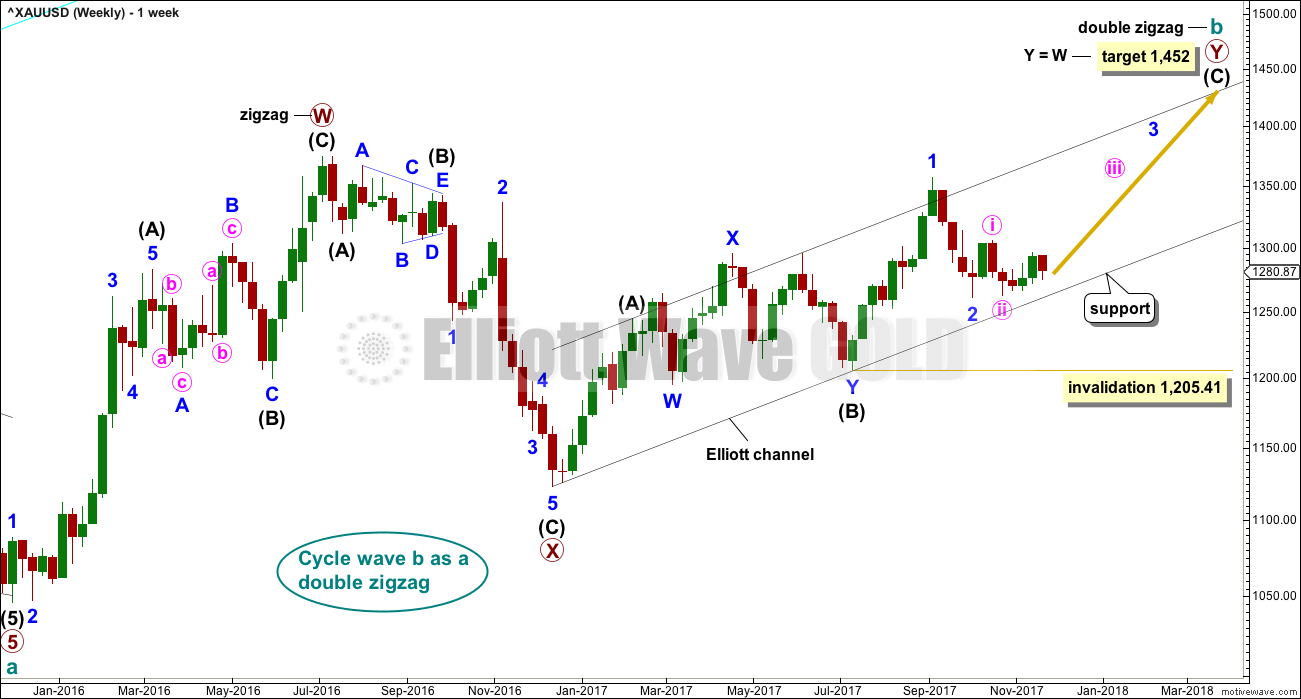

A little upwards movement fits the second Elliott wave count again quite nicely. This preferred wave count expects some more sideways movement, and then a breakout from the range Gold has been contained in now for some weeks.

Summary: Members please note: the second wave count is now strongly preferred. It expects sideways movement to continue probably for all of this week, and then a downwards breakout. If this wave count is correct, then the next upwards swing may present a good entry opportunity for a short position.

For the very short term, volume for both Gold and GDX are bearish; a small downwards swing may unfold (may be preceded by some more sideways movement).

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

To avoid repeatedly swapping wave counts over while cycle wave b continues, they will be labelled in the order they were developed: first, second and third. At this time, the second wave count is preferred because its Elliott wave structure has a better fit and has more support from classic technical analysis.

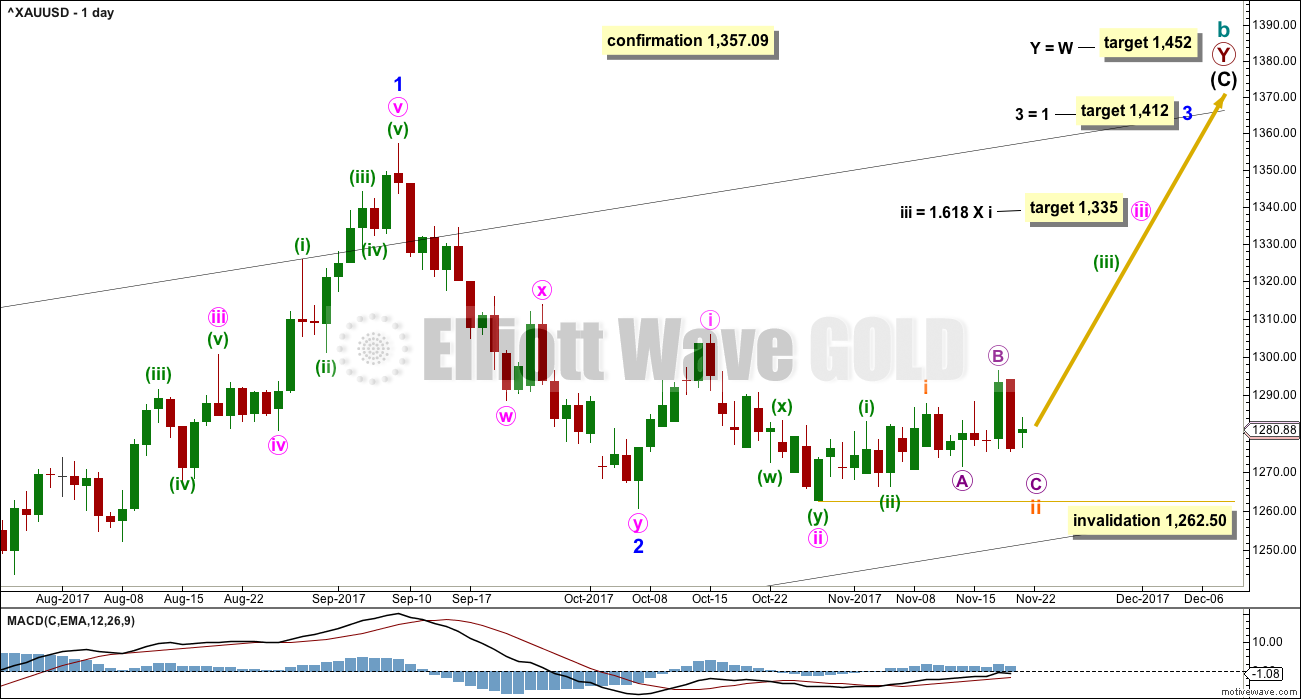

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

Both wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

Both wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave W. Primary wave W lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This first wave count expects that cycle wave b may be an incomplete double zigzag.

While this first wave count is entirely possible, there are three problems now which reduce its probability.

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration of minor wave 2 within it now looks to be too large at the weekly time frame.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

Minor wave 1 was a long extension. The target for minor wave 3 expects that too may be a long extension. If this is the case, then minor wave 5 may be shorter (only two actionary waves in an impulse may be extended).

The target for minute wave iii fits with higher targets and expects it to exhibit the most common Fibonacci ratio to minute wave i.

If price makes a new high above 1,357.09, then the second wave count below would be discarded and more confidence may be had in this first wave count.

This first wave count expects now that recent movement should be the start of a third wave. Friday’s strong upwards movement looked like a convincing beginning to the middle of a third wave, but now Monday’s full retracement of that movement looks wrong for this wave count. Price is not behaving as this wave count expects, so it has a very low probability. It will be published mostly to continue to consider all possibilities.

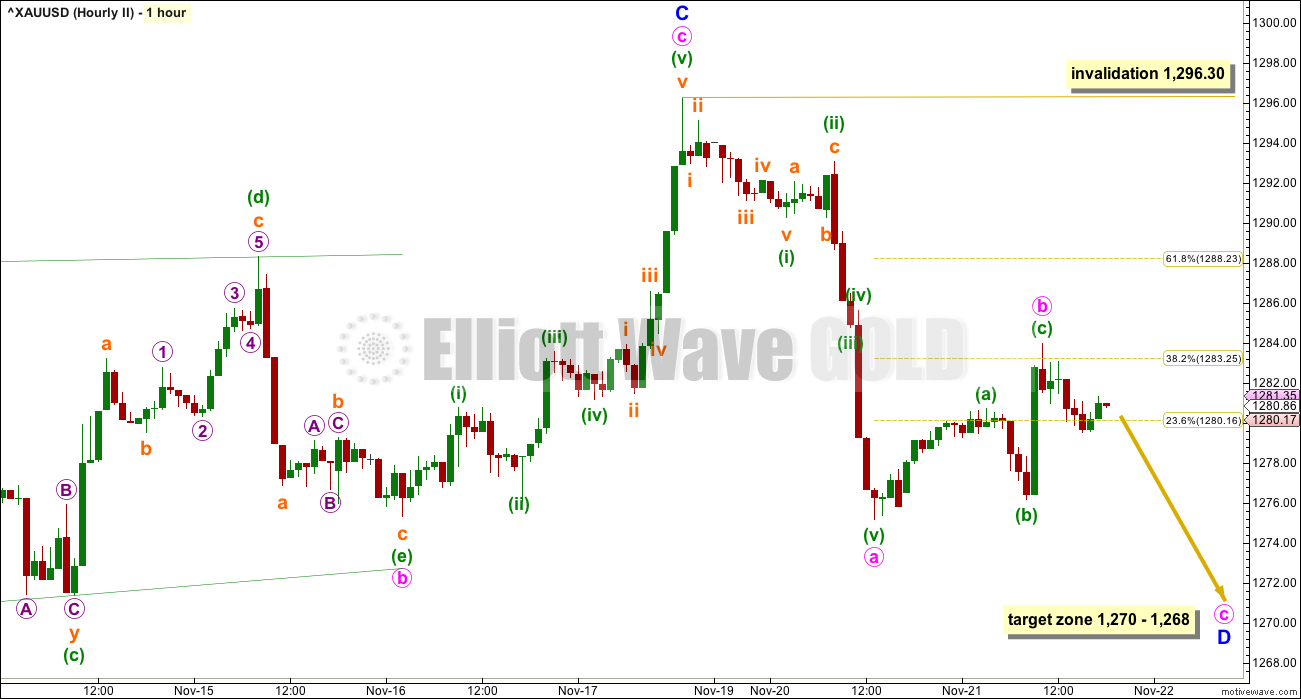

HOURLY CHART

The last wave up is now complete, and it was a three. For this first wave count, it may have been a B wave within an expanded flat correction. Micro wave B here is a 1.52 length to micro wave A. This is longer than the most common length of B waves within flats of up to 1.38, but within the allowable convention of up to 2.

Micro wave C would need to move beyond the end of micro wave A below 1,271.40 for subminuette wave ii to complete as an expanded flat. Failure to do so would see micro wave C truncated, and subminuette wave ii a very rare running flat. At this time, with a lack of upwards momentum, a running flat should not be allowed as part of the wave count. This is not the type of market in which a running flat may occur.

Subminuette wave ii may not move beyond the start of subminuette wave i below 1,266.25.

At this stage, the size of sub-micro wave (4) is now looking too large to still be a part of micro wave C downwards. But for this wave count to work the structure needs to be labelled sub-micro wave (4) because micro wave C has still not moved beyond the end of micro wave A.

The probability of this wave count is further reduced today.

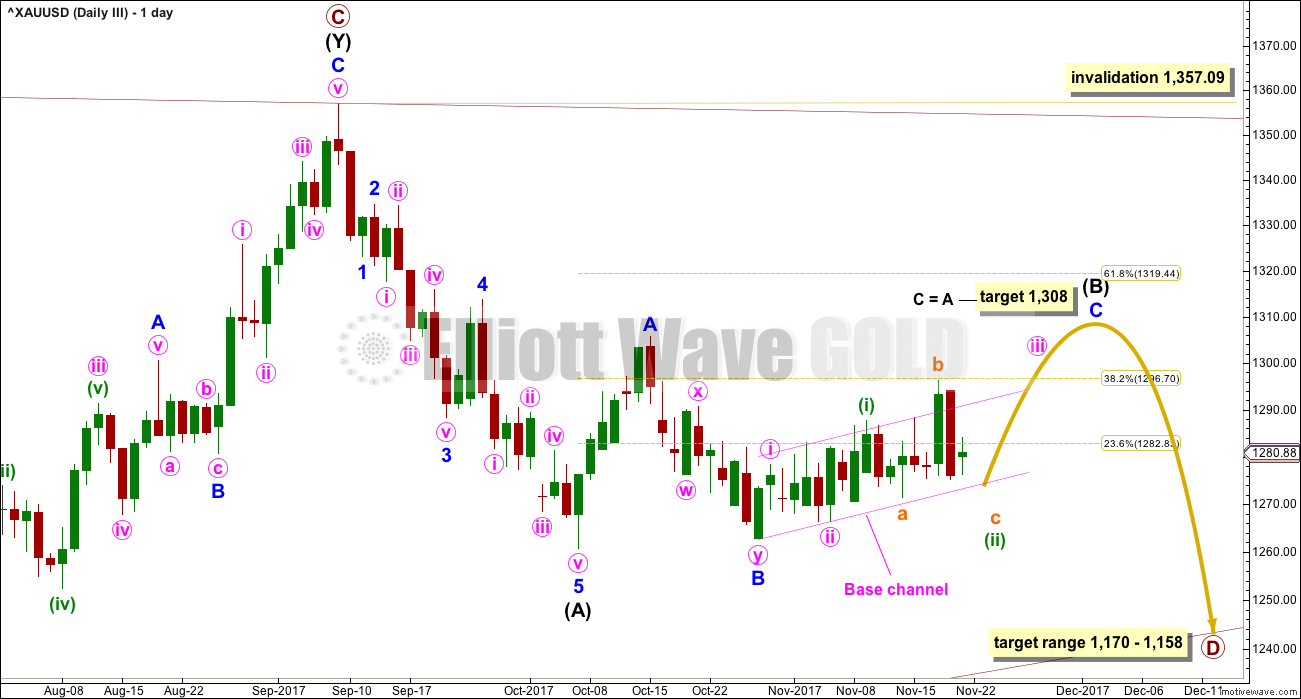

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

Both wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag. This is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level. Within primary wave D, intermediate wave (B) is incomplete. At this stage, it looks like intermediate wave (B) may be unfolding as a triangle. This now has a better fit at the daily and hourly chart level. At its conclusion, intermediate wave (B) should look like a corrective structure at the weekly chart level.

DAILY CHART

This is the preferred wave count.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

Primary wave D should subdivide as a zigzag, and within it intermediate wave (B) looks incomplete.

So far intermediate wave (B) has lasted thirty-two sessions; it is incomplete and needs several more sessions now to complete. The next Fibonacci ratio in the sequence is thirty four. If intermediate wave (B) completes as a triangle, then it may not end within a total Fibonacci thirty-four sessions and may need longer than that for the structure to complete. It may either not exhibit a Fibonacci duration, or it may last a total Fibonacci fifty-five sessions.

At this stage, intermediate wave (B) will be labelled as a triangle.

Within the triangle of intermediate wave (B), the zigzag of minor wave C may now be complete.

For a contracting triangle, minor wave D may not move beyond the end of minor wave B below 1,262.50. For a barrier triangle, minor wave D may end about the same level as minor wave B at 1,262.50. The triangle for intermediate wave (B) will remain valid as long as the lower B-D trend line remains essentially flat. Unfortunately, this is the only Elliott wave rule which is not black and white; it involves a subjective grey area.

When minor wave D is complete, then a final zigzag upwards for minor wave E should unfold. Minor wave E would most likely fall short of the A-C trend line. If it does not end there, it may overshoot the trend line slightly. Minor wave E may not move beyond the end of minor wave C.

Although minor wave C now looks most likely complete, patience and flexibility are important when triangles are considered. The upper invalidation point will be left at the same point to allow for the possibility that minor wave C may not be complete and may yet move higher. It may not move beyond the end of minor wave A above 1,305.72.

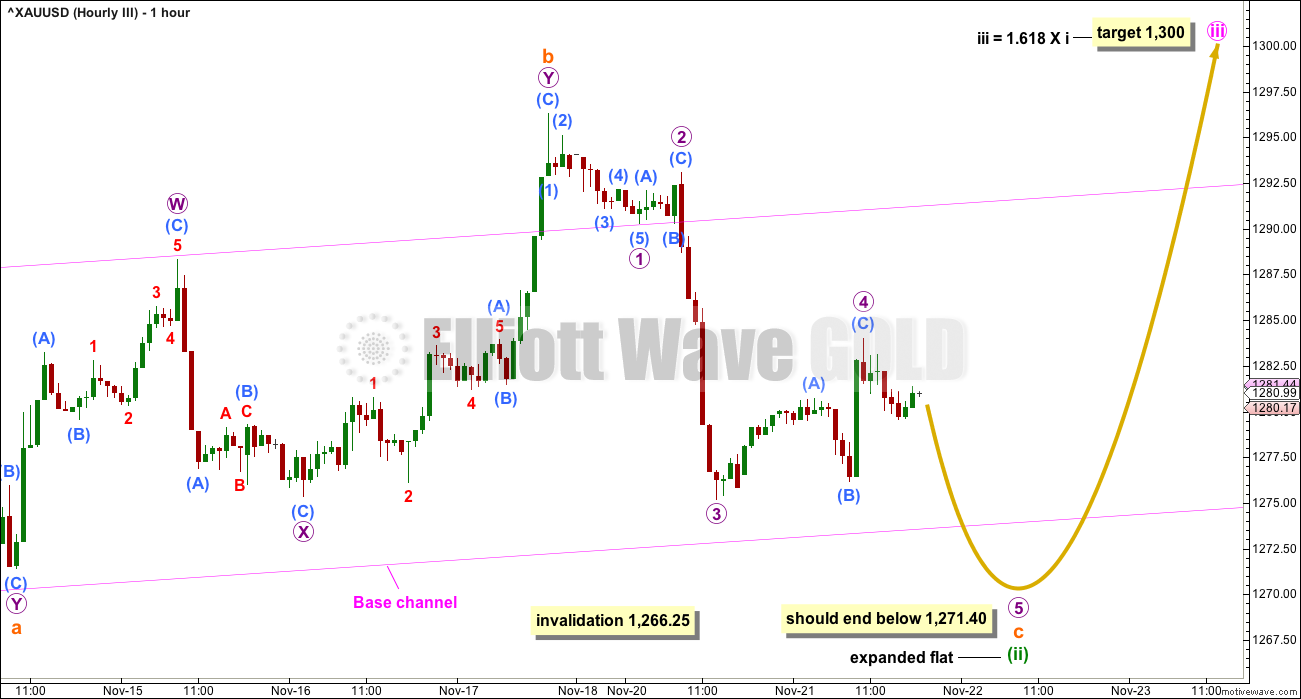

HOURLY CHART

Within the possible triangle for intermediate wave (B), so far it is minor wave B that subdivides best as a double zigzag. This means that all remaining sub-waves of the triangle for intermediate wave (B) must be simple A-B-C structures, most likely zigzags, if that portion of the analysis is correct.

Minor wave C now looks complete. Minor wave D downwards should have begun and must subdivide as a simple A-B-C structure; the most common structure would be a zigzag by a reasonable margin.

The size of the last small upwards bounce looks too big to be part of the prior wave down. Minute wave a looks like it was over at yesterday’s low.

Minute wave b may be over here as a single zigzag ending close to the 0.382 Fibonacci ratio of minute wave a at 1,283. But equally as likely, minute wave b may continue higher as a double zigzag to end closer to the 0.618 Fibonacci ratio at 1,288, or sideways as a flat, combination or triangle to take up more time.

Minute wave b may not move beyond the start of minute wave a above 1,296.30.

When minute wave b is over, then minute wave c should unfold as a five wave structure downwards. That would complete the zigzag down for minor wave D. This may take another one to few days.

THIRD ELLIOTT WAVE COUNT

DAILY CHART

This third wave count looks at intermediate wave (B) as a flat correction. Within a zigzag, minor wave C would need further upwards movement for the structure to complete. The target at 1,308 remains the same.

Minor wave C must subdivide as a five wave structure. So far within it, minute waves i and ii, and minuette waves (i) and (ii), may be complete.

The strong downwards movement for Monday does not look right for this wave count. By now minor wave C upwards should have shown clearer upwards movement as the middle of its third wave unfolds.

Now the weak upwards movement of Tuesday further reduces the probability of this wave count. Like the first wave count, it now has a very low probability.

HOURLY CHART

If intermediate wave (B) is unfolding as a flat correction, then minor wave C upwards must subdivide as a five wave structure. It may be either an impulse or an ending diagonal.

The middle of the third wave cannot have yet passed.

I have considered the possibility that an ending diagonal may be unfolding for minor wave C, but at this stage I have not been able to find a solution which meets all Elliott wave rules.

This wave count looks at the possibility that an expanded flat correction is unfolding for another second wave, in the same way that the first wave count does. For the short term, both this third and the first wave counts expect the same movement next.

TECHNICAL ANALYSIS

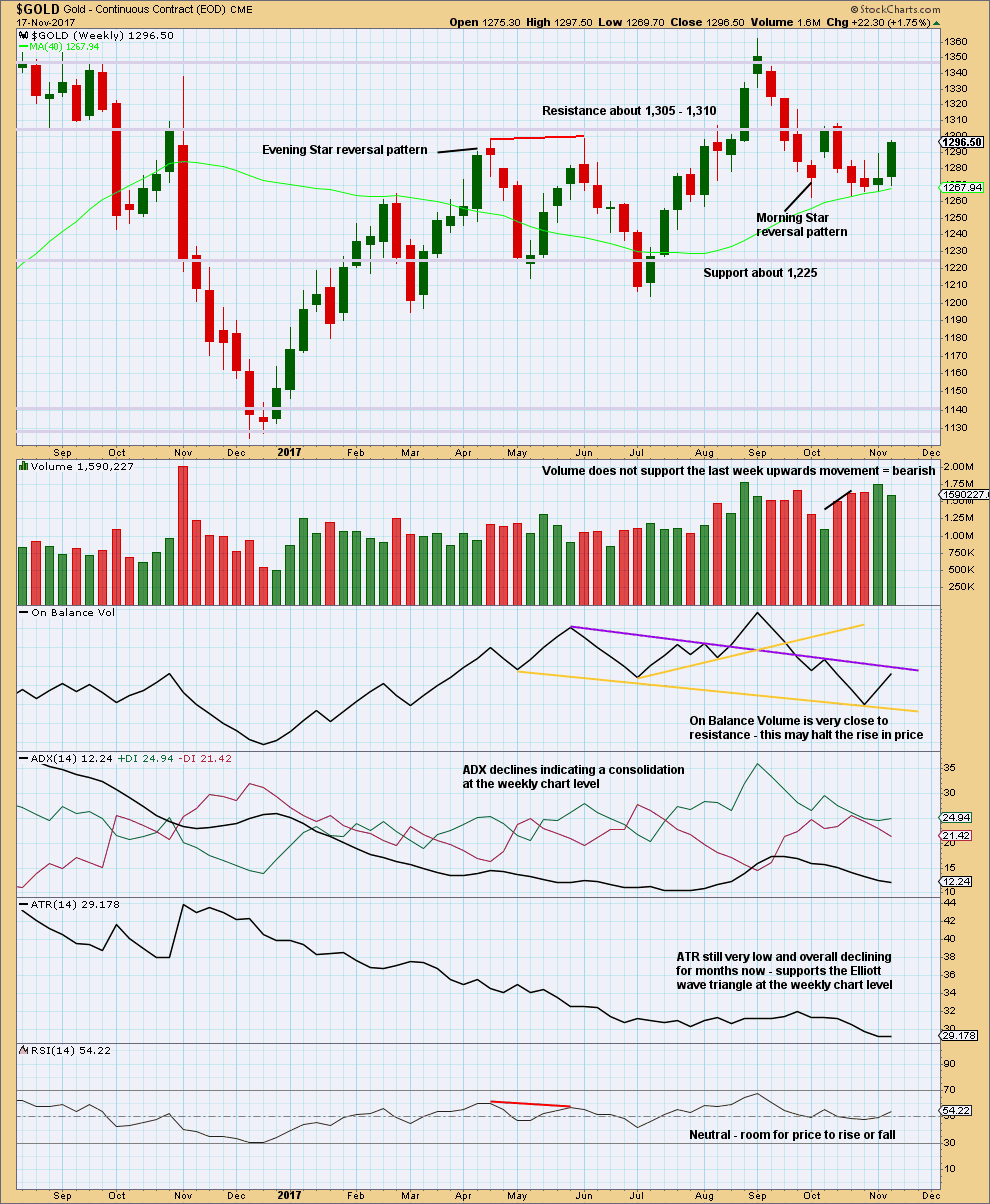

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

All commentary this week is on the chart.

On Balance Volume at the weekly chart level favours the second wave count.

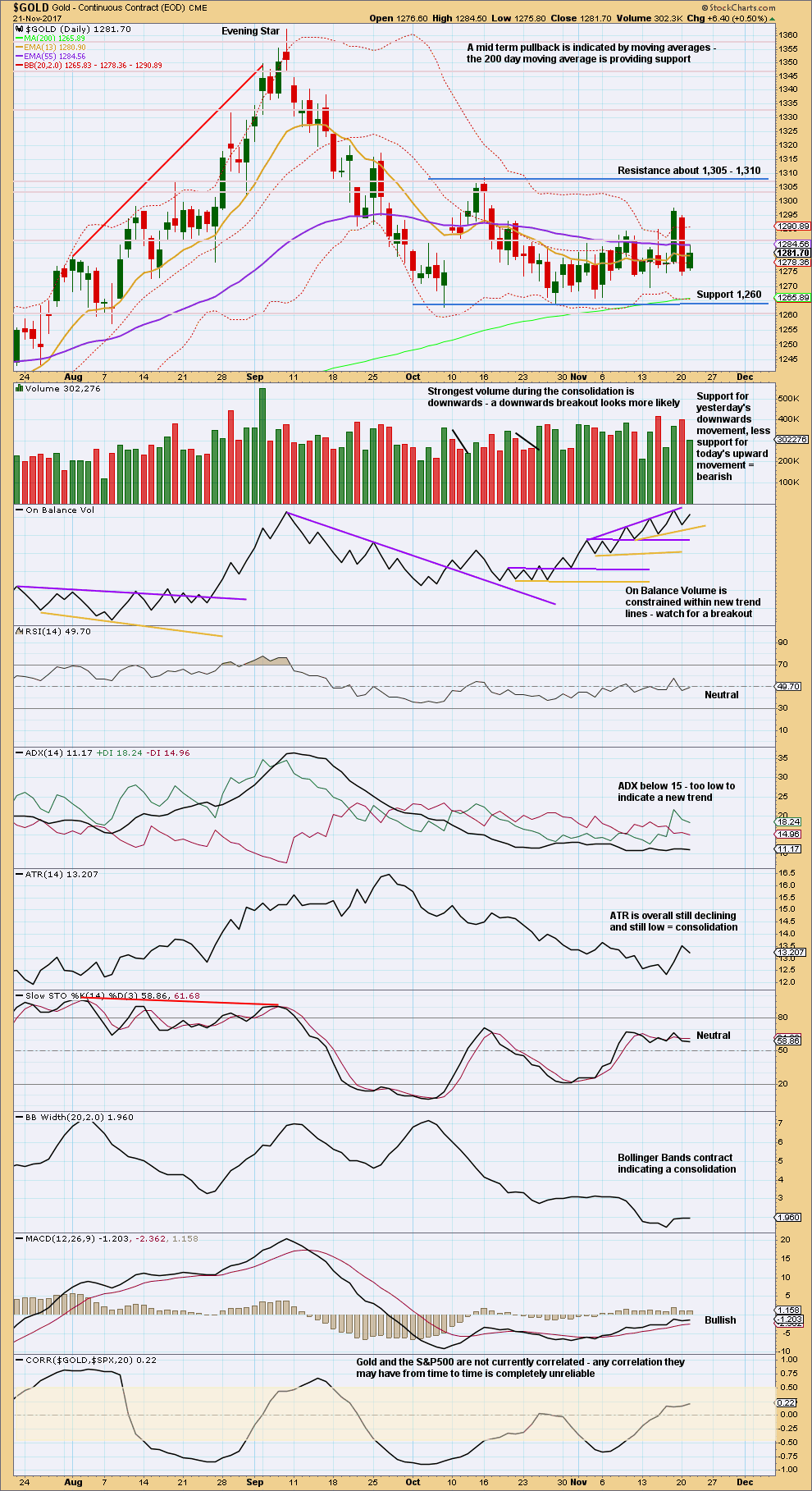

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume continues to agree more neatly with the second wave count. For the short term, look out for a little more downwards movement.

Now that On Balance Volume has a new range with each trend line tested at least three times, a breakout will be a reasonable signal.

ADX, ATR and contracted Bollinger Bands all agree that this market is consolidating. A breakout will come, and volume suggests it may more likely be down than up. This agrees with the second Elliott wave count.

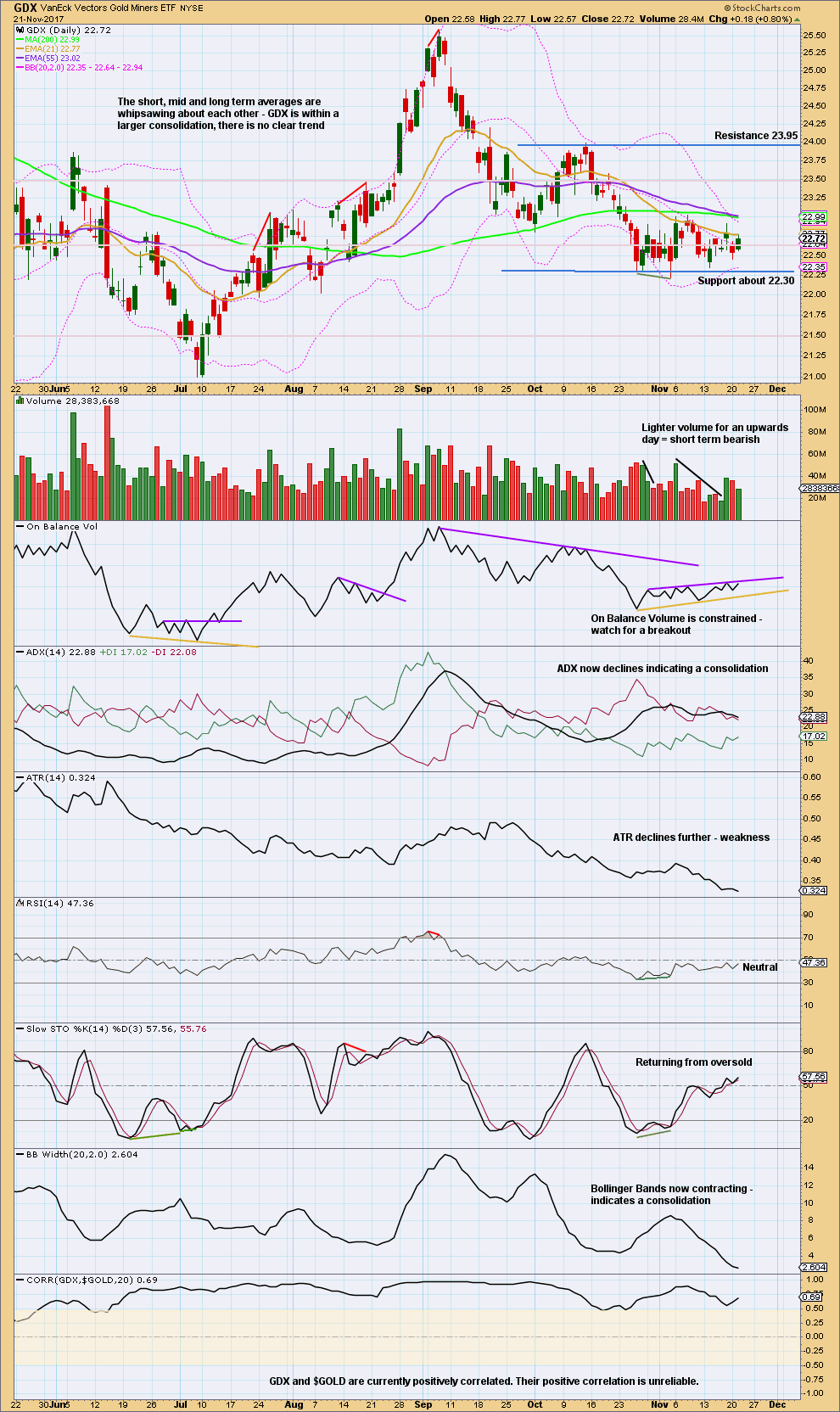

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards swing may be expected to continue to resistance about 23.95.

Price does not move in straight lines within consolidations, making them poor trading opportunities. If trading this upwards swing, then reduce risk to only 1-3% of equity to acknowledge higher risk.

Published @ 08:10 p.m. EST.

Second hourly chart updated:

wild wild swings, one direction then the other…. so far in a decreasing range, which is exactly what a triangle calls for

if the second wave count is right then as long as price remains below 1,296.30 it may present an entry opportunity to go short, waiting for the downwards breakout

as always, I am wrong sometimes (its impossible to be always right, for anyone) which is why risk management is so important:

always always trade with stops, and keep trade size to no more than 1-5% of equity

at this stage of the possible triangle, with the other wave counts not having as good a look (so far) members can either enter short on a bounce, or open a hedge.

if hedging then ideally stops should be just below support and above resistance, and the total of both sides of the hedge should not be larger than 5% of equity

Perfectly fine Lara. No mortal can be correct all the time. Important thing is to acknowledge a miscount if and when it happens and keep going.

Thanks David. I’m aiming to be right more often than wrong, and to give good risk management advice so members minimise losses when I am wrong.

And I’ll change the wave count whenever price and technicals indicate I should. Flexibility in ever changing markets is key.

KS Park,

For my bullish ABX count, one more quick low may be it before a strong move up begins.

https://www.tradingview.com/x/e5cw6QPm/

Wow!!!!!

I didn’t expect you to go through charting out the whole thing. I was only looking for a confirmation of what I was thinking… that GDX may have one more leg down here pulled by ABX.

YOU ARE AWESOME

THANK YOU

One thing to watch, I think ABX can make a new low while GDX does not. 😀

Lara,

For the First hourly count, have you considered a leading expanding diagonal for the low from Oct 27 to the recent high? The wave lengths work with TV data and I think it has a better look.

Thanks,

https://www.tradingview.com/x/Uex6kj93/

Hi Dreamer. I’ve been looking at this very possibility as well. Would explain a lot of things, but remains to be proven by an upwards breakout. But i think should be considered

it does not work for BarChart data

wave 4 is not longer than 2; for an expanding diagonal it needs to be

so it breaches an EW rule 🙁

that’s a pity, because yeah, it looks like a good explanation of this chop

Lara,

Wow, impressive. It is great to remember all these rules. A gigantic task, indeed.

Where would I find these rules, please? The section on “Summary of Rules and Guidelines for Waves” in the Frost and Prechter book good?

Thanks.

Exactly. If you have the 10th edition of Frost and Prechter, there is a list on pages 86 to 91.

When you do a wave count, for each structure you are labelling, use the list of rules like a checklist. Then if the structure you’ve labelled meets all rules, go through the guidelines.

A wave count which meets more guidelines than one that does not should theoretically have a higher probability.

A methodical logical approach to EW, IMO 🙂

Thank you very, very much, Lara. Yep, pages 86 to 91.

Dreamer: with your TV data, is wave 4 longer than 2?

looking at pmbull data, it’s close but i think same issue. 4 appaers slightly shorter than 2. I forget the rules, are any of these sub-3 waves allowed to be an expanded flat?

or maybe there’s a way to count it so that this upwards movement is wave 5 of the diagonal

for a leading diagonal all the sub-waves are most commonly zigzags

but sometimes waves 1, 3 or 5 may be impulses

so no, no expanded flats allowed, only zigzags or impulses

to see wave 3 over at the last high would see it as a double zigzag

I think this is possible, because double zigzags can take the place of single zigzags, they are in the same family

but I do think it reduces the probability of the count

Yes. 4 is just slightly longer than 2.

https://www.tradingview.com/x/NhVVwrK9/

Cheers Dreamer.

That’s interesting. How frustrating that it doesn’t work for BarChart data.

Because it really looks like a very good wave count indeed.

There’s that very nice overshoot of the 1-3 trend line, and both trend lines are tested at least once and held perfectly. It all looks so good….