US OIL: Elliott Wave and Technical Analysis | Charts – June 4, 2021

An upwards week closes above prior resistance.

The alternate Elliott wave count from last week now looks likely.

Summary: The main Elliott wave count expects upwards movement to continue to 87.90.

The alternate Elliott wave count allows for a deep pullback here to 54.86 – 54.42 before the upwards trend resumes.

The larger trend remains up.

Oil may have found a major sustainable low in April 2020.

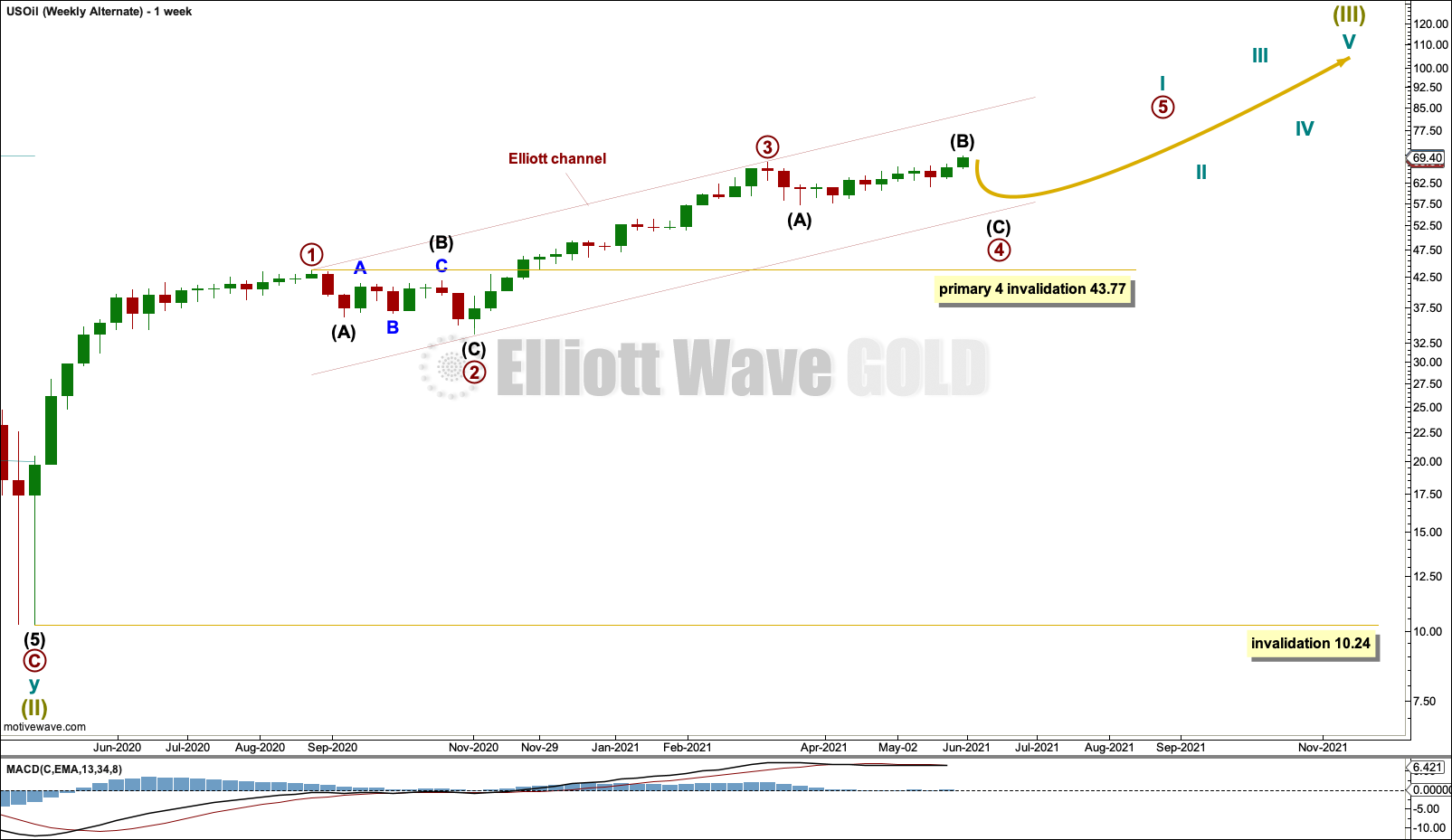

ELLIOTT WAVE COUNT

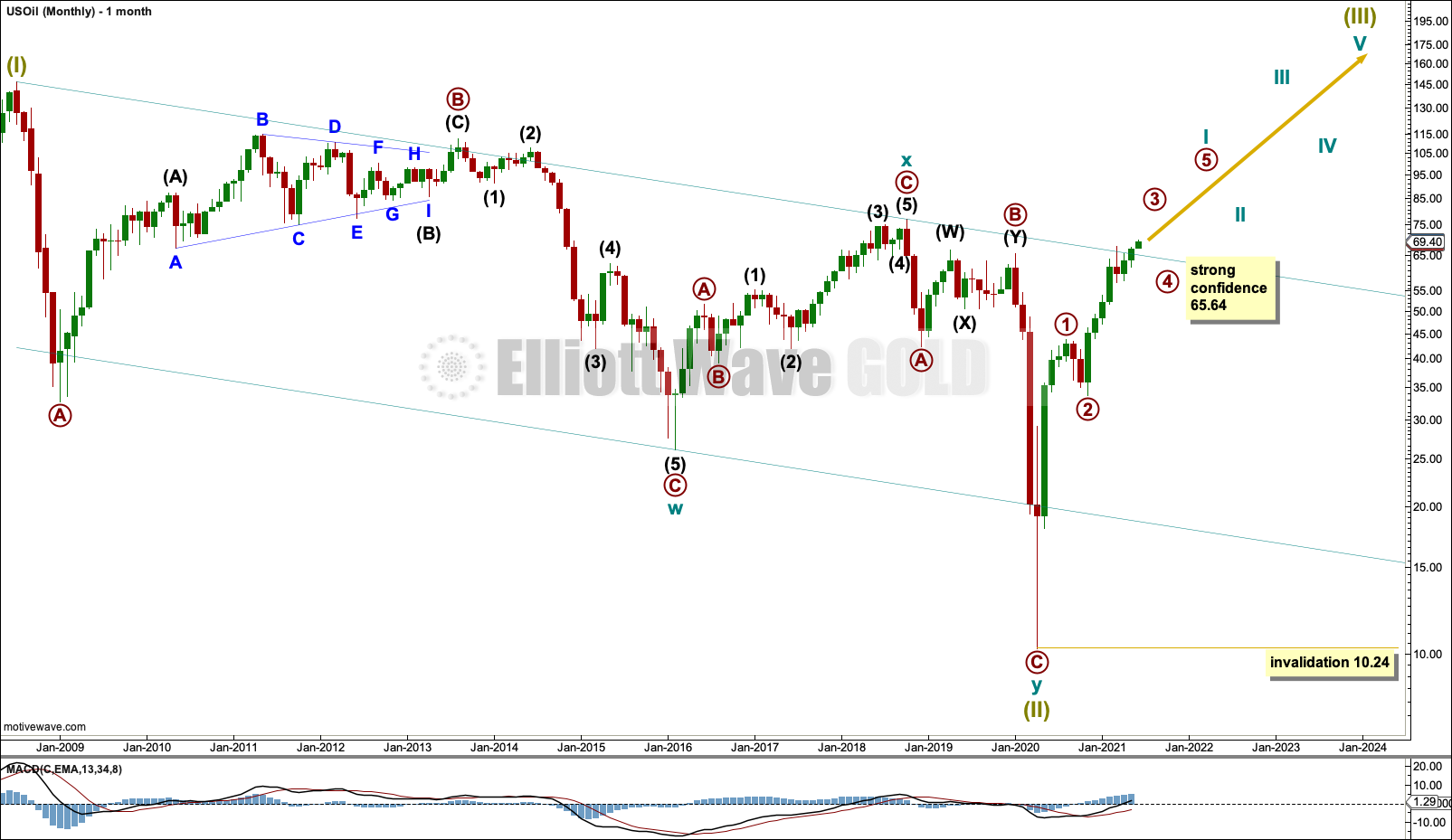

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

Following Super Cycle wave (II), which was a correction (three steps back), Super Cycle wave (III), which may have begun, should be five steps up when complete. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. This trend line is breached to the downside, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance. Price is reacting down from the upper edge of this channel.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. However, while this is a common tendency, it is not always seen and may not have been seen in this instance. The first reasonably sized pullback may be over already.

WEEKLY CHART

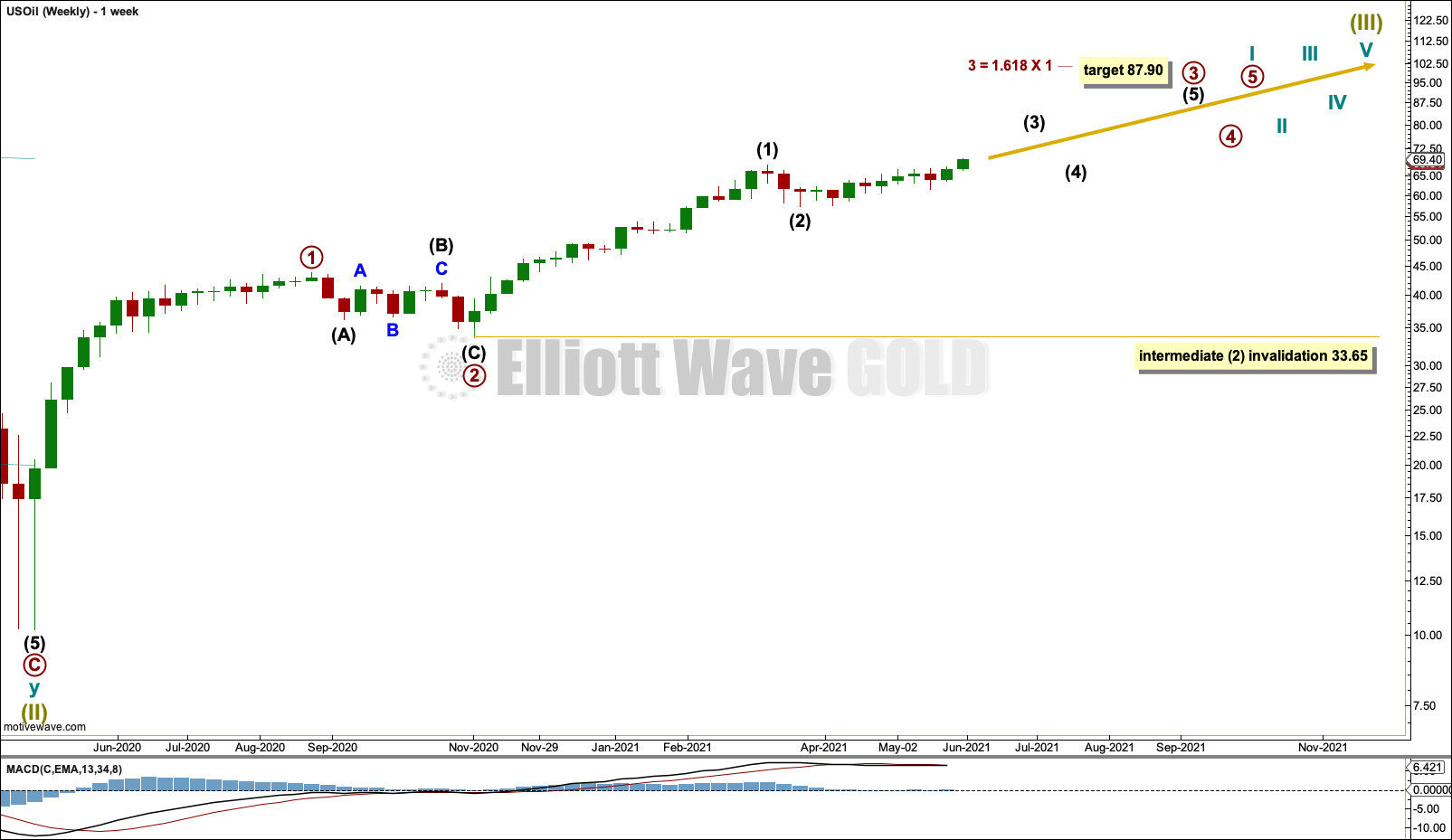

Super Cycle wave (III) must subdivide as an impulse.

Cycle wave I within Super Cycle wave (III) may be incomplete.

Within cycle wave I: Primary waves 1 and 2 may be complete, and primary wave 3, which may only subdivide as an impulse, may have begun.

Within primary wave 3: Intermediate waves (1) and (2) may be complete. If it continues lower, then intermediate wave (2) may not move beyond the start of intermediate wave (1) below 33.65.

MAIN DAILY CHART

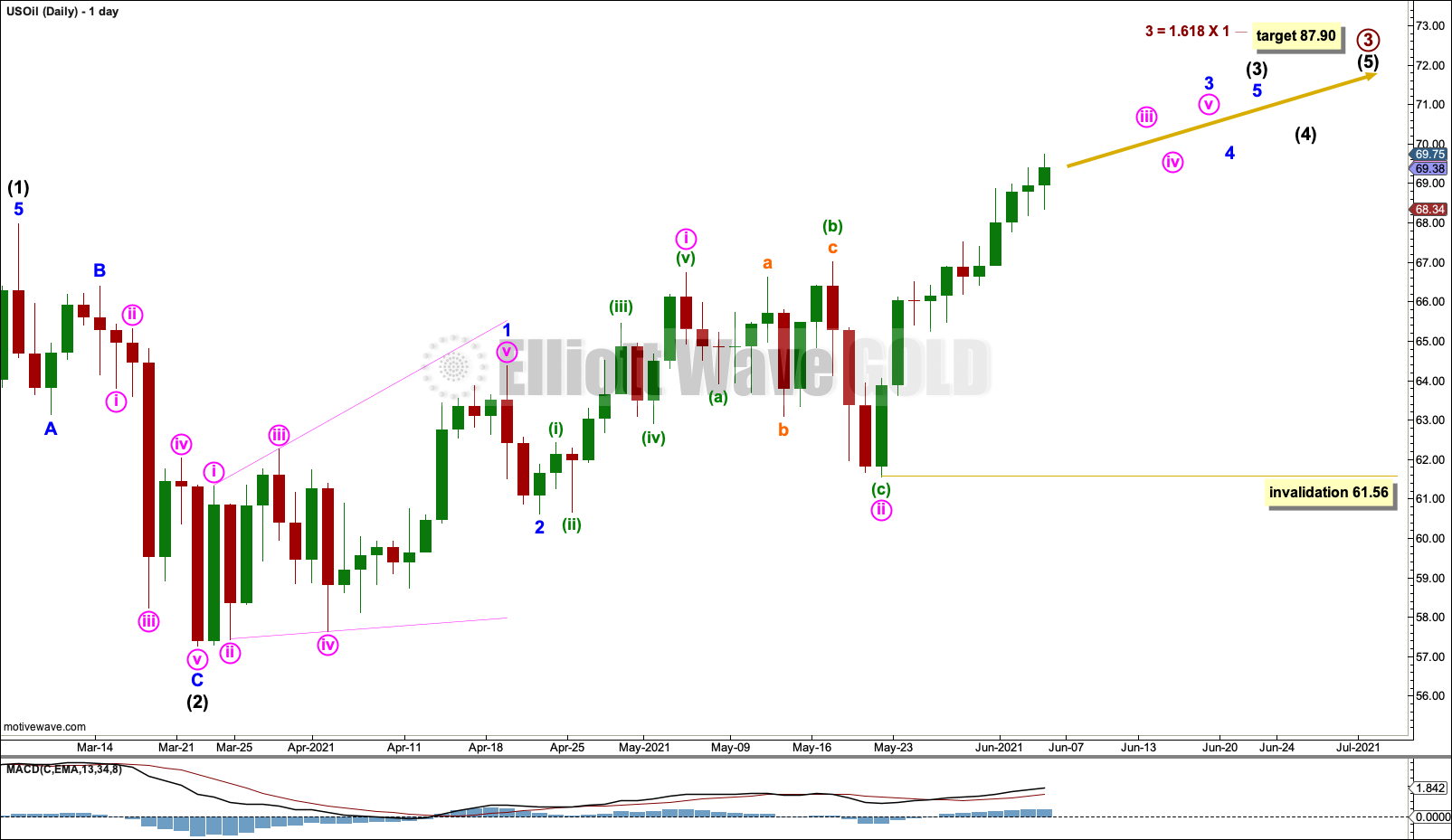

It is possible that intermediate wave (2) was over as a brief and shallow zigzag.

This wave count must see the downwards wave ending on 23rd of March as a three, but this movement looks best as a five. For this reason an alternate below is still considered.

If intermediate wave (3) has begun, then minor wave 1 within it may be a complete leading expanding diagonal. Leading expanding diagonals are less common than impulses. This reduces the probability of this wave count.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3: Minute waves i and ii may be complete, minute wave iii may only subdivide as an impulse, and no second wave correction within minute wave iii may move beyond its start below 61.56.

ALTERNATE DAILY CHART

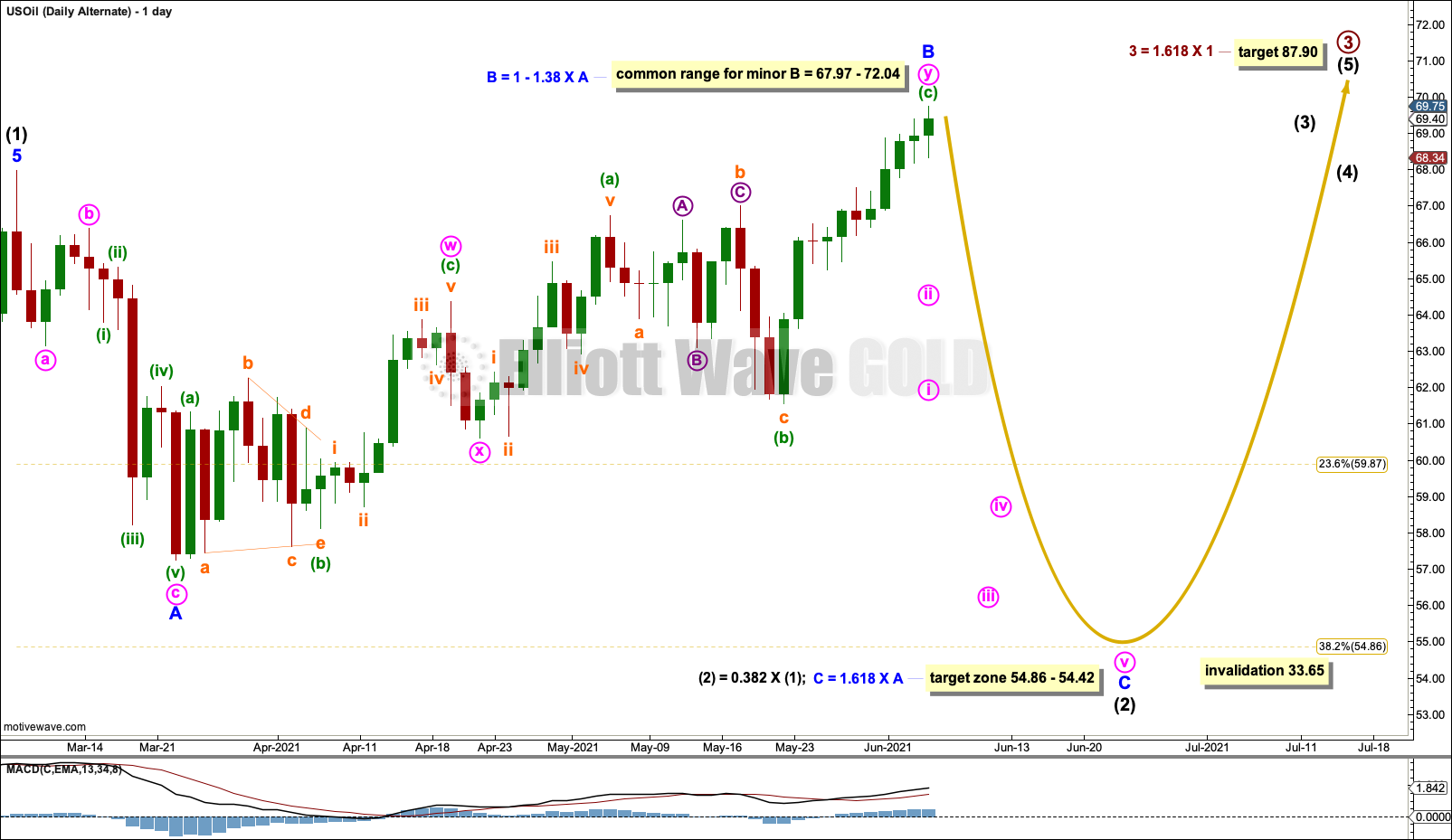

Intermediate wave (2) may be continuing as a flat.

Within a flat the common range for minor wave B would be from 67.97 to 72.04. Minor wave B may make a new high beyond the start of minor wave A, as in an expanded flat. If minor wave B is complete at this week’s high, then intermediate wave (2) may be unfolding as a regular flat. Minor wave B remains within this most common range.

Minor wave C would be likely to make at least a slight new low below the end of minor wave A at 57.26 to avoid a truncation.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 33.65.

ALTERNATE WEEKLY CHART

This alternate wave count considers the possibility that primary wave 3 may have been over at the last high.

Primary wave 3 is close to equal in length with primary wave 1; it is 0.79 longer than primary wave 1.

Primary wave 4 may be continuing as a flat, triangle or combination. The daily charts for this alternate wave count would look the same as the daily charts above, the degree of labelling would be one degree higher.

TECHNICAL ANALYSIS

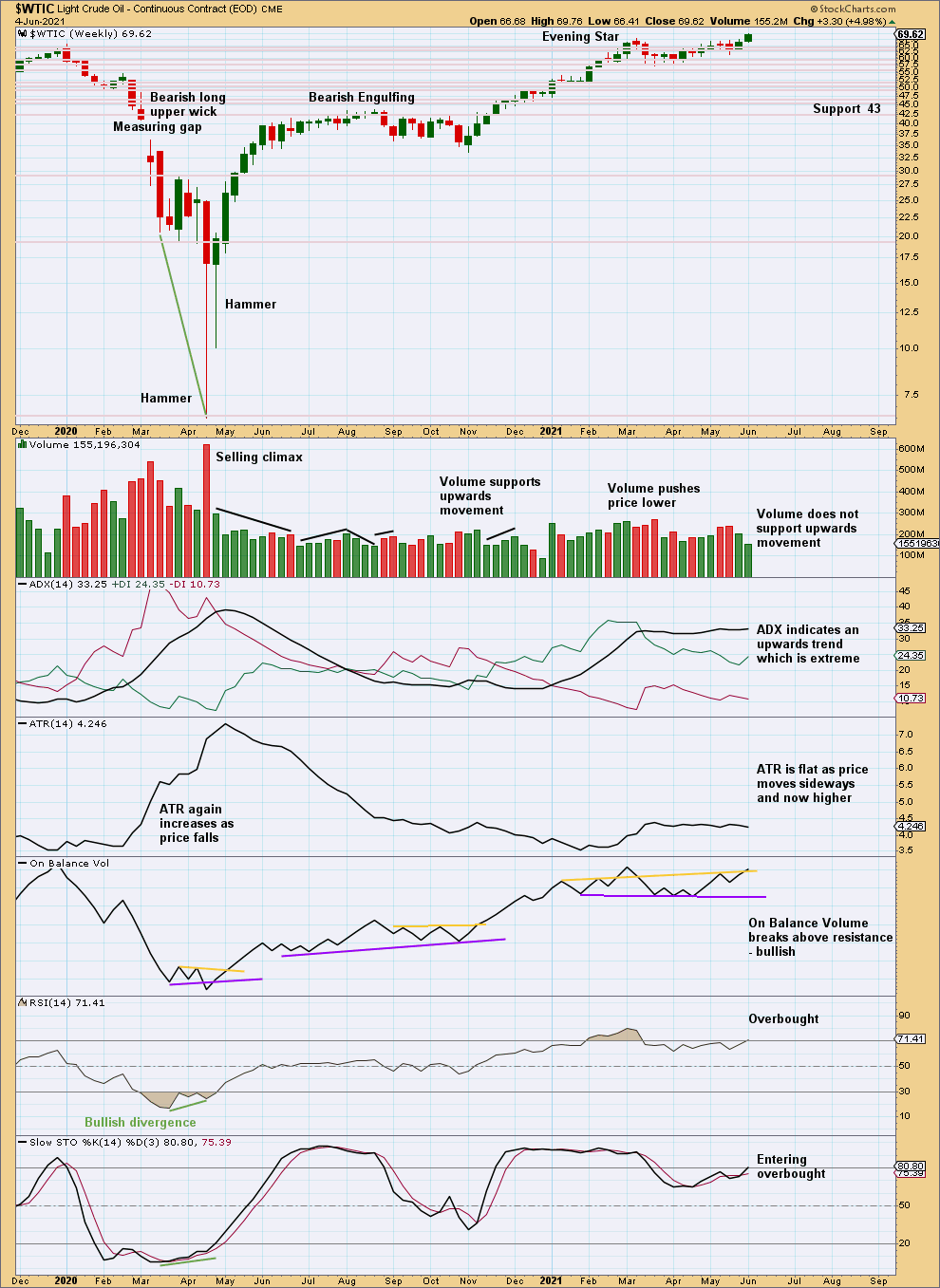

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week has closed above prior resistance. Volume does not support upwards movement, but the price history of this market shows that volume may not support upwards movement within an early stage of a new bullish movement yet that movement may be sustainable.

A bullish signal by On Balance Volume supports the main Elliott wave count.

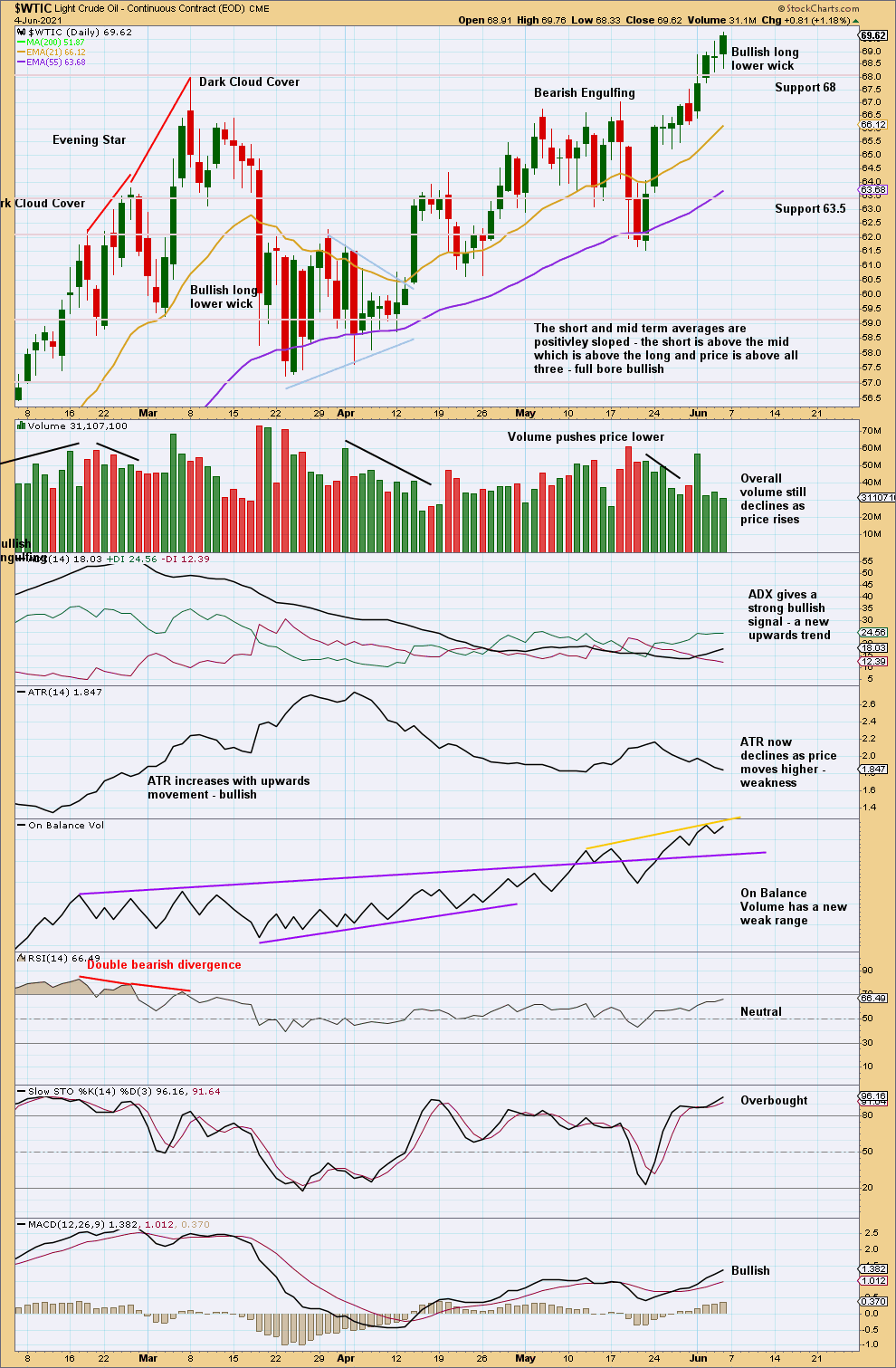

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is again an upwards trend in a relatively early stage.

Published @ 07:14 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—