The bounce continues towards the target as expected.

Summary: The larger picture still sees Oil in a new downwards trend to end reasonably below 26.06.

While price remains within the channel on the daily chart, assume the bounce will continue. The target remains at 63.71.

If the target is wrong, it may be too high. There is now reasonable weakness in upwards movement. Price is within a strong zone of resistance. Stochastics is overbought. Look for this bounce to end soon.

If the channel is breached by a full daily candlestick below and not touching the lower edge, assume the bounce is over and a third wave down has begun.

New updates to this analysis are in bold.

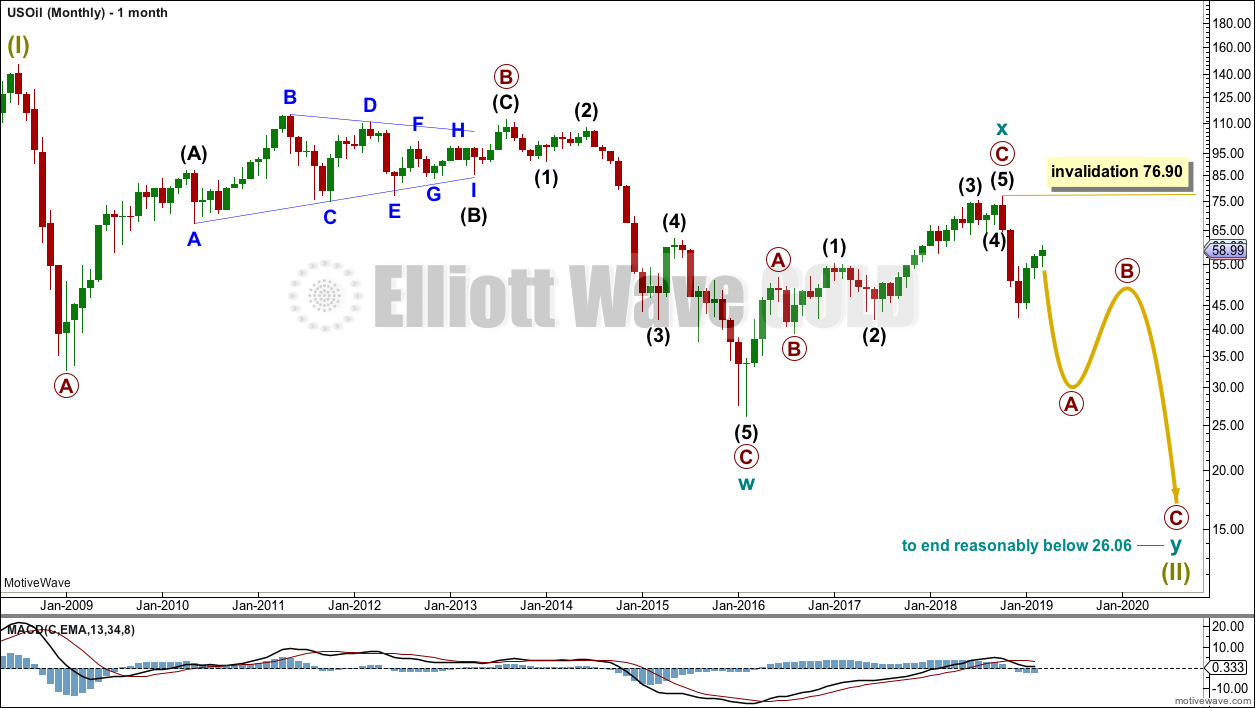

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

Classic technical analysis favours a bearish wave count for Oil at this time.

The large fall in price from the high in June 2008 to February 2016 is seen as a complete three wave structure. This large zigzag may have been only the first zigzag in a deeper double zigzag.

Upwards movement from February 2016 to October 2018 will not fit readily as a five wave structure but will fit very well as a three. With a three wave structure upwards, this indicates the bear market may not be over.

The first zigzag down is labelled cycle wave w. The double is joined by a now complete three in the opposite direction, a zigzag labelled cycle wave x.

The purpose of a second zigzag in a double is to deepen the correction when the first zigzag does not move price deep enough. Cycle wave y would be expected to move reasonably below the end of cycle wave w to deepen the correction. Were cycle wave y to reach equality with cycle wave w that takes Oil into negative price territory, which is not possible. Cycle wave y would reach 0.618 the length of cycle wave w at $2.33.

A better target calculation would be using the Fibonacci ratios between primary waves A and C within cycle wave y. This cannot be done until both primary waves A and B are complete.

Within cycle wave y, no second wave correction nor B wave may move beyond its start above 76.90.

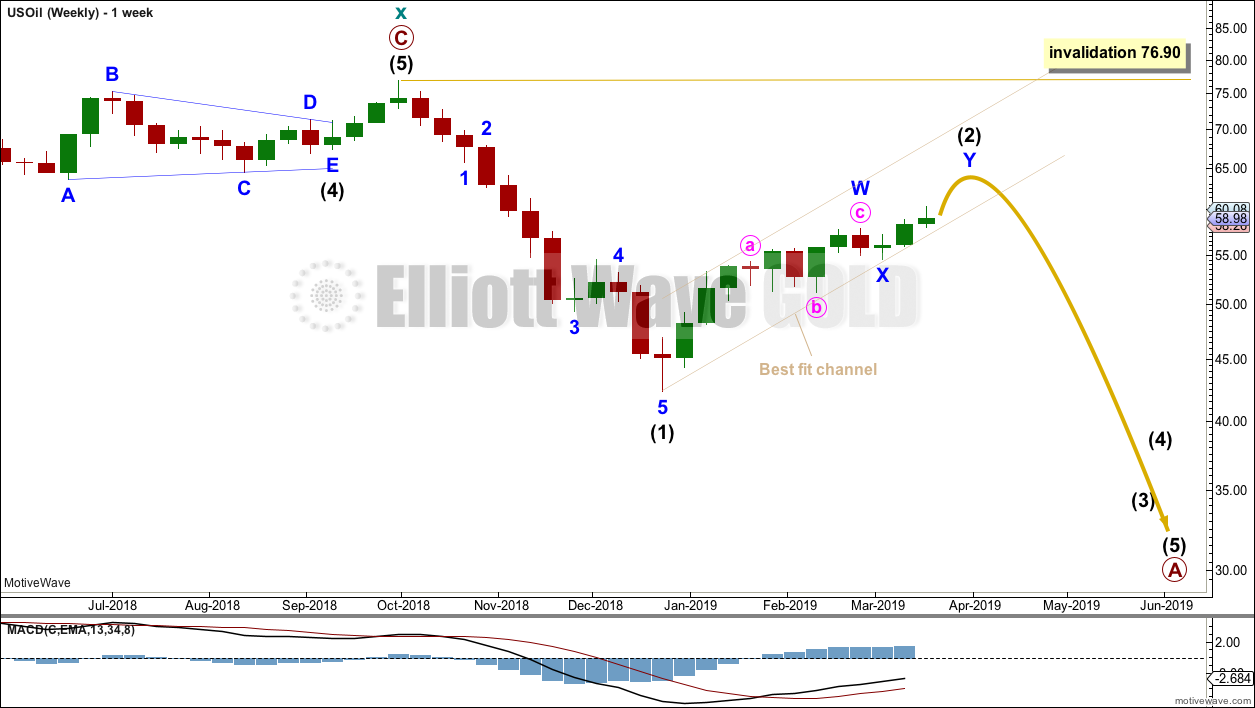

WEEKLY CHART

This weekly chart is focussed on the start of cycle wave y.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Within primary wave A, intermediate wave (1) may now be complete.

Intermediate wave (2) is a possibly incomplete double zigzag.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 76.90.

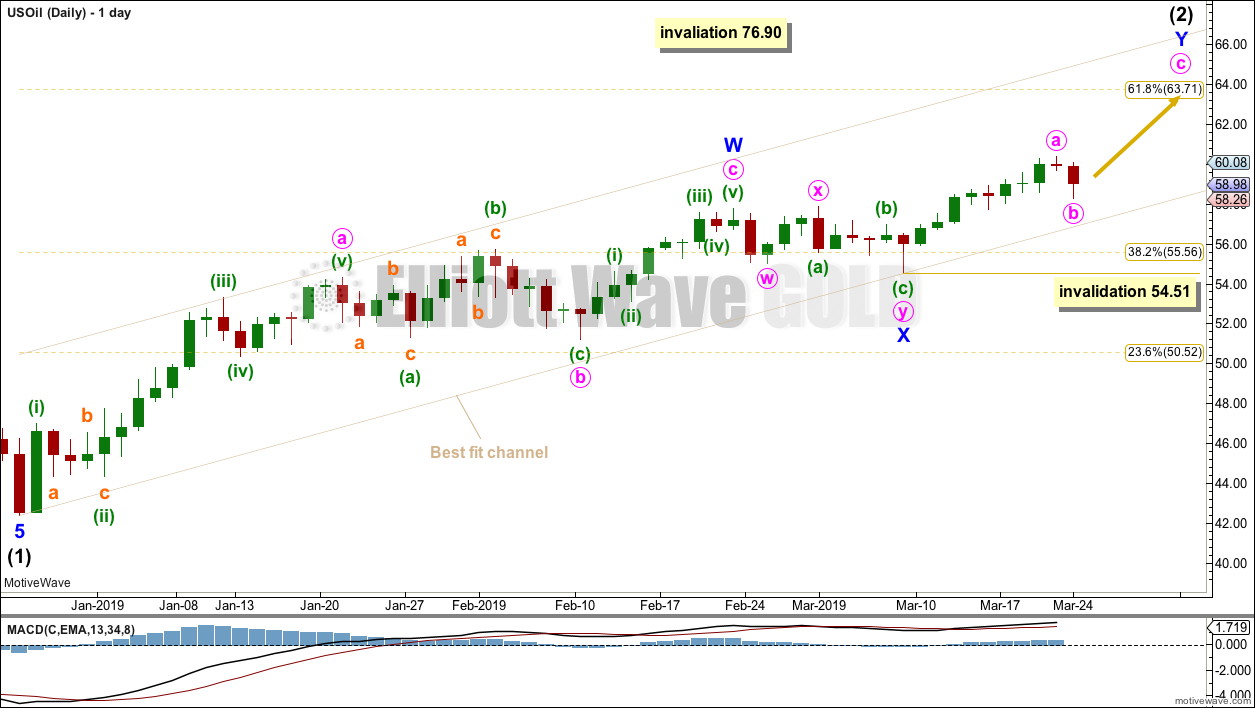

DAILY CHART

Always assume the trend remains the same until proven otherwise.

Intermediate wave (2) may be an incomplete double zigzag. The first zigzag may be complete, labelled minor wave W. The double may be joined by a three in the opposite direction, a double zigzag labelled minor wave X.

The maximum number of corrective structures in a multiple is three. Waves W, Y and Z may only subdivide as single corrective structures (they may not be multiples). But X waves may subdivide as any corrective structure including a multiple. However, X waves almost always subdivide as single zigzags, rarely do they subdivide as multiples. However, the alternate wave count is invalidated. This main wave count is now the only wave count at this time frame.

The channel is drawn as a best fit. If this channel is breached by a full candlestick below and not touching it, that may indicate a trend change.

If minute wave b moves a little lower early next week, then look for it to find support about the lower edge of the channel.

Minor wave Y may end about the 0.618 Fibonacci ratio at 63.71.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 76.90.

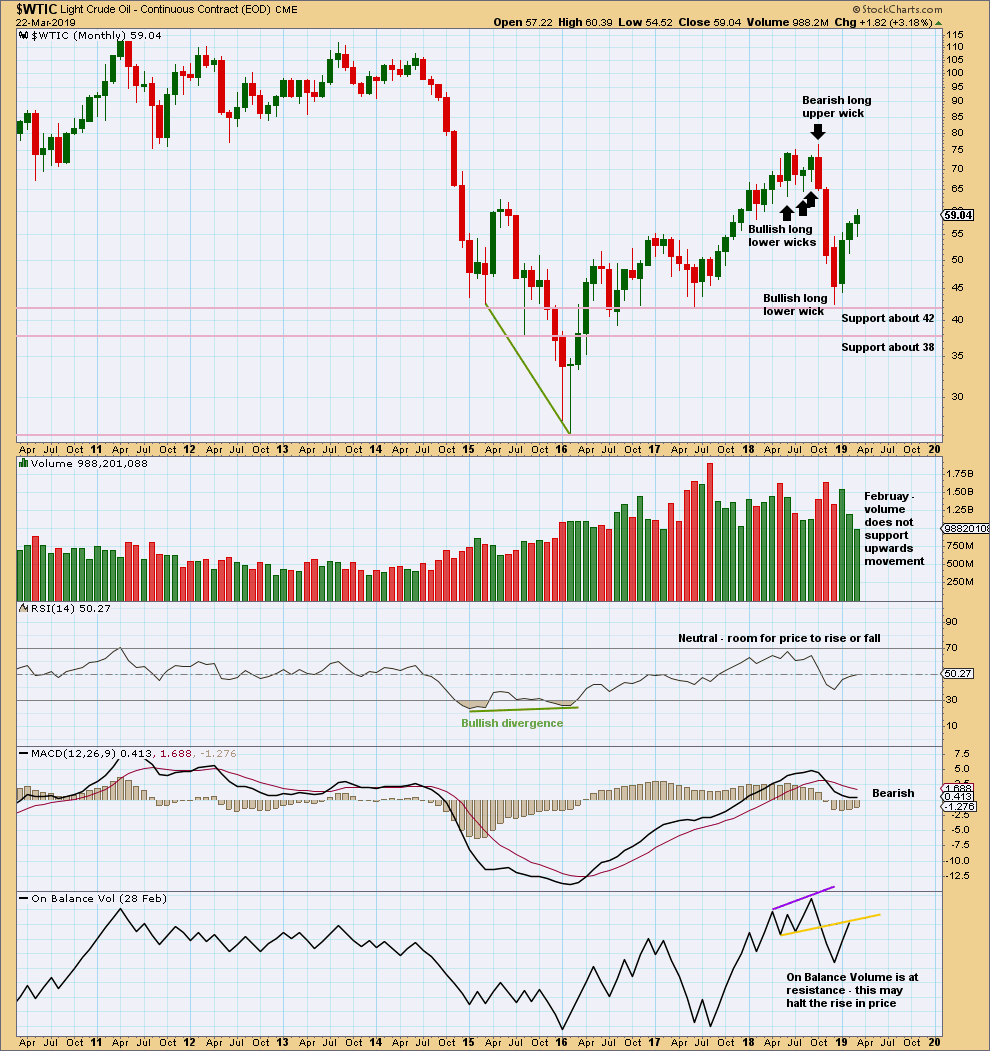

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement for February lacks support from volume. This bounce may be ending here or very soon.

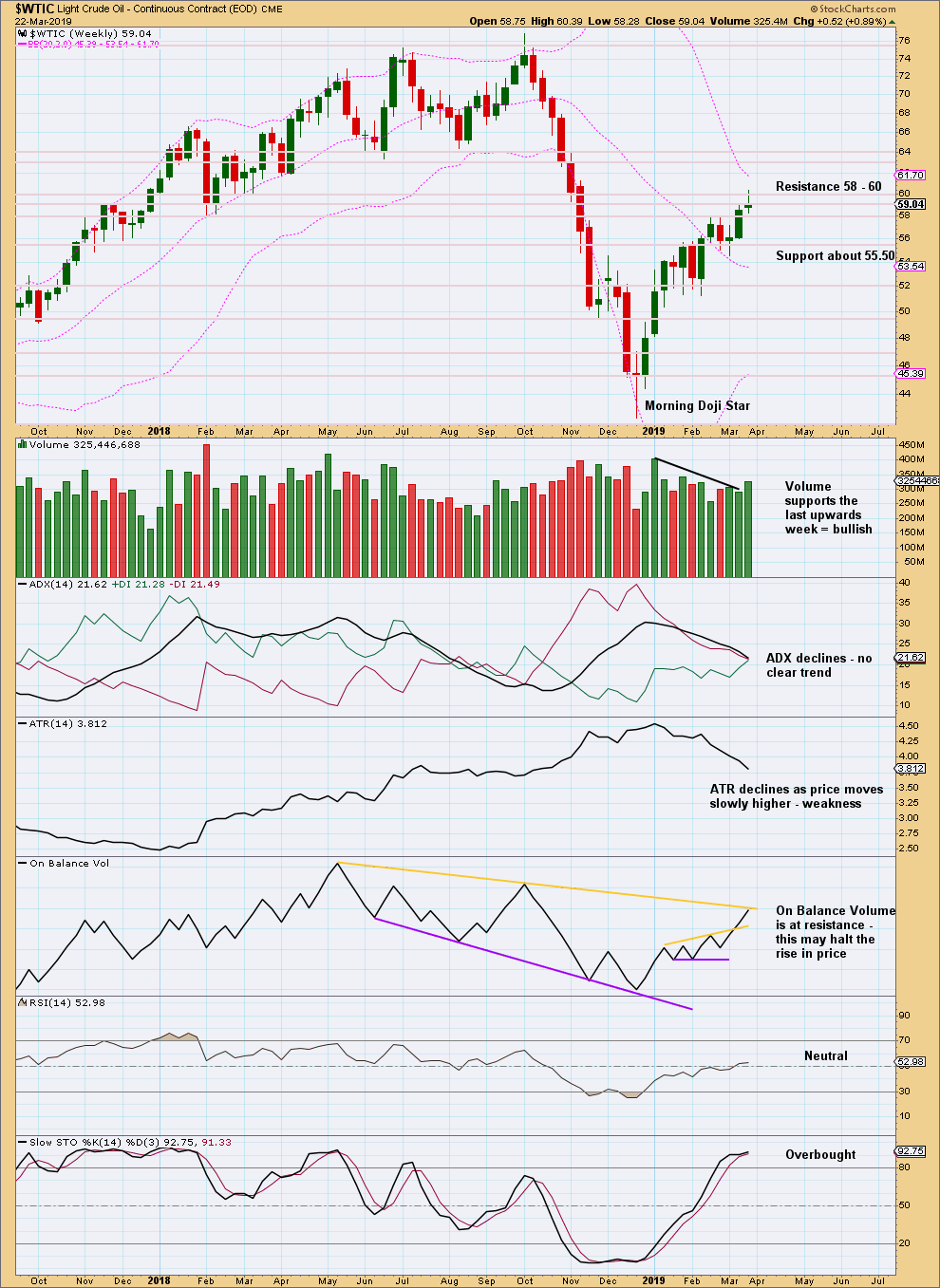

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week completes a doji candlestick. This puts the trend for the short term from up into neutral. Doji on their own are not reversal signals, but they are a warning of possible weakness.

On Balance Volume may halt this bounce here. But the yellow resistance line does not have strong technical significance, so a breach of resistance would be a weak bullish signal.

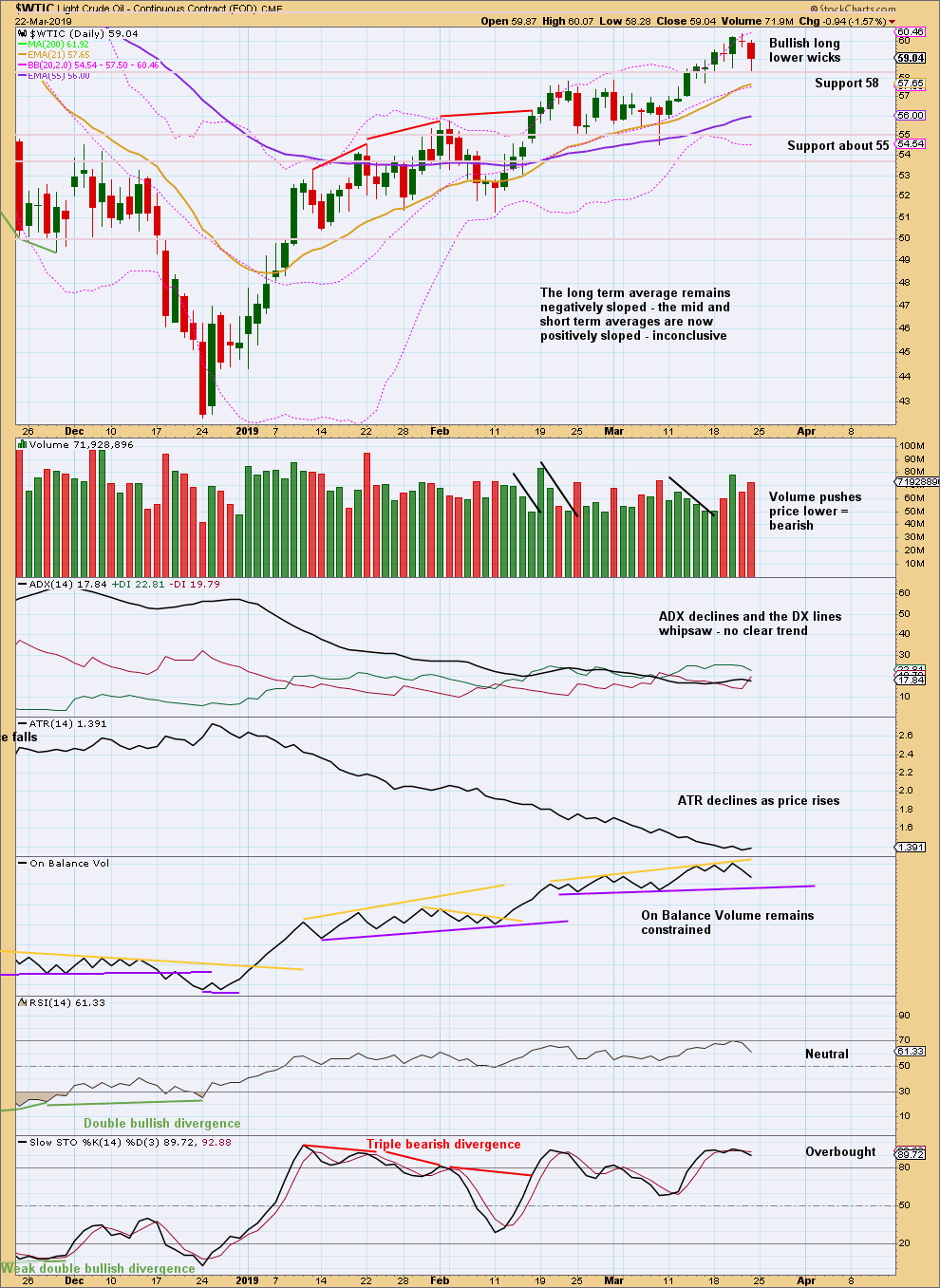

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 58 so far is holding.

Volume suggests more downwards movement to begin next week, but it may be limited by support for On Balance Volume.

Published @ 09:31 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.