Last Elliott wave analysis advised to assume the trend remains the same until proven otherwise. More upwards movement continues the trend, but it is now weakening.

Summary: While price remains above 1,284.48 and most importantly within the pink base channel on the main hourly chart, assume the trend remains the same, upwards. The target is at 1,319 in the first instance and may be as high as 1,412.

If price breaks below the base channel, then expect a pullback to test support at prior resistance is underway. The target for it to end would now be at 1,273 to 1,268. If a pullback does eventuate here, then use it as an opportunity to join the new upwards trend.

Declining volume and a Hanging Man candlestick now followed by a Spinning Top suggests a pullback here. The Elliott wave analysis would see this a most common structure with a common target. While analysis points to this as the preferred scenario, we should only have confidence in it if the channel on the hourly chart is breached by downwards movement.

Always use stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

The wave counts will be labelled first and second. Classic technical analysis will be used to determine which wave count looks to be more likely. In terms of Elliott wave structure the second wave count has a better fit and fewer problems.

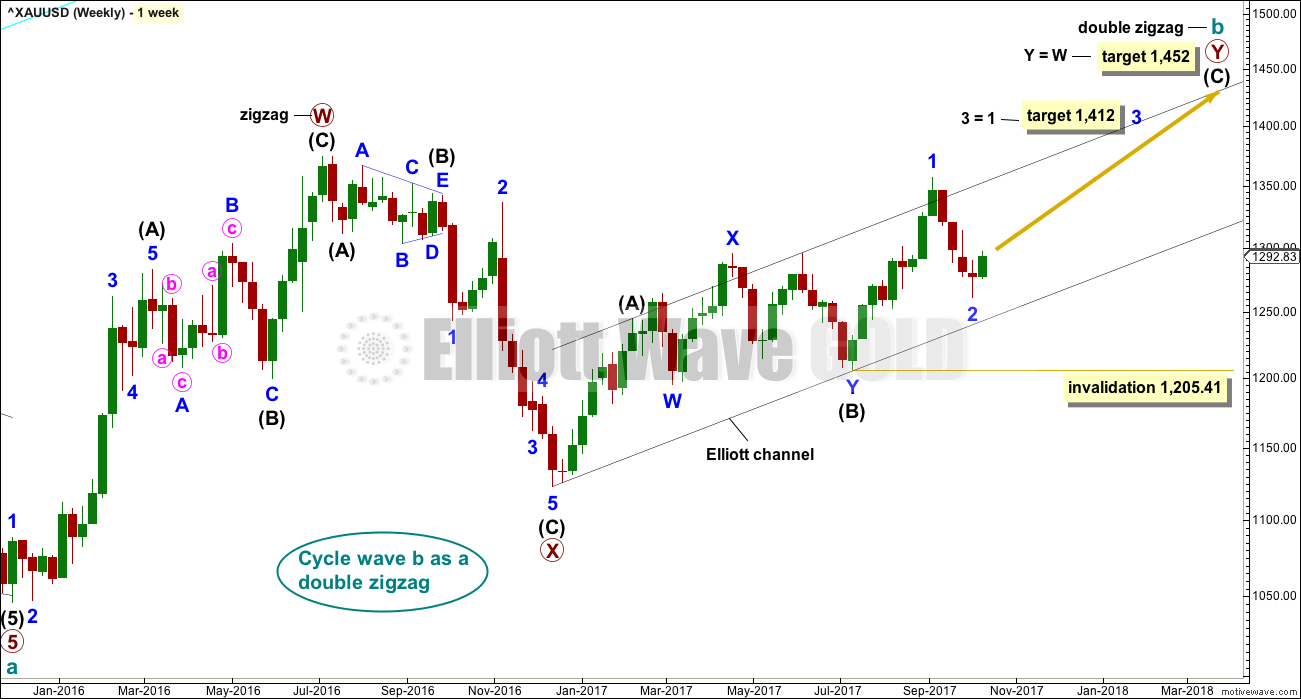

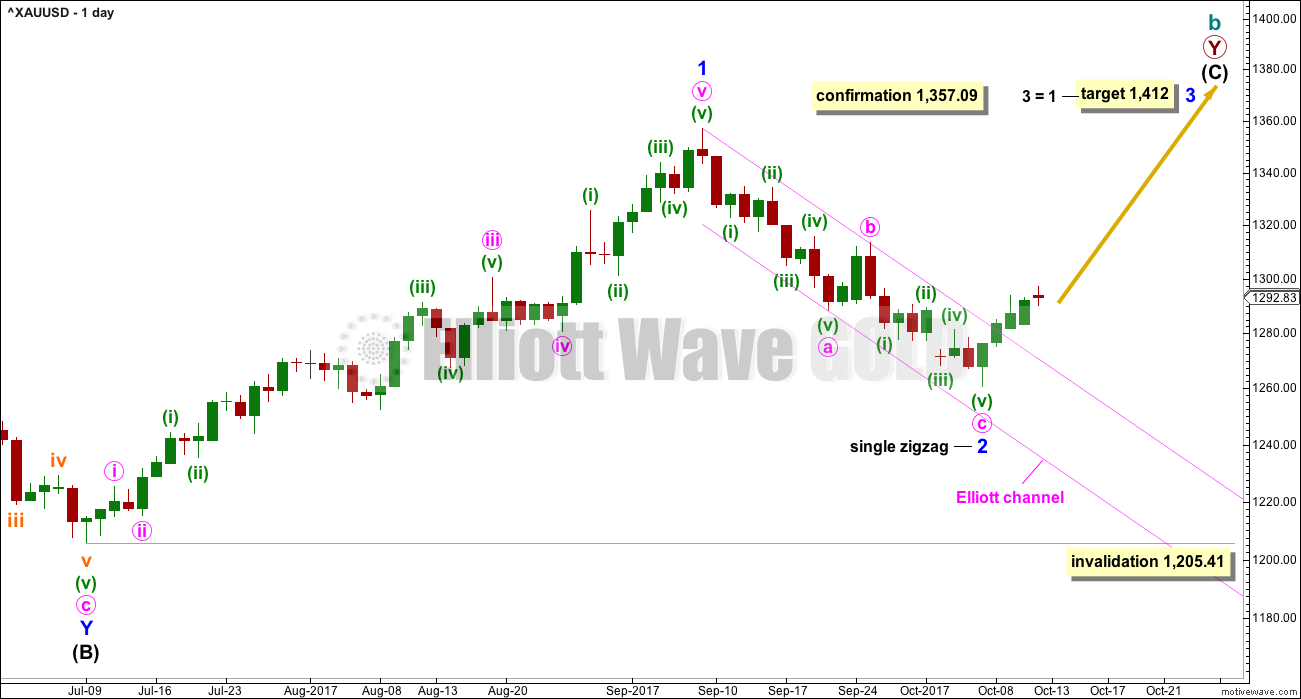

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits well at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

There are two problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

It is possible that minor waves 1 and now 2 may both be over. Minor wave 2 may have ended very close to the 0.618 Fibonacci ratio. If it continues lower, then minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

Minor wave 1 lasted 44 days and minor wave 2 may have lasted 20 days, just one short of a Fibonacci 21.

It is of some concern now that minor wave 3 appears to be starting out rather slowly. This is somewhat unusual for a third wave and offers some support now to the second Elliott wave count. With StockCharts data now fixed and showing a steady decline in volume as price rises, this concern is now validated.

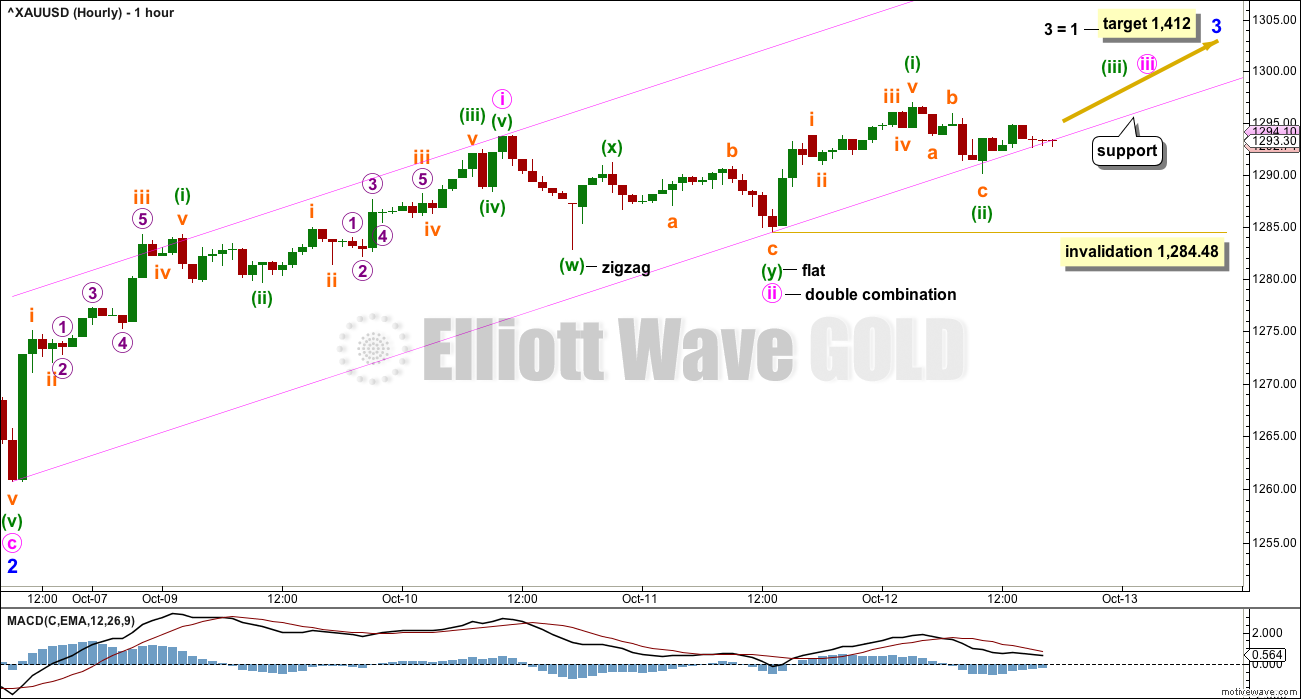

HOURLY CHART

Assume the trend remains the same until proven otherwise. It is possible that minute wave ii may be over as a very shallow double combination.

If this first hourly wave count is correct, then within minute wave iii any corrections should find very strong support at the lower edge of the pink base channel about minute waves i and ii. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,284.48.

This first wave count requires more upwards movement to have support from volume and exhibit an increase in upwards momentum. A third wave up at three degrees should show strength, but that is not the case today. This is labelled the first hourly chart, but it has less support today from volume analysis and will only remain the main wave count because we should assume the trend remains the same until proven otherwise.

If price breaks below the lower edge of the base channel, then use the alternate hourly chart below.

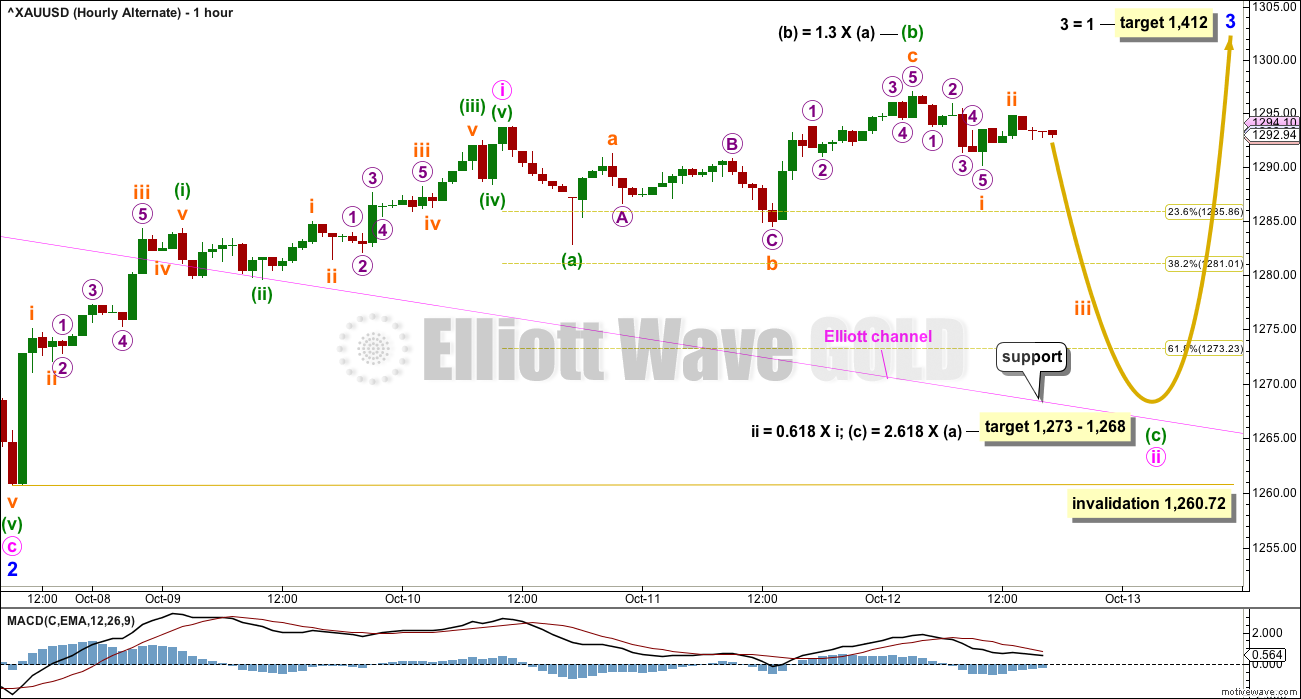

ALTERNATE HOURLY CHART

If price breaks below the lower edge of the pink base channel on the first hourly chart, expect a pullback to test support at prior resistance is underway. Prior resistance was the upper edge of the pink Elliott channel, which has been copied over here from the first daily chart.

The first second wave correction at the start of a new trend for Gold is almost always very deep. The target is recalculated today and is now deeper, which may see minute wave ii come down to test support at the upper edge of the pink Elliott channel. This would be a typical curve down to back test, and a typical deep early correction within a new trend.

This wave count expects the most typical behaviour from Gold and has more support today from volume analysis.

Minute wave ii may be unfolding as a very common expanded flat correction. Minuette wave (b) may have moved a little higher and is still within the most common range of 1 to 1.38 times the length of minuette wave (a).

Minute wave ii may not move beyond the start of minute wave i below 1,260.72.

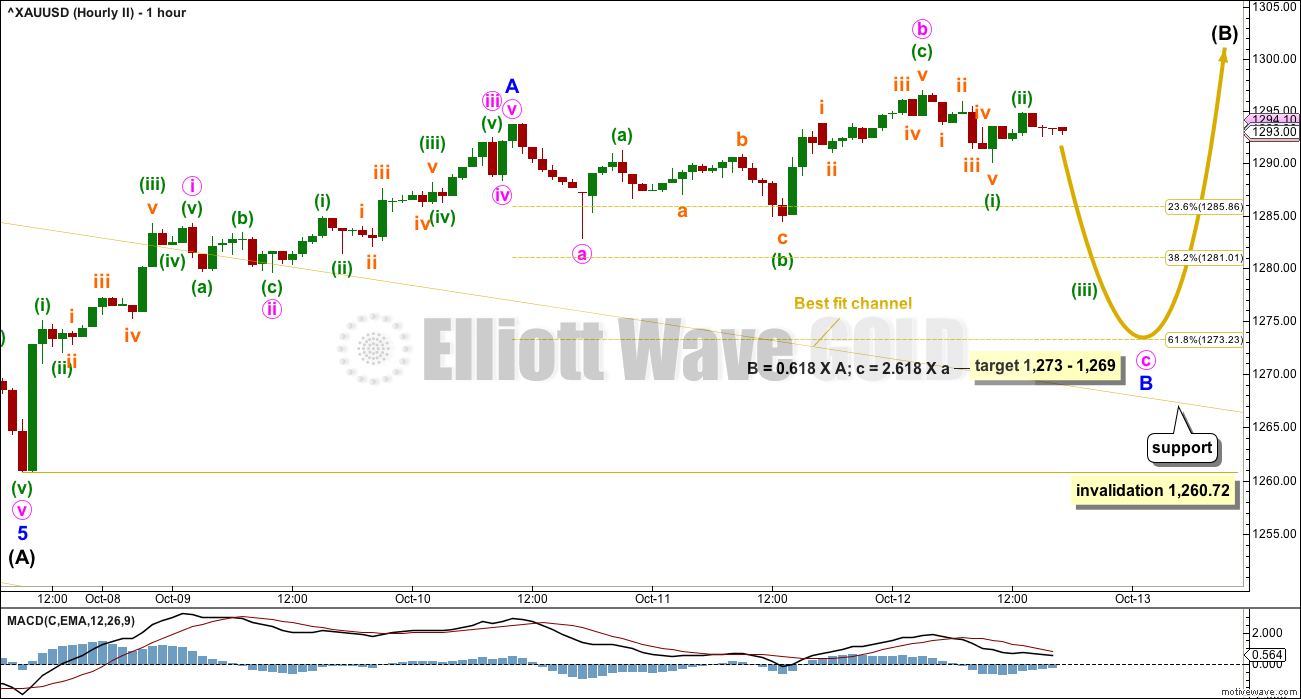

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

It is still possible that cycle wave b is unfolding as a regular contracting or barrier triangle.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a complete zigzag at the weekly chart level.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C lasted 38 weeks.

The A-C trend line now has too weak a slope. At this stage, this is now a problem for this wave count, the upper A-C trend line no longer has such a typical look.

Within primary wave D, no part of the zigzag may move beyond its start above 1,357.09.

DAILY CHART

This second wave count expects the new wave down may be deeper and longer lasting than the first wave count allows for.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a single zigzag.

Within the single zigzag of primary wave D, intermediate wave (A) is labelled as a complete impulse.

Intermediate wave (A) lasted 20 days, just one short of a Fibonacci 21. Intermediate wave (B) may be about the same duration, so that this wave count has good proportions, or it may be longer because B waves tend to be more complicated and time consuming.

Intermediate wave (B) may be a sharp upwards zigzag, or it may be a choppy overlapping consolidation as a flat, triangle or combination. At this stage, it looks most likely to be incomplete because an intermediate degree wave should last weeks. At its conclusion intermediate wave (B) should have an obvious three wave look to it here on the daily chart.

HOURLY CHART

This hourly chart is the same as the alternate hourly chart for the first wave count. This is because 1-2-3 of an unfolding impulse (alternate hourly chart for the first wave count) will subdivide 5-3-5, which is exactly the same as A-B-C of a zigzag.

Subdivisions are the same, the target is now the same, and the invalidation point remains the same.

TECHNICAL ANALYSIS

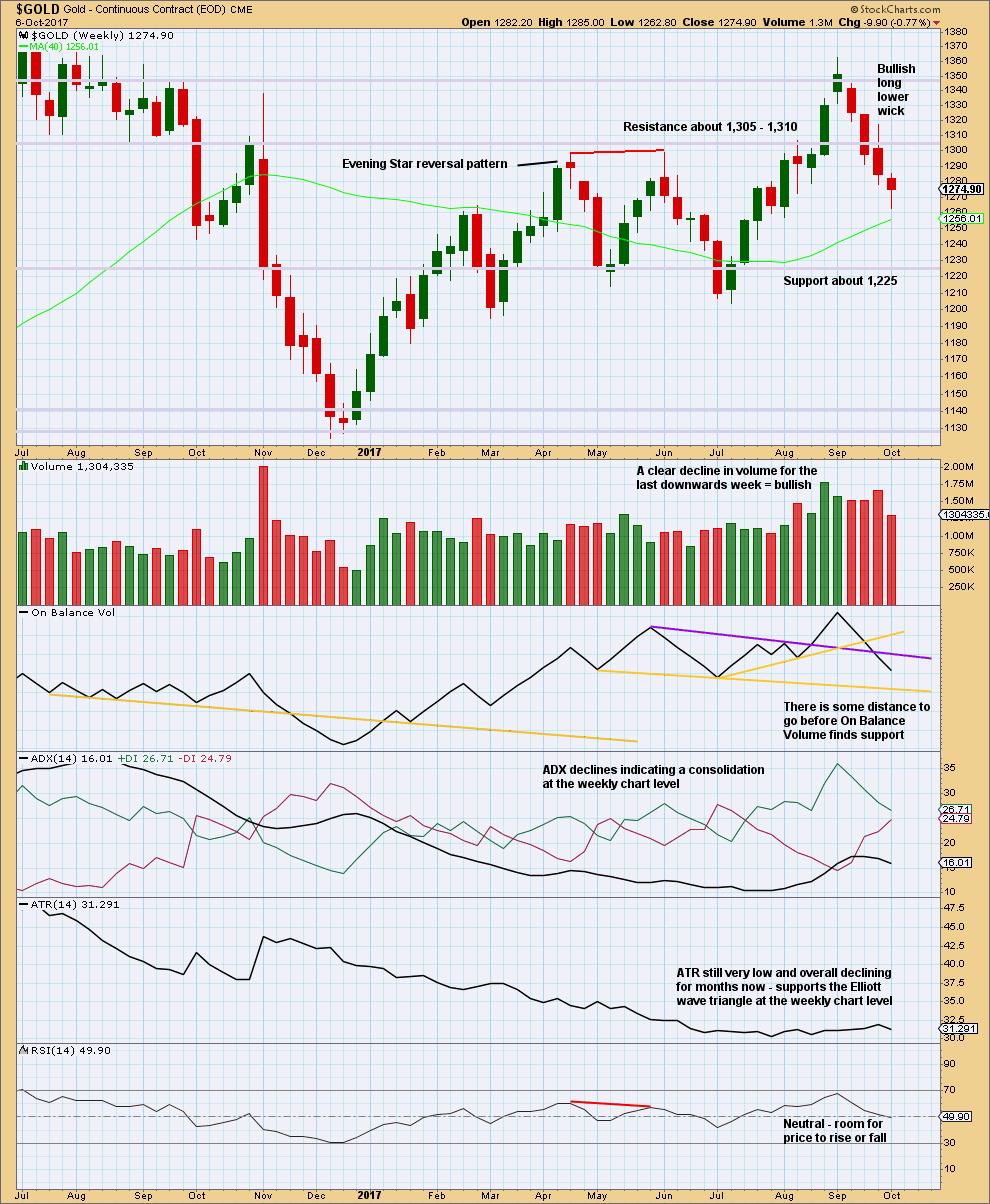

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The candlestick for last week is not a Hammer reversal pattern. The lower shadow must be at minimum twice the length of the real body and this one falls short. The long lower wick is still bullish though.

The lower wick with a decline in volume for downwards movement last week does look like at least an interim low is in place.

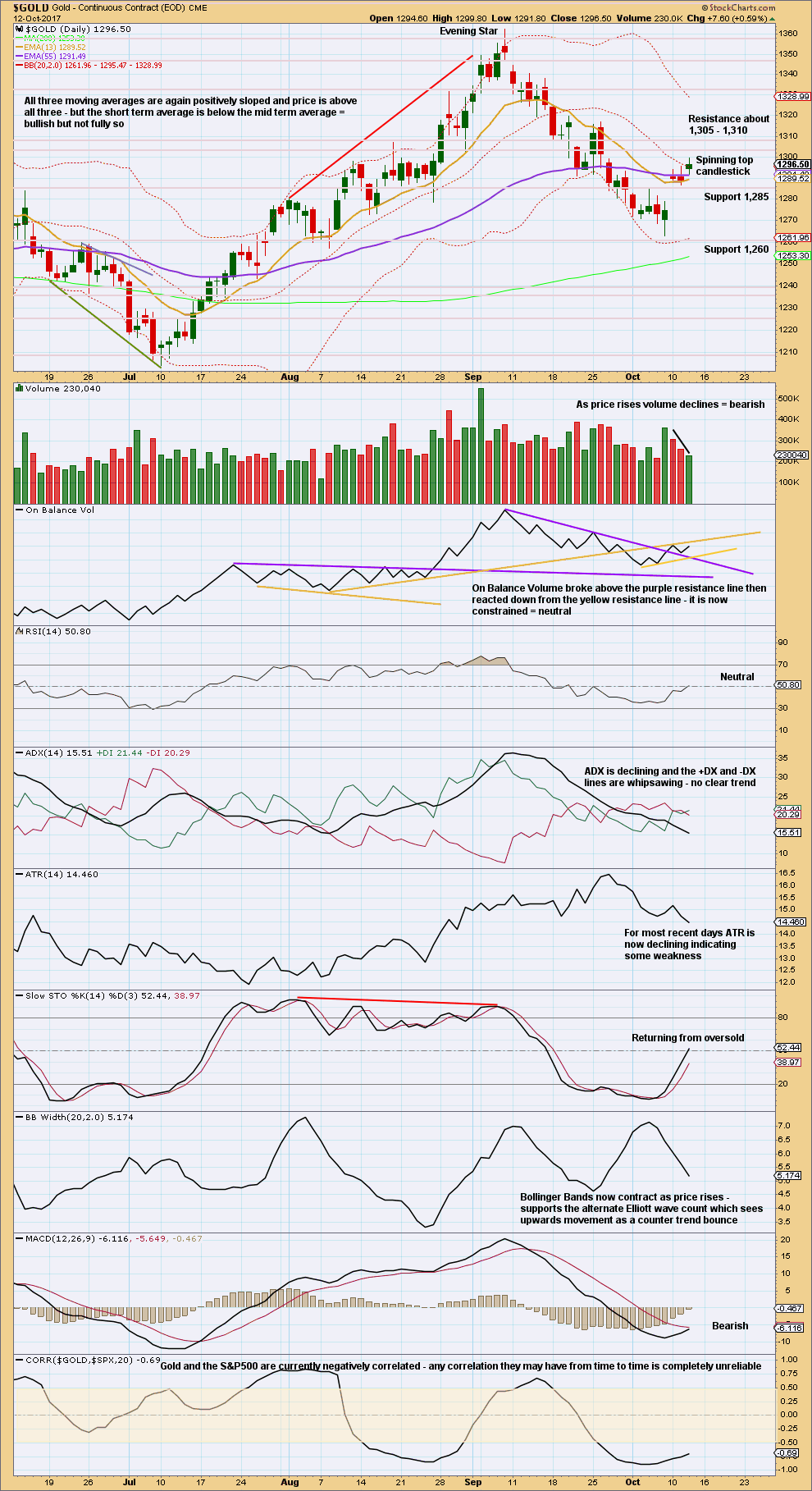

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

StockCharts use data from CME exchange. CME was closed on Monday the 9th of October for Columbus day, and this is the reason for the “missing” candlestick and gap on that data. This data for the last sessions is now accurate and can be relied upon. It is different from BarChart data as they use different sources for this global market.

It is now clear that this upwards movement comes with declining volume, which does not support the rise in price. This supports the second wave count and also supports the idea that we should expect a pullback here or very soon indeed. Some patience in waiting for the pullback to enter long for the next wave up may be well rewarded.

The Spinning Top candlestick represents indecision, a balance of bulls and bears today. The bulls were slightly winning as it made a new high and a higher low, but the small real body in conjunction with a decline in volume is today bearish for the short term.

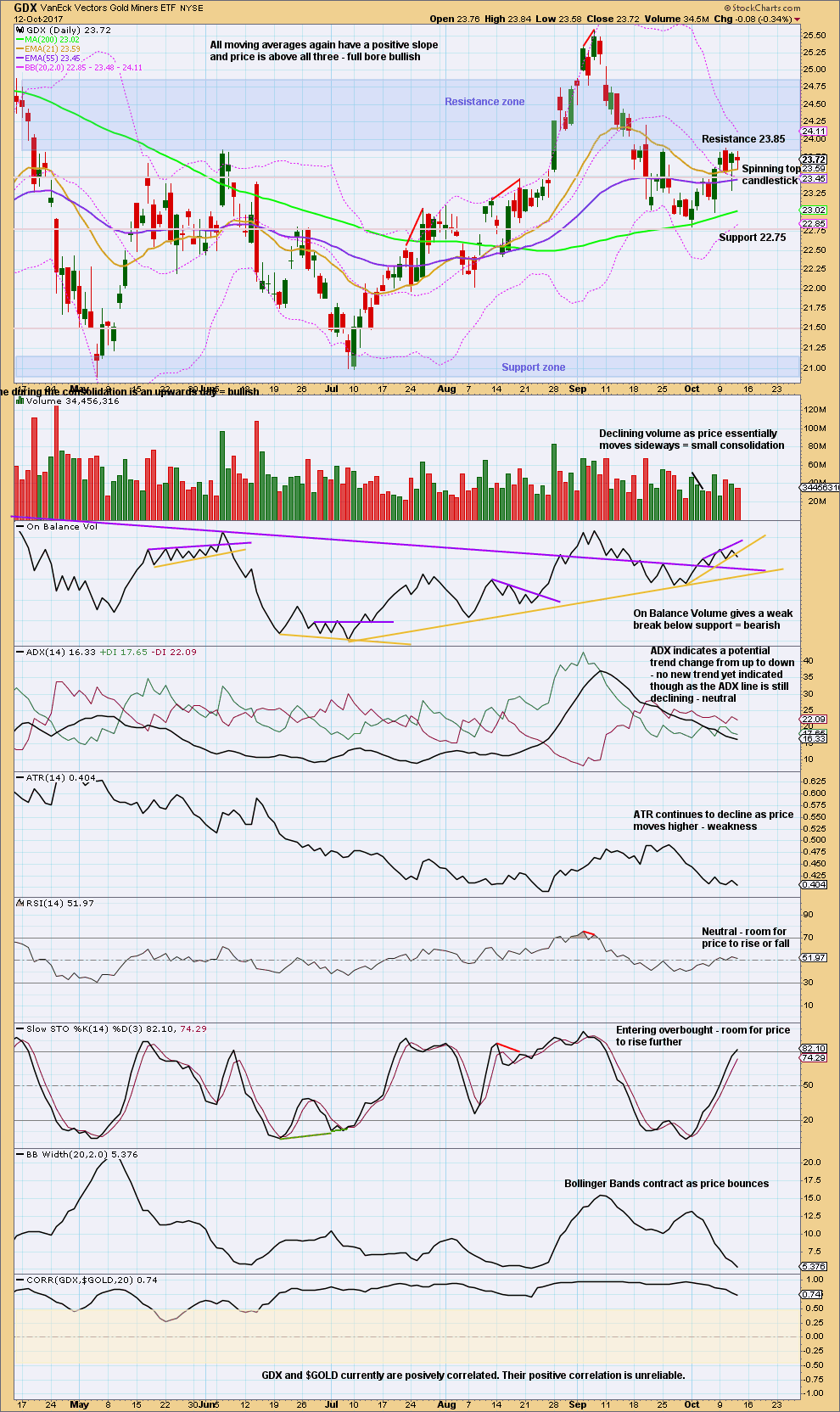

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards day was expected for GDX today and this is what happened, but not by much. The small Spinning top candlestick is not conclusive bearish confirmation of the last Hanging Man candlestick; these two side by side present some indecision.

On Balance Volume, however, may be giving a weak bearish signal today. This supports the idea of a pullback here for GDX. The signal is only weak because the short upwards sloping yellow line is not long held, has only been tested three times, and has a strong slope.

All together these signals suggest some downwards movement for GDX tomorrow. Look out for a pullback. If it happens, it may offer a good entry point to join an upwards trend. Look for support about 22.75.

Always use stops and invest only 1-5% of equity on any one trade.

All trades should always be with the trend. Do not trade against the trend. For the short term, it looks like the trend for GDX is up for the last nine days.

Published @ 06:35 p.m. EST.

It’s looking like Alan and Dreamer are right. The strong upwards hourly candlestick may be the middle of the third wave.

When minute i is over then there will be a pullback, but this wave count doesn’t expect that to begin for another one or two sessions possibly.

I like your new idea that Minute 1 is not over. That likely means GDX is carving out a leading expanding diagonal which has more up to go before a deep retrace. One to two more days sounds perfect 🙂

Gold price now needs to begin holding above 1296 (bounce off 50dma) to target 1305-1313 and face possible rejection there with the upper band beginning to fall… Tomorrow is another day to figure out what fortunes are ahead for next week.

nice to see it over 1300. Concerned it wasn’t a more decisive move and the USD retraced a lot. I wonder what is making it so hesitant, but it might just be that it had a nice move in the past 7 days, all the way from 1260ish. Was hoping for 1320 but perhaps next week. Not sure what the catalyst would be

Anyone else finding trading really hard these days? I guess it’s down to the fact that the trends and therefore the waves , are not really clear.

Yep. I’m pretty confident gold is going higher, but the path it is taking to get there is sure making it challenging. 🤔😵🙃😣😀

Better returns in Equity market than Gold for now. Trying to catch sector which is yet to catch up. Airlines gave nice return in last 2 weeks and never to fall “NVDA”

Well, looking at Gold on the weekly chart back to December 2015 the only thing that is clear is its in a huge consolidation.

It’s been essentially going sideways since then, with wild swings in one direction then the other.

And the Elliott wave explanation for that is it’s a B wave. And they really are the worst. Because there’s so much variety within them.

This will end and Gold will enter a better more sustained trend in the form of an impulse (hopefully and more likely) for cycle wave C downwards.

Hi Dreamer,

Love to see your updated GDX chart when possible.

Thanks,

Jennifer

Sure. Will post over the weekend.

The bullish idea for gold appears back on track if it can stay in the channel. What a crazy morning!

Let’s see what happens…

https://www.tradingview.com/x/IIDCegMW/

IKR! Crazy indeed.

Trend channels tend to work almost all of the time for Gold, but occasionally they fail 🙁

And as we know now that right there is the biggest problem with all of technical analysis. There is nothing that will work all of the time with 100% reliability.

I wish there was. It would make my job so much easier, and we’d all be multi millionaires.

Bitcoin

My simple EW count : a topping corrective running flat wave is in process “after completing five wave up” (Lara’s Sept 5 report).

Wave A down to 2972 from Primary wave 3.

Wave B up to 5846

Wave B traveled 96% of wave A.

Wave C down to below 2972 preferably to Lara’s target of 2256 ?????? to complete PM

wave 4.

All data from Bitstamp chart.

https://bitcoinwisdom.com/markets/bitstamp/btcusd

So I need to update my breakout post below. Got a little too excited I guess.

The channel break puts us in corrective mode short term. Either Lara’s deeper correction to 1,273ish is in play or maybe a more shallow correction could be in play for Minuette 2 instead of Minute 2 as I show on this updated chart. Need to see how this plays out today and maybe into next week.

https://www.tradingview.com/x/1KcwZNg5/

Theoretically Gold price should not really break below 1292-90 to remain in channel up & target a break above 1298 to test tough resistance 1305-1310 as also shown on Lara’s charts. I guess we will know soon whats happens next!

Amazing! Soon after posting this, the $USD spiked down and gold spiked back up into the channel.

Not a good day for my posting. Wow!

Gold Ichimoku Daily Analysis

Data as at 5:30 am ET, October 13

=============================

Gold prices had broken above the important 38.2% Fibonacci resistance at 1297, and this is a bullish continuation sign. But, in the short-term, gold prices will need to pull back a bit before moving higher. The 4-hour Ichimoku Chart shows that the support for this relief drop is at 1288.84 (kijun-sen) followed by 1283.28 kumo support. Kumo support levels are dropping as the cloud slopes downwards.

We are now at a critical juncture. The bears must bring prices down to the 1270s, or lower, or their case becomes more precarious by the minute. The bulls must defend the 1280s. A pullback to a point higher than the last low of 1284.48 would provide more muscle to the upside momentum. Perhaps after today the picture can become clearer.

Successful Breakout!

As shown previously, the resistance at 1,295 – 1,296 area of the April and June tops was strong. Price was rejected twice at this resistance, then on the 3rd try after consolidating, just now, it broke through. This is very bullish.

If you are not long, now looks like a good time to buy. The move up may accelerate. Good luck!

https://www.tradingview.com/x/ZiPQLwPu/

The bull in me would like to say a big thank you to you for your support for his case.

Oops, Channel break does not make this breakout look good yet…..