Upwards movement was expected from last analysis of Silver.

Price has moved overall sideways.

Summary: Upwards movement should continue. The target is 25.63 to 26.87.

New updates to this analysis are in bold.

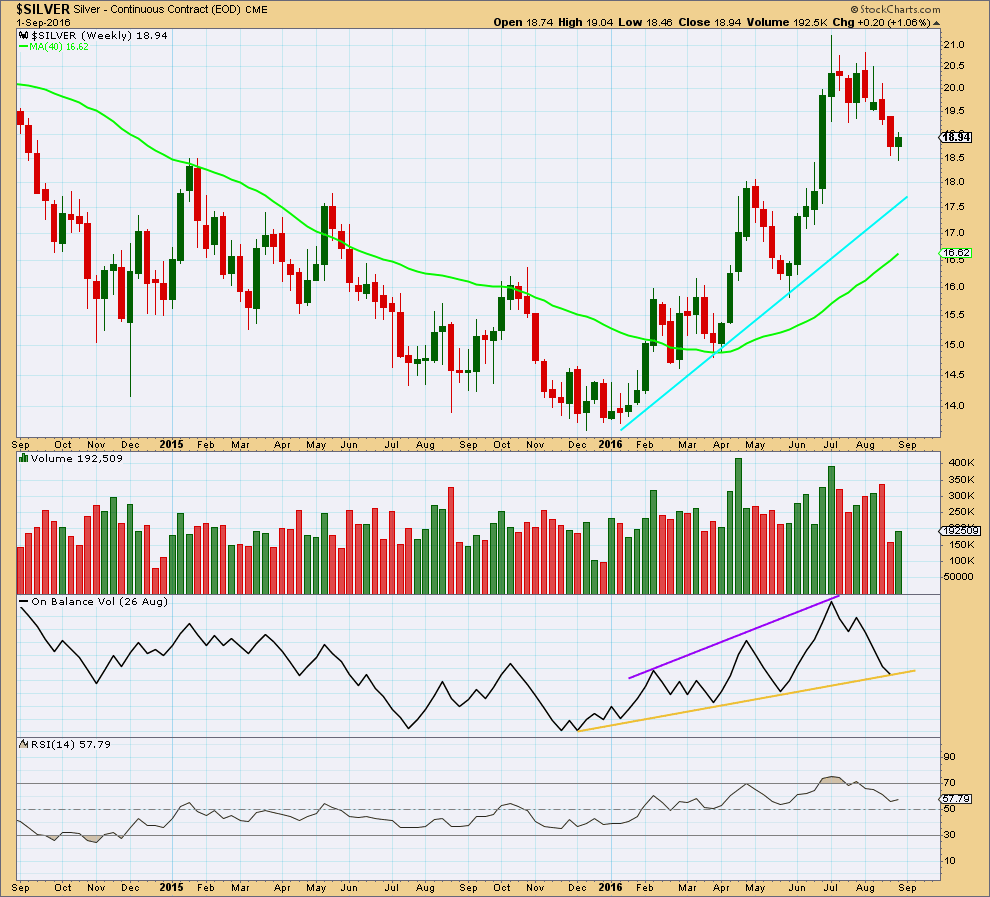

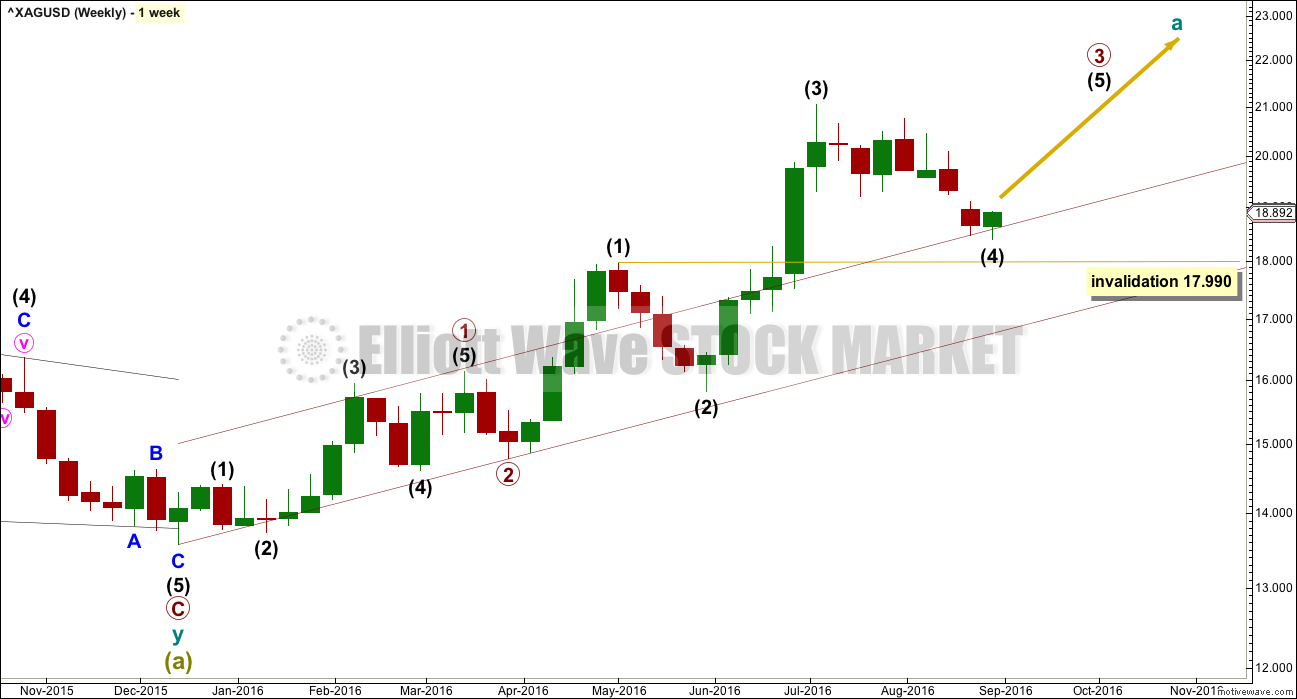

WEEKLY WAVE COUNT

Within primary wave 3, intermediate waves (1), (2) and (3) may be complete. Intermediate wave (4) may be unfolding.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 17.990.

Intermediate wave (5) may be a swift sharp extension. It may end with a blowoff top.

A base channel about primary waves 1 and 2 is added this week. Intermediate wave (4) may find support about the upper edge.

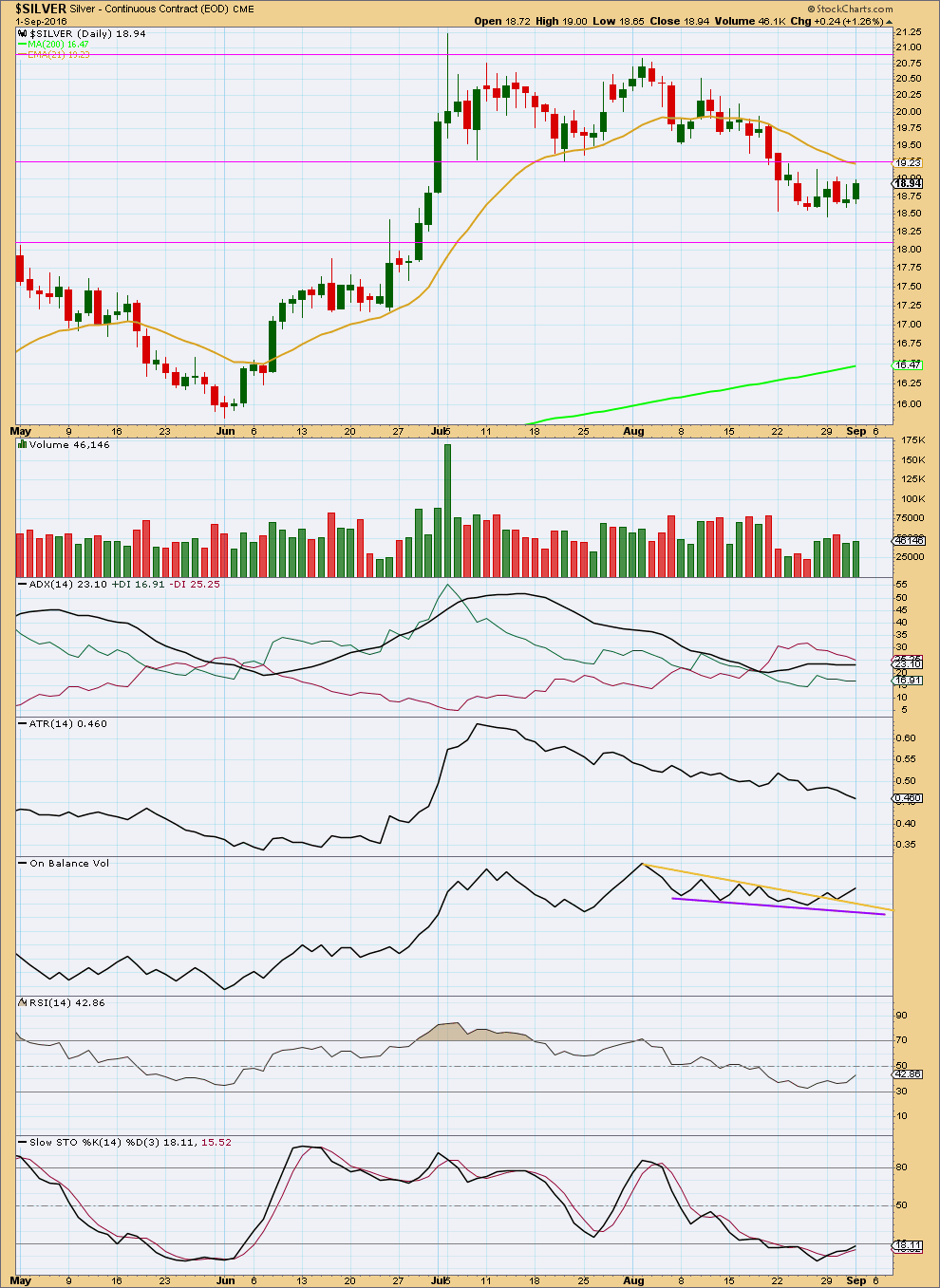

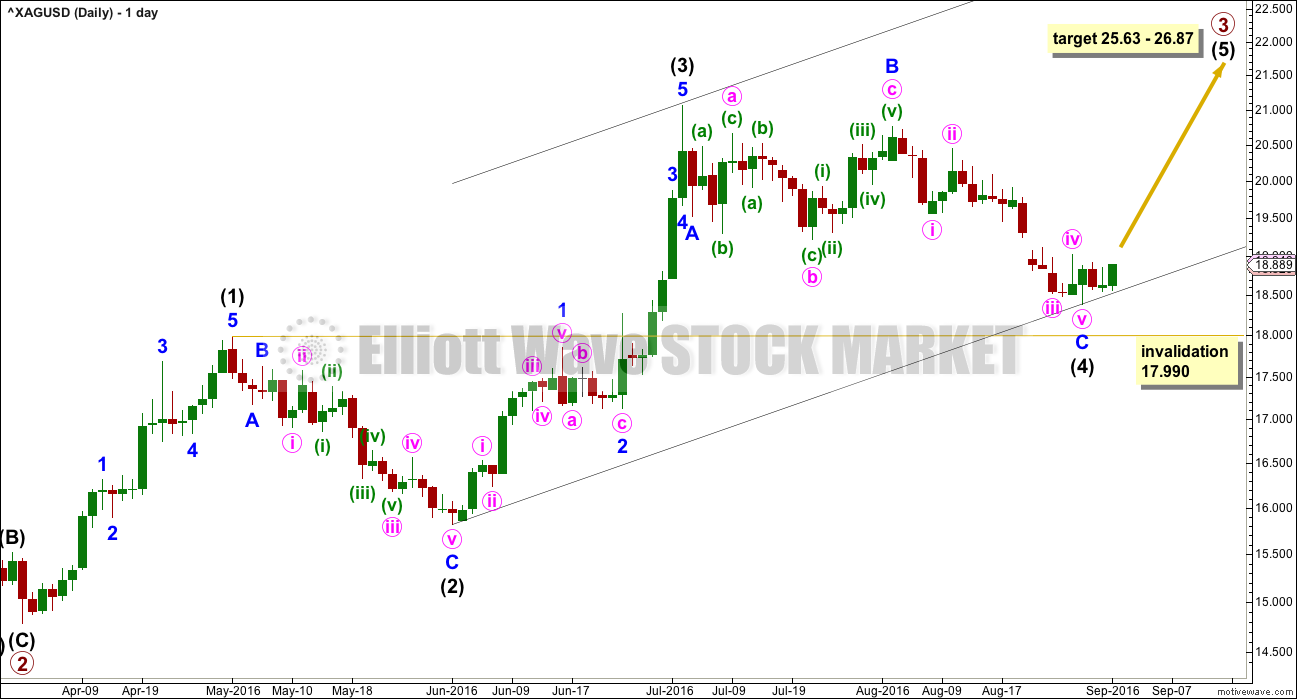

DAILY WAVE COUNT

The channel is redrawn using Elliott’s second technique. If intermediate wave (4) moves any lower, then redraw the channel.

At 25.63 primary wave 3 would reach 4.236 the length of primary wave 1.

At 26.87 intermediate wave (5) would reach 1.618 the length of intermediate wave (3). This gives a 1.24 target zone calculated at two wave degrees.

There is inadequate alternation between intermediate waves (2) and (4) because they are both subdividing as zigzags. There is some alternation so far within the structure: within intermediate wave (2) minor wave B was very brief and within intermediate wave (4) minor wave B is very time consuming. Intermediate wave (2) was a 0.68 correction of intermediate wave (1) and so far intermediate wave (4) is a 0.51 correction of intermediate wave (3), so there is no reasonable alternation in depth. This lack of alternation reduces the probability of this wave count.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 17.990.

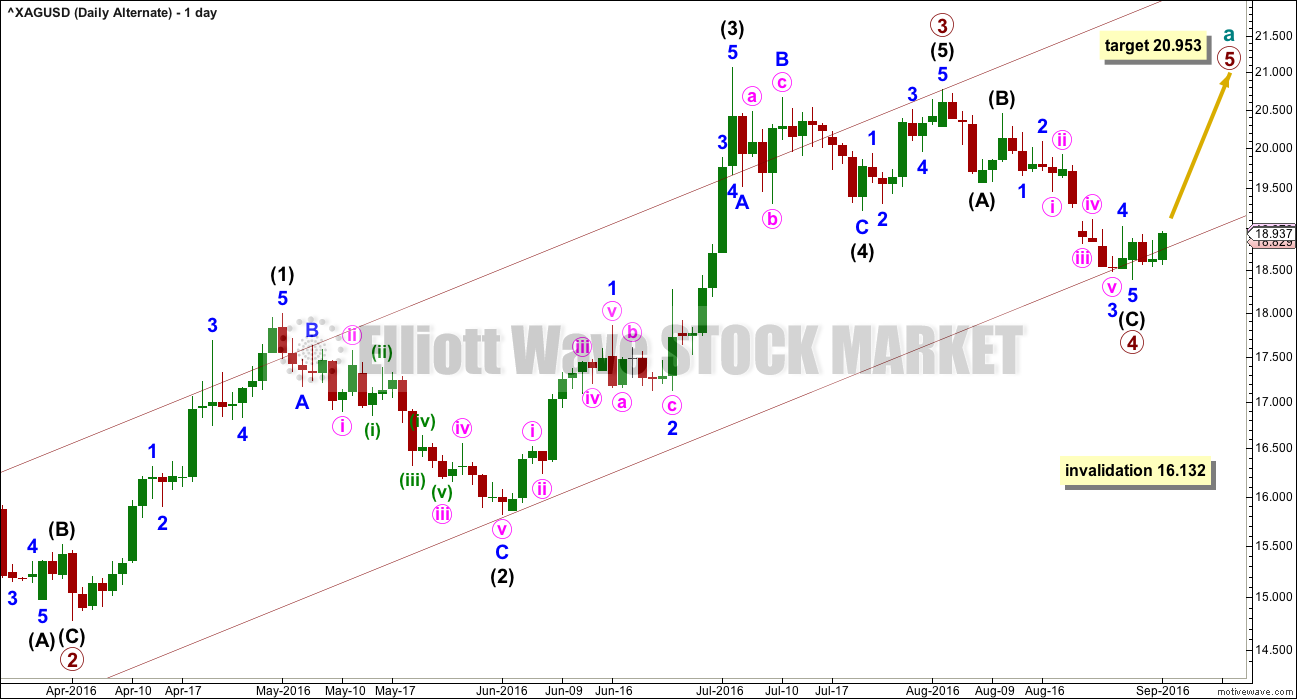

ALTERNATE DAILY WAVE COUNT

This alternate is new this week.

It is possible that primary wave 3 is already over. Intermediate wave (5) would be truncated by 0.294, which reduces the probability of this alternate.

Primary wave 3 has no adequate Fibonacci ratio to primary wave 1. At 20.953 primary wave 5 would reach equality in length with primary wave 1.

If primary wave 4 moves lower, then the target for primary wave 5 would have to be recalculated.

The maroon channel is drawn here using Elliott’s first technique. Primary wave 4 may be finding some support about the lower edge of the channel, This may be where primary wave 5 begins.

If primary wave 4 continues lower as a deeper double zigzag, then it may not move into primary wave 1 price territory below 16.132.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week completed a red weekly candlestick with much lighter volume than prior weeks. The fall in price is no longer supported by volume. This downwards wave looks like it may be exhausted. The longer lower shadow for last week’s candlestick is slightly bullish.

On Balance Volume has come down to touch the yellow support line. This line should offer enough support to initiate a bounce up from price about here.

RSI has returned from overbought. There is room again for price to rise.

Price remains above the cyan support line.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has moved sideways over the last few days, but the rise in price has been supported by volume. Price needs to break back above prior support, which is now resistance at 19.20, on a day with increased volume for confidence in the Elliott wave counts. If price falls further, it may find support next about 18.10.

ADX is slightly increasing and the -DX line is above the +DX line. A downwards trend is indicated.

ATR disagrees though as it is declining. This downwards trend is more likely a counter trend movement than the start of a more sustainable long term trend.

On Balance Volume is this week giving a bullish signal with a break above the yellow resistance line. OBV has tested that line, giving another bullish signal.

Price and RSI show some divergence at the low of 29th of August. This adds a little confidence to seeing a low in place here.

Stochastics is oversold. This also adds a little confidence to seeing a low in place.

This analysis is published @ 10:55 p.m. EST.

Thanks Lara for the silver analysis. It seems to me the tide has indeed turned for silver. It tested the 18.50 several times and then bounced strongly. We’ll see what it does this coming week.