A little more upwards movement was expected for the week.

The weekly candlestick forms an important pattern, and the daily volume profile supports it.

Summary: Oil may have now found a high. The next wave down may begin. The final target is now calculated at 10.72.

Confidence that a high is in place may be had if the channel on the daily chart is breached by a full candlestick below and not touching the lower edge of the trend channel.

New updates to this analysis are in bold.

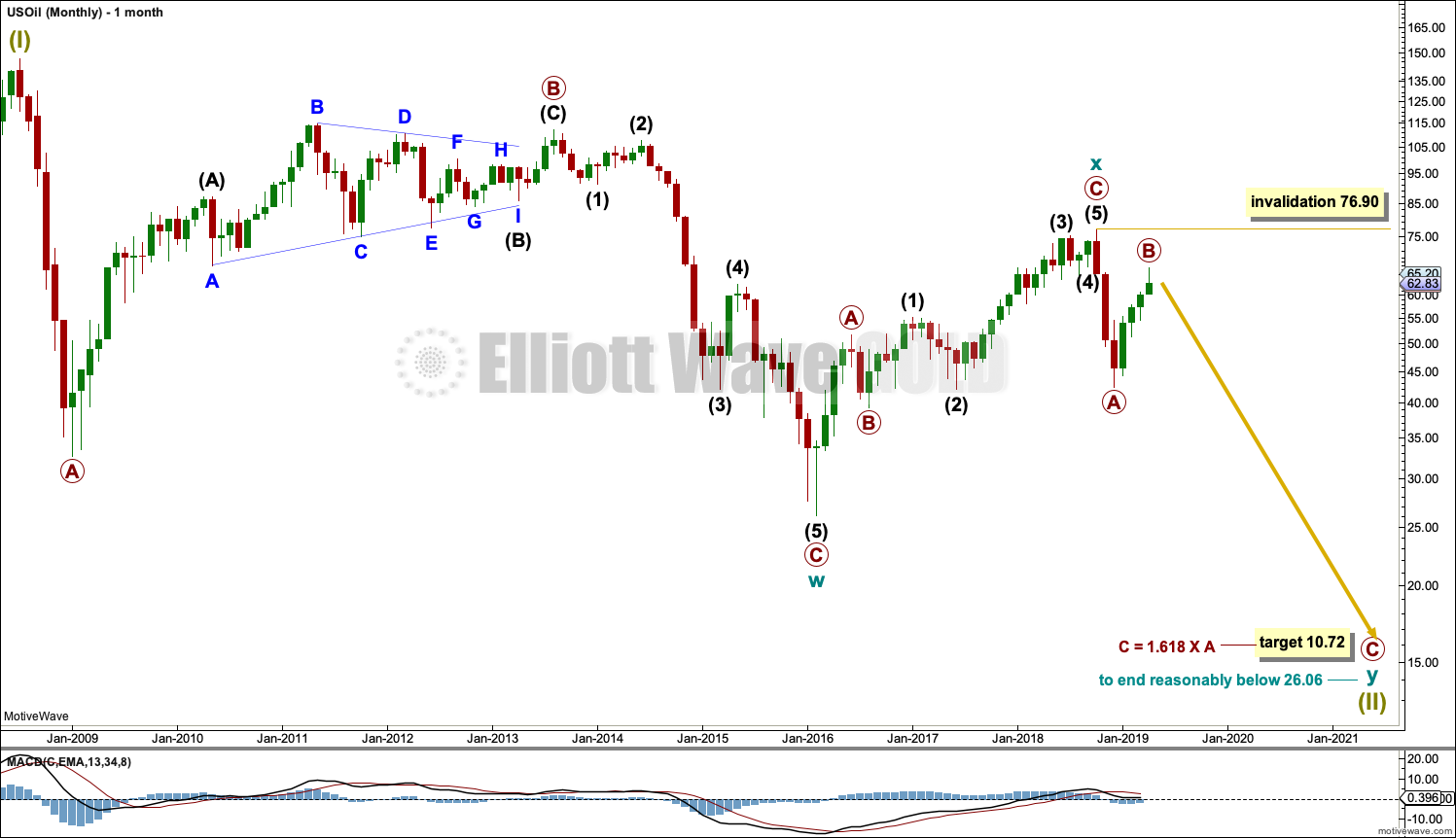

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

Classic technical analysis favours a bearish wave count for Oil at this time.

The large fall in price from the high in June 2008 to February 2016 is seen as a complete three wave structure. This large zigzag may have been only the first zigzag in a deeper double zigzag.

Upwards movement from February 2016 to October 2018 will not fit readily as a five wave structure but will fit very well as a three. With a three wave structure upwards, this indicates the bear market may not be over.

The first zigzag down is labelled cycle wave w. The double is joined by a now complete three in the opposite direction, a zigzag labelled cycle wave x.

The purpose of a second zigzag in a double is to deepen the correction when the first zigzag does not move price deep enough. Cycle wave y would be expected to move reasonably below the end of cycle wave w to deepen the correction. Were cycle wave y to reach equality with cycle wave w that takes Oil into negative price territory, which is not possible. Cycle wave y would reach 0.618 the length of cycle wave w at $2.33.

A better target calculation would be using the Fibonacci ratios between primary waves A and C within cycle wave y.

This week the degree of labelling within cycle wave y is moved up one degree in consideration of the size of the last two waves.

Within the zigzag of cycle wave y, primary wave A may have been over at the last low and now primary wave B may be complete this week. Were primary wave C to reach only equality in length with primary wave A, then cycle wave y would not move beyond the end of cycle wave w. The next Fibonacci ratio in the sequence is used to calculate a target for primary wave C.

If it continues higher, then primary wave B may not move beyond the start of primary wave A above 76.90.

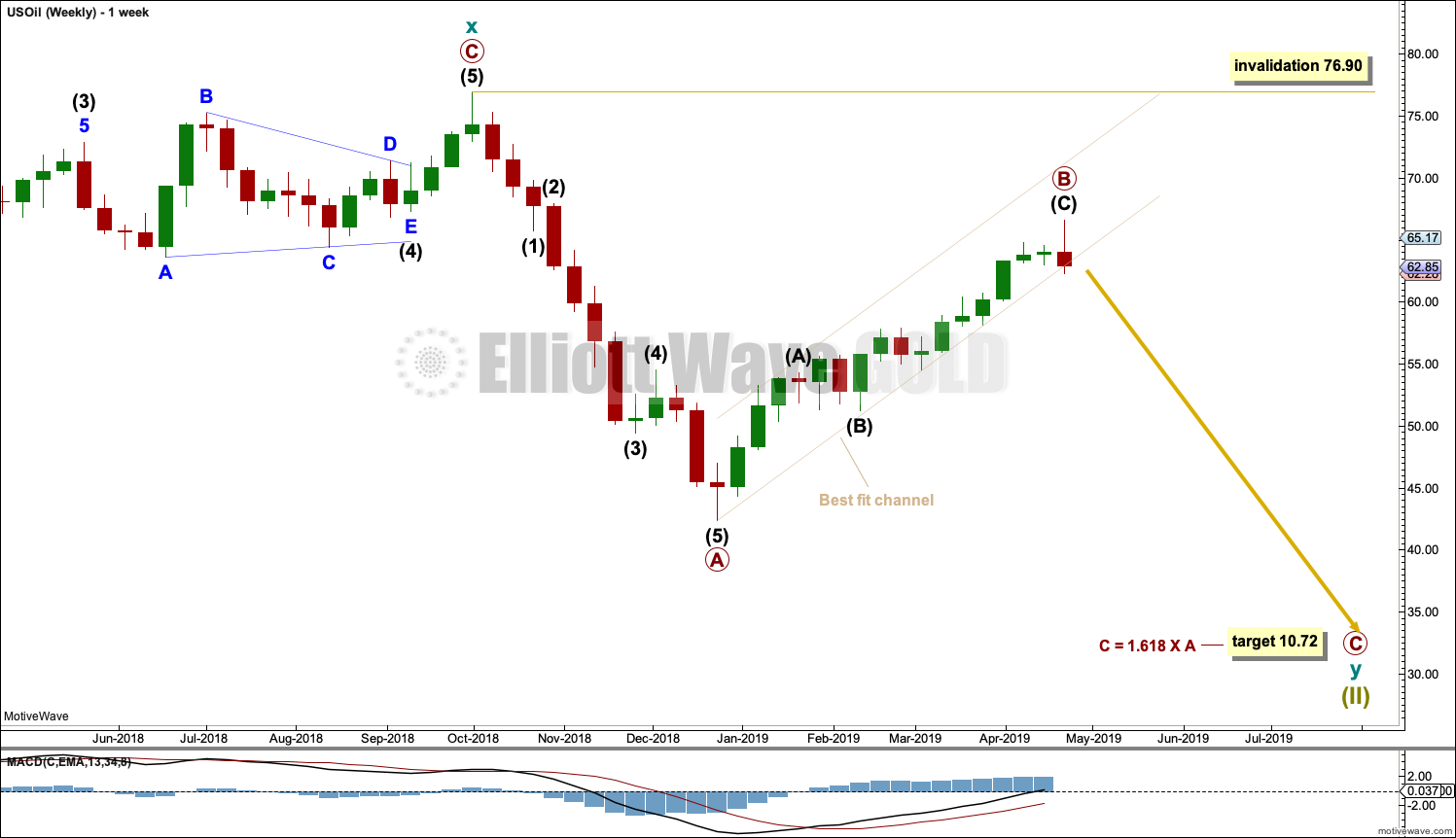

WEEKLY CHART

This weekly chart is focussed on the start of cycle wave y.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

Primary wave B may now be a complete single zigzag at the last high.

Primary wave C may have just begun. Primary wave C must subdivide as a five wave structure.

While there has not yet been a trend channel breach of the channel about primary wave B, the invalidation point must remain the same. If it continues higher, then primary wave B may not move beyond the start of primary wave A above 76.90.

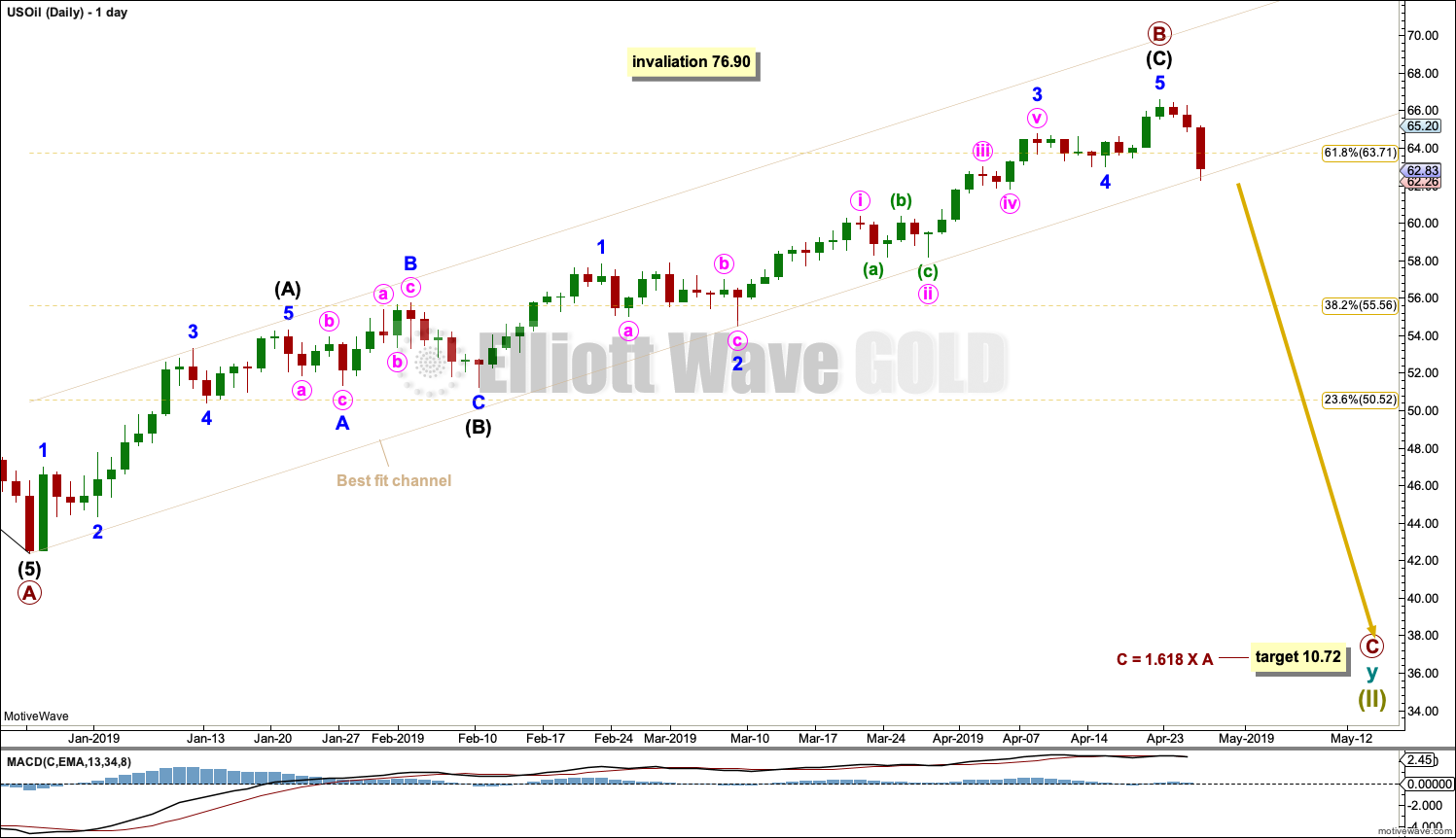

DAILY CHART

Primary wave B is now labelled as a complete single zigzag.

Note that monthly and weekly charts are on a semi-log scale, but this daily chart is on an arithmetic scale. This makes a slight difference to trend channels. Use this channel on a daily chart on an arithmetic scale.

The channel is drawn conservatively to contain all of the bounce of primary wave B. If a full daily candlestick is printed below and not touching the lower edge of this channel by a red daily candlestick, then that may be taken as indication primary wave B is over and primary wave C downwards has begun. At that point, the invalidation point may then be moved down to the high labelled primary wave B.

Primary wave C may last at least a year, and possibly longer. It may be extended in time; the subdivisions of intermediate waves (2) and (4) may show up at the weekly time frame.

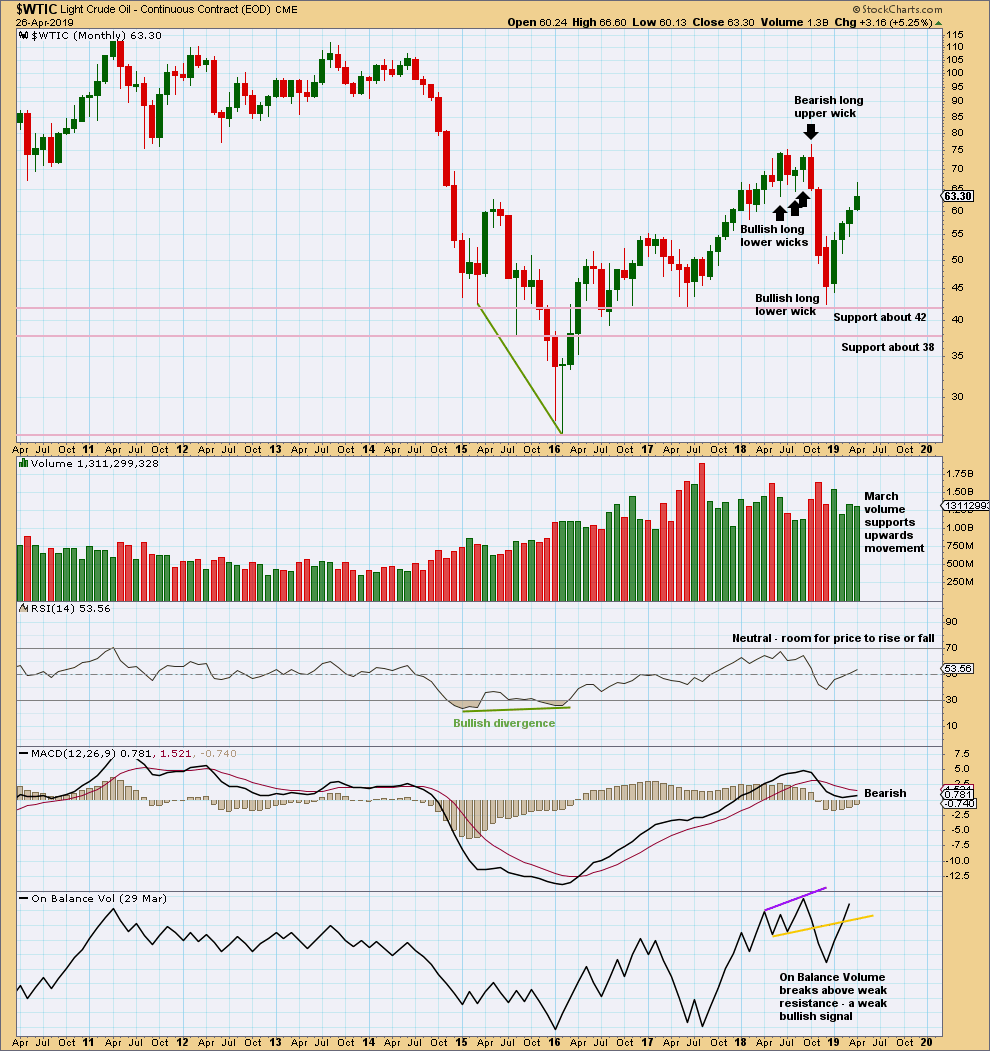

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This upwards bounce may be tiring.

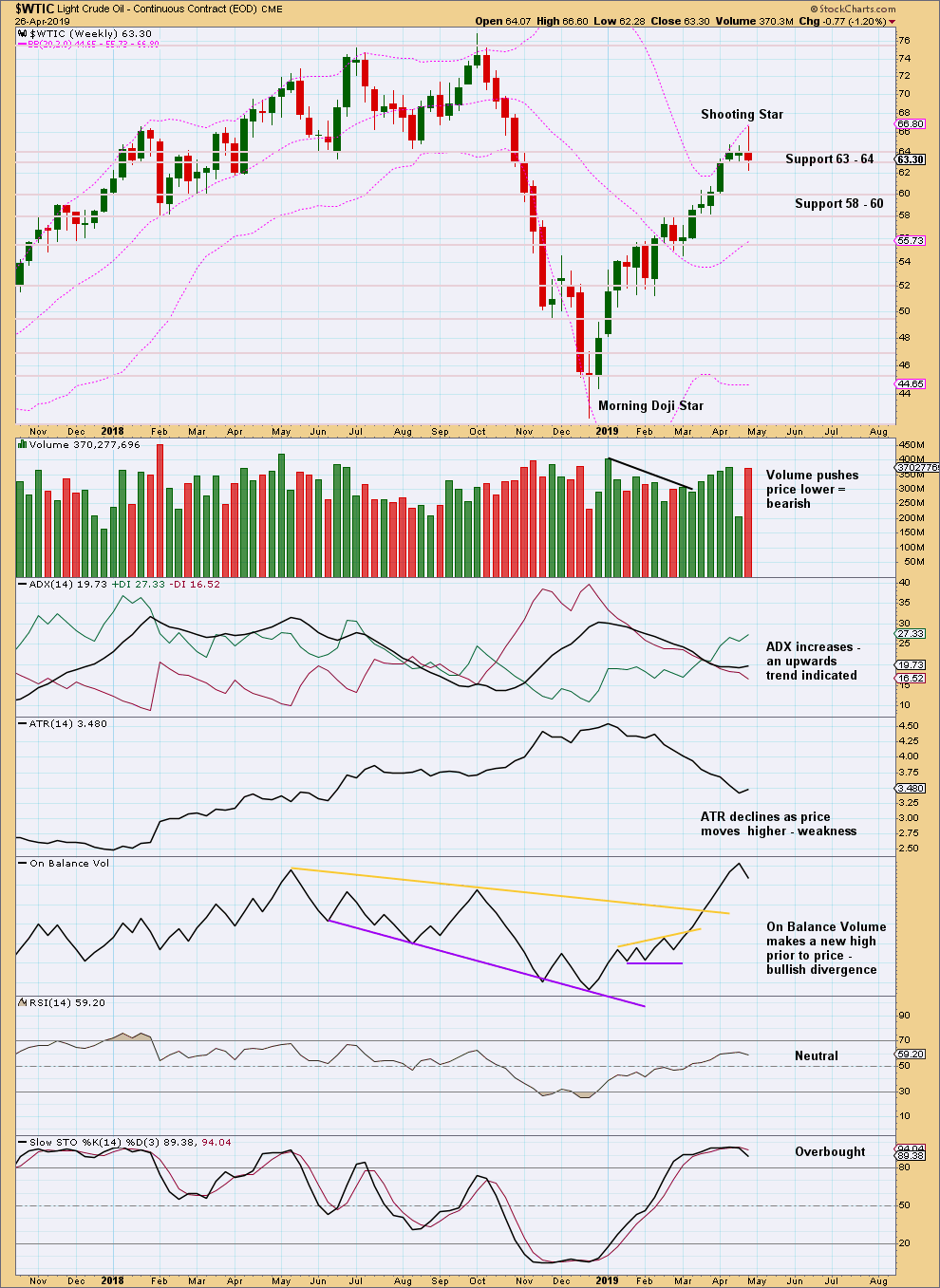

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A Shooting Star candlestick pattern is a bearish reversal pattern when it comes at the end of an upwards movement.

This week completed an outside week with the balance of volume downwards and a red candlestick. Volume during the week supports downwards movement. This adds significance to the Shooting Star pattern.

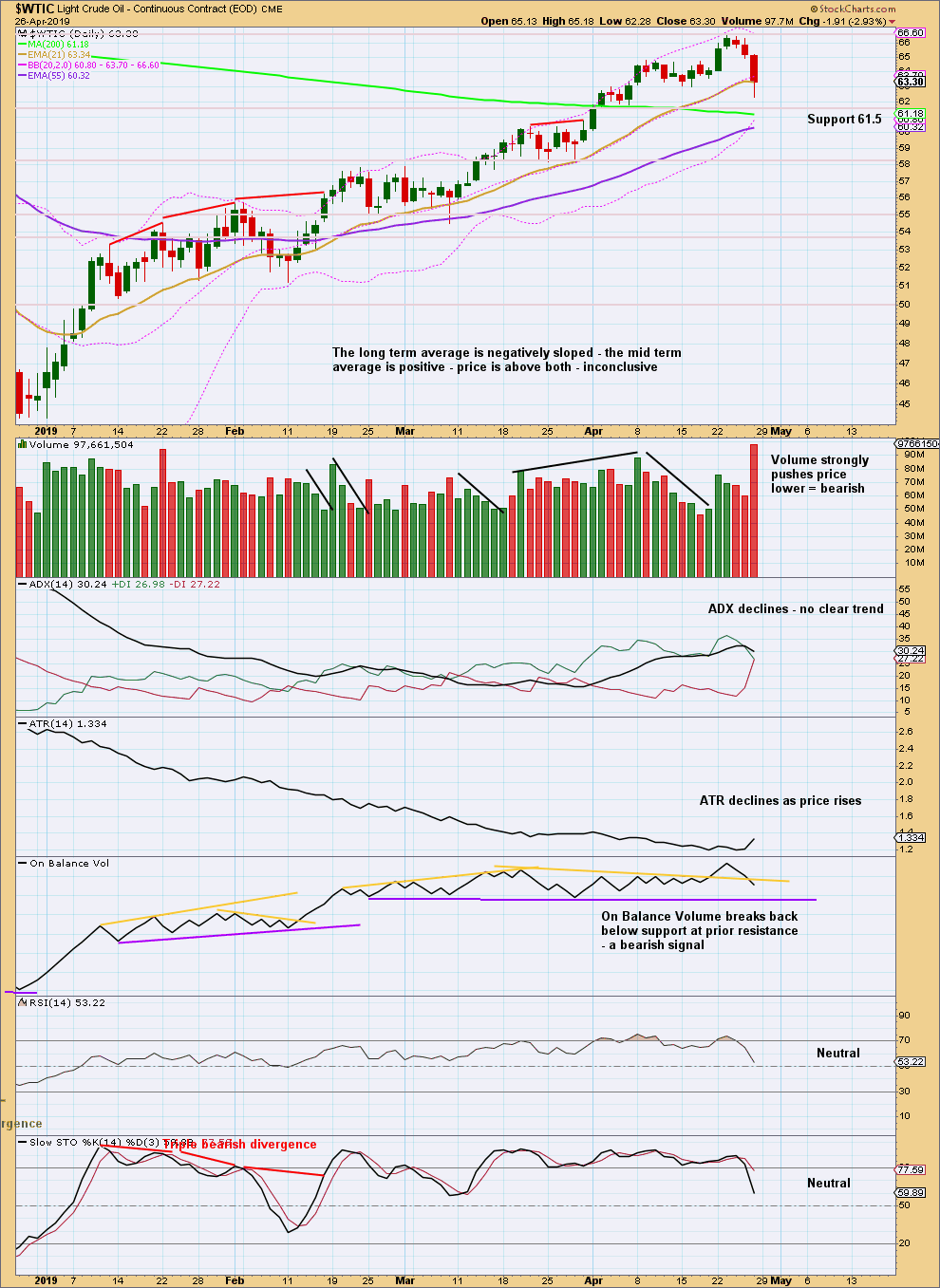

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the 24th of December 2018 there has been a series of higher highs and higher lows, the basic definition of an upwards trend. Assume this will continue until proven it has ended. A lower low below the low of the 28th of March 2019 would provide evidence the bounce is over.

Divergence between price and On Balance Volume almost disappeared at the last high. The signal from On Balance Volume is weak because this line was weakened by the prior bullish breach.

The short-term volume profile is strongly bearish. In conjunction with extreme RSI at highs and now a bearish reversal pattern on the weekly chart, it does look here like Oil may have finally found a high.

Published @ 06:52 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.