US OIL: Elliott Wave and Technical Analysis | Charts – June 11, 2021

Last week’s analysis of US Oil expected upwards movement to continue towards the next target, which is exactly what has happened.

Summary: The main Elliott wave count expects upwards movement to continue to a new short-term target at 76.91, with a longer term target at 87.90.

Oil may have found a major sustainable low in April 2020.

ELLIOTT WAVE COUNT

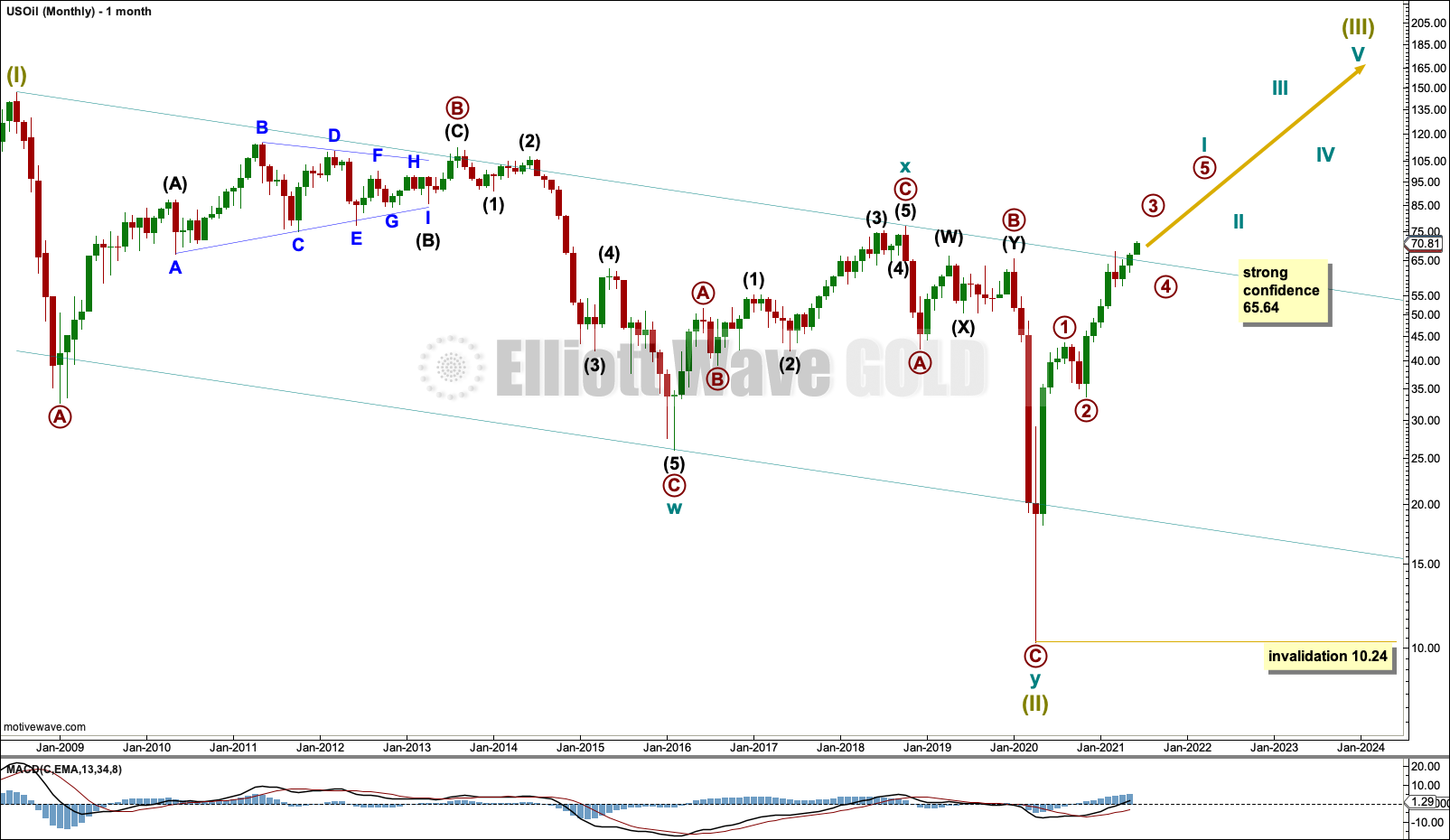

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

Following Super Cycle wave (II), which was a correction (three steps back), Super Cycle wave (III), which may have begun, should be five steps up when complete. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. This trend line is breached to the downside, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance. Price is reacting down from the upper edge of this channel.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. However, while this is a common tendency, it is not always seen and may not have been seen in this instance. The first reasonably sized pullback may be over already.

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse.

Cycle wave I within Super Cycle wave (III) may be incomplete.

Within cycle wave I: Primary waves 1 and 2 may be complete, and primary wave 3, which may only subdivide as an impulse, may have begun.

Within primary wave 3: Intermediate waves (1) and (2) may be complete. No second wave correction within intermediate wave (3) may move beyond its start below 57.26.

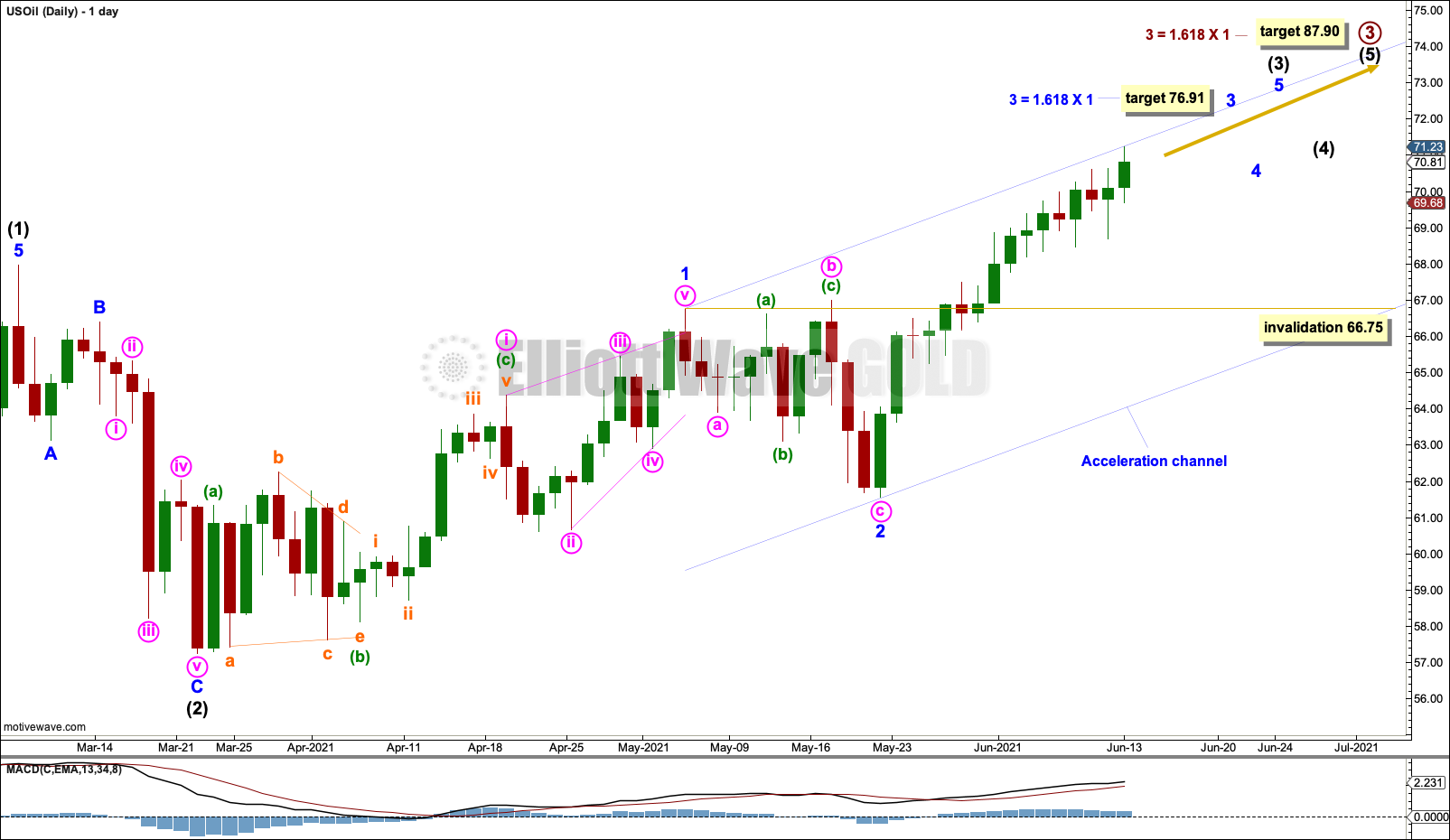

DAILY CHART

It is possible that intermediate wave (2) was over as a brief and shallow zigzag.

If intermediate wave (3) has begun, then minor wave 1 within it may be a complete leading contracting diagonal. Following a leading diagonal in a first wave position, the second wave correction is usually very deep. Minor wave 2 is a 0.55 depth of minor wave 1.

A target is calculated for minor wave 3 that expects it to exhibit a common Fibonacci ratio to minor wave 1. Minor wave 4 may not move into minor wave 1 price territory below 66.75.

Draw an acceleration channel about intermediate wave (3). Draw the first trend line from the end of minor wave 1 to the last high, then place a parallel copy on the end of minor wave 2. Keep redrawing the channel as price continues higher. When minor wave 3 may be over, then this channel would be drawn using Elliott’s first technique and may show were minor wave 4 may find support.

TECHNICAL ANALYSIS

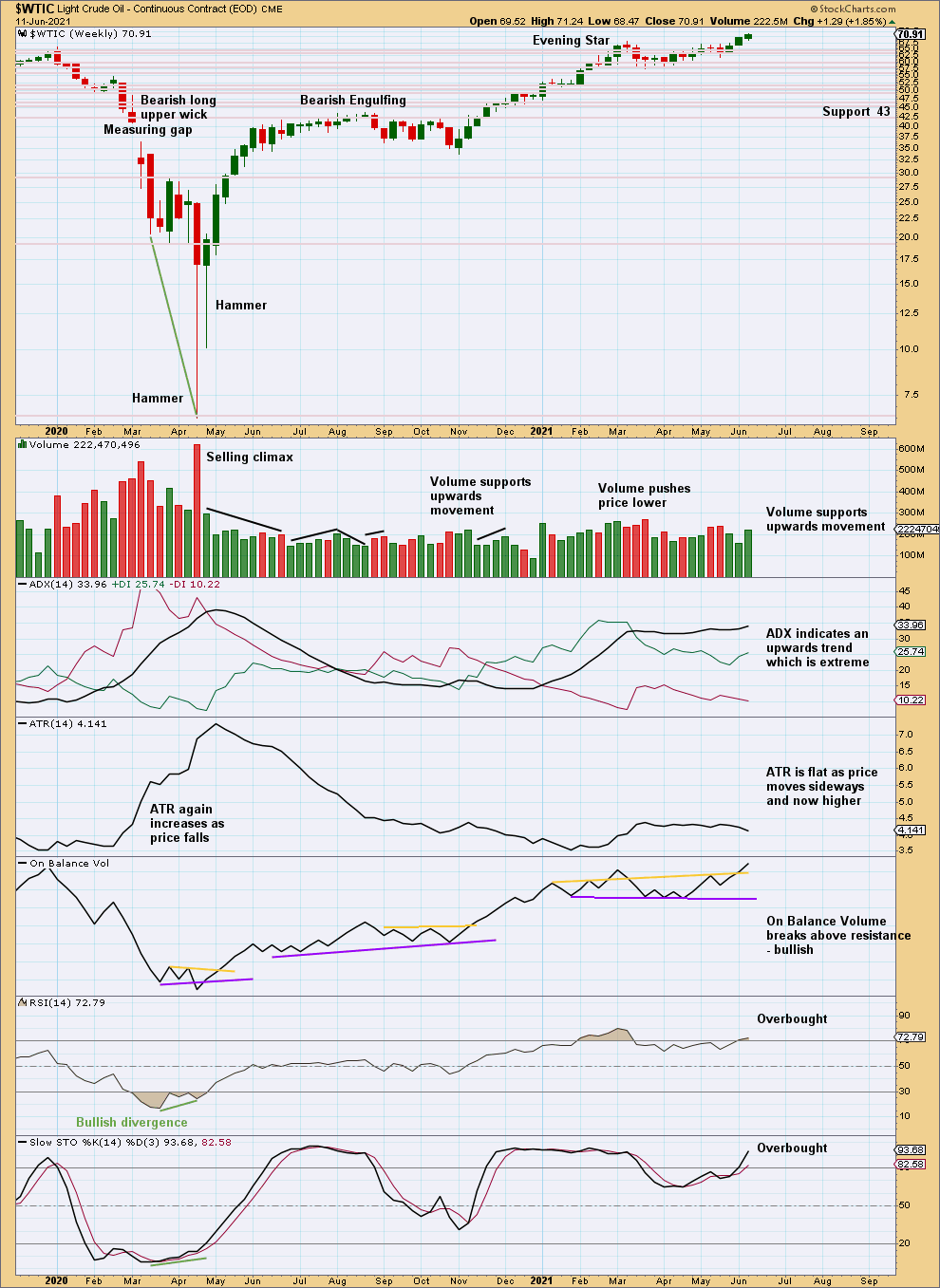

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume and On Balance Volume support the main Elliott wave count. This market can sustain extreme trends for a reasonable period of time.

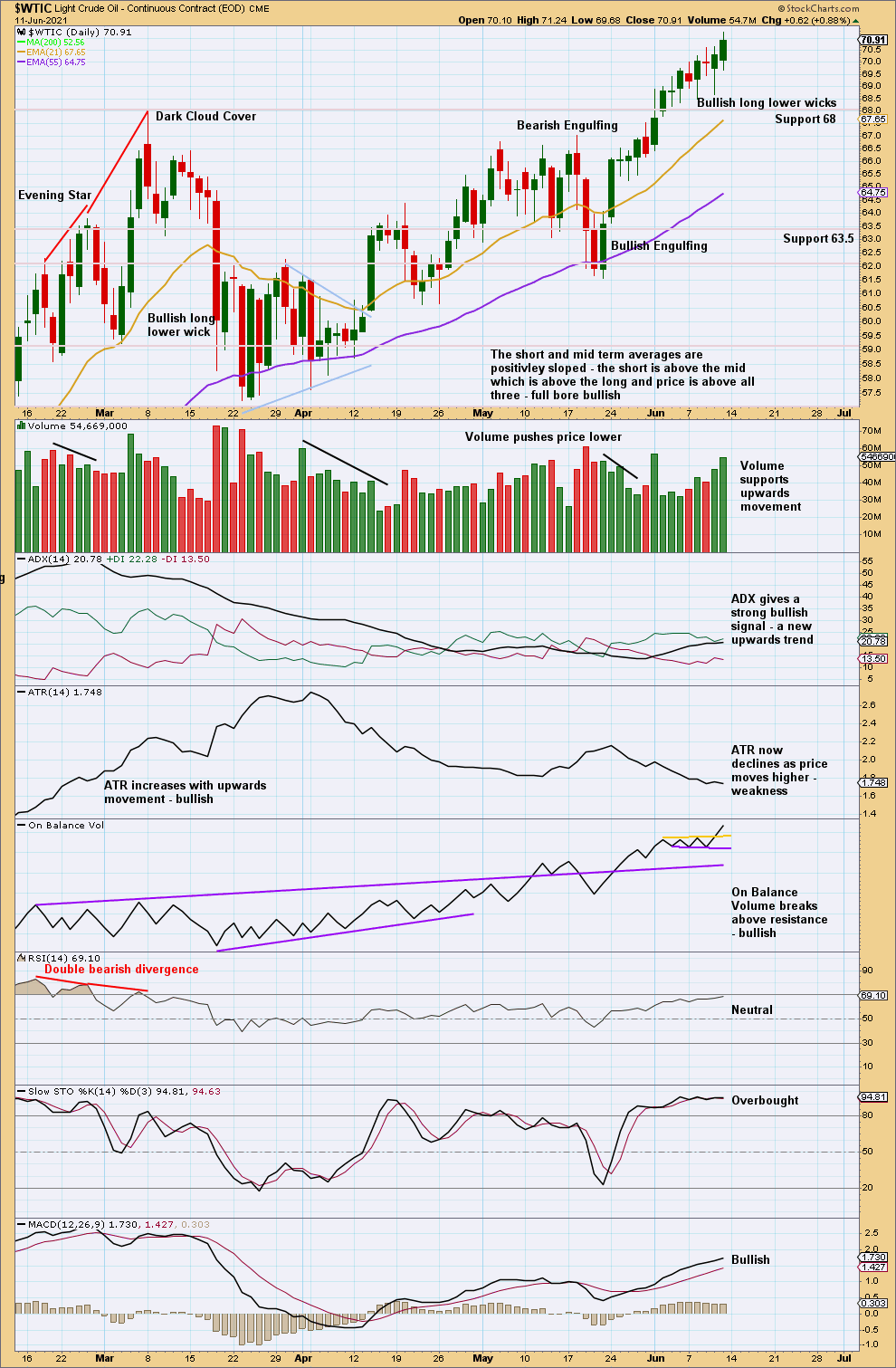

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The upwards trend is not yet extreme at the daily chart level. There is plenty of room for the upwards trend to continue.

Published @ 07:13 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—