US OIL: Elliott Wave and Technical Analysis | Charts – April 9, 2021

The Elliott wave count expected that a B wave may be unfolding sideways. A small range downwards week remains within a consolidation zone and fits expectations.

Summary: For the short term, price may continue sideways to complete a triangle or combination for intermediate wave (B).

A pullback or consolidation may continue for a few to several weeks. A first target is at 54.86. Thereafter, the next target is at 46.76 if price keeps falling.

The larger trend remains up.

A longer-term target for a third wave is at 87.90 or 121.43.

Oil may have found a major sustainable low in April 2020.

ELLIOTT WAVE COUNT

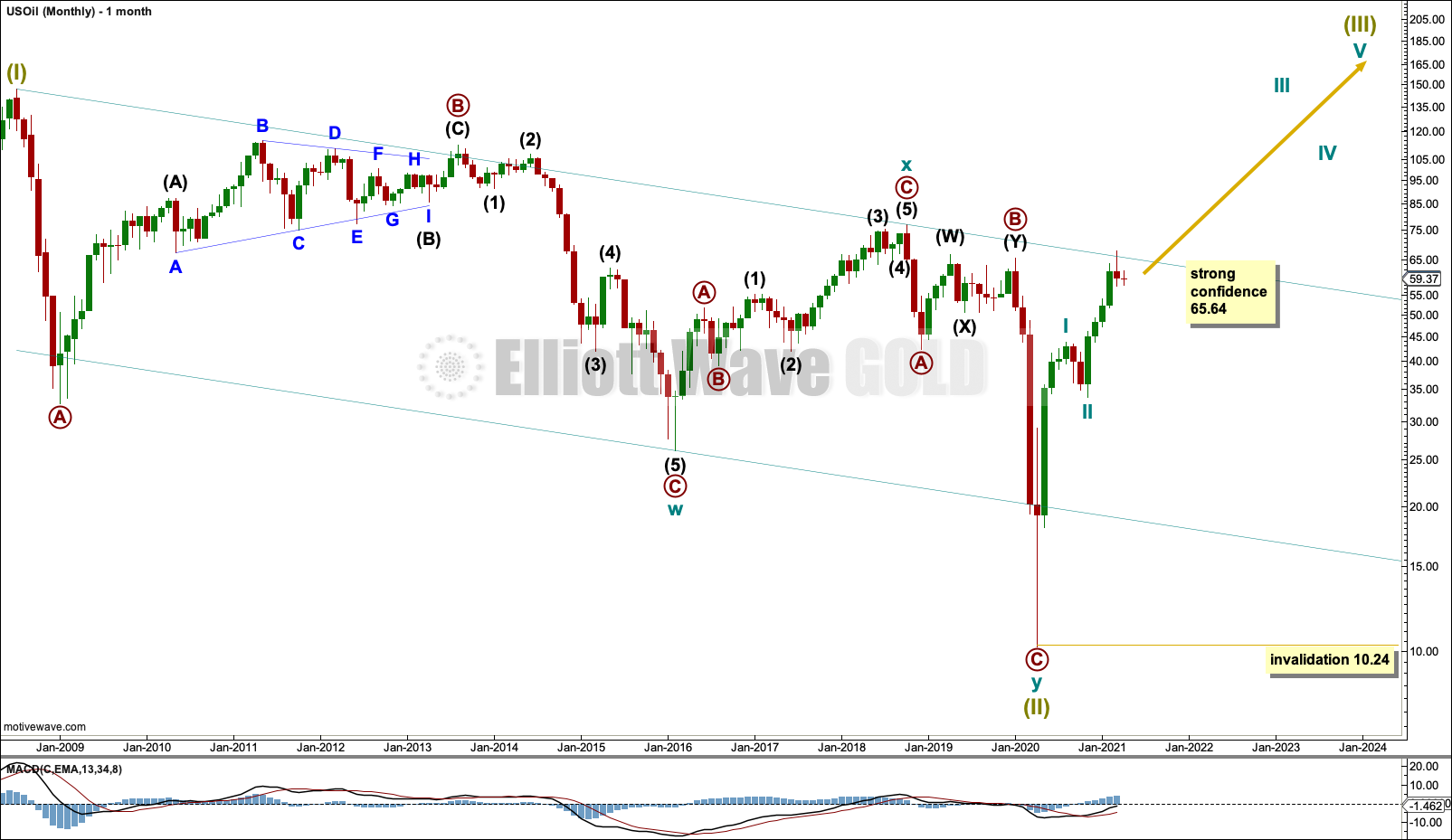

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

Following Super Cycle wave (II), which was a correction (three steps back), Super Cycle wave (III), which may have begun, should be five steps up when complete. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. This trend line is breached to the downside, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance. Price is reacting down from the upper edge of this channel.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. However, while this is a common tendency, it is not always seen and may not have been seen in this instance. The first reasonably sized pullback may be over already.

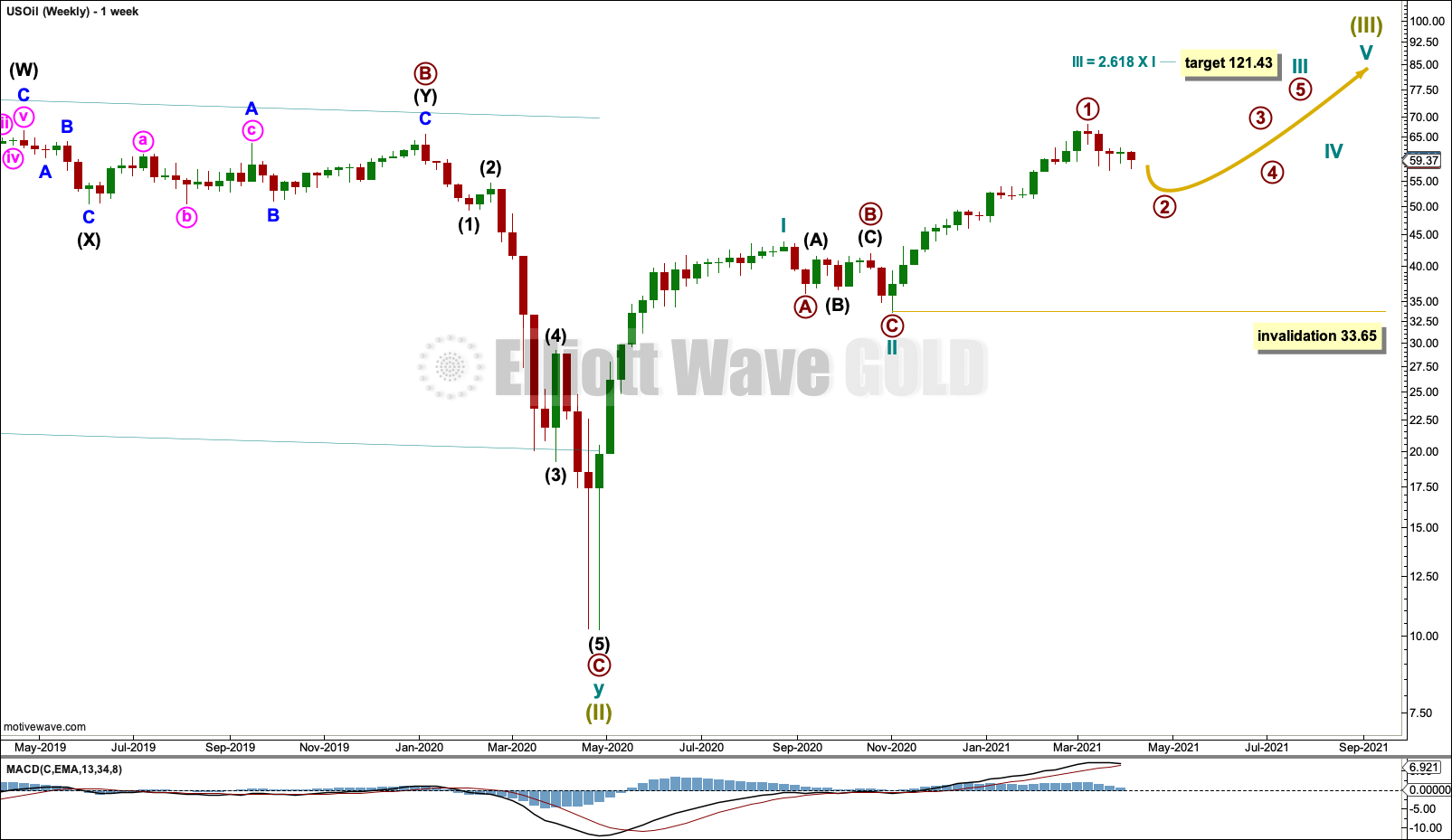

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse. Cycle wave I within the impulse may be complete. Cycle wave II may also now be complete, and cycle wave III upwards may now have begun. Primary wave 2 within cycle wave III may not move beyond the start of primary wave 1 below 33.65.

There is only one daily chart following this main weekly chart. An alternate is presented below on a weekly chart.

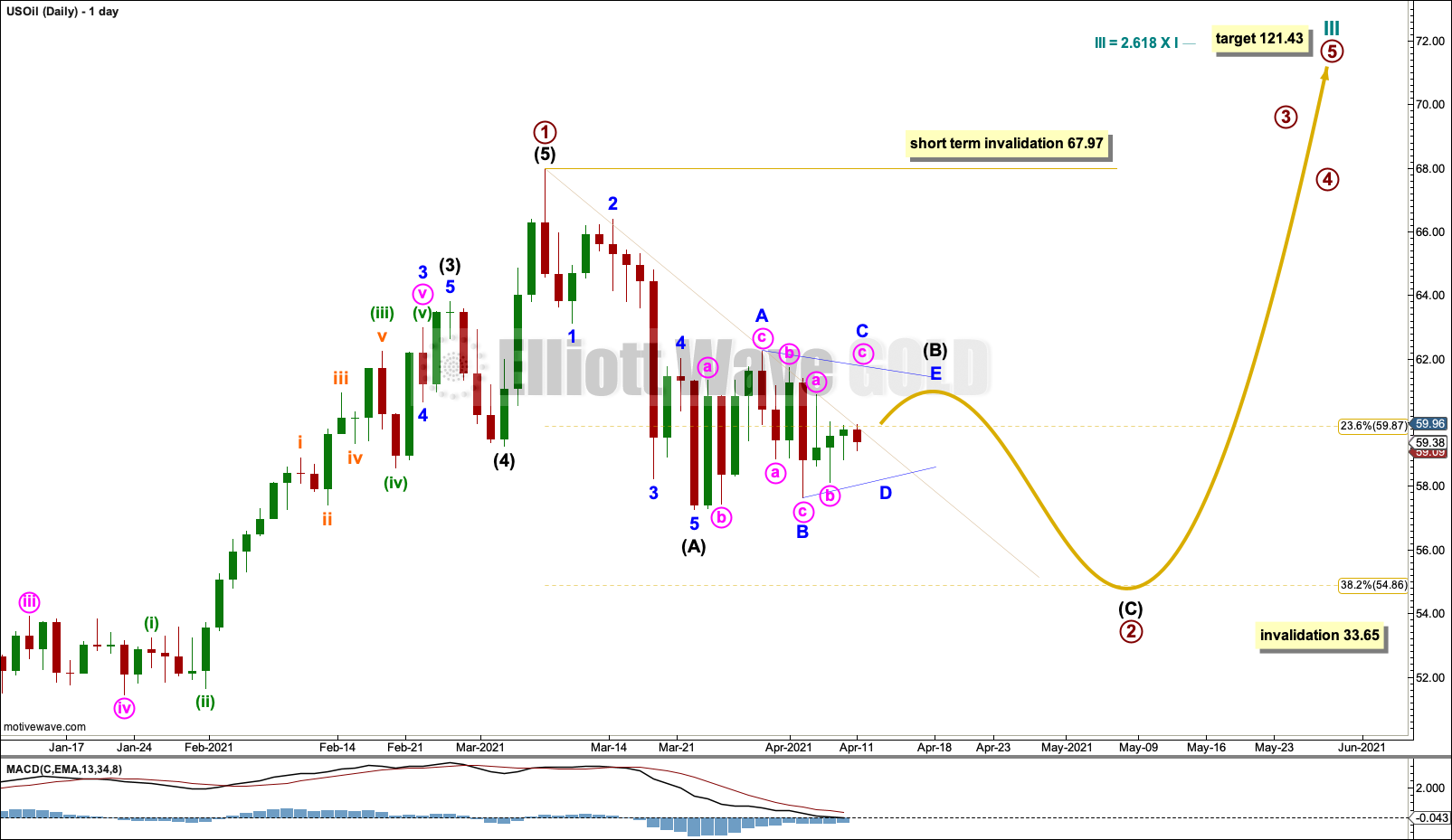

DAILY CHART

Primary wave 2 would most likely subdivide as a zigzag. Intermediate wave (A) within the zigzag may be a complete impulse. Intermediate wave (B) may continue sideways and higher. If intermediate wave (A) is correctly labelled as a five wave impulse, then intermediate wave (B) may not move beyond its start above 67.97.

If intermediate wave (B) continues further, then it should breach the trend line drawn above intermediate wave (A). Intermediate wave (B) may continue as a regular contracting triangle as labelled, or it may continue as a double combination and need to be relabelled next week.

Primary wave 2 may last weeks to months.

As price approaches the first target at the 0.382 Fibonacci ratio at 54.86 and if then the structure is complete and technical analysis indicates a low may be in place, then it may end there. But if price keeps falling and / or the structure of primary wave 2 is incomplete, then the 0.618 Fibonacci ratio at 46.76 would be the next target.

Labelling within primary wave 2 may change as it unfolds and alternate wave counts for the short-term structure may need to be considered. There are several different structures that primary wave 2 may unfold as.

Primary wave 2 may not move beyond the start of primary wave 1 below 33.65.

ALTERNATE WEEKLY CHART

This alternate wave count moves the degree of labelling within the start of the bull market down one degree. It is possible that cycle wave I is incomplete.

Primary wave 3 may have ended at the last high. Primary wave 3 is close to equal in length with primary wave 1; it is 0.79 longer than primary wave 1.

Primary wave 4 may subdivide as any corrective structure. Primary wave 4 should last weeks to months. Primary wave 4 may not move into primary wave 1 price territory below 43.77.

A daily chart for this alternate would be the same as the daily chart for the main wave count, except the pullback would be labelled primary wave 4.

TECHNICAL ANALYSIS

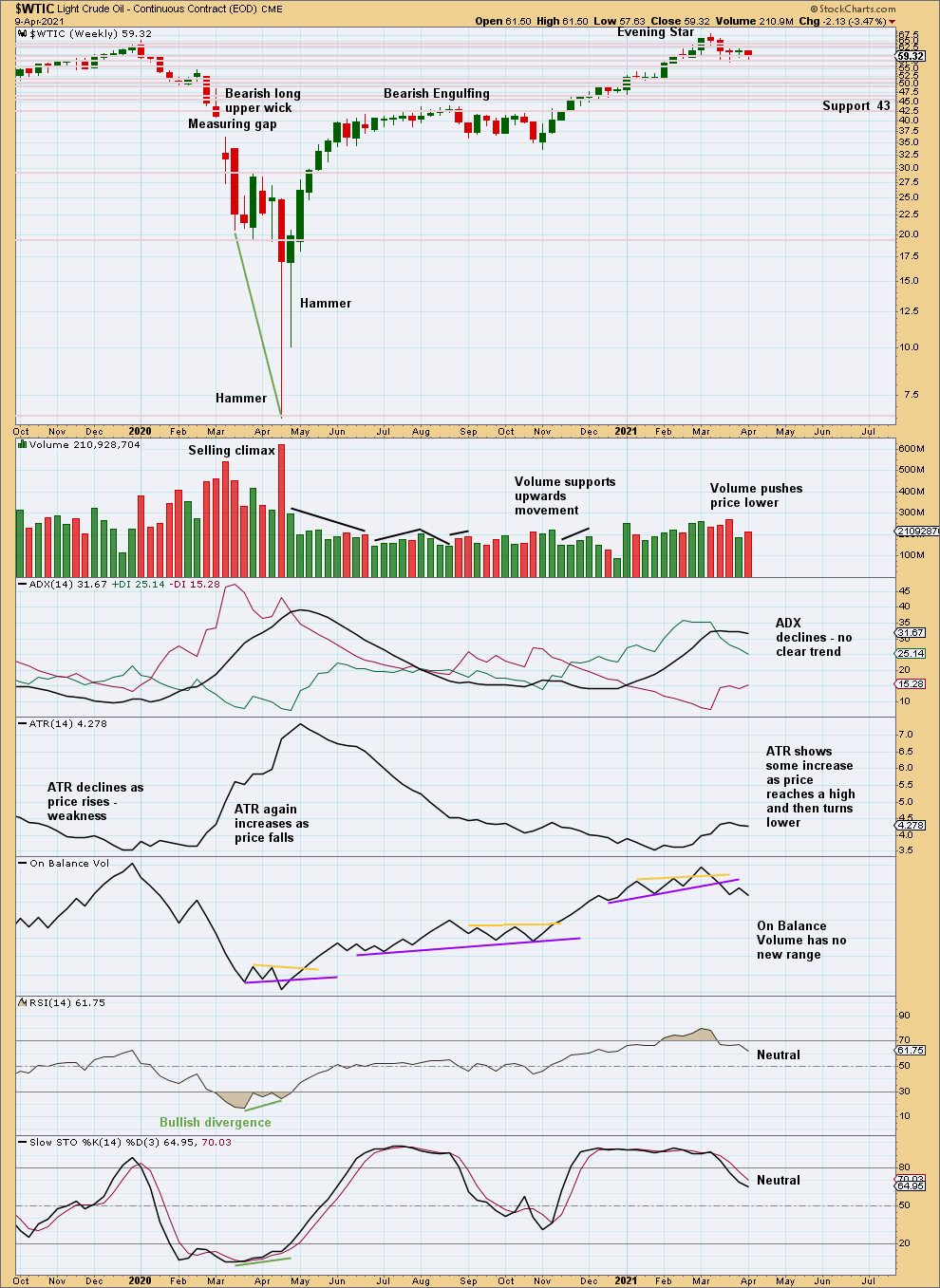

WEEKLY CHART

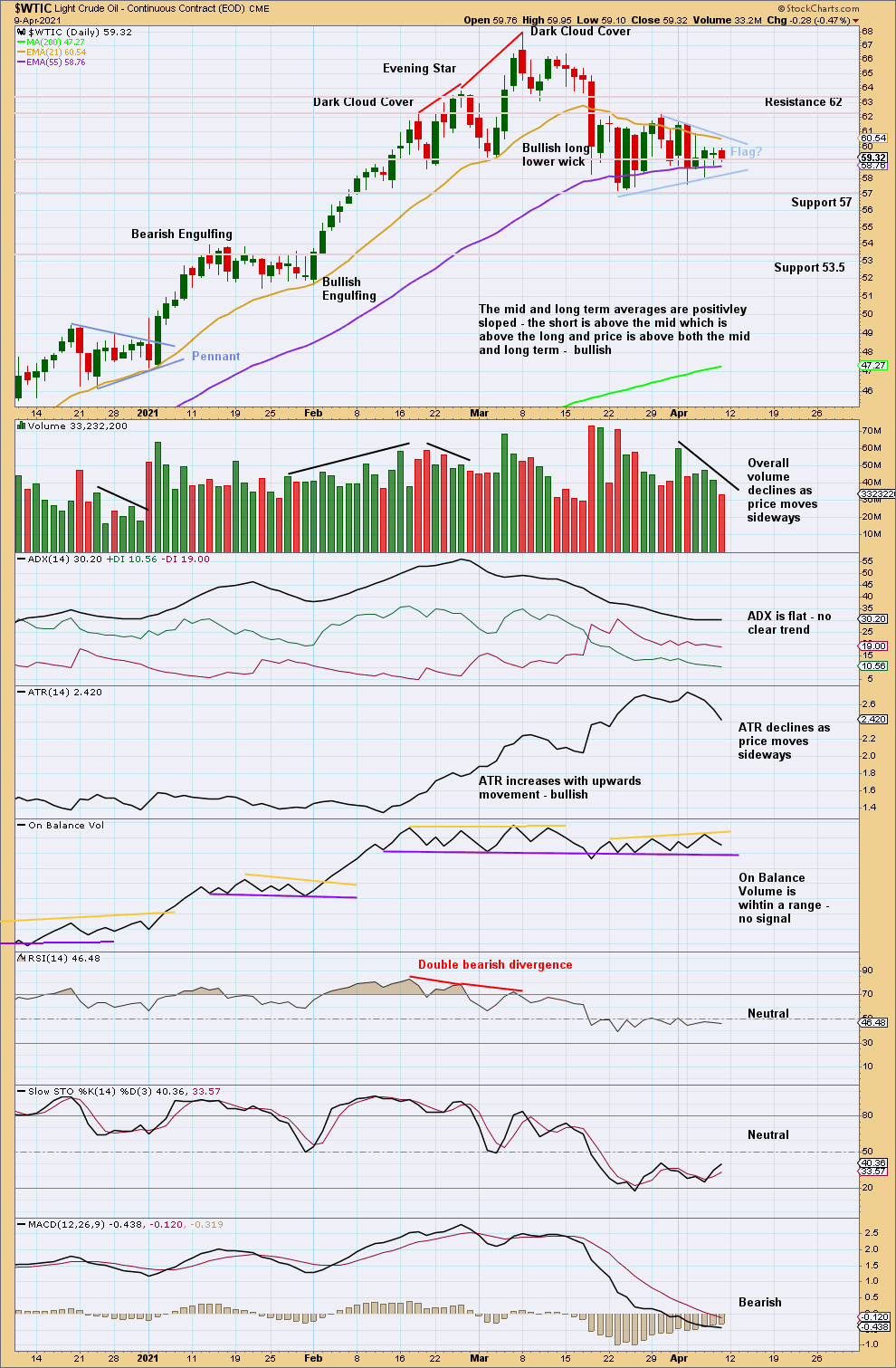

Click chart to enlarge. Chart courtesy of StockCharts.com.

A bearish candlestick pattern on the weekly chart supports the Elliott wave counts.

ADX at the high reached extreme. RSI reached extreme at the last high. Given extreme conditions a bearish candlestick pattern should be given weight. A multi-week to multi-month pullback is a reasonable expectation here.

The short-term volume profile is bearish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The prior extreme upwards trend may have now ended. A multi-week to multi-month pullback or consolidation may have begun. It may continue until RSI reaches extreme oversold.

Price is now consolidating within a narrow range of resistance about 62 and support about 57. A breakout from this range is required for confidence in the next direction.

The consolidation may be forming a flag pattern (these are reliable continuation patterns). A target to be used following a downwards breakout would be about 47.77.

Published @ 05:34 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.