A new low below 51.67 has invalidated the alternate bullish Elliott wave count, adding confidence to the main bearish Elliott wave count. The short-term target remains the same.

Summary: Oil is in a downwards trend. The probability that Oil may continue to move reasonably below 26.06 has increased.

Trends do not move in straight lines. There will be bounces and consolidations along the way. Look for a candlestick reversal pattern on the daily chart to signal the first multi week bounce or consolidation for a second wave. The target for this to begin is at 46.80.

New updates to this analysis are in bold.

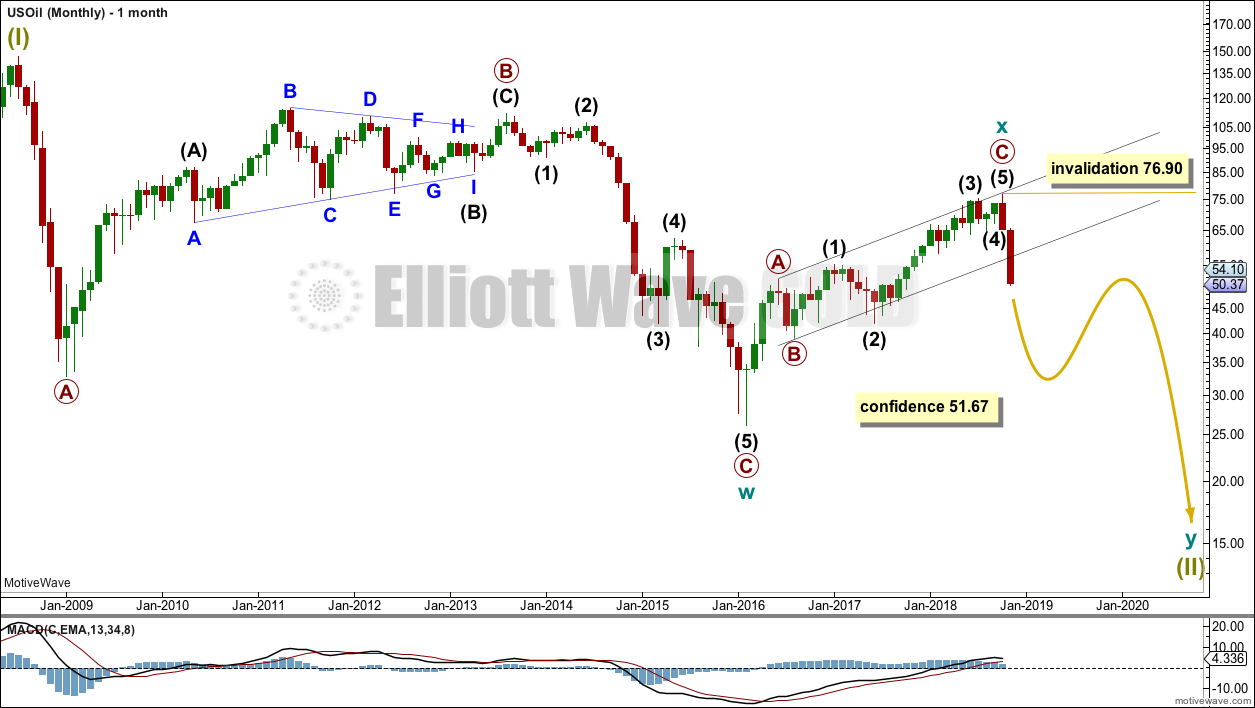

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

Classic technical analysis favours a bearish wave count for Oil at this time.

The large fall in price from the high in June 2008 to February 2016 is seen as a complete three wave structure. This large zigzag may have been only the first zigzag in a deeper double zigzag.

The first zigzag down is labelled cycle wave w. The double is joined by a now complete three in the opposite direction, a zigzag labelled cycle wave x.

The purpose of a second zigzag in a double is to deepen the correction when the first zigzag does not move price deep enough. Cycle wave y would be expected to move reasonably below the end of cycle wave w to deepen the correction. Were cycle wave y to reach equality with cycle wave w that takes Oil into negative price territory, which is not possible. Cycle wave y would reach 0.618 the length of cycle wave w at $2.33.

A better target calculation would be using the Fibonacci ratios between primary waves A and C within cycle wave y. This cannot be done until both primary waves A and B are complete.

Within cycle wave y, no second wave correction nor B wave may move beyond its start above 76.90.

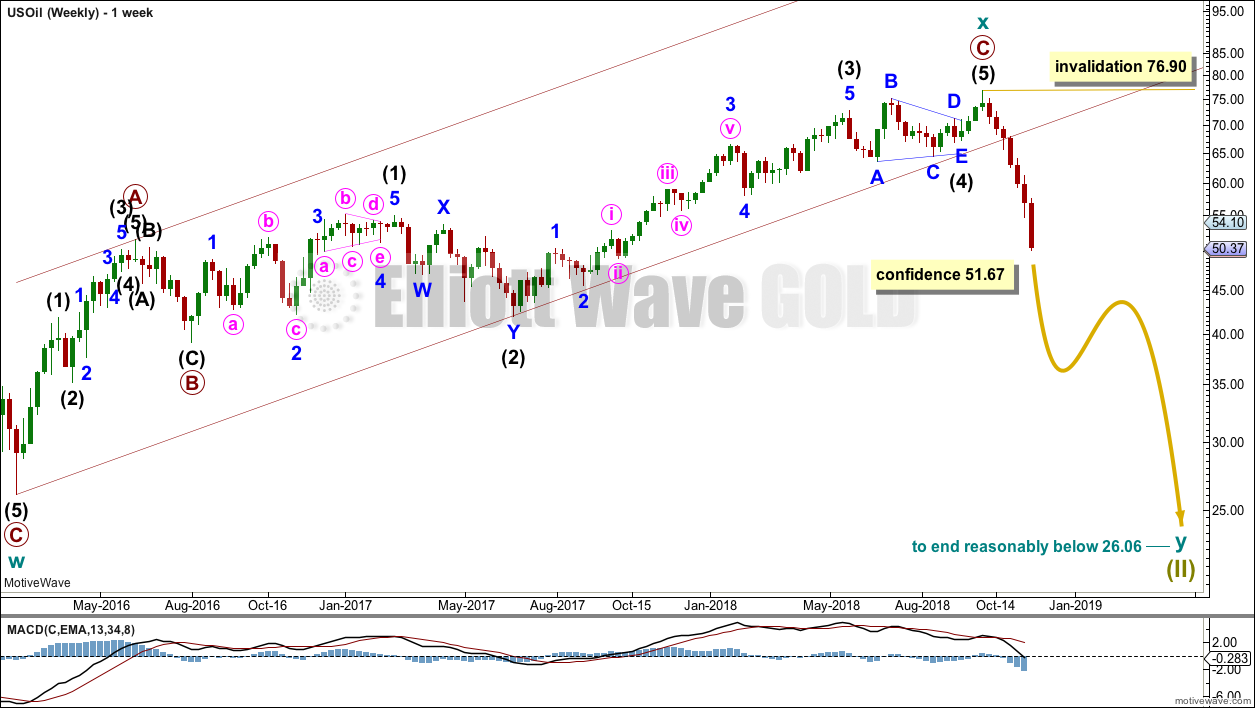

WEEKLY CHART

Cycle wave x is seen as a complete zigzag. Within the zigzag, primary wave C is a five wave impulse and within it intermediate wave 4 is a triangle.

A new low below 51.67 has added confidence in this bearish wave count. At that stage, the bullish alternate was invalidated.

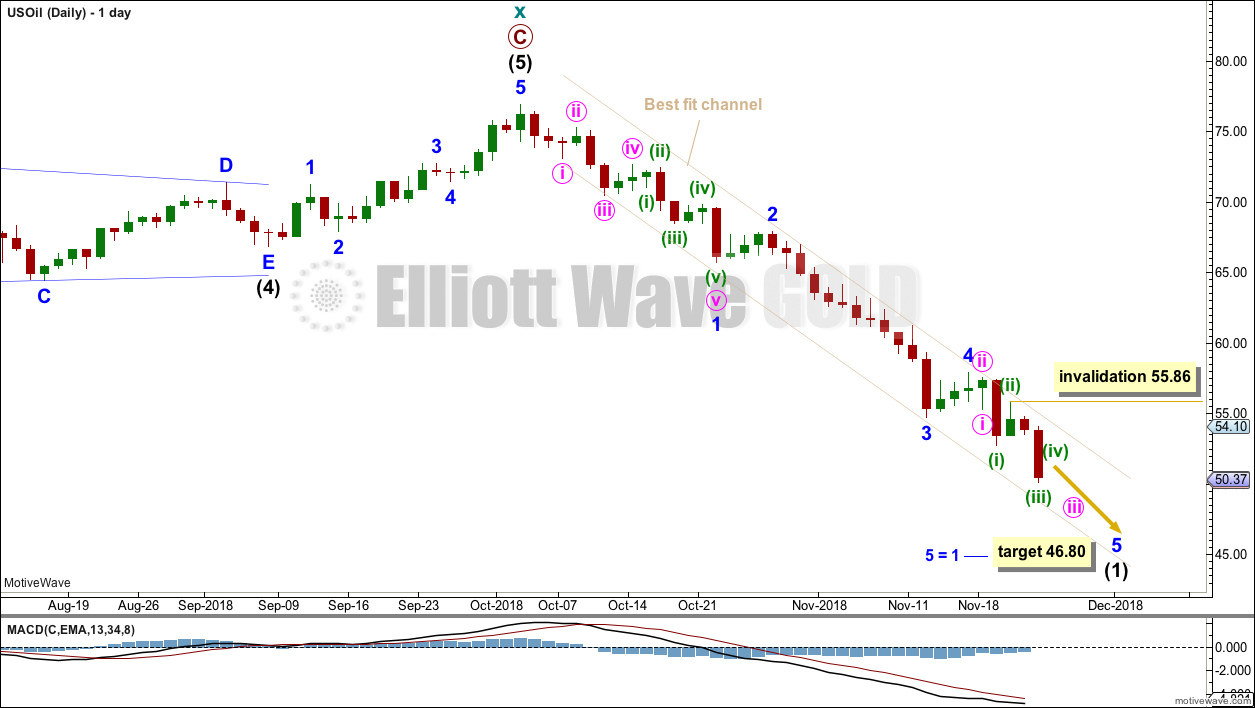

DAILY CHART

Attention now turns to the structure of downwards movement. An impulse is unfolding lower.

Minor wave 3 is longer than minor wave 1 and does not exhibit a Fibonacci ratio to minor wave 1.

Minor wave 4 has remained contained within the best fit channel.

The most common Fibonacci ratio for minor wave 5 is used to calculate a target for it to end. Minor wave 5 must subdivide as a five wave motive structure, either an impulse or an ending diagonal. So far it looks most likely to be unfolding as an impulse. Within the impulse, minute wave iii may be nearing an end.

Within minuette wave (iii), no second wave correction may move beyond its start above 55.86.

Keep using the best fit channel as the first guide for an upcoming trend change. If the channel is breached by clearly upwards movement (not sideways), that would be an early indication that intermediate wave (1) may be over and intermediate wave (2) may have begun.

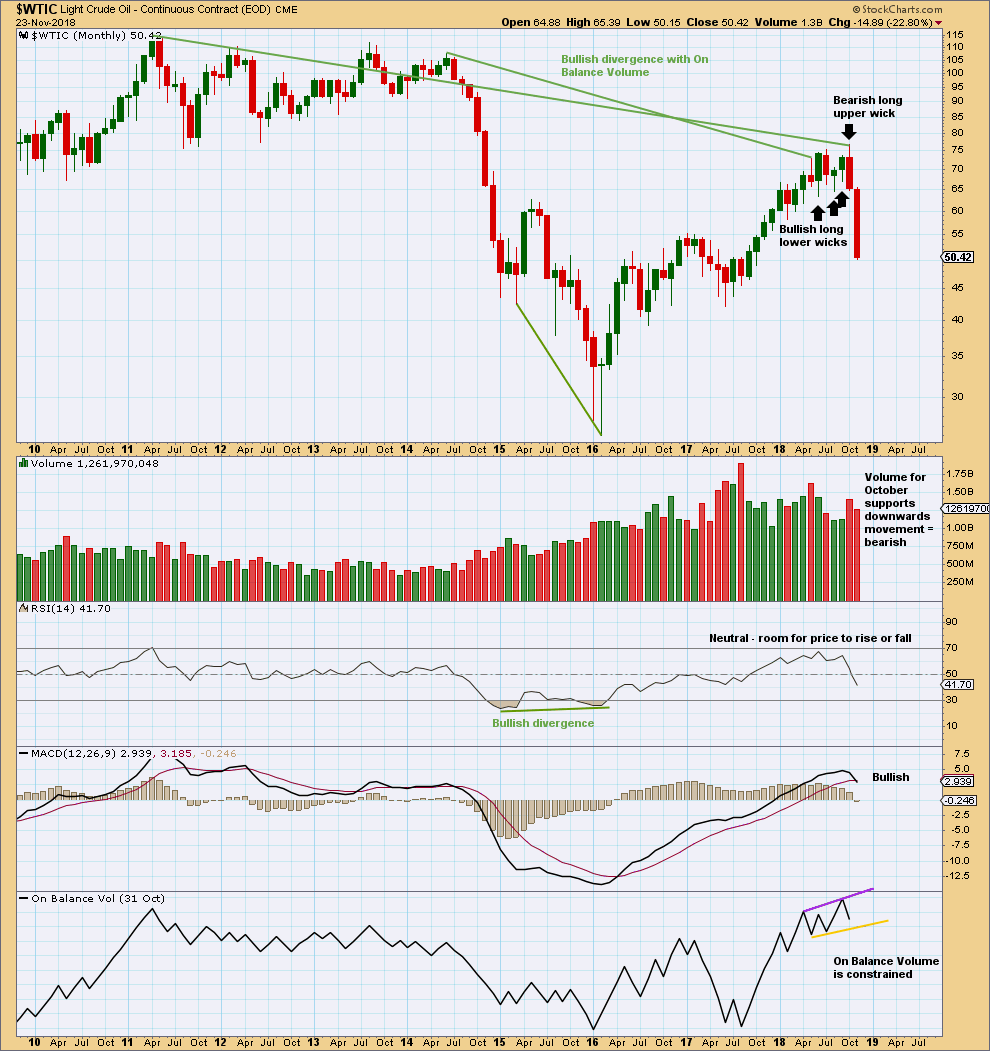

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

With very strong downwards movement now moving to lower lows, it now looks clear that there has been a trend change at the monthly chart level.

With a long upper candlestick wick and support from volume, the last completed month of October is bearish. On its own, this is not an indication of the end of the upwards trend though; it is noted that August 2017 was similar yet price continued higher.

However, the month of October also completes a Bearish Engulfing candlestick pattern. This is a strong reversal pattern. This strong reversal pattern is now being followed by more downwards movement. Now it does look like there may have been a trend change.

Bullish divergence between price and On Balance Volume remains, and is still a strong technical indicator that price may continue upwards to make new highs. However, at this time, it looks like this may fail.

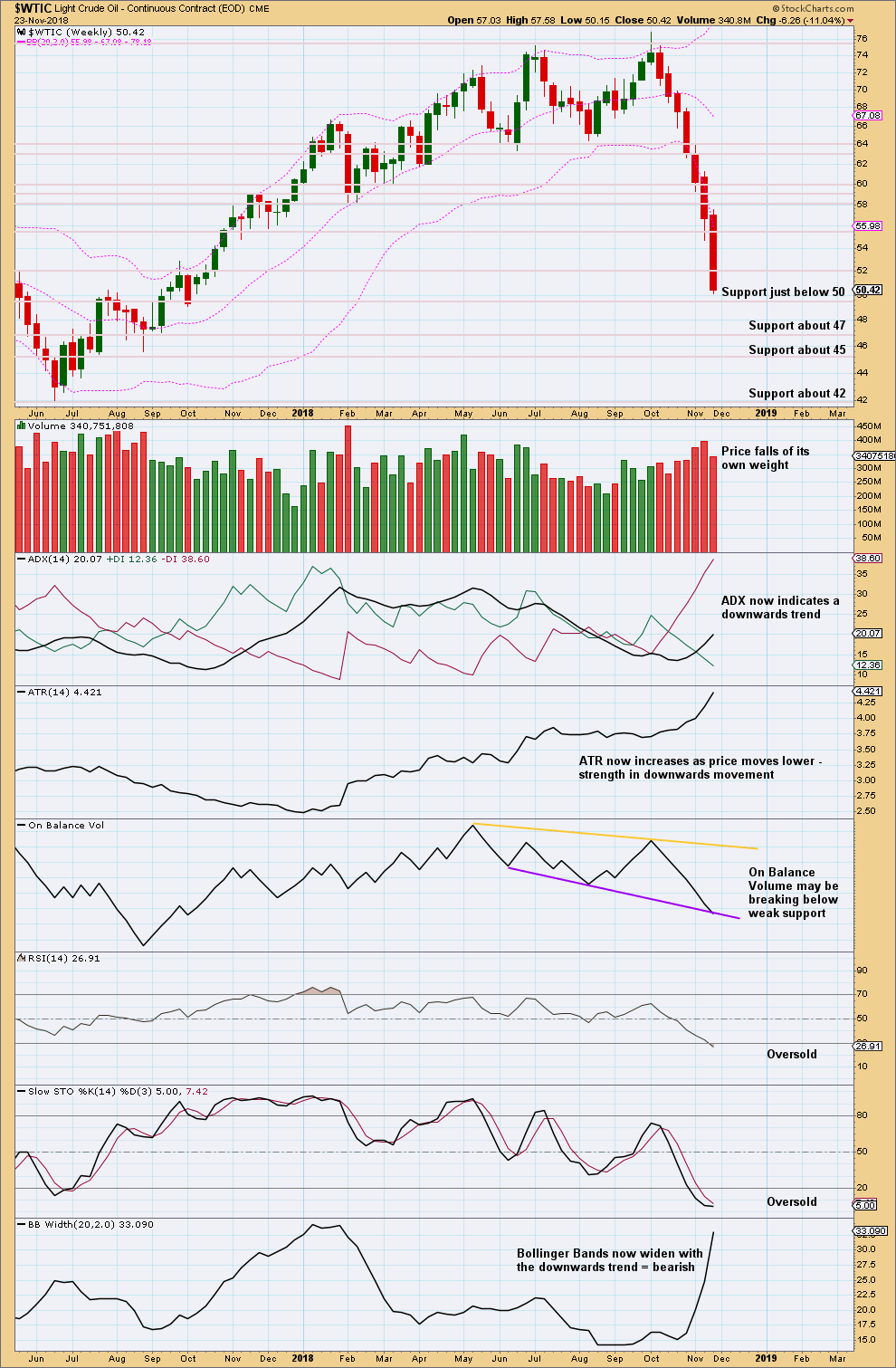

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is still plenty of room for this downwards trend to continue.

RSI can reach deeply oversold and remain there for many weeks when Oil has a strong bearish trend. Also, Stochastics may remain oversold for many weeks, and ADX can reach very extreme and remain there for weeks.

At this time, Stochastics and RSI are just oversold, and ADX is not yet extreme.

With no candlestick reversal pattern and not even a long lower wick this week, it looks most likely that downwards movement will continue here.

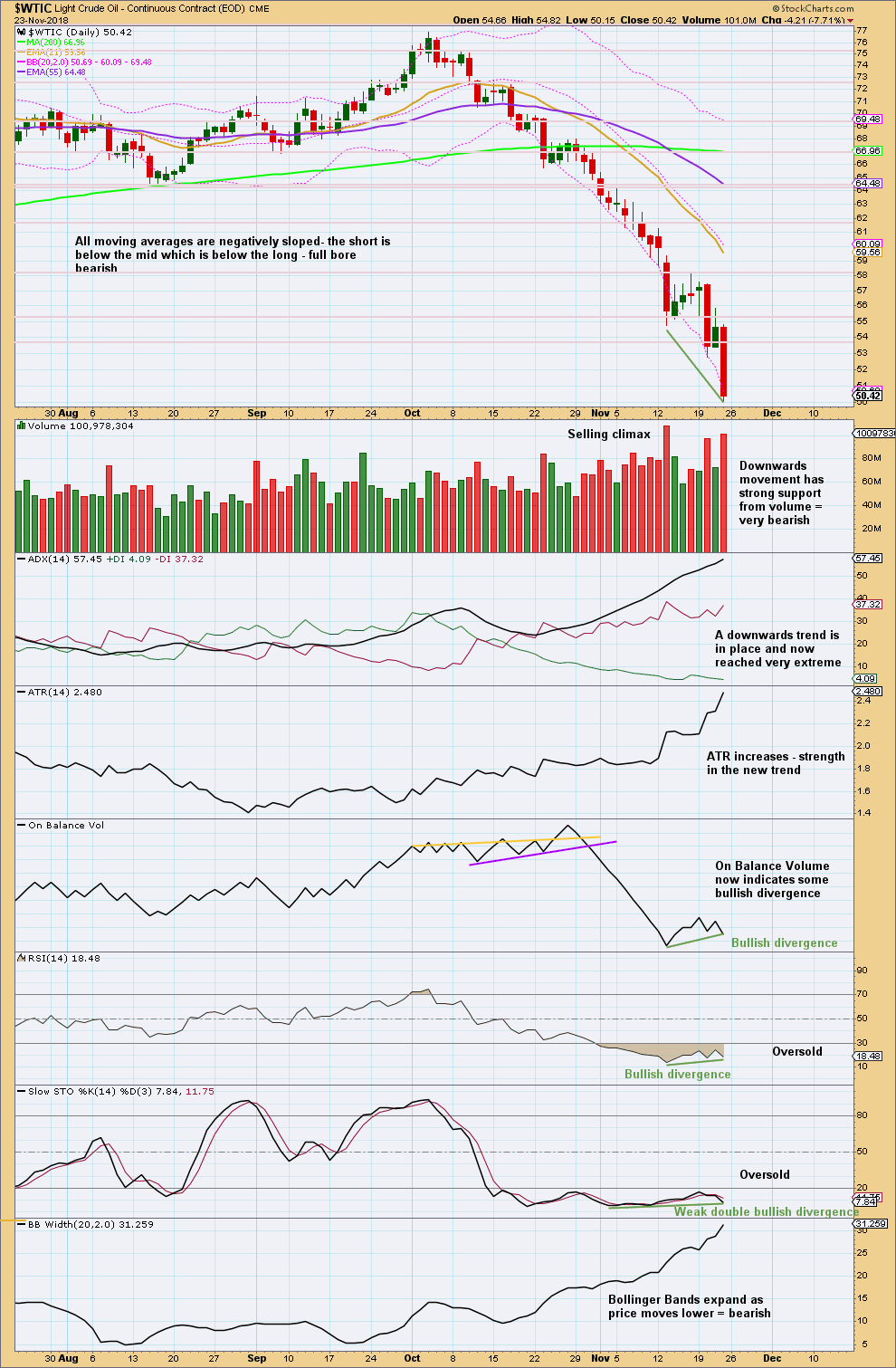

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

I have taken some time to look back at the last strong bearish trend from Oil from about May 2014 to January 2016. I have noticed that downwards waves often end with support from volume, and sometimes do not even end with a long lower wick. Bullish reversal patterns are often but not always found at lows. RSI can reach very extreme and remain so for as long as three months when this market has a strong downwards trend. At lows Stochastics often will exhibit bullish divergence, but this can be rather weak. At lows RSI sometimes, not always, exhibits bullish divergence and can remain deeply oversold for long periods of time.

US Oil is a particularly difficult market to find lows in. It can trend strongly for very long periods of time with indicators remaining very extreme.

At this time, there is now clearly a downwards trend in place. This could continue for months yet. While price remains within the channel on the daily Elliott wave chart, expect it to continue to fall.

Expect that a low has been found only if a bullish candlestick reversal pattern appears, or the channel is clearly breached. But note that even if these occur, that any bounce may still be short lived.

Published @ 09:38 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.