US OIL: Elliott Wave and Technical Analysis | Charts – September 11, 2020

Last analysis expected a pullback to continue, which is what has happened for the week.

Summary: Oil may have found a major sustainable low.

A multi-week pullback is expected to end about 23.05. It is possible the pullback may be deeper than this though; the first major correction within a new trend for Oil tends to be very deep.

When this pullback may be complete, then an upwards trend should resume with increased strength.

ELLIOTT WAVE COUNT

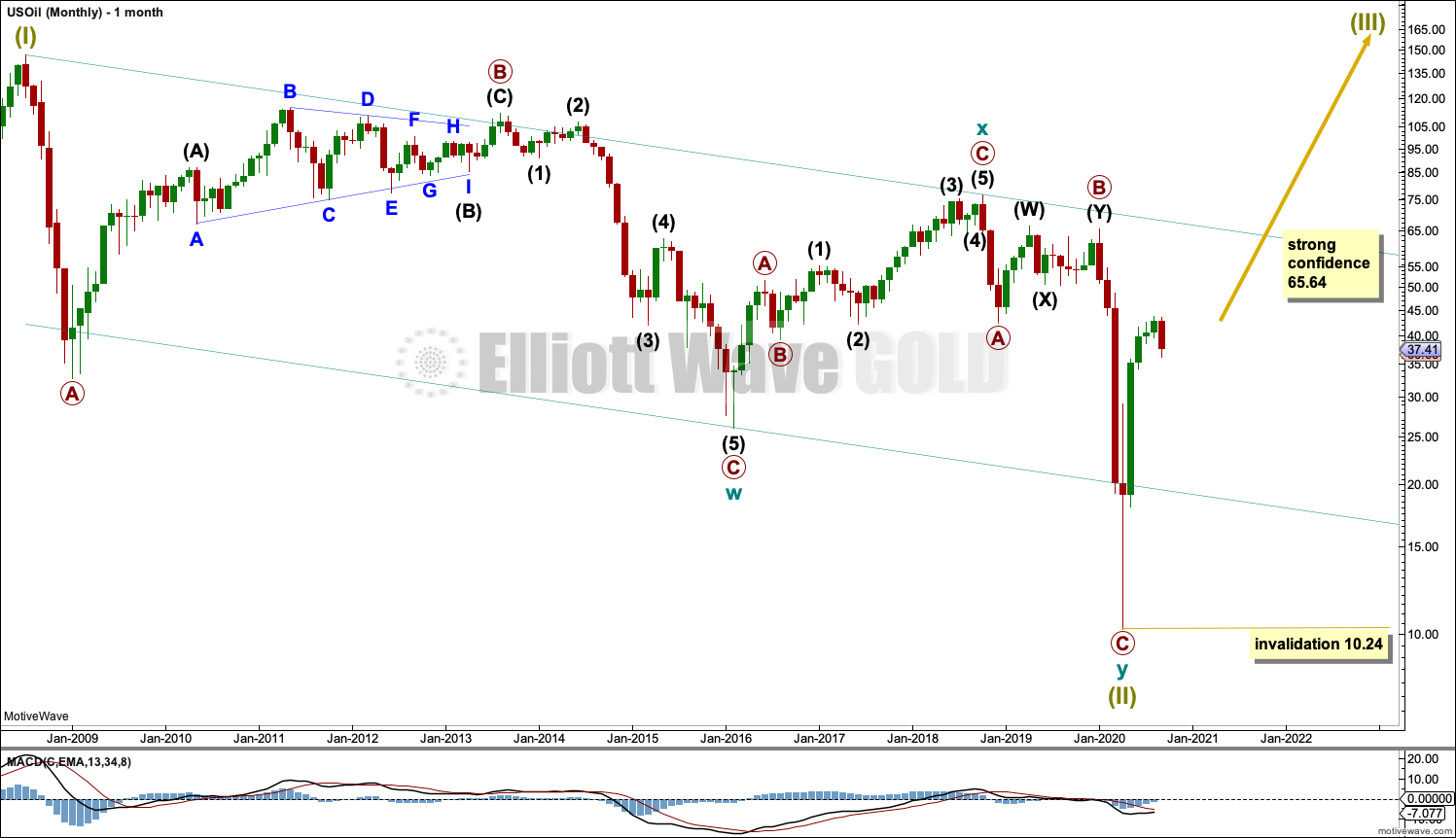

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. Price has bounced up off the channel. This trend line is breached, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance.

Following five waves up and three steps back should be another five steps up; this is labelled Super Cycle wave (III), which may only have just begun. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. Basing action over a few years may now have begun.

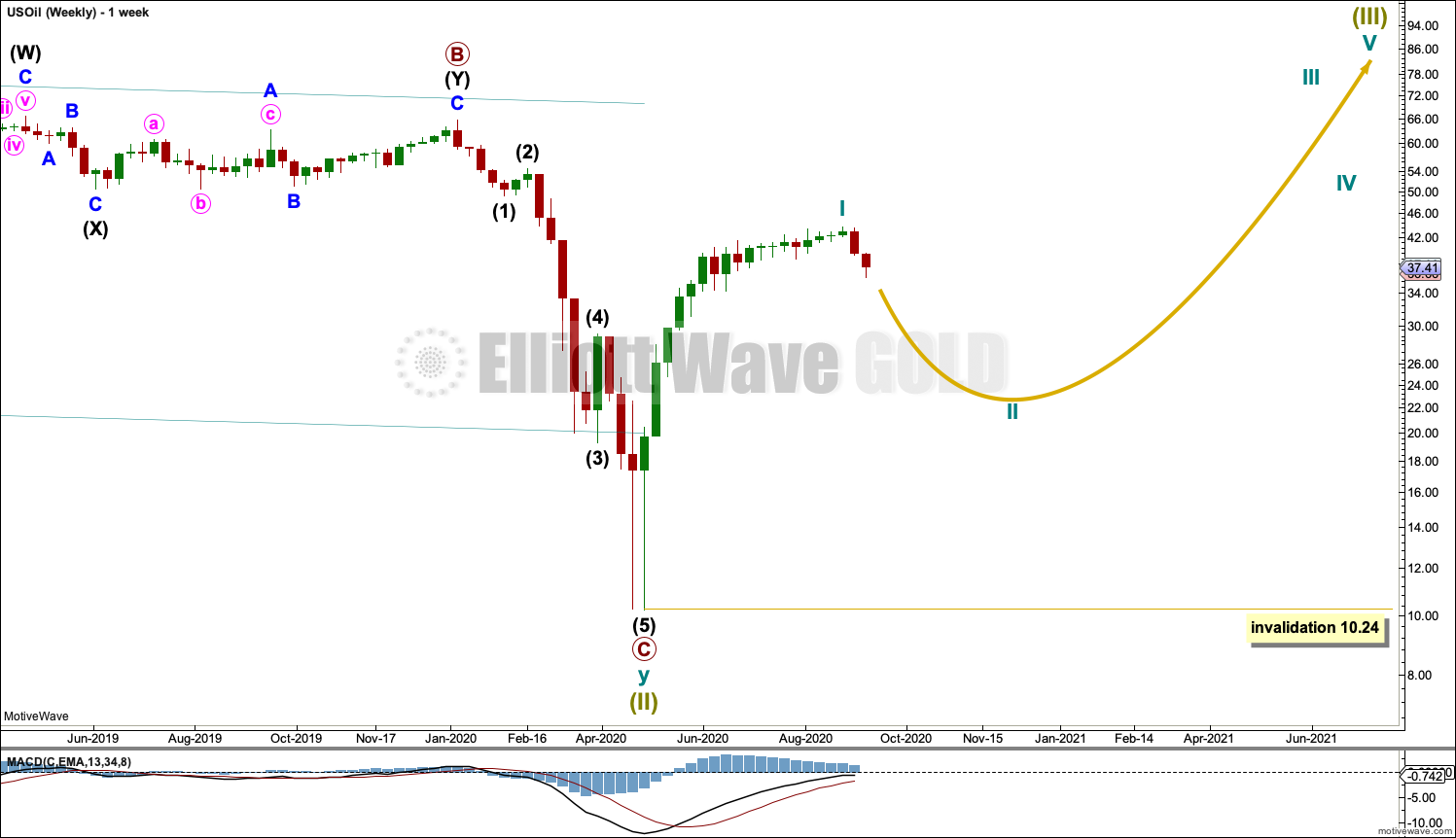

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse. Cycle wave I within the impulse may be complete. Cycle wave II may not move beyond the start of cycle wave I below 10.24.

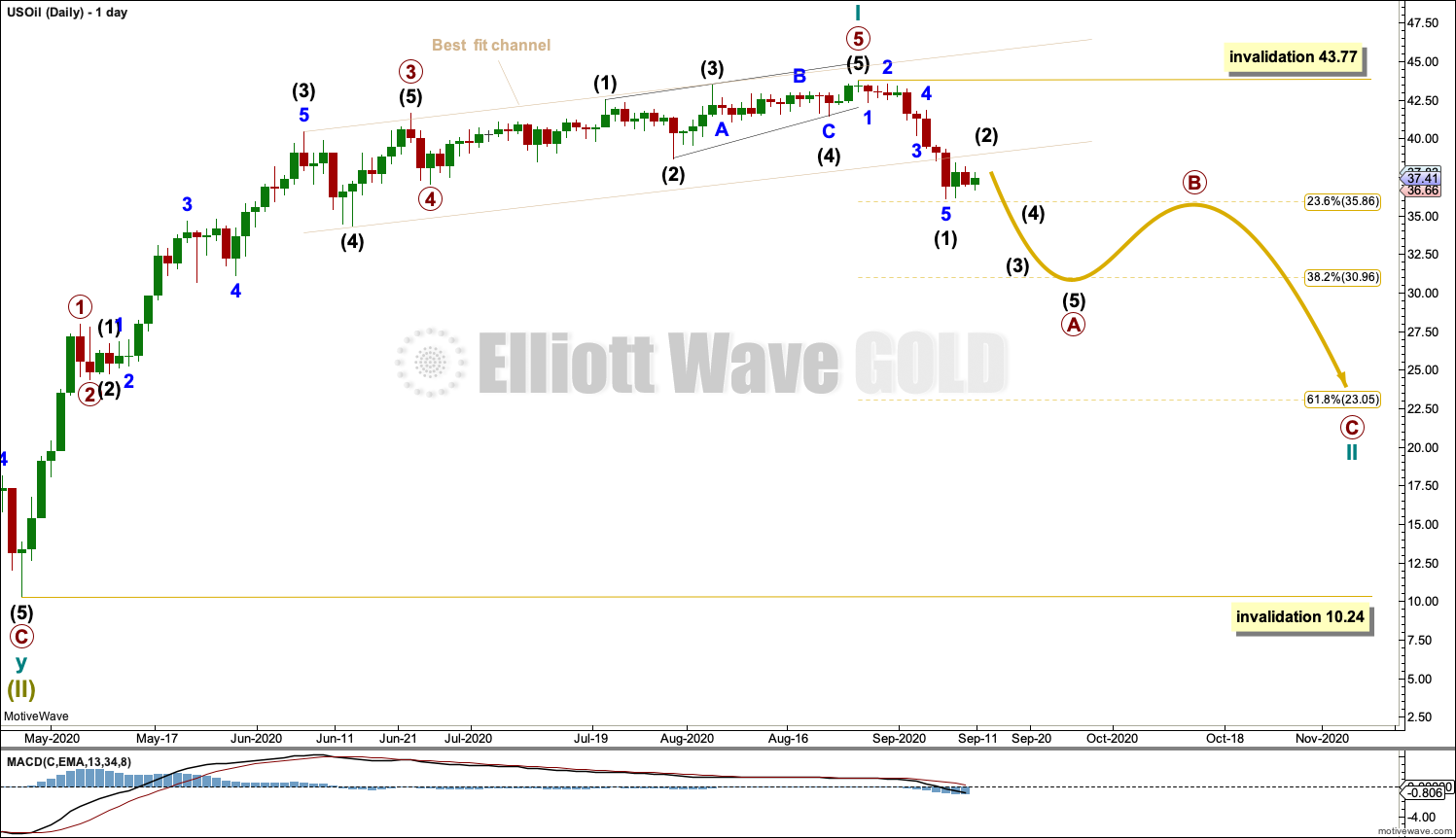

DAILY CHART

Cycle wave I now looks very likely to be over.

Cycle wave II may subdivide as any corrective Elliott wave structure except a triangle. The 0.618 Fibonacci ratio of cycle wave I at 23.05 is a preferred target, but it is possible that cycle wave II may be deeper than this.

Cycle wave II may not move beyond the start of cycle wave I below 10.24.

A new trend at cycle degree should begin with a five wave structure. This is labelled intermediate wave (1), which may now be complete. Intermediate wave (2) may not move beyond its start above 43.77.

Cycle wave II would most likely subdivide as a zigzag. Zigzags subdivide 5-3-5 and are labelled A-B-C. Cycle wave II may last at least two months.

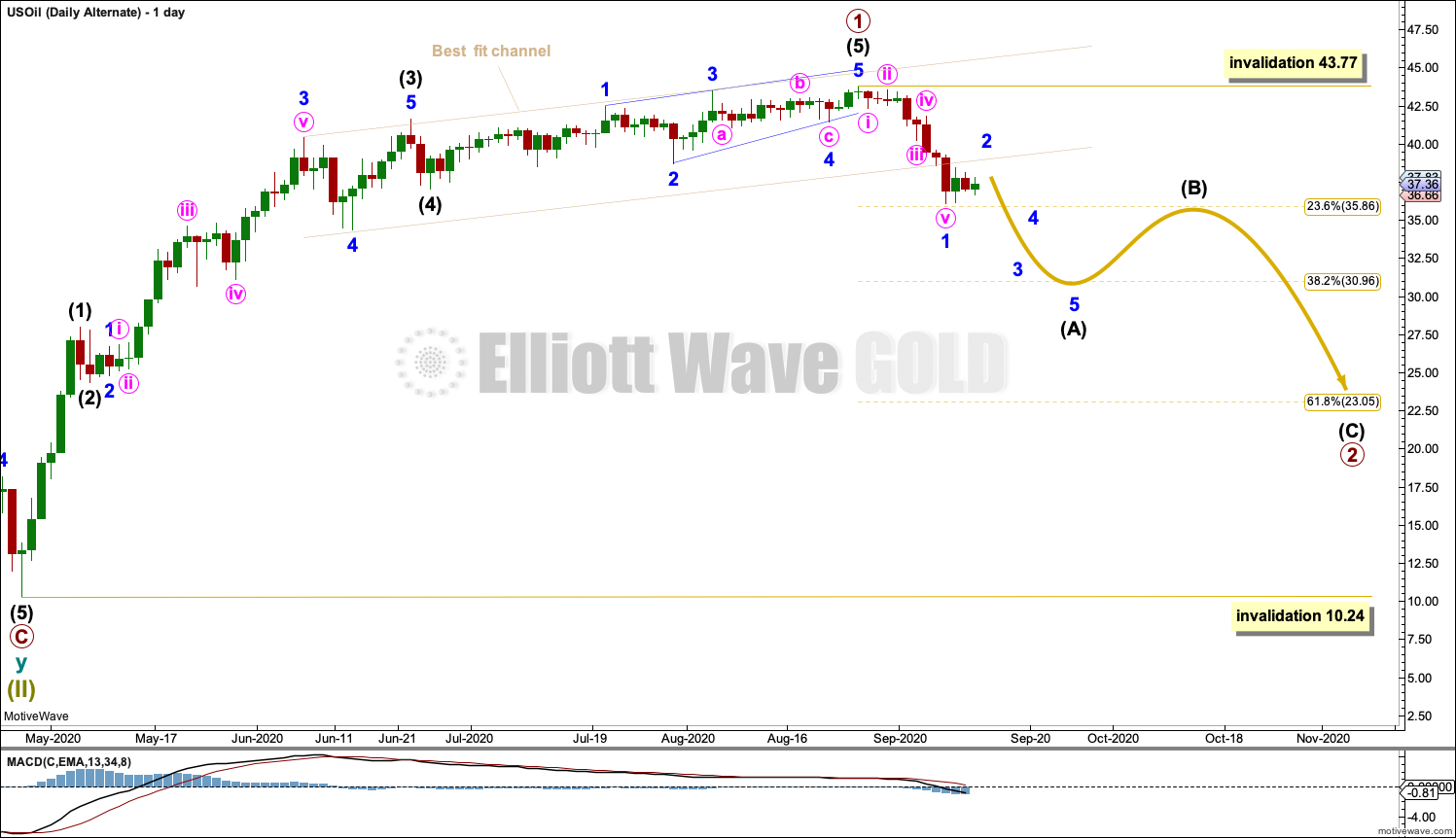

ALTERNATE DAILY CHART

It is also possible that the degree of labelling at the daily chart level may need to be changed back down one degree. It may be that only primary wave 1 is complete within cycle wave I and the current pullback may be primary wave 2.

Primary wave 2 may last several weeks to a few months.

TECHNICAL ANALYSIS

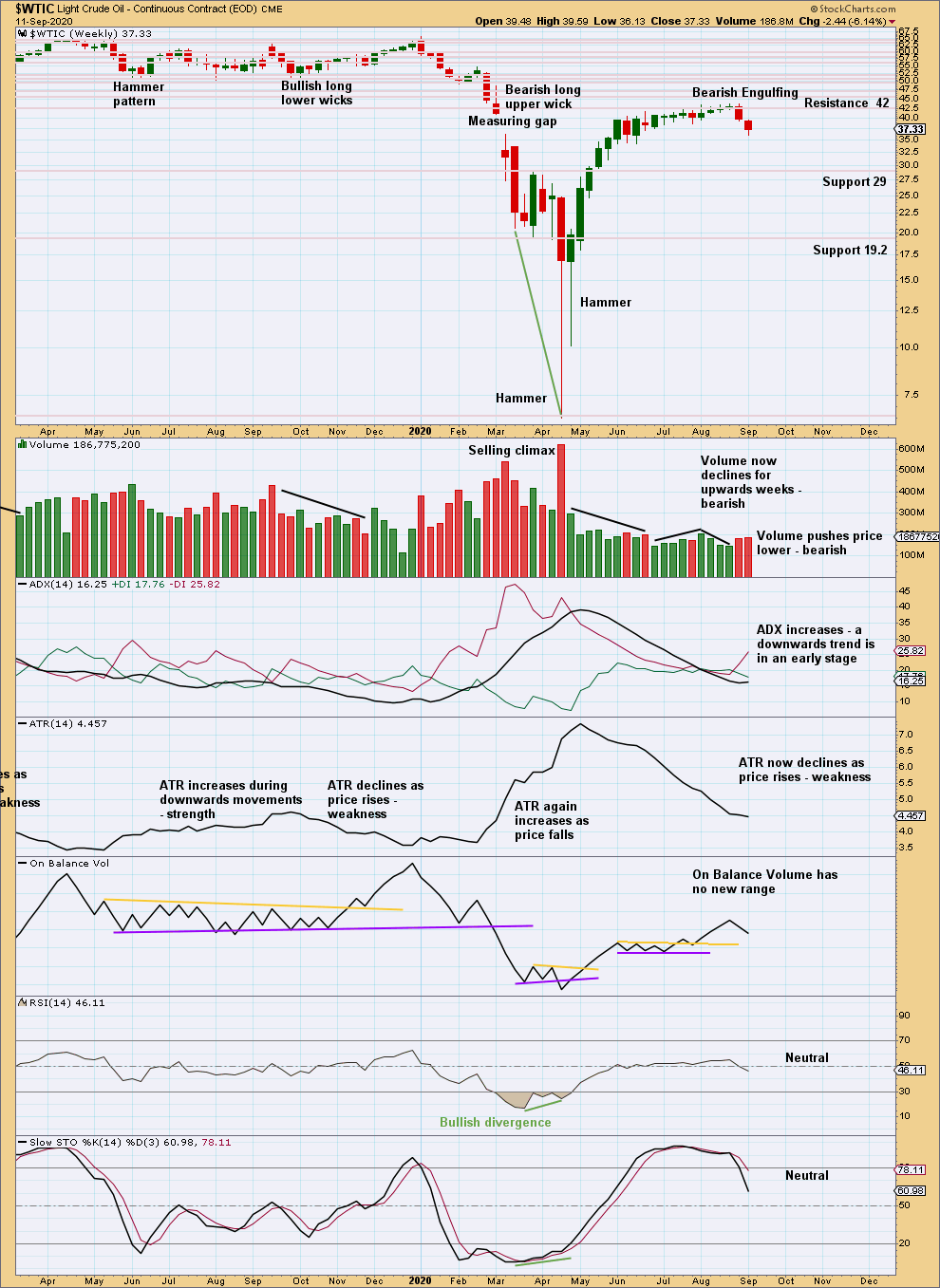

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a downwards trend. Expect price to continue lower until either conditions reach extreme or price finds support and then exhibits a bullish candlestick reversal pattern. Support lines are identified on the chart.

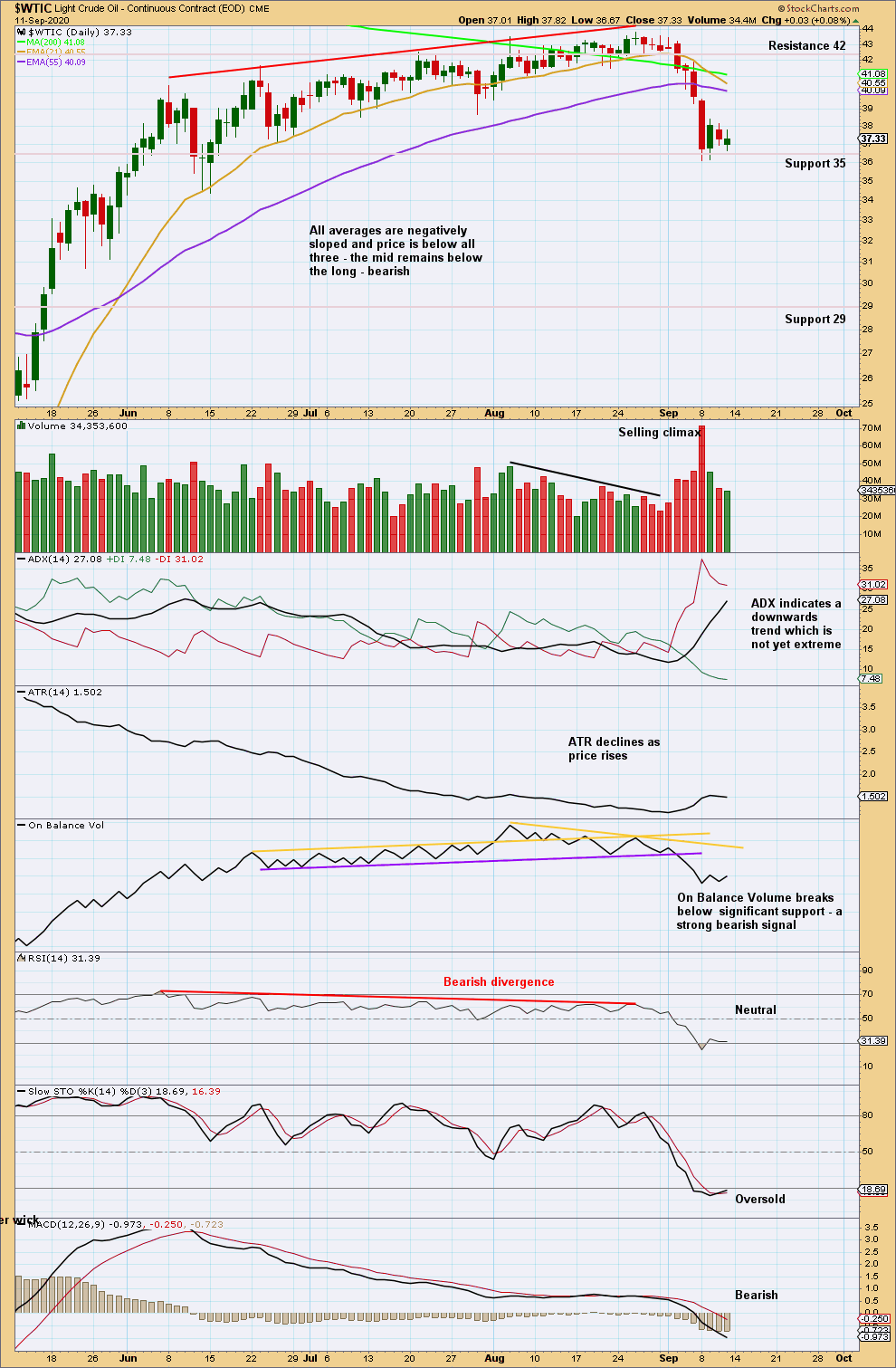

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is a new downwards trend in an early stage. Expect it to continue until conditions reach oversold or a bullish candlestick pattern forms.

At this time, there is no bullish reversal pattern. The trend is not extreme. The last three sessions look like a pause within an ongoing downwards trend. When this market trends, conditions may reach extreme and remain so while price travels a reasonable distance.

Published @ 05:46 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.