Last week’s analysis of US Oil expected more downwards movement towards a target at 88.83 to 87.82. Price has moved lower. The structure is incomplete and the target has not yet been reached. The wave count remains the same.

Click on the charts below to enlarge.

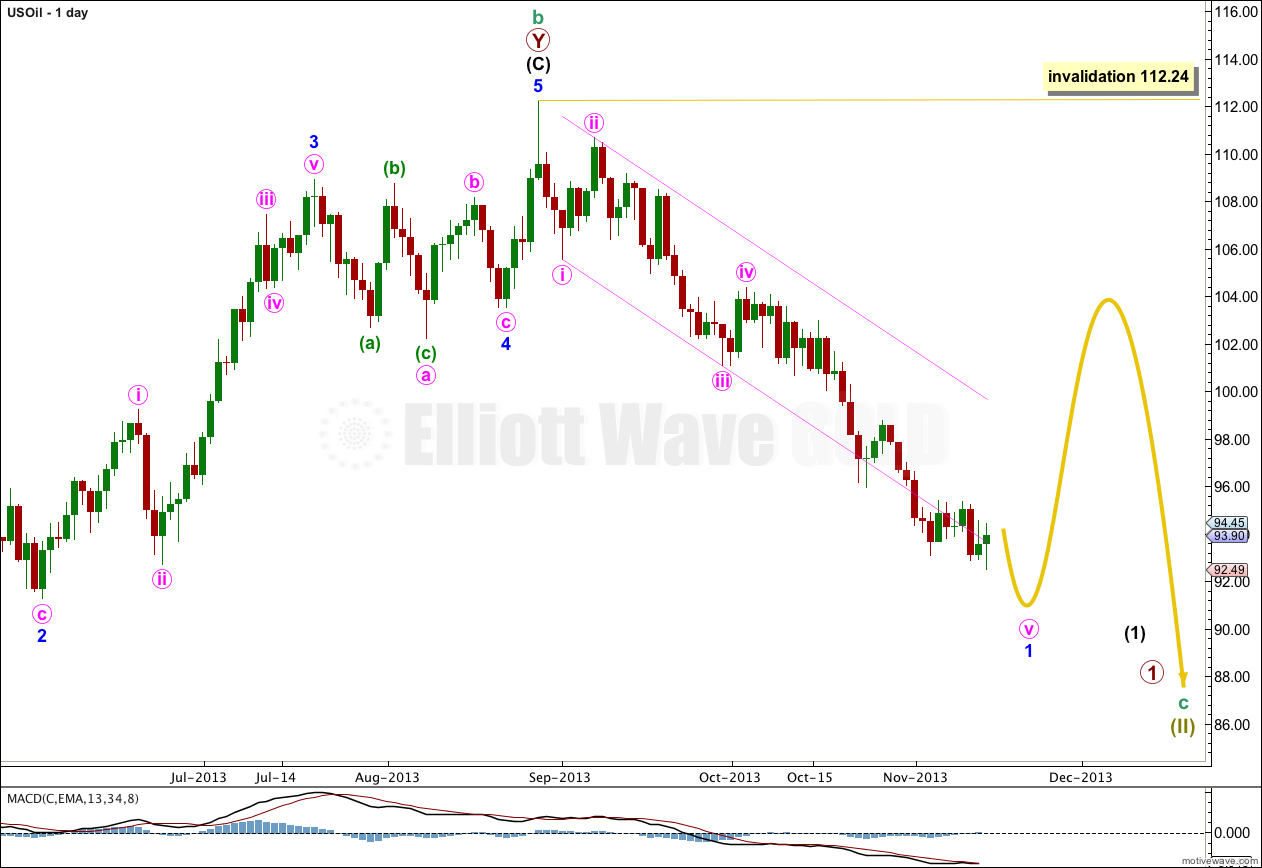

The bigger picture sees US Oil in a new downwards trend to last from one to several years. When I can see a clear five wave structure downwards on the daily chart I will have confidence in a trend change at cycle degree. So far the downwards structure for the first wave at minor degree is incomplete, and I cannot say that there is yet a clear five down.

Typical of commodities, the fifth wave is showing an overshoot of the parallel channel. When minute wave v completes minor wave 1 then I would expect upwards movement for several days to a couple of weeks or so for minor wave 2.

The parallel channel drawn here about minor wave 1 is drawn first with a trend line from the lows of minute waves i to iii, then a parallel copy is placed upon the high of minute wave ii. When this channel is clearly breached by upwards movement then I would have confidence that minor wave 1 is completed and minor wave 2 is underway.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 112.24.

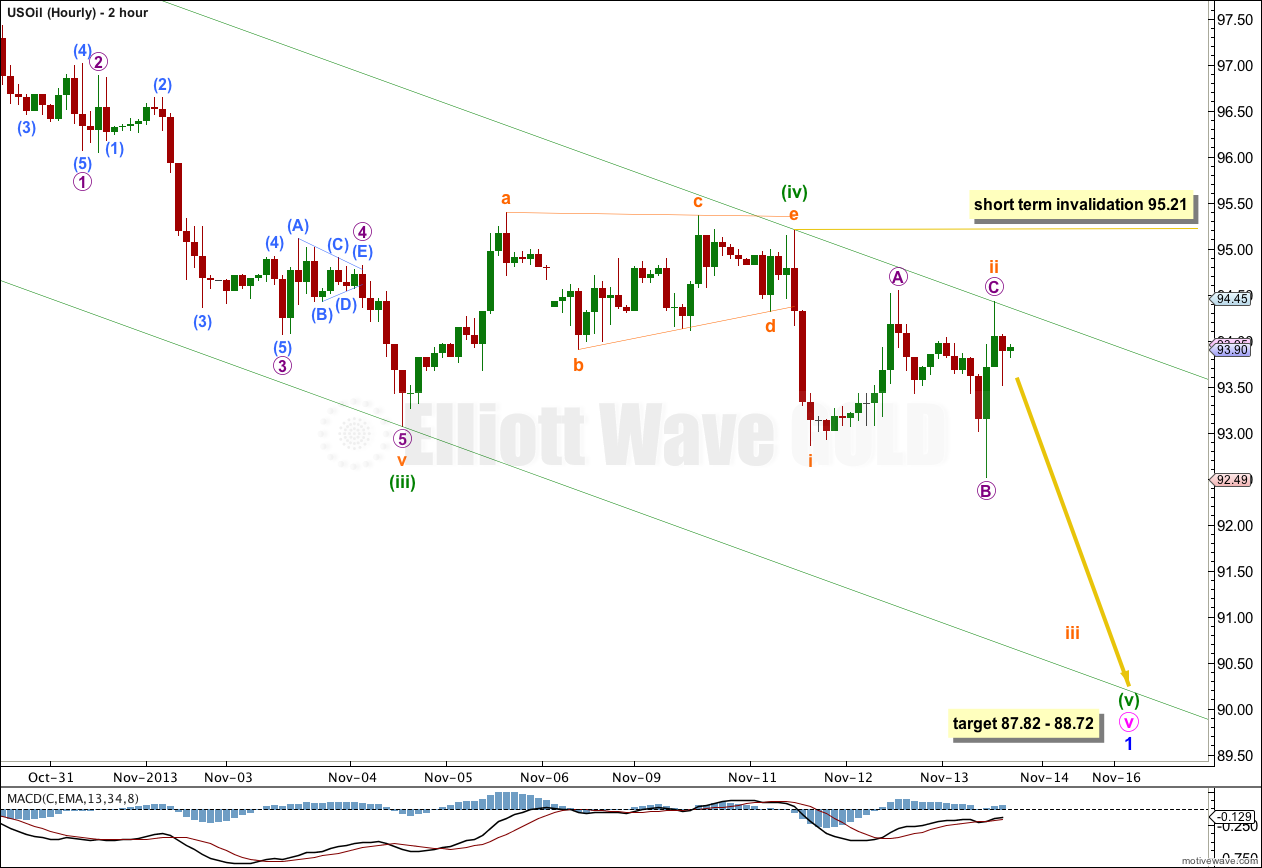

This two hourly chart shows the end of minor wave 1. There is now divergence between MACD and price; as price moves lower MACD moves higher. I would expect divergence to continue between the end of minuette waves (iii) and (v) to come.

Minuette wave (iv) was a contracting triangle. Minuette wave (v) has begun. Within it a first and second wave are complete.

Draw the parallel channel about the impulse of minute wave v using Elliott’s second technique. Draw the first trend line from the highs of minuette waves (ii) (at 103.57) to minuette wave (iv), then place a parallel copy on the low of minuette wave (iii). I will expect downwards movement to find support at the lower edge of this channel, and it may overshoot the channel. Along the way down the upper edge of the channel should provide resistance.

When this channel is clearly breached by subsequent upwards movement that may be a first indication that minor wave 1 in it’s entirety is over and a time consuming deep second wave correction for minor wave 2 may have begun.

At 88.72 minuette wave (v) would reach 0.618 the length of minuette wave (iii).

At 88.83 minute wave v would reach 1.618 the length of minute wave iii.

I will expect this target now to be reached within a few days, probably before next week’s analysis.

Within minuette wave (v) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 95.21.

Lara,which of the recent charts you have shown would be your preferred count??

The current main wave count.