SILVER: Elliott Wave and Technical Analysis | Charts – July 3, 2020

A new high slightly above 18.357 has invalidated the main daily Elliott wave count and left an alternate wave count valid.

Summary: For the short to mid term, price may continue higher but should turn before 21.023. A possible target is 19.50.

A new low now below 16.962 would indicate a trend change and a multi-week pullback.

The main wave count is now bullish and expects new highs substantially above 49.752 in coming years.

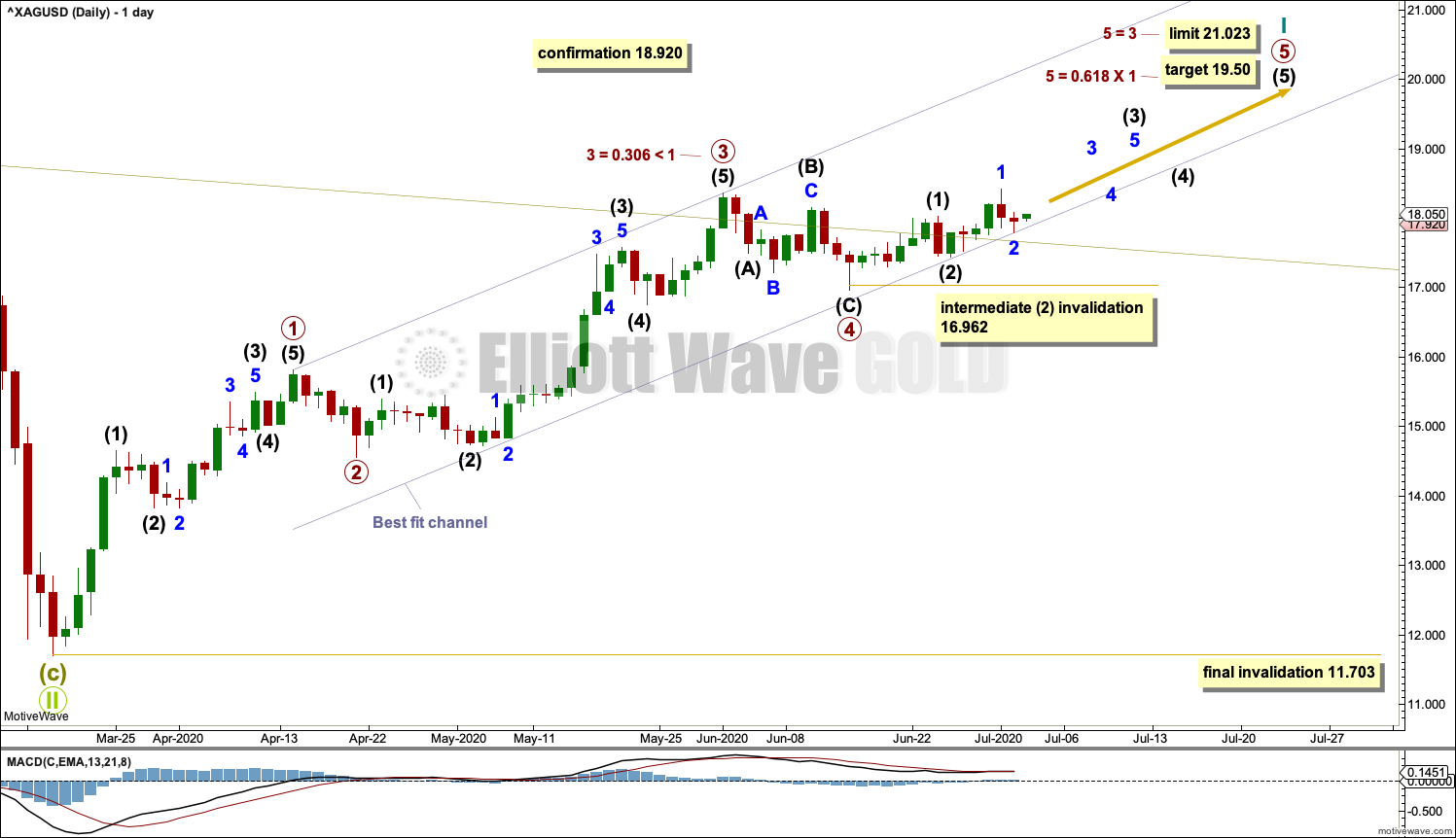

ELLIOTT WAVE COUNT

MONTHLY CHART

The bear market for Silver may be complete.

This Elliott wave structure for this bear market is labelled as a single zigzag for Grand Super Cycle wave II. Single zigzags are the most common Elliott wave corrective structure.

Within the zigzag: Super Cycle wave (a) subdivides as a five wave impulse, Super Cycle wave (b) subdivides as a complete regular contracting triangle, and Super Cycle wave (c) subdivides as a complete five wave impulse that is relatively brief and shallow.

Draw a channel about the entire bear market of Grand Super Cycle wave II as shown. A breach of the upper edge of this channel would add confidence to this wave count. Price may have found resistance at the upper edge of this channel, which may have initiated a pullback.

When charts are drawn on a semi-log scale, price has perfectly turned down from the upper edge of the trend channel. Copy this channel over to weekly and daily charts.

Grand Super Cycle wave III must subdivide as a five wave impulse at Super Cycle degree.

WEEKLY CHART

Grand Super Cycle wave II may be a complete zigzag. A new bull market may have begun for Silver.

The channel about Grand Super Cycle wave II is copied over from the monthly chart and extended outwards.

Super Cycle wave (I) must subdivide as a five wave motive structure, either an impulse or a leading diagonal. An impulse is much more common, so that is what shall be expected unless overlapping suggests a diagonal should be considered.

Cycle wave I may be incomplete.

Cycle wave II may not move beyond the start of cycle wave I below 11.703.

DAILY CHART

Cycle wave I may be an incomplete five wave impulse. Primary waves 1 and 2 within the impulse may be complete.

Primary wave 3 may be complete, finding resistance about the upper edge of the channel copied over from weekly and monthly charts.

Primary wave 4 may be complete.

Primary wave 5 may have begun. Intermediate wave (2) within primary wave 5 may not move beyond the start of intermediate wave (1) below 16.962. Leaving the invalidation point here allows for the possibility that labelling within primary wave 5 may be wrong and intermediate wave (2) may be yet to begin. This is more conservative.

Draw a channel as shown about cycle wave I. The lower edge continues to be where pullbacks are finding support. While price is within this channel, assume this wave count may be correct. A breach of this channel would indicate a possible trend change; at that stage, cycle wave I may be over.

Cycle wave II may not move beyond the start of cycle wave I below 11.703.

TECHNICAL ANALYSIS

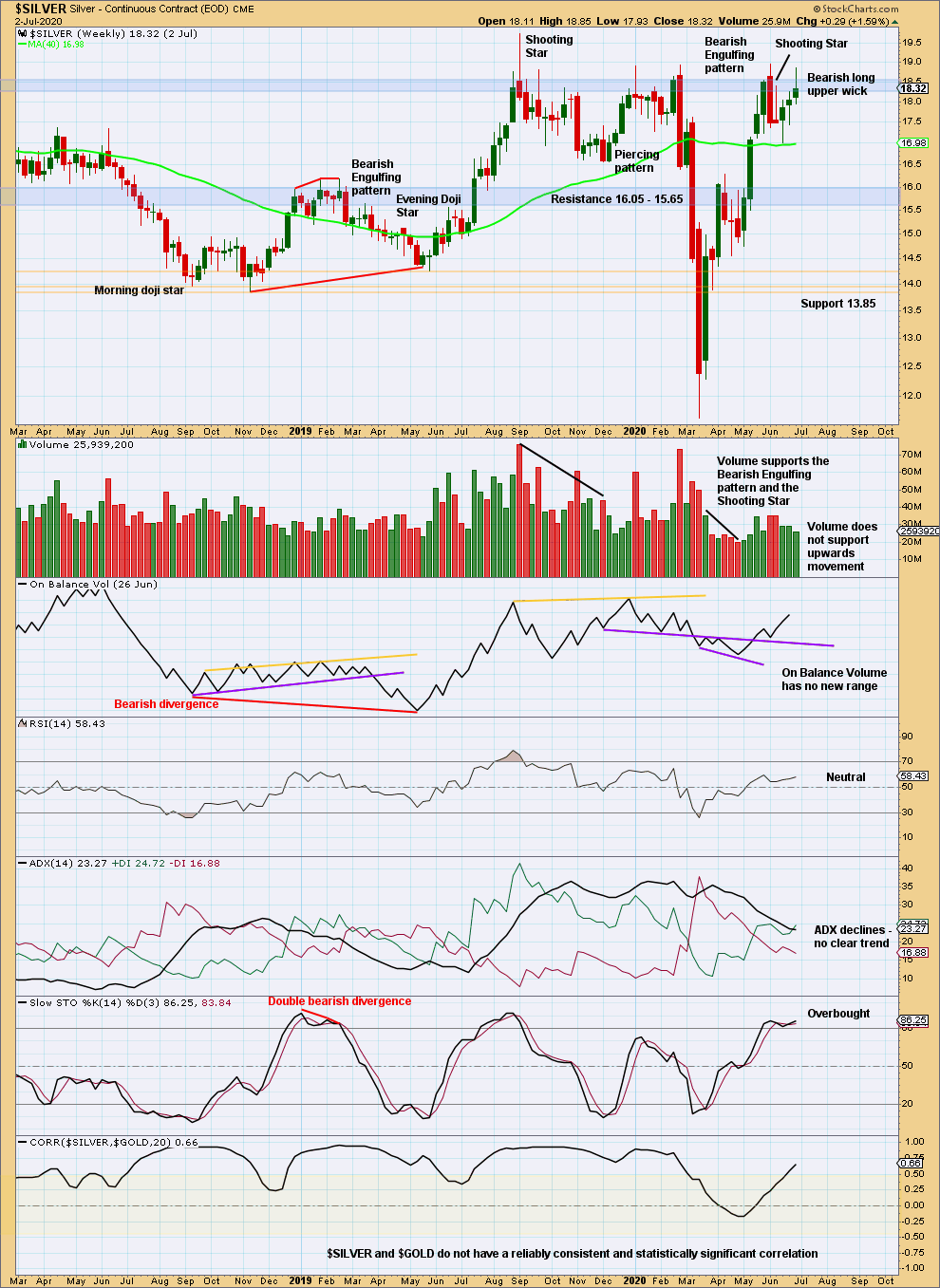

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looks bearish for the short term due to the long upper wick, inability of price to close above resistance, and weak volume.

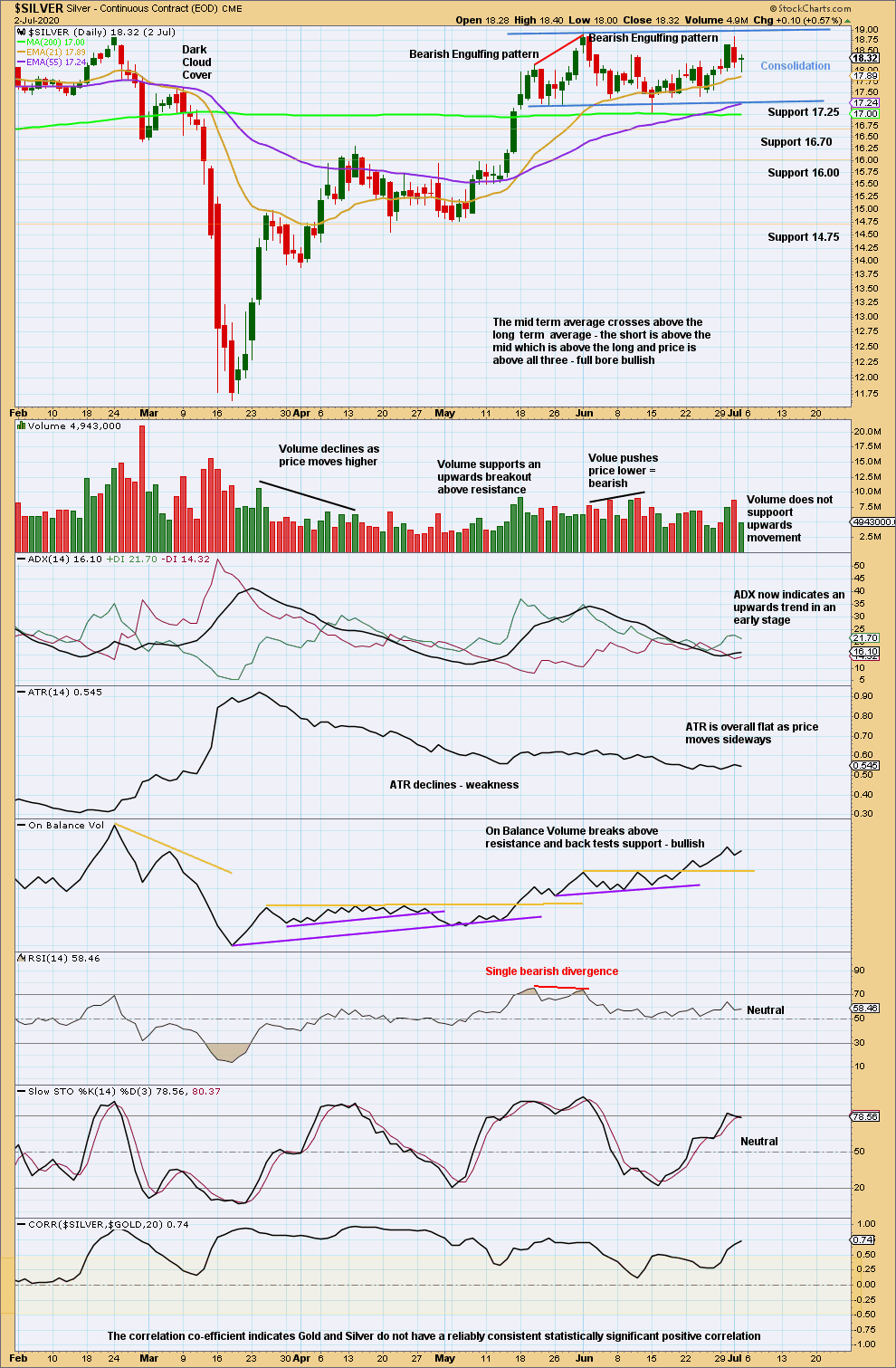

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains within a consolidation zone with resistance about 18.95 and support about 17.20. A breakout is required for confidence in the next trend direction. On Balance Volume suggests the breakout may be upwards, which would support the Elliott wave count.

Published @ 09:23 a.m. ET on July 4, 2020.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.