SILVER: Elliott Wave and Technical Analysis | Charts – July 10, 2020

Summary: For the short to mid term, price may continue higher but should turn before 21.023. A possible target is 19.50. A classic analysis target is 20.90.

A new low now below 18.034 would indicate a trend change and a multi-week pullback. Prior to this a breach of the best fit channel on the daily chart would be an early warning.

The Elliott wave count is now very bullish and expects new highs substantially above 49.752 in coming years.

ELLIOTT WAVE COUNT

MONTHLY CHART

The bear market for Silver may be complete.

This Elliott wave structure for this bear market is labelled as a single zigzag for Grand Super Cycle wave II. Single zigzags are the most common Elliott wave corrective structure.

Within the zigzag: Super Cycle wave (a) subdivides as a five wave impulse, Super Cycle wave (b) subdivides as a complete regular contracting triangle, and Super Cycle wave (c) subdivides as a complete five wave impulse that is relatively brief and shallow.

Draw a channel about the entire bear market of Grand Super Cycle wave II as shown. A breach of the upper edge of this channel would add confidence to this wave count. Price may have found resistance at the upper edge of this channel, which may have initiated a pullback.

When charts are drawn on a semi-log scale, price has now breached the upper edge of the trend channel. Copy this channel over to weekly and daily charts.

Grand Super Cycle wave III must subdivide as a five wave impulse at Super Cycle degree.

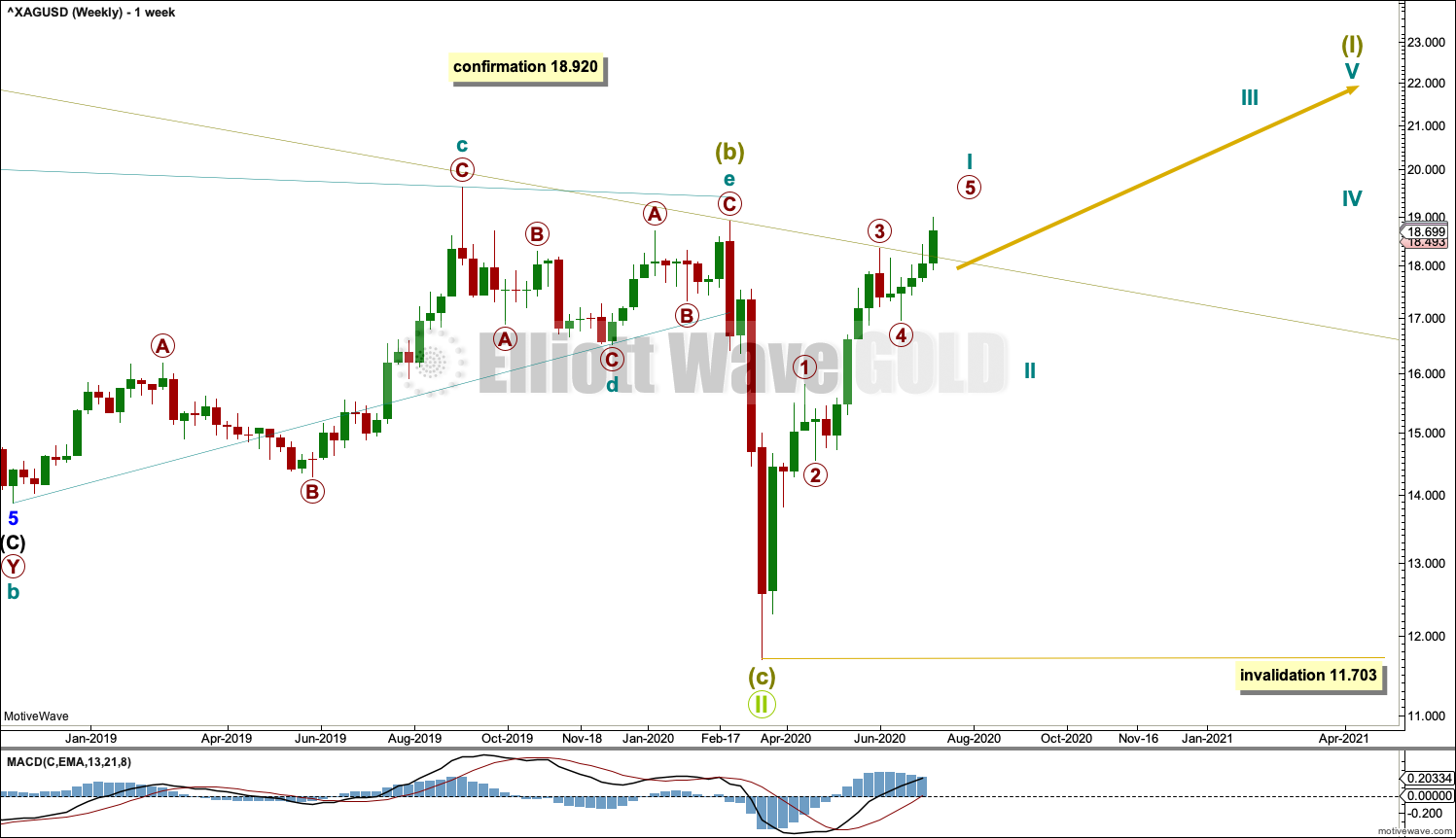

WEEKLY CHART

Grand Super Cycle wave II may be a complete zigzag. A new bull market may have begun for Silver.

The channel about Grand Super Cycle wave II is copied over from the monthly chart and extended outwards.

Super Cycle wave (I) must subdivide as a five wave motive structure, either an impulse or a leading diagonal. An impulse is much more common, so that is what shall be expected unless overlapping suggests a diagonal should be considered.

Cycle wave I may be incomplete.

Cycle wave II may not move beyond the start of cycle wave I below 11.703.

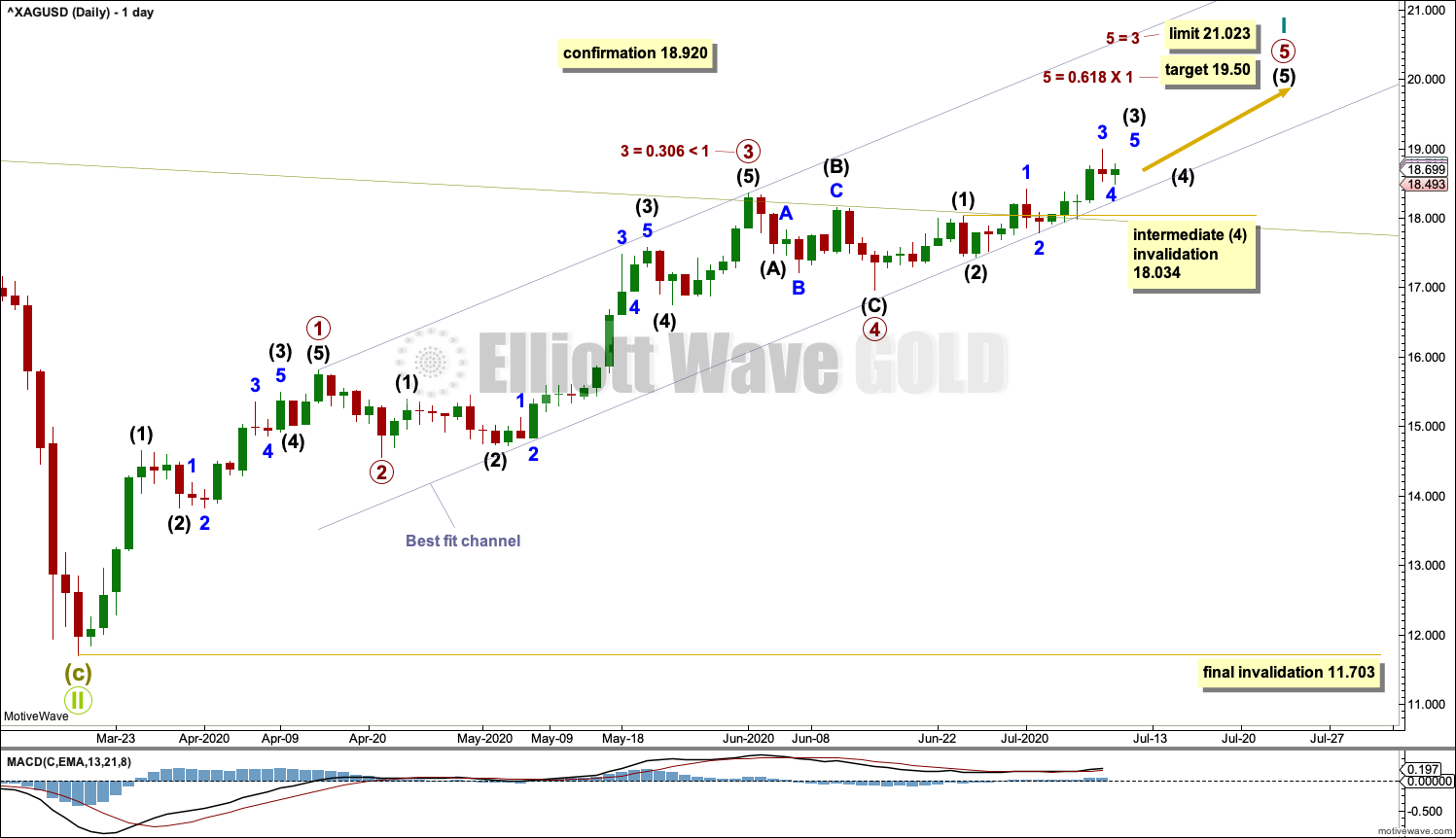

DAILY CHART

Cycle wave I may be an incomplete five wave impulse. Primary waves 1 and 2 within the impulse may be complete.

Primary wave 3 may be complete, finding resistance about the upper edge of the channel copied over from weekly and monthly charts.

Primary wave 4 may be complete.

Primary wave 5 may have begun. Intermediate waves (1) and (2) within primary wave 5 may be complete. Intermediate wave (3) may be almost complete; it may be complete with one new high. Intermediate wave (4) may not move into intermediate wave (1) price territory below 18.034.

Draw a channel as shown about cycle wave I. The lower edge continues to be where pullbacks are finding support. While price is within this channel, assume this wave count may be correct. A breach of this channel would indicate a possible trend change; at that stage, cycle wave I may be over.

Cycle wave II may not move beyond the start of cycle wave I below 11.703.

TECHNICAL ANALYSIS

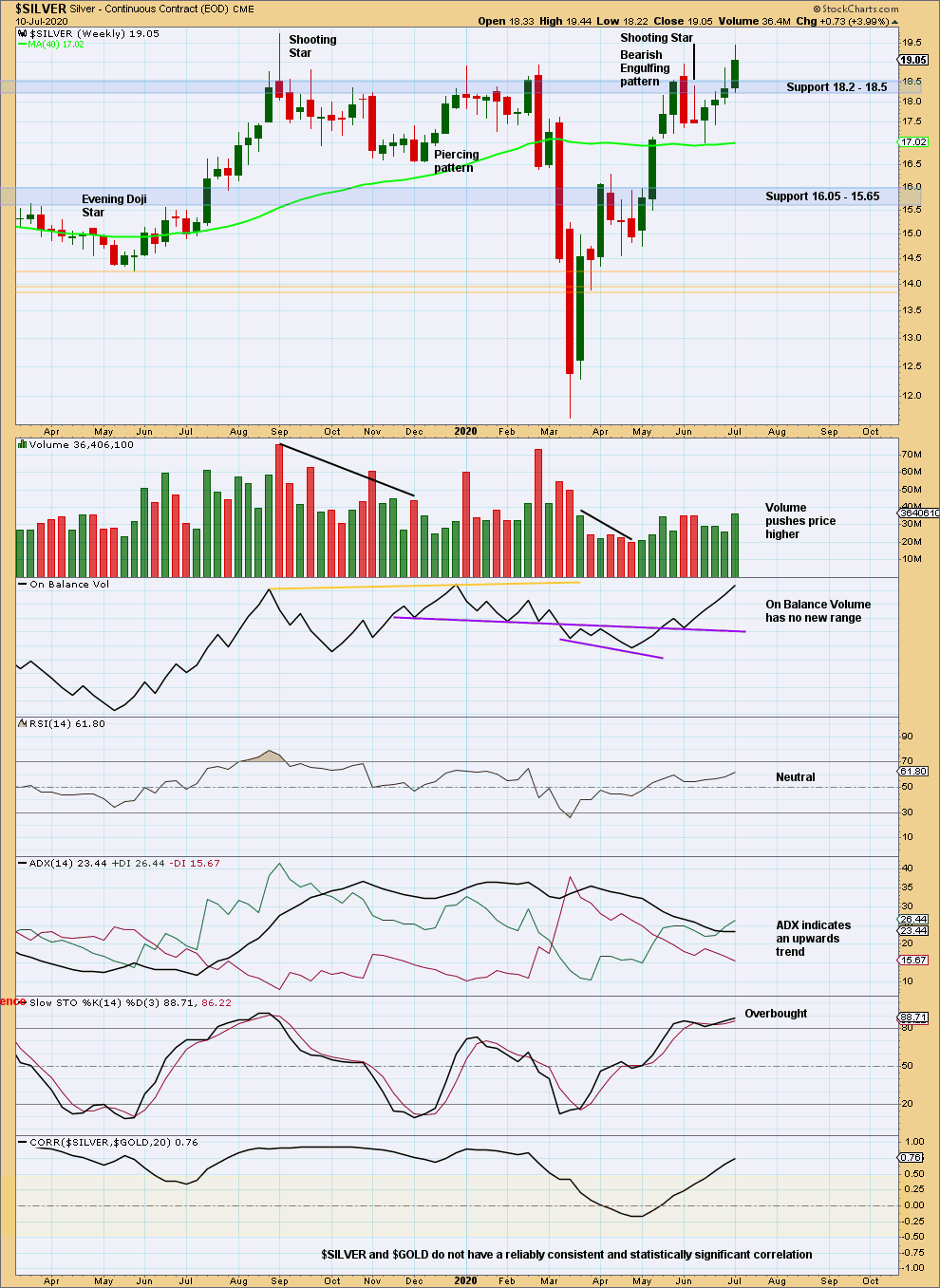

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

For the first time since at least April 2017 price has closed above strong resistance at 18.50. This is very bullish. The breakout has support from volume.

Neither RSI nor ADX are extreme. ADX indicates an upwards trend. There is room for this trend to continue. There is resistance above about 21.20 to 21.30.

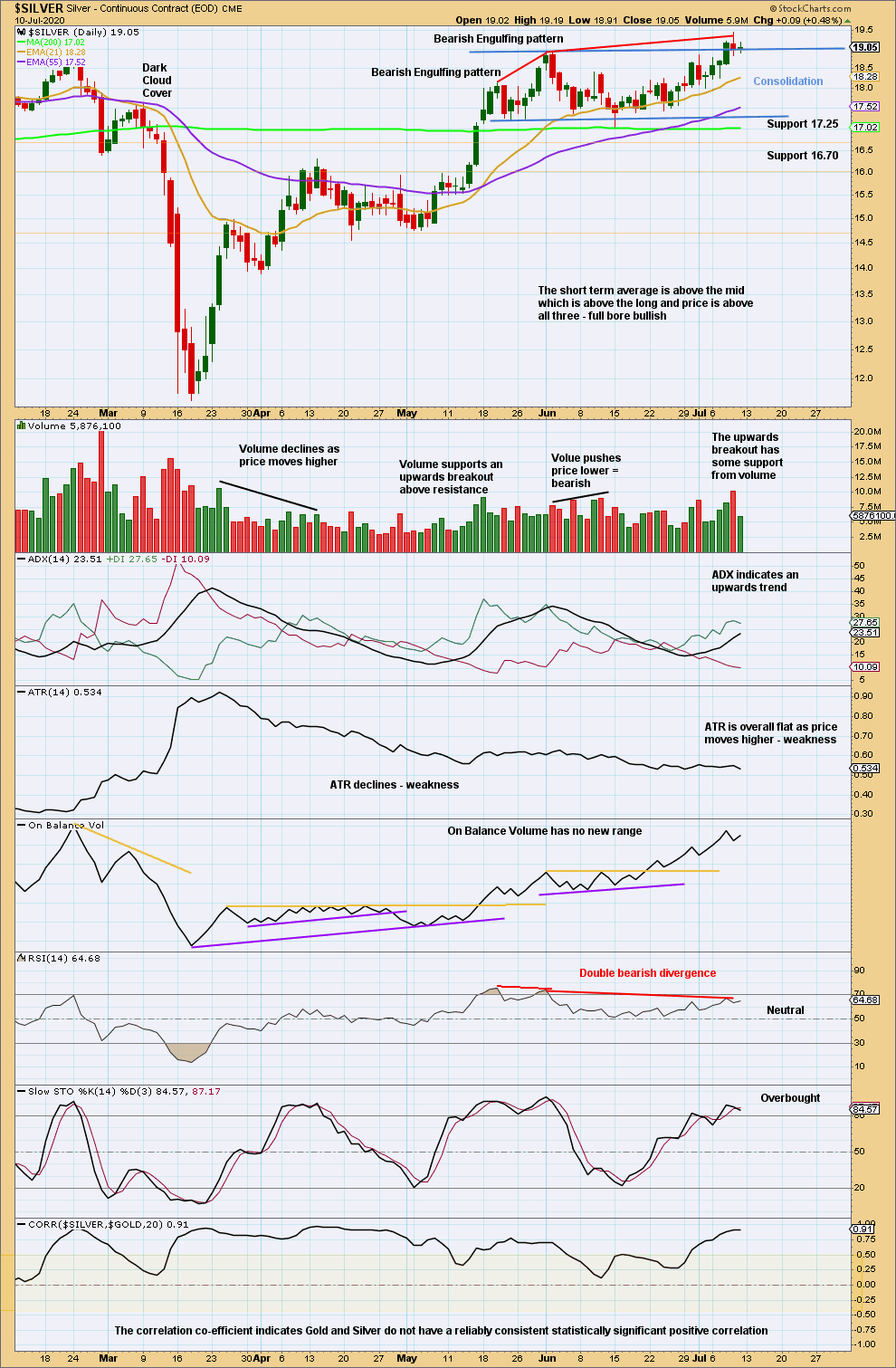

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards breakout has been effected this week. A back test of support at prior resistance may have ended the week. A target would be calculated at 20.90.

Published @ 02:37 p.m. ET on July 12, 2020.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.