Downwards movement continues as both Elliott wave counts expect. The short term target remains the same.

Summary: Expect downwards movement now to continue at least for the short term. A short term target is at 1,261. This downwards swing may go as low as 1,170 to 1,158.

Use the channels drawn on the hourly charts (they are the same). Expect price to keep falling while it remains within the channel. If that channel is breached by upwards movement, expect a big bounce. The upper edge of the channel may be used to place trailing stops for shorts.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

The wave counts will be labelled first and second. Classic technical analysis will be used to determine which wave count looks to be more likely.

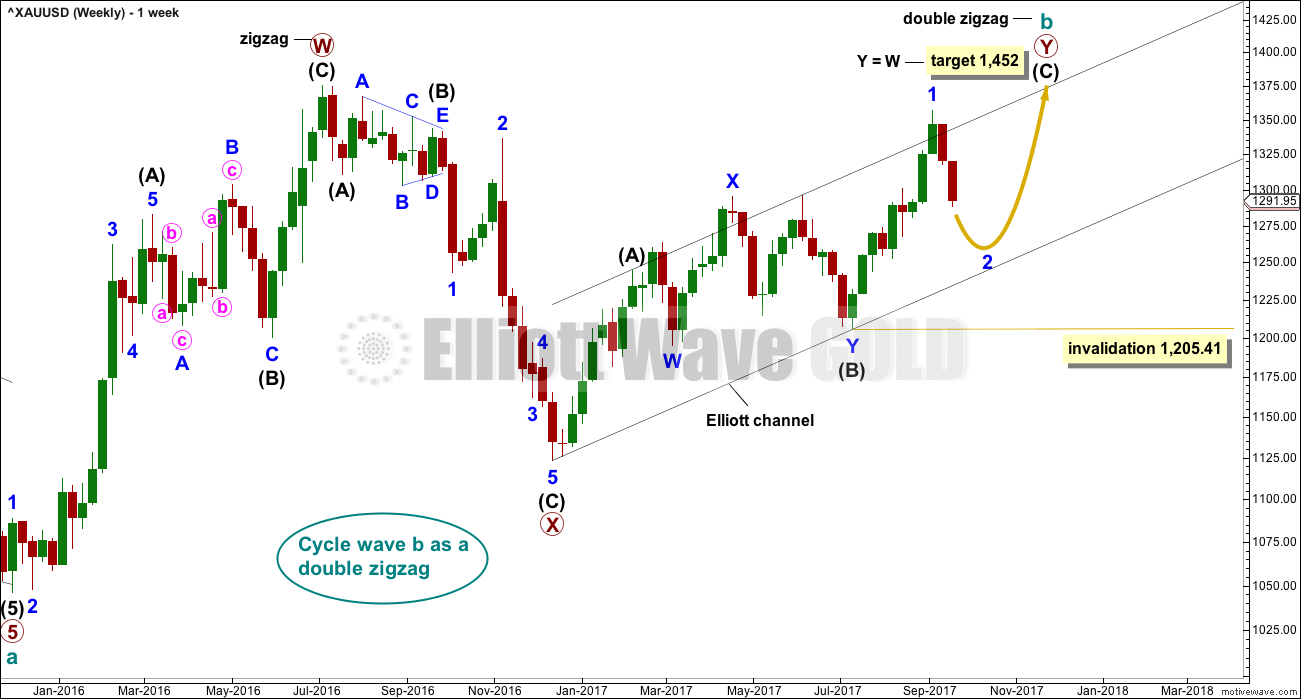

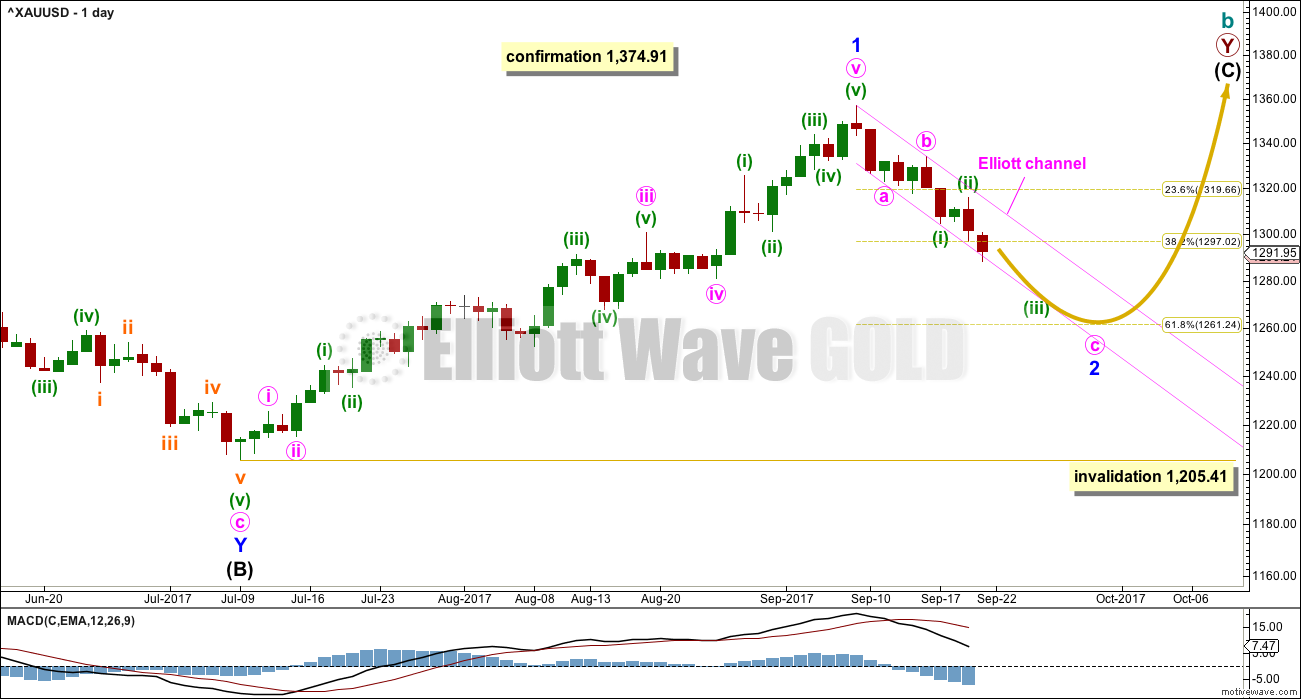

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits well at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

There are two problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

It is possible that minor wave 1 may have been over at the last high and the current pullback may be minor wave 2. Minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

The target for minor wave 2 is at the 0.618 Fibonacci ratio of minor wave 1.

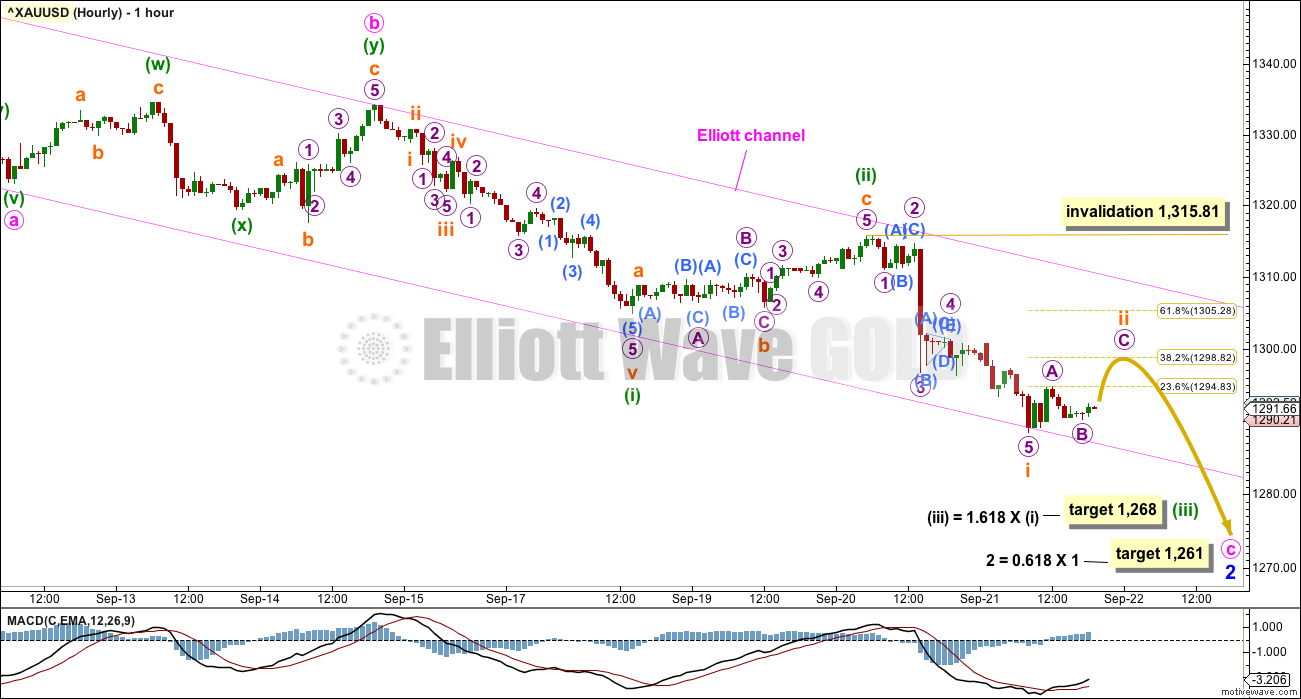

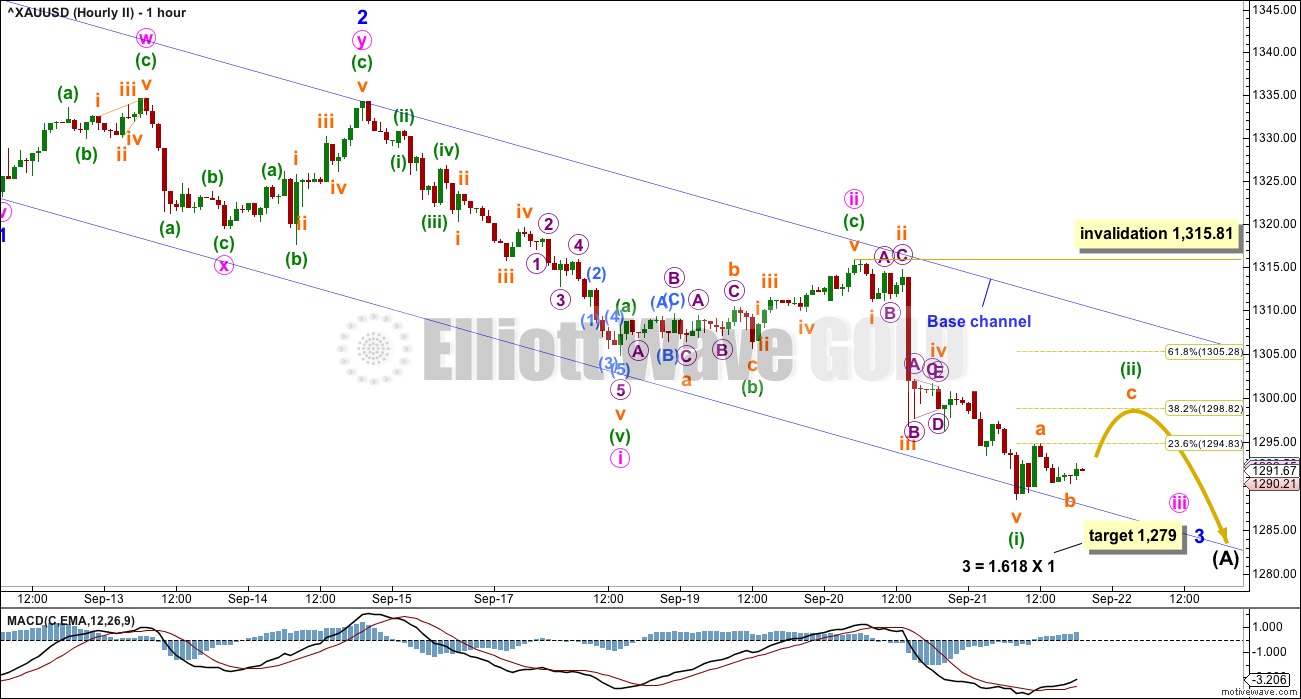

HOURLY CHART

Minor wave 2 may be unfolding as a single zigzag, which is one of the most common structures for a second wave.

Zigzags subdivide 5-3-5. So far minute waves a and b look complete. Minute wave c must subdivide as a five wave structure and at this stage looks to be the more common impulse.

This hourly wave count follows on directly from labelling on the daily chart. For this wave count minute waves a, b and now c look to have good proportion at the daily chart level and the Elliott channel has a good fit. Minute wave c is expected to be extending.

So far, within minute wave c, minuette waves (i) and now (ii) look complete.

Minuette wave (iii) should exhibit an increase in downwards momentum; third waves are usually stronger than first waves. Minuette wave (iii) now does exhibit slightly stronger momentum than minuette wave (i). A further increase may be expected if this wave count is correct.

Minuette wave (iii) may only subdivide as an impulse. Subminuette wave i may now be complete. At the five minute chart level, micro wave 5 will subdivide as an impulse following on from the regular contracting triangle of micro wave 4. Subminuette wave ii may bounce and may not move beyond the start of subminuette wave i above 1,315.81.

If subminuette wave ii is deep, then it should find very strong resistance at the upper edge of the pink Elliott channel copied over from the daily chart.

Minor wave 1 lasted 44 days in total. So far minor wave 2 has only lasted 9 days. It should be expected to last longer than this for the wave count to have good proportions. A Fibonacci 13 is now a minimum expectation, which would see minor wave 2 end next Tuesday.

Price should remain with the Elliott channel while minor wave 2 continues. If this channel is breached by upwards movement, that shall be an early indicator that minor wave 2 may be over.

If this wave count is correct, then when this pullback is complete then a third wave up should unfold. That may now begin next Tuesday at the earliest.

ALTERNATE HOURLY CHART

It is possible that minute wave b ended earlier as a more quick zigzag. If minute wave c begins a little earlier, then it may be closer to completion.

This alternate idea does not have such good proportions between minute waves a, b and c. With minute wave b ending earlier, a channel drawn about this movement using Elliott’s technique for a correction would not fit, so the channel is a best fit. The channel supports the first hourly chart and not this alternate.

The final fifth wave down of subminuette wave v may be an ending expanding diagonal. Within the diagonal, micro wave 4 may not move beyond the end of micro wave 2 above 1,297.31. If this alternate wave count is invalidated, then more confidence in the first hourly chart may be had.

The diagonal would be expanding, so micro wave 5 must be longer than equality in length with micro wave 3.

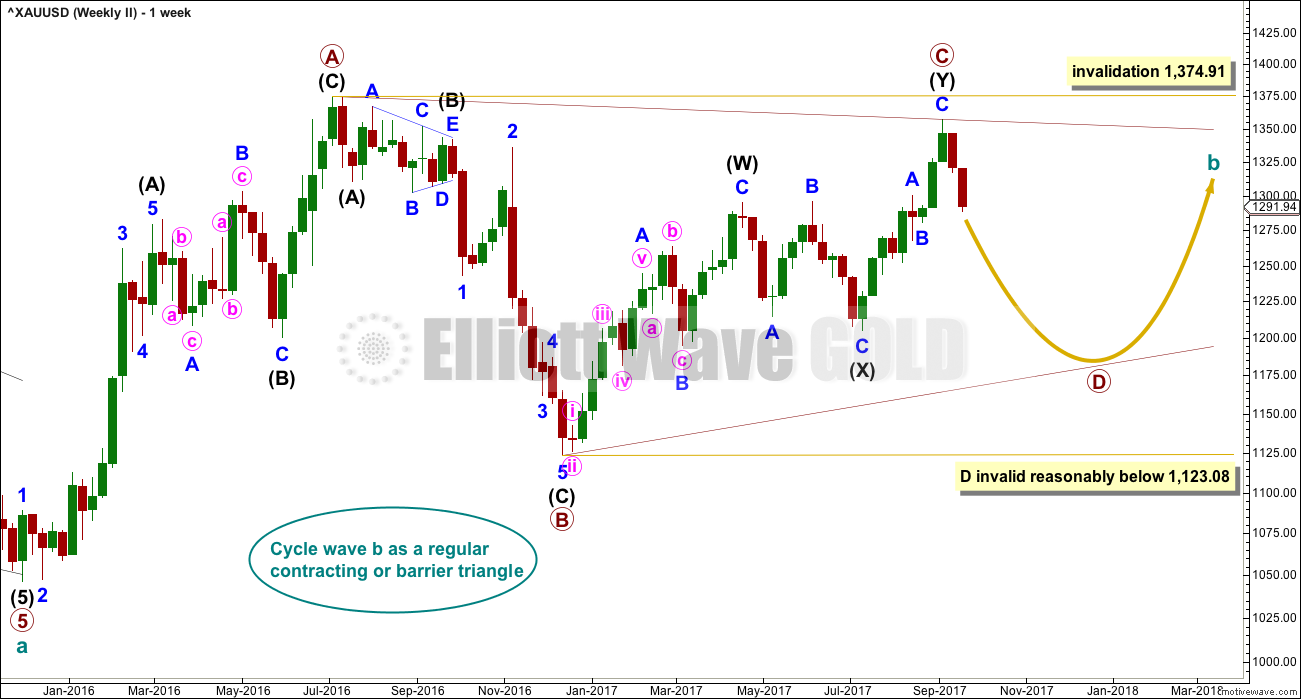

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

It is still possible that cycle wave b is unfolding as a regular contracting triangle.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a complete zigzag at the weekly chart level.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C lasted 38 weeks.

The A-C trend line now has too weak a slope. At this stage, this is now a problem for this wave count, the upper A-C trend line no longer has such a typical look.

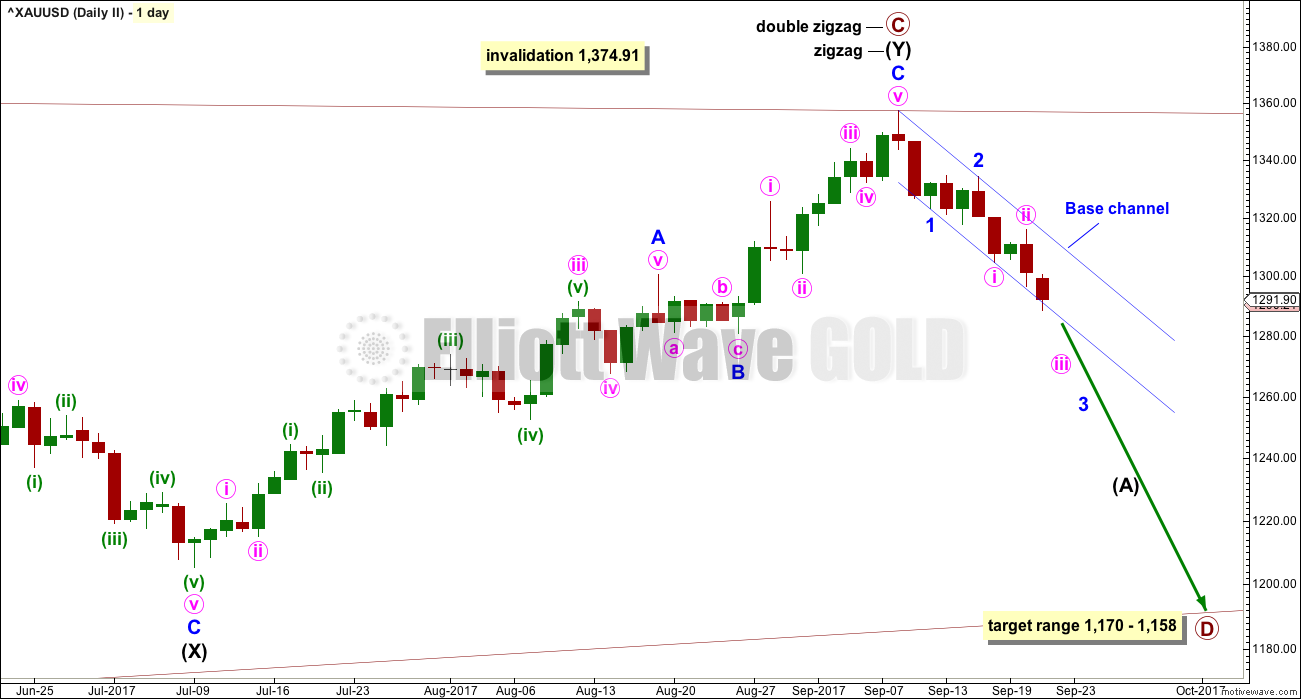

DAILY CHART

This second wave count expects the new wave down may be deeper and longer lasting than the first wave count allows for.

The blue base channel on this second wave count is drawn in exactly the same way as the pink Elliott channel on the first daily chart. For this second wave count the middle of minor wave 3 should have the power to break below support at the lower edge of the base channel. If price does behave like this, it would offer support for this second wave count over the first wave count.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a single zigzag.

HOURLY CHART

1-2-3 of an unfolding impulse and a-b-c of a zigzag have exactly the same subdivisions: 5-3-5. Subdivisions of downwards movement are seen in the same way for both hourly wave counts.

Minor wave 3 may reach a common Fibonacci ratio to minor wave 1.

Minor wave 3 may only subdivide as an impulse. So far minute waves i and ii look complete. Minute wave iii also may only subdivide as an impulse. Within minute wave iii, minuette wave (i) may now be complete.

It is also possible that while price remains below 1,304.85 minute wave iii may be over at the low labelled minuette wave (i). However, this may have a reasonably low probability because the wave labelled minute wave i is 29.39 in length and the last wave to today’s low is 27.30 in length. Minute wave iii is more likely to be longer than minute wave i, not shorter.

A bounce should be expected for minuette wave (ii). Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,315.81.

Use the 0.382 Fibonacci ratio as a preferred target for minuette wave (ii). At this stage, within a third wave, corrections may begin to be more brief and shallow.

The base channel is exactly the same as the Elliott channel on the first wave count. If this second wave count is correct, then along the way down corrections should find resistance about the upper edge of the base channel.

A third wave should have the power to break below a base channel. If price does break below the lower trend line, that shall offer a little confidence in this wave count.

TECHNICAL ANALYSIS

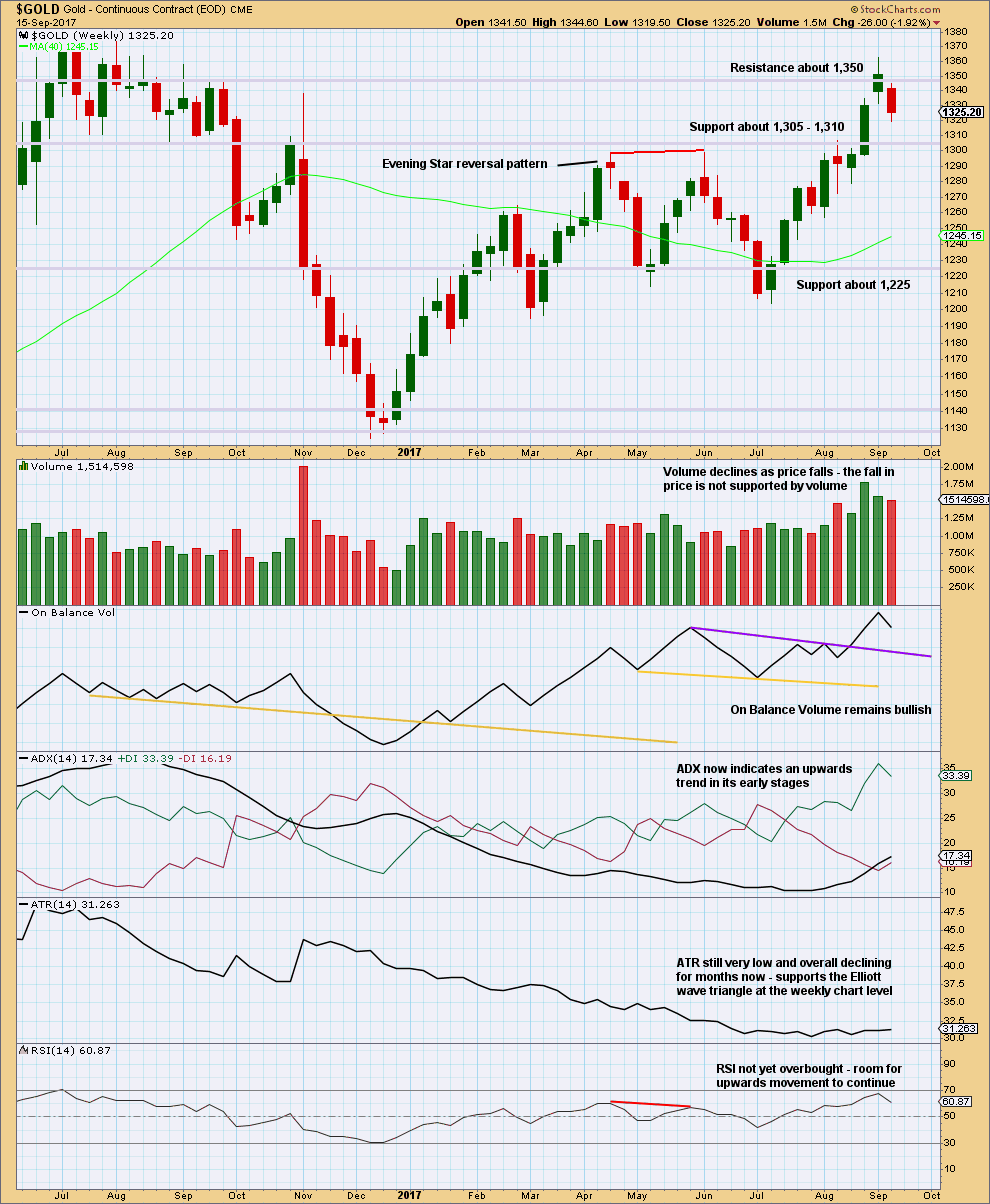

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last weekly candlestick completes as very bearish. It is not engulfing the prior weekly candlestick, but it is even more bearish than that. The week gaps open lower and then closes well below the prior weekly candlestick. Bears dominated last week. They managed to pull price down to new lows substantially below the prior week, closing below the lower wick of the week before.

This candlestick supports the second Elliott wave count.

ADX and On Balance Volume however remain very bullish.

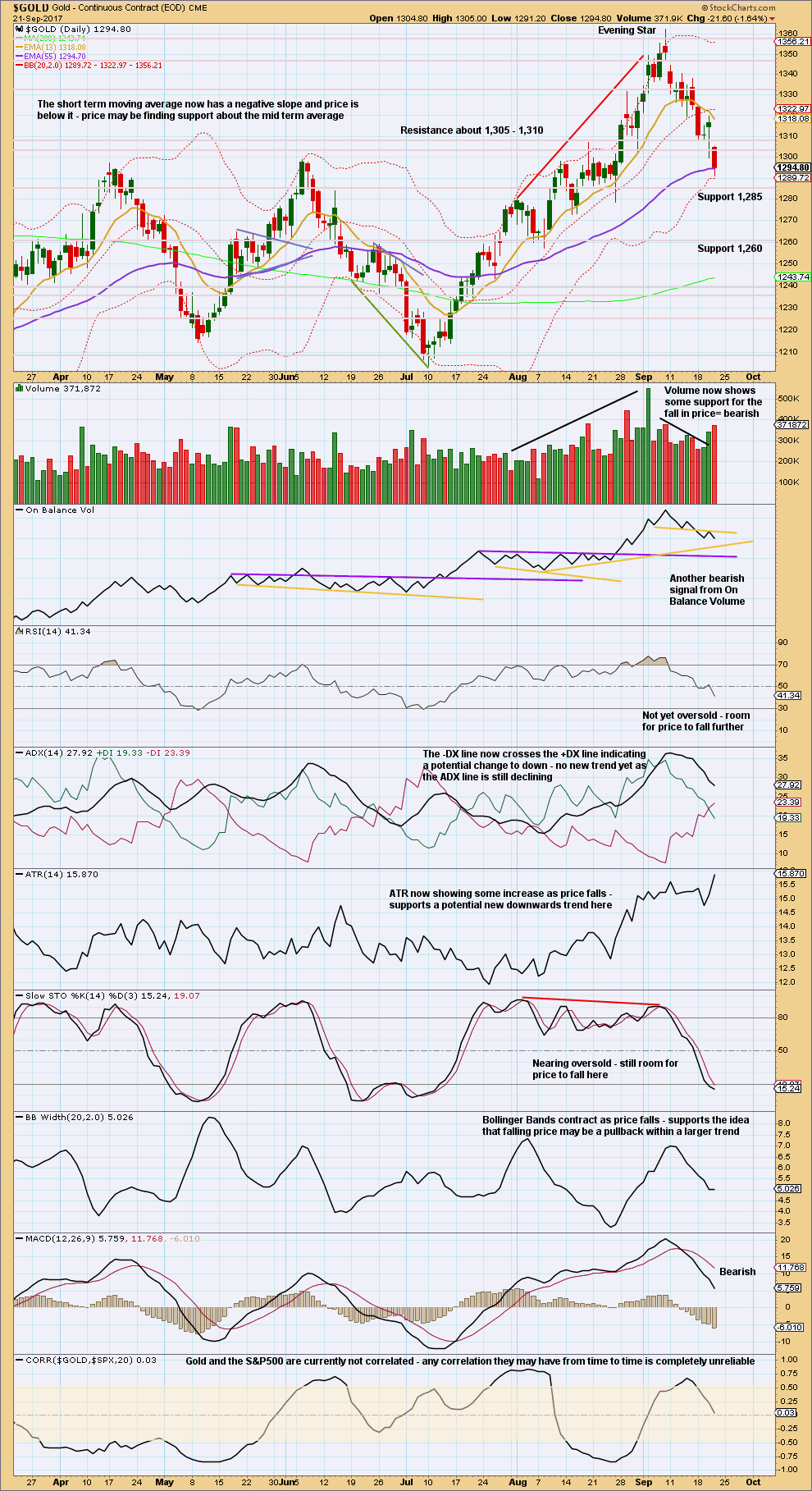

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now support from volume for the fall in price and another bearish signal today from On Balance Volume.

For the very short term, a longer lower wick on today’s candlestick suggests a bounce for the very short term. This fits neatly with the expectations from the Elliott wave counts at the hourly chart level.

Expect price to keep falling here until it finds resistance at the same time Stochastics is oversold and exhibits divergence with price. If RSI is oversold at the same time, that would be a strong warning of a low in place.

Those conditions are not met yet. The trend is down for the short term, despite ADX not yet recognising it. ADX is a lagging indicator.

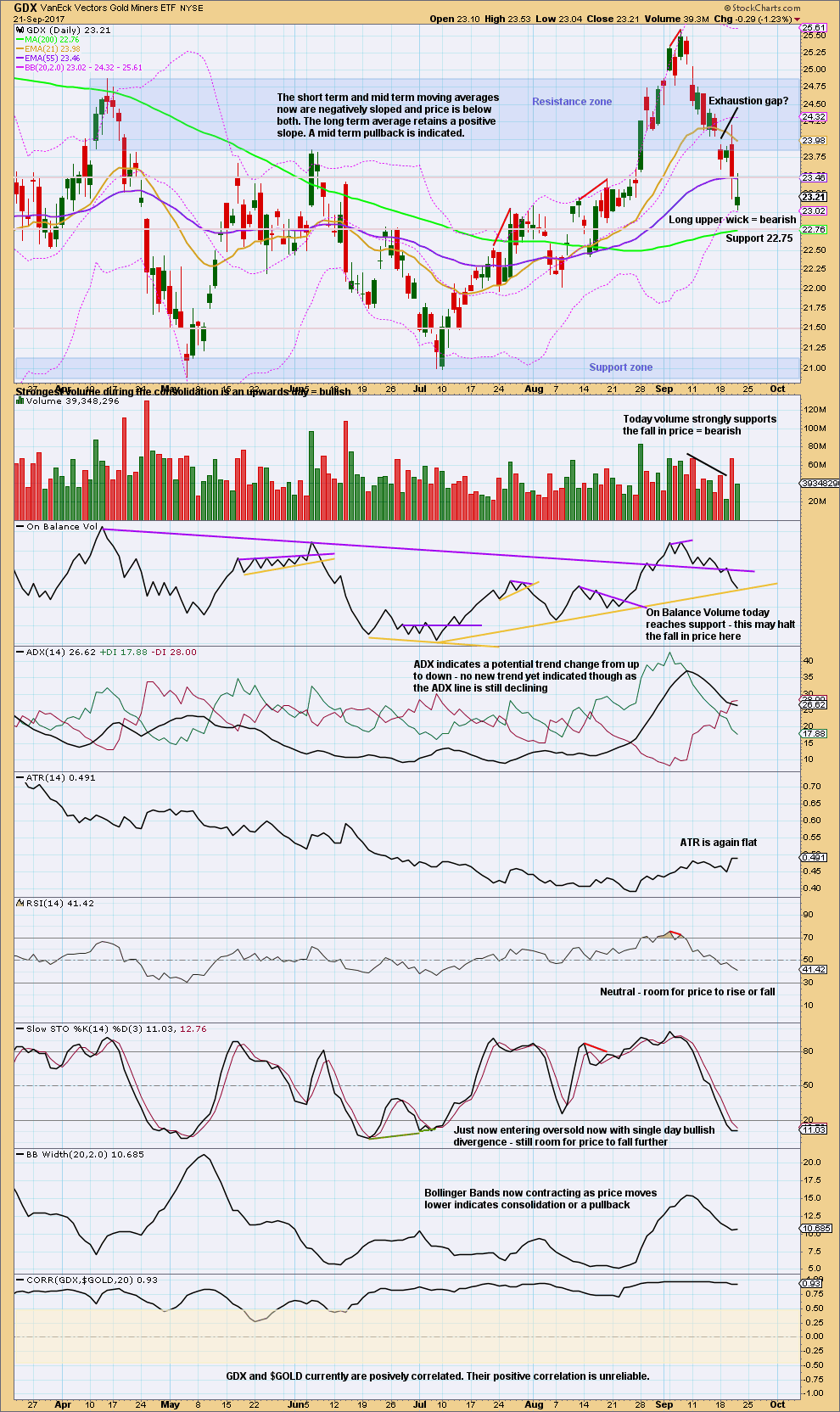

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The exhaustion gap indicated only a very short term consolidation. The downwards trend continues.

Volume today did not support a further fall in price. Volume is bullish for the very short term. Stochastics indicates some exhaustion here. If On Balance Volume turns upwards tomorrow, that should be taken as a strong bullish signal; the pullback may then be over. But if On Balance Volume breaks below support tomorrow, that should be taken as a strong bearish signal.

Next support is about 22.75.

Published @ 08:36 p.m. EST.

can some one tell me what does the unwinding of the fed balanced sheet will do to Gold? it seem s that the media has many different ideas about the possible outcome…..

A slightly new idea:

What if minute wave c is closer to completion? What if it only needs a final fifth wave down now?

It does look like todays sideways movement is a small triangle, if this remains so it may be minuette wave (iv).

Minuette wave (iii) is a little shorter than minuette wave (i), so this would limit minuette (v) to no longer than equality with (iii).

This will be the alternate today. The main hourly will be the same, expecting a bigger drop down.

The trend at the hourly chart level is still down while price remains within the pink channel.

Thanks Lara. COT structure might reveal a confirmation of new downtrend. Commercials finally started covering and hedge funds getting out of longs and starting to short. Those are the momentum players and they will drive price for now if this remains the case. Open interest has been reduced as well. All points to lower prices for now, as the hedge funds have a lot of longs to liquidate and shorts to build up before the next meaningful turn.

NK hydrogen bomb threats and congress’ premature defeat of the new health care overhaul (which signals trouble with planned tax reform) all happened between yesterday and today, and price is only just returning to 1300, perhaps before resuming downtrend next week.

Just a theory!

What would be the target for v

In this case?

I expect a short squeeze. Take care… If this is a bull market higher highs and lower lows are obligatory. Shake out the weak hands!

Alt hourly is now invalid

Yes?

You deserve a good fun time!

Most airlines have wi-fi but may be pricy!

“This downwards swing may go as low as 1,170 to 1,158.”

If this price is accomplished you are expecting to invalidation of current weekly wave count (1205).

Is that correct?

Thanks.

Looks like the more bullish DZZ count will be discarded if the channel on the weekly chart is broken. Looks like around 1,250ish.

“However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.”

Which count is the DZZ

The primary?

Ok

Re read

Got it now

Have a great time Lara!

Will do Nick, thank you!

So, it’s time to let you all know that I’ll be doing some travelling next week, and this will affect analysis. I will not be able to jump in just prior to the NY close to update hourly charts for you.

I’m flying to Hong Kong next Thursday 28th September (my time, remember, I’m living in the future down here). The flight is a daytime one, they tell me I’ll have internet access in flight so I hope to get work done. But if the connection is horrible then it is just possible that I may not be able to upload charts and publish your analysis that day.

While I’m in Hong Kong for 9 nights the time zone means I’ll not be able to give a quick update before NY close. I’ll be up at 6am HK time (6pm NY time) to begin end of day analysis.

The return flight will not affect your analysis.

Back to normal as of Monday 9th October.

I’ll let you all know in comments on the last “normal” day of analysis.

Beautiful city! Have a great time and buy a little Gold while you are there as premiums are quite low! 🙂

Lara, enjoy yr trip to HK. I used to visit my aunts there. It’s a fun town really fast paced and modern… Dimsum & roasting goose are delicious there…

Yum! 🙂

Awesome! I have a good friend who is a HK native, she’ll show me all the best places to eat and shop.

A big change from my home in Mangawhai. Looking forward to it!

Lara, the alternate hourly chart for the first wave count looks the same as the hourly chart. Is it possible the same chart was posted twice? Thanks,

Oops! Thank you Dreamer. I forgot a bit of code there 🙁

Fixed it now.