Elliott wave and traditional TA analysis of NZDUSD.

ELLIOTT WAVE COUNT

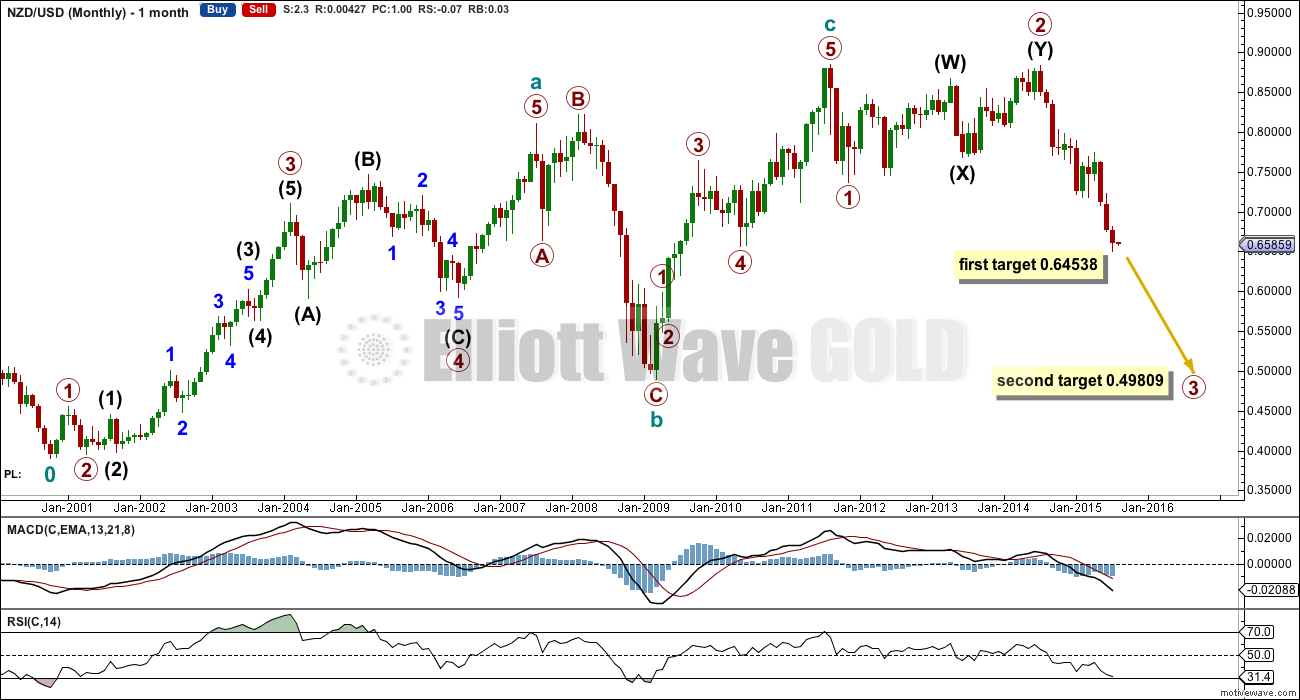

Primary 3 should end when RSI indicates oversold and most likely not before.

The first target is for primary wave 3 to reach 1.618 the length of primary wave 1 at 0.64538. The second target is 2.618 the length of primary wave 1 at 0.49809. The second target looks more likely at this stage.

The strongest part of primary wave 3 is probably still ahead.

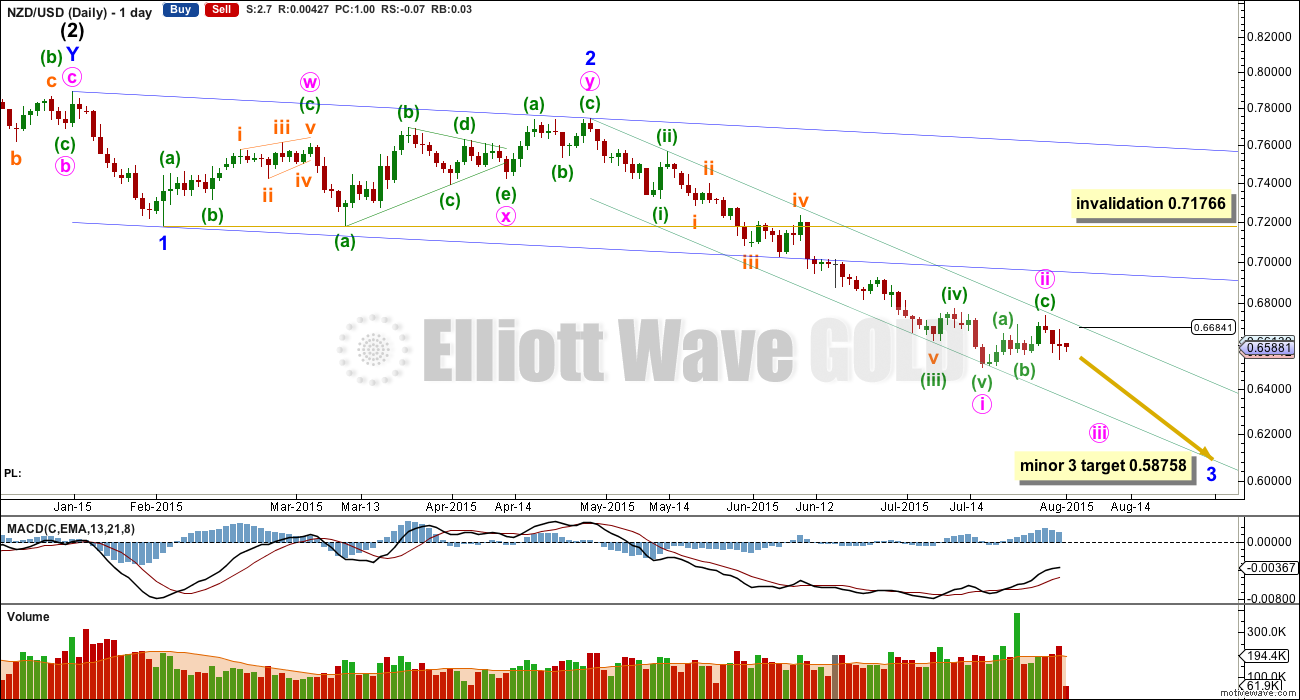

I am redrawing the trend channel about the downwards wave: the first trend line from the two swing highs, and a parallel copy on the lower edge to almost contain all this movement. The upper trend line so far has held, and if it continues to hold, then I’ll expect the downwards trend to be in place. I may move my stop down to 50 pips above 0.66841. Price should find resistance at the upper green line, and if it does not, then I don’t want to hold the trade while the market goes against me for too long. If my position is stopped out, then I’ll wait for the correction to be over before entering another short.

I’ll keep moving my stop daily to just above the trend line. 50 pips should allow for a small overshoot of the trend line, and the widening of spreads during times of extreme volatility.

If the lower edge of the channel is breached by strong downwards movement, then I’ll redraw the upper line of resistance also.

The fall in price for the last three days was supported by a rise in volume. The wave count expects the middle of a big third wave has just begun.

At 0.58758 minor wave 3 would reach 2.618 the length of minor wave 1. Although another five wave impulse down is complete (labelled minute wave i), I do not think this is minor wave 3 in its entirety because it has not shown a clear strong increase in downwards momentum beyond that seen for minor wave 1 at the daily chart level. Third waves should be stronger than first waves, and they normally are for NZDUSD. So far this last wave down has also not shown stronger momentum than intermediate wave (1). I expect downwards momentum to increase in the next few weeks.

I want to exit my trade at the end of minor wave 3. My take profit is at 0.58758.

Minor wave 4 may not move into minor wave 1 price territory above 0.71766.

TECHNICAL ANALYSIS

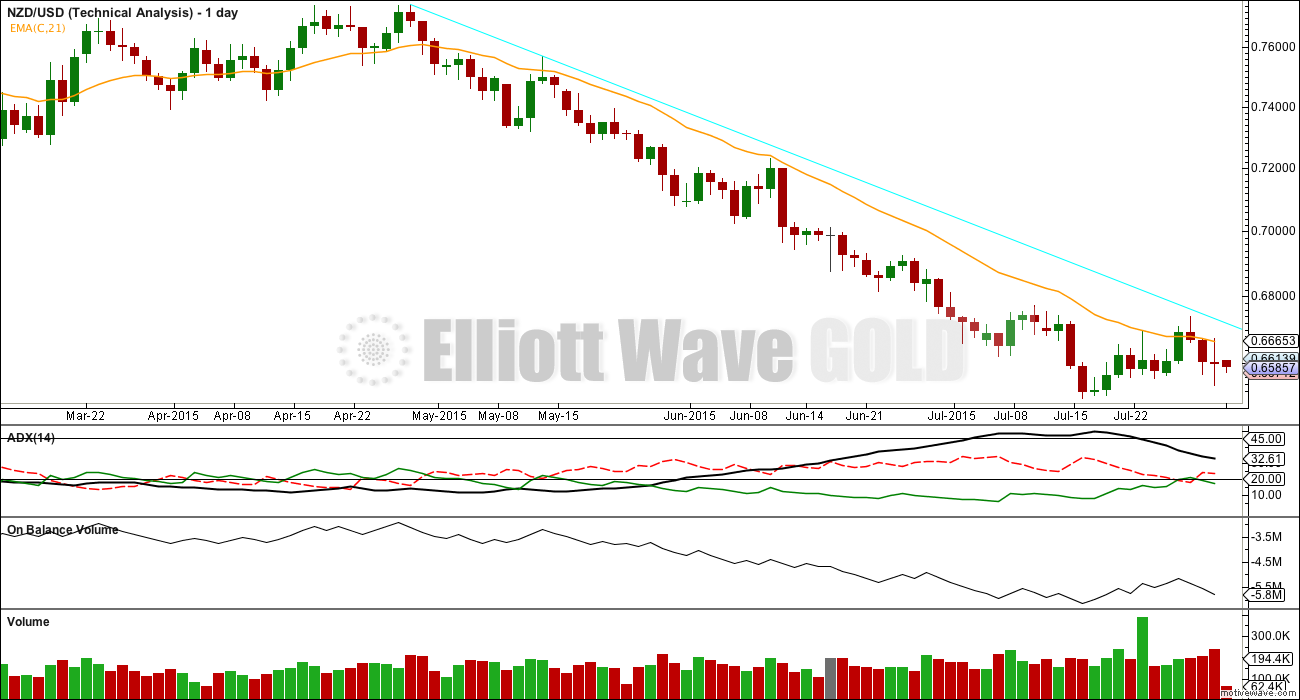

ADX is between 30 and 45 and declining, indicating a correction from the extreme is likely. Patterns and trending indicators should be used.

The correction which the Elliott wave counts labels minute wave ii may have resolved this extreme. While price remains below the 21 day EMA and the aqua blue trend line (drawn the same as the upper green line on the daily Elliott wave count), I will expect the trend remains down.

With On Balance Volume pointing lower and volume bars supporting this fall in price for the last three days, it looks like the trend for the Kiwi remains down.

Lara, you are so lucky to keep your bet that long, I won before but was swung away when price were bounced from 0.72 to 0.76 and missed the chance to catch it back the substantial dropping that was I waited for half years. Is it high chance to have 2.618 this time? But I won’t miss the chance in gold