Downwards movement was expected from both hourly Elliott wave counts.

Summary: Gold is still range bound. There are still at least two valid wave counts for this correction and they encompass four possible structures which may unfold next week. This means that short term price swings within the consolidation will be impossible to accurately predict. The safest approach to a range bound market is to wait for a breakout and the resumption of a trend before joining the trend.

New updates to this analysis are in bold.

Last published weekly chart is here.

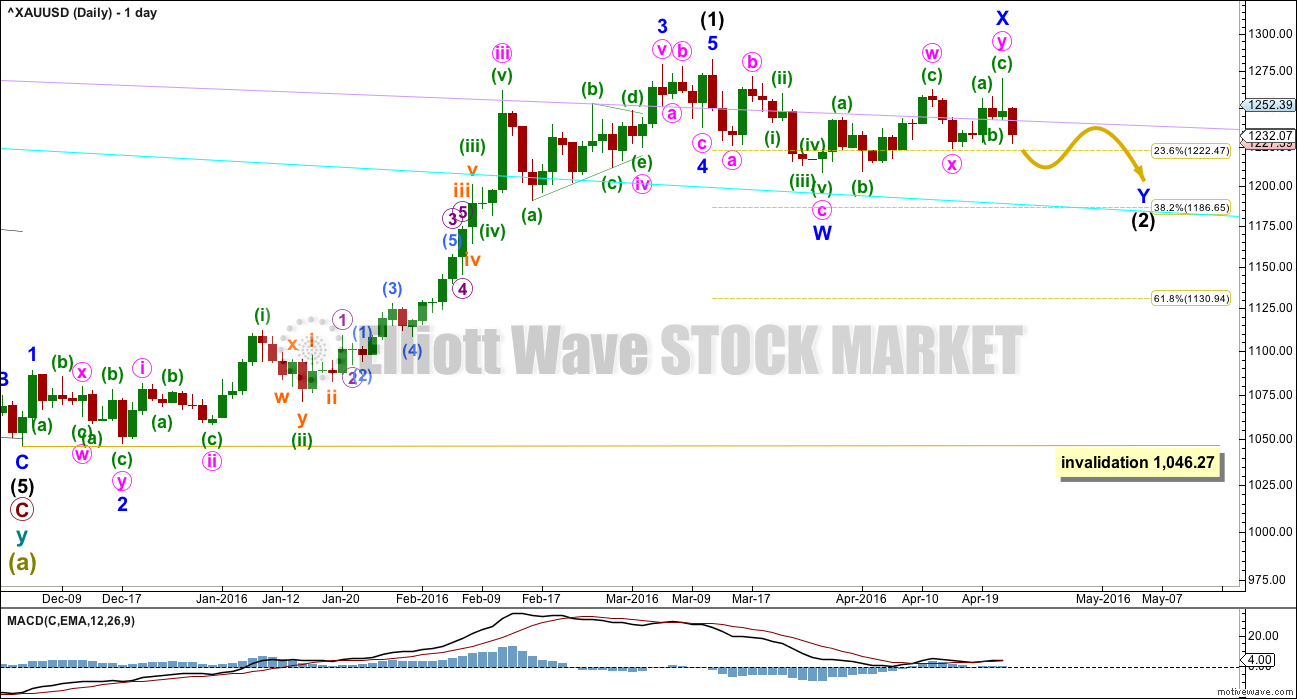

FIRST DAILY ELLIOTT WAVE COUNT

Intermediate wave (1) is a complete impulse. Intermediate wave (2) has begun and is most likely incomplete.

The first movement down within intermediate wave (2) fits as a zigzag.

Upwards movement labelled minor wave X may be a complete double zigzag. Subwaves W, Y and Z within multiples may only be single corrections. The maximum number of corrective structures within a multiple is three. To label W, Y and Z multiples themselves increases the maximum beyond three and violates the rule. But X waves are movements in the opposite direction and are not included in the count of the number of corrective structures, so they may take any corrective form.

Occasionally X waves subdivide as multiples themselves. This may have happened here. All possibilities should be considered.

Minor wave X is a 0.83 length of minor wave W. This may not be a B wave within a flat correction for intermediate wave (2) because it falls short of 0.9 the length of the the first zigzag down labelled minor wave W.

Intermediate wave (2) may be unfolding as a double combination or double zigzag. Because minor wave X is relatively deep, a double combination would be more likely now. Double zigzags more commonly have shallow (and relatively brief) X waves than this one.

If intermediate wave (2) is a double zigzag, then minor wave Y downwards must be a zigzag and must deepen the correction so that the structure has a downwards slope. The most likely point for this to end would be about the 0.618 Fibonacci ratio of intermediate wave (1) at 1,131. This scenario is still possible but has reduced in probability due to the depth and duration of minor wave X.

If intermediate wave (2) is a double combination, then the first structure in the double is a zigzag labelled minor wave W. The double is joined by a three in the opposite direction, a double zigzag labelled minor wave X. The second structure in the double may be either a flat or triangle labelled minor wave Y. It would most likely end close to the same level as minor wave W at 1,208 so that the whole structure moves sideways. This is now more likely.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,046.27.

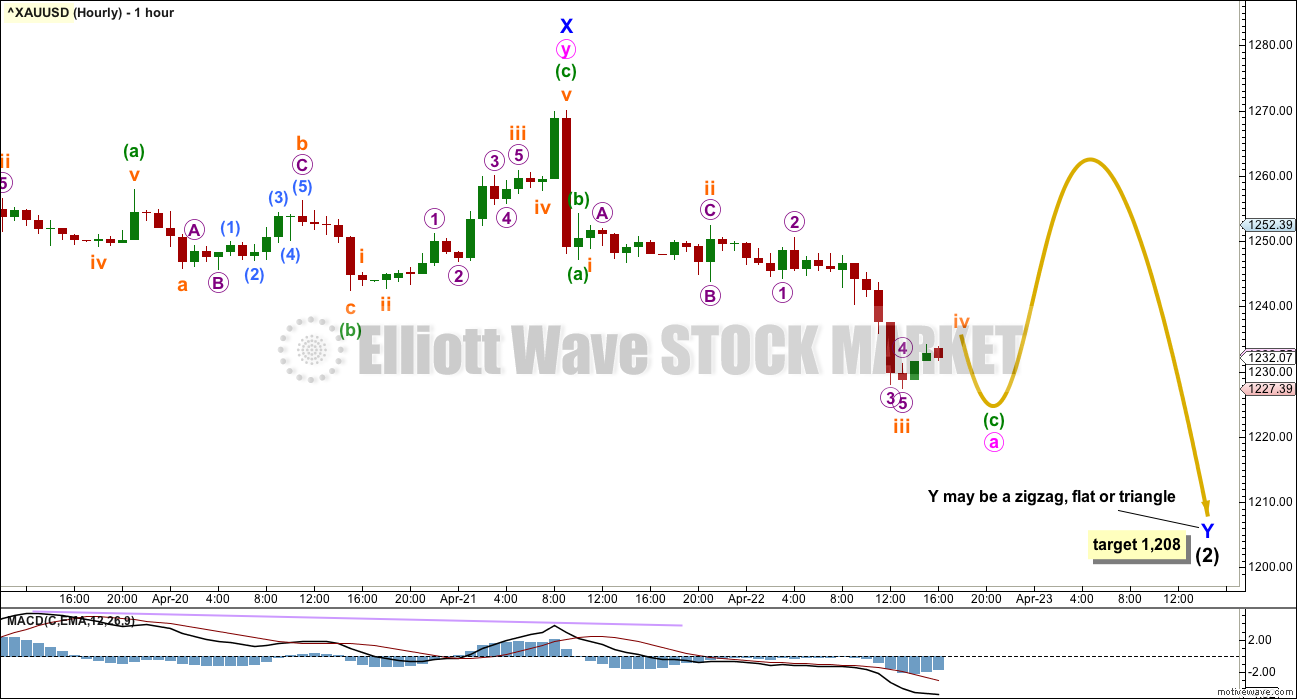

FIRST HOURLY ELLIOTT WAVE COUNT

Minor wave Y may be a zigzag if intermediate wave (2) is a double zigzag. Within the zigzag, no second wave nor B wave may move beyond its start above 1,270.08. A new high above this point at any stage would invalidate the idea of a double zigzag.

Minor wave Y is more likely to be a flat or triangle to complete a double combination for intermediate wave (2). Within both a flat or triangle, minute wave must be a three wave structure. Here, it may be unfolding as a zigzag. Within an expanded flat or running triangle, the B wave may move beyond the start of the A wave which here would begin at 1,270.08. A new high above 1,270.08 may be part of minor wave Y for this wave count and would not invalidate this wave count at this stage.

A flat or triangle for minor wave Y would most likely end about 1,208, so that it ends close to the end of minor wave W.

Both flats and triangles are essentially sideways structures as are double combinations. The purpose of combinations is to take up time. They test our patience. This first wave count would expect overall sideways movement for several days yet, most likely all of next week.

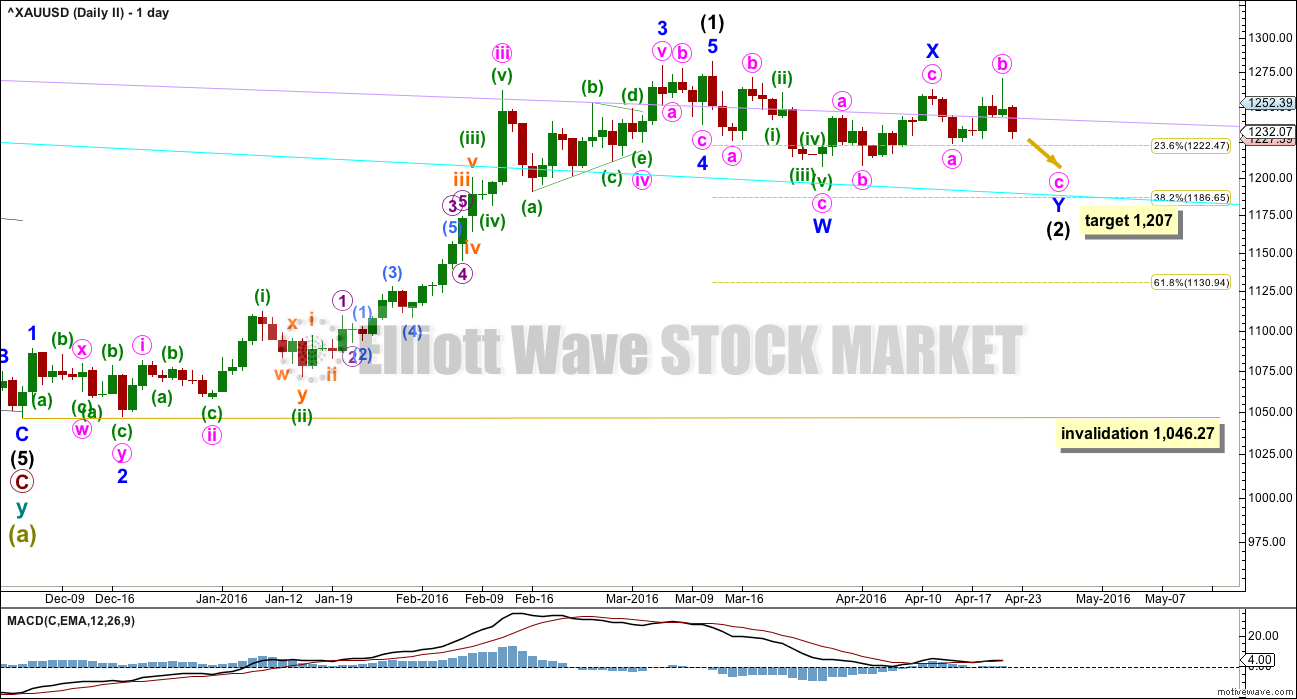

SECOND DAILY ELLIOTT WAVE COUNT

I am labelling these wave counts “one” and “two” rather than main and alternate because it is my judgement that they have a close to even probability. If pressed to state which one I would prefer, I would slightly favour this second wave count because it has overall a slightly more typical look.

Intermediate wave (2) may be a double combination with minor wave X ending earlier as labelled.

Minor wave W is a zigzag, the first structure in a double. The two structures in the double may be joined by a simple zigzag for minor wave X in the opposite direction.

Minor wave Y may be underway as an expanded flat correction.

At 1,207 minute wave c would reach 1.618 the length of minute wave a within the expanded flat of minor wave Y. This target would see minor wave Y end very close to the end of minor wave W. The whole structure for intermediate wave (2) would have a sideways look, typical of a combination.

Minute wave c downwards must subdivide as a five wave structure.

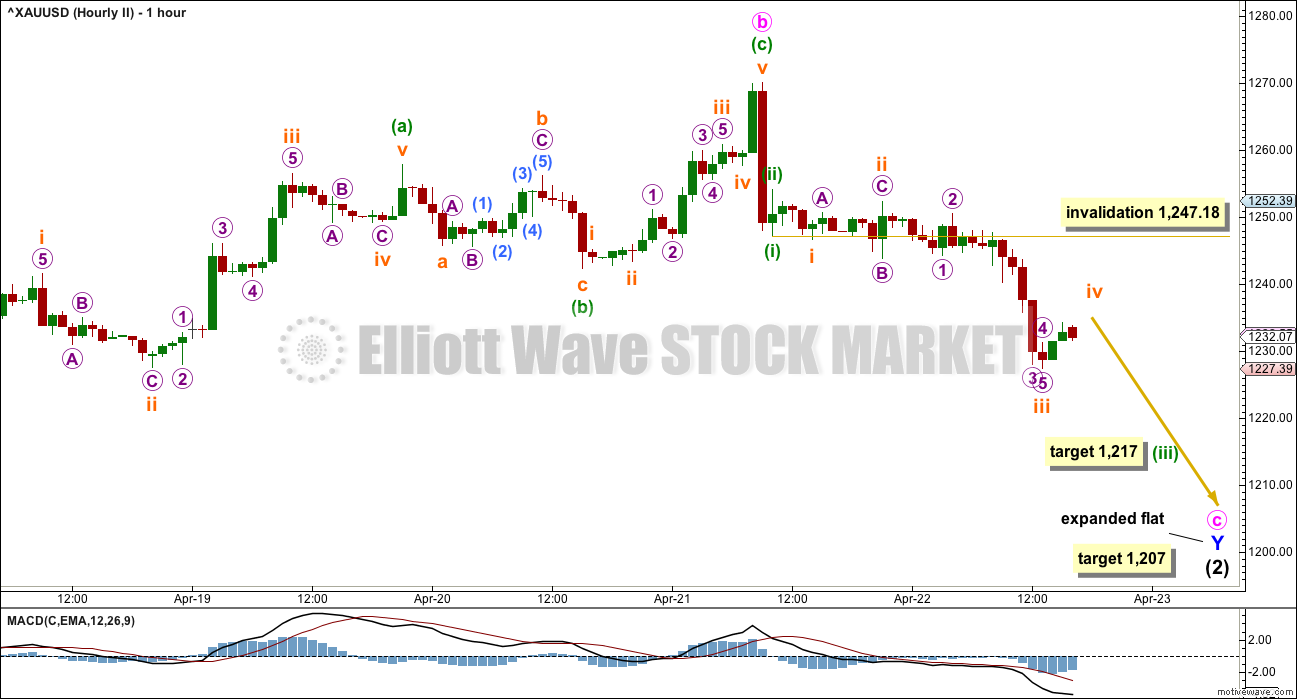

SECOND HOURLY ELLIOTT WAVE COUNT

This wave count now expects a quicker end to the correction for intermediate wave (2).

Within the flat correction for minor wave Y, minute wave b is a 1.20 length of minute wave a. This is within the normal range for a B wave within a flat of 1 to 1.38.

At 1,207 minute wave c would reach 1.618 the length of minute wave a.

Minute wave c at this stage looks like it may be unfolding as an impulse. So far within the impulse minuette wave (iii) may be incomplete. At 1,217 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

The following small correction for minuette wave (i) may not move into minuette wave (i) price territory above 1,247.18. Minuette wave (iv) should be over within a few hours and should not show up on the daily chart.

This wave count would expect another one or two red daily candlesticks down to 1,207 to complete the entire structure for intermediate wave (2).

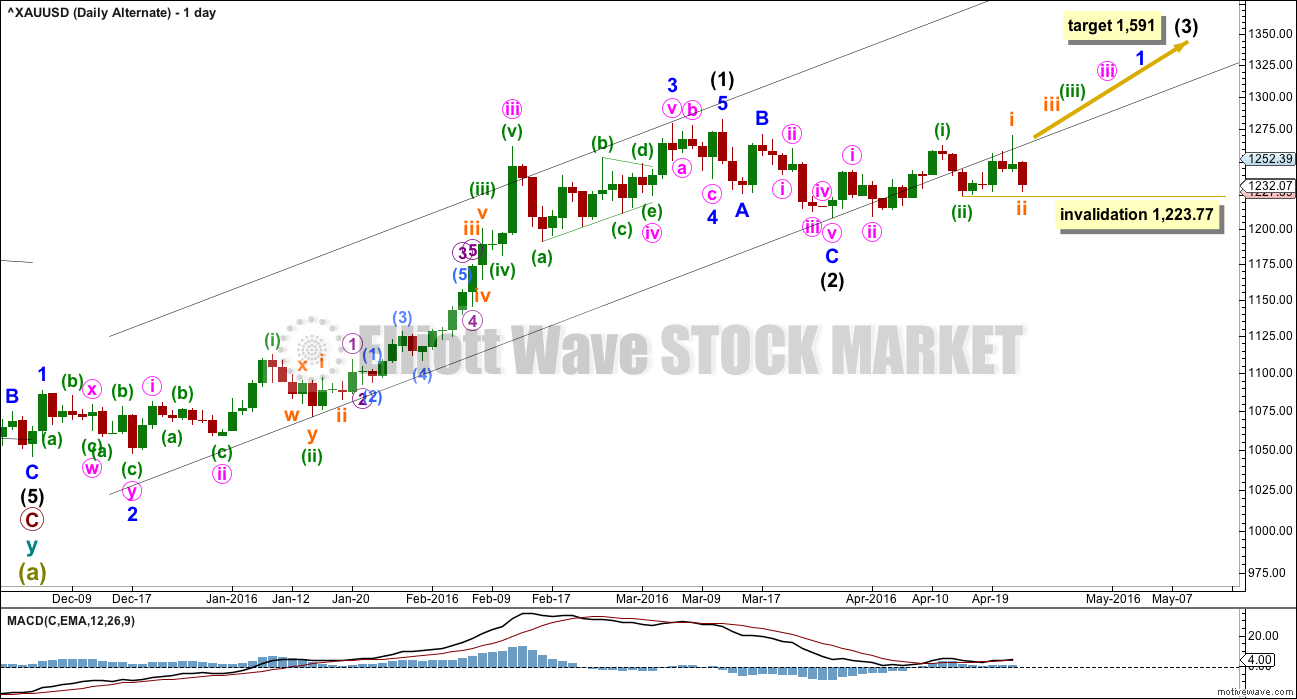

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is technically possible but highly unlikely that intermediate wave (2) is over. This wave count requires confirmation with a five up on the hourly chart for confidence. A new high is not confirmation of this wave count. If price exhibits a classic breakout, a strong upwards day closing comfortably above 1,282.68 on high volume, then this wave count would increase in probability and should be used.

If intermediate wave (2) is over, then it is a very brief and shallow 0.31 zigzag lasting only eleven days (intermediate wave (1) lasted 69 days). The probability of this is very low.

At 1,591 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Minuette wave (ii) may not move beyond the start of minuette wave (i) at 1,209.08.

The best fit black channel about this upwards movement contains all except the end of minute wave iii within intermediate wave (1). It is very common for the ends of third waves to overshoot channels as they are the strongest movement within a trend. Minuette wave (iii) overshoots the upper edge giving this channel a typical look.

It is indicative that the lower edge of this channel is now being breached. If a big third wave up has begun, price should be finding support at the lower trend line. For this reason with now two full daily candlesticks below the line the probability of this alternate wave count at this stage is reduced.

There is now a five wave movement upwards from the low labelled intermediate wave (2). However, this is not an impulse because the fourth wave overlaps first wave price territory significantly. It will not meet the rules for a leading diagonal either in terms of wave lengths: the third wave would be longer than the first, the fourth wave would be longer than the second, but the fifth wave would be shorter than the third.

This upwards movement will not subdivide as a five and meet all Elliott wave rules. The only way to label this upwards movement, if it is the start of intermediate wave (3), is as a series of three overlapping first and second waves. Subminuette wave ii may not move beyond the start of subminuette wave i below 1,223.77. A new low below this point would see this wave count fully invalidated and discarded.

TECHNICAL ANALYSIS

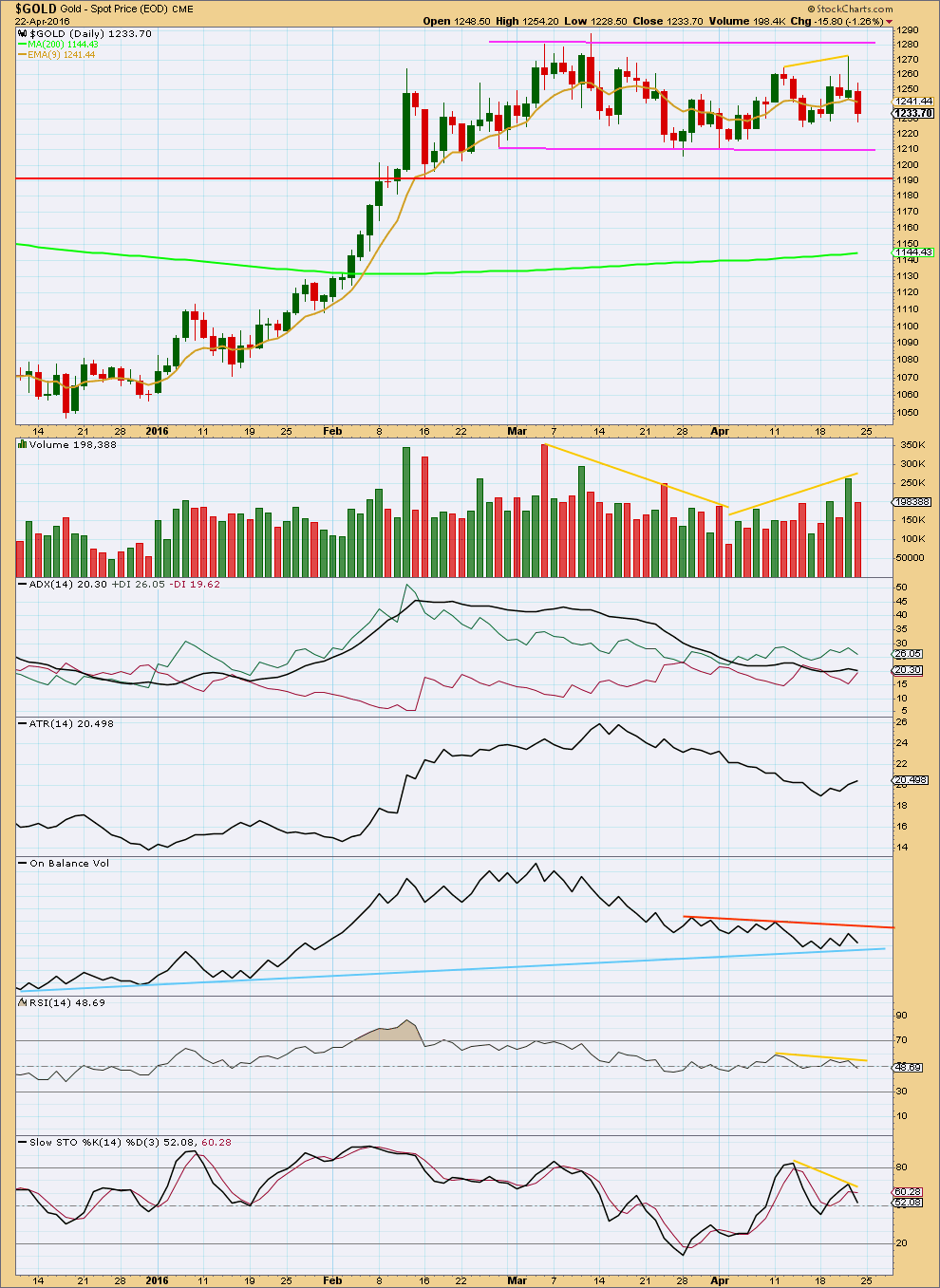

Click chart to enlarge. Chart courtesy of StockCharts.com.

The bottom line is price remains range bound and has been so since February. During a range bound market, price will swing from resistance to support and back again. It won’t move in a straight line and it may overshoot resistance or support before turning around and moving back within the range. The safest approach to a range bound market is to exercise patience and wait for price to breakout, and then join the trend. Only the most highly experienced traders should attempt to trade a range bound market; mean reverting systems are characterised by a few large losses and many small profits; it is more difficult to profit in a range bound market using a mean reverting system. Trend following systems are easier to profit from but require a trending market.

During this consolidation, it remains a downwards day with strongest volume. This indicates a downwards breakout is more likely than upwards. Recently, volume has been rising overall as price has overall moved higher. This gives slight cause for concern to the breakout direction indicated by volume. More normally, during a consolidation volume declines particularly towards the end. Here it is not.

ADX is declining today, no longer indicating a trend may be beginning, and indicating price is consolidating. ATR disagrees though; it is increasing.

The long upper wick of the candlestick for 21st April was a warning that upwards movement was over there, along with the volume spike which looked like a typical blowoff. Divergence between price and RSI and price and Stochastics also warned of downwards movement. Some more downwards movement may be expected until price finds support about 1,208.

The lower orange line is removed from On Balance Volume today. The lower blue line is left. A break above the upper orange line would indicate a bullish breakout from price. A break below the lower blue line would indicate a bearish breakout from price.

This analysis is published @ 09:39 p.m. EST.

At this rate will be lucky to get a break below 1231; more likely a run up to 1250+…..

Lara’s intermediate wave (2) target is at 1,207 – 1,208.

Jim Wyckoff of Kitco.com said this morning that solid technical support for gold is at the March low of $1,207.70.

I can see a double zigzag complete upwards. This should be complete. For both hourly wave counts this should be subminuette iv.

Gold is still range bound. Small inside days are par for the course during a consolidating market. It’s kinda like watching paint dry if you’re being patient and waiting for the breakout.

I’m sitting on hands waiting for this market to finish this sideways move. No breakout today folks.

Subminuette wave iv appears to have ended at the day high of $1,242.37 at 10:18 am.

I believe to fit both hourly wave counts at this time.

Any comments?

Most likely.

I’m wondering now if minor Y is unfolding as a triangle. So much overlapping….

The number of possibilities is quite large right now.

I think gold now at 1239.90 at 10:03 am may be about to top subminuette wave iv any minute now.

With a narrow range inside day so far, 1227 appears to be holding. This is a tough one to navigate! Expecting a pullback/short term decline though for bottoming……A real test of patience. Will just have to wait and see how this pans out.

Gold Stocks Climbing Epic Wall of Worry

04/22/2016 | Jordan Roy-Byrne, CMT

http://thedailygold.com/gold-stocks-climbing-epic-wall-of-worry/

Turning to the present, it appears that those who have called for a correction could finally be correct. Both GDX and GDXJ appear to have completed an interim top in recent days. The miners are filling Tuesday’s gap and should test lower levels in the weeks ahead. GDXJ has initial support below $31 with strong support at $29 while GDX has initial support at $21.50 with strong support near $20.50.

For the Hourly 1 wave count, it has the same invalidation point as the Hourly 2 wave count at 1,247.18, correct?

Thanks

No. Just look at the chart and see a possible curve above 1,260.

See also analysis about First Hourly chart, “Within an expanded flat or running triangle, the B wave may move beyond the start of the A wave which here would begin at 1,270.08. A new high above 1,270.08 may be part of minor wave Y for this wave count and would not invalidate this wave count at this stage.”

Thanks Richard!

April 22nd

“At least for now, evidence suggests that gold is exhibiting bullish characteristics representative of an early positive long-term trend,” said Adam Koos, president of Libertas Wealth Management Group. Gold climbed for four sessions in a row before ending lower Thursday.

But Koos said he’s waiting for a “short-term bounce in the dollar to push [gold] prices back to around $1,220-1,230, at which point, I’d be looking to open a position myself.”

PM sector is getting overbought. Take money off the table.

Is the advise of Bob Hoye of Institutional Advisor.

http://www.321gold.com/editorials/hoye/hoye042416.pdf

Every small/medium rallies in PM sector ended with Silver to Gold ratio becoming overbought.

Richard i believe that immediate rate hike is actually healthy for gold market…an initial downward move and than a strong upward breakout for int 3 can be seen if fed hikes rate next week…else a delay in hike will not give clearity and will invite bears on higher levels in anticipation of a rate hike in following meetings…

I think a rate hike is the only trigger for getting the downward target of 1180 and than an upward breakout

Ruppu you may be right, however I think if Wednesday the FED announces a rate hike then gold may drop more and gold will not be moving up. You mention an 1180 target, however I don’t see that on the charts now.

It would be great if gold could reach 1207 before the FED FOMC Wed 2:00 pm EST and they delay interest rate hikes due to weak US inflation and or world economy and gold takes off up for weeks toward intermediate wave (3) target of $1,500???

Lara you are truly the Elliott Wave Wizard of the world.

Thank you for all of your efforts and mastery.

May you live long and prosper and all of your subscribers as well.

Thank you Richard!