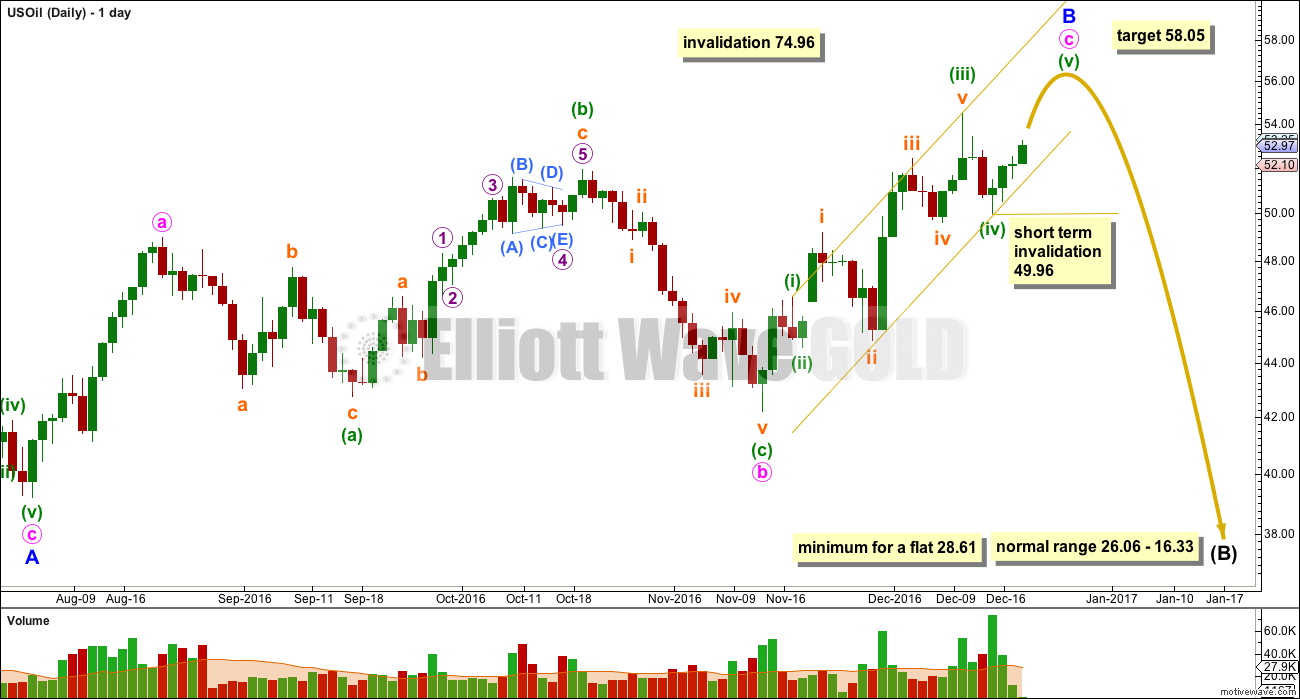

Another small consolidation unfolded as expected finding support at the trend line on the daily Elliott wave chart. Thereafter, upwards movement has continued as expected.

Summary: The target for upwards movement to end is still about 58.05. Another small consolidation, the last one on the way up to the target, may continue for a few more days.

New updates to this analysis are in bold.

MONTHLY ELLIOTT WAVE COUNT

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

Primary wave 4 is likely to exhibit alternation with primary wave 2. Primary wave 4 is most likely to be a flat, combination or triangle. Within all of these types of structures, the first movement subdivides as a three. The least likely structure for primary wave 4 is a zigzag.

Primary wave 4 is likely to end within the price territory of the fourth wave of one lesser degree; intermediate wave (4) has its range from 42.03 to 62.58.

Primary wave 4 may end if price comes up to touch the upper edge of the maroon channel. The upper edge of this channel has been pushed up to sit on the end of intermediate wave (2) within primary wave 3.

Primary wave 4 is most likely to be shallow to exhibit alternation in depth with primary wave 2. So far it has passed the 0.382 Fibonacci ratio at 45.52. It may now continue to move mostly sideways in a large range.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

At this stage, primary wave 4 has completed intermediate wave (A) only. Intermediate wave (B) is incomplete.

DAILY ELLIOTT WAVE COUNT

Intermediate wave (B) still looks like it is unfolding as a flat correction. Within intermediate wave (B), minor wave A is a zigzag and minor wave B is an incomplete zigzag.

Minute wave b fits as an expanded flat correction. Minute wave c must subdivide as a five wave structure.

Within minute wave c, the upwards movement began with two overlapping first and second waves, labelled minuette waves (i) and (ii), and subminuette waves i and ii. Now it must end with two corresponding fourth wave corrections and final fifth waves up. It looks like the last fifth wave up is now underway.

Minuette wave (iv) unfolded as a relatively brief correction. It is likely to be over at the lower edge of the parallel channel.

Within minuette wave (v), no second wave correction may move beyond the start of its first wave below 49.96.

At 58.05 minute wave c would reach 1.618 the length of minute wave a.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

When minor wave B is a complete zigzag structure, then a major trend change would be expected still for Oil. Minor wave C downwards must subdivide as a five wave structure.

A small channel is drawn as a best fit about minute wave c. When this channel is breached by downwards movement, it would indicate that minute wave c and minor wave B should be over and that minor wave C down should have begun. Use this channel to indicate a trend change whether or not the target is met.

Because intermediate wave (A) fits so well as a three wave structure, it is still most likely that intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 28.61. When an A wave subdivides as a three, then a flat correction is indicated.

The normal range for intermediate wave (B) within a flat correction is from 1 to 1.38 the length of intermediate wave (A) giving a range from 26.06 to 16.33.

TECHNICAL ANALYSIS

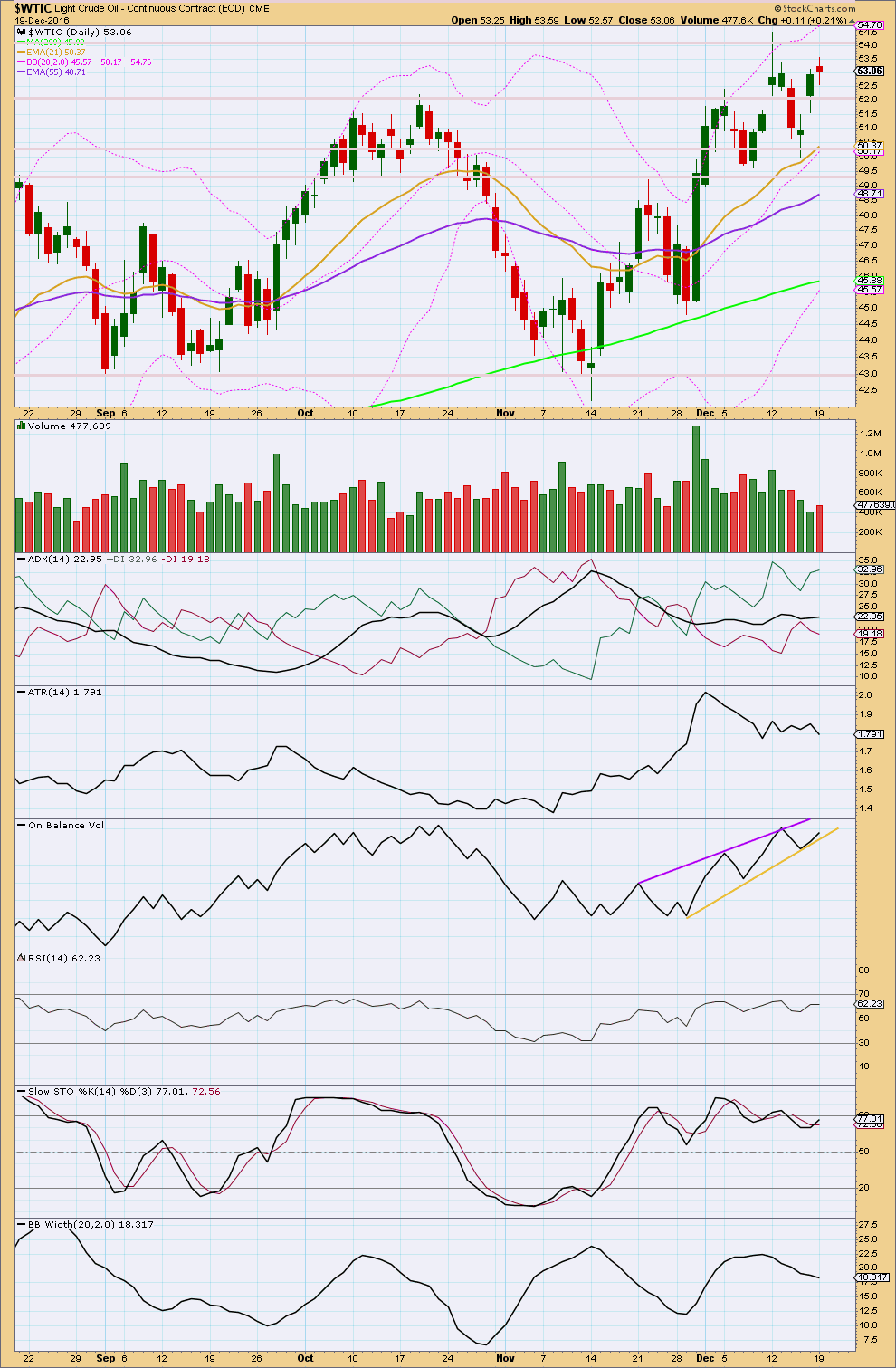

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume is now declining as price moves higher. This indicates some weakness for bulls, but it will not pinpoint a trend change.

Along the way up, price is finding support at the short term Fibonacci 13 day moving average.

All three moving averages are pointing up and price is above all three. The trend is up.

ADX is flat at this time indicating no trend. When a trend returns, it should be up. The +DX line remains above the -DX line.

ATR is flat and Bollinger Bands are contracting. The market is not trending at this time.

The Elliott wave count is ahead of this analysis; these indicators are lagging as they are based upon averages.

On Balance Volume trend lines are redrawn. A break above resistance or below support may indicate the next direction for price, but these lines do not have good technical significance as they are steep.

Overall, this analysis agrees fairly well with the Elliott wave count. Some weakness is now seen in this trend and the Elliott wave count expects a final wave up to new highs to end it.

This analysis is published @ 04:07 a.m. EST.

I’m beginning to suspect that the high of 2 weeks ago was a significant one. The channel is well breached. I’m going to ask Santa for a nice short opportunity.

Not so fast there Johno… look out for one more high first. I’m not seeing the channel well breached.

But if you see a full daily candlestick below the lower edge of the channel then I’m wrong and you should by all means go short.

Merry Christmas!