Downwards movement was expected for the week, but a new high above 58.75 indicated a deeper bounce. At that stage, the target was at 74.75.

Summary: A consolidation is expected to most likely continue sideways for a few more weeks. Resistance is about 66.59 and support is about 50.53. The breakout is expected to most likely be downwards.

The bullish alternate wave count would have confidence above 76.90. At that stage, a target for a third wave to end would be at 89.80.

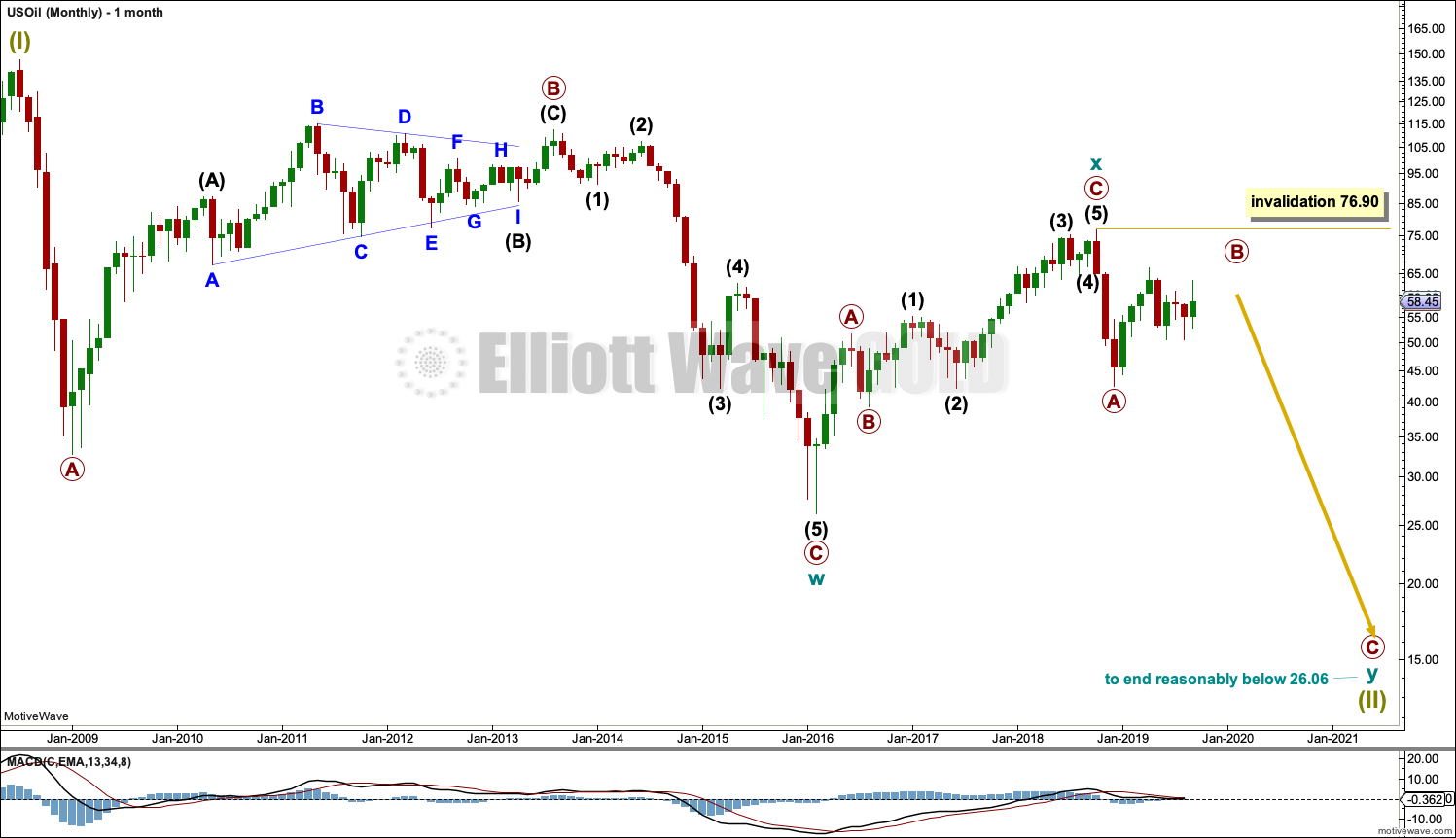

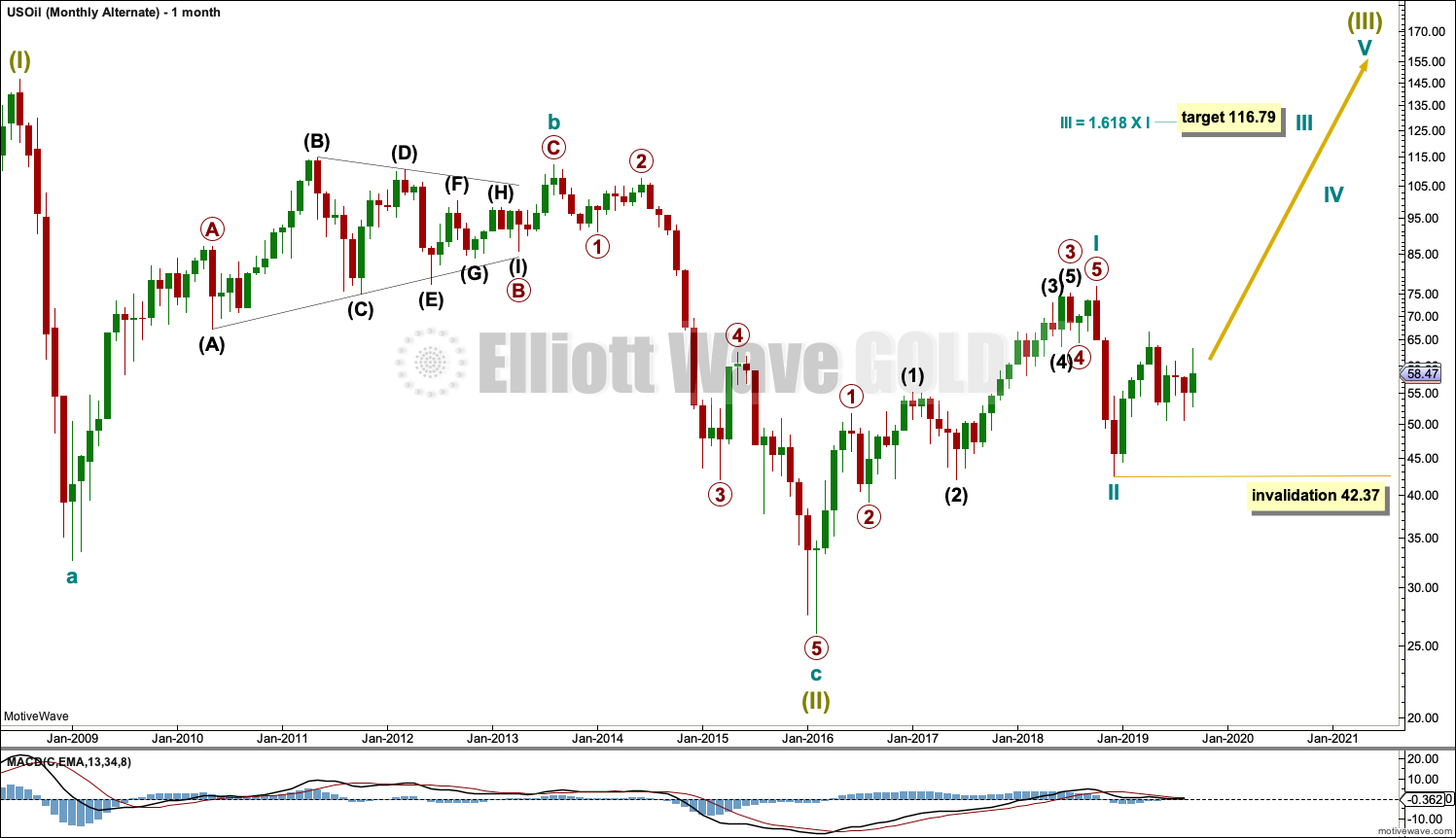

MAIN ELLIOTT WAVE COUNT – BEARISH

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil is still within a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil continues.

This Elliott wave corrective structure is a double zigzag, which is a fairly common structure. The correction is labelled Super Cycle wave (II).

The first zigzag in the double is complete and labelled cycle wave y. The double is joined by a three in the opposite direction labelled cycle wave x, which subdivides as a zigzag. The second zigzag in the double may now have begun, labelled cycle wave w.

The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price deep enough. To achieve this purpose cycle wave y may be expected to move reasonably below the end of cycle wave w at 26.06. The target is this week removed as primary wave B continues. When primary wave B may again be complete then the start of primary wave C may be known and a target may again be calculated.

Cycle wave y is expected to subdivide as a zigzag, which subdivides 5-3-5.

Cycle wave w lasted 7.6 years and cycle wave x lasted 2.7 years. Cycle wave y may be expected to last possibly about a Fibonacci 5 or 8 years.

Primary wave B may not move beyond the start of primary wave A above 76.90.

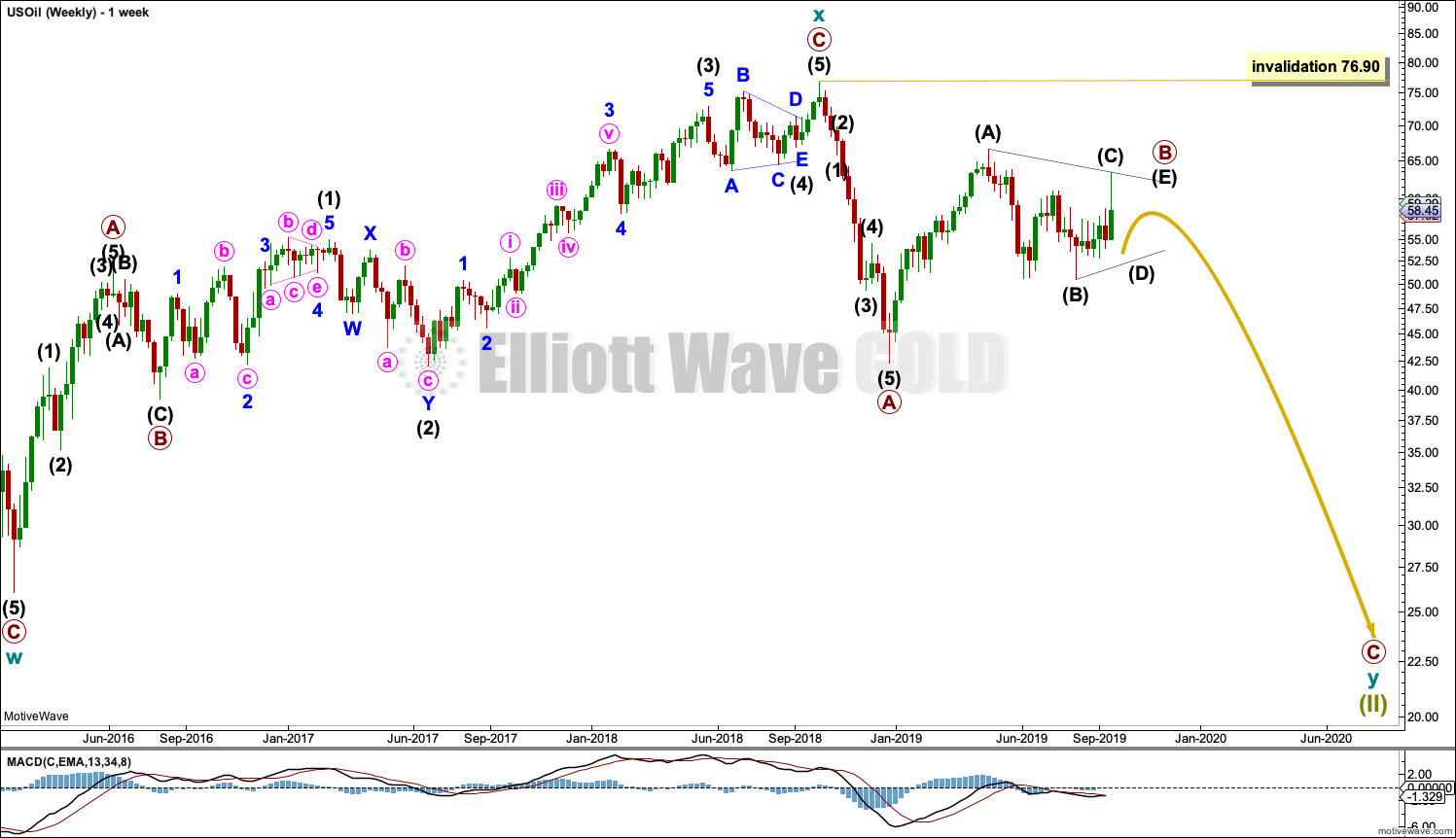

WEEKLY CHART

This weekly chart shows all of cycle waves x and y so far.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

Primary wave B may now be continuing further as a triangle or combination. Both ideas are outlined in daily charts below, and a triangle is labelled on the weekly chart.

When primary wave B may be complete, then a downwards breakout would be expected for primary wave C.

Primary wave B may not move beyond the start of primary wave A above 76.90.

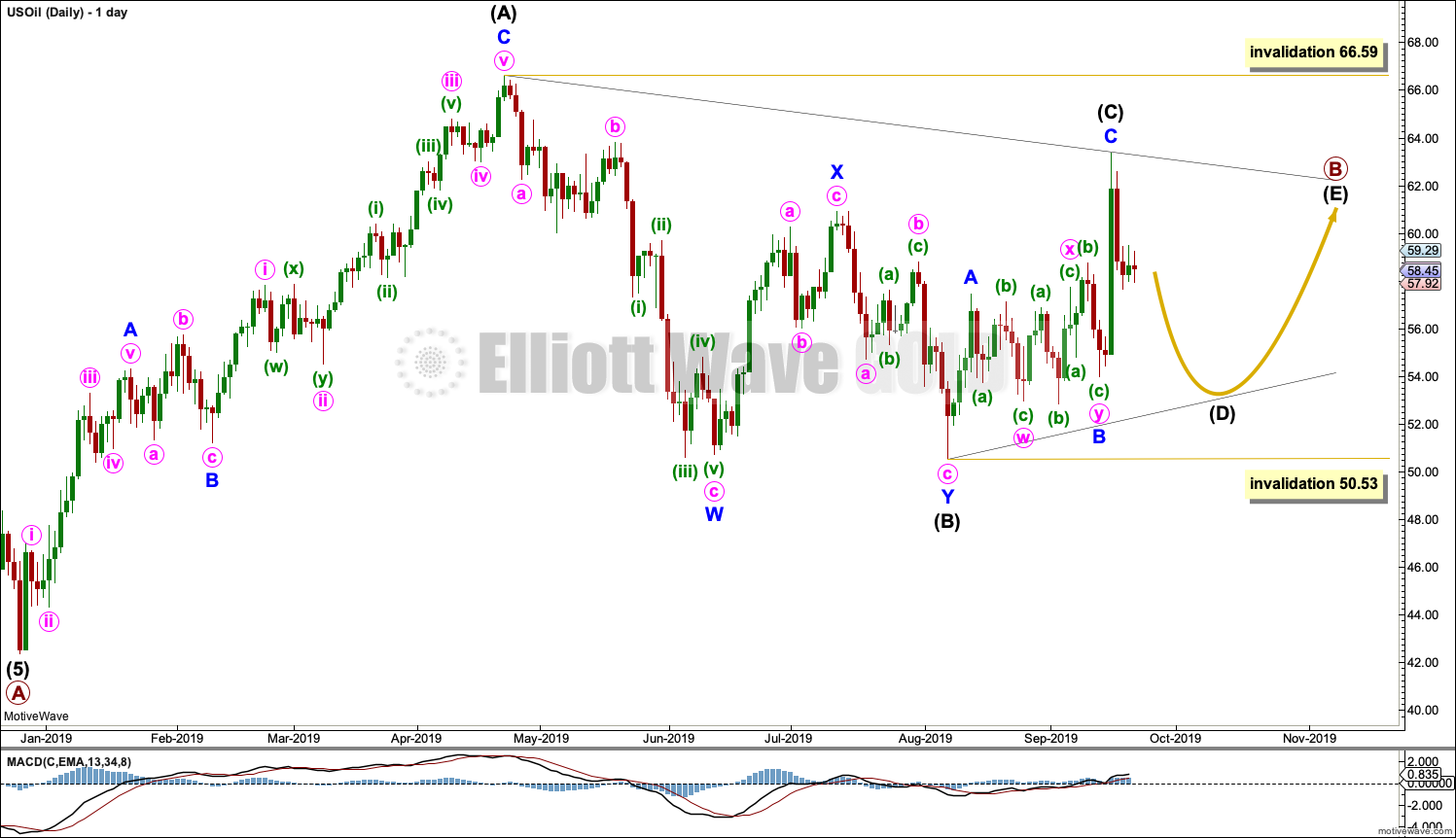

DAILY CHART

Note that monthly and weekly charts are on a semi-log scale, but this daily chart is on an arithmetic scale. This makes a slight difference to trend channels.

Elliott wave triangles are always continuation patterns. When primary wave B is complete, then a downwards breakout would be expected for primary wave C.

This chart considers a triangle for primary wave B. The triangle may be a regular contracting or regular barrier triangle.

Within a contracting triangle: intermediate wave (C) may not move beyond the end of intermediate wave (A) above 66.59; intermediate wave (D) may not move beyond the end of intermediate wave (B) below 50.53; intermediate wave (E) may not move beyond the end of intermediate wave (C), and would most likely fall short of the (A)-(C) trend line.

Within a barrier triangle: intermediate wave (C) may not move beyond the end of intermediate wave (A) above 66.59; intermediate wave (D) should end about the same level as intermediate wave (B) at 50.53 so that the (B)-(D) trend line is flat (in practice, this means that intermediate wave (D) may move slightly below intermediate wave (B) at 50.53; this invalidation point is not absolute for a barrier triangle); and, finally, intermediate wave (E) may not move beyond the end of intermediate wave (C), and would most likely fall short of the (A)-(C) trend line.

Within both a barrier and contracting triangle, the sub-wave of intermediate wave (C) could be over at this week’s high.

Within the zigzag, I have finally been able to see a satisfactory solution for minor wave B as a double flat correction. This labelling avoids all rare structures (such as running flats), meets all Elliott wave rules, and has a fairly normal and mostly sideways look of a double flat. Within the double flat, minute wave w is a regular flat and minute wave y is an expanded flat, exhibiting alternation.

All triangle sub-waves must subdivide as corrective structures. Four of the five sub-waves must subdivide as zigzags or zigzag multiples, with only one sub-wave allowed to subdivide as a multiple. So far intermediate wave (B) fits best as a double zigzag. All remaining waves of intermediate waves (C), (D) and (E) should now subdivide as single zigzags.

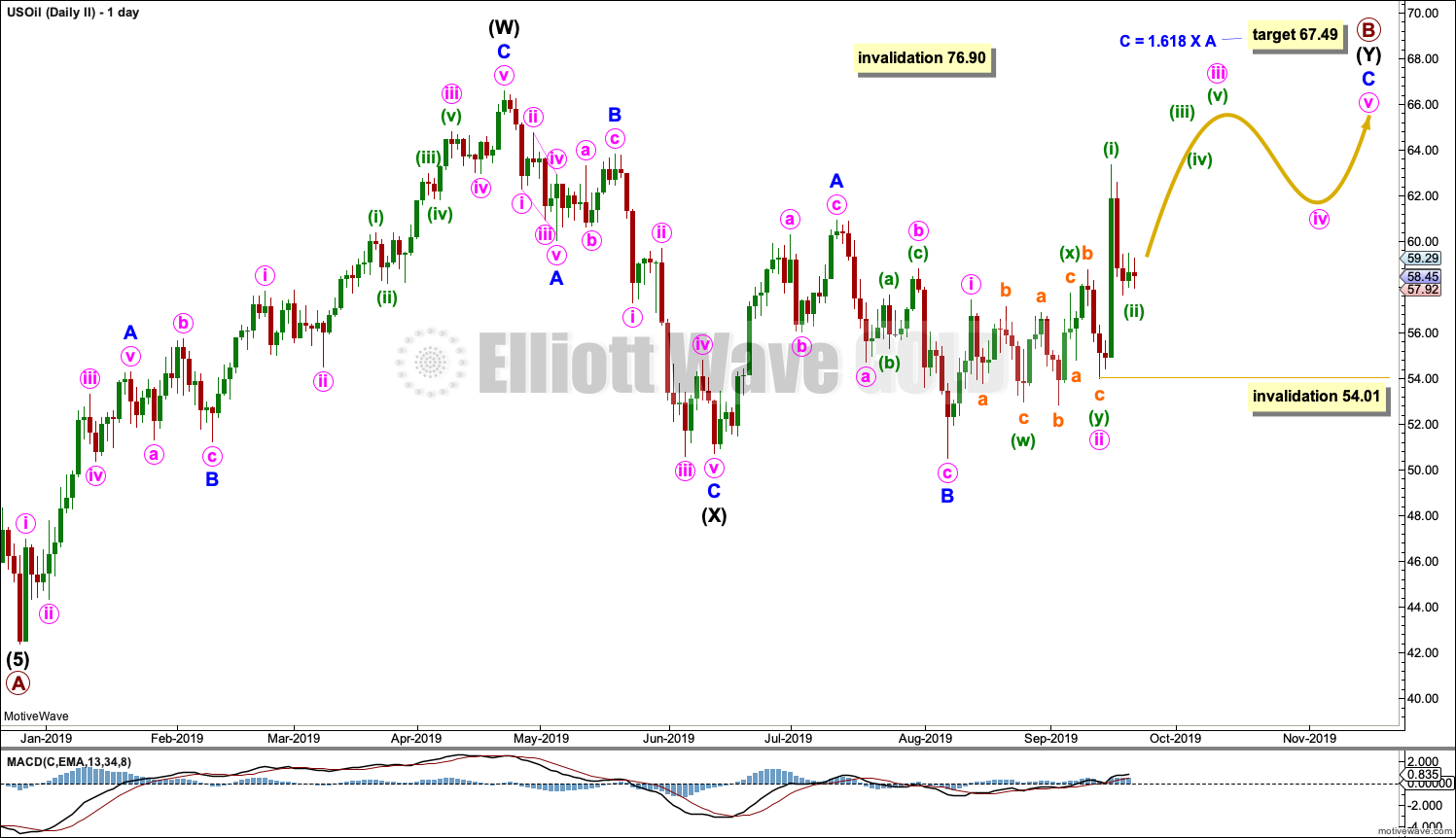

DAILY CHART II

When an Elliott wave triangle is considered, it is essential that alternates are also considered. Too many times an Elliott wave triangle may look to be completing only for the structure to be invalidated; the correction turns out to be something else, and the something else is almost always a combination.

Primary wave B may be a double combination: zigzag – X – flat. Intermediate wave (W) fits as a zigzag. Intermediate wave (Y) fits as a regular flat correction.

Within intermediate wave (Y), minor waves A and B both subdivide as threes. Minor wave B is a 1.02 length of minor wave A. For minor wave C to have room to complete its structure, the target calculated is for it to reach 1.618 the length of minor wave A.

The purpose of double combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends about the same level as the first. The target for intermediate wave (Y) would see this purpose achieved.

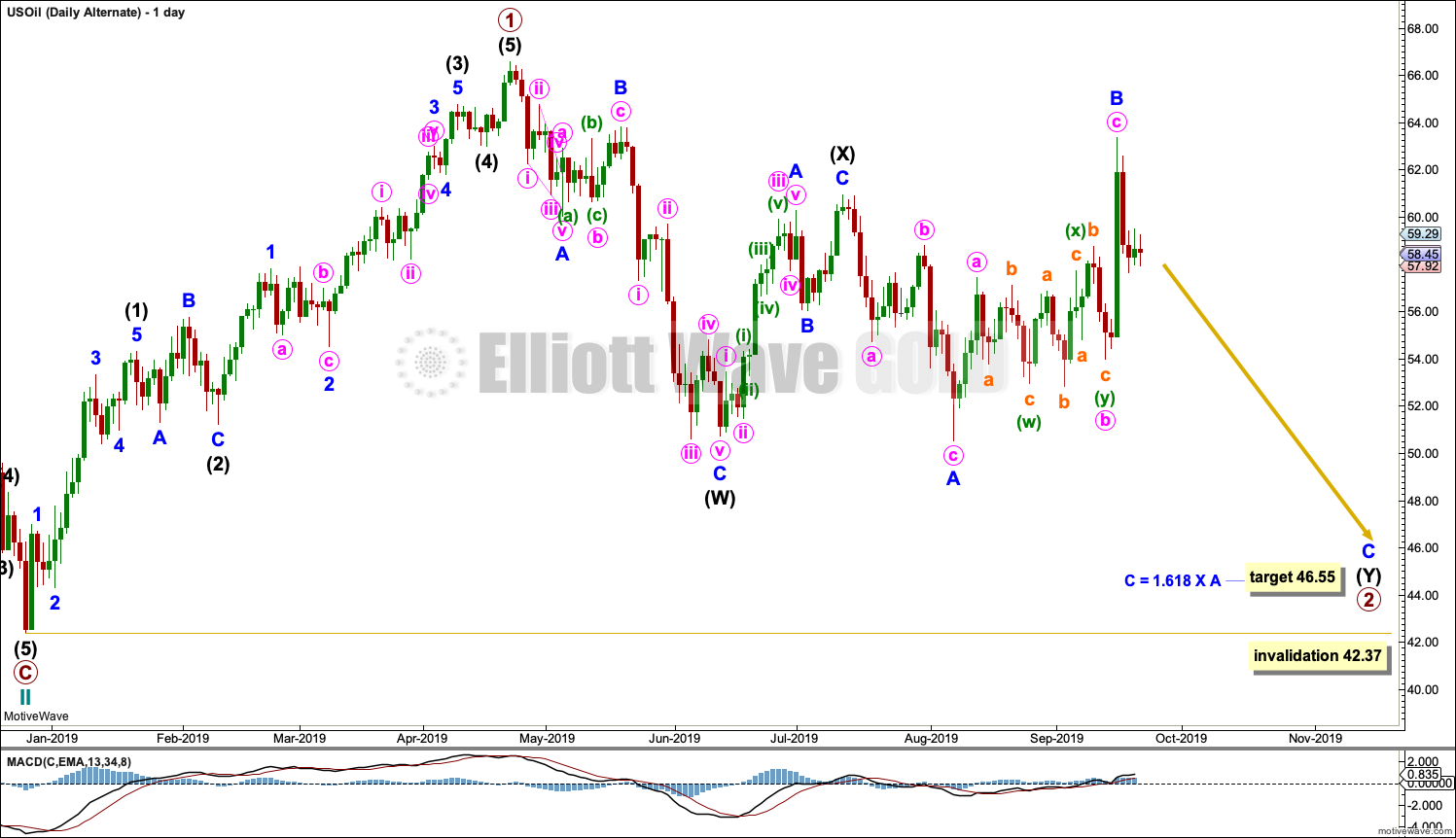

ALTERNATE ELLIOTT WAVE COUNT

MONTHLY CHART

It is possible that the bear market is over for Oil and a new bull market has begun.

For a bullish wave count for Oil, the upwards wave from the major low at 26.06 in February 2016 must be seen as a complete five wave impulse. This is labelled cycle wave I.

Cycle wave II may be a complete zigzag at 0.679 the depth of cycle wave I.

A target is calculated for cycle wave III to reach a common Fibonacci ratio to cycle wave I.

Within cycle wave III, no second wave correction may move beyond the start of its first wave below 42.37.

WEEKLY CHART

This weekly chart shows detail of cycle wave I as a five wave impulse.

Cycle wave II does look best as a three. This is the only part of this wave count that has a better look than the main wave count, which sees this downwards wave as a five.

The upwards wave of primary wave 1 within cycle wave III must be seen as a five wave structure for a bullish wave count to work. This movement at lower time frames does not subdivide well at all as a five; this reduces the probability of this wave count.

Cycle wave III may only subdivide as an impulse. Within cycle wave III, so far primary wave 1 may be complete. Primary wave 2 may be moving lower as a double zigzag. Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

DAILY CHART

Primary wave 2 may be continuing lower as a double combination.

The first structure in the double would be complete, a zigzag labelled intermediate wave (W). Within intermediate wave (W), minor wave C ends with a slight truncation for minute wave v. This is acceptable.

The double may be now joined by a complete three in the opposite direction, a zigzag labelled intermediate wave (X).

Intermediate wave (Y) may now be completing as an expanded flat correction. Within intermediate wave (Y), minor waves A and B both subdivide as threes, and minor wave B is a 1.24 length of minor wave A (this is within the most common range for B waves of flats from 1 to 1.38).

A target is calculated for minor wave C to exhibit the most common Fibonacci Ratio to minor wave A within an expanded flat.

Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

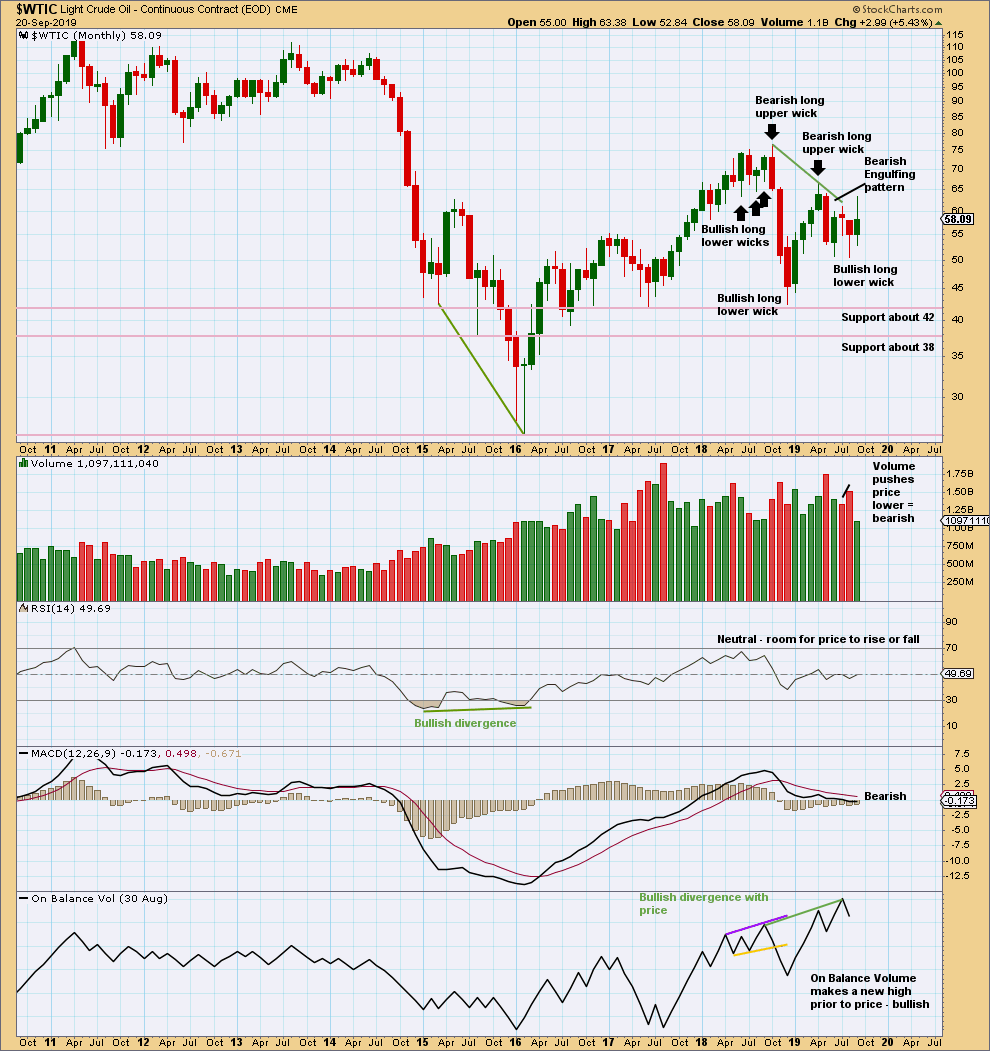

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

August has closed with a long lower wick, which is bullish, but price has moved lower with push from volume, which is bearish.

Overall, August is judged to be more bearish than bullish.

There is now double bullish divergence between price and On Balance Volume. This supports the alternate Elliott wave count.

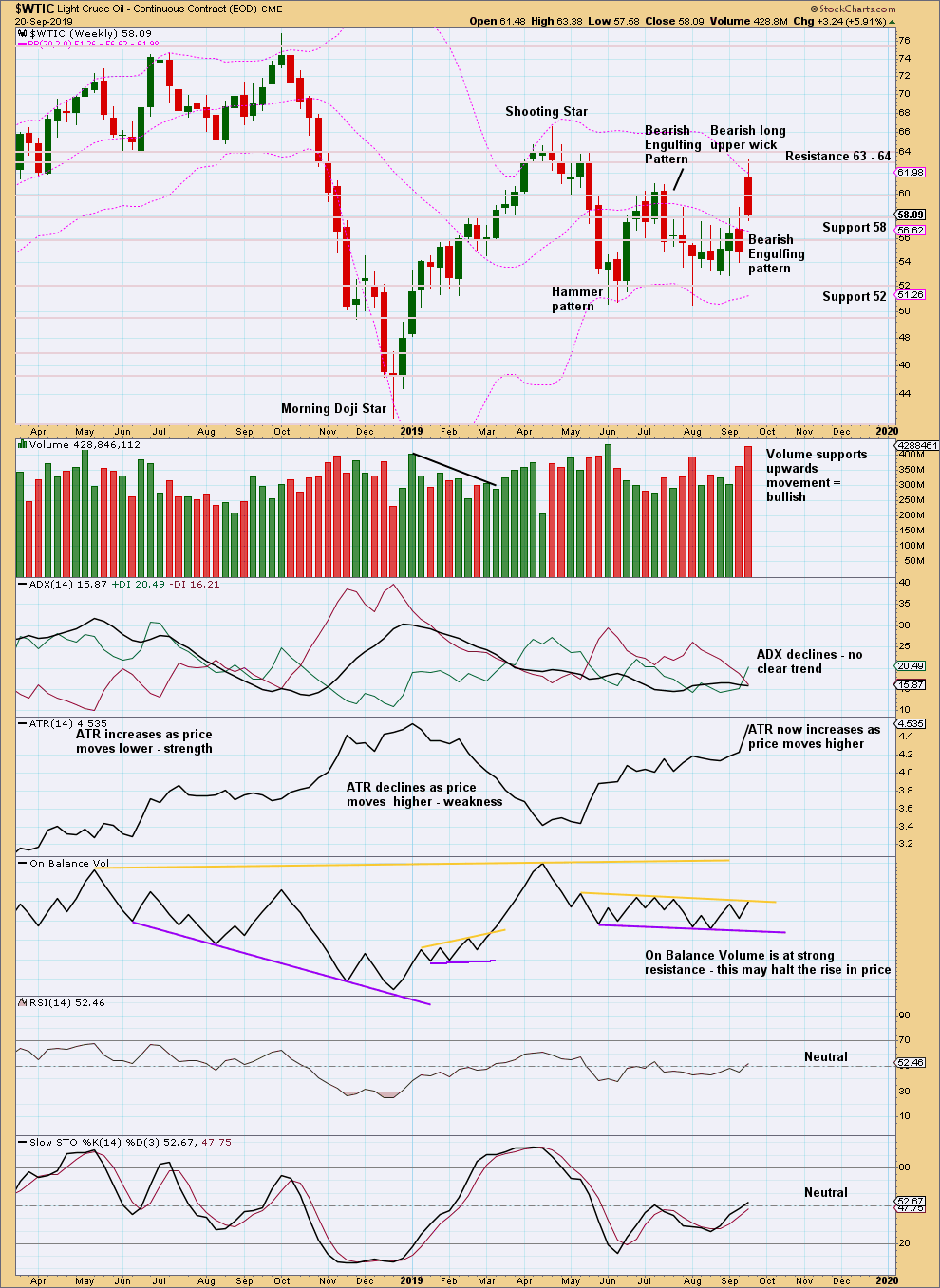

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week price broke out of a small range upwards. Next resistance is shown at 63 – 64.

Upwards movement has support from volume. The breakout is attended by a breakaway gap. But this week’s candlestick closes strongly red with a long upper wick; this looks concerning for bulls.

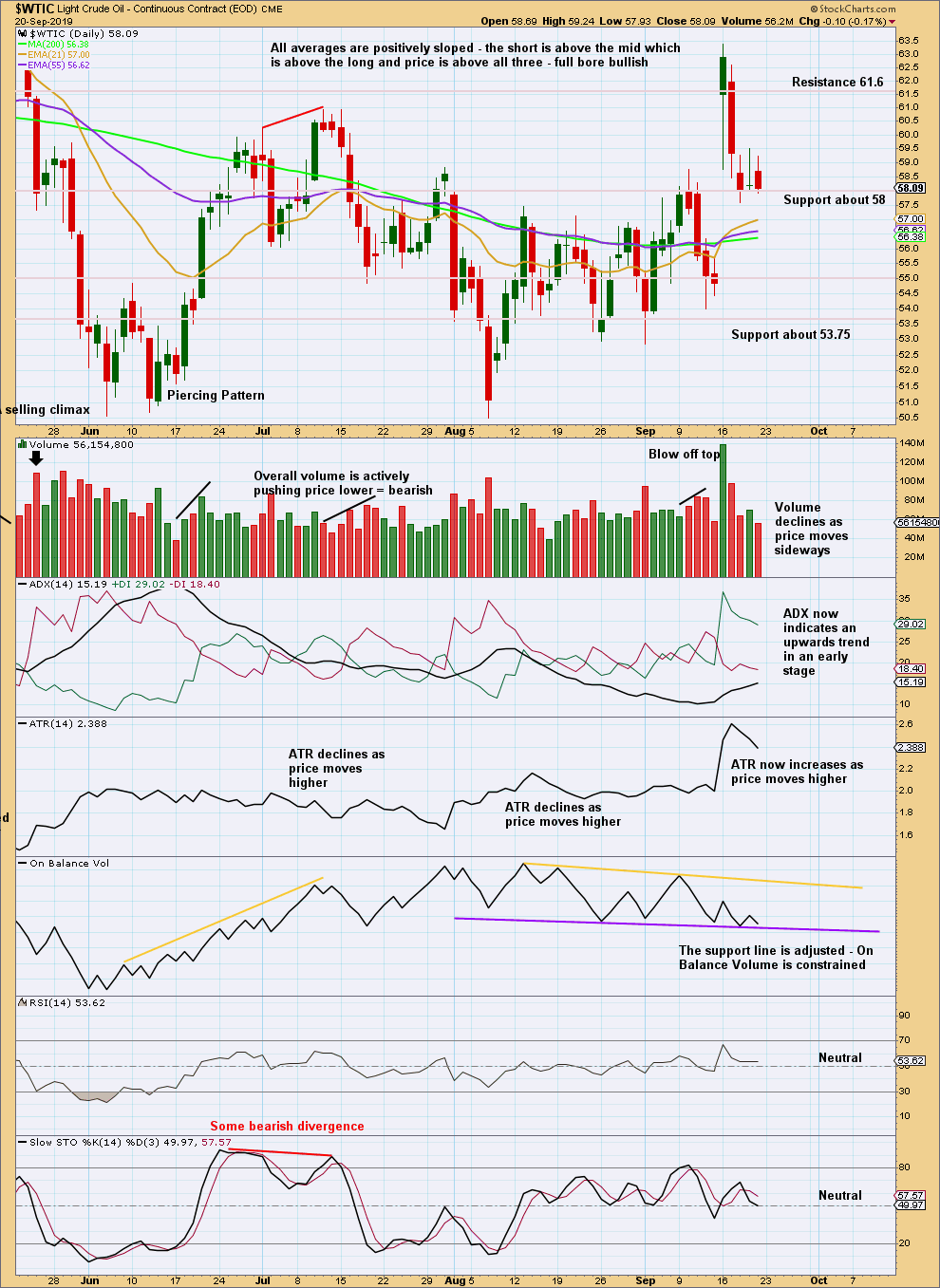

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The breakout above resistance, which was about 58 (and is now support), has strong support from volume, giving confidence. However, it has immediately been followed by a very strong bearish daily candlestick.

An upwards trend may be developing. Downwards movement to end the week may be a typical back test of support, but it does look stronger than is normal.

On Balance Volume may offer the next strong signal if it breaks out of its consolidation.

Published @ 08:09 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.