Overall, more upwards movement was expected; a slight new high fits the main Elliott wave count.

Downwards movement during Monday’s session remained above the short term invalidation point on the hourly chart.

Summary: The target is 1,277. Use the blue Elliott channel on the daily and hourly charts to indicate when price has turned. Expect more upwards movement while price remains within the channel.

Look out for strong resistance ahead at the upper maroon trend line on the main weekly and daily charts.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts and alternate weekly charts are here, video is here.

Grand SuperCycle analysis is here.

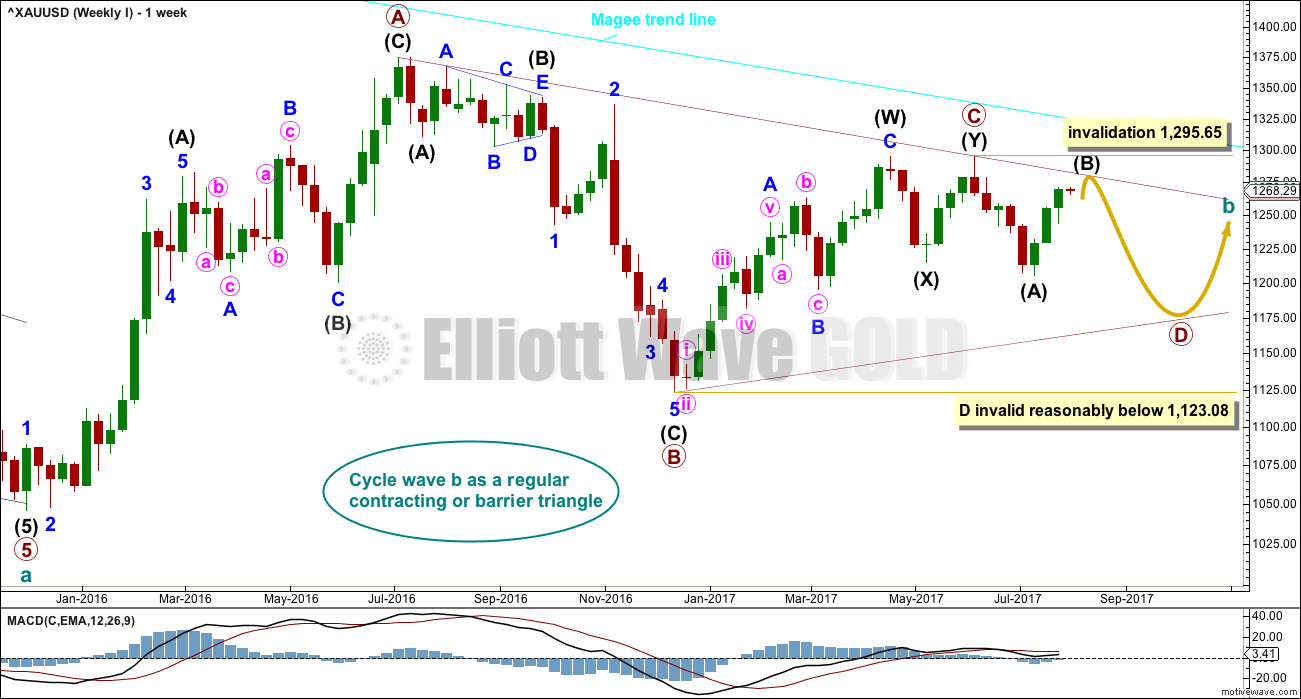

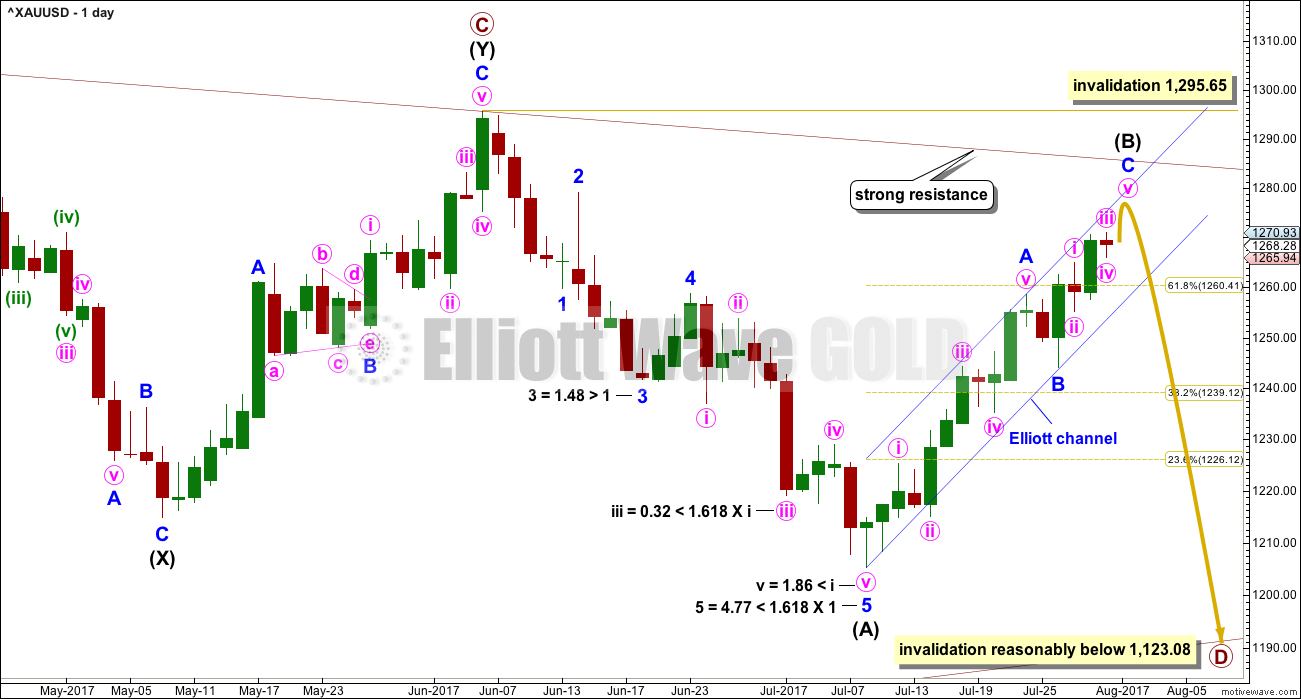

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has some support from declining ATR and MACD now beginning to hover about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Triangles normally adhere very well to their trend lines. So far the A-C trend line has been tested 11 times; this line has very strong technical significance. If this wave count is correct, then intermediate wave (B) should find very strong resistance if it gets up to the A-C trend line. A small overshoot is acceptable. A breach is not. If price reaches up to that trend line in the next one to few days, it would offer a good entry point for a short position. Stops then may be set a little above the line, or just above the invalidation point.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may have been complete in 25 weeks.

Primary wave D should now be expected to last a Fibonacci 13 or 21 weeks in total.

DAILY CHART

A common range for triangle sub-waves is from about 0.8 to 0.85 the prior sub-wave, this gives a range for primary wave D from 1,158 to 1,149.

At this stage, to try and see the whole of primary wave D complete at the last low does not look right. The B-D trend line would be too steep for a normal looking contracting Elliott wave triangle, and primary wave D would have been far too brief at only 5 weeks duration. For the wave count to have the right look and good proportions (as Gold almost always does), primary wave D should not be labelled over yet.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a simple A-B-C structure and would most likely be a zigzag.

With intermediate wave (A) complete and now intermediate wave (B) a large and deep correction, primary wave D is beginning to look very typically like a large exaggerated zigzag.

Intermediate wave (B) looks to be unfolding as a zigzag, a three wave structure. Corrective waves have a count of 3, 7, 11, 15 etc. Each extension adds another 4. So far intermediate wave (B) has a count of 10 on the daily chart, so it now again looks incomplete.

Draw an Elliott channel about the zigzag of intermediate wave (B). Use this as a guide to when it may be over. When price breaks below the lower edge, that may be taken as an indication of a trend change.

So far intermediate wave (B) has lasted 15 days. It may not exhibit a Fibonacci duration now if it ends below the maroon A-C trend line.

Within the zigzag of primary wave D, intermediate wave (B) may not move beyond the start of intermediate wave (A) above 1,295.65.

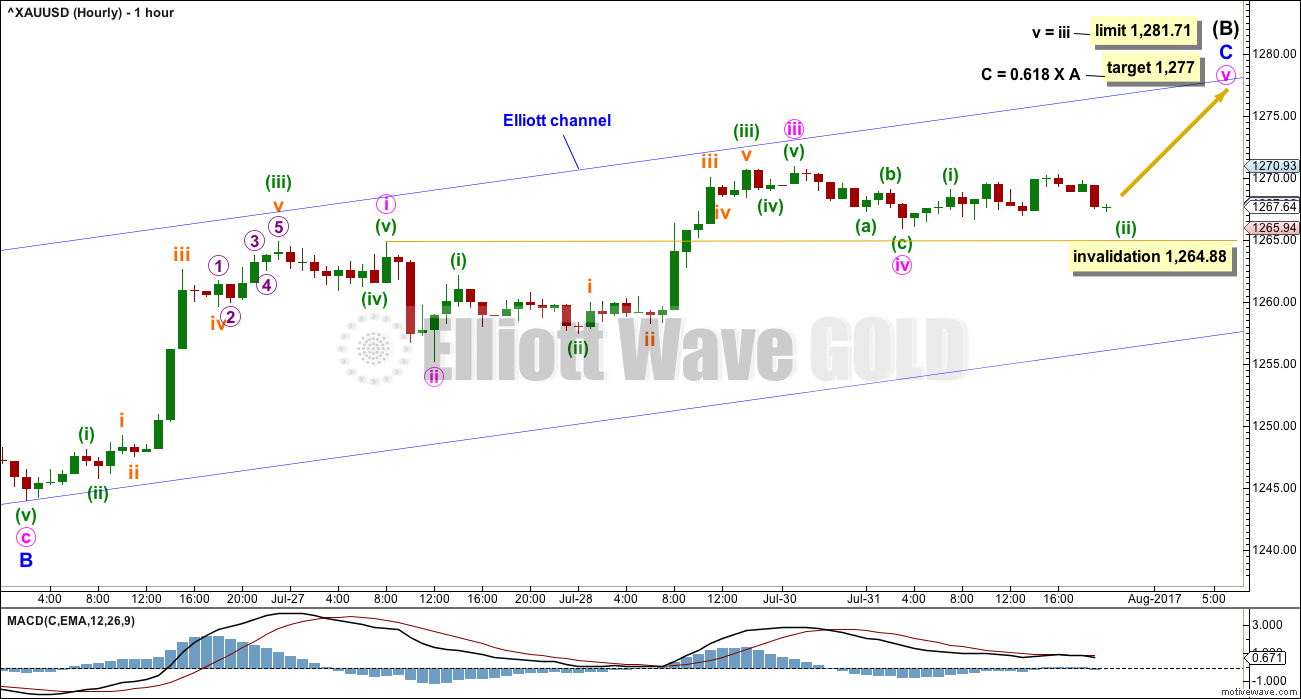

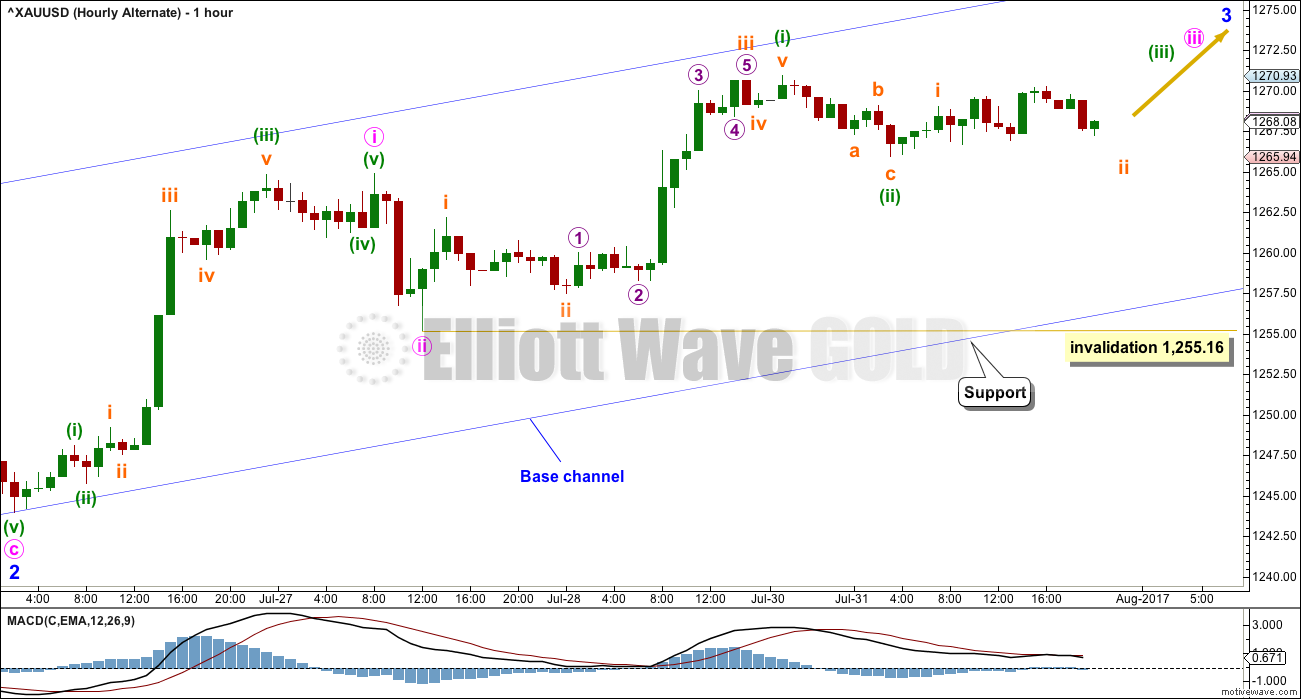

HOURLY CHART

It looks like minor wave C is extending. Within minor wave C, minute wave ii shows up on the daily chart as one red daily candlestick. So for the structure to have the right look at the daily chart level minute wave iv may also show up as one or more red daily candlesticks or doji.

At the end of Monday’s session, minute wave iv now shows up on the daily chart as one small red daily candlestick. This wave count has the right look at the daily chart level.

If it continues further as a flat, combination or triangle, then minute wave iv may not move into minute wave i price territory below 1,264.88.

If this labelling is invalidated in the short term, then the second hourly chart below may be correct. However, a new low below the channel and then below 1,244.01 would still be required for reasonable confidence in a trend change.

The target given here for intermediate wave (B) to end would see it fall slightly short of the maroon A-C trend line on the daily and weekly charts. If the target is wrong, it may be a little too low. Price may move higher to touch the trend line.

Because minute wave iii is shorter than minute wave i (if this labelling within minor wave C is correct) minute wave v is limited to no longer than equality in length with minute wave iii, so that the core Elliott wave rule stating a third wave may not be the shortest is met.

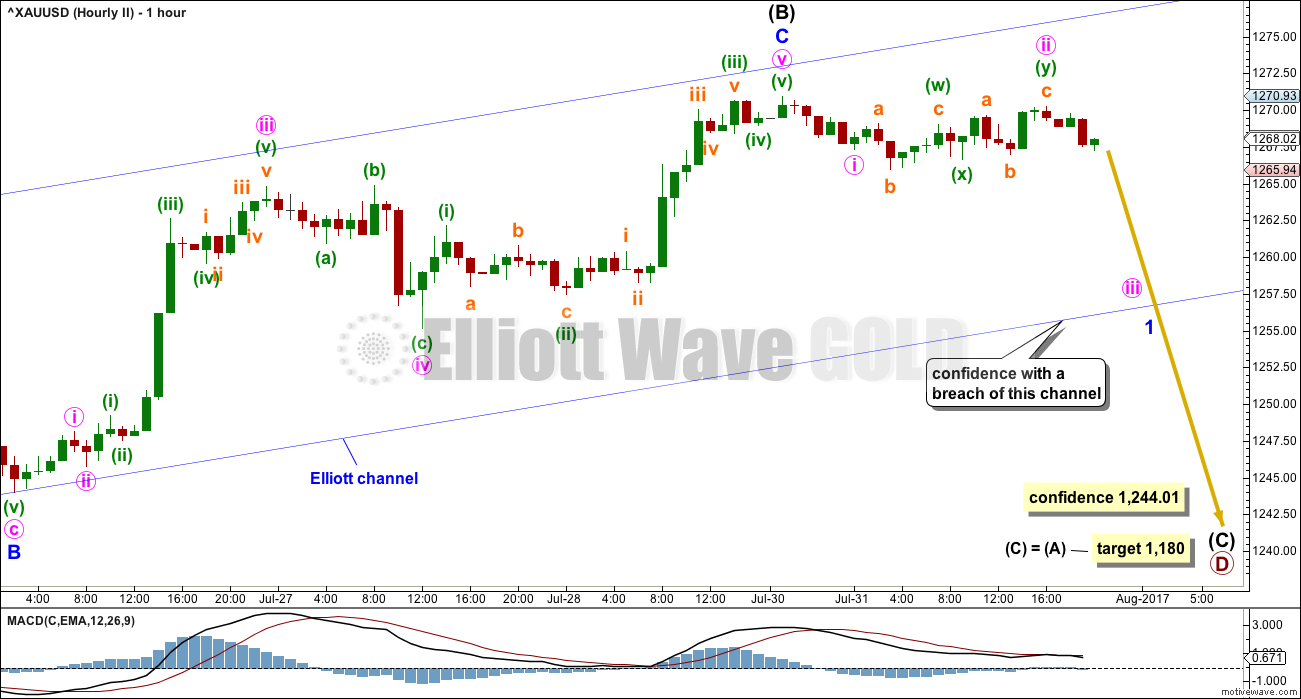

SECOND HOURLY CHART

It is possible that intermediate wave (B) is over at Friday’s high.

Within minor wave C, there is gross disproportion between minute waves ii and iv. Minute wave iv shows up at the daily chart level but minute wave ii does not. This disproportion must necessarily reduce the probability of this wave count to an alternate.

This wave count requires a breach of the blue Elliott channel and then a new low below 1,244.01 before reasonable confidence may be had in it.

1,244.01 is the start of minor wave C. A new low below its start may not be a second wave correction, so at that stage minor wave C would have to be over.

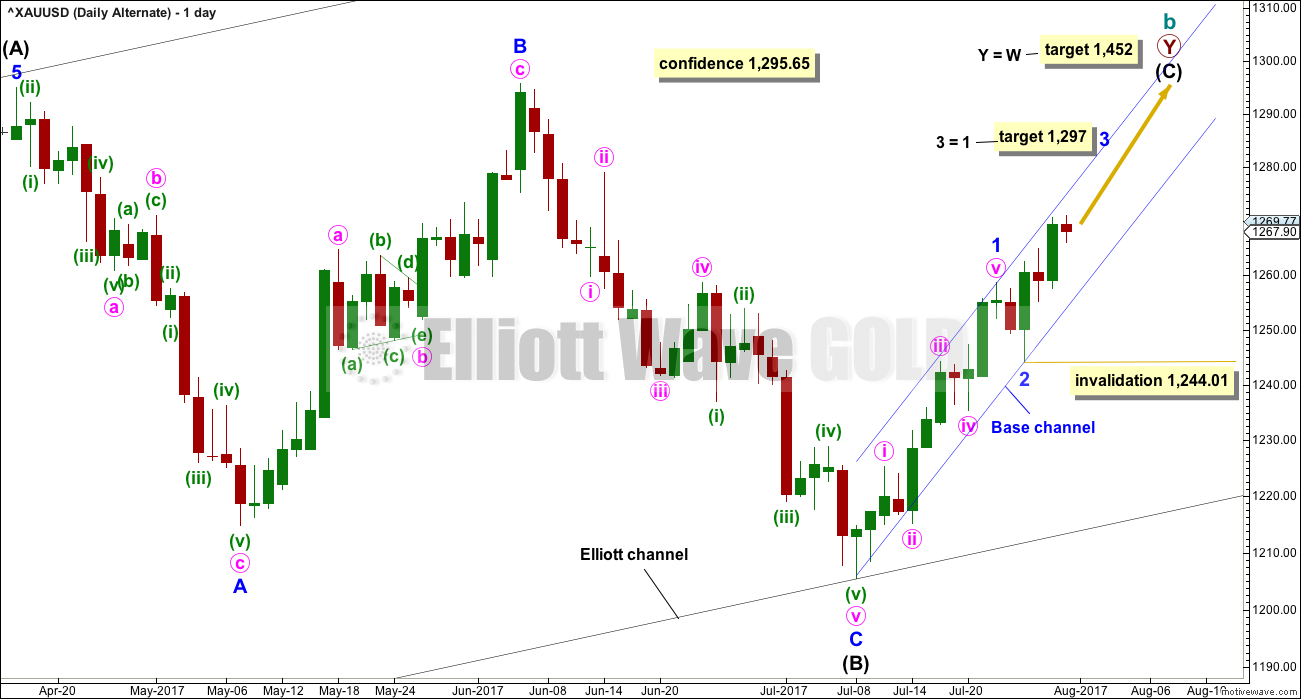

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has been published only in historical analysis. At this stage, it will be published on a daily basis.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The biggest problem with this wave count is the structure of intermediate wave (A) within primary wave Y. This upwards wave looks very much like a three and not a five. This upwards wave must be seen as a five for this wave count to work.

Within the second zigzag of primary wave Y, intermediate wave (B) is a completed regular flat correction. Minor wave C ends just slightly below the end of minor wave A avoiding a truncation. There is no Fibonacci ratio between minor waves A and C.

The target remains the same as previously published for this wave count.

Along the way up, some resistance should be expected at the cyan Magee trend line.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Minor wave 2 may be over as a very quick and shallow zigzag.

Because minor wave 1 was a long extension, the target for minor wave 3 is for equality with minor wave 1.

Within minor wave 3, no second wave correction may move beyond the start of its first wave below 1,244.01.

HOURLY CHART

If minor wave 3 for this alternate is to be an extension reaching equality with minor wave 1, then its subdivisions may show up on the daily chart like those for minor wave 1 do.

This wave count would now expect a strong increase in upwards momentum as the middle of a third wave passes.

For this alternate, only minuette wave (i) within minute wave iii may be completing. Minuette wave (i) shows weaker momentum than minute wave i, which is acceptable.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,255.16.

TECHNICAL ANALYSIS

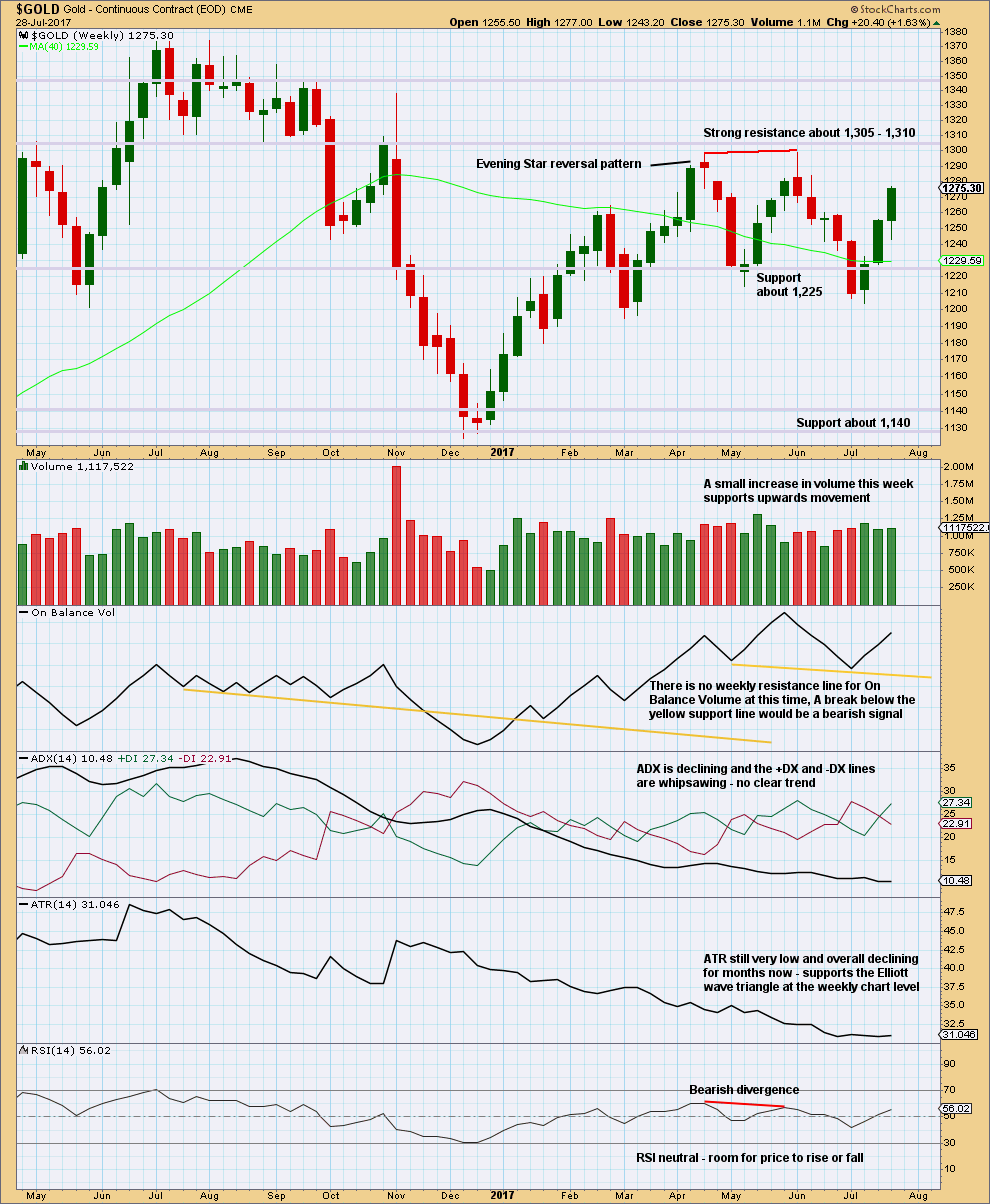

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A long lower wick and some support from volume suggest more upwards movement this week.

Price is range bound with resistance about 1,305 to 1,310 and support about 1,225 to 1,205. During this range bound period, it is an upwards week that has strongest volume suggesting an upwards breakout may be more likely than downwards. This is contrary to the main Elliott wave count.

ATR continues to decline, which does support the main Elliott wave count.

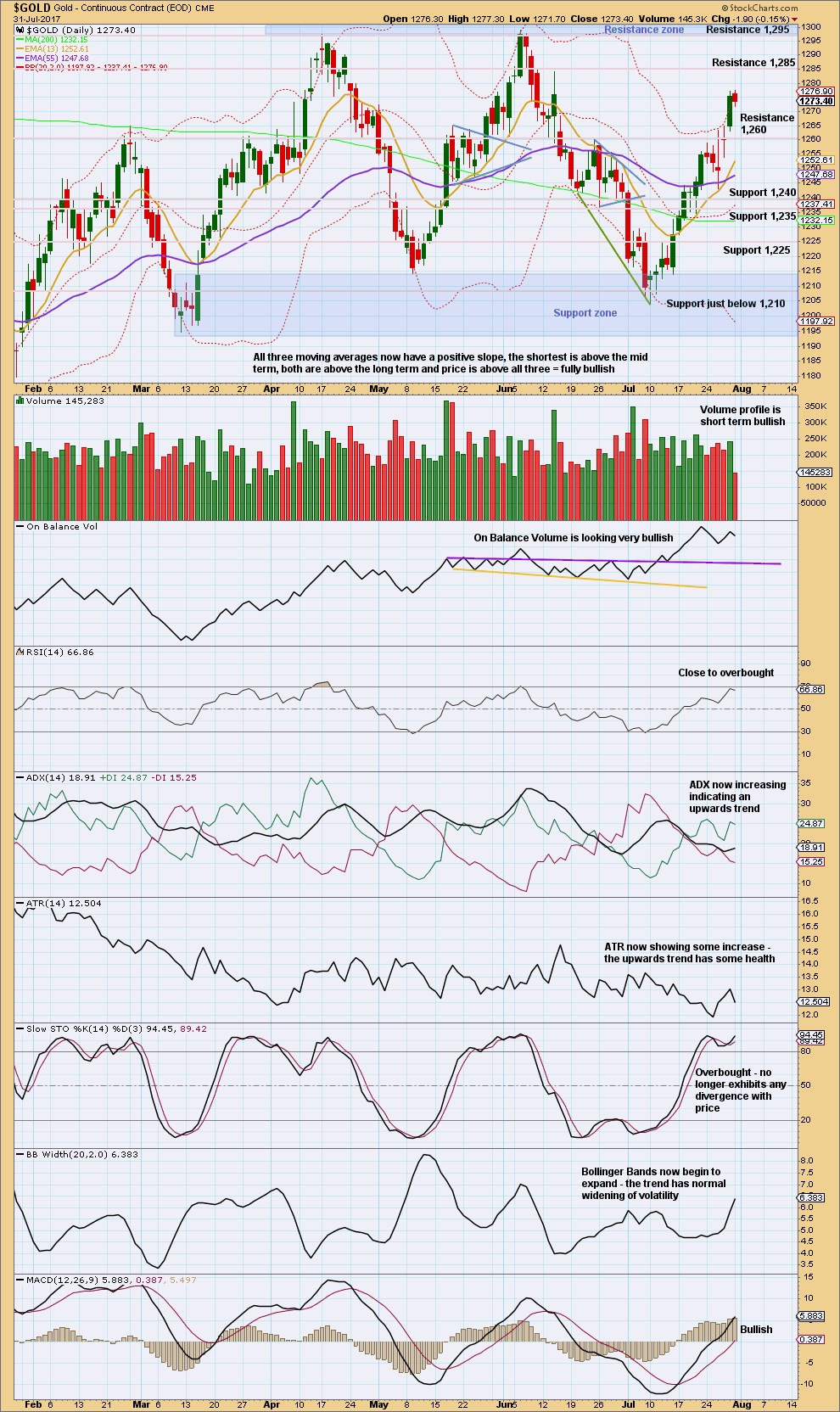

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back and looking at the larger consolidation, Gold moved into a range back in February this year, delineated by support and resistance zones. During this consolidation, it is two upwards days of 7th of April and the 17th of May that have strongest volume. This suggests an upwards breakout is more likely than downwards, and it supports the alternate Elliott wave count and not the main Elliott wave count.

Divergence between price and Stochastics has today disappeared. There is now nothing bearish in this chart for the short term.

The last upwards day for Friday had support from volume. Now a red daily candlestick for Monday with a balance of volume downwards does not have support from volume. The short term volume profile is bullish.

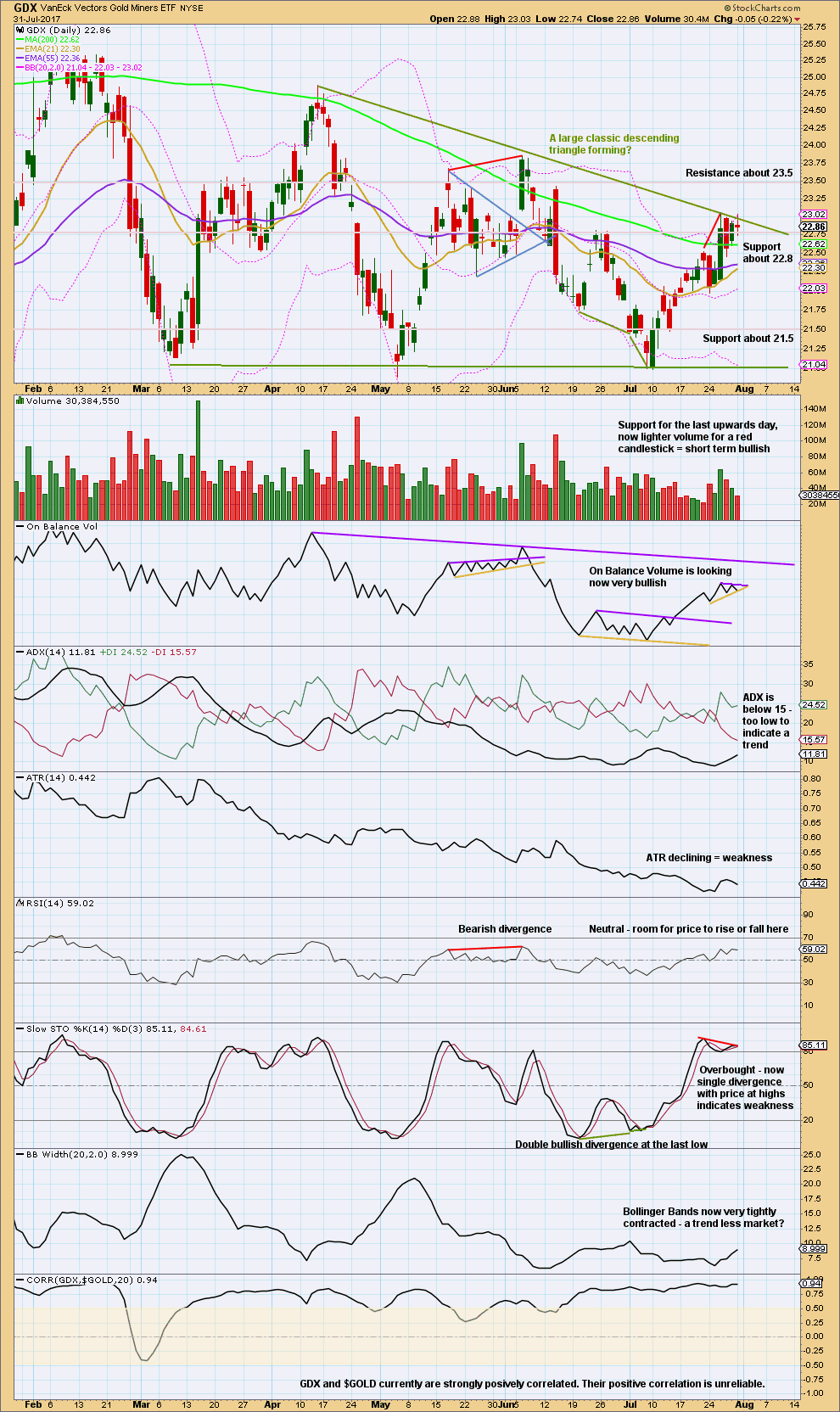

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back for GDX too, to look at the past six months, a large descending triangle looks like it has formed and may be close to a breakout. Breakouts from descending triangles are usually downwards.

During this structure though it is an upwards day for the 15th of March that has strongest volume suggesting an upwards breakout may be more likely than downwards.

There is overall some decline in volume lately. This supports the view that a triangle is nearing completion. ATR also supports this view.

The last three sessions look like a small pennant pattern may be forming. Pennants are reliable continuation patterns, so the breakout would be expected to be upwards.

Published @ 08:44 p.m. EST.

Your analysis may be later than normal today. I have a fever of 101 F.

Thank you for your patience.

Wow, take care of yourself!! Maybe go for a fin swim.

Feel better Lara

Do take care. Even here in Singapore, the flu bug is in the air. I too was ill yesterday.

Hourly chart updated:

My mistake yesterday was in labelling minute iii over too soon.

I still can’t see the structure complete. It still needs minute iv to complete then minute v.

New high favours alternate hourly with today’s low minuette 2 of minute 3?

That’s certainly what it looks like. Or subminuette 2 going into middle of a big third wave. Same difference. There is potential weakening of upwards momentum on short term charts but this is probably overruled by strong daily chart

other bearish possibility could be this last wave up is an ending contracting diagonal? Lara would have to confirm this is possible

I looked at that. The trend lines would diverge, so violating a rule. So it must be an impulse.

Silver is developing inv HnS in 4 hour period time frame.

NL @ 16.91

Shoulders @ 16.21

Silver may drop to 6.21 and should reverse if this HnS is to be validated.

we may have seen a top?

The ALT hr chart is much appreciated at this stage, thx Lara

If price fails to make a new high, is this possible?

Do you mean 5 to be an ending diagonal? That’s possible. Check the trend lines converge though first.