The channel about intermediate wave (C) is finally breached.

Summary: I am expecting a fifth wave down. Typical of commodities, this may be swift and strong and may offer an excellent trading opportunity. I am looking for an entry point to hold a trade for weeks / months as this fifth wave unfolds.

Changes and additions to last analysis are italicised.

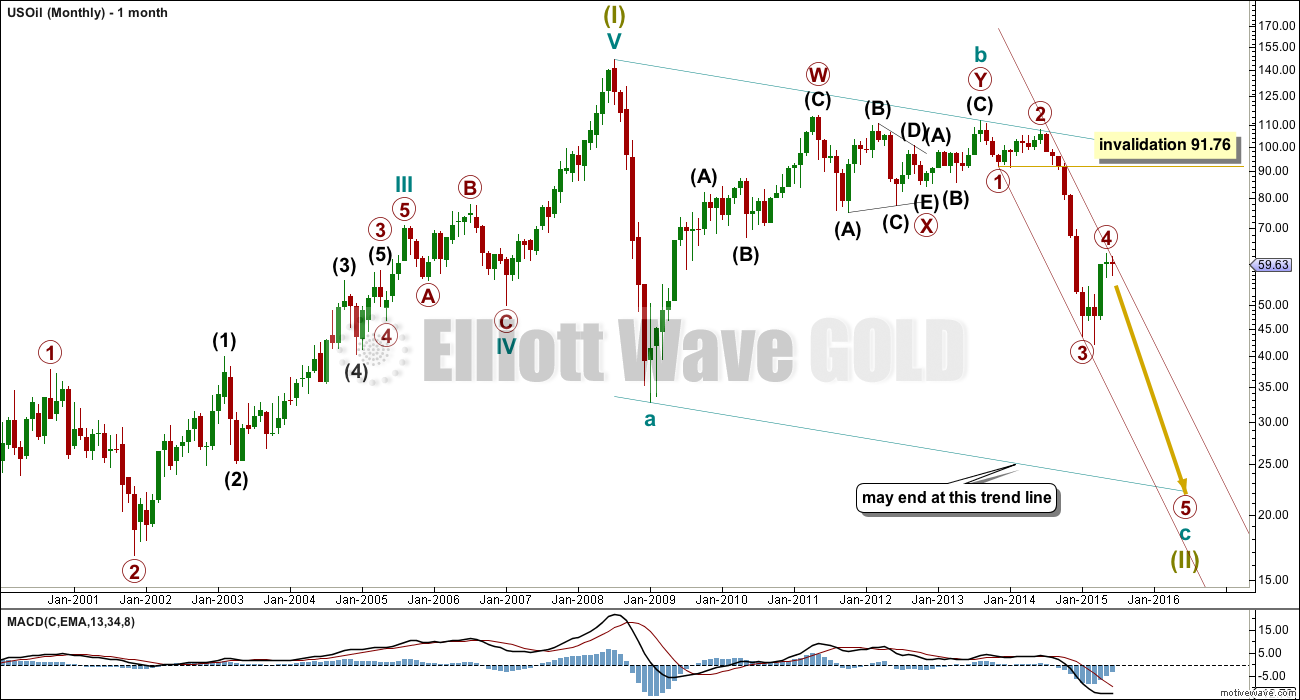

Monthly Chart

This wave count sees US Oil as within a big super cycle wave (II) zigzag. Cycle wave c is highly likely to move at least slightly below the end of cycle wave a at 32.70 to avoid a truncation. Cycle wave c may end when price touches the lower edge of the big teal channel about this zigzag.

Within cycle wave c, primary wave 5 is expected to be extended which is common for commodities.

Primary wave 4 may not move into primary wave 1 price territory above 91.76.

Draw a channel about this unfolding impulse downwards. Draw the first trend line from the lows labelled primary waves 1 and 3 then push up a parallel copy to contain all of primary wave 2. Copy this maroon trend line carefully over to the daily chart.

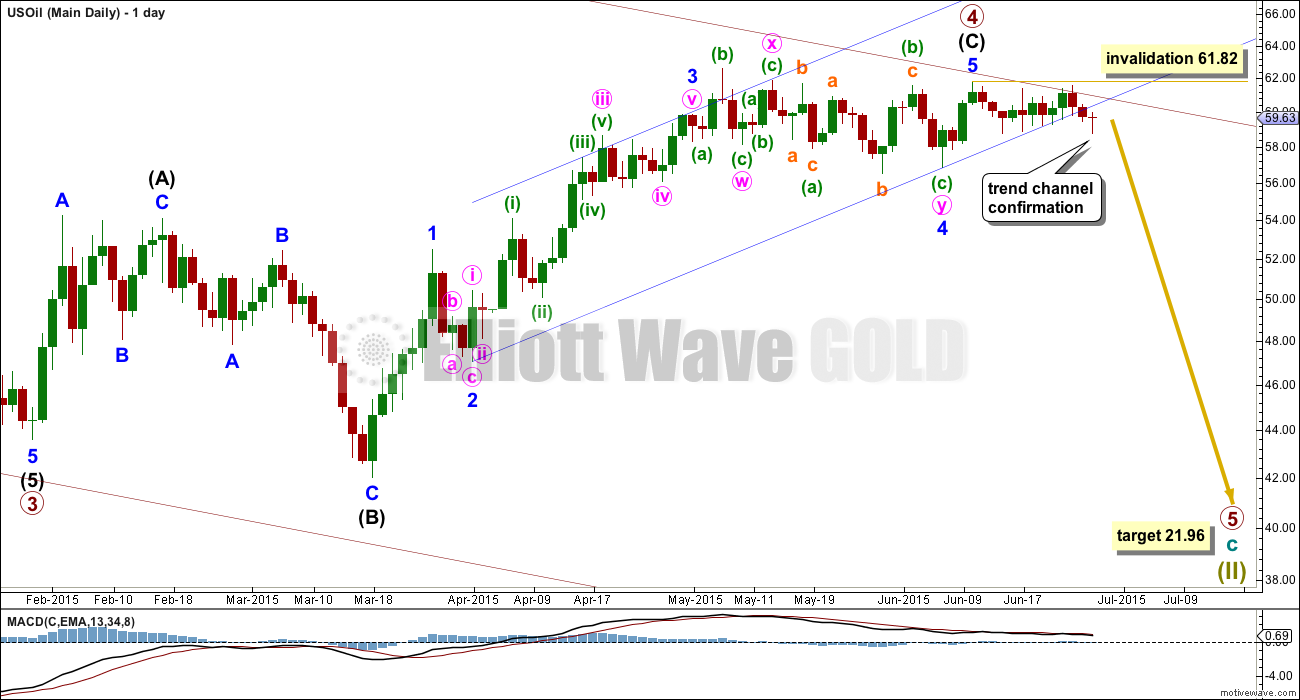

Daily Chart

Primary wave 4 moved higher. Again it may be a complete expanded flat correction.

Draw a channel about intermediate wave (C) using Elliott’s second technique: draw the first trend line from the lows labelled minor waves 2 to 4 then place a parallel copy on the high labelled minor wave 3. Downwards movement has breached the lower edge of this trend channel.

Now that the channel about intermediate wave (C) is again breached, I will wait for a throwback, maybe on Monday, and use the 15 minute chart below to find an entry point. My usual approach is to set a stop using the Elliott wave invalidation point (and so to adjust my position size to keep risk minimal). In this instance, the invalidation point is at 61.82, and if the trade is positive within the first 24 hours, then I will move my stop to just beyond my entry point (on the positive side) so that if price goes against me I have no loss, but a tiny profit and will then wait for the next possible opportunity to enter.

My concern today is the volume which has been declining for the last three down days, so volume does not support a downward trend.

Side note: I have a new broker I am trialling, but I’m not happy with their roll over fees. I prefer long term trades (I’ll hold them for weeks or months) so the roll over fees really are a concern. But this new broker allows to trade US Oil, so I’m wondering if I should hold a long term position for the duration of primary wave 5 down with them, if it turns out to be that US Oil is in a typically strong extended fifth wave. Therefore, if any members or readers in New Zealand or Australia can recommend a broker please let me know. Thank you.

Entry Point

To find an entry point this is the technique I use.

1. The last move against the expected trend (in this case the last upwards move) must subdivide as a clear three. So far this first condition is not met in this instance.

2. Price must sit within the two Bollinger bands on the opposite side to the expected / traded direction. In this case I expect price to move down, so I want to wait until price is within the upper two Bollinger bands.

3. I sometimes also wait after that to see a smaller bar on the MACD histogram and enter as soon as I see that happen.

On Monday I expect price to move higher and complete a clear three up. Because volume is not supporting this recent price drop of the last three days, I will be very cautious in my entry and may not enter Monday. I may wait another few days yet, but either way I expect we are very close now to a good entry point for a short on US Oil for a primary degree fifth wave.

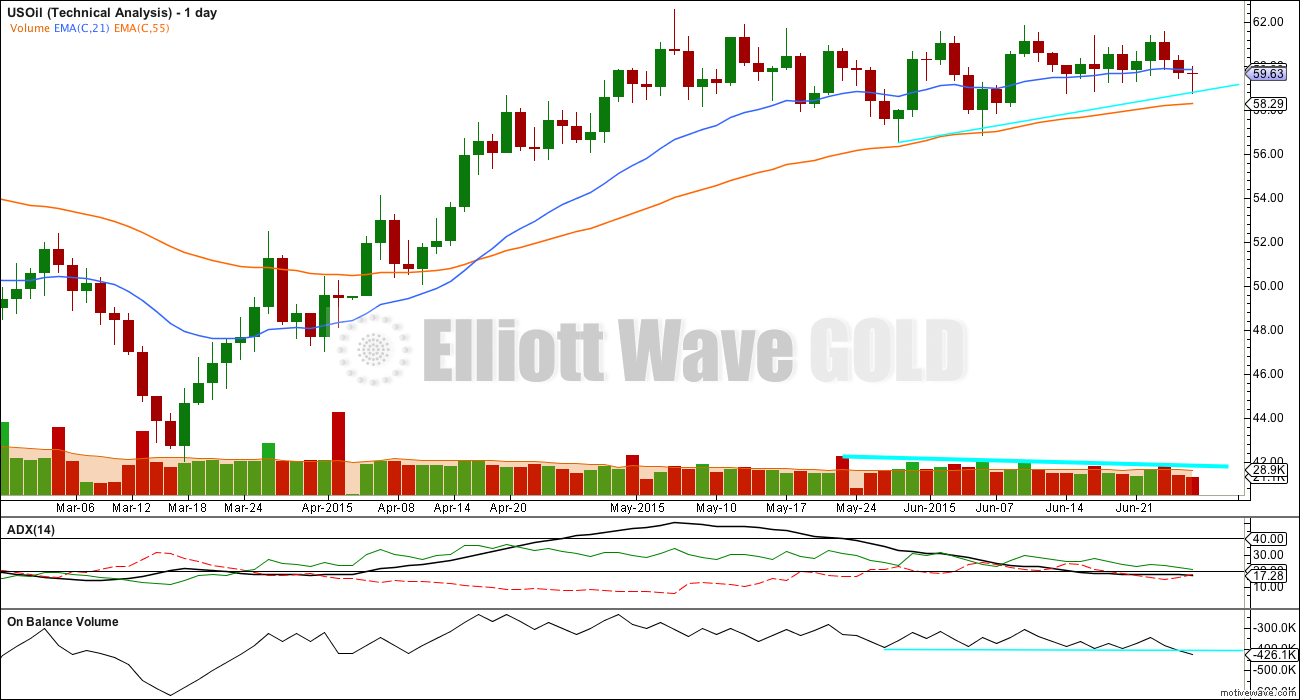

Trend Lines

Price keeps breaking below upwards sloping trend lines. The two aqua blue lines are drawn using Magee’s approach as outlined in the classic “Technical Analysis of Stock Trends”. These were both breached days ago.

The other trend lines are my own.

Technical Analysis

It is concerning that ADX is declining and is now below 15. There is no clear trend indicated. However, ADX can sometimes be a lagging indicator. At the start of primary wave 3 I note that it was 20 days from the high before ADX indicated the downwards trend.

The shorter EMA still needs to cross below the longer EMA, and price needs to cross below the longer EMA before full confidence in a downward trend can be had.

There is slight negative divergence between price trending higher (higher lows) and On Balance Volume very slightly lower (almost horizontal). This negative divergence is so slight it may not be reliable.

While price has been moving sideways in a narrow range, volume is declining (aqua blue trend lines). The highest volume day was a down day. I am concerned that the last three days downwards movement has occurred on declining volume, so we may yet see a strong bounce up before the new downwards trend begins in earnest.

This analysis is published about 07:17 p.m. EST.

Hi Lara, do you think this wave count is possible? Appreciate your comment if my green 4 looks silly or incorrect.

green 3 is almost 150% of green 1, within green 3 blue 1 is almost 100% of blue 5, and blue 3 is just 123.6% of 1 (and 5). As blue 2 in green 5 has retraced to 78.6% of blue 1, 56.83 is the invalidation point if green 4 is over.

http://s16.postimg.org/vddk6tvrp/oil.png

Thank you.

Yes, it’s possible. You’d have to resolve how blue a subdivides; is it a three or a five? if it’s a three then blue b must be 90% of blue a, is it? if it’s a five then it may only be a leading diagonal or an impulse. Then, if you manage that you’d have to acknowledge that lime 4 ends with a truncated blue C wave. And it’s quite a reasonable sized truncation. Truncations only normally happen after the prior wave moves too far too fast… and you can’t say that about that a wave. So that is a real big problem which reduces the probability of your wave count.

Apart from all that it’s possible. It just overall has a really low probability. Really low.

And that illustrates nicely something about Elliott wave. Even if you pay attention to all the rules and meet them all, you may still come up with a wave count which has a low probability because of problems in regards to guidelines or the “right look”.

At the end of the day there will be only ONE right wave count. The idea is to find it. It must meet all the rules all the time. And it will be the one (most often) which meets the most guidelines and has the right look. Based upon probability.

But you still have to keep in mind alternates… and I would see your idea here as an alternate. I would be looking for a wave count which resolves the problems I’ve identified here as a more likely count.

I do hope this all makes sense.

Thanks for the comment, that’s really informative!

Lara, thanks, a very thoughtful analysis.

Would you provide a timeline to reach 5th wave target, I realize timeline will not be precise but your estimate will be appreciated.

And, as you are following this market closely (already doing the analysis work) consider providing updates on oil action and entry points?

If primary wave 5 is equal in duration with primary wave 3 it may end in another 6 months.

Hi Lara

Regarding your question in the text above, I have traded gold and oil (and lots of other instruments) with IG Markets for over 12 years. In my opinion, they are one of the most reputable and reliable CFD providers. They are strict on the segregation of clients’ funds. Withdrawals appear in your bank a/c the next day.

The rollover charge for futures is 60% of the spread which seems reasonable. However, you can also trade cash oil (and a few other markets) with no rollovers but with a small financing charge for long positions.

The ‘procharts’ function is pretty good too and could give you a useful backup to that which you currently use.

Thank you Johno!

I’ve taken a closer look… and noted they only trade CFD’s.

This is not something I’m interested in at all. I’m way to risk averse to trade CFD’s.

So that’s a no for me. But cheers for the tip anyway.

Why? The leverage is whatever you want to make it and with your discipline I can’t see how that would be a problem. Also in the case of IG, the quotes are always based on the underlying market rather than software generated.

People lose with CFD’s because they can’t trade, not because there is anything intrinsically dangerous with them. As we both know, it’s a very long apprenticeship but we’ve both served it.

That’s true.

I just don’t like the idea of a broker potentially having access to my bank account.

It’s the same reason I never sign direct debit authority forms.

When I do place a trade I tend to hold it for weeks / months. I hate day trading, too much in and out for me, too much risk. I’m not quite an investor, but never a day trader either. My entire style is very risk averse. And so I shy away naturally from CFDs because of the potential risk involved.

I know I can manage the risk by keeping leverage very low. I know it may appear to be unreasonable…. and make no sense to you…. and you may be right.

I’ll think on it.

One last comment. Neither of my CFD providers have access to my bank a/c. Where did that idea come from? I’m also allergic to direct debits.

The platform I’m currently trialling (and trading NZDUSD) has access to my bank account for their roll over fees. Which are charged daily. I fund my account well for this, but they still have access. Which I don’t like. Hence the desire to move.

I have made the assumption (and probably made an ass out of me, maybe not u though) that the warning on IG Markets website regarding trading CFD’s that you can lose more than your deposit means they can debit your bank account.

I’ll stop assuming and give them a call. Thank you Johno.