SILVER: Elliott Wave and Technical Analysis | Charts – April 3, 2020

An inside small range week continues a consolidation, which was expected. The breakout is still expected to be in the same direction but a new alternate Elliott wave count considers a new possibility.

Summary: Sideways movement may continue for another one to few weeks in a range with support about 11.70 and resistance about 14.46 or 16.16. Thereafter, the downwards trend may resume. The final target is at 5.806.

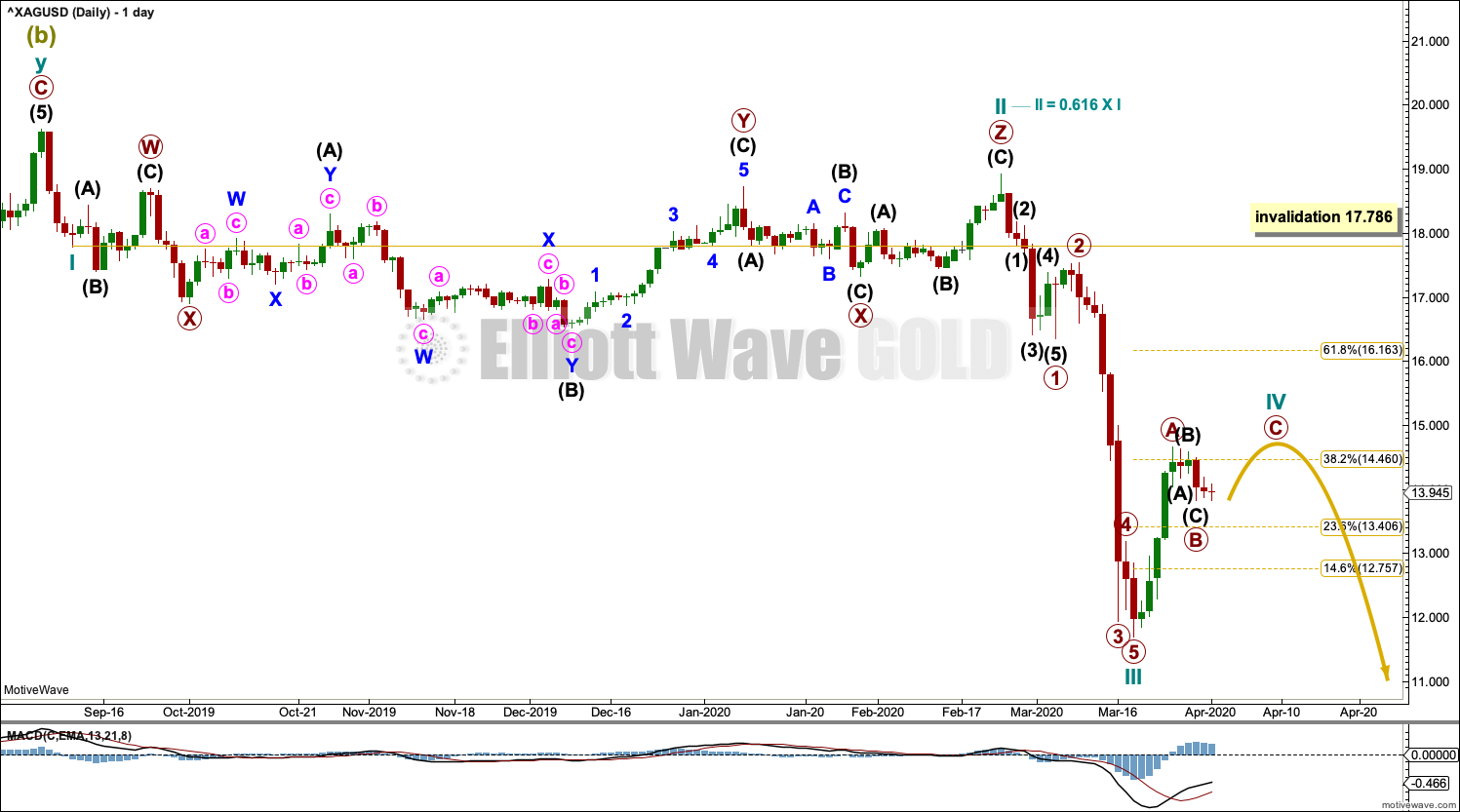

ELLIOTT WAVE COUNTS

MAIN WAVE COUNT

MONTHLY CHART

The bear market for Silver may be incomplete. Within a bearish movement, in the middle there should be a large interruption to the trend in the form of a B wave; bearish movements should have a three wave look to them. This wave count expects that normal look.

This Elliott wave structure for this bear market is labelled as a single zigzag for Grand Super Cycle wave II. Single zigzags are the most common Elliott wave corrective structure.

Within the zigzag, Super Cycle wave (a) subdivides as a five wave impulse, and Super Cycle wave (b) may now be a complete double combination. Super Cycle wave (c) may have begun and must subdivide as a five wave motive structure, either an impulse (much more likely) or an ending diagonal (less likely but still possible).

A target is now calculated for Super Cycle wave (c) to complete the zigzag for Grand Super Cycle wave II. Calculations using the more common ratios of equality and 0.618 yield negative results, so the next Fibonacci ratio in the sequence of 0.382 is used.

Within Super Cycle wave (c), no second wave correction may move beyond its start above 19.628.

Draw a channel about the zigzag of Grand Super Cycle wave II: draw the first trend line from the start of Super Cycle wave (a) to the end of Super Cycle wave (b), then place a parallel copy on the end of Super Cycle wave (a). The lower edge of then channel may provide support and may show where Grand Super Cycle wave II finally ends.

WEEKLY CHART

Super Cycle wave (b) may be a complete double combination.

Super Cycle wave (c) must subdivide as a five wave motive structure, most likely an impulse.

Cycle waves I through to III may be complete. Cycle wave IV may not move into cycle wave I price territory above 17.786.

DAILY CHART

Cycle wave IV may have begun. Cycle wave IV may not move into cycle wave I price territory above 17.786.

Cycle wave II was a rare triple combination that lasted 24 weeks and was deep at 0.616 of cycle wave I. Cycle wave IV may exhibit alternation as a zigzag, although it may subdivide as any Elliott wave corrective structure. Cycle wave IV may most likely be shallow and so resistance about the 0.382 Fibonacci ratio may hold.

Cycle wave IV may be more brief than cycle wave II; fourth waves tend to be more brief than second waves in commodities, particularly if fourth waves are zigzags. However, it may still be expected to last at least a few weeks.

Cycle wave IV may be subdividing as a zigzag. Within Cycle wave IV, primary wave B may be complete as labelled, or equally as likely primary wave B may continue sideways or lower.

TECHNICAL ANALYSIS

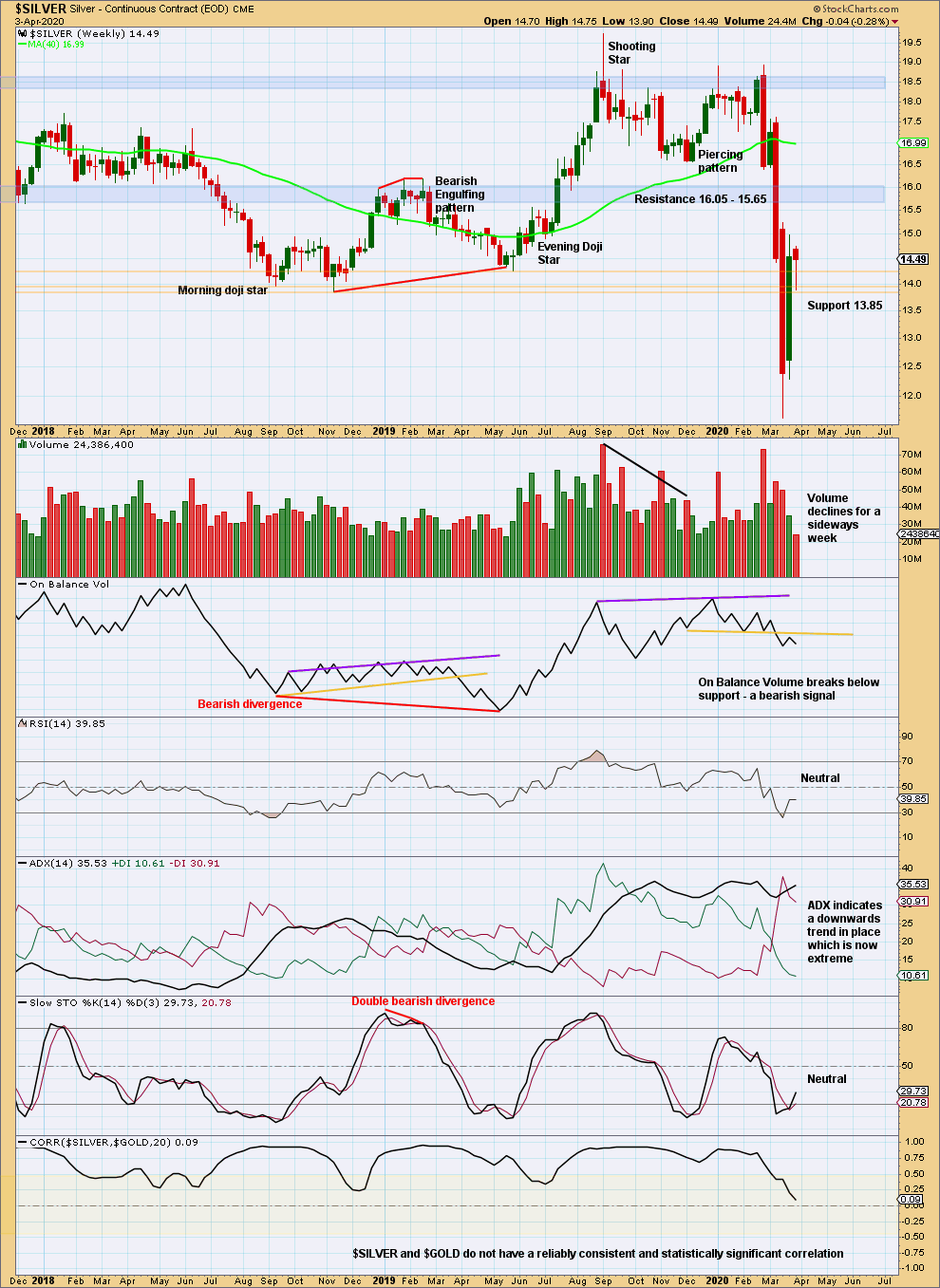

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range inside week with very weak volume looks like a small pause within a consolidation.

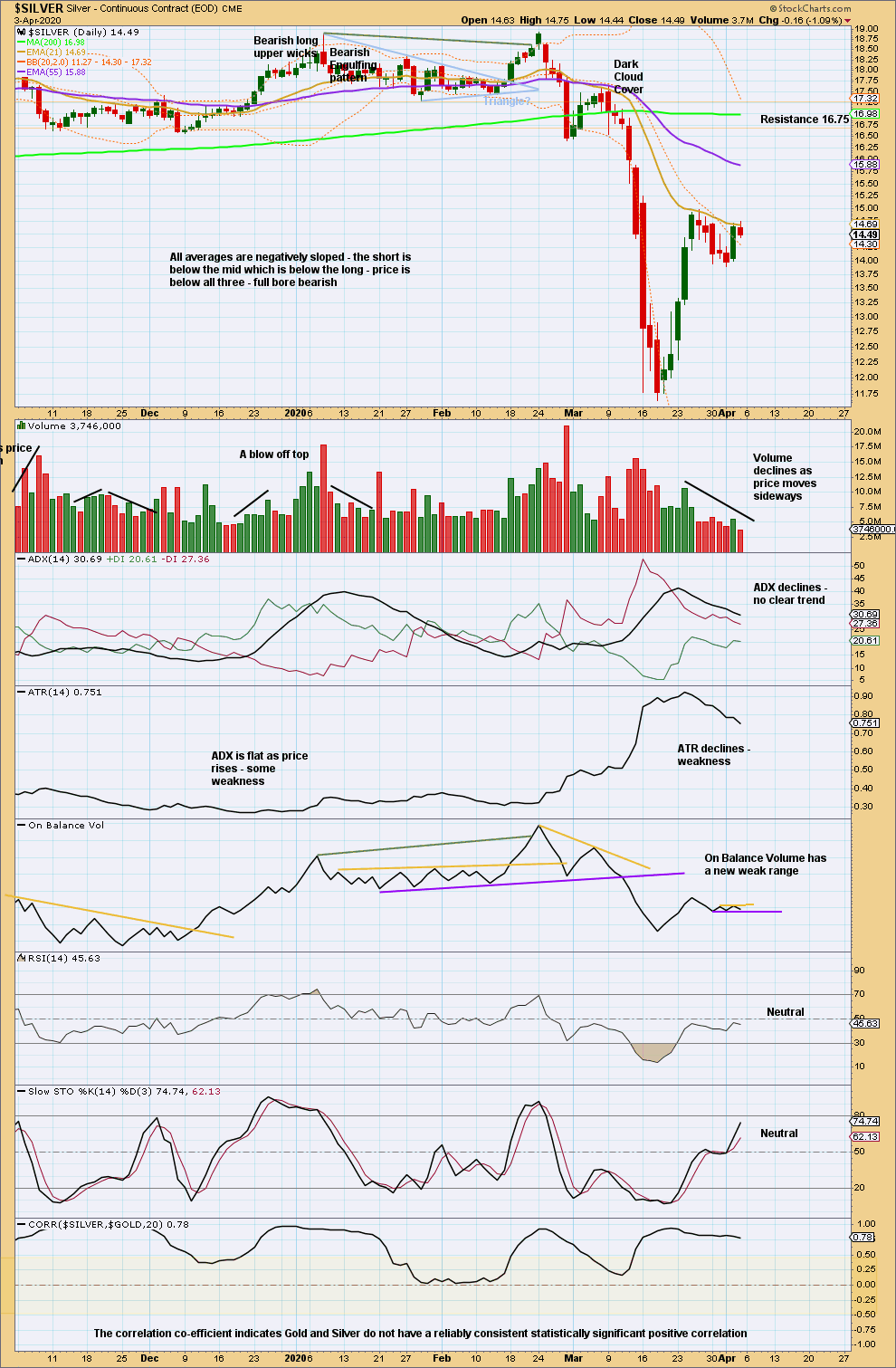

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A bounce and now a consolidation is relieving extreme conditions. The bounce may not be over yet. The short-term volume profile is bullish.

Published @ 01:47 p.m. EST on April 4, 2020.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.