A turn was expected. Price has remained just below the invalidation point and printed a red weekly candlestick.

Summary: Price must continue lower here for the main Elliott wave count. A new high above 66.65 would substantially reduce the probability of the bearish wave count and increase the probability of a huge new bull market for Oil, which would have final confidence above 74.96.

Classic technical analysis this week still favours a bullish outlook for the bigger picture, but it supports the view here that price may move lower for a week or so.

If price turns lower here, then the target for a new low remains at 13.39. A new low on the way down, below 55.24, would add substantial confidence in a bearish outlook.

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.

New updates to this analysis are in bold.

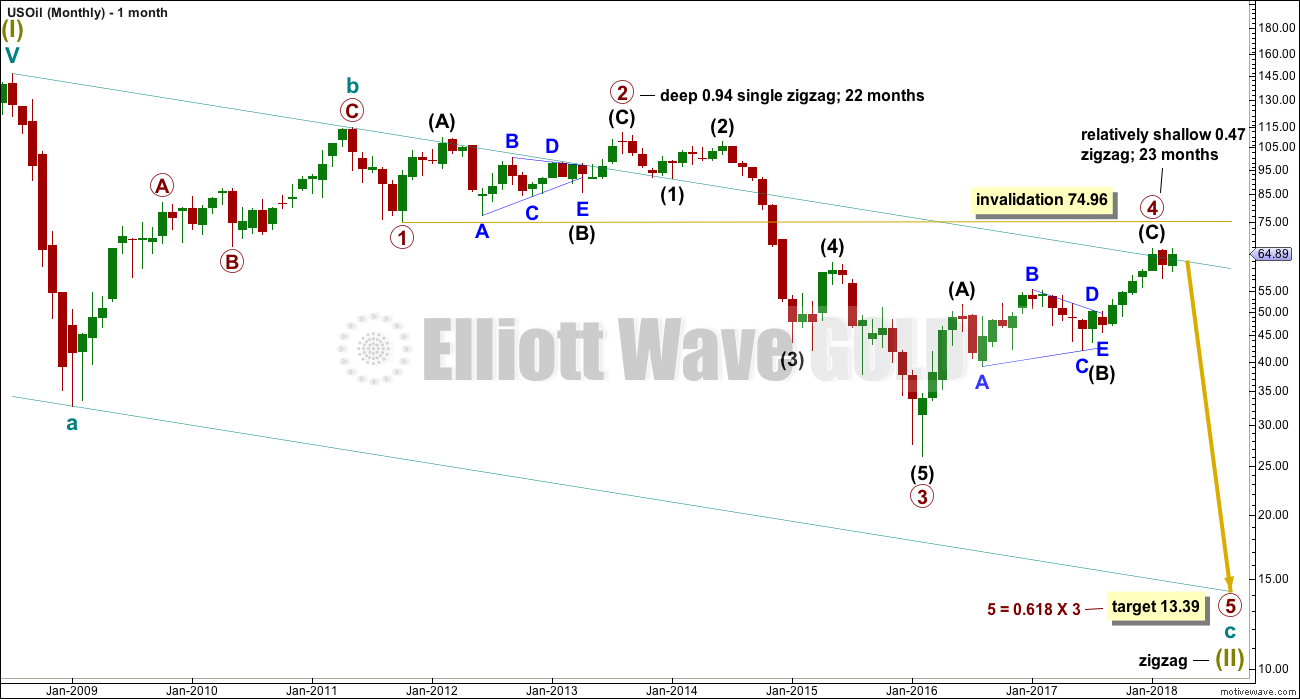

MAIN WAVE COUNT

MONTHLY CHART

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

There is alternation in depth with primary wave 2 very deep and primary wave 4 relatively shallow. There is inadequate alternation in structure, both are zigzags. So far primary wave 4 has lasted 23 months. At this stage, there is almost perfect proportion between primary waves 2 and 4.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

The wider Elliott channel (teal) about this whole movement may offer support to primary wave 5.

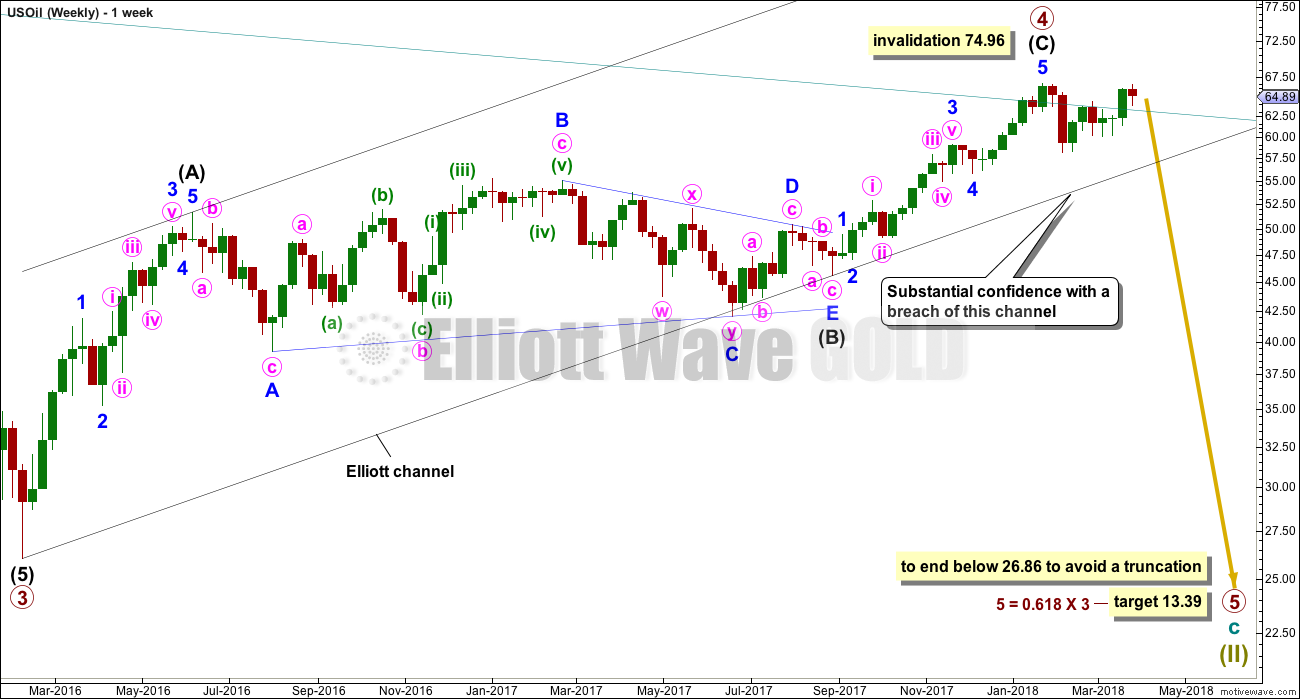

WEEKLY CHART

Primary wave 4 subdivides as a zigzag, and within it intermediate wave (C) may now be complete. If primary wave 5 were to only reach equality in length with primary wave 3, it would end with a small truncation. A target for primary wave 5 may best be calculated at intermediate degree. That can only be done when intermediate waves (1) through to (4) within primary wave 5 are complete.

For now a target will be calculated at primary degree using a ratio between primary waves 3 and 5. This target only has a small probability. This target will be recalculated as primary wave 5 nears its end, so it may change.

An Elliott channel is added to this possible zigzag for primary wave 4. A breach of the lower edge of this channel would provide a very strong indication that primary wave 4 should be over and primary wave 5 should be underway. Look out for some support on the way down, perhaps a short term bounce about the lower edge of the channel.

DAILY CHART

Minor wave 1 will subdivide as a complete impulse at lower time frames.

Minor wave 2 looks like a double zigzag. The first structure in the double zigzag is labelled minute wave w. The double is joined by a three in the opposite direction, an expanded flat labelled minute wave x. The second zigzag in the double has deepened the correction achieving its purpose, and it is labelled a zigzag for minute wave y.

There is now almost no room left for this wave count to move into. Minor wave 2 must end here and minor wave 3 downwards must have begun last week if this wave count is correct.

A target is calculated for minor wave 3 which expects the most common Fibonacci ratio to minor wave 1. If price reaches down to this target and the structure is incomplete or price keeps falling through it, then the next Fibonacci ratio in the sequence of 2.618 would be used to calculate a new target.

Minor wave 2 may not move beyond the start of minor wave 1 above 66.65.

A new low below 55.24 would invalidate the bullish alternate below and provide reasonable confidence in this main wave count.

Price has moved slightly below the yellow best fit channel, but the channel is not properly breached by downwards movement. I classify a breach by a full daily candlestick below and not touching the channel. This wave count will be in doubt while the channel is not breached.

Again, this week’s classic analysis supports the alternate wave count and does not support this main wave count.

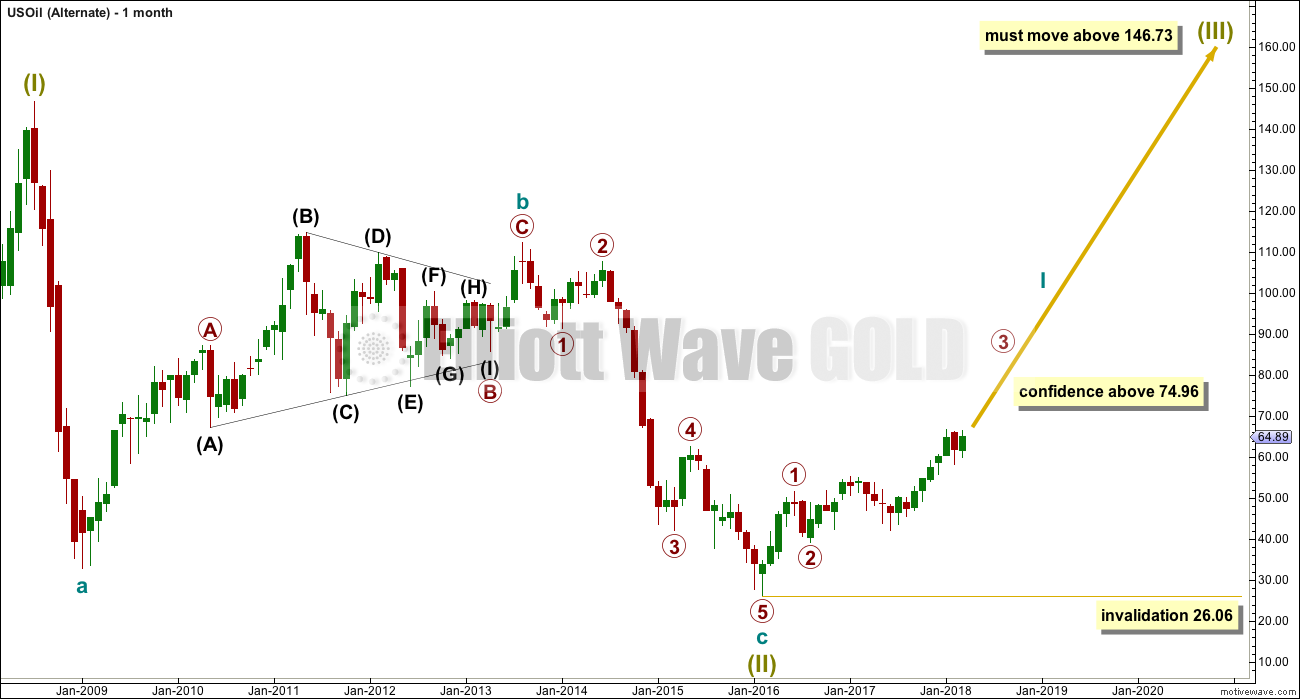

ALTERNATE WAVE COUNT

MONTHLY CHART

It is possible that the bear market for Oil is over and a new bull market is in the very early stages.

A huge zigzag down to the last low may be complete and is labelled here Super Cycle wave (II).

Cycle wave b must be seen as complete in August 2013 for this wave count to work. It cannot be seen as complete at the prior major swing high in May 2011.

Cycle wave b is seen as a zigzag, and within it primary wave B is seen as a running contracting triangle. These are fairly common structures, although nine wave triangles are uncommon. All subdivisions fit.

Primary wave C moves beyond the end of primary wave A, so it avoids a truncation. But it does not have to move above the price territory of primary wave B to avoid a truncation, which is an important distinction.

If cycle wave b begins there, then cycle wave c may be seen as a complete five wave impulse.

Super Cycle wave (III) must move beyond the end of Super Cycle wave (I). It must move far enough above that point to allow room for a subsequent Super Cycle wave (IV) to unfold and remain above Super Cycle wave (I) price territory.

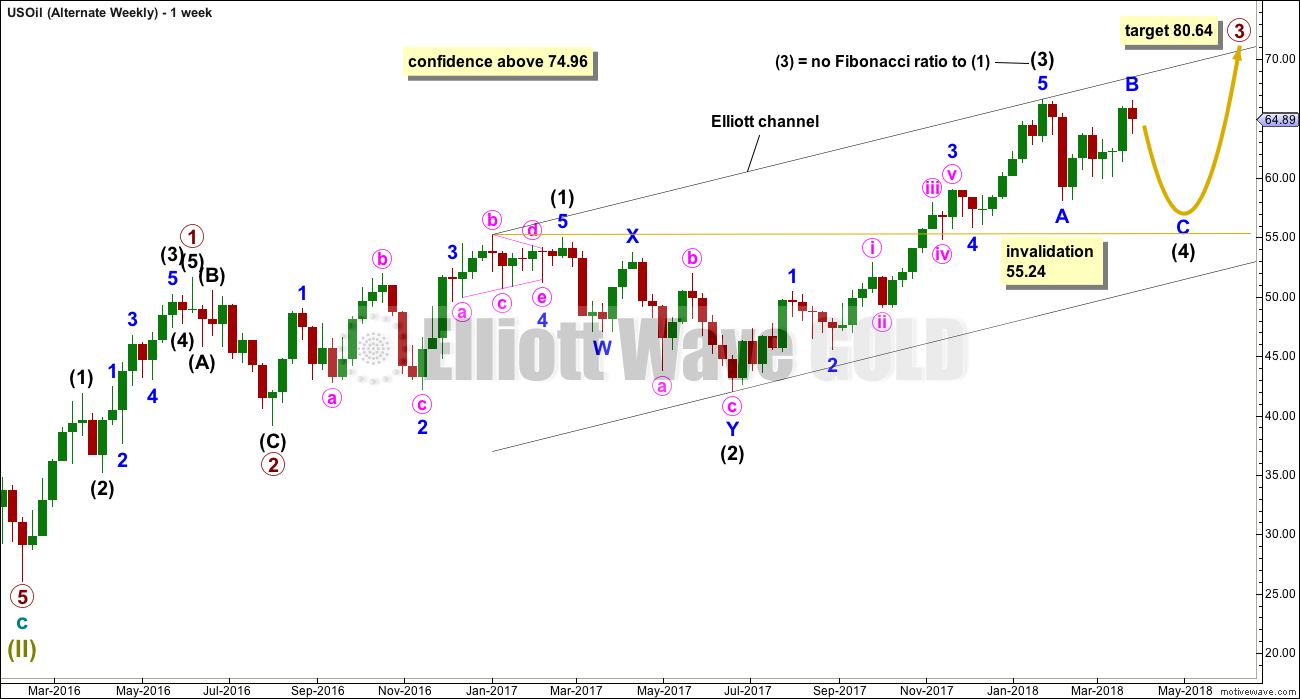

WEEKLY CHART

If a new bull market is in the very early stages for Oil, then it may have begun with two overlapping first and second waves at primary then at intermediate degree.

Primary wave 3 may only subdivide as an impulse, and within it intermediate wave (3) may be complete.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 55.24. Intermediate wave (4) would most likely be incomplete. It may continue further sideways or lower.

Intermediate wave (2) is labelled as a double zigzag. To exhibit alternation intermediate wave (4) may most likely be a flat, combination or triangle. Intermediate wave (2) lasted 17 weeks. For good proportion and the right look, intermediate wave (4) may last a Fibonacci 13 or even 21 weeks in total. So far it has lasted only nine weeks.

DAILY CHART

It would be unlikely that intermediate wave (4) would be over a the last low labelled minor wave A. That would be too brief.

If intermediate wave (4) is continuing, then it may be as a flat correction. If minor wave B is now over at 0.99 the length of minor wave A, then intermediate wave (4) may be a regular flat correction. Regular flats normally fit nicely into trend channels. The most likely Fibonacci ratio for minor wave C would be equality in length with minor wave A.

Minor wave C downwards must be a five wave structure.

It is possible that minor wave B could continue higher. No upper invalidation point may yet be used for this wave count.

TECHNICAL ANALYSIS

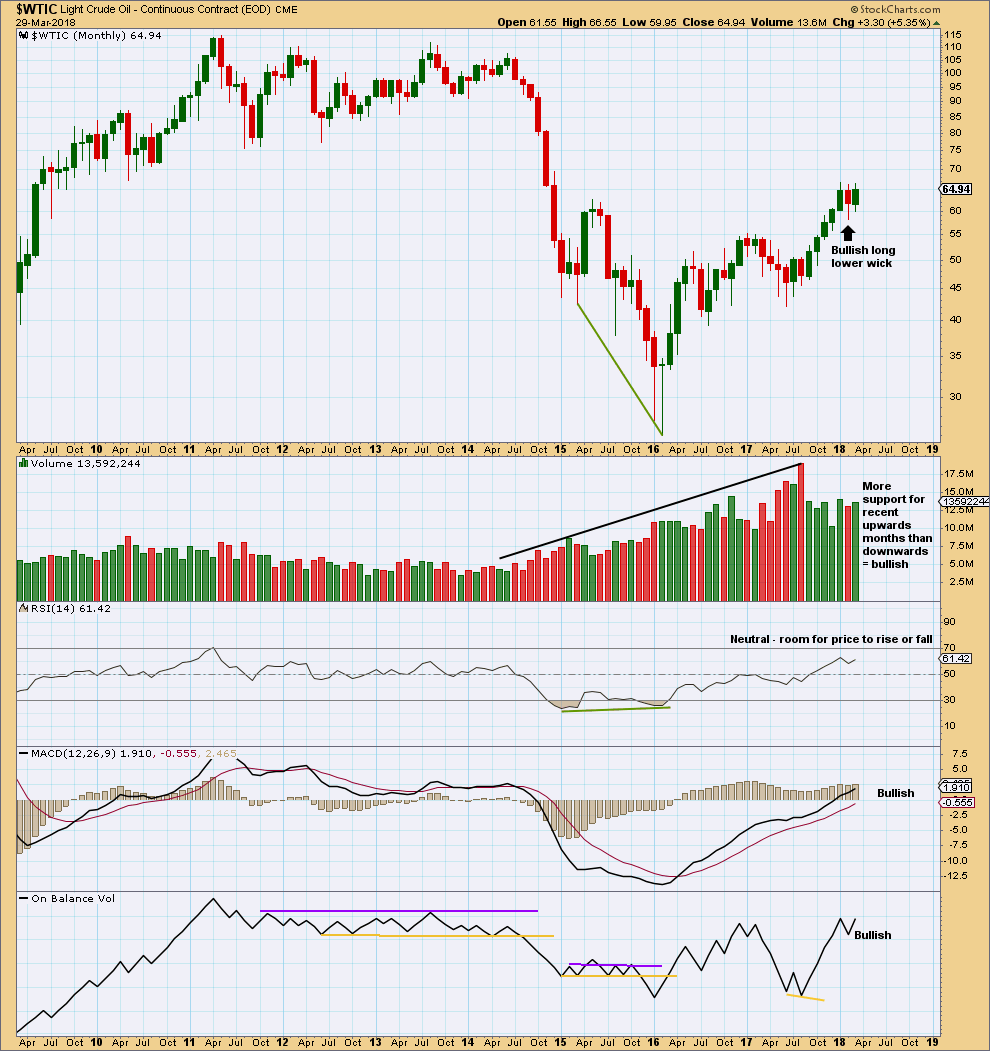

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest recent monthly volume is for the downwards month of August 2017. This is bearish.

For the last three months all now complete, the volume profile is bullish.

This chart is overwhelmingly bullish. It supports the alternate Elliott wave count.

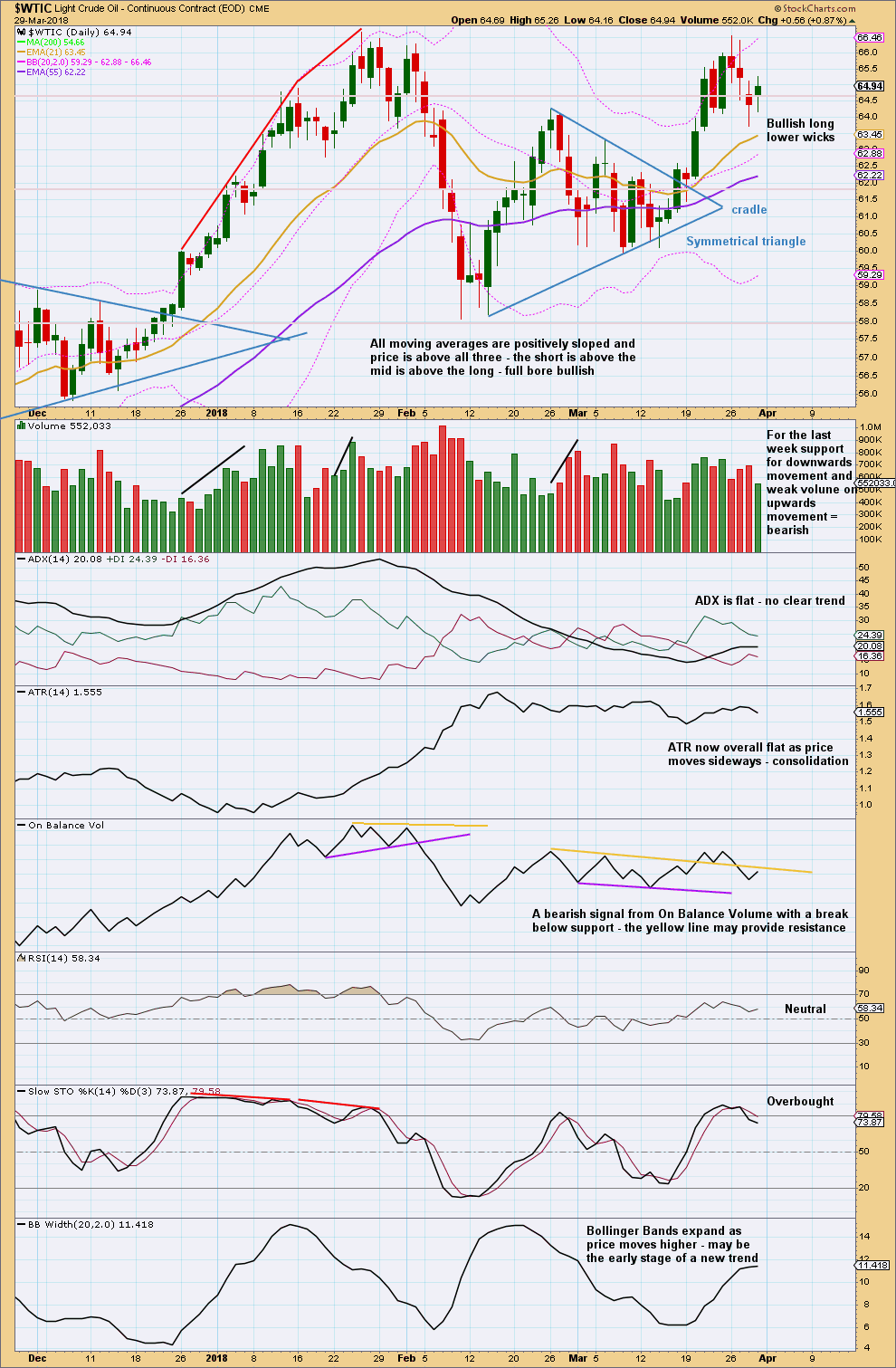

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The bullish long lower wicks strongly suggest some upwards movement to start the new trading week. They make no comment on how much or for how long though.

The short term volume profile from last week is bearish. The last two signals from On Balance Volume are bearish. Stochastics is overbought. These all support the short term outlook for both Elliott wave counts, which expect some downwards movement for about three weeks.

Oil and $OVX Volatility Index currently have a positive correlation. There is a view within the trading community that they should have a negative correlation, and that any divergence may be a signal. At this time, that relationship is absent and $OVX is not providing signals, so it will not be used in this analysis at this time.

Published @ 12:47 a.m. EST on 1st April, 2018.