US OIL: Elliott Wave and Technical Analysis | Charts – January 15, 2021

Again, more upwards movement has unfolded as expected.

Price remains within the channel on the daily chart.

Summary: Classic analysis suggests a high may be in place for the short to mid term, but the Elliott wave count allows for one final small wave up to a target at 55.40.

A new low below 48.96 and a breach of the channel on the daily chart would indicate a trend change. At that stage, a multi-week pullback or consolidation may be expected.

A longer-term target for a third wave is at 87.90 or 121.43.

Oil may have found a major sustainable low in April 2020.

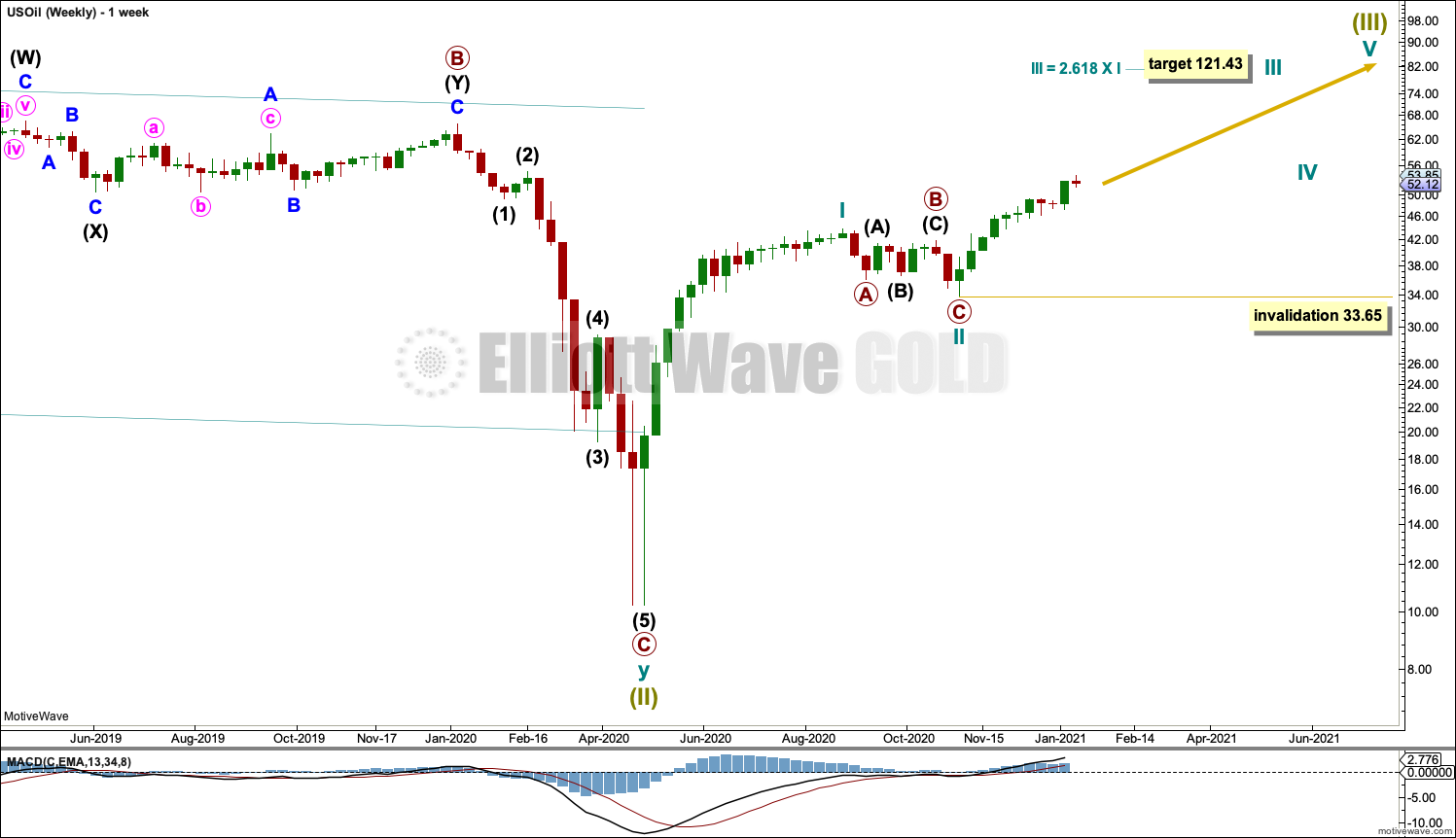

ELLIOTT WAVE COUNT

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

Following Super Cycle wave (III), which was a correction (three steps back), Super Cycle wave (III), which may have begun, should be five steps up when complete. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. This trend line is breached, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance. If resistance is breached, then the upper edge may provide support for a back test.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. However, while this is a common tendency, it is not always seen and may not have been seen in this instance. The first reasonably sized pullback may be over already.

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse. Cycle wave I within the impulse may be complete. Cycle wave II may also now be complete, and cycle wave III upwards may now have begun. If cycle wave II continues lower, then it may not move beyond the start of cycle wave I below 10.24.

There is only one daily chart following this main weekly chart. An alternate is presented below on a weekly chart.

DAILY CHART

Cycle wave III may only subdivide as an impulse. Within the impulse: Primary wave 1 may be incomplete, and primary wave 2 may not move beyond the start of primary wave 1 below 33.65.

Intermediate wave (5) within primary wave 1 may have begun.

Minor waves 1 through to 4 within intermediate wave (5) may be complete. If minor wave 4 moves lower, then it may not move into minor wave 1 price territory below 48.96. If minor wave 3 is over at the last high, then it would be 0.59 short of 2.618 the length of minor wave 1.

Intermediate wave (5) has passed equality in length with intermediate wave (1), and the structure is incomplete. The next Fibonacci ratio in the sequence is used to calculate a new target for intermediate wave (5).

In the short term, a new low below 48.96 prior to new highs would be a strong indication that primary wave 1 should be over and primary wave 2 should be underway. A new low below 48.96 prior to new highs could not be minor wave 4, so minor waves 4 and 5 would have to be over at that stage. This would also come with a breach of the best fit channel.

When primary wave 1 is complete, then a multi-week pullback or consolidation for primary wave 2 should begin. The best fit channel may help as a guide to when primary wave 1 may be over. When this channel is breached by at least one full daily candlestick of downwards movement below and not touching the lower edge, then it may indicate a trend change.

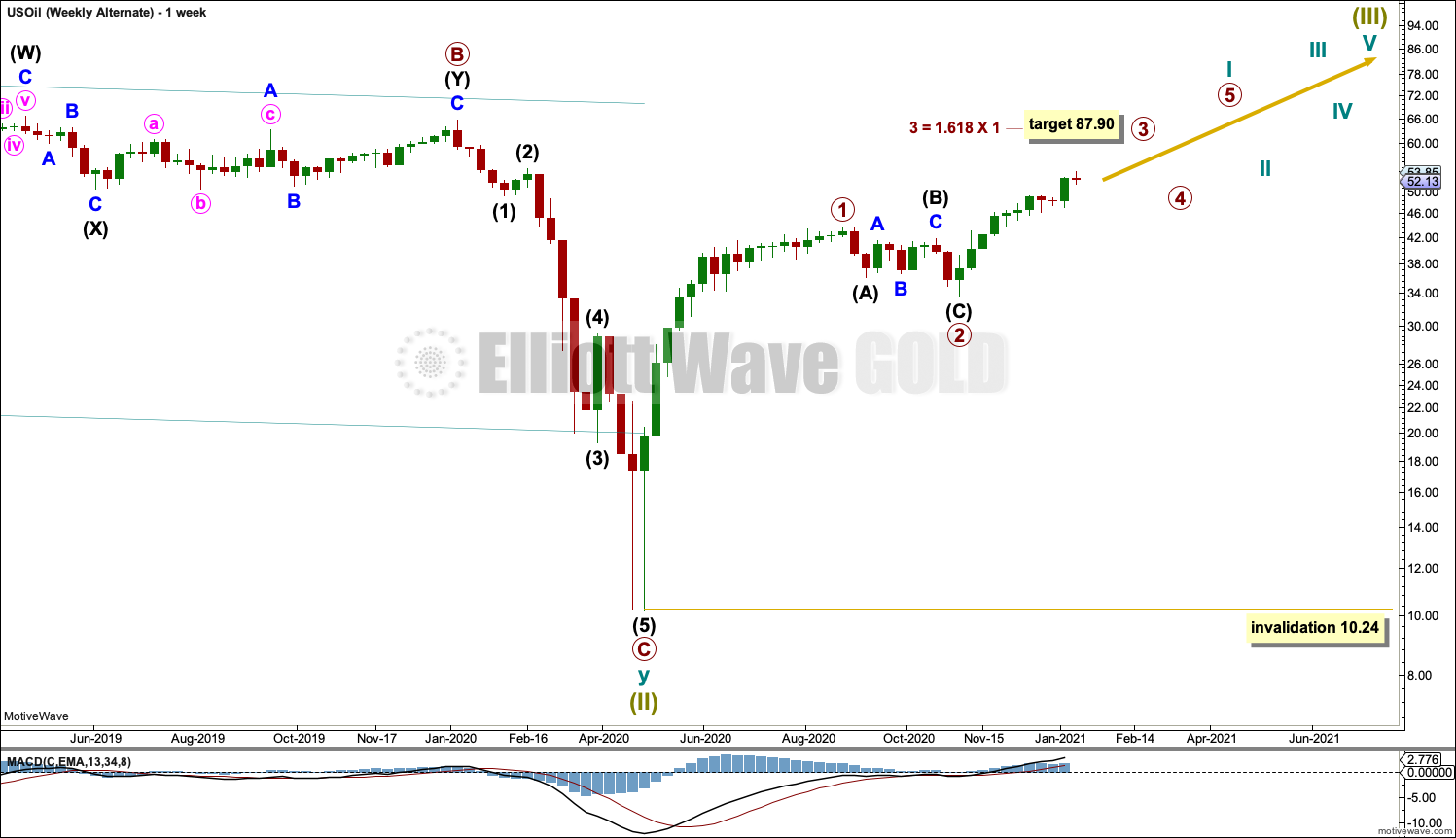

ALTERNATE WEEKLY CHART

This alternate wave count moves the degree of labelling within the start of the bull market down one degree. It is possible that cycle wave I is incomplete.

The target for primary wave 3 is lower than the target on the first wave count.

A daily chart for this alternate would be the same as the daily chart for the main wave count, except the degree of labelling would be one degree lower. The channel would be the same.

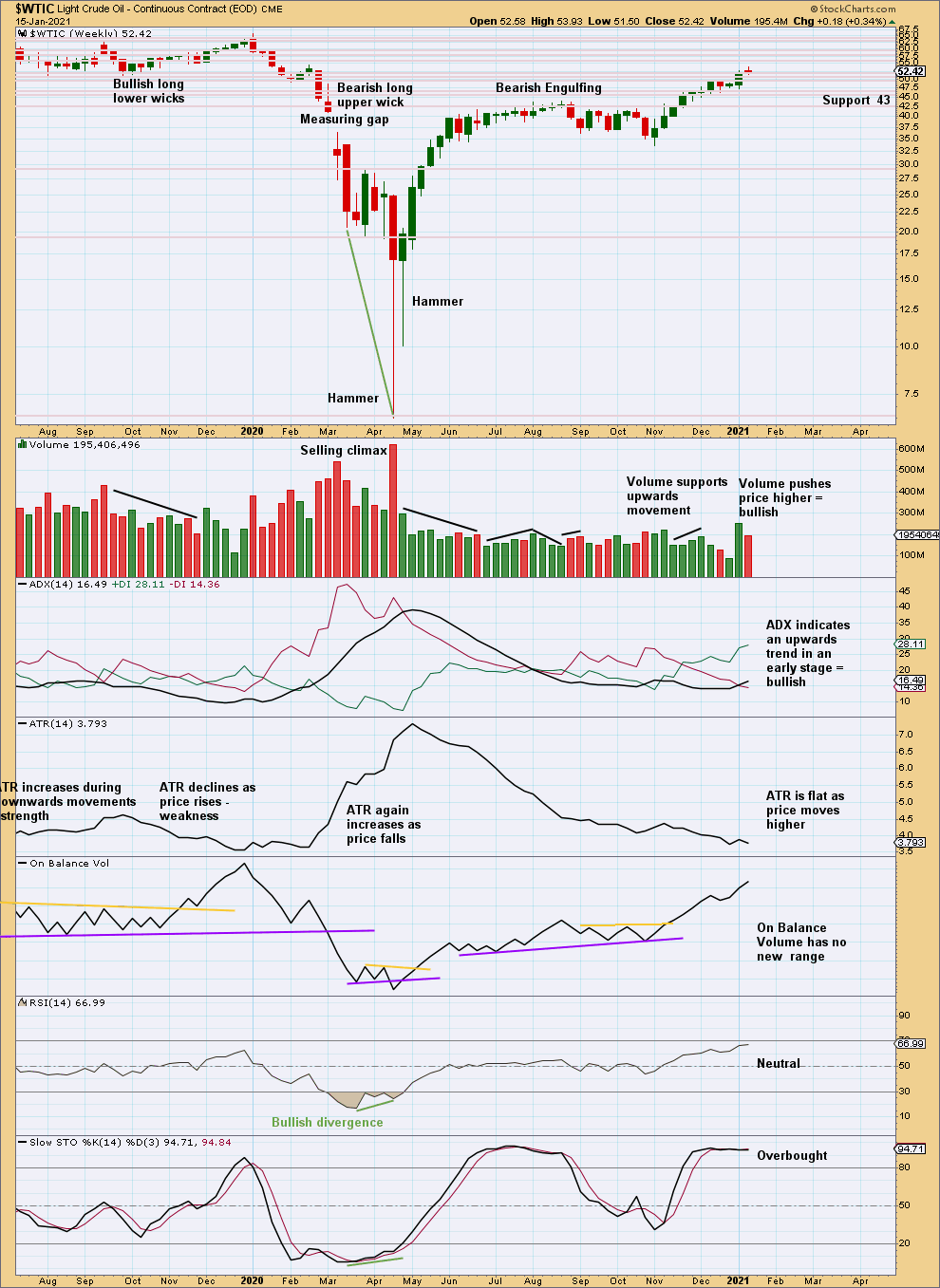

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is within a cluster of resistance and support; this may slow it down.

ADX gives a strong bullish signal. There is a lot of room for an upwards trend to continue as RSI and ADX are not extreme.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the pennant pattern at 53.03 has been met and slightly exceeded, and is now followed by a Bearish Engulfing candlestick pattern. At the time this chart was prepared the Bearish Engulfing pattern did not have support from volume, but sometimes StockCharts data is changed retrospectively. If it does change to have support from volume, then a little confidence that a high may be in place may be had.

At the daily chart level, this upwards trend is now extreme and RSI is overbought. However, this market can sustain extreme conditions for some time while price travels a reasonable distance.

Published @ 06:17 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.