Upwards movement for the last week for US Oil was not expected and has breached an important trend line. The Elliott wave count this week is changed.

Summary: Expect Oil now to continue higher to reach above 52.00. Use the pink base channel on the daily chart; if that is breached by downwards movement, expect a trend change and the next wave down has begun.

The bigger picture for Oil is still bearish, but it looks now like this bounce is not done.

New updates to this analysis are in bold.

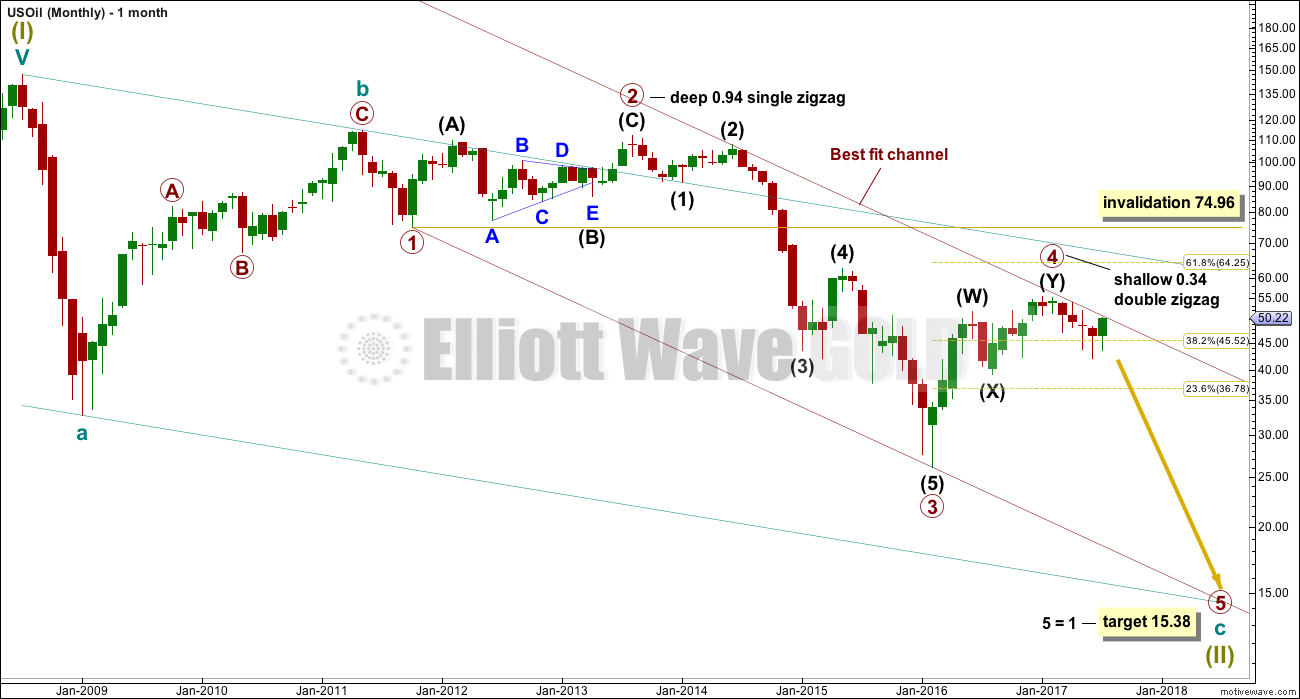

MONTHLY ELLIOTT WAVE COUNT

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

There is alternation in depth with primary wave 2 very deep and primary wave 4 shallow. There is inadequate alternation in structure, both are of the zigzag family, but there is some alternation within structure. Primary wave 2 is a single zigzag and the triangle for intermediate wave (B) gives it a sideways look. Primary wave 4 is a sharper and quicker double zigzag.

If it continues as per the alternate, then primary wave 4 may not move into primary wave 1 price territory above 74.96.

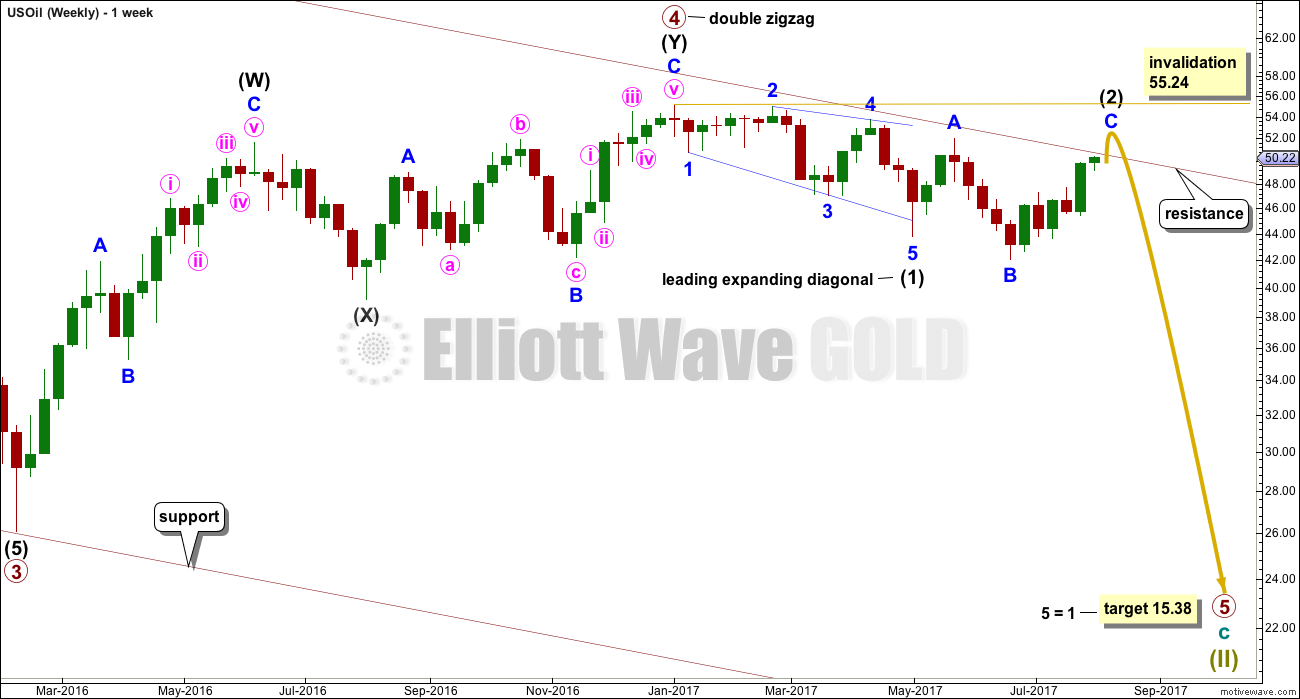

WEEKLY ELLIOTT WAVE COUNT

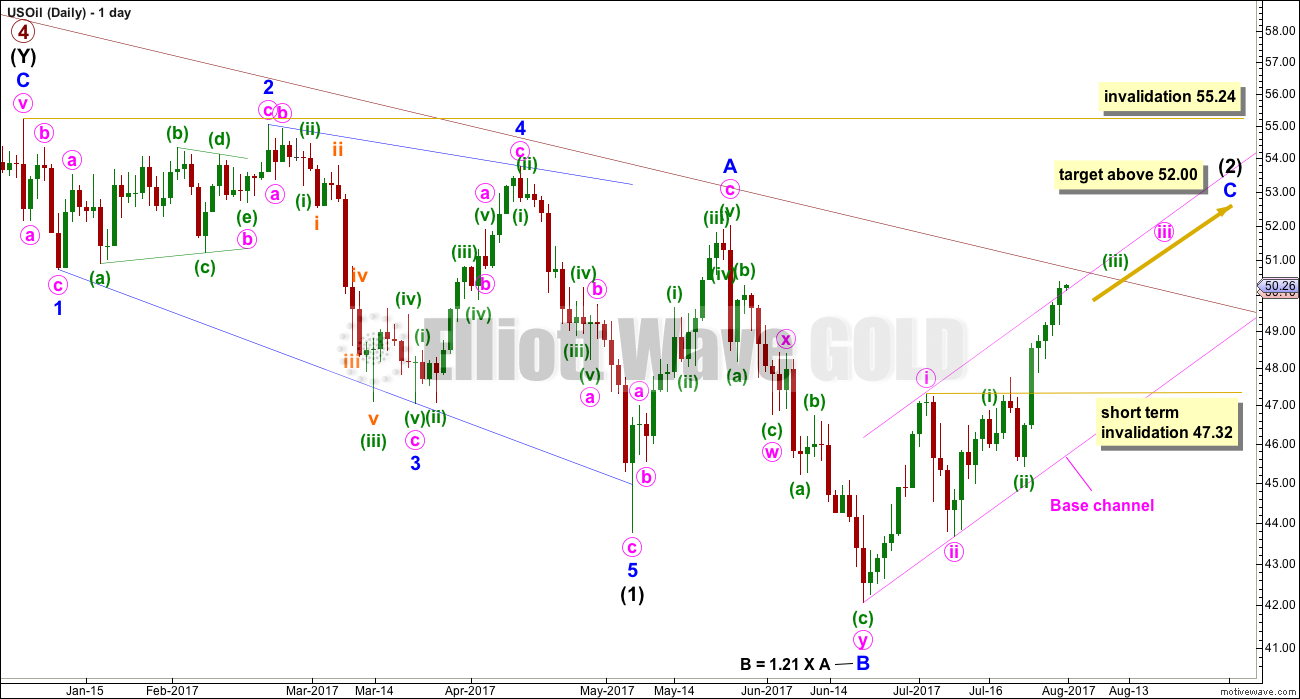

The wave count today is changed to see primary wave 5 beginning with a leading diagonal for intermediate wave (1), and now a deep expanded flat for intermediate wave (2). This has good proportion, fits at the daily chart level, and explains the breach of the trend line on the last published daily charts.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 55.24.

The only problem at this stage with this wave count is that it would require an overshoot of the maroon channel for minor wave C of intermediate wave (2) to avoid a truncation. If that trend line provides resistance, then it may force intermediate wave (2) to be a rare running flat.

DAILY ELLIOTT WAVE COUNT

The possible leading expanding diagonal for intermediate wave (1) meets all Elliott wave rules for this structure and has a good look. Minor wave 5 overshoots the 1-3 trend line.

Leading diagonals in first wave positions are often followed by very deep second wave corrections. At its end, if intermediate wave (2) is an expanded flat, it would fit the description of very deep.

Minor wave C must move above the end of minor wave A at 52.00 to avoid a truncation. If it does not manage to do this, then intermediate wave (2) may be a rare running flat. Running flats can occur before very strong movements. If intermediate wave (2) completes as a running flat, then expect intermediate wave (3) to be very strong indeed.

Price is now very close to the upper edge of the maroon best fit channel, copied over from monthly and weekly charts. This trend line may provide resistance.

Minor wave C must subdivide as a five wave structure. At this stage, it looks like an incomplete impulse. Within minor wave C, minute wave iv may not move into minute wave i price territory below 47.32.

The base channel about minute waves i and ii so far contains all pullbacks. Lower degree second wave corrections should find support or resistance at base channels drawn about first and second waves one or more degrees higher. A third wave should have the power to break through the other side of the base channel; it looks like minute wave iii may now be beginning to do that.

At this stage, the alternate published in last analysis now offers very little to the analysis and does not diverge in terms of expected direction from this new wave count. For clarity it will not be published this week.

TECHNICAL ANALYSIS

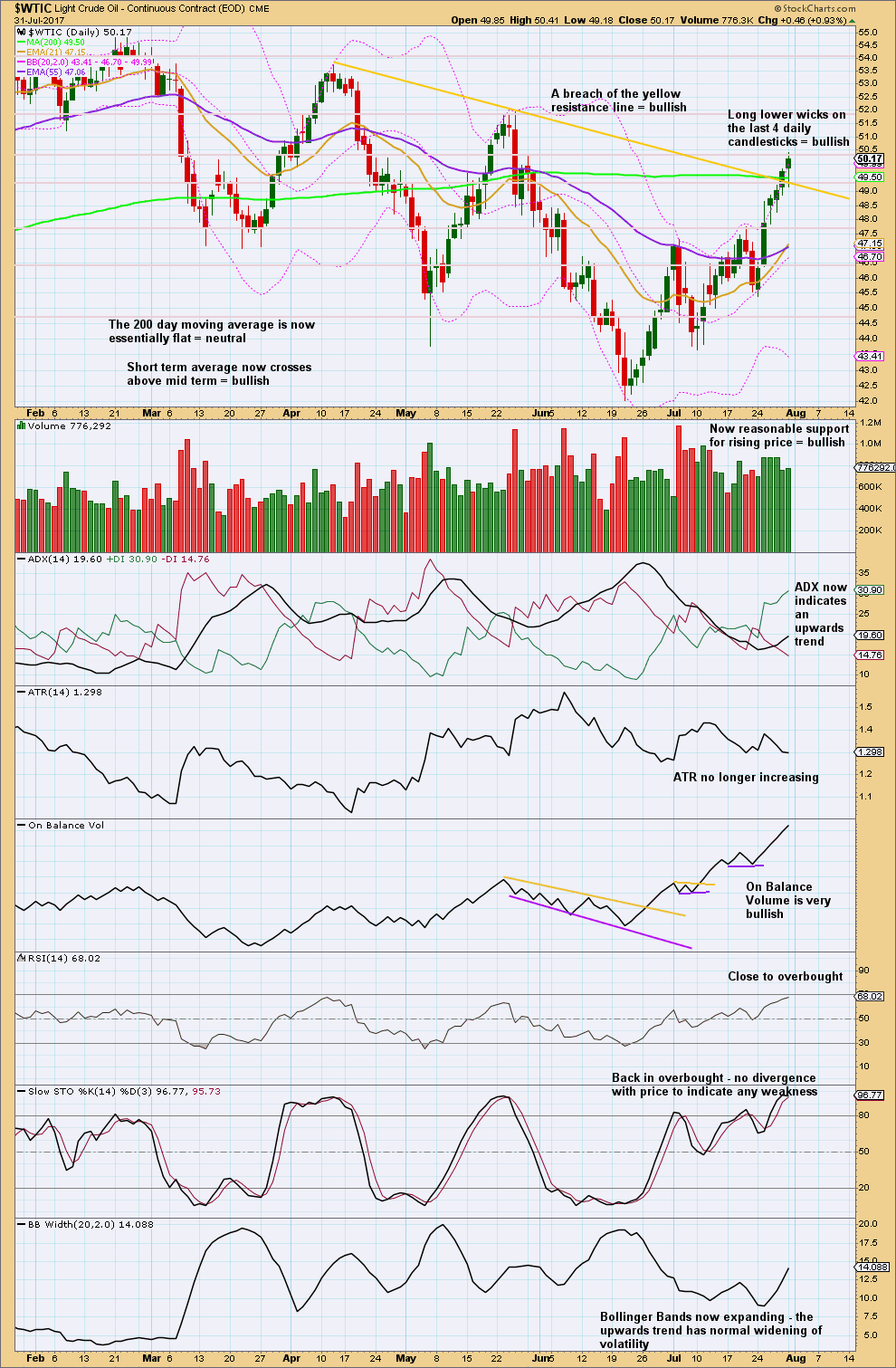

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week, for the short term at least, Oil is now looking fairly bullish. Next resistance is about 52.00 and then about 54.00.

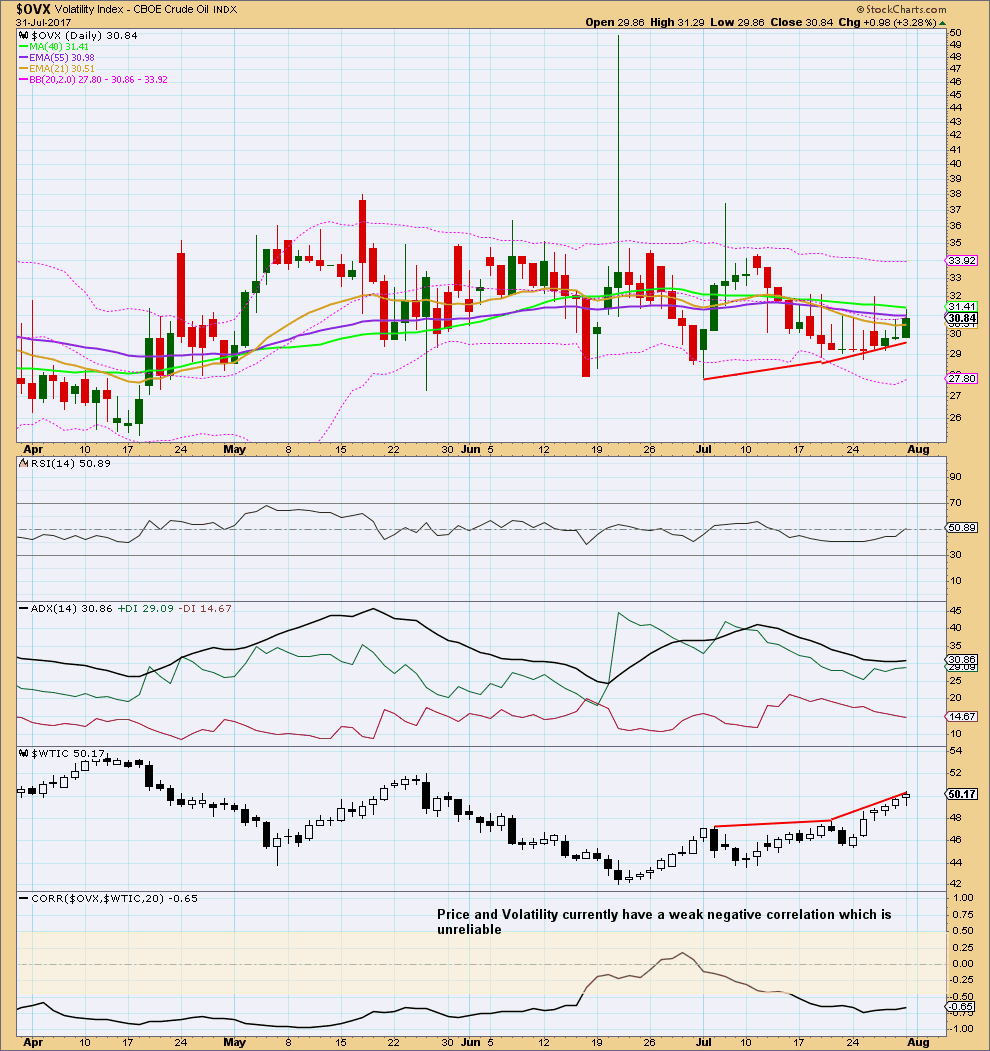

VOLATILITY INDEX

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price rises and volatility should increase as price falls. Divergence from this normal can provide a bullish or bearish signal for Oil. However, it is noted that this signal occurs both in minor and major lows and it cannot be used to distinguish between them.

At this time, volatility and price have a weak negative correlation.

There is now double bearish divergence between price and volatility: as price rises volatility is increasing. The rise in price does not come with a normal decline in volatility, so this is interpreted as weakness within price and in turn is interpreted as bearish.

Published @ 10:06 p.m. EST.

I think oil is going through a descending triangle. Not sure if it will go down or up once it finishes. Any thoughts?

Triangles are usually continuation patterns. This could be a 4th wave (Minuette wave 4) that will break upwards. Try moving the points on your triangle to the left, so E would go where D is, etc. Then the breakout will be up. Take a look at Lara’s chart below in comments.

Thanks for the feedback dreamer.

Elliott wave triangles are different to triangle patterns in classic technical analysis. EW triangles are more prescriptive, the rules are tougher.

EW triangles are always continuation patterns.

They’re analogous to classic pennants.

Back under the 200 day moving average.

The move above it could have been a head fake.

Not sure if intermediate (2) can break above resistance at the maroon trend line.

Thank you for the prompt update at the end of day like today.

Using a standard math, I am thinking a double top soon… unless something happens like a hurricane in the Gulf Coast of USA or a geopolitical event.

Any wisdom is appreciated 😉

Great Analysis- Love the way you think out of the box. Thanks.

Thank you very much. It was a chart shared by Dreamer actually that had the leading diagonal. So I can’t take credit for that one really.

Still, a change to the wave count was obviously required.

I like the solution you found. It seems like often when there are too many 1-2’s, that the market fools us and another count appears more likely.

did minute 3 end and beginning of min4?

dont think so kyong, rsi doesnt look oversold enough on 4 hourly chart