US OIL: Elliott Wave and Technical Analysis | Charts – January 3, 2020

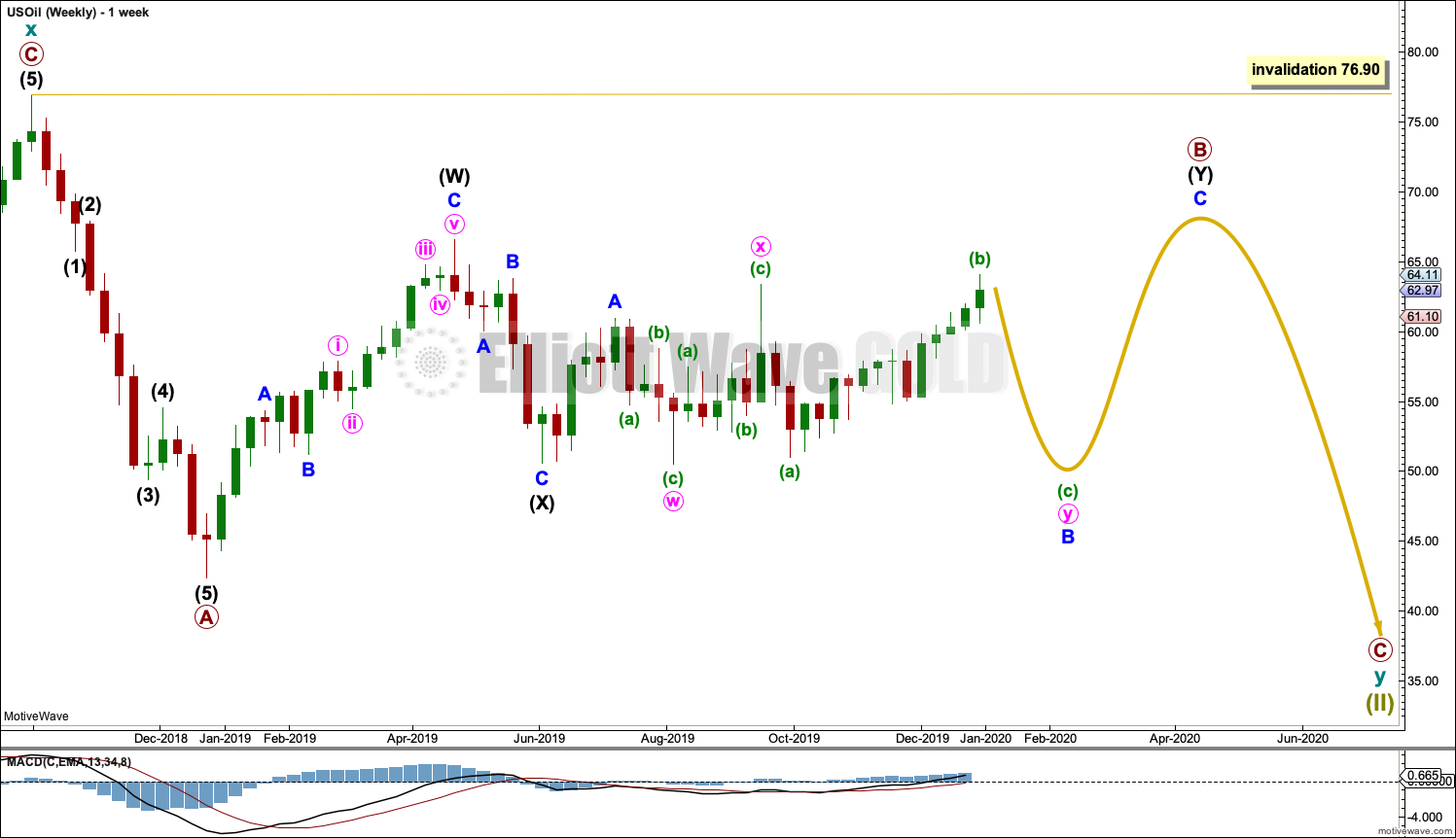

The triangle has been invalidated and the alternate Elliott wave count, which considers a combination, is now the main Elliott wave count.

Summary: Both the bullish and bearish Elliott wave counts now expect downwards movement. Targets are either 47.25 or 44.05.

MAIN ELLIOTT WAVE COUNT – BEARISH

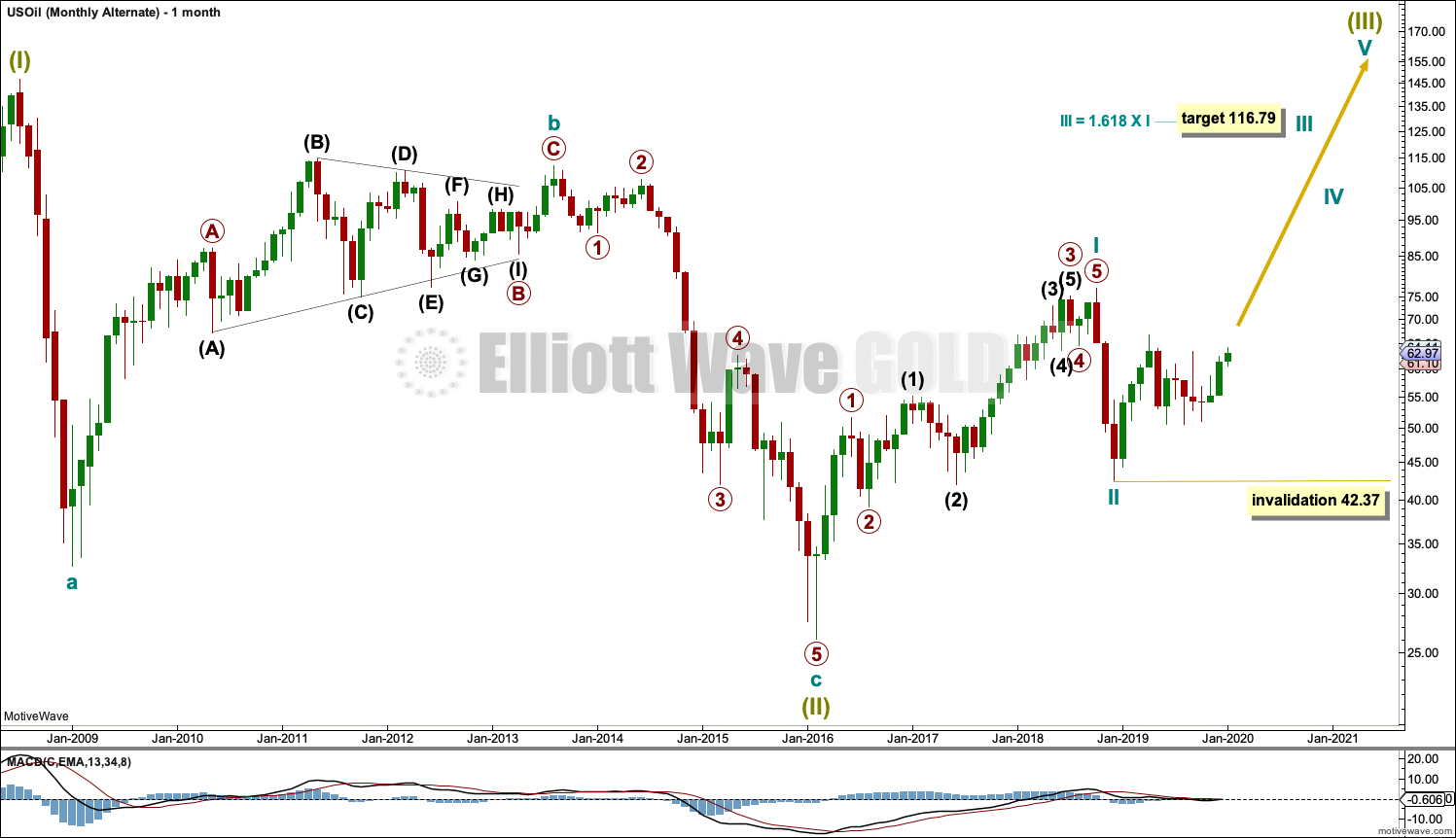

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil is still within a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil continues.

This Elliott wave corrective structure is a double zigzag, which is a fairly common structure. The correction is labelled Super Cycle wave (II).

The first zigzag in the double is complete and labelled cycle wave w. The double is joined by a three in the opposite direction labelled cycle wave x, which subdivides as a zigzag. The second zigzag in the double may now have begun, labelled cycle wave y.

The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price deep enough. To achieve this purpose cycle wave y may be expected to move reasonably below the end of cycle wave w at 26.06. When primary wave B may be complete then the start of primary wave C may be known and a target may be calculated.

Cycle wave y is expected to subdivide as a zigzag, which subdivides 5-3-5.

Cycle wave w lasted 7.6 years and cycle wave x lasted 2.7 years. Cycle wave y may be expected to last possibly about a Fibonacci 5 or 8 years.

Primary wave B may not move beyond the start of primary wave A above 76.90.

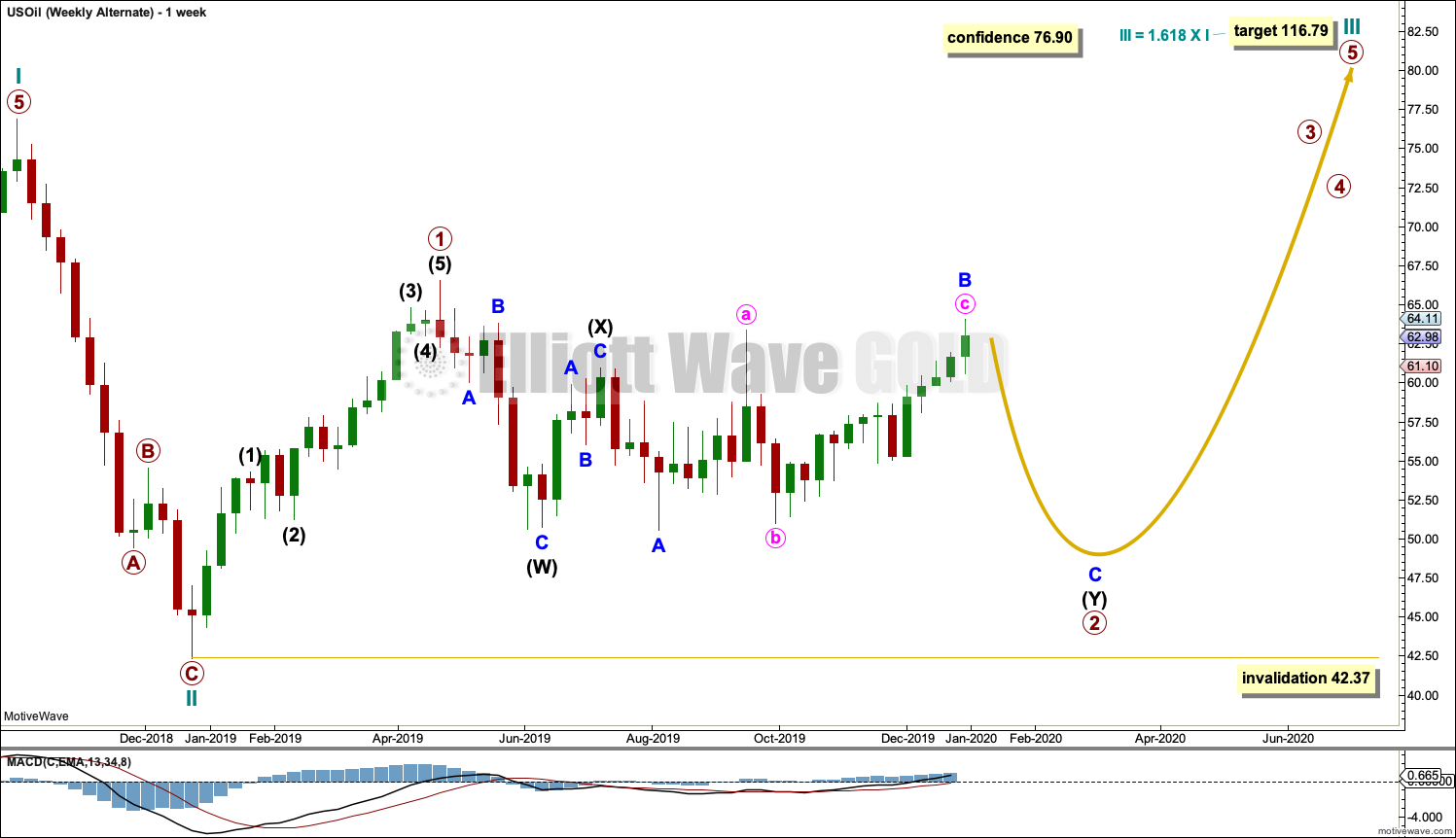

WEEKLY CHART

This weekly chart shows all of cycle wave y so far.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

This week a triangle for primary wave B was invalidated with a new high above 63.38. There is now only one wave count left for primary wave B.

Primary wave B may be a double combination: zigzag – X – flat. Intermediate wave (W) fits as a zigzag. Intermediate wave (Y) may be unfolding as a flat correction.

Within intermediate wave (Y), minor wave A may be complete. Minor wave B may be an incomplete double combination.

When primary wave B may be complete, then a downwards breakout would be expected for primary wave C.

Primary wave B may not move beyond the start of primary wave A above 76.90.

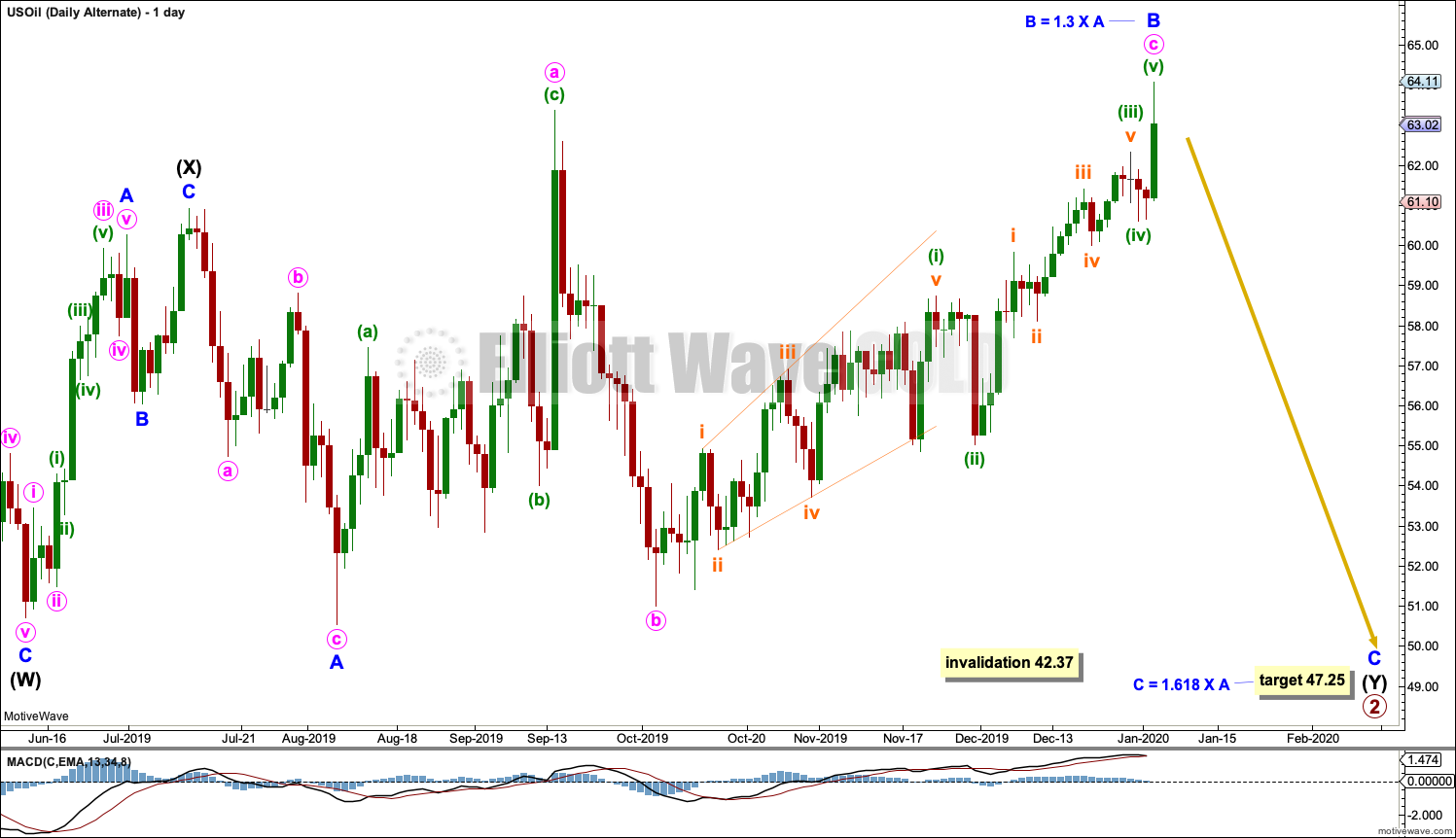

DAILY CHART

This daily chart shows all of intermediate wave (Y) so far.

Intermediate wave (Y) may be subdividing as a flat correction. Within the flat, minor wave A subdivides as a three and minor wave B may be an incomplete three. At its end, minor wave B must retrace a minimum 0.9 of minor wave A at 51.74.

Minor wave B may be subdividing as a double combination: zigzag – X – flat. Within the flat correction of minute wave y, minuette wave (b) has now retraced the minimum requirement of 0.9 the length of minuette wave (a); minuette wave (b) is within the common range of 1 – 1.38 times the length of minuette wave (a). Minuette wave (c) should now move at least slightly below the end of minuette wave (a) at 51.00 to avoid a truncation and a very rare running flat. The target calculated expects a common Fibonacci ratio to minuette wave (a).

When minor wave B may be complete, then minor wave C should move higher to end above the end of minor wave A at 60.93.

This wave count now expects the consolidation that Oil has been in for some months now may continue for several more weeks. An upwards swing may be complete and a downwards swing may develop from here.

ALTERNATE ELLIOTT WAVE COUNT

MONTHLY CHART

It is possible that the bear market is over for Oil and a new bull market has begun.

For a bullish wave count for Oil, the upwards wave from the major low at 26.06 in February 2016 must be seen as a complete five wave impulse. This is labelled cycle wave I.

Cycle wave II may be a complete zigzag at 0.679 the depth of cycle wave I.

A target is calculated for cycle wave III to reach a common Fibonacci ratio to cycle wave I.

Within cycle wave III, no second wave correction may move beyond the start of its first wave below 42.37.

WEEKLY CHART

Cycle wave II does look best as a three. This is the only part of this wave count that has a better look than the main wave count, which sees this downwards wave as a five.

The upwards wave of primary wave 1 within cycle wave III must be seen as a five wave structure for a bullish wave count to work. This movement at lower time frames does not subdivide well as a five; this reduces the probability of this wave count.

Cycle wave III may only subdivide as an impulse. Within cycle wave III, so far primary wave 1 may be complete. Primary wave 2 may be moving sideways as a double combination. Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

Primary wave 2 may be continuing as a double combination.

The first structure in the double would be complete, a zigzag labelled intermediate wave (W). Within intermediate wave (W), minor wave C ends with a slight truncation for minute wave v. This is acceptable.

The double may be now joined by a complete three in the opposite direction, a zigzag labelled intermediate wave (X).

Intermediate wave (Y) may now be completing as an expanded flat correction.

DAILY CHART

A triangle for intermediate wave (Y) has been invalidated with a new high reasonably above 63.38.

Intermediate wave (Y) may be unfolding as an expanded flat correction. Within the expanded flat, minor wave A subdivides as a three and minor wave B may now be a complete three that is within the normal range of 1 to 1.38 times the length of minor wave A.

A target is calculated for minor wave C that expects a common Fibonacci ratio to minor wave A. Minor wave C would be likely to make at least a slight new low below the end of minor wave A at 50.53 to avoid a truncation and a very rare running flat.

Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

TECHNICAL ANALYSIS

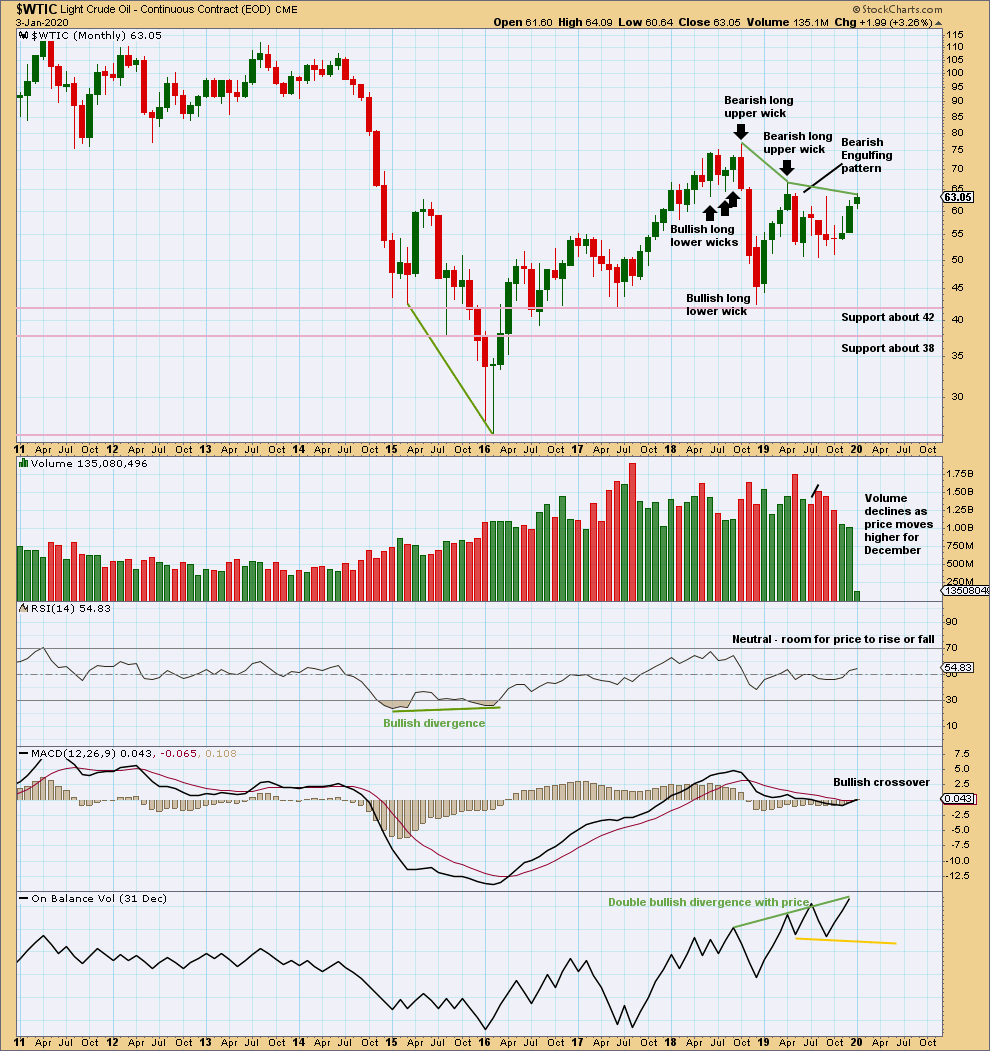

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now double bullish divergence between price and On Balance Volume. This supports the alternate Elliott wave count.

Overall, price has been moving sideways for a few months now. Within this sideways movement, the downwards month of May has greatest range and volume; this supports the main Elliott wave count. The last completed month of December 2019 closes within the range and lacks support from volume.

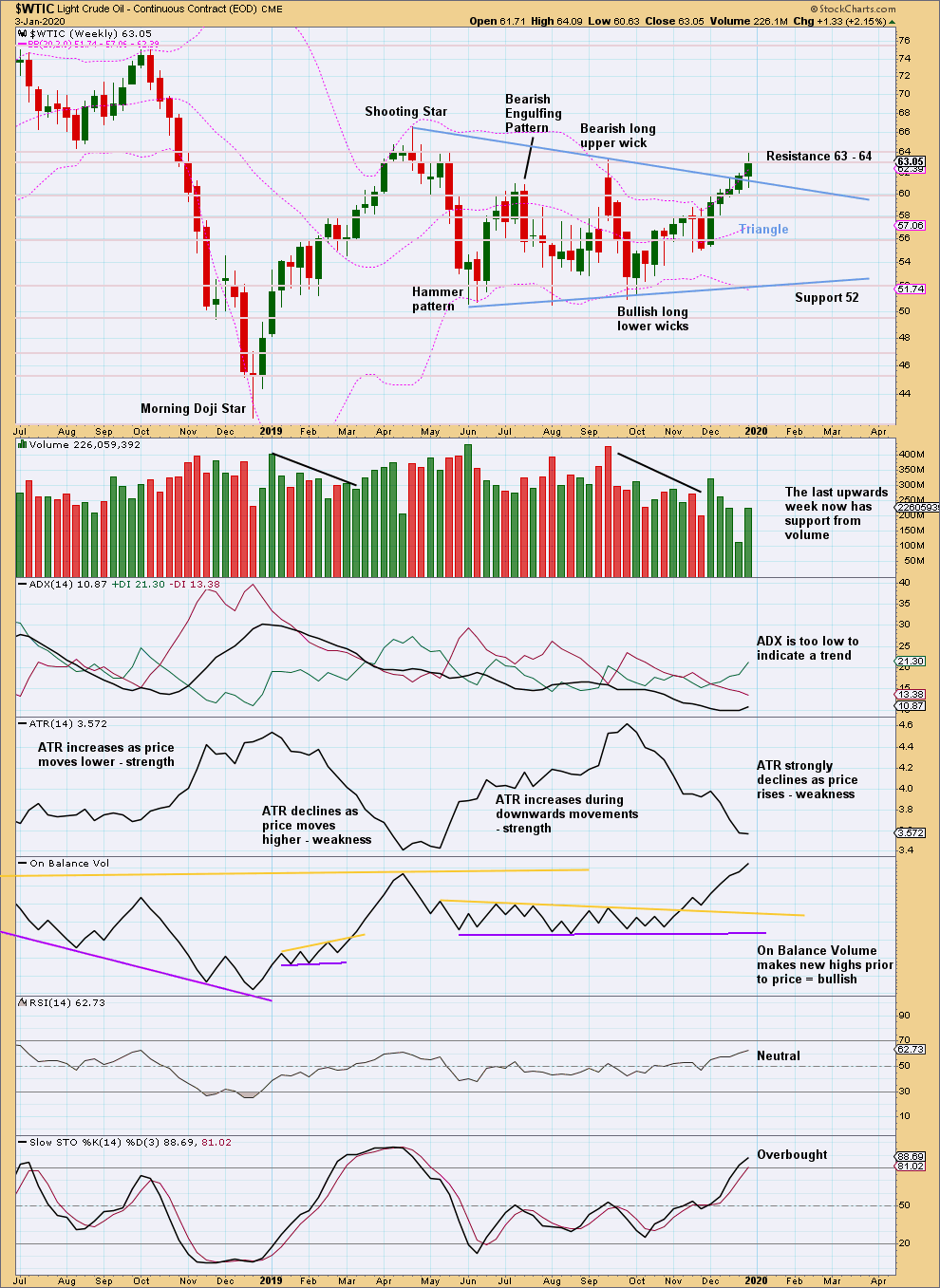

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A large triangle may be complete. The upwards breakout now has some support from volume.

A target calculated from the triangle would be at 77.21.

However, price remains within a larger consolidation zone and has not been able yet to overcome resistance at 64.

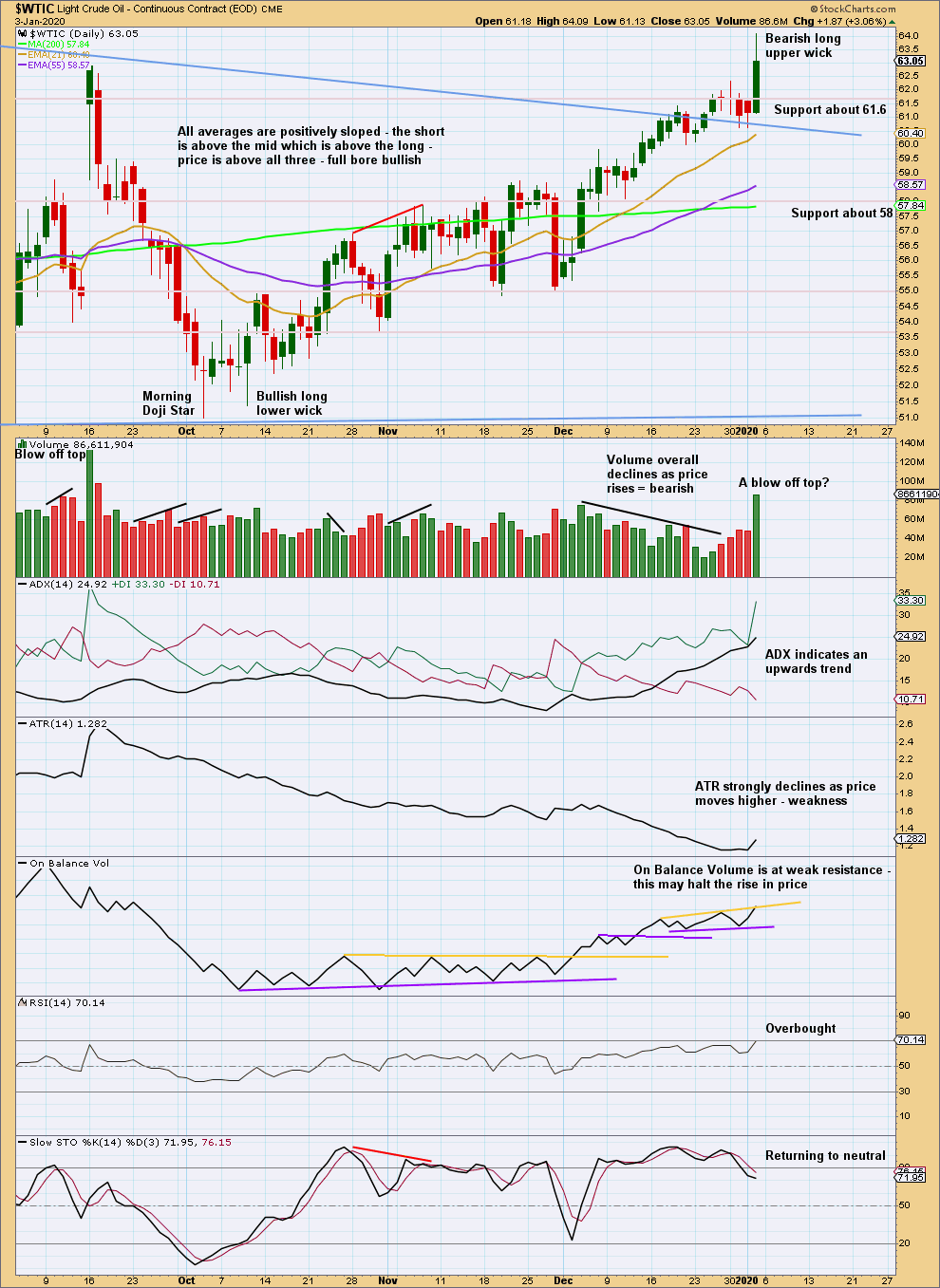

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is currently an upwards trend in place at this time frame, but it lacks both support from volume and ATR. This trend is weak. Conditions are now extreme and price is at resistance (larger picture on the weekly chart level). This upwards trend at the daily chart level may be an upwards swing within the context of a larger consolidation, which may end here or soon.

Published @ 06:32 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

0 Comments