Price continued lower.

Two short term pictures with a clear price point which differentiates them are presented today.

Summary: While price remains below 1,247.37, then allow for new lows to the target at 1,216 – 1,211.

If price starts to move higher and makes a new high by any amount at any time frame above 1,247.37, then a low should be in place for the mid term, and a new wave up towards 1,310 should have begun.

This downwards trend is very extreme. There is bullish divergence between price and RSI and Stochastics (they are both oversold), and now there is a small green candlestick with a long lower wick. A low may now be in place.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

There are six weekly charts published in the last historic analysis. All but two expect more downwards movement at this time; the two bullish wave counts would be invalidated below 1,236.54. Because the remaining four bearish wave counts all expect the same movement next only one shall be published on a daily basis. Members should keep the other wave counts in mind. They will be published on a daily basis if they begin to diverge from the triangle wave count.

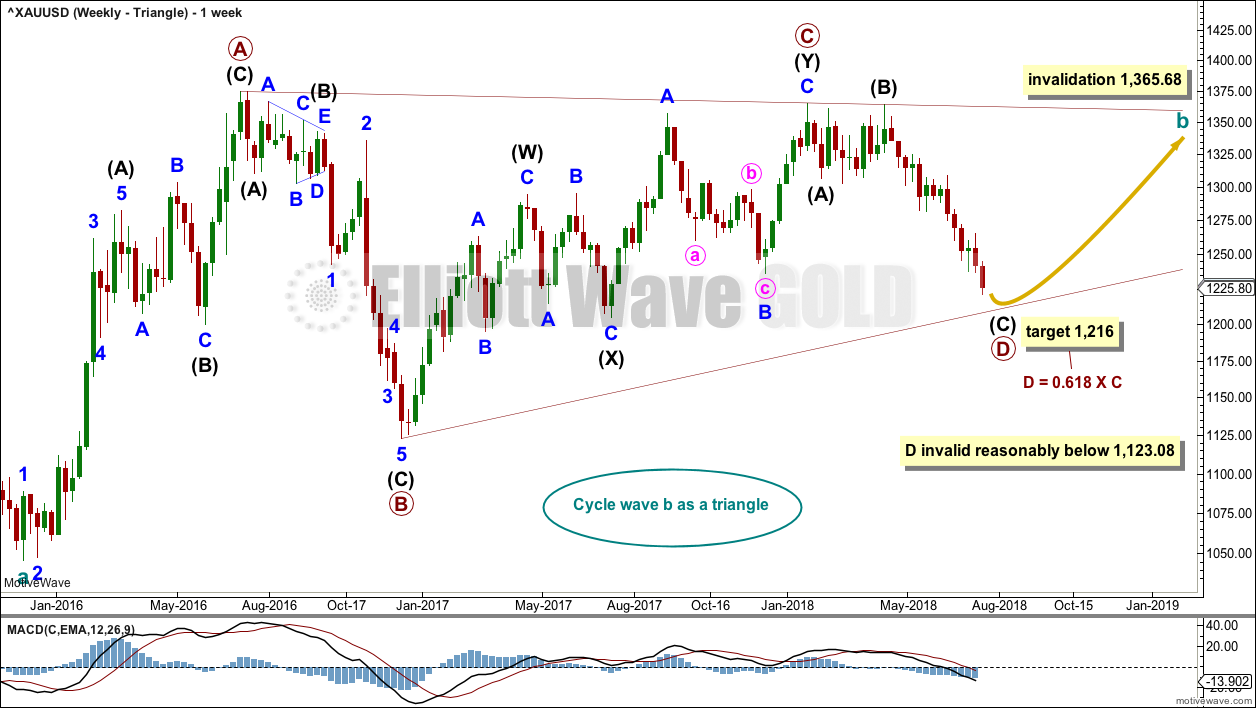

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

The triangle so far has the best fit and look. If price shows a combination or flat may be more likely, then those ideas may be published on a daily basis. The flat and combination ideas expect movement reasonably below 1,123.08, or perhaps a new low below 1,046.27.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag. It is possible that primary wave D could be over today. If it is not over, then it may be over very soon at the target.

One triangle sub-wave tends to be close to 0.618 the length of its predecessor; this gives a target for primary wave D.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

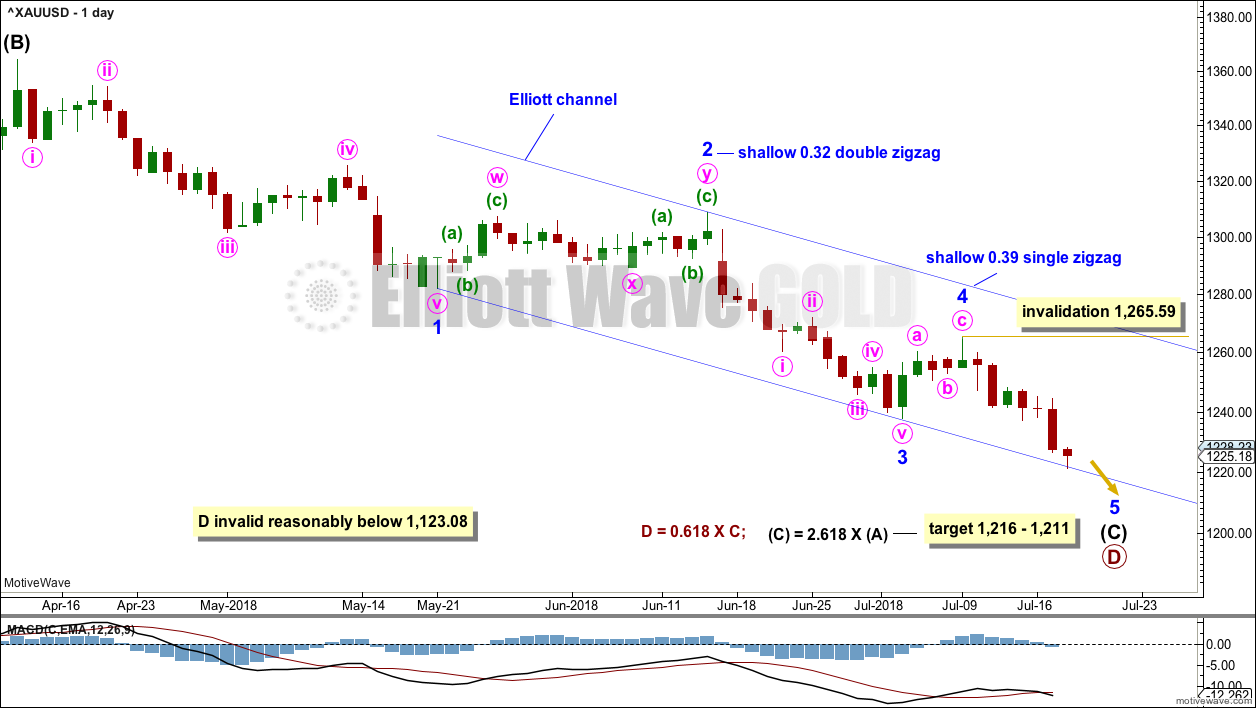

DAILY CHART – TRIANGLE

Primary wave D may be unfolding lower as a single zigzag, and within it intermediate waves (A) and (B) may be complete.

The target is widened to a $5 zone calculated at two degrees. This should have a reasonable probability.

Within intermediate wave (C), it looks likely that all of minor waves 1, 2, 3 and 4 may now be over.

It is also possible now that minor wave 5 could be over at today’s low, finding support about the lower edge of the blue Elliott channel. An alternate hourly chart looks at this possibility.

If primary wave D continues lower, it may end tomorrow or within a very few days. This downwards trend is now very extreme and stretched. The target remains the same.

Look out for a primary degree trend change here or very soon.

Let price tell us when a low is in place. For this reason, the two hourly charts below are simply labelled first and second. The price point at 1,247.37 differentiates them.

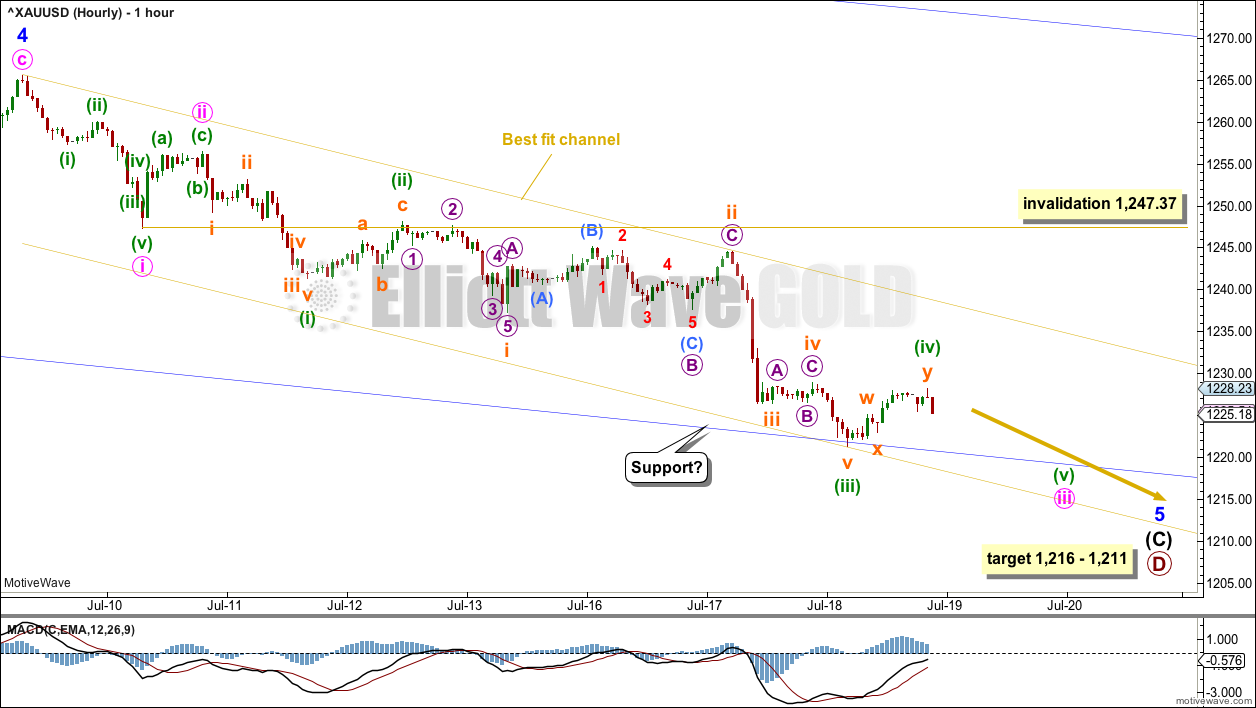

FIRST HOURLY CHART

There is more than one way to see downwards movement of minor wave 5. This first hourly chart allows for more downwards movement to complete the impulse.

Within minor wave 5, minute waves i and ii may be complete. Minute wave iii may be an incomplete impulse. When it is over, then minute wave iv may not move back up into minute wave i price territory above 1,247.37.

It is possible that minor wave 5 could overshoot the lower edge of the blue Elliott channel; fifth waves for commodities are sometimes swift and strong.

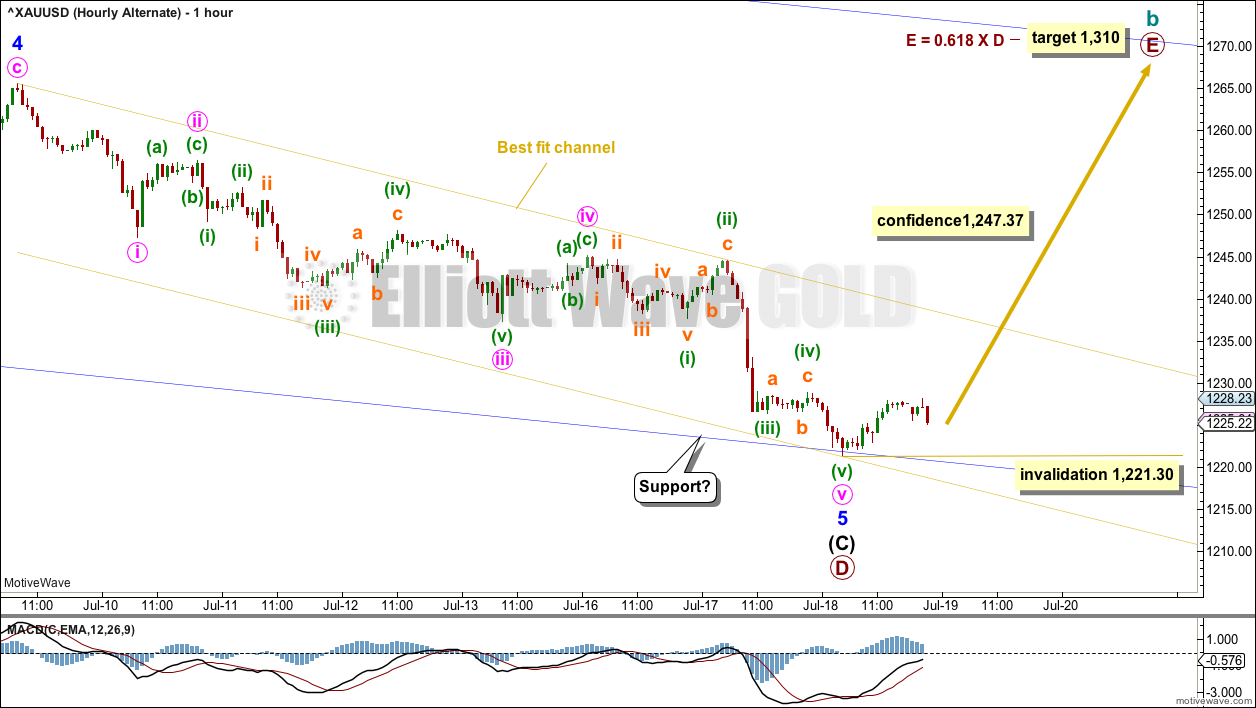

SECOND HOURLY CHART

It is also possible to see minor wave 5 as a complete impulse, ending almost right at the lower edge of the blue Elliott channel.

If minor wave 5 is over, then within the new upwards wave to start primary wave E no second wave correction may move beyond the start of its first wave below 1,221.30.

A new high above 1,247.37 would invalidate the first hourly wave count and provide strong confidence in this second wave count.

TECHNICAL ANALYSIS

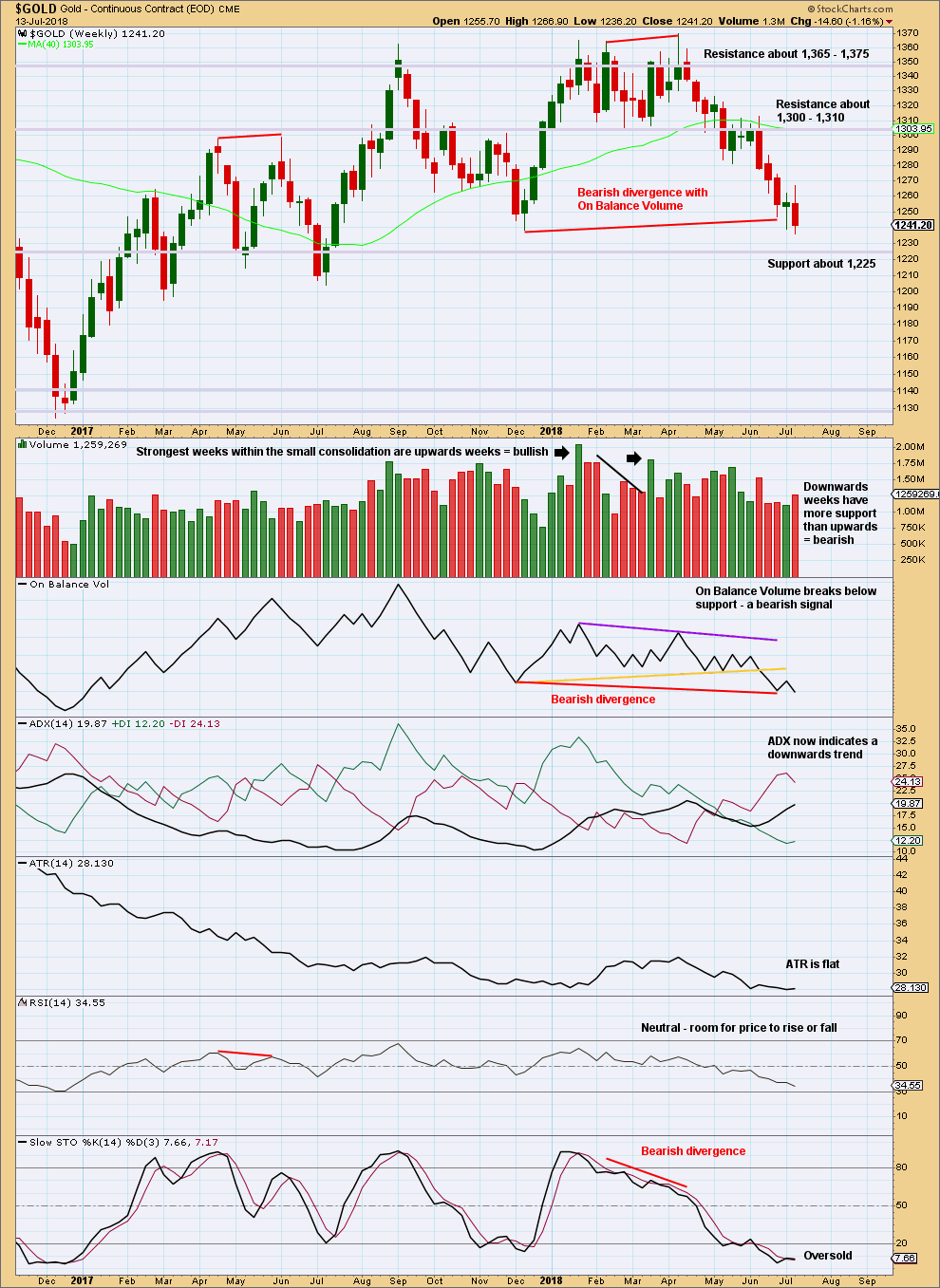

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards week last week has support from volume.

There is single but weak bullish divergence between price and Stochastics.

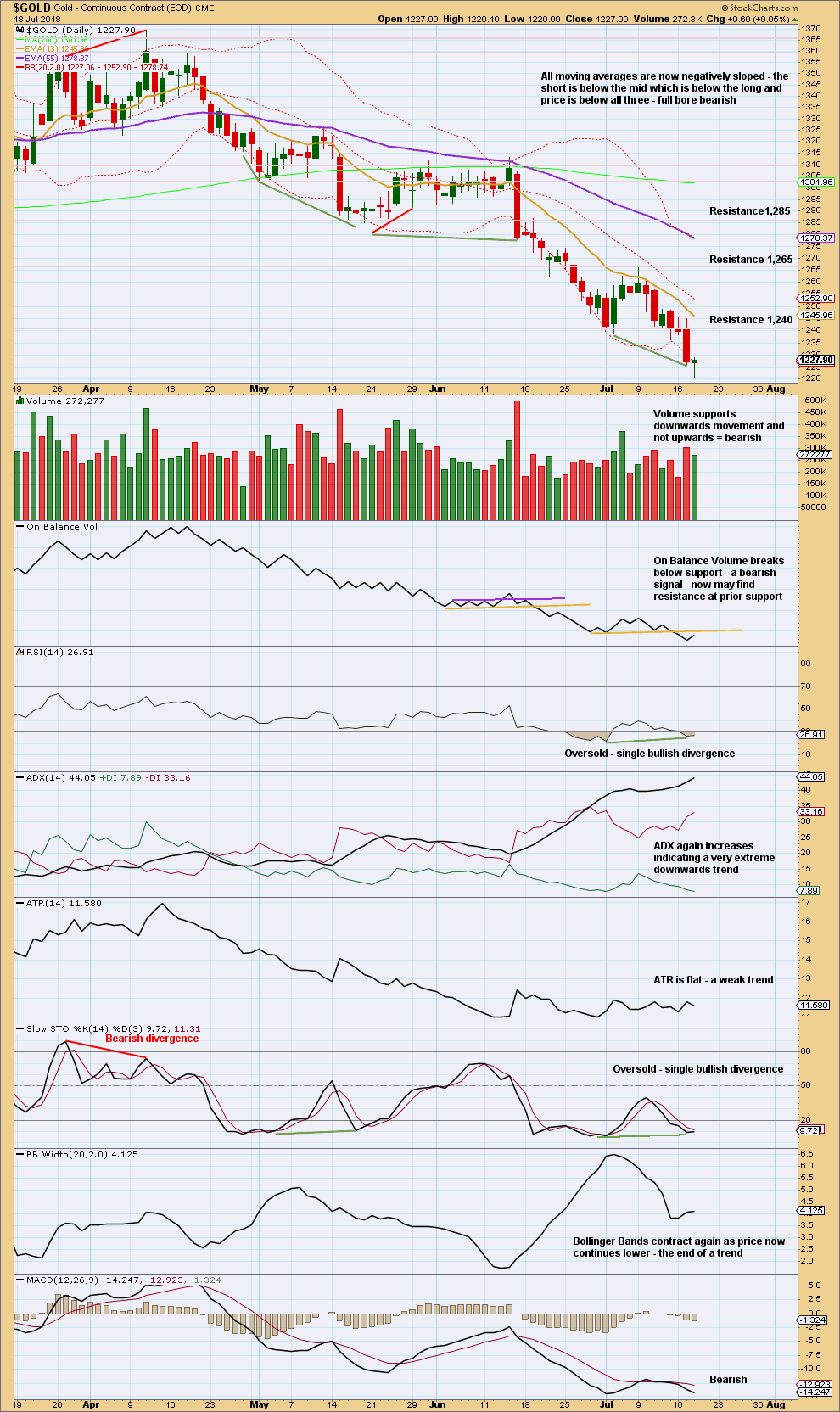

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At this stage, there is some indication that a low may be in place. There is now a small green daily candlestick with a long lower wick. This looks bullish. If tomorrow completes a green daily candlestick and shows any strength, then confidence that a low is in place may be had.

There is bullish divergence between price and RSI and Stochastics; it is reasonable but not very strong.

The short term volume profile is not bullish though.

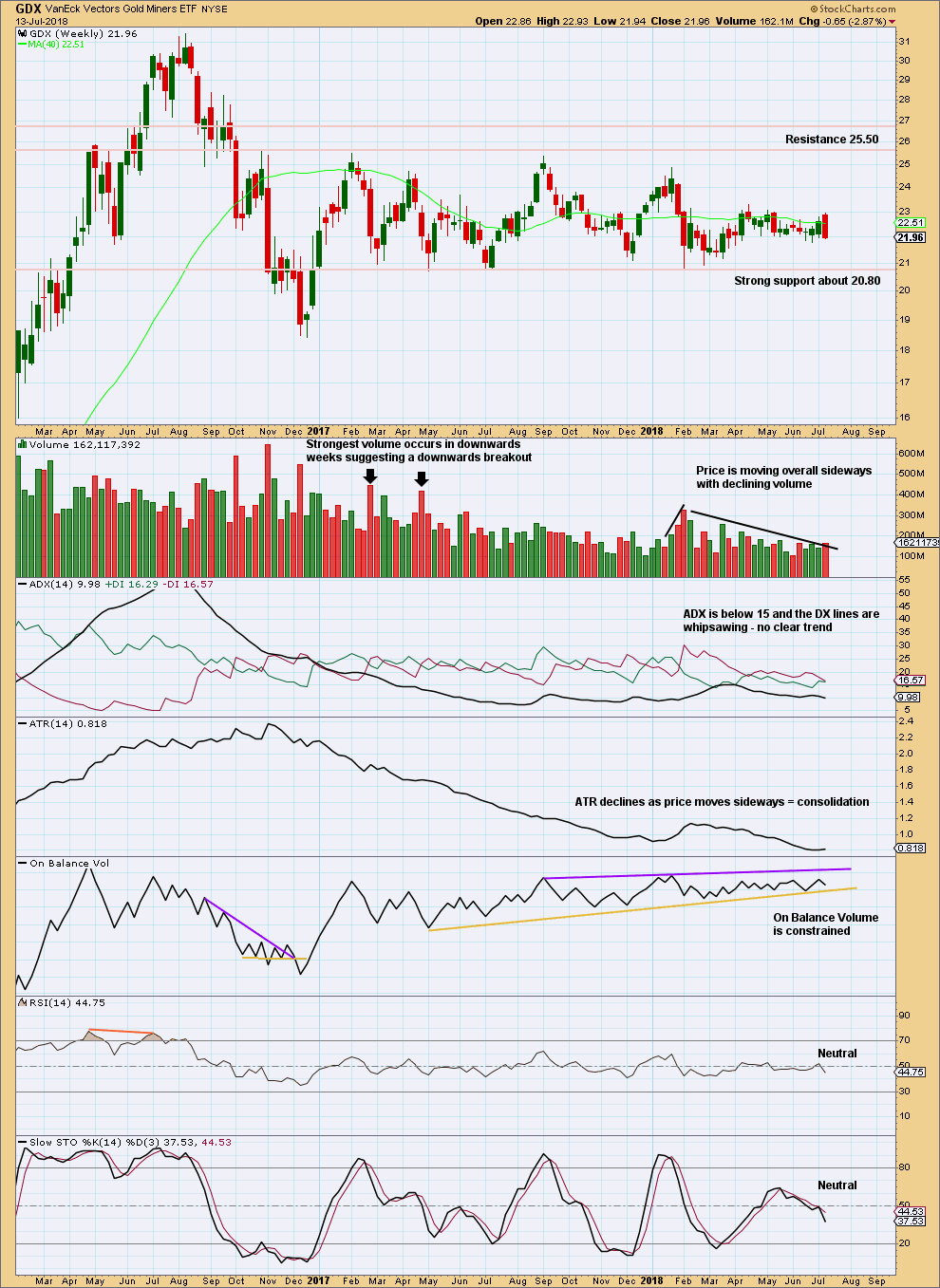

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

There is some support this week for downwards movement from volume.

This weekly candlestick should not be read as a bearish engulfing pattern. For a candlestick reversal pattern to be read as such, there has to be something to reverse. Here, price is moving sideways and not trending.

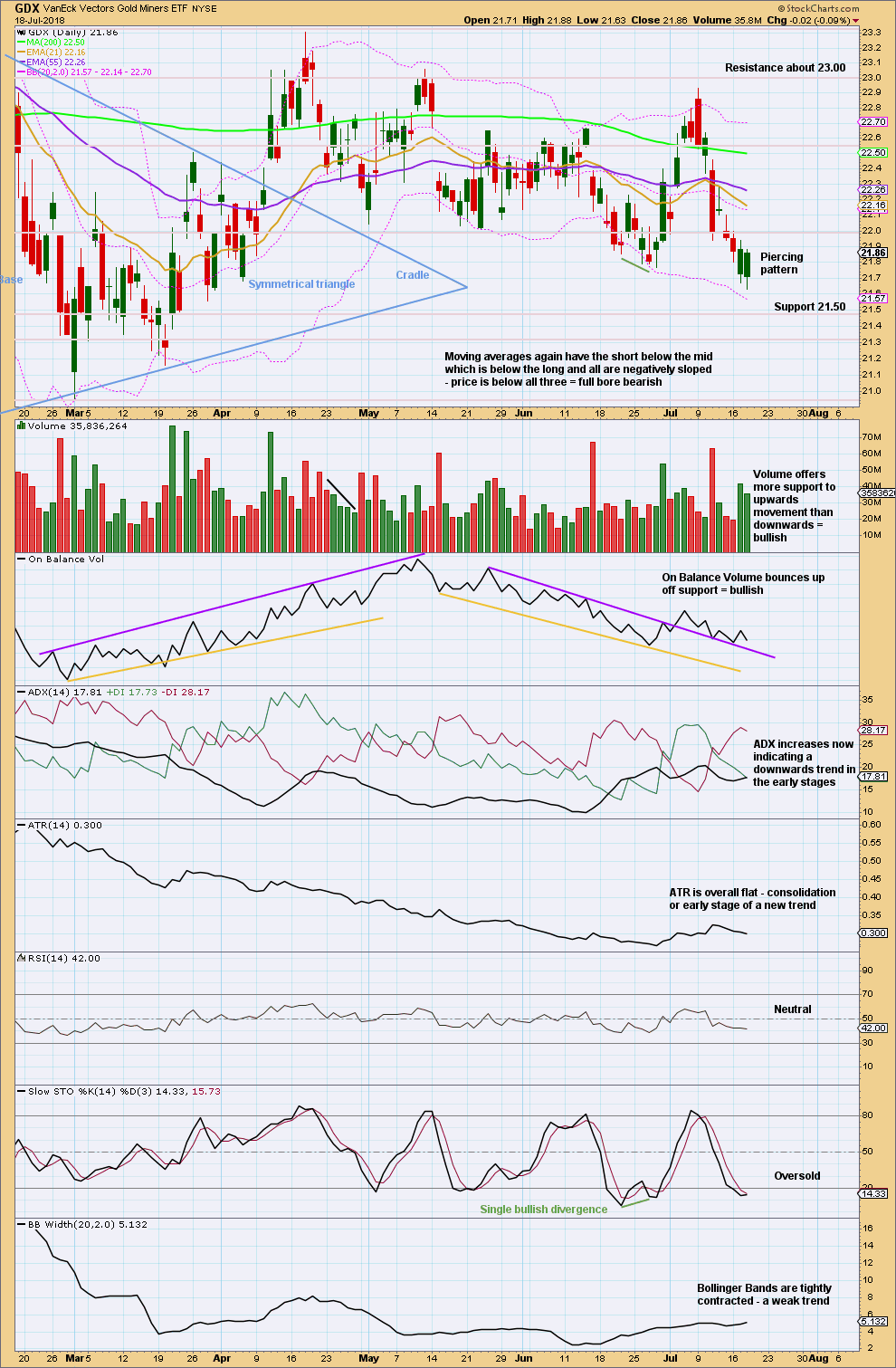

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Next support is about 21.50.

Today’s daily candlestick moved price lower.

The balance of volume was downwards. Weaker volume today does not support downwards movement; the short term volume profile remains bullish.

Another piercing pattern is bullish.

It looks like a low could be in place here or very soon for GDX.

Published @ 10:23 p.m. EST.

updated hourly chart:

the first hourly chart remains valid, the second is invalidated

the target is the same, and now lets favour the lower edge.

one more low after some consolidation.

I’ll look again today at another possibility that today’s low could be the final low because I do not want us to be surprised if it is. the price point to differentiate the two ideas remains the same

Is the minor wave 5 finished as of today low?

I hope everybody is waiting for a new major Bull market.

It could be Pete, it could be.

Or we may yet see one more low.