTT WAVE COUNT

Intermediate wave (B) still looks like it is unfolding as a flat correction. Within intermediate wave (B), minor wave A is a zigzag and minor wave B is an incomplete zigzag.

Minute wave b fits as an expanded flat correction. Minute wave c must subdivide as a five wave structure.

Within minute wave c, the upwards movement began with two overlapping first and second waves, labelled minuette waves (i) and (ii), and subminuette waves i and ii. Now it must end with two corresponding fourth wave corrections and final fifth waves up.

Subminuette wave iv unfolded as a small correction and remained above subminuette wave i price territory at 49.19.

Now minuette wave (iv) must unfold as a small correction and remain above minuette wave (i) price territory at 46.57. When minuette wave (iv) is complete, then minuette wave (v) upwards should be the final short wave to end upwards movement. Minuette wave (v) would reach equality in length with minuette wave (i) if it is 4.36 in length. When minuette wave (iv) is complete, then the target may be calculated at a second degree and this may change the target or widen it to a small zone.

At 58.05 minute wave c would reach 1.618 the length of minute wave a.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

When minor wave B is a complete zigzag structure, then a major trend change would be expected still for Oil. Minor wave C downwards must subdivide as a five wave structure.

A small channel is drawn as a best fit about minute wave c. When this channel is breached by downwards movement, it would indicate that minute wave c and minor wave B should be over and that minor wave C down should have begun.

Because intermediate wave (A) fits so well as a three wave structure, it is still most likely that intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 28.61. When an A wave subdivides as a three, then a flat correction is indicated.

The normal range for intermediate wave (B) within a flat correction is from 1 to 1.38 the length of intermediate wave (A) giving a range from 26.06 to 16.33.

TECHNICAL ANALYSIS

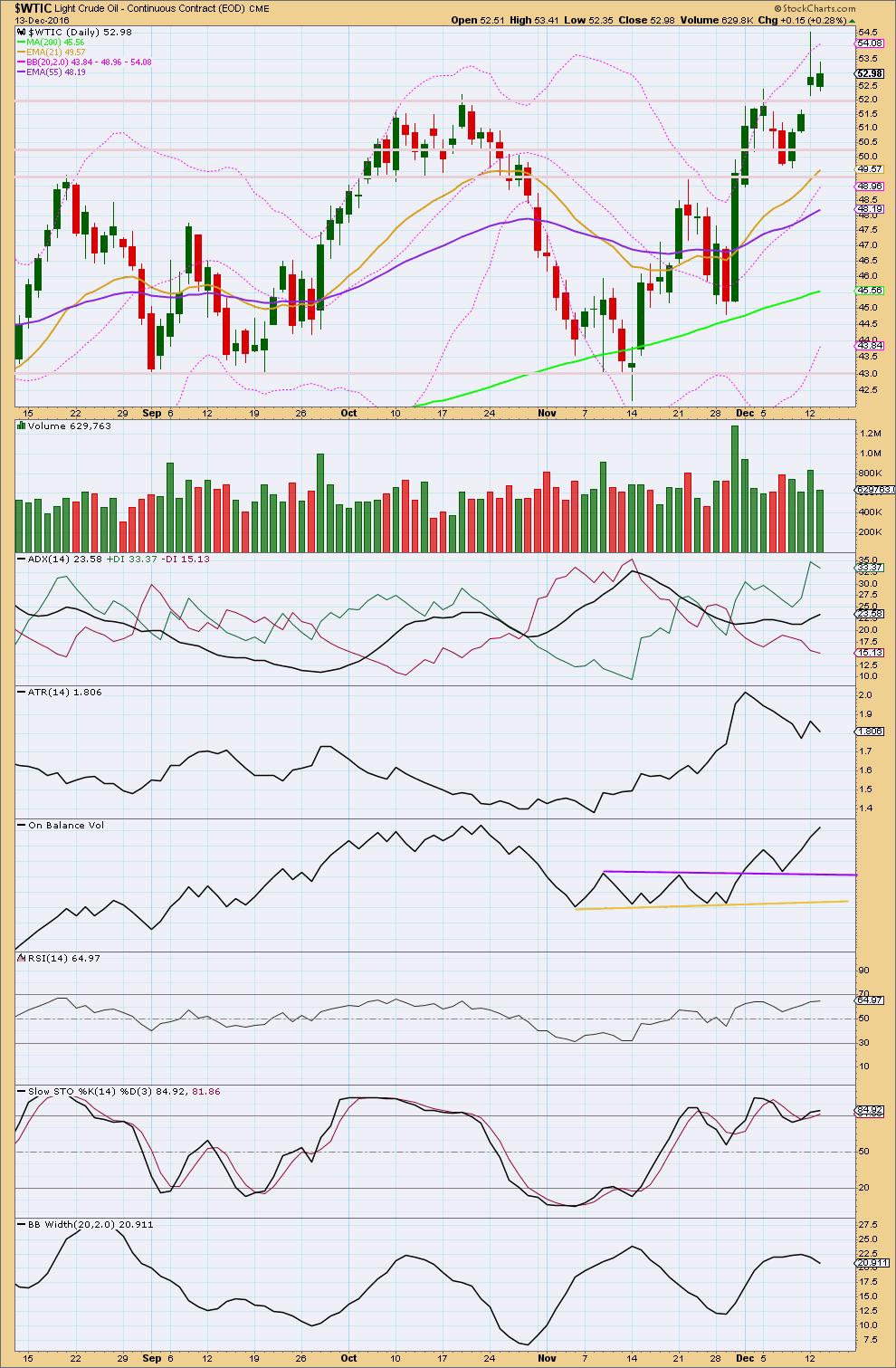

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The very long upper wick on the candlestick for the 12th of December is bearish. The following day closed green and comes with a decline in volume, and this is also bearish. This supports the Elliott wave count, which expects a small consolidation about here to last a few days.

ADX now indicates an upwards trend in place. ADX is not extreme, so there is room for this trend to continue.

ATR is declining, so this trend may be tiring. Bollinger Bands are contracting. Some consolidation should be expected here, and this supports the Elliott wave count.

Stochastics exhibits divergence with price between the last two highs of the 5th of December and the 12th of December: price has made new highs, but Stochastics has made lower highs while extreme. This indicates either some consolidation before another divergence or a possible trend change here.

RSI is not yet extreme. There is room for price to rise further.

On Balance Volume is bullish. If it turns down, it may find some support at the purple trend line. No line is found at this stage to provide resistance.

This analysis is published @ 01:22 a.m. EST.

I guess it has breached the channel – but I am not sure about the values. I have 4 different (also sources).

Can I trust to forex capital markets or should I watch somewhere else?

Hi Rafael

It did not breach the channel on my charts. It tested twice and I went long on the second touch. So far so good with a stop for me on a closing hourly bar below the channel. If it continues upwards, I expect it to hesitate again at around 53.40 before continuing towards 58.

With view to the winter it is reasonable to have an increase up to 58.05$. Round about 10%.

With view to the downtrend it is hard to trade the invalidation at 74.96$. This is round about 50%.

So my question to all is: Wich is the recommended setup for the leverage (long or short) in this values?

I wouldn’t be entering long here, I’d wait patiently a few days for price to consolidate. Then I’d be looking for signs of weakness in the consolidation.

That should bring price closer to the invalidation point improving the risk / reward ratio.

If it doesn’t get good enough, then don’t take the trade.

The lower edge of the channel may also be used to calculate risk; just below it. That would run the risk of an overshoot before price turns up though, closing out a position for a loss only to see price move in the expected direction.

It’s a conundrum.

So it’s up to each member to decide if they want to take a punt at this one.

Lara’s two golden rules:

1. Always always use a stop loss.

2. Do not invest more than 3-5% of equity on any one trade.